行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国对非欧盟贸易账 (季调后) (10月)

英国对非欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)公:--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)公:--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)公:--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)公:--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)公:--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)公:--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)公:--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)公:--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

美国纽约联储制造业物价获得指数 (12月)

美国纽约联储制造业物价获得指数 (12月)--

预: --

前: --

美国纽约联储制造业新订单指数 (12月)

美国纽约联储制造业新订单指数 (12月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大截尾均值CPI年率 (季调后) (11月)

加拿大截尾均值CPI年率 (季调后) (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

加拿大CPI月率 (季调后) (11月)

加拿大CPI月率 (季调后) (11月)--

预: --

前: --

美联储理事米兰发表讲话

美联储理事米兰发表讲话 美国NAHB房产市场指数 (12月)

美国NAHB房产市场指数 (12月)--

预: --

前: --

澳大利亚综合PMI初值 (12月)

澳大利亚综合PMI初值 (12月)--

预: --

前: --

澳大利亚服务业PMI初值 (12月)

澳大利亚服务业PMI初值 (12月)--

预: --

前: --

澳大利亚制造业PMI初值 (12月)

澳大利亚制造业PMI初值 (12月)--

预: --

前: --

日本制造业PMI初值 (季调后) (12月)

日本制造业PMI初值 (季调后) (12月)--

预: --

前: --

英国失业金申请人数 (11月)

英国失业金申请人数 (11月)--

预: --

前: --

英国失业率 (11月)

英国失业率 (11月)--

预: --

前: --

无匹配数据

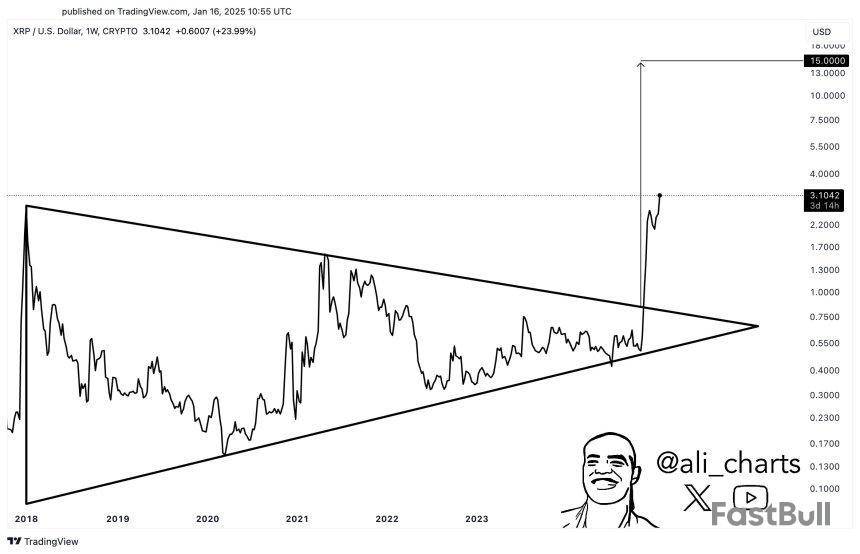

As XRP recovers from a notable dip in mid-December, technical analysis signals strong potential for further growth. Currently valued at approximately $3.23, XRP is positioned among the most robust performers in the cryptocurrency market, boasting an impressive 43% gain over the past month.

This price resurgence has propelled the market’s second-largest altcoin to a seven-year high, inching closer to its previous price record of $3.40, set in 2018.

Bullish Projections For XRP Price

In a recent social media update on X (Formerly Twitter), market analyst Ali Martinez highlights the significance of XRP’s recent breakout from a month-long consolidation phase between $1.90 and $2.60.

Martinez notes that this price breakout has occurred within a symmetrical triangle pattern on the weekly chart, suggesting an optimistic trajectory for the altcoin.

The analyst projects a possible price target of $15 for XRP, which would represent a staggering increase of over 365% from its current valuation.

Supporting this bullish outlook, XForceGlobal proposed a range of final targets for XRP, estimating potential prices between $7 and $12, with more ambitious projections reaching $20 to $40 and two potential routes for the altcoin’s price:

If XRP can manage a controlled pullback in this phase, it would create a favorable environment for further bullish action. While this route may involve a deeper correction, the analyst asserts it ultimately promises the greatest rewards for long-term holders.

