行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国对非欧盟贸易账 (季调后) (10月)

英国对非欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

Despite ongoing consolidation across the broader crypto market, Tron (TRX) has managed to maintain a steady upward trajectory. The token has recorded a 2.6% increase over the past two weeks and is currently trading at $0.2495, reflecting a 0.7% uptick in the last 24 hours.

This relative strength comes at a time when several major altcoins are experiencing muted price action. Tron’s stability amid broader volatility has drawn the attention of market participants analyzing on-chain dynamics for insight into potential future moves.

Tron On-Chain Trends Suggest Network Consolidation

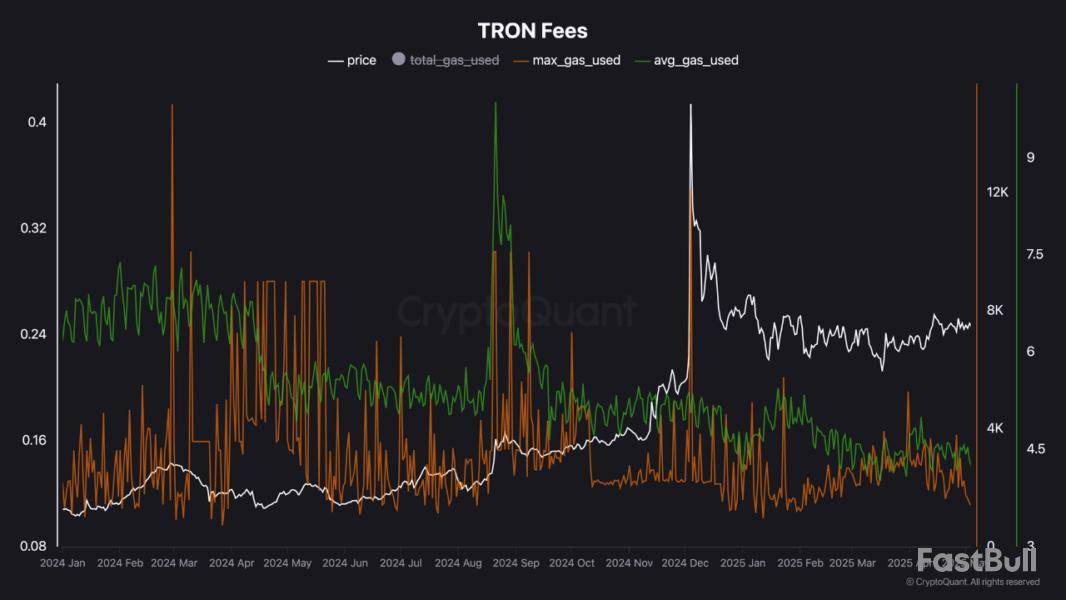

According to a recent analysis by CryptoQuant contributor BorisVest, the Tron network is currently signaling an accumulation phase. In a report titled “Tron Network Signals Accumulation Phase Amid Decreased Activity,” the analyst outlines a number of on-chain indicators that support this conclusion.

