Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

WTI Crude Oil Futures For March Delivery Closed At $65.42 Per Barrel. Nymex Natural Gas Futures For March Delivery Closed At $3.9180 Per Million British Thermal Units (MMBtu). Nymex Gasoline Futures For February Delivery Closed At $1.92 Per Gallon, And Nymex Heating Oil Futures For February Delivery Closed At $2.5854 Per Gallon

United Nations Spokesperson Says Secretary General ' Deeply Concerned' By Continued Escalation Of Violence In South Sudan

New York Fed Accepts $2.852 Billion Of $2.852 Billion Submitted To Reverse Repo Facility On Jan 29

US President Trump Claimed That He Would Add Somali Pirates To The List Of "drug-snatching Vessels"

US. Defense Secretary On Iran: They Have All The Options To Make A Deal But We Will Be Prepared To Deliver

LME Copper Rose $532 To Settle At $13,618 Per Tonne. LME Aluminum Fell $38 To Settle At $3,218 Per Tonne. LME Zinc Rose $48 To Settle At $3,412 Per Tonne. LME Lead Fell $3 To Settle At $2,014 Per Tonne. LME Nickel Rose $99 To Settle At $18,369 Per Tonne. LME Tin Fell $869 To Settle At $55,084 Per Tonne. LME Cobalt Was Unchanged At $56,290 Per Tonne

According To Sources, Officials In U.S. President Trump's Administration Met With Separatist Groups In Alberta, A Major Oil-producing Province In Canada

The U.S. Senate Agriculture Committee Is Advancing The Legislative Process For Its Own Version Of A Digital Asset Market Architecture. Under This Proposal, The Commodity Futures Trading Commission (CFTC) Is Expected To Become The Primary Regulator Of The Digital Asset Industry

Spot Gold Briefly Exhibited A V-shaped Trend, Currently Down 0.8%, Returning Above $5370. Before 23:00 Beijing Time, It Experienced A Sharp Drop, Hitting A Daily Low Of $5106.21 At 23:36

European Commission Forecasts EU Rapeseed Imports In 2025/26 At 5.5 Million T Versus 5.5 Million T Last Month

European European Commission Forecasts EU Rapeseed Usable Production In 2025/26 At 20.1 Million T Versus 20.2 Million T Last Month

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)A:--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)A:--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)A:--

F: --

P: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)A:--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)A:--

F: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)A:--

F: --

Euro Zone Economic Sentiment Indicator (Jan)

Euro Zone Economic Sentiment Indicator (Jan)A:--

F: --

Euro Zone Consumer Inflation Expectations (Jan)

Euro Zone Consumer Inflation Expectations (Jan)A:--

F: --

P: --

Italy 5-Year BTP Bond Auction Avg. Yield

Italy 5-Year BTP Bond Auction Avg. YieldA:--

F: --

P: --

Italy 10-Year BTP Bond Auction Avg. Yield

Italy 10-Year BTP Bond Auction Avg. YieldA:--

F: --

P: --

France Unemployment Class-A (Dec)

France Unemployment Class-A (Dec)A:--

F: --

P: --

South Africa Repo Rate (Jan)

South Africa Repo Rate (Jan)A:--

F: --

P: --

Canada Average Weekly Earnings YoY (Nov)

Canada Average Weekly Earnings YoY (Nov)A:--

F: --

U.S. Nonfarm Unit Labor Cost Final (Q3)

U.S. Nonfarm Unit Labor Cost Final (Q3)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Trade Balance (Nov)

U.S. Trade Balance (Nov)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

Canada Trade Balance (SA) (Nov)

Canada Trade Balance (SA) (Nov)A:--

F: --

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)A:--

F: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)A:--

F: --

U.S. Unit Labor Cost Revised MoM (SA) (Q3)

U.S. Unit Labor Cost Revised MoM (SA) (Q3)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

B HODL Plc, a new British firm founded to accumulate and generate revenue from bitcoin in its treasury, listed on the Aquis Stock Exchange in London on Monday after raising approximately £15.3 million ($20.7 million) to embark on its strategy.