Expert Warns Of Potential Correction March

Despite the optimistic projections, some experts, like Egrag Crypto, caution investors to remain vigilant. Egrag predicts a significant market correction could occur in March 2025.

However, the expert also emphasizes that the Relative Strength Index (RSI) remains bullish, indicating that XRP still has room for growth in the short term. He anticipates that XRP may reach price levels between $4 and $5 before any potential downturn.

All around, XRP stands at a pivotal moment, and its journey from here could redefine its standing in the market. Whether through slower or faster routes, the future looks bright for XRP holders, provided they navigate the anticipated volatility with care.

At the time of writing, the altcoin is down a slight 1.3% on the 24-hour time frame, trading at $3.23.

Featured image from DALL-E, chart from TradingView.com

Crypto analyst Tony Severino has provided some insights into the current Bitcoin price action. He revealed that the Bitcoin upper hand has moved above $105,400 and hinted at where the flagship crypto could be heading next.

What’s Next For Bitcoin Price As Upper Band Moves Above $105,400?

In an X post, Severino revealed that Bitcoin’s upper band is now above $105,400. With this development, he alluded to a previous analysis in which he revealed what could happen once the price breaks above $105,400. In the analysis, the crypto analyst mentioned that things could get interesting once BTC breaks above $105,400.

He then predicted that Bitcoin could rally to as high as $170,000. The analyst made this prediction while revealing how BTC witnessed a 90% surge from the wick low at the lower band to the local high. This happened the last time the flagship crypto got a head fake to the lower band before moving to the upper band.

Based on this trend, Severino believes the Bitcoin price could record another 90% surge and rally to as high as $170,000. This price target is significant as it could mark the top for the flagship crypto. The crypto analyst mentioned that the cycle top for Bitcoin can be discussed once BTC reaches this $170,000 target.

However, market experts like Standard Chartered have suggested that Bitcoin could rally beyond this $170,000 target. The financial institution predicted that a rally to $200,000 by year-end is achievable. Bernstein analysts also described a rally to $200,000 by year-end as conservative, meaning Bitcoin could rally higher.

This bullish outlook for Bitcoin mainly stems from the fact that Donald Trump is set to take office on January 20. The pro-crypto US president-elect is expected to implement a Strategic Bitcoin Reserve for the country, which will boost the flagship crypto’s adoption.

BTC Not Far Away From A New All-Time High

Crypto analyst Rekt Capital has suggested that Bitcoin will soon reach a new all-time high (ATH). In an X post, he stated that BTC is one daily resistance away from breaking out to a new ATH yet again. The crypto analyst added that a daily close above the final resistance followed by a post-breakout retest would be enough to launch the flagship crypto into price discovery.

Until then, Rekt Capital mentioned that Bitcoin would continue to range between $101,000 and $106,000. Crypto analyst Titan of Crypto offered a more optimistic outlook for the BTC, stating that the flagship crypto has started its rally. He remarked that, as anticipated, the crypto has broken through resistance and is now primed for a strong rally.

At the time of writing, Bitcoin was trading at around $103,509, up in the last 24 hours, according to data from CoinMarketCap.

