Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

On Wednesday (February 11), In Late New York Trading, S&P 500 Futures Ultimately Rose 0.07%, Dow Jones Futures Fell 0.11%, And NASDAQ 100 Futures Rose 0.29%. Russell 2000 Futures Fell 0.30%

Reserve Bank Of Australia Governor Bullock: Board Decided Inflation At 3-Point Something Was Unacceptable

On Wednesday (February 11) At The Close Of Trading In New York (05:59 Beijing Time On Thursday), The Offshore Yuan (CNH) Was Quoted At 6.9095 Against The US Dollar, Up 26 Points From The Close Of Trading In New York On Tuesday. It Traded In The Range Of 6.9195-6.9059 During The Day, Hitting A New Daily Low When The US Non-farm Payrolls Report Was Released

Federal Trade Commission (FTC) Official Ferguson Wrote To Apple CEO Tim Cook Regarding Apple News

On Wednesday (February 11), Spot Silver Rose 4.20% To $84.2080 Per Ounce In Late New York Trading, Continuing Its Upward Trend Since The Start Of The Asian Session, Reaching A Daily High Of $86.3058 At 8:00 PM Beijing Time. Comex Silver Futures Rose 4.42% To $83.935 Per Ounce. Comex Copper Futures Rose 1.27% To $5.9885 Per Pound. Spot Platinum Rose 2.48%, And Spot Palladium Rose 0.61%

Cleveland Fed President Hammack: US Government Debt Is On Unsustainable Path, Must Be Dealt With

On Wednesday (February 11), Spot Gold Rose 1.06% To $5,078.98 Per Ounce In Late New York Trading. It Reached A Daily High Of $5,119.30 At 8:00 PM Beijing Time, Before Plunging To A Daily Low Of $5,020.28 Following The Release Of The US Non-farm Payrolls Report, Continuing To Test The Psychological Level Of $5,000 Since January 30. Comex Gold Futures Rose 1.48% To $5,105.43 Per Ounce

US President Trump: I Hope There Won't Be Any New Wind Farms Approved During My Four-year Term

USA Secretary Of Energy Chris Wright Says USA Sees Dramatic Increase In Oil, Gas, Power Production In Venezuela This Year

The 2-year US Treasury Yield Rose Approximately 5.8 Basis Points On Non-farm Payrolls Day. In Late New York Trading On Wednesday (February 11), The Yield On The Benchmark 10-year US Treasury Note Rose 2.77 Basis Points To 4.1704%, Trading Within A Range Of 4.1170%-4.2041% During The Day. It Maintained A Slight Decline Before The Release Of The Non-farm Payrolls Report At 21:30 Beijing Time, Hitting A New Daily Low One Minute Before The Data Release, Before Gapping Up And Quickly Reaching A New Daily High. The 2-year US Treasury Yield Rose 5.79 Basis Points To 3.5099%, Trading Within A Range Of 3.4415%-3.5472% During The Day. After The Release Of The Non-farm Payrolls Report, It Also Rose From Around 3.45% And Quickly Reached A New Daily High

USA Secretary Of Energy Chris Wright Says President Trump Committed To Transforming Relationship With Venezuela

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. YieldA:--

F: --

P: --

Mexico Industrial Output YoY (Dec)

Mexico Industrial Output YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Dec)

Brazil PPI MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Russia Trade Balance (Dec)

Russia Trade Balance (Dec)A:--

F: --

P: --

U.S. Average Weekly Working Hours (SA) (Jan)

U.S. Average Weekly Working Hours (SA) (Jan)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Jan)

U.S. Private Nonfarm Payrolls (SA) (Jan)A:--

F: --

U.S. Manufacturing Employment (SA) (Jan)

U.S. Manufacturing Employment (SA) (Jan)A:--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Jan)

U.S. Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

U.S. Average Hourly Wage MoM (SA) (Jan)

U.S. Average Hourly Wage MoM (SA) (Jan)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Jan)

U.S. U6 Unemployment Rate (SA) (Jan)A:--

F: --

P: --

U.S. Average Hourly Wage YoY (Jan)

U.S. Average Hourly Wage YoY (Jan)A:--

F: --

U.S. Unemployment Rate (SA) (Jan)

U.S. Unemployment Rate (SA) (Jan)A:--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Jan)

U.S. Nonfarm Payrolls (SA) (Jan)A:--

F: --

Canada Building Permits MoM (SA) (Dec)

Canada Building Permits MoM (SA) (Dec)A:--

F: --

U.S. Employment Benchmark (Not SA)

U.S. Employment Benchmark (Not SA)A:--

F: --

P: --

U.S. Employment Benchmark (SA)

U.S. Employment Benchmark (SA)A:--

F: --

P: --

U.S. Government Employment (Jan)

U.S. Government Employment (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)A:--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. Budget Balance (Jan)

U.S. Budget Balance (Jan)A:--

F: --

P: --

FOMC Member Hammack Speaks

FOMC Member Hammack Speaks Japan Domestic Enterprise Commodity Price Index MoM (Jan)

Japan Domestic Enterprise Commodity Price Index MoM (Jan)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Jan)