The company's shares began trading on the AQSE Growth Market at 8 a.m. local time under the ticker "HODL." Aquis is a UK exchange for small and mid-sized growth firms, with fewer than 100 listings and a total market capitalization below £5 billion ($6.8 billion) — a low-cost alternative to the London Stock Exchange, but far smaller and less liquid.

Ahead of the listing, B HODL raised a total of £15.3 million ($20.7 million) before expenses through the issue of 109,537,520 new ordinary shares at £0.14 ($0.19) each. This includes a previously announced £13.3 million ($18 million) from a direct subscription for 95,251,802 shares and an additional £2 million ($2.7 million) from an oversubscribed WRAP Retail Offer conducted by Winterflood Securities, which added 14,285,718 shares. The new shares rank equally with existing ordinary shares in all respects, including dividend and distribution rights following exchange admission.

Backed by CoinCorner and Adam Back

The company is headed up by former solicitor and co-founder of the advocacy group Bitcoin Policy UK, Freddie New, as CEO, and is backed by UK bitcoin exchange CoinCorner, which holds 14.3% of issued share capital. CoinCorner CEO Danny Scott serves as Chief Bitcoin Officer and as a director of B HODL.

"We are delighted to welcome a broad base of new shareholders alongside our strategic investors and look forward to this journey together," Scott said in the statement. "Our team has been building in Bitcoin for over a decade, and we are determined to make B HODL the leading UK-listed Bitcoin Company. The hard work of building the future of finance begins now."

Additionally, Blockstream CEO Adam Back is listed as a major shareholder, having acquired over 25.5% of the issued share capital. Back is also set to lead the U.S.-based Bitcoin Standard Treasury Company as CEO once it goes public on the Nasdaq via a merger with Cantor Fitzgerald–backed SPAC Cantor Equity Partners I. BSTR will launch with 30,021 BTC on its balance sheet, placing it in the top-four public bitcoin treasury companies globally, and aims to raise up to $1.5 billion through a mix of equity, convertible notes, and preferred stock.

B HODL's directors aim to build the company into a global player in Bitcoin services, with a focus on Lightning liquidity and infrastructure to support mainstream adoption, according to a statement shared with The Block. The strategy centers on building a substantial bitcoin treasury, with an initial focus on utilizing it to operate highly ranked Lightning nodes, including existing nodes run by CoinCorner. This approach aims to provide scalable liquidity, generating routing fees from Lightning payments. Over time, the company plans to expand and diversify its revenue streams as new opportunities emerge, while continuing to accumulate bitcoin quickly through further issuance of ordinary shares, according to the firm.

“Today's admission is a landmark moment for B HODL," New said in the statement. "We are proud to be the first listed British company dedicated from day one to bitcoin accumulation and revenue generation. The strong support we have received from our new investors, with the WRAP offer upsized and closed early due to demand, underlines the scale of interest in Bitcoin's long-term potential — both as an asset and as a means of payment. With our admission complete, we can now focus on building our bitcoin treasury and deploying it productively through Lightning infrastructure. We believe this strategy positions us at the heart of Bitcoin's next phase of growth, and we are excited to be commencing this journey with all our stakeholders."

UK bitcoin treasury companies on the rise

While U.S. firms, led by Michael Saylor's Strategy, continue to dominate corporate bitcoin acquisitions, the number of BTC treasury companies in the UK is also on the rise.

The Smarter Web Company is the largest of more than a dozen UK firms that have adopted or plan to adopt a bitcoin treasury strategy, with 2,470 BTC ($278 million). The second-largest is Satsuma Technology with 1,149 BTC ($129 million), and Phoenix Digital Assets is third with 247 BTC ($28 million), according to Bitcoin Treasuries data.

B HODL shares are currently trading for £17.88 ($21) per TradingView.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Japanese Bitcoin treasury firm Metaplanet has deepened its crypto bet with its biggest purchase yet after adding 5,419 BTC for roughly $632.5 million at an average price of $116,724.