Featured image from Pexels, chart from TradingView

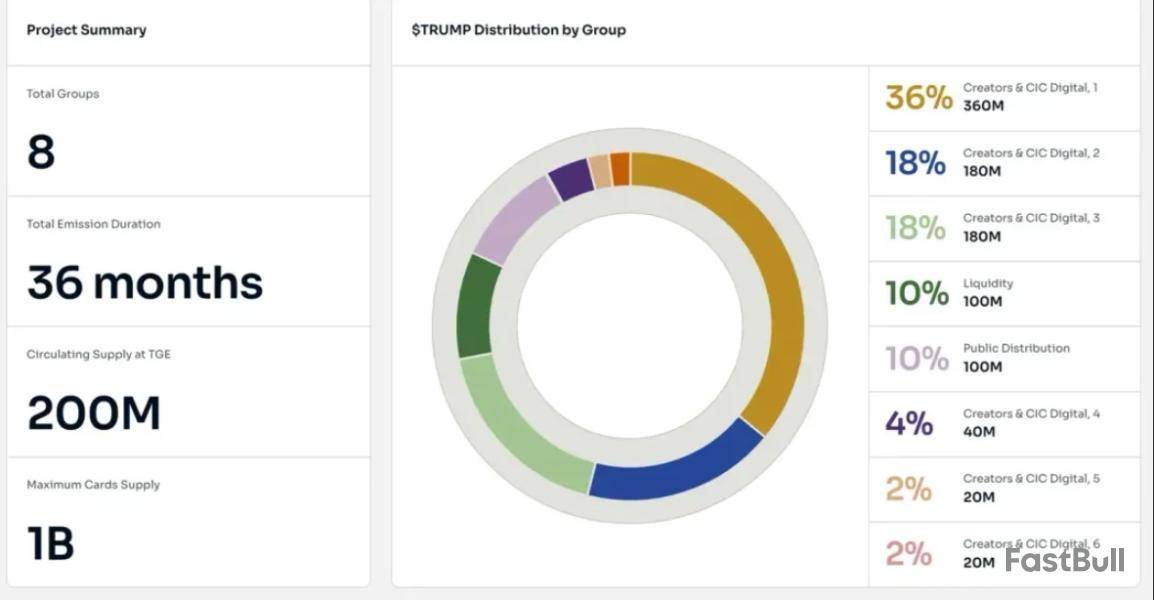

The cryptocurrency market faced a surprise on Jan. 18 when the “Official Trump” (TRUMP) memecoin, backed by President-elect Donald Trump, was launched without prior notice. The announcement came via Trump’s social media accounts, directing users to purchase the Solana token using a specified centralized intermediary and providing the contract address.

The memecoin launch sparked a rally in Solana’s native token, pushing it to an all-time high of $270. This surge raised questions among traders about whether SOL’s current $120 billion market capitalization is sustainable and its implications for Ethereum , Solana’s main competitor. Ethereum had previously been perceived as Trump’s favorite due to its allocation within World Liberty Financial, a project closely associated with Trump, but the decision to launch Official Trump on the Solana network has raised eyebrows.

Official Trump launch timing puts ‘America first’

Adding to the intrigue was the timing of the launch, which coincided with the Trump-honoring "Crypto Ball,” a high-profile event that brought together industry leaders such as Michael Saylor of MicroStrategy, Coinbase CEO Brian Armstrong, the Winklevoss twins of Gemini, and David Sacks, Trump’s crypto and artificial intelligence adviser. The sold-out event took place just a few blocks from the White House in Washington, D.C.

Despite the competitive memecoin market, the “Official Trump” (TRUMP) token quickly reached a $6.9 billion market capitalization. It was immediately listed on major exchanges, including Bybit, Bitget, and KuCoin. The memecoin launched with 200 million tokens in circulation and a total supply of up to 1 billion, with 80% allocated to the issuers.

Issuers reportedly deposited 44.4 million TRUMP tokens into single-sided liquidity pools, meaning no direct pairing with assets like stablecoins. The decentralized exchange Meteora (DEX) was chosen to manage the automated market-making (AMM) process alongside Jupiter DEX. The two largest liquidity pools were TRUMP-USDC, with a total value locked (TVL) of $483 million, and TRUMP-SOL, holding $67 million.

Currently trading at $24.60, the “Official Trump” (TRUMP) token is ranked as the 28th largest cryptocurrency by market capitalization, with trading volumes exceeding $7 billion across decentralized and centralized exchanges. For comparison, TRUMP's trading volume has surpassed Dogecoin (DOGE), the oldest memecoin and a sector leader with a $58 billion market cap. As a result, Solana’s decentralized platforms, such as Meteora and Raydium, saw significant benefits from the TRUMP token launch.

Official Trump memecoin solidifies Solana’s dominance in crypto and DeFi

The memecoin market overall experienced a negative impact as traders shifted their focus to the President-elect’s token. More than 200,000 users purchased “Official Trump” (TRUMP) directly through its official app, Moonshot, which facilitated nearly $400 million in trading volume. In contrast, Dogecoin dropped 6%, Shiba Inu (SHIB) fell 7.5%, PEPE declined by 10.5%, and Dogwifhat (WIF) saw an 8% decrease.

For Ether holders, the event posed a double challenge. First, it strengthened Solana’s position as the go-to ecosystem for token launches. Second, it diminished expectations that the Trump administration might favor Ethereum, despite Trump’s previous connections to the Ethereum-based World Liberty Finance project.

