Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Dollar/Yen Rises 0.2% To 157.5 After Japanese Prime Minister Takaichi's Decisive Election Victory

United Arab Emirates Says Algeria's Cancellation Of Air Services Agreement Between Both Countries Doesn't Result In Any Immediate Impact On Air Traffic Operations

[U.S. Treasury Secretary Yellen: Gold Seems Like A Classic Speculative Sell-Off Rally] February 9Th, According To Market Sources, U.S. Treasury Secretary Yellen Said Gold Is Looking Like A Typical Speculative Sell-Off.

Residential Building Collapses In Lebanese City Of Tripoli, Trapping Unknown Number Of People Under Rubble - Security Sources And Officials

Taiwan President: Look Forward To Cooperating With You So Taiwan And Japan Can Continue To Face Regional Challenges Together And Promote Peace And Prosperity In The Indo-Pacific

Ukraine President Zelenskiy: Russian Energy Infrastructure Is A Legal Target For Ukrainian Strikes

Japan Election: PM Takaichi Says Will Deepen Economic Security Ties With US, Including Concerning Rare Earth Supply, When She Visits Trump In March

Japan Election: PM Takaichi Says Japan's Lethal Arms Export Restrictions Will Be Eased From Current Levels

Japan Finance Minister Katayama: Need To Take Professional Approach As Tapping This Not Easy, When Asked Whether Japan Could Tap Forex Reserves To Fund Tax Cuts, Spending

Russian President Putin Held A Telephone Call With United Arab Emirates President On Saturday - RIA Cites Kremlin

SOMO - Iraq Sets March Basrah Medium Crude Official Selling Price To North And South America At Minus $1.30/Bbl Versus Asci

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

No matching data

Bitcoin has dropped below the $85,000 level as selling pressure returns across the crypto market. After several days of tight consolidation just under the $88K resistance zone, bearish momentum has regained control, dragging prices lower and signaling the end of a short-lived period of stability. The broader financial landscape remains tense, with trade war fears and mounting uncertainty continuing to weigh heavily on risk assets — and Bitcoin is no exception.

Global markets are facing increasing volatility, driven by geopolitical tensions and fragile investor sentiment. As traditional markets falter, the crypto space has followed suit, showing signs of weakness amid macro headwinds. Many traders are now watching for signs of deeper corrections across the board.

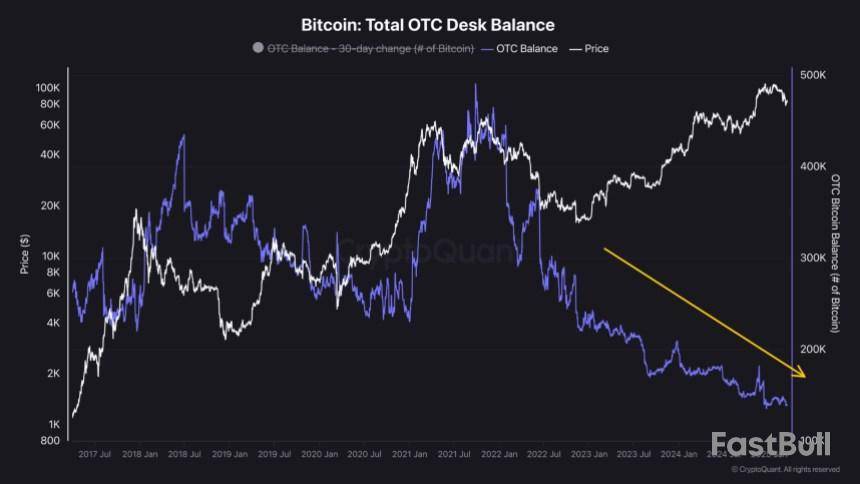

Despite the pullback, there may be a silver lining. According to fresh data from CryptoQuant, OTC (Over-the-Counter) desks are draining at a fast pace. This trend often indicates increased institutional accumulation — as OTC transactions are typically used by larger players to avoid slippage on exchanges. While short-term price action remains bearish, the reduction in OTC supply could be an early signal of long-term confidence building under the surface. For now, Bitcoin must find stability before bulls can attempt a meaningful rebound.

Bitcoin Holds $84K As Analysts Debate Market Direction

Bitcoin is at a critical point, with bulls struggling to reclaim the $90,000 level but managing to hold firm above the $84,000 support zone. This tight range reflects growing uncertainty in the market, as price action stalls and sentiment becomes increasingly divided. Some analysts argue that the bull market has run its course, pointing to fading momentum and macroeconomic pressure as signs that a deeper correction is underway. Others believe that this is simply a healthy pause in a longer-term uptrend, with new all-time highs still ahead.

Top analyst Quinten Francois has weighed in, pointing to a key on-chain metric that may support the bullish case. According to Francois, the total balance held by OTC desks has been steadily draining since January 2022 — a trend that has continued into 2025.

A declining OTC desk balance typically signals increasing demand from large-scale buyers, such as institutions or high-net-worth investors. These desks are used to facilitate large trades off-exchange to avoid slippage, so when their balances trend down, it often means big players are buying directly and moving assets into cold storage or long-term holdings. This can reduce circulating supply and act as a quiet form of accumulation during periods of uncertainty.

While short-term price action remains uncertain, the continued OTC desk outflows suggest that large investors are positioning for long-term gains. For now, all eyes remain on the $84K–$90K range. A breakdown below support could trigger deeper losses, but a breakout above resistance may reignite bullish momentum — especially if institutional interest continues to grow behind the scenes.

BTC Struggles To Reclaim Higher Supply Levels

Bitcoin is trading at $84,100 after losing the 200-day moving average (MA) and exponential moving average (EMA), both of which were positioned around $85,500. This breakdown has weakened the bullish structure and placed BTC in a vulnerable position, with momentum now clearly favoring the bears. For bulls to regain control, they must hold above the $82,500 support level in the coming sessions.

Maintaining this level would signal stability and could pave the way for a rebound toward the key resistance zone between $89,000 and $91,000. Reclaiming that area would be a significant step toward restoring bullish sentiment and potentially reigniting the broader uptrend.

However, if BTC fails to hold above the $82,000 mark, the market could see intensified selling pressure and a sharp drop below $80,000. A break of that psychological level would likely confirm a deeper correction and shift sentiment further in favor of the bears.

With volatility rising and macroeconomic uncertainty still shaking global markets, the next few days will be critical for Bitcoin’s short-term direction. Bulls need to act quickly to avoid further downside and re-establish momentum above the $85K mark.

Featured image from Dall-E, chart from TradingView

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up