The move has boosted the company’s total holdings to 25,555 BTC, which were accumulated for about $2.71 billion at an average cost of $106,065 per BTC, according to CEO Simon Gerovich.Metaplanet’s Bitcoin Hoard Expands

Metaplanet’s aggressive accumulation strategy has delivered a whopping 395.1% year-to-date BTC yield in 2025. With this purchase, the Tokyo-listed firm now ranks as the fifth-largest public corporate BTC holder, overtaking Bullish and trailing only Michael Saylor’s Strategy, Marathon Digital, XXI, and Bitcoin Standard Treasury Company, according to the data compiled by Bitcoin Treasuries.

Metaplanet hasintensifiedits Bitcoin acquisition strategy after boosting its year-end target from 10,000 to 30,000 BTC. To support this goal, the company raised $837 million via international share offerings, of which the bulk of the funds were allocated for purchases scheduled in September and October.

Building on this momentum, the firm disclosed plans to generate $1.4 billion through the issuance of 385 million new shares, earmarked entirely for additional BTC acquisitions.

Last week, the company also announced the launch of Metaplanet Income Corp., a Miami-based US subsidiary with an initial capital of $15 million. The subsidiary is designed to focus on Bitcoin income generation and derivatives trading, thereby creating a clear separation from Metaplanet’s core BTC holdings. Leadership responsibilities will be shared between CEO Gerovich, Dylan LeClair, and Darren Winia.

According to the firm, this organizational structure will allow revenue-generating activities to operate efficiently while having minimal impact on consolidated financial statements for the fiscal year ending December 31.Weathering Bitcoin Turbulence

The latest announcement comes as Bitcoin rattled markets heading into the final week of September and retreated to $112,000. The sharp pullback triggered more than $1 billion in liquidations of crypto long positions, as it marked the largest single liquidation event of 2025 to date.

Meanwhile, Metaplanet’s stock fell 3.12% to $3.98 during Monday’s session in Japan, according to the Yahoo Finance data. The stock showed significant intraday volatility. Despite this, it remains up almost 70% year-to-date.

The cryptocurrency market faced a brutal shake-up as Bitcoin slipped below the $115,000 mark and Ethereum dropped under $4,500, erasing weeks of bullish momentum. What started as a period of cautious optimism quickly turned into a wave of panic selling, leaving bulls struggling to regain control. The sharp correction has pushed the market into a new, uncertain phase where confidence is being tested, and short-term volatility is dominating sentiment.

Top analyst Maartunn highlighted one of the key drivers behind the downturn: an overleveraged derivatives market. In the last 24 hours alone, the crypto market witnessed $597 million in BTC and ETH long liquidations, marking one of the heaviest waves of forced selling in recent months. This liquidation wipeout serves as a harsh reminder to tradersof the risks of excessive leverage in a market that can turn abruptly.

The selloff also underscores the fragile balance between bullish enthusiasm and macroeconomic uncertainty. With central banks recalibrating policy and liquidity conditions tightening, crypto faces a complex environment. As prices test lower support levels, the coming days will reveal whether this correction is a temporary shakeout or the beginning of a deeper phase of market revaluation.

Liquidations Trigger Speculation on Crypto’s Next Phase

According to Maartunn, the past 24 hours delivered one of the harshest blows to overleveraged traders this year. Data shows that $189 million in Bitcoin longs were liquidated, alongside an even larger $408 million in Ethereum longs, bringing the total wiped out positions close to $600 million. This wave of liquidations happened within hours, highlighting just how fragile sentiment can be when leverage builds up across major assets.

The sudden sell-off sent shockwaves through the market, forcing bulls to retreat as Bitcoin slipped under the $115K level and Ethereum dropped below $4,500. Traders who had built aggressive long positions in anticipation of continued upside quickly found themselves on the losing side, as cascading liquidations amplified the decline. Such events are not uncommon in crypto, but the size and speed of this move have left investors reassessing the short-term landscape.

Now, speculation is heating up about what comes next. Some analysts argue this was nothing more than a leverage reset, a necessary purge to clear excessive speculation and allow the market to build a healthier foundation for the next leg upward. Others are less optimistic, viewing the event as a potential trigger for a corrective stage, where broader selling pressure could drag prices lower before any recovery.