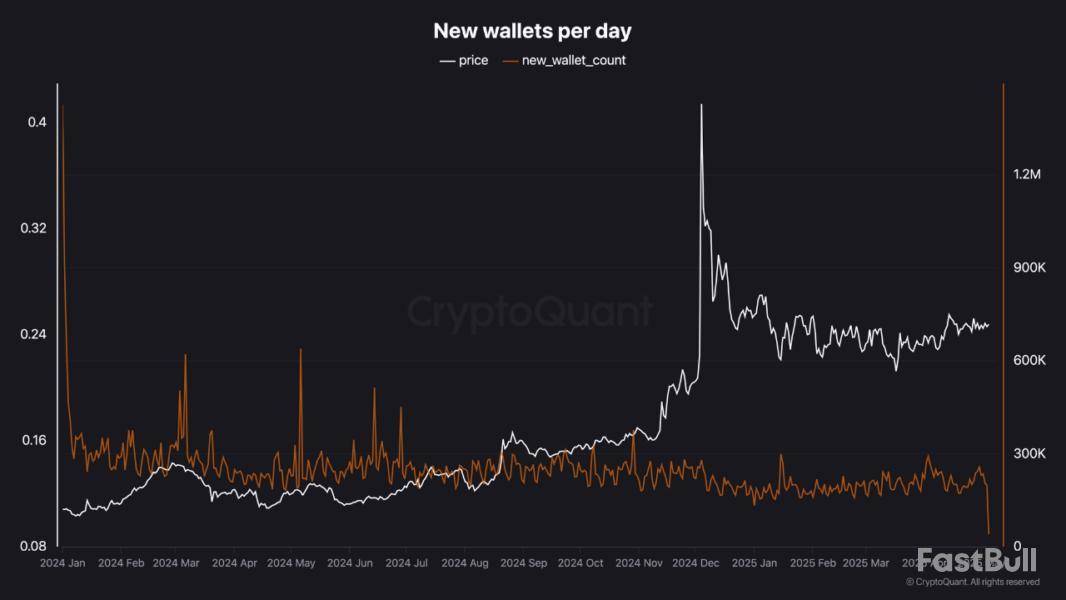

Most notably, the number of new wallets and transaction fees on the network has declined, pointing to a cooldown in network activity. However, rather than indicating weakness, BorisVest interprets this as a pause in active participation as the network consolidates.

BorisVest notes that the Tron network experienced a spike in complex transactions and gas usage during its recent highs. However, both average and maximum gas usage have since fallen, suggesting a slowdown in usage intensity.

Additionally, despite occasional price surges, the number of new wallet addresses has remained either flat or in decline. This trend implies limited retail or organic growth during the current market phase.

Historically, such patterns of stagnation in user growth and fee activity have often preceded stronger market moves, according to the analyst. The decline in wallet creation and overall gas usage may signal a broader accumulation pattern across the Tron ecosystem.

Fewer participants transacting on-chain and a lack of significant new user onboarding typically coincide with phases where existing holders increase their positions quietly. If historical cycles are any indication, this period of reduced activity could eventually give way to renewed momentum once investor confidence returns.

USDT Activity Paints a Different Picture

In contrast to the slowing activity suggested by wallet creation and gas fees, stablecoin usage on the Tron blockchain continues to show notable growth. CryptoQuant analyst Darkfost highlighted that the amount of Tether (USDT) circulating on Tron has reached a new all-time high, now surpassing $71 billion.

This figure places Tron just behind Ethereum, which currently hosts around $75 billion in USDT. The increasing stablecoin supply indicates strong demand for value transfer and settlement use cases on the network.

Darkfost also emphasized that Tron’s low transaction costs make it an attractive platform for stablecoin users. As more liquidity flows into the Tron ecosystem via USDT, the network’s role in decentralized finance (DeFi) continues to expand.

Featured image created with DALL-E, Chart from TradingView

Former Maryland Governor Martin O'Malley took aim at Bitcoin during an event organized by Social Security Works, an American political advocacy group.

The prominent politician, who recently ran for chair of the Democratic National Committee in 2025, suggested that Bitcoin might be a Ponzi scheme when advocating for social security.

"It's not a Ponzi scheme. Bitcoin might be, but not social security," O'Malley said.

The comments made by O'Malley show that crypto remains largely a partisan issue in the U.S. after many industry leaders chose to fully align themselves with the Republican Party.

Democrats sour on stablecoin legislation

Meanwhile, a bipartisan effort to pass a major stablecoin appears to be failing.

As reported by U.Today, Massachusetts Senator Elizabeth Warren, one of the leading progressive voices within the Democratic Party, recently drew criticism from crypto advocates for opposing key stablecoin legislation. Crypto-friendly Democrats are now reportedly reconsidering their support for the bill that the crypto industry has persistently lobbied for.

Earlier today, Politico reported that Senate Majority Leader John Thune was open to amending the stablecoin bill to secure enough votes from wary Democrats.

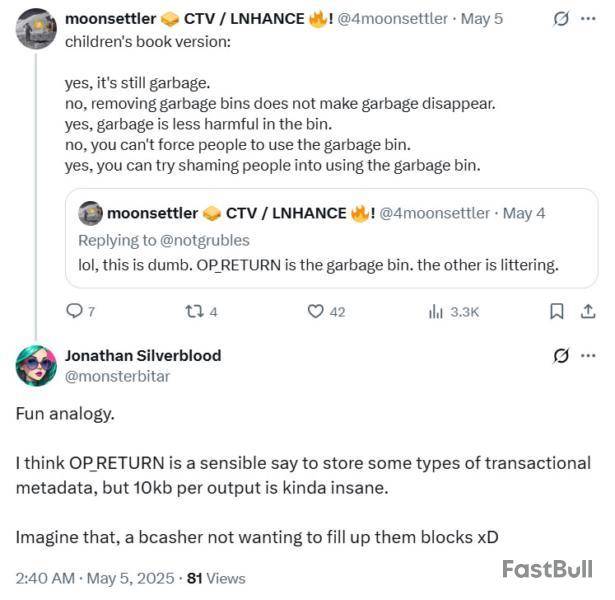

Bitcoin Core developers have decided to remove a limit on transaction data in the next network upgrade, enabling more data to be included in a more efficient way.

