Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Democratic Representative Al Green Was Escorted Out Of The Venue Of President Trump's State Of The Union Address

U.S. Secretary Of State Marco Rubio, Treasury Secretary Bessenter, Commerce Secretary Lutnick, And Other Cabinet Members Entered The U.S. House Of Representatives Chamber

Japanese Prime Minister Sanae Takaichi: We Are Closely Monitoring Foreign Exchange Trends With A High Sense Of Urgency

Reserve Bank Of India: Voluntary Retention Route - Imparting Predictability And Increasing Ease Of Doing Business

Reserve Bank Of India: Reserve Bank Of India Issues Amendment Directions On Lending To Micro, Small & Medium Enterprises (Msme) Sector

Reserve Bank Of India: Reserve Bank Of India Issues Draft Amendment Directions For 'Conduct Of Regulated Entities In Recovery Of Loans And Engagement Of Recovery Agents'

The US 15% global tariff takes effect.

The US 15% global tariff takes effect. U.K. CBI Retail Sales Expectations Index (Feb)

U.K. CBI Retail Sales Expectations Index (Feb)A:--

F: --

P: --

U.K. CBI Distributive Trades (Feb)

U.K. CBI Distributive Trades (Feb)A:--

F: --

P: --

Brazil Current Account (Jan)

Brazil Current Account (Jan)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. FHFA House Price Index (Dec)

U.S. FHFA House Price Index (Dec)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Dec)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Dec)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Dec)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Dec)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Dec)

U.S. S&P/CS 10-City Home Price Index YoY (Dec)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Dec)

U.S. FHFA House Price Index YoY (Dec)A:--

F: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Dec)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Dec)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Dec)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Dec)A:--

F: --

P: --

U.S. FHFA House Price Index MoM (Dec)

U.S. FHFA House Price Index MoM (Dec)A:--

F: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Dec)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Dec)A:--

F: --

P: --

FOMC Member Waller Speaks

FOMC Member Waller Speaks U.S. Richmond Fed Manufacturing Composite Index (Feb)

U.S. Richmond Fed Manufacturing Composite Index (Feb)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Feb)

U.S. Conference Board Present Situation Index (Feb)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Feb)

U.S. Conference Board Consumer Expectations Index (Feb)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Feb)

U.S. Conference Board Consumer Confidence Index (Feb)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Dec)

U.S. Wholesale Sales MoM (SA) (Dec)A:--

F: --

U.S. Richmond Fed Manufacturing Shipments Index (Feb)

U.S. Richmond Fed Manufacturing Shipments Index (Feb)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Feb)

U.S. Richmond Fed Services Revenue Index (Feb)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Jan)

Australia RBA Trimmed Mean CPI YoY (Jan)A:--

F: --

P: --

Australia Construction Work Done YoY (Q4)

Australia Construction Work Done YoY (Q4)A:--

F: --

P: --

Australia Construction Work Done QoQ (SA) (Q4)

Australia Construction Work Done QoQ (SA) (Q4)A:--

F: --

P: --

US President Trump delivers State of the Union address

US President Trump delivers State of the Union address Germany GDP Final QoQ (SA) (Q4)

Germany GDP Final QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Revised YoY (Working-day Adjusted) (Q4)

Germany GDP Revised YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Germany GDP Final YoY (Not SA) (Q4)

Germany GDP Final YoY (Not SA) (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Mar)

Germany GfK Consumer Confidence Index (SA) (Mar)--

F: --

P: --

RBA Gov Bullock Speaks

RBA Gov Bullock Speaks Euro Zone Core HICP Final MoM (Jan)

Euro Zone Core HICP Final MoM (Jan)--

F: --

P: --

Euro Zone Core CPI Final YoY (Jan)

Euro Zone Core CPI Final YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Final YoY (Jan)

Euro Zone Core HICP Final YoY (Jan)--

F: --

P: --

Euro Zone HICP Final MoM (Jan)

Euro Zone HICP Final MoM (Jan)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Jan)

Euro Zone HICP MoM (Excl. Food & Energy) (Jan)--

F: --

P: --

Euro Zone HICP Final YoY (Jan)

Euro Zone HICP Final YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Final MoM (Jan)

Euro Zone Core CPI Final MoM (Jan)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Jan)

Euro Zone CPI YoY (Excl. Tobacco) (Jan)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

Argentina Retail Sales YoY (Dec)

Argentina Retail Sales YoY (Dec)--

F: --

P: --

Nvidia releases financial report

Nvidia releases financial report Australia Building Capital Expenditure QoQ (Q4)