What’s clear is that the market has entered a new phase of uncertainty. Investors are watching closely for whether fresh demand steps in to stabilize prices, or if further selling pressure forces a deeper pullback. Until clarity emerges, volatility is likely to dominate.

Total Crypto Market Cap Analysis

The total cryptocurrency market cap has experienced a sharp pullback, currently sitting around $3.83 trillion after a 3.3% daily decline. The chart highlights the rejection near the $4 trillion mark, a key psychological resistance level that has repeatedly capped upward moves in recent weeks. Despite this setback, the market remains well above its medium-term supports, suggesting the broader uptrend is still intact.

Looking at the moving averages, the 50-day SMA (~$3.87T) is being tested, and a decisive close below could open the door to further downside toward the 100-day SMA (~$3.68T). However, as long as the market holds above this zone, the bullish structure remains valid. The 200-day SMA (~$3.31T) continues to provide a strong foundation for the longer-term trend, showing that the bull market context remains strong.

This recent drop reflects the heavy liquidations across BTC and ETH longs, which have rippled through altcoins, increasing volatility across the board. If the market stabilizes above $3.8T, it could set the stage for another attempt at breaking $4T. Conversely, a deeper breakdown below $3.7T may shift momentum, signaling a potential corrective phase in the short term.

Featured image from Dall-E, chart from TradingView

South Korean authorities flagged a record number of suspicious crypto transactions this year, with total numbers reportedly already surpassing combined figures from the past two years.

Citing Financial Intelligence Unit (FIU) data provided to Representative Jin Sung-joon and the Korea Customs Service (KCS) statistics, Yonhap News reported that local virtual asset service providers (VASPs) filed 36,684 suspicious transaction reports (STRs) between January and August 2025.

STRs are one of South Korea’s core Anti-Money Laundering (AML) tools. Under the country’s laws, financial institutions, casinos and VASPs must file STRs when they have reasonable grounds to suspect that the funds involve criminal proceeds, money laundering or terrorist financing.

According to the data, the STRs filed between January and August exceed the combined totals of 2023 and 2024, when STRs were 16,076 and 19,658, respectively. It also dwarfs 2021, which had 199 cases and 2022, which had 10,797.

Authorities eye illegal foreign remittances and stablecoins

South Korean officials said a majority of the flagged transaction flows involve “hwanchigi,” or illegal foreign exchange remittances. In these cases, criminal proceeds are converted into crypto using offshore platforms. These are then routed into domestic exchanges and then cashed out in won.

From 2021 through August 2025, the KCS referred $7.1 billion worth of crypto-linked crimes to prosecutors, with $6.4 billion (about 90%) tied to hwanchigi schemes.

In May, customs officials uncovered an underground broker accused of using the Tether stablecoin to illegally move around $42 million between South Korea and Russia. Two Russian nationals were accused of carrying out over 6,000 illegal transactions between January 2023 and July 2024.

Because of cases like these, Jin urged agencies like the KCS and the FIU to strengthen effective enforcement to track criminal funds and block disguised remittances.

The official said the government agencies must establish systematic countermeasures against new types of foreign exchange crimes.

A global policy concern

South Korea’s numbers show a broader policy dilemma facing regulators across the globe. While stablecoins and digital currencies offer faster and cheaper payments, they also create new channels for illicit flows.

The European Union’s Markets in Crypto-Assets (MiCA) regulation addresses illicit cross-border transaction risks by requiring issuers to be licensed to ensure transparency.

It also caps large stablecoin volumes. MiCA limits stablecoin transfers to one million transactions per day or a notional value of 200 million euros per day.

In 2021, the European Central Bank’s policymakers floated the idea of limiting digital euro holdings to 3,000 euros per person to prevent unchecked foreign exchange activity.

In 2023, the Bank of England floated setting individual caps on digital pounds between 10,000 ($13,558) and 20,000 British pounds. However, UK crypto groups slammed the approach, saying these limits don’t work in practice.

With over $1 billion liquidated across exchanges in less than 60 minutes, the cryptocurrency market just saw one of the most brutal hours of 2025. Fears of one of the biggest coordinated sell-offs of the year have been aroused by the abrupt wave of forced position closures that has affected major cryptocurrencies, a wave of market-wide liquidation.

