Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Key takeaways:

Bitcoin price rose 1.5% to over $115,000, with onchain indicators suggesting market momentum is picking up.

BTC must hold above $115,000 to secure the recovery, with resistance at $116,000-$121,000.

Bitcoin price was up on Friday, rising 1.5% over the past 24 hours to trade above $115,000. Several technical and onchain indicators suggest the BTC market is “advancing on firmer footing” to higher levels, according to Glassnode.

Bitcoin derivatives “set the tone” for BTC price

Bitcoin’s ability to stage a sustained recovery has been curtailed by weak spot demand and softening ETF inflows.

“Attention now shifts to derivatives markets, which often set the tone when spot flows weaken,” Glassnode wrote in its latest Week Onchain report.

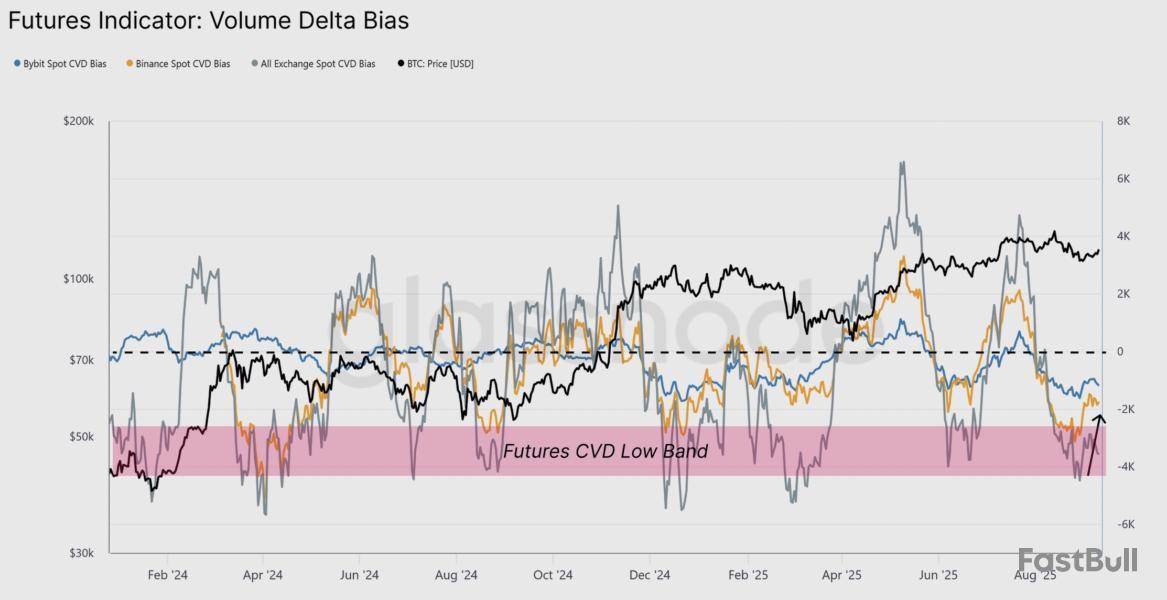

The chart below shows that Bitcoin’s volume delta bias, measuring the imbalance between buying and selling pressure, recovered during the rebound from $108,000, signaling seller exhaustion across exchanges like Binance and Bybit.

This suggests that futures traders “helped absorb recent sell pressure,” said the market intelligence firm, adding:

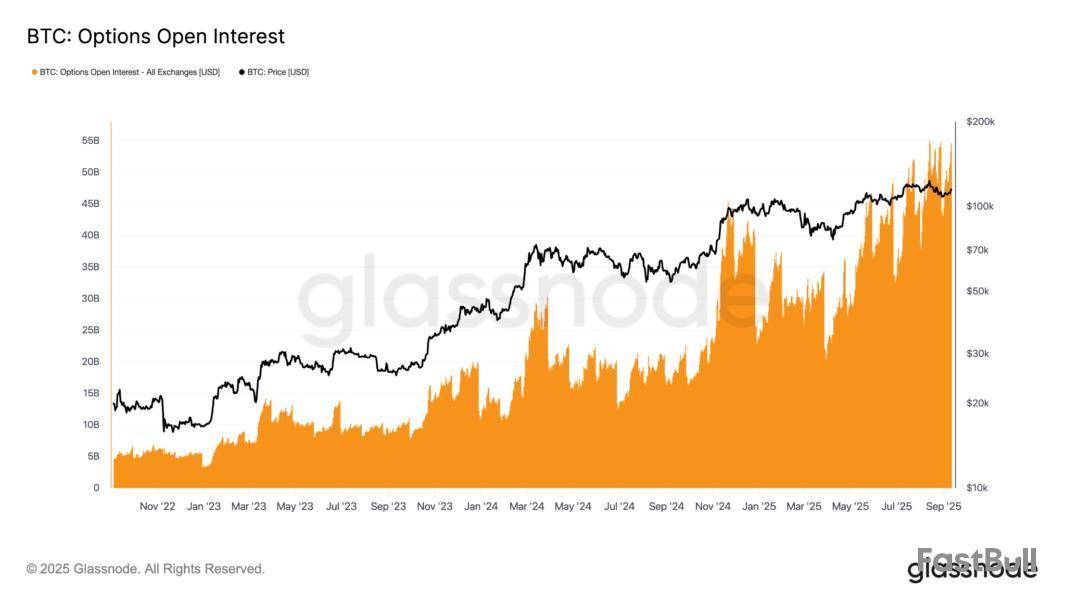

Meanwhile, options open interest (OI) reached $54.6 billion, an all-time high, up 26% from $43 billion on Sept. 1. This reflects growing investor interest in the derivatives market, which can positively affect BTC price.

Note that when options OI reached its previous record high in mid-August, it was accompanied by Bitcoin's rise to new all-time highs above $124,500.

Additional options OI data shows a clear bias toward calls over puts, “highlighting a market that leans bullish while still managing downside risk,” Glassnode said, adding:

As Cointelegraph reported, Bitcoin’s $4.3 billion options expiry on Friday favors bullish bets, and could open the door for BTC rally to $120,000 as long as the price stays above $113,000.

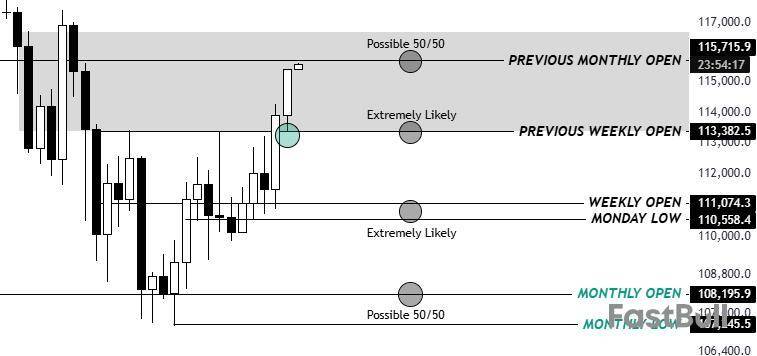

Key Bitcoin price levels to watch next

Data from Cointelegraph Markets Pro and TradingView shows Bitcoin price trading at $115,400 after running into resistance around $116,000. The pair must hold above $115,000 for a sustained recovery.

There is a major supply zone stretching from $116,000 to $121,000, which Bitcoin will have to overcome to continue its uptrend toward all-time highs.

Conversely, the bears will attempt to defend the $116,000 level and push the price back down. A key area of interest lies between $114,500, where the 50-day simple moving average (SMA) currently sits, and $112,200, embraced by the 100-day SMA.

Another area of importance stretches from the local low at $107,200 (reached on Sept. 1) to the $110,000 psychological level.

Bitcoin is “now pushing to the previous monthly open,” said pseudonymous trader KillaXBT in an analysis on X, referring to the August open around $115,700.

The liquidation heatmap shows the liquidity clusters between $116,400 and $117,000, per data from CoinGlass.

If broken, this level could spark a liquidation squeeze, forcing short sellers to close positions and driving prices toward $120,000.

On the downside, heavy bid orders are sitting around $114,700, with the next major cluster sitting between $113,500 down to $112,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Bitcoin sharks – wallets holding between 100 and 1,000 BTC – have absorbed 65,000 BTC in just the past week. The aggressive accumulation has boosted their total holdings to a record 3.65 million BTC and even continued as spot prices consolidated near $112,000.

