Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Swiss National Bank Reports A Profit Of Chf 26.1 Billion For 2025 (2024: Profit Of Chf 80.7 Billion)

[At Least Two Dead In Missile Strike In Iranian Kurdistan Province] On The Morning Of February 2nd Local Time, A Missile Strike Hit The Iranian City Of Sanandaj In Kurdistan Province, Destroying Several Residential Buildings Near The Sanandaj Police Station. The Attack Resulted In The Deaths Of At Least Two Iranian Civilians And Injuries To Several Others

Bank Of Japan Deputy Governor Himino: At Present, We Don't See Asset Price Moves As Showing Risks That Warrant Monetary Policy Response

Bank Of Japan Deputy Governor Himino: Accommodative Monetary Conditions May Be Among Factors Pushing Up Domestic Property, Stock Prices So Must Watch Developments Carefully

[Iranian Military Says It Fired More Missiles At Israel] March 2nd, According To Al Jazeera: Iranian Military Says It Has Launched More Missiles At Israel.

Germany CPI Prelim MoM (Feb)

Germany CPI Prelim MoM (Feb)A:--

F: --

P: --

Germany HICP Prelim MoM (Feb)

Germany HICP Prelim MoM (Feb)A:--

F: --

P: --

Germany CPI Prelim YoY (Feb)

Germany CPI Prelim YoY (Feb)A:--

F: --

P: --

Germany HICP Prelim YoY (Feb)

Germany HICP Prelim YoY (Feb)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Jan)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Jan)A:--

F: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Jan)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Jan)A:--

F: --

P: --

Canada GDP QoQ (SA) (Q4)

Canada GDP QoQ (SA) (Q4)A:--

F: --

P: --

Canada GDP Annualized QoQ (SA) (Q4)

Canada GDP Annualized QoQ (SA) (Q4)A:--

F: --

P: --

Canada GDP YoY (SA) (Q4)

Canada GDP YoY (SA) (Q4)A:--

F: --

P: --

U.S. Core PPI MoM (SA) (Jan)

U.S. Core PPI MoM (SA) (Jan)A:--

F: --

Canada GDP MoM (SA) (Dec)

Canada GDP MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Jan)

U.S. PPI MoM (SA) (Jan)A:--

F: --

U.S. Core PPI YoY (Jan)

U.S. Core PPI YoY (Jan)A:--

F: --

P: --

Canada GDP YoY (Dec)

Canada GDP YoY (Dec)A:--

F: --

P: --

U.S. PPI YoY (Jan)

U.S. PPI YoY (Jan)A:--

F: --

P: --

Canada GDP Deflator QoQ (Q4)

Canada GDP Deflator QoQ (Q4)A:--

F: --

P: --

U.S. Chicago PMI (Feb)

U.S. Chicago PMI (Feb)A:--

F: --

P: --

U.S. Construction Spending MoM (Dec)

U.S. Construction Spending MoM (Dec)A:--

F: --

Canada Federal Government Budget Balance (Dec)

Canada Federal Government Budget Balance (Dec)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

South Korea Trade Balance Prelim (Feb)

South Korea Trade Balance Prelim (Feb)A:--

F: --

Japan Manufacturing PMI Final (Feb)

Japan Manufacturing PMI Final (Feb)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Feb)

Indonesia IHS Markit Manufacturing PMI (Feb)A:--

F: --

P: --

Indonesia Trade Balance (Jan)

Indonesia Trade Balance (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Feb)

Indonesia Core Inflation YoY (Feb)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Feb)

Indonesia Inflation Rate YoY (Feb)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Feb)

India HSBC Manufacturing PMI Final (Feb)A:--

F: --

P: --

Australia Commodity Price YoY (Feb)

Australia Commodity Price YoY (Feb)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Feb)

Russia IHS Markit Manufacturing PMI (Feb)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Feb)

U.K. Nationwide House Price Index MoM (Feb)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Feb)

