Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

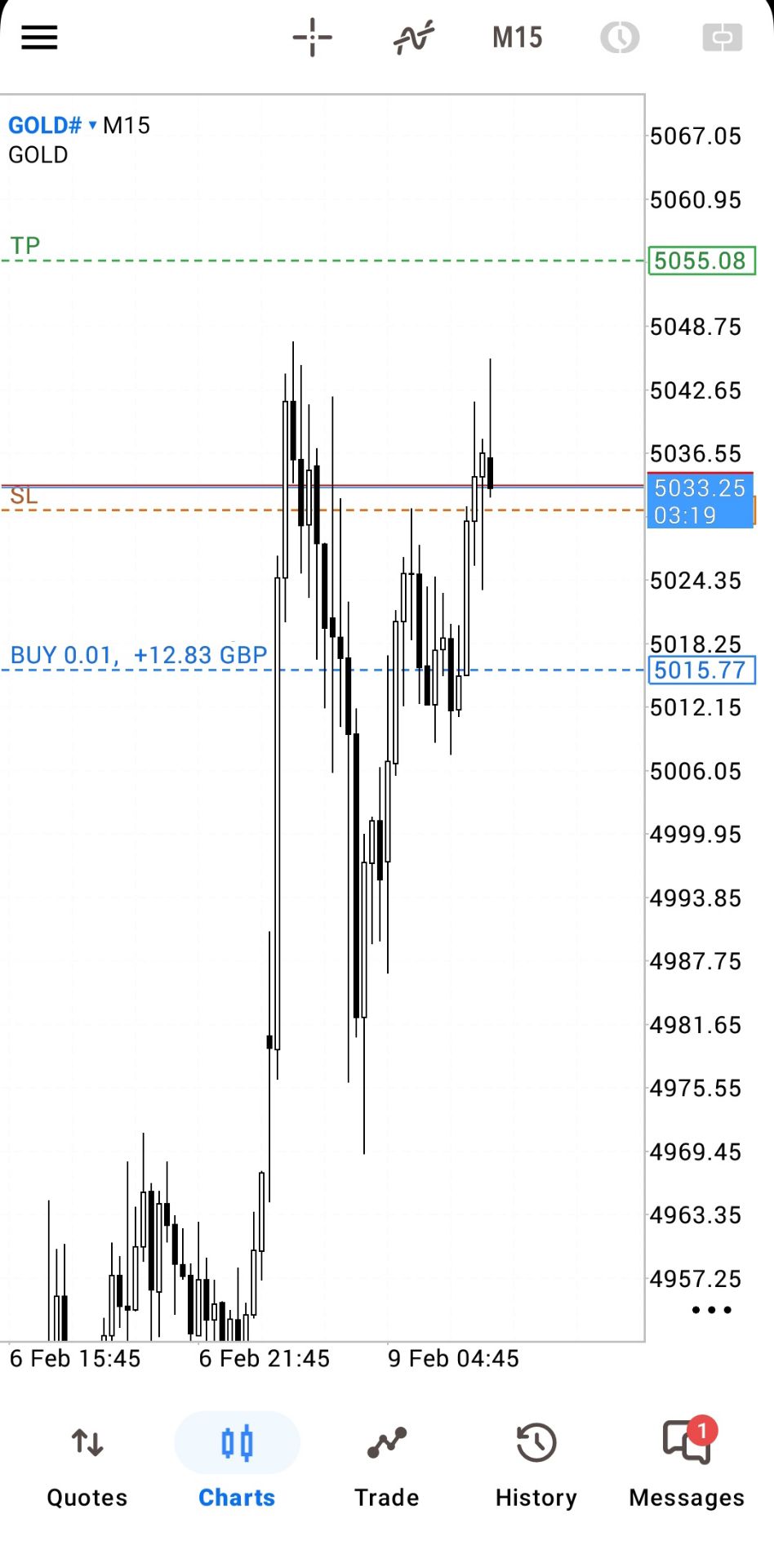

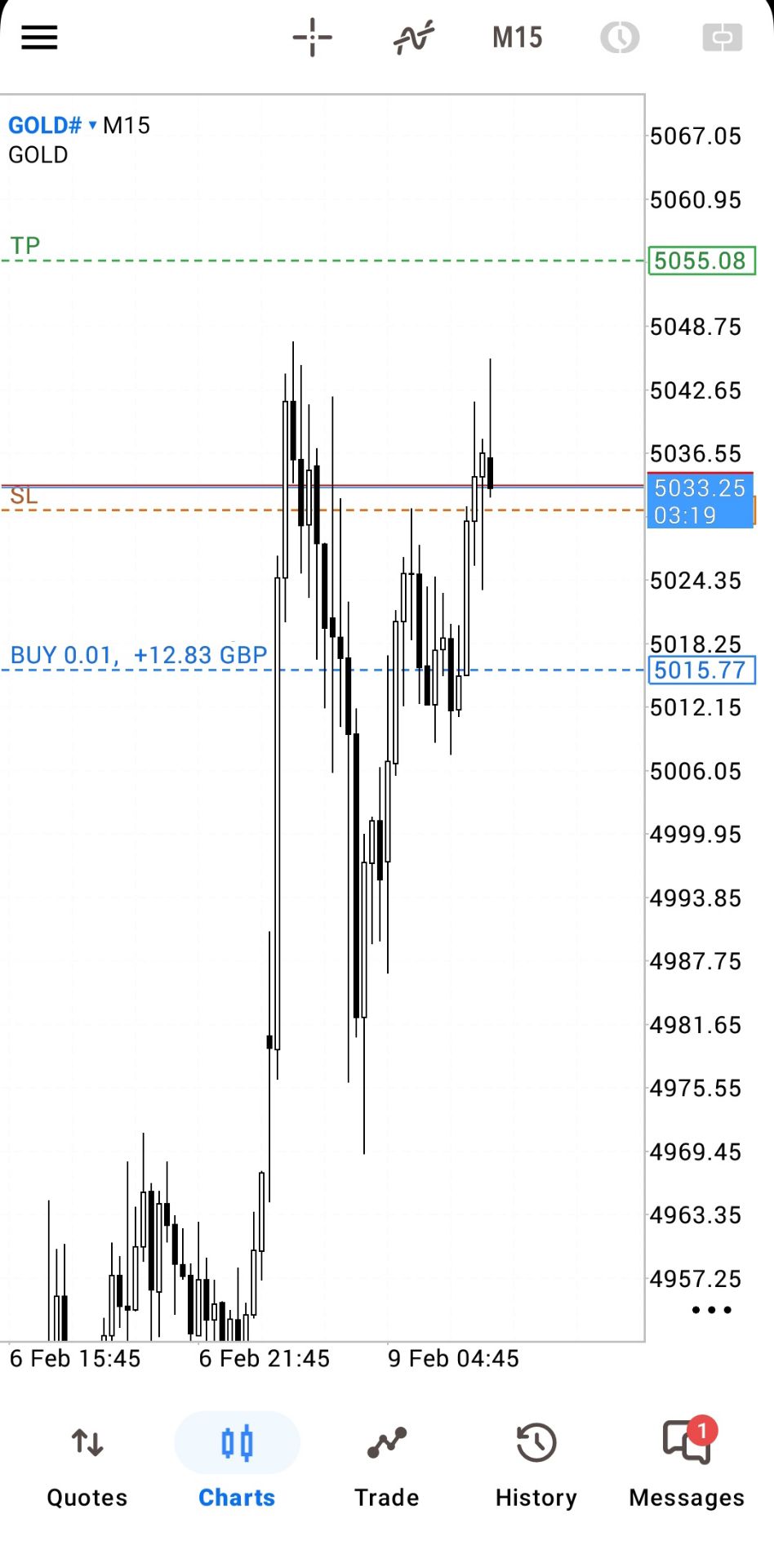

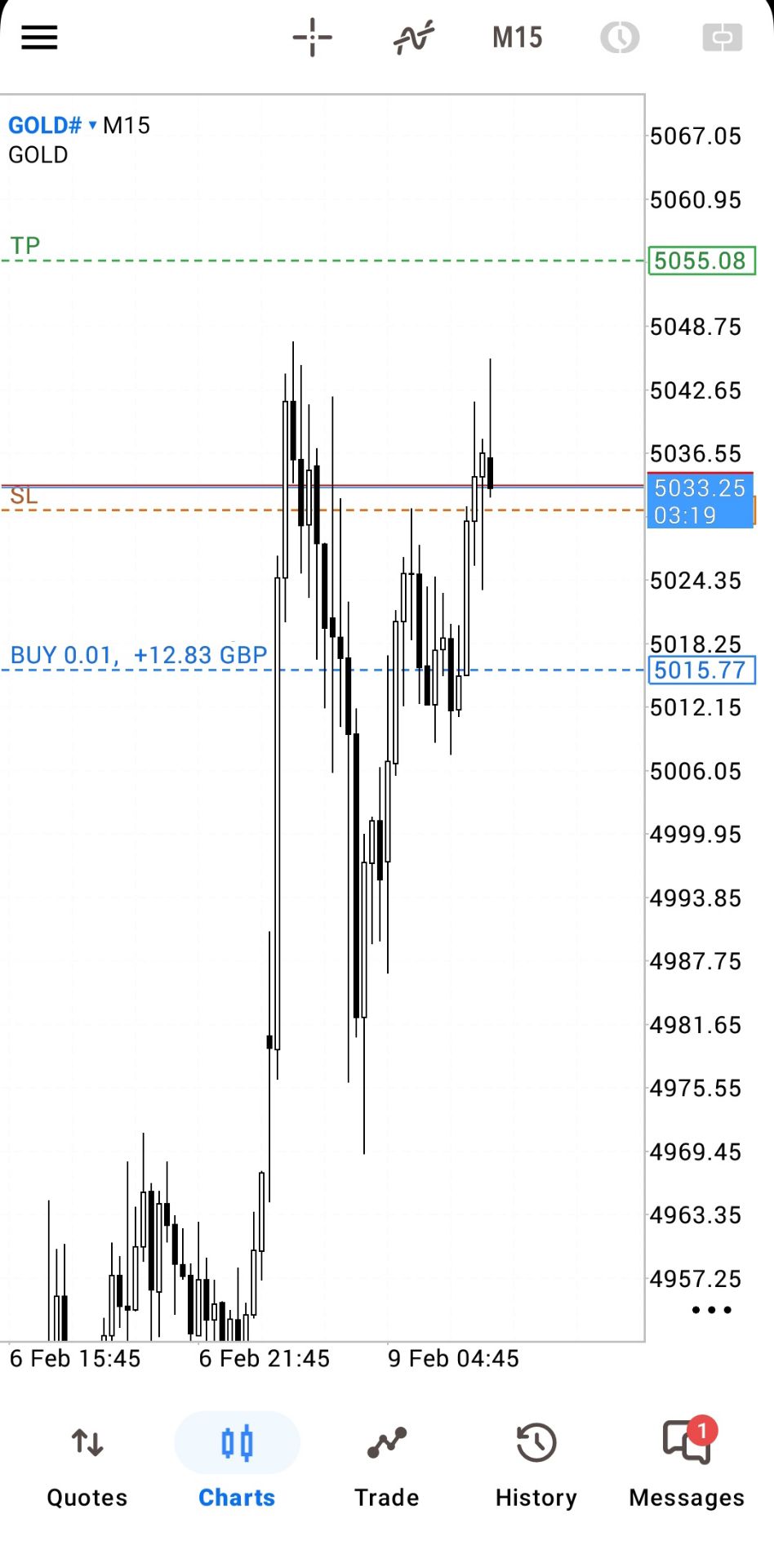

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Treasury Yields Rose Sharply In The Short Term, With The 10-year Treasury Yield Rising More Than 2 Basis Points To 4.242% And The 30-year Treasury Yield Rising More Than 3 Basis Points To 4.885%

Russia's Fsb Says Attempted Assassination Of General Alexeyev Was Ordered By Ukraine With Poland's Participation

South Korea President Lee Congratulates Japan Prime Minister Takaichi For Party's Election Victory, Wishes Japan's Continued Success Under Her Leadership - X Message

Jp Morgan Raises 2026 Year End Target For Japan's Nikkei Index To 61000 Versus Prior Target Of 60,000

[Market Update] Spot Silver Surged 5.00% Intraday, Currently Trading At $81.72 Per Ounce. New York Silver Futures Jumped 6.00% Intraday, Currently Trading At $81.52 Per Ounce

Jpm, Barclays Expect Yen To Stay Soft Following Sanae Takaichi's Landslide Victory In Election

Former Bank Of Korea Board Member Lee Ju Yeol: Dollar-Won Rate Between 1400 And 1470 Looks Appropriate

[US Companies File Section 337 Investigation Request Against Certain Automotive Parts, Components, And Downstream Vehicles] According To The Trade Remedy And Investigation Bureau Of The Ministry Of Commerce Of China, On February 5, 2026, General Motors Filed An Application With The US International Trade Commission Under Section 337 Of The Tariff Act Of 1930, Alleging That Certain Vehicle Parts, Components, And Downstream Vehicles Exported To, Imported Into, Or Sold In The US Infringe Its Patent Rights. General Motors Requested A Section 337 Investigation And The Issuance Of A General Exclusion Order, A Limited Exclusion Order, And A Cease And Desist Order. Twenty Companies From The US And China Are Involved In The Case