Australia Building Capital Expenditure QoQ (Q4)--

F: --

P: --

South Korea Benchmark Interest Rate

South Korea Benchmark Interest Rate--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks Euro Zone Private Sector Credit YoY (Jan)

Euro Zone Private Sector Credit YoY (Jan)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Jan)

Euro Zone M3 Money Supply YoY (Jan)--

F: --

P: --

No matching data

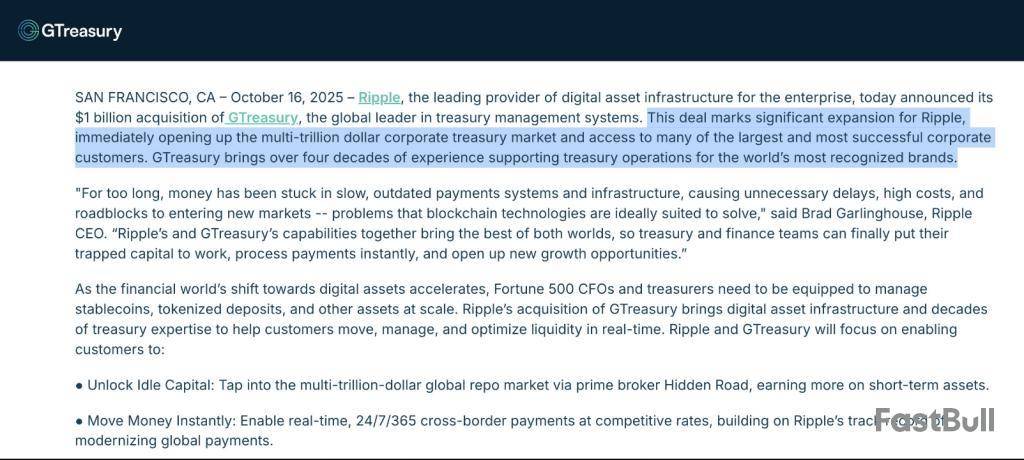

According to reports, Ripple is moving into corporate treasury services with an acquisition valued at $1 billion. The purchase, tied to a treasury management firm, has prompted some market educators to lay out aggressive price scenarios for XRP, including a top-end projection of $1,000+.

Ripple Hits Corporate Treasury

A crypto educator who posts under the name “X Finance Bull” has mapped out a sequence of price milestones. Based on his outline, investors might see XRP trade near $2 to $3 in the immediate phase, climb to $5–$10 over a longer stretch, and reach $20–$100+ in a bullish expansion.

The educator then presents a theoretical maximum of $1,000+ if XRP were to capture a major share of corporate treasury flows. These figures are being shared widely, often without the caveats that would temper expectations.

X Finance Bull@XfinancebullOct 16, 2025THIS IS WHERE IT BEGINS! $XRP is about to go parabolic to $1,000 and beyond!

Ripple just acquired GTreasury for $1B

This is a domino that sets off the biggest capital flow event in crypto history

Make sure BUY every dips of $XRP! Here’s what most aren’t seeing pic.twitter.com/6qs5KjKWgp

Why The Move Matters

The logic behind the bullish scenario is straightforward at a glance. If Ripple ties its software and token into treasury operations used by large firms, demand for on-ledger liquidity could rise.

Corporations handling cash, currency conversion, and liquidity tend to move very large sums. People in markets point out that tapping into those flows can change adoption dynamics for a token. Still, adoption at scale, legal clarity, and real usage patterns would all have to align for token prices to rise dramatically. Bull Case And Numbers

Supporters highlight the $1 billion price tag of the deal as proof that Ripple sees enterprise opportunity. They argue that treasury customers could need fast settlement rails and that XRPL tools might fit into those processes.

The educator’s projections include concrete bands: $2 to $3 early, $5–10 mid, and $20–$100+ later. But those bands assume broad corporate adoption and token demand patterns that are not yet proven.

Market caps implied by a $1,000+ XRP would be orders of magnitude larger than today’s totals, unless the circulating supply shrinks or new economic models are introduced.Regulatory Signals

Regulatory signals are a key variable. Courts and regulators have begun to clarify how tokens are treated in various jurisdictions, and that treatment will shape institutional appetite.

Also important are integration details: how the token is used in treasury software, whether firms hold or simply pass through XRP, and how custody and risk models adapt to tokenized liquidity.

Each of those steps can either support price appreciation or leave the token’s value marginal to enterprise operations.

Featured image from Unsplash, chart from TradingView

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up