U.K. Nationwide House Price Index YoY (Feb)--

F: --

P: --

Turkey GDP YoY (Q4)

Turkey GDP YoY (Q4)--

F: --

P: --

Germany Actual Retail Sales MoM (Jan)

Germany Actual Retail Sales MoM (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Feb)

Turkey Manufacturing PMI (Feb)--

F: --

P: --

Italy Manufacturing PMI (SA) (Feb)

Italy Manufacturing PMI (SA) (Feb)--

F: --

P: --

South Africa Manufacturing PMI (Feb)

South Africa Manufacturing PMI (Feb)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Feb)

Euro Zone Manufacturing PMI Final (Feb)--

F: --

P: --

U.K. M4 Money Supply MoM (Jan)

U.K. M4 Money Supply MoM (Jan)--

F: --

P: --

U.K. M4 Money Supply YoY (Jan)

U.K. M4 Money Supply YoY (Jan)--

F: --

P: --

U.K. Mortgage Lending (Jan)

U.K. Mortgage Lending (Jan)--

F: --

P: --

U.K. Mortgage Approvals (Jan)

U.K. Mortgage Approvals (Jan)--

F: --

P: --

U.K. M4 Money Supply (SA) (Jan)

U.K. M4 Money Supply (SA) (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Feb)

U.K. Manufacturing PMI Final (Feb)--

F: --

P: --

India Manufacturing Output MoM (Jan)

India Manufacturing Output MoM (Jan)--

F: --

P: --

India Industrial Production Index YoY (Jan)

India Industrial Production Index YoY (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Feb)

Brazil IHS Markit Manufacturing PMI (Feb)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks Canada Manufacturing PMI (SA) (Feb)

Canada Manufacturing PMI (SA) (Feb)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Feb)

U.S. IHS Markit Manufacturing PMI Final (Feb)--

F: --

P: --

New York Federal Reserve President Williams delivered a speech.

New York Federal Reserve President Williams delivered a speech. U.S. ISM Inventories Index (Feb)

U.S. ISM Inventories Index (Feb)--

F: --

P: --

U.S. ISM Output Index (Feb)

U.S. ISM Output Index (Feb)--

F: --

P: --

Mexico Manufacturing PMI (Feb)

Mexico Manufacturing PMI (Feb)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Feb)

U.S. ISM Manufacturing New Orders Index (Feb)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Feb)

U.S. ISM Manufacturing Employment Index (Feb)--

F: --

P: --

U.S. ISM Manufacturing PMI (Feb)

U.S. ISM Manufacturing PMI (Feb)--

F: --

P: --

RBA Gov Bullock Speaks

RBA Gov Bullock Speaks Japan Unemployment Rate (Jan)