Rare but not unheard of, these kinds of liquidity events typically occur when overly leveraged long positions are wiped out during sharp price drops. It is clear from the sharp red candles displayed by Bitcoin, Ethereum and Shiba Inu that no significant asset was spared by the liquidation wave. Chart by TradingView">

Will this be 2025’s worst bloodbath?

Hourly liquidations of $1 billion are severe, but they are still below the $1.06 billion liquidation spike that occurred in early 2025. However, the move’s timing and scope, affecting both altcoins and top caps, make it a crucial stress test for market sentiment.

Deeper instability may result from a recurrence if leveraged trading keeps taking the lead. As volatility continues to be high, the carnage highlights the dangers of overexposure and the necessity of cautious positioning.

TL;DR

Key Levels to Watch

XRP is trading around $2.8, holding just above the 50 EMA on the 3-day chart. The moving average is projected to meet the price at $2.77, making it the next level to watch. Analyst EGRAG CRYPTO said,

“If we break through this target, we could see further downside, which isn’t what we want to hear.”

Notably, the $2.77 support is short-term, while $2.65 remains the most critical area for the broader trend. This level has been a pivot in past cycles. A hold above $2.65 keeps the higher timeframe outlook intact. If it fails, further supports are seen at $2.50, $2.37–$2.41, and $1.85 at the 200 EMA.Throw Back Phase Confirmed

EGRAG also noted that XRP has completed a 5-wave downside move, with the asset reaching $2.82. He described this as the “Throw Back Process,” confirming a projection they made earlier. The move followed rejection at $3.13, which has acted as a strong resistance point.

Support remains at $2.82, with a possible retest of $2.65 if selling pressure continues. On the upside, a recovery above $2.94, where the 21 EMA and 33 SMA converge, would be the first step toward stabilization. If achieved, XRP could then test $3.13 and $3.40.Signs of Accumulation

Analyst Erica Hazel pointed to buying activity, stating, “76% of traders are long (Binance L/S ratio 3.34),” with more than $66 million in outflows over the past two days. She suggested that larger players may be positioning for higher prices.

Hazel added that XRP recently broke out of a descending trendline in place since mid-July. The retest of $2.95 held, confirming it as support. As long as the asset holds above $2.95 and $2.85, the bullish setup remains valid.

XRP faces resistance at $2.96 and $3.13. A move above these levels could open the way to $3.31. The next major test sits at $3.64, which Hazel said,

$XRP is grinding higher after retesting $2.95 support.

• 76% of traders are long (Binance L/S ratio 3.34) • $66M+ outflows in 48h = clear accumulation • RSI neutral at 54, EMA still holding

Next key test: $3.64 resistance. Break it, and bulls take full control.#XRP #Ripple pic.twitter.com/4GBY5wfuaV

— Erica Hazel (@Erica__Hazel) September 22, 2025

Situated at 54, this value of RSI suggests a neutral reading and allows space for further movement. The 50-day EMA, however, still ascends after putting in a crossing, providing support for the medium-term trend. Although volatility remains, analysts agree that all-time highs above $2.65 are a prerequisite for maintaining the general bullish outlook.

Crypto is red today but tradeCompass is open to both sides, depending on how price is located in relation to the bullish or bearish tresholds.

Bullish above: $114,050 Bearish below: $113,485 Current price: $112,810 Primary Bias: Bearish while under $113,485