This was indicative of a growing divergence between short-term retail speculation and conviction-driven structural demand.Exchanges Bleed BTC as Sharks Hoard

Two critical datasets validate this outlook, according to CryptoQuant’s observation:

The LTH metric has flipped sharply positive, as seasoned investors are accumulating rather than distributing coins. Historically, such green spikes precede larger bull cycles as BTC migrates into “strong hands” less likely to sell into temporary volatility. Meanwhile, exchange flows continue to show pronounced outflows, with investors steadily withdrawing coins into cold storage instead of leaving them available for immediate trading.

This confirms that the recent buying is not just speculative repositioning but actual supply removal from liquid markets. When shark accumulation converges with LTH absorption and exchange withdrawals, the setup becomes highly conducive to a supply squeeze.

While the potential for short-term pullbacks remains, particularly if derivatives markets become overheated, the structural forces at play tilt the balance toward higher valuations once renewed demand emerges.

Beneath the surface-level swings, Bitcoin’s market structure is quietly but decisively moving toward scarcity, which could mean that the groundwork for Bitcoin’s next strong leg higher is already being laid.

CryptoPotato had previouslyreportedthat Bitcoin’s liquidity on Binance is showing signs of stress, as withdrawals have been accelerating even as deposits remain subdued. As the platform with the deepest order books, Binance’s liquidity patterns often reflect the broader market’s underlying tone.

Earlier in August, inflows climbed sharply as traders positioned for distribution or hedging while BTC approached $120,000. That activity cooled in the latter half of the month, which brought inflows and outflows into temporary balance and stabilized price action.

This changed in September as outflows surged above 22 million BTC while inflows stalled. This sharp divergence points to reduced willingness to sell and stronger preference for self-custody, which strengthens the case for upward market moves.

The result is a tightening liquidity pool that could act as fuel once demand strengthens. Should these conditions continue, Binance’s shrinking reserves may prove the catalyst for Bitcoin’s next leg higher.Miners Join the Bulls

Adding to this tightening supply story, Bitcoin miners are alsorewritingthe playbook this cycle as they have transformed from aggressive sellers to steady accumulators. Traditionally, the Miners’ Position Index (MPI) spikes before halvings and late in bull markets as miners dump reserves into retail-driven demand.

Despite record-high mining difficulty and surging transaction fees, miners are holding tight. Catalysts such as US spot Bitcoin ETF approvals and sovereign adoption are fueling this accumulation-first strategy.

A growing number of companies are beginning to include XRP alongside Bitcoin and Ethereum in their crypto reserves.

Amber International Joins the Trend

Amber International Holdings has outlined a $100 million crypto reserve plan. The filing shows that its strategy will initially focus on high-conviction assets such as BNB, Solana, SUI, XRP, Bitcoin, and Ethereum, with flexibility to expand into other ecosystem tokens and stablecoins. The company’s latest balance sheet confirms it now holds XRP alongside other top cryptocurrencies.

Portfolio Approach Over Bitcoin-Only Strategy

Attorney Bill Morgan said that more companies are now holding a portfolio of digital assets rather than only Bitcoin. While some firms, like MicroStrategy, stick strictly to Bitcoin, others see value in diversification. Amber International’s filing shows this shift, meaning that companies are beginning to adopt a multi-asset reserve strategy.

bill morgan@Belisarius2020Sep 12, 2025Companies hold XRP on their balance sheet continue to emerge.

Here is an extract from another filing with the SEC that showing the trend of companies increasingly holding digital assets on their balance sheet including XRP.

This company, Amber International holdings, has… pic.twitter.com/1IyhxfFhHh

“What seems to be becoming more prevalent is that companies are holding a portfolio of digital assets and not just bitcoin,” Morgan said.

Several public companies have already committed funds to XRP. Trident Digital Tech Holdings has announced a planned $500 million allocation, while Webus International has a $300 million mandate. VivoPower International has raised $121 million for its XRP reserves, and Wellgistics Health secured a $50 million credit facility for the same purpose.

Conclusion

The filings reviewed show that XRP is no longer a fringe asset in corporate portfolios. With whales, exchanges, and now companies steadily building positions, the case for XRP as part of institutional reserves is strengthening. This also means that crypto treasuries are evolving beyond Bitcoin into multi-asset strategies.

XRP is showing a bullish trend and has risen above $3. Recent legal developments and pending XRP ETF filings may also add to the growing list of catalysts.