Japan Unemployment Rate (Jan)--

F: --

P: --

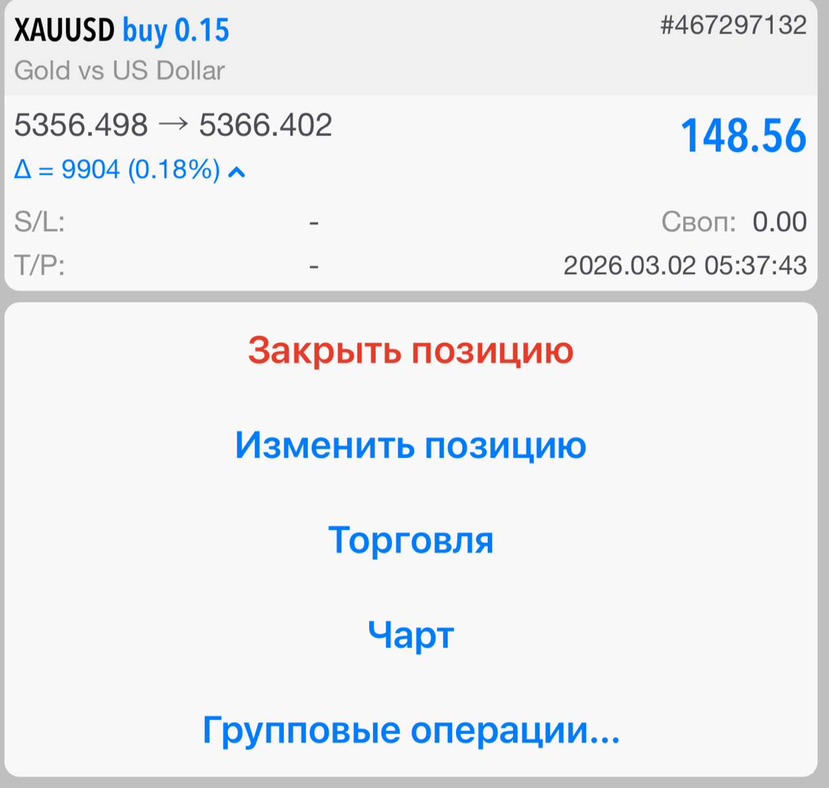

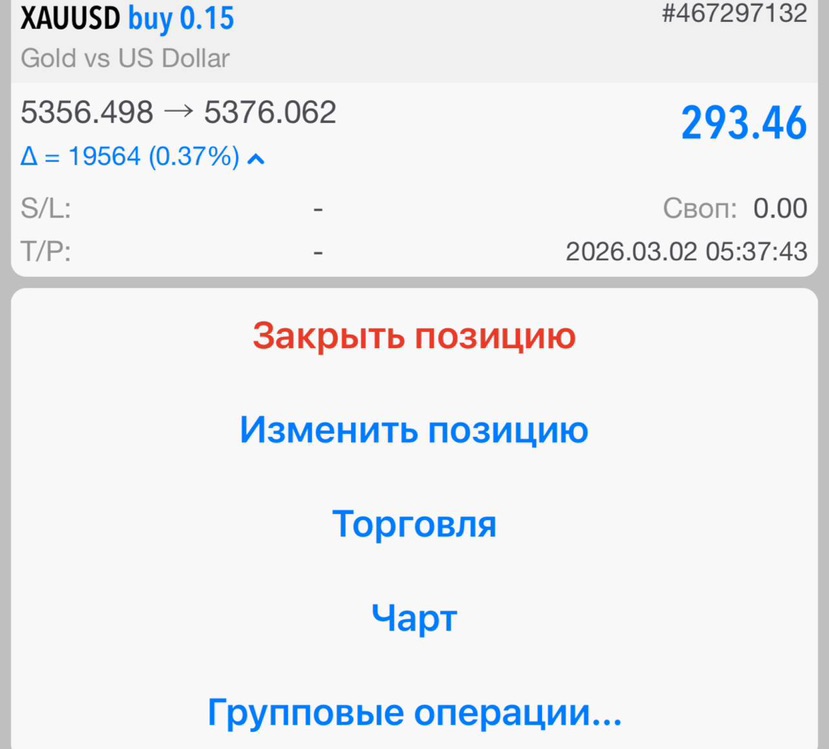

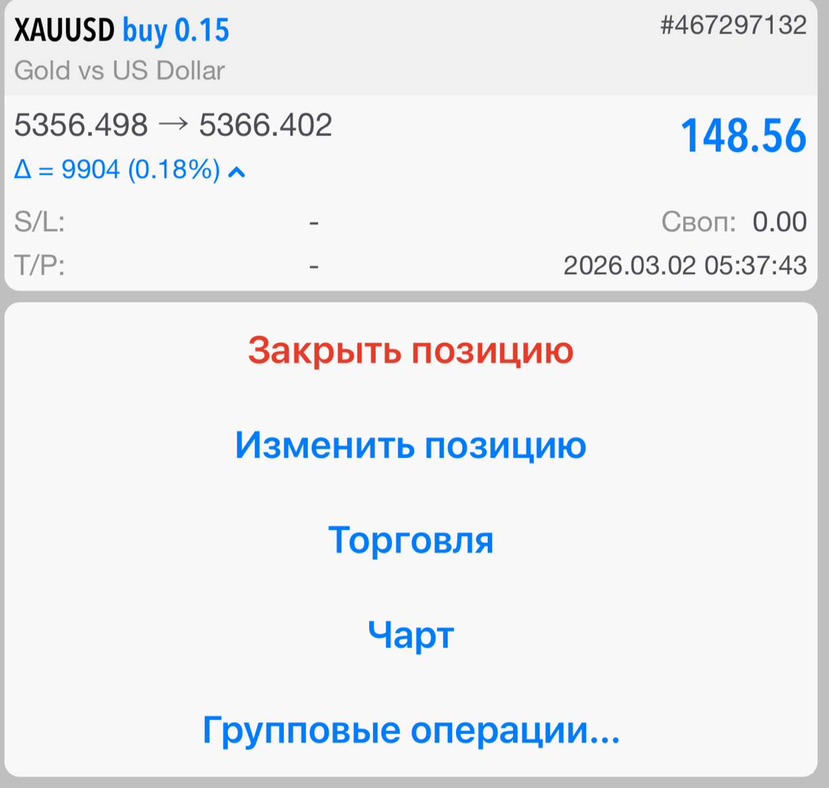

But surely it can fly 6000 for all I care at this point

But surely it can fly 6000 for all I care at this point

No matching data

Arkham Intelligence has unveiled its latest rankings of the world’s largest crypto holders.

Top exchanges, institutions, major protocols, corporations, and early adopters are all in the list, reflecting a diverse mix of players.

In the list, Arkham has grouped wallets that belong to the same person, company, protocol, or exchanges, into entities. This provides a clearer view of an entity’s total holdings and its real influence in the crypto market. Together, these entities control roughly $1.6 trillion in crypto.

The Top Crypto Holders

Binance tops the list with over $209 billion worth of crypto. Right behind is Coinbase, the U.S.-based exchange, with more than $155 billion in crypto. Satoshi Nakamoto, Bitcoin’s pseudonymous creator, stands at number three, with over $125 billion in Bitcoin.

In the top five, is BlackRock, the world’s largest asset manager, with over $100 billion in crypto exposure. Fidelity Custody and Grayscale are in the top 10 with $47.5 billion and $34 billion in crypto holdings. MicroStrategy, the Bitcoin treasury giant has amassed more than $53 billion worth of BTC.

