Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Ukraine's Oil And Gas Firm Naftogaz Says Russia Attacked Its Facilities In Eastern Poltava Region Overnight

[Polymarket Prediction: "Bitcoin To Rebound To $75K In February" Probability Rises To 64%] February 8Th, As Bitcoin Surged Back Above $70,000, Currently Trading At $70,132. The Probability Of "Bitcoin Rising To $75,000 In February" On Polymarket Has Increased To 64%. Additionally, The Probability Of Rising To $80,000 Is 30%, And The Probability Of Falling To $60,000 Is 37%

[Ethereum Surges Above $2,100, Up 4.06% In 24 Hours] February 8Th, According To Htx Market Data, Ethereum Rebounded And Broke Through $2100, With A 24-Hour Increase Of 4.06%

[Bitcoin Breaks $70,000, 24-Hour Gain 2.1%] February 8, According To Htx Market Data, Bitcoin Broke Through $70,000, With A 24-Hour Growth Of 2.1%

Ukraine President Zelenskiy: He Has Imposed Sanctions Against Some Foreign Manufacturers Of Components For Russian Drones And Missiles

Apk-Inform Cuts Ukraine's 2026/27 Rapeseed Exports To 2.70 Million Tons From 2.96 Million Tons

Apk-Inform Increases Ukraine's 2025/26 Grain Ending Stocks To 11.5 Million Tons From Previous 6.8 Million Tons Due To Lower Exports

Apk-Inform Cuts Ukraine's 2025/26 Barley Export Forecast To 2.0 Million Tons From 2.5 Million Tons

Apk-Inform Cuts Ukraine's 2025/26 Grain Export Forecast To 40.48 Million Tons From Previous 45.18 Million Tons Due To Slow Pace Of Shipments

Russia's Fsb Says Perpetrator And Accomplice In Assassination Attempt On General Alekseyev Detained In United Arab Emirates

China Foreign Ministry: 'Strongly Condemns' The Attack, Supports Pakistan Government Effort To 'Maintain National Security'

Trump: Have Close Partnership With Asfura On Security, Working Together To Counter Cartels And Drug Traffickers, Deporting Illegal Migrants & Gang Members Out Of USA

[Bank Of Canada Governor: Canada Faces Recession If It Loses Cusma Access] Bank Of Canada Governor Tiff Macklem Stated That If Canada Loses Its Preferential Trade Access To The US Through The US-Mexico-Canada Agreement (USMCA), The Canadian Economy Is Likely To Fall Into Recession. However, He Emphasized That Despite Recent Trade Frictions, This Is Not The Bank Of Canada's Baseline Scenario—the Central Bank's Baseline Forecast Still Assumes Canada Will Maintain Its Exempt Status. Under This Assumption, The Central Bank Projects Economic Growth Of 1.1% In 2026 And 1.5% In 2027

South Africa Keen For Access To New European Central Bank Repo Lines: Central Bank Governor Kganyago

Egypt Signs Record Frequencies Deal With Four Telecom Operators Worth About $3.5 Billion - Cabinet

French Foreign Affairs Minister Barrot Acknowledges Resignation Of Former French Culture Minister Jack Lang

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

No matching data

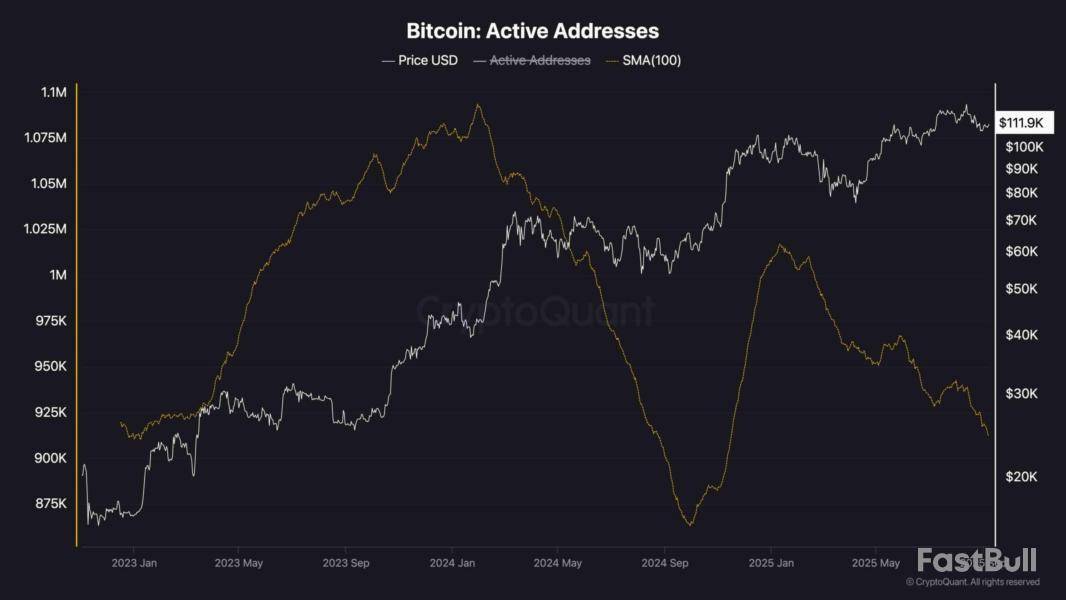

Bitcoin is trading around $112K after showing signs of recovery from recent dips. The charts highlight a potential shift in structure, but on-chain activity reveals a concerning slowdown in network usage, which could weigh on the sustainability of bullish momentum.

By ShayanThe Daily Chart

On the daily chart, BTC is retesting the $112K level after bouncing from the $107K support zone. The price is currently sitting just under the 100-day moving average, which has turned into short-term resistance. The RSI remains weak near 48, suggesting that buyers are present but lack strong conviction.

For now, the $110K area remains the key pivot. If it holds, Bitcoin could aim for $116K and eventually the $124K high. But failure to stay above this zone risks dragging the price back toward $104K, where a larger pool of demand lies.

The 4-hour chart shows a double-bottom pattern forming around $106K, which has triggered a bounce back toward the $112K neckline zone. RSI has climbed toward 59, reflecting stronger short-term momentum as buyers attempt to regain control.

If bulls can break above $112K with volume, the next target is the $117K supply zone. However, repeated rejections here would weaken the structure and possibly push price back toward the $110K region, making it another battleground for short-term traders.

Despite the price stability, active addresses have been trending downward for months and show no signs of meaningful recovery. This decline suggests that retail participation and organic network demand are fading. Fewer active users often indicate that short-term speculation dominates the market, while real adoption and usage slow down.

Behind the scenes, this trend could be explained by several factors: first, increased institutional dominance, where Bitcoin is treated more as a tradable asset than a medium of exchange; second, retail users shifting toward altcoins, DeFi, or stablecoins; and finally, long-term holders moving coins into cold storage, reducing transactional activity on-chain.

This divergence between price strength and weak address activity signals that liquidity is thinner, making BTC more vulnerable to volatility spikes if demand doesn’t return.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up