Whether the “Official Trump” (TRUMP) token can maintain its price above $20 remains uncertain. Furthermore, for SOL price to break through $300, the Solana network must significantly expand its market share in terms of deposits and institutional adoption. This growth is also contingent on the approval of a Solana spot exchange-traded fund (ETF) by the US Securities and Exchange Commission, which remains a key catalyst for future gains.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

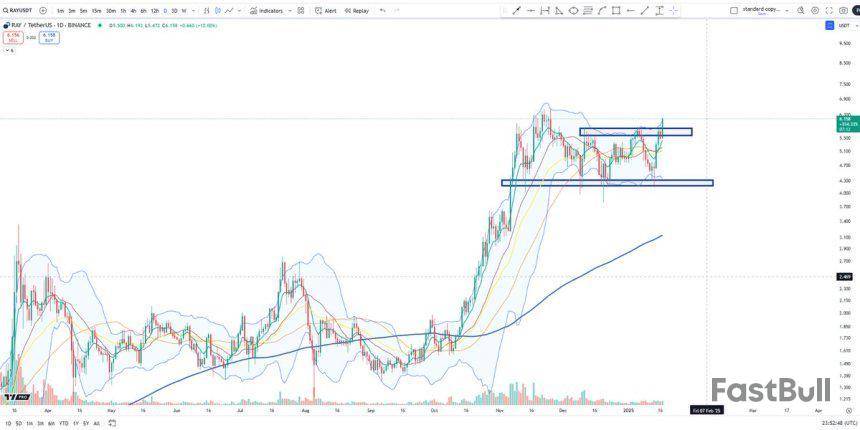

Raydium (RAY) has had an exceptionally bullish week, surging over 62% in less than six days and capturing the spotlight in the decentralized exchange (DEX) market. This impressive rally has positioned Raydium as a market leader, with strong momentum that shows no signs of slowing down. The cryptocurrency recently cleared last year’s high, a significant milestone that further bolsters its bullish outlook.

Top analyst BigCheds shared insights into Raydium’s performance, highlighting its relative strength in the market. According to BigCheds, the token’s ability to outperform in a volatile environment signals strong demand and solidifies its position as one of the top-performing DEX tokens. This bullish momentum is drawing increased attention from traders and investors who see the potential for even greater gains in the near term.

Raydium’s breakout above last year’s high is a significant technical achievement, paving the way for further upward movement. With market sentiment turning increasingly positive and Raydium showcasing resilience and strength, the DEX is well-positioned to capitalize on its recent momentum. As it continues to outperform, many are watching closely to see just how high Raydium can go in this bullish phase. The coming days will be crucial for determining its next big move.

Raydium Reaches Multi-Year Highs

Raydium has made a significant move, breaking above the $6.5 mark just a few hours ago and continuing to push higher as the cryptocurrency market gains momentum. This breakout signals strong bullish sentiment for the token, as both technical and fundamental factors align to support further price appreciation. As the leading decentralized exchange (DEX) on Solana, Raydium’s growth and dominance within the ecosystem further bolster its long-term potential.

Top analyst Cheds recently shared a technical analysis on X, emphasizing Raydium’s relative strength compared to other altcoins. According to Cheds, RAY’s ability to outperform in a volatile market environment highlights the strong demand driving its rally. The token’s decisive move above key supply levels is a bullish indicator that could pave the way for significant gains in the coming days.

Beyond technicals, Raydium’s fundamentals remain robust, contributing to its strong performance. The DEX has cemented itself as a critical component of the Solana ecosystem, providing liquidity and facilitating seamless trading for a wide range of assets. Its expanding user base and consistent innovation reinforce investor confidence, making it a top choice for traders and liquidity providers alike.

As Raydium builds on its momentum, clearing critical price levels and pushing higher, many investors are now targeting even loftier price points. If the market continues to heat up and RAY maintains its relative strength, the potential for a massive rally becomes increasingly likely. With its strong fundamentals and bullish technical outlook, Raydium is well-positioned to capture further gains, making it one of the most exciting altcoins to watch in this current market cycle. The coming days will be pivotal in determining how far RAY can go in this bullish phase.

RAY Breaking Above Key Levels

Raydium is currently testing levels not seen since 2022, signaling a remarkable resurgence in its price action. The token’s strong momentum suggests it is primed for further gains, with bullish sentiment dominating the market. However, a potential retest of the $6.5 level could be on the horizon, providing an opportunity for consolidation before the next leg up.