Exchanges, DeFi Protocols, Governments, and Major Crypto Players

South Korea’s leading exchange, Upbit, has over $32 billion in crypto. Major exchanges like OKX, Kraken, and Bitfinex each hold over $30 billion in crypto. Meanwhile, decentralised protocols, Lido and Aave hold nearly $70 billion and over $31 billion in crypto.

Governments are also in the list with the U.S holding about $23 billion in crypto, while the U.K. controls around $6.9 billion. Other notable entities on the list include projects like Pump.fun with $3.3 billion, Mt. Gox with $3.9 billion and key networks such as Polygon with $10.6 billion. The Official Trump Meme also holds over $7 billion in crypto.

Tron founder Justin Sun and Winklevoss Capital also hold over $2 billion each in crypto.

Corporate Crypto Treasuries

Publicly traded companies collectively hold over 1 million BTC. Companies are not just investing in Bitcoin, they are increasingly exploring other cryptocurrencies as well. Ethereum treasuries are also gaining strength with entities now holding 4.91 million ETH. Solana, Dogecoin, and BNB Coin are also held by companies in their treasuries.

This data highlights the growing diversity of crypto holders, from exchanges and DeFi protocols to governments, early investors, and corporate treasuries. While Bitcoin continues to dominate, entities are also diversifying into Ethereum and other tokens.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up