Bitcoin rises after U.S. stock indices reached fresh record highs overnight as expectations for interest-rate cuts from the Federal Reserve boost risk sentiment. Rate-cut bets firmed after data Thursday showed U.S. initial jobless claims rose more than expected to 263,000 last week, the highest since 2021. U.S. inflation rose to 2.9% in August but this was in line with expectations and did little to change rate pricing. The market is now pricing in close to three consecutive rate cuts by year-end, LSEG data show. Bitcoin rises 0.8% to $115,320 after reaching a nearly three-week high of $116,314 overnight, according to LSEG.(renae.dyer@wsj.com)

On September 11, both spot ETFs, Bitcoin and Ethereum, recorded strong inflows. According to SoSoValue, Bitcoin ETFs recorded a positive of $552.78 million, marking the fourth consecutive day of inflows, while Ethereum ETFs extended their streak to 3 consecutive days of inflows.

Bitcoin ETF Breakdown

Bitcoin ETF saw a combined $552.78 million of inflows, led by BlackRock IBIT’s $366.20 million. Fidelity FBTC followed with $134.71 million, then Bitwise BITB $40.43 million, and Invesco BTCO $5.71 million. Franklin EZBC also added $3.31 million, while VanEck HODL gained $2.43 million.

Overall, Bitcoin ETFs recorded a total trading volume of $2.83 billion with $149.64 billion in net assets. It marked 6.57% of the BTC market capitalization, slightly higher than the previous day.

Ethereum ETF Breakdown

Ethereum ETF recorded a net inflow of $113.12 million, led by $88.34 million from Fidelity FETH. Bitwise ETHW also recorded $19.65 million in inflows, followed by Grayscale ETHE’s $14.58 million.

Grayscale ETH added $4.58 million while Franklin EZET gained $3.36 million. Overall trading volume in Ethereum ETFs reached $1.53 billion, with total assets of $28.51 billion, representing 5.53% of Ethereum’s market cap. This marks a clear rise compared to previous records.

Market Context

Bitcoin is trading at $115,604 with a market cap of $2.299 trillion, marking a rise from the previous day. Its daily trading volume stands at $49.611 billion. Ethereum is trading at $4,538.89 with a market capitalization of $546.318 billion. Its trading volume has reached $37.171 billion.

Both assets continue to benefit from the growing regulatory environment across the globe. With increasing interest in ETFs and strategic reserves, countries continue to update their framework for cryptocurrency.

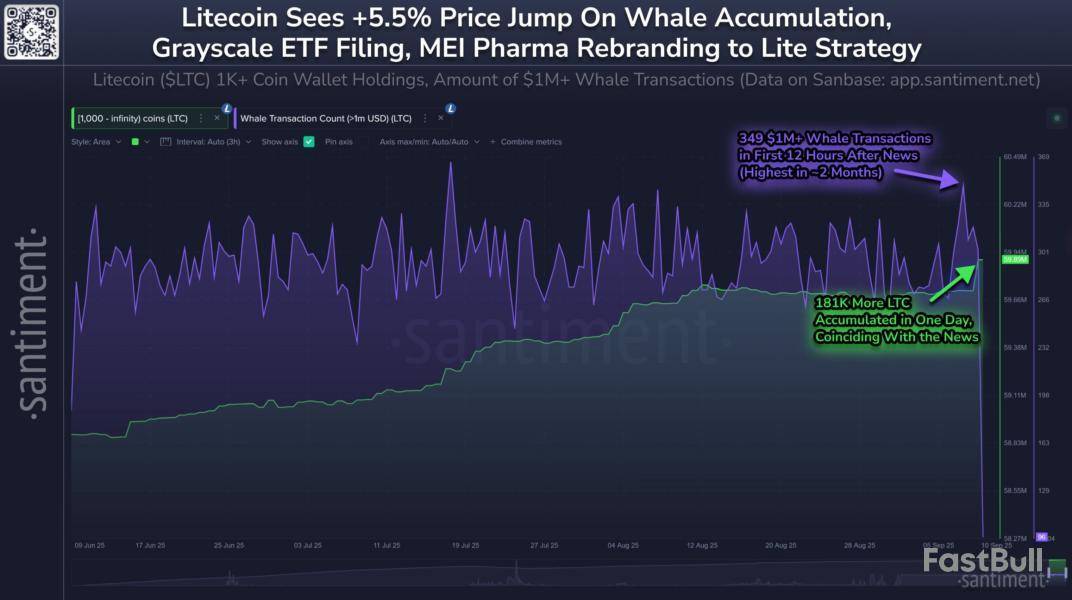

Litecoin has observed a surge in its price as on-chain data shows the whales have participated in a significant amount of buying.