Japan Domestic Enterprise Commodity Price Index YoY (Jan)--

F: --

P: --

Japan PPI MoM (Jan)

Japan PPI MoM (Jan)--

F: --

P: --

Australia Consumer Inflation Expectations (Feb)

Australia Consumer Inflation Expectations (Feb)--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Jan)

U.K. 3-Month RICS House Price Balance (Jan)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Dec)

U.K. Monthly GDP 3M/3M Change (Dec)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Trade Balance (Dec)

U.K. Trade Balance (Dec)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Dec)

U.K. Trade Balance Non-EU (SA) (Dec)--

F: --

P: --

U.K. Manufacturing Output MoM (Dec)

U.K. Manufacturing Output MoM (Dec)--

F: --

P: --

U.K. Construction Output MoM (SA) (Dec)

U.K. Construction Output MoM (SA) (Dec)--

F: --

P: --

U.K. Services Index YoY (Dec)

U.K. Services Index YoY (Dec)--

F: --

P: --

U.K. Industrial Output YoY (Dec)

U.K. Industrial Output YoY (Dec)--

F: --

P: --

U.K. Services Index MoM (SA) (Dec)

U.K. Services Index MoM (SA) (Dec)--

F: --

P: --

U.K. Construction Output YoY (Dec)

U.K. Construction Output YoY (Dec)--

F: --

P: --

U.K. GDP MoM (Dec)

U.K. GDP MoM (Dec)--

F: --

P: --

U.K. Industrial Output MoM (Dec)

U.K. Industrial Output MoM (Dec)--

F: --

P: --

U.K. Trade Balance (SA) (Dec)

U.K. Trade Balance (SA) (Dec)--

F: --

P: --

U.K. Manufacturing Output YoY (Dec)

U.K. Manufacturing Output YoY (Dec)--

F: --

P: --

U.K. Trade Balance EU (SA) (Dec)

U.K. Trade Balance EU (SA) (Dec)--

F: --

P: --

U.K. GDP YoY (SA) (Dec)

U.K. GDP YoY (SA) (Dec)--

F: --

P: --

U.K. GDP Revised YoY (Q4)

U.K. GDP Revised YoY (Q4)--

F: --

P: --

U.K. GDP Revised QoQ (Q4)

U.K. GDP Revised QoQ (Q4)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report South Africa Gold Production YoY (Dec)

South Africa Gold Production YoY (Dec)--

F: --

P: --

South Africa Mining Output YoY (Dec)

South Africa Mining Output YoY (Dec)--

F: --

P: --

India CPI YoY (Jan)

India CPI YoY (Jan)--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)--

F: --

P: --

Brazil Services Growth YoY (Dec)

Brazil Services Growth YoY (Dec)--

F: --

P: --

No matching data

Nu de crypto markt zich in een moeilijke fase bevindt gaan investeerders op zoek naar alternatieve cryptocurrency’s die wel in staat zijn om goede resultaten neer te zetten. Hieronder gaan we daarom verder in op de drie beste crypto met potentie om vandaag te kopen.

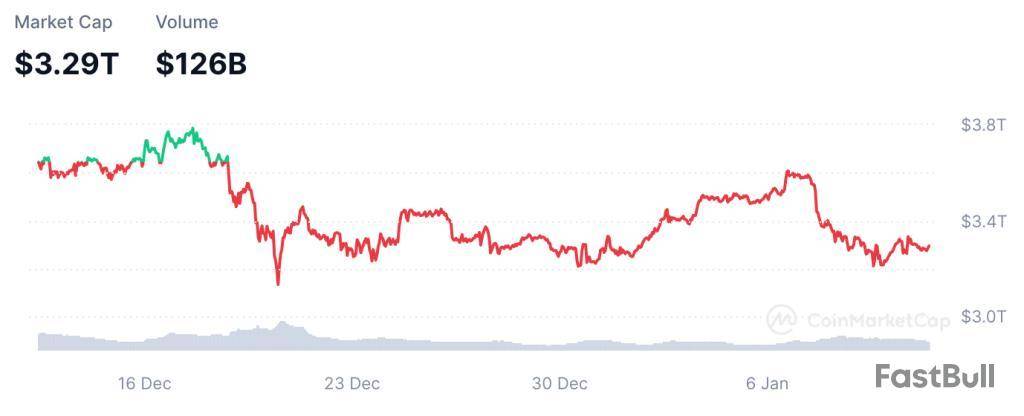

De crypto markt is rood vandaag. Met een totale market cap van $3,29 miljard is de crypto markt nu iets meer dan 0,8% gedaald sinds gisteren. Vier dagen geleden bevond deze market cap zich nog boven de $3,60 miljard.

Een van de belangrijkste redenen achter de recente prestaties van de crypto markt is Bitcoin. Bitcoin is er namelijk nog altijd niet in geslaagd om een waarde boven de $100.000 vast te houden. Bitcoin was op 7 januari nog in staat was om kort boven de $102.000 uit te stijgen. Diezelfde dag moest het echter weer een daling tot onder de $97.000 accepteren.