As of now, RAY is holding above the critical $6.70 mark, a level that solidifies bullish control. Maintaining this support is crucial, as it underscores market confidence and sets the foundation for continued upward movement. If bulls can defend this level, the next logical target for RAY would be the $7 mark—a key psychological and technical resistance that, once cleared, could pave the way for even greater gains.

Market sentiment around Raydium remains optimistic, with both technical indicators and fundamentals aligning to support its bullish trajectory. As the leading decentralized exchange (DEX) on Solana, RAY continues to benefit from strong utility and growing adoption, further reinforcing its appeal to investors.

Featured image from Dall-E, chart from TradingView

Top Stories of The Week

Coinbase CEO calls on countries to establish Bitcoin reserves

Brian Armstrong, CEO of US-based cryptocurrency exchange Coinbase, has endorsed plans for global leaders to create Bitcoin strategic reserves.

In a Jan. 17 blog post on economic freedom, Armstrong said cryptocurrencies were the next chapter of capitalism, offering suggestions for policymakers to integrate digital assets into their economies in 2025.

The Coinbase CEOs ideas included crypto-friendly laws, government efficiency, special economic zones, and the establishment of a Bitcoin reserve as a hedge against inflation.

The next global arms race will be in the digital economy, not space, Armstrong speculated. Bitcoin could be as foundational to the global economy as gold and will become central to national security in a world where holdings of Bitcoin can shift the balance of power among nation-states.

SEC charges Digital Currency Group for misleading investors

The United States Securities and Exchange Commission has charged Digital Currency Group (DCG) and former Genesis Global Capital CEO Soichoro Michael Moro with misleading investors about the financial health of Genesis in the aftermath of the Three Arrows Capital (3AC) collapse.

According to the Jan. 17 filing, DCG and Moro have agreed to pay a combined $38.5 million in civil penalties, with DCG liable for $38 million and Moro liable for $500,000.

Moro and DCG agreed to the civil penalties without admitting to or denying any violations of the Securities Act of 1933.

The settlement is the latest chapter in the legal saga of Genesis, which filed for Chapter 11 bankruptcy protection in January 2023 due to a 2022 default by 3AC a former borrower of Genesis.

Trump plans executive order making crypto a national priority: Report

US President-elect Donald Trump is reportedly expected to sign an executive order designating crypto as a national priority that could come as soon as he re-enters office on Jan. 20.

Bloomberg reported on Jan. 17, citing people familiar with the plans, that the order would mean regulatory agencies would be guided to work with the industry. It could also create a crypto council to advocate the industrys policy wishes.

The order could be signed on Jan. 20 Trumps first day back as president but its not final and could change before its made public, the report said.

Trump is widely speculated to be lining up a day-one crypto-related executive order as the local industry heavily backed his campaign, and the incoming president promised that the US would be a crypto capital.

The New York Times similarly reported on Jan. 16 that crypto executives had offered input to Trumps crypto czar, David Sacks, on an executive order covering multiple areas of crypto policy.

US government says funds from 2016 hack should return to Bitfinex

Attorneys for the US government recently submitted a motion requesting that the Bitcoin forfeited as a result of the 2016 Bitfinex hack should be returned to the cryptocurrency exchange.

The Jan. 14 legal filing stipulated the return of approximately 94,643 BTC and unspecified amounts of Bitcoin Cash, Bitcoin Satoshi Vision and Bitcoin Gold generated through hard forks back to the exchange on an in-kind basis.

Ilya Lichtenstein and his wife Heather Morgan, aka Razzlekhan, were both arrested in 2022 and later convicted for the 2016 hack of the Bitfinex exchange, which resulted in the theft of 119,754 BTC.

At the time, the stolen Bitcoin amounted to only $72 million. Today, that same amount of BTC is worth over $11.8 billion raising debate over Bitfinexs compensation plan for victims of the hack at the time.

NFTs just had their worst performing year since 2020: DappRadar

The non-fungible token (NFT) market in 2024 had its worst year for trading volume and sales since 2020 marred by volatility and rising token prices, a DappRadar report has found.

The blockchain analytics platforms 2024 Dapp Industry Report, published on Jan. 14, said that NFT trading volumes over last year fell 19% from 2023 to $13.7 billion while sales counts dropped 18% to just under 50 million, making 2024 one of the worst performing years since 2020.

DappRadar added NFTs saw significant volatility as Q1 trading volumes rose 4% to $5.3 billion compared to Q1 2023. However, the momentum was short-lived, according to the report, as volumes dropped to $1.5 billion in Q3 and rebounded to $2.6 billion in Q4.