Litecoin Whales Have Added 181,000 LTC To Their Wallets

In a new post on X, on-chain analytics firm Santiment has talked about the latest trend in the holdings of the Litecoin whales. The indicator of interest here is the Supply Distribution, which tells us about the total amount of the LTC supply that a given address group is holding.

Investors or wallets are put into these cohorts based on the number of coins that they are carrying in their balance. The 1 to 10 coins group, for instance, contains all addresses holding between 1 and 10 LTC.

In the context of the current topic, the holders of interest are those who own more than 1,000 tokens of the cryptocurrency. At the current exchange rate, this cutoff converts to around $114,300.

Thus, the only investors qualifying for the cohort would be the big-money ones, popularly known as the whales. This group can hold some degree of influence in the market, so the holdings of its members can be worth keeping an eye on.

Now, here is the chart shared by Santiment that shows the trend in the Litecoin Supply Distribution of the whales over the last few months:

As displayed in the above graph, the Litecoin whales have seen their Supply Distribution shoot up recently, indicating that these large entities have expanded their holdings.

In just one day, this group added 181,000 LTC (worth $20.7 million) to its balance. The buying spree came as LTC saw some bullish news surface. Grayscale has officially filed form S-3 with the US Securities and Exchange Commission (SEC) for their LTC exchange-traded fund (ETF).

If the ETF gets approved, investors will be able to buy LTC-backed shares and gain exposure to the digital asset without having to directly own it.

Another bullish development is related to Mei Pharma, a company that adopted an LTC treasury strategy back in August and secured around $100 million in the token. According to a press release, the pharmaceutical company has decided to rebrand itself as “Lite Strategy.”

The firm notes:

The rebranding to Lite Strategy, Inc. underscores the Company’s commitment to building a long-term corporate strategy around Litecoin (LTC) as our primary reserve asset.

LTC Price

At the time of writing, Litecoin is trading around $114, up more than 4% over the past week.

The countdown to the Fed’s first rate cut of 2025 has begun, and Wall Street is treating it as a done deal. With the decision just 5 days away, the big question isn’t if the Fed will cut, but how much.

A smaller 25bps move seems almost certain, but whispers of a deeper cut are stirring fresh debate. And how will this impact crypto market.

September Cut Locked In

According to a Reuters survey of 107 economists, almost all expect the Fed to cut rates by 25 basis points on September 17, lowering the benchmark range to 4.00%–4.25%. The CME FedWatch Tool supports this outlook, showing a 92.5% probability of the same move.

Only two analysts think the Fed could act more aggressively with a 50 bps cut, but markets are already pricing in chances of deeper easing before the year ends. Most economists now see at least one more cut by December, with total reductions likely between 50–75 basis points.

Looking further ahead, additional cuts in 2026 could bring rates closer to 3.00%. For now, though, the September rate cut is seen as almost certain.

Jobs Take Priority Over Inflation

The shift in certainty comes after weak labor market data pushed many analysts to rethink their outlook. August showed slower job growth, and previous numbers were revised downward, signaling the U.S. economy is cooling faster than expected.

But this time, the Fed appears more worried about jobs than inflation. Chair Jerome Powell and other officials have hinted they are ready to support the labor market, even though inflation still sits slightly above the 2% target.

Michael Gapen, chief U.S. economist at Morgan Stanley, put it simply: “Ignore where inflation is today and ease policy to support the labor market.”

Market Reaction: Crypto and Stocks Soar

Financial markets are already reacting. U.S. stocks have edged higher this week, fueled by expectations of cheaper borrowing costs. Meanwhile cryptocurrency including Bitcoin, have also seen a neary 3% bounce, trading at $115,530 well above the strong resistance level .

Traders say that lower rates reduce financing costs and weaken the U.S. dollar, making Bitcoin and other cryptocurrencies more attractive to global investors.

Crypto analysts add that if easing continues through year-end, the liquidity boost could fuel fresh inflows into Bitcoin ETFs, which have already seen strong demand.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up