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)A:--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales (Dec)

U.S. Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

Kung Fu

ID: 4603470

No matching data

CMC20 brings institutional-grade, single-trade access to diversified crypto portfolios

NEW YORK, Nov. 17, 2025 /PRNewswire/ -- CoinMarketCap, the world's leading cryptocurrency data platform, today announced CoinMarketCap 20 DTF (CMC20), the first DeFi-enabled tradable crypto index token on BNB Chain. Built on Reserve, a platform for creating Decentralized Token Folios (DTFs), onchain portfolios that bundle multiple crypto assets into a single token, CMC20 tracks the top 20 cryptocurrencies by market capitalization, giving retail and institutional investors a simple, single-trade way to access diversified crypto market exposure.

Deployed by Lista DAO, CMC20 combines the transparency of DeFi with the characteristics of traditional institutional-grade indexes. As the first tradable index token native to BNB Chain, CMC20 brings sophisticated portfolio exposure tools to one of crypto's largest ecosystems. The token enables permissionless 24/7 minting and redemption, while supporting spot listings across CEXs, DEXs, wallets & platforms, futures tracking, and integration into advanced trading strategies.

By partnering with Reserve and Lista DAO to launch the first index token on BNB Chain, CMC20 brings institutional-grade products to one of the world's most active blockchain ecosystems."

Unlike reference-only indexes, CMC20 is purpose-built for active use across the crypto ecosystem. Monthly rebalancing maintains exposure to the 20 largest cryptocurrencies, excluding stablecoins, wrapped assets, and tokens with limited investability. The methodology captures growth across Layer-1 blockchains, exchange tokens, infrastructure projects, DeFi protocols, and emerging sectors, delivering broader market representation than BTC-ETH-only products.

CMC20's DeFi-native architecture on BNB Chain enables use cases unavailable to traditional index products. Institutional investors can incorporate the token into delta-neutral strategies, collateralized lending, and automated portfolio rebalancing. Retail traders benefit from simplified exposure management and lower transaction costs than when manually constructing diversified portfolios. Exchange listings enable both spot trading and derivatives products, while the underlying assets remain verifiable onchain.

Reserve's infrastructure ensures transparent collateralization and redemption mechanics. Users can mint CMC20 by depositing the underlying basket of tokens or redeem CMC20 for its constituent assets at any time, maintaining tight tracking to index value.

CMC20 is launching with full ecosystem support on BNB Chain and is available for trading on PancakeSwap and mintable on the Reserve dapp. CoinMarketCap is actively partnering with DeFi protocols, centralized exchanges, and fintechs to increase CMC20's utility, enabling lending products and yield-generation mechanisms for CMC20 holders and expanding distribution beyond DeFi.

Institutional inquiries and partnership opportunities can be directed to: institutional@coinmarketcap.com

For complete index methodology, real-time holdings data, and integration documentation, visit: https://coinmarketcap.com/charts/cmc20/

About CoinMarketCap

CoinMarketCap stands as the Home of Crypto. With over 880 million monthly page views and 14 million tracked cryptocurrencies, CoinMarketCap drives the industry forward by organizing and delivering comprehensive crypto intelligence. Major media outlets including Forbes, Bloomberg, CNBC, and The Wall Street Journal, rely on CoinMarketCap as their primary source for crypto data.

About Reserve

Reserve is a free, permissionless platform to create, own, and govern DTFs (Decentralized Token Folios), index products and asset-backed currencies launched on its protocols. Reserve's mission is to create a more accessible financial system through decentralized index technology, allowing anyone to build and manage token baskets that work like traditional ETFs but with the benefits of blockchain.

About Lista Dao

Lista DAO is the leading BNBFi protocol on BNB Chain, offering overcollateralized decentralized stablecoin (CDP), BNB LST, Lista Lending and innovative solutions that allow users to earn rewards from Binance Launchpool, Megadrop, and HODLer Airdrops. As the first to have DeFi BNB recognized for Binance Launchpool, Lista DAO has achieved a TVL growth of 1,000% year-to-date, reaching $4.5B, making it the biggest protocol on BNB by TVL.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up