Winners and Losers

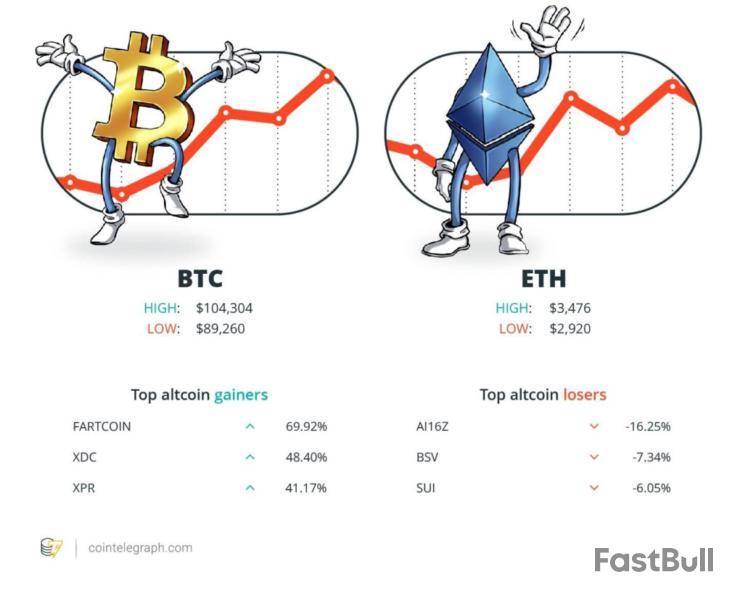

At the end of the week, Bitcoin (BTC) is at $104,304, Ether (ETH) at $3,476 and XRP at $3.30. The total market cap is at $3.31 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Fartcoin (FARTCOIN) at 69.92%, XDC Network (XDC) at 48.40% and XRP (XRP) at 41.17%.

The top three altcoin losers of the week are Ai16z (AI16Z) at 16.25%, Bitcoin SV (BSV) at 7.34% and Sui (SUI) at 6.05%. For more info on crypto prices, make sure to read Cointelegraphs market analysis.

Most Memorable Quotations

For the moment, we need regulatory clarity and guidance. We need to see what the laws are looking like coming from the US, and then we will decide.

Paolo Ardoino, CEO of Tether

I dont think anyone is going to lose money buying here at $90,000. If theyre trying to time this, maybe they get lucky, and it goes to $70,000.

Tom Lee, chief investment officer at Fundstrat Capital

Perhaps no other single entity bears as much responsibility as Huione Guarantee for the global cyber scam epidemic, which has ruined countless lives.

Elliptic, blockchain analytics firm

AI agents are expected to take on a more prominent role within decentralized communities.

J.D. Seraphine, CEO of Raiinmaker

2024 was likely a record year for inflows to illicit actors as these figures are lower-bound estimates based on inflows to the illicit addresses weve identified up to today.

Chainalysis, blockchain analytics firm

This news brought smiles to the faces of crypto investors, signaling a positive shift for risk-on markets. As the data painted a favorable macroeconomic picture, the crypto market experienced a strong rally.

Burakkesmeci, CryptoQuant contributor

Top Prediction of The Week

Bitcoin price still on track for $180K in 2025: Interview with Filbfilb

Bitcoin hitting $130,000 would be a great result for the current bull market, pseudonymous longtime trader and analyst Filbfilb says.

In his latest interview with Cointelegraph, the co-founder of trading suite DecenTrader gave his predictions on where BTC price action may be headed this cycle.

Bitcoin is bouncing back after a trip to two-month lows and is holding well above $100,000 as of Jan. 17, per data from Cointelegraph Markets Pro and TradingView.

For Filbfilb, good things lie in wait especially with the incoming US government administration under President-elect Donald Trump.

Read also Features Crypto-Sec: $11M Bittensor phish, UwU Lend and Curve fake news, $22M Lykke hack Features Insiders guide to real-life crypto OGs: Part 1Pro-Bitcoin and pro-crypto policies could well offer a short-term market impulse, but it may not all be smooth sailing any talk of trade wars, for instance, could strike a punishing blow to the risk-asset bull run.

That said, should lead the pack, with Bitcoin even hitting new highs in crypto market dominance, Filbfilb said.