Sinds 7 januari heeft Bitcoin zich vooral zijwaarts bewogen met als gevolg de huidige waarde van rond de $94.300. De markt lijkt nu vooral de inauguratie van Trump af te wachten. De hoop is dat zijn beleidsveranderingen een positieve invloed kunnen uitoefenen op de crypto markt.

Maar waarom wachten tot 20 januari als er vandaag al meerdere kansen zijn te vinden binnen de crypto markt? Hieronder beschrijven we drie kleine crypto’s die ondanks de moeilijke fase van de crypto markt veel potentie met zich meebrengen.

Welke crypto kopen vandaag? Wall Street Pepe is een van de beste opties van vandaag

Pepe coin is nog altijd een van de beste meme coins van dit moment, en wat nou als je de virale Pepe coin combineert met de trading strategieën van de Wolf of Wall Street? Dan krijg je Wall Street Pepe, een nieuw crypto project dat de nodige potentie met zich meebrengt. Dit project probeert de kleine trader een eerlijke kans te geven tegen de grote whales en financiële instituten.

Door de kleine particuliere trader te voorzien van exclusieve trading inzichten en strategieën hoopt het deze groep investeerders een voordeel te geven over de rest van de markt. Het doel van Wall Street Pepe is dan ook om van zijn Wepe Army de volgende golf van rijke investeerders te maken. Word nu onderdeel van Wall Street Pepe en grijp jouw kans om een voordeel te behalen over de grote whales van de crypto markt.

Wall Street Pepe wordt aangedreven door de native WEPE token, een token die op dit moment te koop is tijdens zijn presale fase. Deze presale heeft nu al meer dan $ 45 miljoen aan investeringen opgehaald. Een indrukwekkend bedrag dat aangeeft hoeveel aandacht er al is voor dit project. Tokens kosten op dit moment $ 0,00036645 per stuk, maar deze prijs zal binnen korte tijd verder gaan stijgen. Grijp vandaag dus je kans om goedkoop WEPE tokens te kopen.

Bezoek Wall Street Pepe Presale

Ontdek de eerste Solana Layer 2 blockchain van Solaxy

De Solana blockchain is hard op weg om de grootste blockchain van de crypto markt te worden. De efficiëntie en snelheid waren een aantal van de functies die Solana al snel populair maakten. Deze snelle groei in omvang komt echter ook met zijn nadelen. Solana heeft namelijk steeds vaker te maken met gefaalde transacties, overvolle transactiekanalen, een toename in tarieven en een afname in snelheden. Met de introductie van Solaxy wordt hier nu echter verandering in aangebracht.

Solaxy is verantwoordelijk voor de eerste Layer 2 blockchain van Solana. Deze Layer 2 oplossing moet de belangrijkste problemen van Solana op gaan lossen. Tegelijkertijd probeert Solaxy ook de liquiditeit van de Ethereum blockchain te combineren met de efficiëntie van Solana. Op deze manier biedt het zijn gebruikers dus nog meer voordelen en mogelijkheden.

De presale van de native $SOLX token geeft gebruikers nu een kans om vroegtijdig in te stappen bij dit project, tegen de laagste mogelijke prijs. Omdat de prijs van $SOLX tokens in elke fase van de presale stijgt zullen gebruikers er dus snel bij moeten zijn. Een investeerder die vandaag nog instapt kan ook meteen al beginnen met het staken van zijn $SOLX tokens en op die manier extra winsten realiseren. $SOLX tokens kosten op dit moment $ 0,001596 per stuk in een presale die al bijna $ 10 miljoen aan investeringen heeft opgebracht.

Bezoek Solaxy Presale

De toekomst van de crypto wallet industrie?

Het is geen verrassing dat de industrie van crypto wallets hard aan het groeien is. Nadat de crypto eind 2024 een opleving doormaakte, is er ook steeds meer vraag naar crypto gerelateerde functies ontstaan. Met Best Wallet is er nu echter een project op de markt verschenen dat de crypto wallet industrie op zijn kop kan gaan zetten. Dit project biedt namelijk veel meer aan dan een simpele crypto wallet; het biedt een volledig multi-chain, multi-wallet platform aan.

Het doel van Best Wallet is om voor het einde van 2026 maar liefst 40% van de crypto wallet industrie in handen te hebben. Door zijn multi-chain, multi-wallet platform in combinatie met de Fireblocks MPC-CMP wallet technologie is dit een zeer realistisch doel. Dit allesomvattende platform geeft zelfs nieuwkomers het vertrouwen dat nodig is om succesvol te zijn binnen de crypto markt.

Best Wallet wordt aangedreven door de native $BEST token, een token die veel voordelen met zich meebrengt. Token houders komen namelijk in aanmerking voor gereduceerde transactietarieven, vroege toegang tot nieuwe projecten, hogere stakingsbeloningen en zeggenschap binnen het bestuur. Om $BEST tokens te kopen tijdens de presale moet je naar de Upcoming Tokens pagina van Best Wallet gaan. Dit is ook de plek waar alle nieuwe tokens op gelanceerd worden zodra het Best Wallet platform live gaat.

Bezoek Best Wallet Presale

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up