Market Backdrop: Bitcoin and Majors in the Past 24 Hours

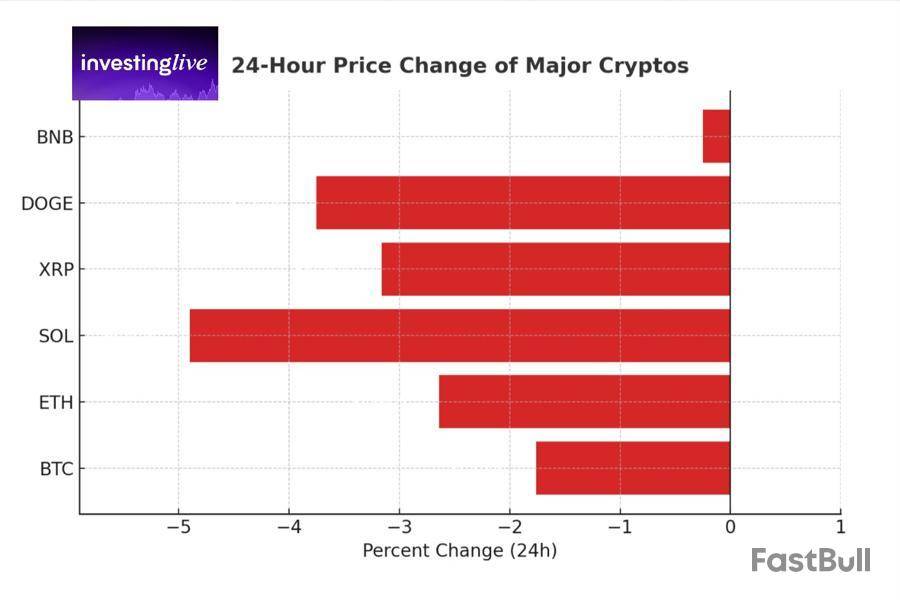

24 hour price change in major cryptos

The last 24 hours have been broadly negative across crypto markets. Bitcoin slipped ~1.8%, Ethereum dropped ~2.6%, and high-beta names underperformed: Solana fell ~4.9%, Cardano lagged, XRP lost ~3.2%, and DOGE ~3.8%. The relative outlier was BNB, which held almost flat (-0.25%), showing resilience compared to peers.

The decline was orderly rather than panicked—no sign of capitulation. Altcoins with higher risk profiles bled harder, a classic risk-off signal. Traders will want to see Bitcoin and Ethereum begin to form higher lows with lighter selling pressure before treating this as anything other than a fade-the-bounce tape.

Bitcoin Technical Analysis: Directional Bias

At the time of this analysis, Bitcoin futures trade at $112,810, directly on today’s Point of Control (POC). With the bearish threshold set at $113,485, price is currently in bearish territory.

That said, intraday retracements back toward $113,400–$113,600 are possible. Some traders may prefer to short closer to that zone for a cleaner entry, while others might scale in—placing a partial short here and saving the bulk of their position for any retrace closer to the threshold.

Bitcoin Analysis for Today: Key Futures Levels and Partial Profit Targets

For bearish setups (shorts): First partial target: $112,875, just above today’s POC, where market flow often slows. Second target: $112,435, overlapping with liquidity pools from September 7–10. Third target: $111,680, matching the September 9 POC. Final target: $111,050, in line with the September 9 VAL and liquidity from September 4–5.

For bullish setups (longs): Activation level: $114,050. First target: $114,330. Second target: $114,745. Third target: $115,560. Final target: $116,000, a potential magnet if buying momentum takes hold.

Educational Corner: POC and Why It Matters in Bitcoin Futures

The Point of Control (POC) highlights the price where the largest trading volume accumulated during the session. It often acts as a market balance line—prices revisit it frequently, and it tends to serve as both support/resistance and a profit-taking magnet. For Bitcoin futures technical analysis, the POC is a vital guidepost because it shows where traders found the most “fair value” during the day.

Trade Management Principles for Bitcoin Technical Analysis

One trade per direction under tradeCompass to avoid overtrading.

After reaching TP2, shift the stop to entry (breakeven) to protect gains and manage the runner.

Stops belong just beyond the entry-side threshold with a small buffer—never beyond the opposite threshold, as that invalidates the trade setup.

Confirmation can be flexible: some traders wait for closes above/below thresholds, others use VWAP retests or intraday higher lows for timing.

Professional Reminder

This Bitcoin analysis for today is designed as a decision support framework. It does not guarantee outcomes and is not financial advice. Futures and crypto markets are volatile, and risk management is essential. Always size positions responsibly. Visit investingLive.com (foremerly ForexLive.com) for additional views. This article was written by Itai Levitan at investinglive.com.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up