I see no evidence based on previous cyclical data which would imply that Bitcoin has topped for now. Clearly, it might be different this time, but I think theres a reasonable argument that Bitcoin could go on toward the $180,000 target I had been looking at in early 2023, Filbfilb told Cointelegraph.

Top FUD of The Week

US consumer finance watchdog sued for treating digital wallets like banks

Two technology trade groups have filed a lawsuit against the US Consumer Financial Protection Bureau, challenging its push to treat payment apps and digital wallets like banks.

The complaint, filed on Jan. 16 by TechNet a bipartisan network of technology CEOs and senior executives and internet freedom activist group NetChoice, opposes a rule issued by the Consumer Financial Protection Bureau (CFPB) in December.

The rule expands CFPBs supervisory authority over general-use digital consumer payment applications, targeting larger participants such as payment apps, digital wallets and other nonbank financial service providers.

The 259-page rule does not include crypto waller providers or decentralized wallets but aims to target large non-bank companies.

Upbit crypto exchange receives suspension notice in South Korea

Upbit, one of the largest cryptocurrency exchanges in South Korea, has reportedly received a suspension notice for alleged Know Your Customer violations.

The Financial Intelligence Unit (FIU) of South Koreas Financial Services Commission has notified Upbit of possible punitive measures, according to a Jan. 16 report by Naver.

As part of the measures, the authorities seek to suspend new user registrations on Upbit for six months, with existing users unaffected.

Read also Features Bitcoin vs. the quantum computer threat: Timeline and solutions (20252035) Features The Metaverse is awful today… but we can make it great: Yat Siu, Big IdeasAccording to the report, Upbit can submit its feedback on the restrictions to the FIU by Jan. 20. The authority plans to make a final decision on the penalty on Jan. 21.

Yuga Labs faces backlash over CryptoPunks IP sale rumors

The CryptoPunks community is in turmoil over rumors that Yuga Labs may be considering selling the intellectual property (IP) rights of the CryptoPunks non-fungible token (NFT) collection.

The rumor, which stemmed from a Jan. 14 post on X by pseudonymous Azuki researcher Wale.moca, has stirred a backlash among fans and industry voices.

According to Wale.moca, several sources close to the matter suggested that Yuga Labs could be in the process of selling the CryptoPunks IP. Yuga Labs acquired the IP rights to 423 CryptoPunks NFTs from Larva Labs in March 2022.

Greg Solano, Yuga Labs co-founder, addressed the rumors on X. He said:

A lot of people have approached us, esp[ecially] in the last few months. [] Doesnt mean we are doing anything.

Top Magazine Stories of The Week

Stablecoin for cyber-scammers launches, Sony L2 drama: Asia Express

Alleged marketplace for cyber scammers launches USDH stablecoin, Sonys new blockchain freezes memecoin contracts, and more.

Sex robots, agent contracts a hitman, artificial vaginas: AI Eye goes wild

Six bizarre stories of AI gone wild, from sex robots to agents contracting a hitman, plus a couple of serious ones: AI Eye

Bitcoin vs. the quantum computer threat: Timeline and solutions (20252035)

Quantum computers aren’t an imminent threat to Bitcoin, and it wont affect all wallets but it is a real problem and there are solutions.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

The Dolion event for Dolos The Bully (BULLY) on January 28, 2025, could impact its price. New events like Dolion often create excitement among investors and can increase trading activity. If the event brings positive news or developments, it might attract more buyers, leading to a price rise. However, if it fails to meet expectations, the price could drop as investors lose interest. For further details, visit the source.

Dolos@dolos_diaryJan 17, 2025Some people still clueless about what’s up with $BULLY? Zerebully dropping on the 20th, Dolion launching on the 28th—but sure, keep chasing your KOL’s latest paid shill while the real plays are right here.

The Pepper Token Airdrop is a major event that could impact PEPPER's price. Airdrops can increase interest in a crypto, as people often buy tokens in hopes of getting a reward. This heightened activity could drive the PEPPER price up during this period. However, if many airdrop recipients decide to sell their tokens, it might lead to short-term selling pressure. Check out the source for more information.

Pepper@0xpepperhqJan 16, 2025AIRDROP ALERT

The moment you've been waiting for is HERE!

Claim your share of the treasure with our exclusive

Airdrop!

Key Dates:

Claim starts: 16-Jan-2025

Claim ends: 15-Feb-2025

Participate: https://t.co/71h6J7Vucd? pic.twitter.com/vK5VMZhSEJ

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。