“Bitcoin Core’s next release will, by default, relay and mine transactions whose OP_RETURN outputs exceed 80 bytes and allow any number of these outputs,” read the announcement on GitHub by Bitcoin developer Greg Sanders on May 5.

The long-standing limit was originally a “gentle signal that block space should be used sparingly for non-payment proof of publication data,” has outlived its utility, he added.

The proposal (PR 32359) was created by Bitcoin pioneer Peter Todd at the request of Chaincode Labs.

OP_RETURN is a special type of Bitcoin transaction output that allows storing small amounts of data on the blockchain, popularized during the ordinals inscriptions craze in early 2024.

Unlike regular transaction outputs, OP_RETURN outputs are not spendable and don’t bloat unspent transaction outputs (UTXOs).

The original limit is no longer effective as people found ways around it, such as using fake output addresses, which are actually worse for the network, while some mining services were already ignoring the limit, said Sanders.

Benefits of removing the limit include a cleaner UTXO set, or database of spendable outputs, more consistent behavior across the network, and better alignment with how Bitcoin is actually being used, he added.

Three possible paths were considered: keeping the cap, raising the cap and removing the cap, which was ultimately decided upon after earning “broad, though not perhaps unanimous, support.”

A controversial change to Bitcoin

“Many users find this to be an undesirable change for a number of reasons,” said Bitcoiner Samson Mow on X on May 5. He added that users “can refuse to upgrade and stay on 29.0 or run another implementation” of the network.

Critics said that the proposal was introduced without a proper consensus process.

“I think one thing is pretty clear, there is no consensus at the moment on this OP_RETURN issue,” said Ten31 Fund managing partner Marty Bent.

Some also expressed concerns about deprioritizing Bitcoin’s financial utility and raised questions about undisclosed conflicts of interest.

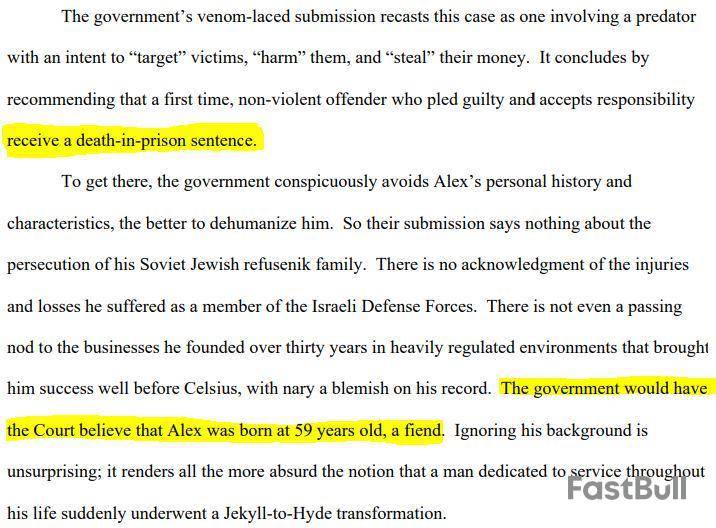

Alex Mashinsky, the founder and former CEO of bankrupt crypto lending platform Celsius, has blasted the government's 20-year “venom-laced” sentence request, declaring it a “death-in-prison sentence.”

The US Department of Justice requested Mashinsky receive at least 20 years behind bars in the May 8 sentencing for his role in misleading Celsius users and profiting from the price manipulation of Celsius (CEL), which would make the 59-year-old 79 if he serves the whole sentence.

Lawyers acting for Mashinsky argued in a May 5 reply memorandum filed in a New York district court that he should receive no more than 366 days, because the DOJ hasn't taken into account his status as a nonviolent first-time offender with a previously unblemished 30-year history in business.

“The government's venom-laced submission recasts this case as one involving a predator with an intent to target victims, harm them, and steal their money,” they said.

“It concludes by recommending that a first time, nonviolent offender who pled guilty and accepts responsibility receive a death-in-prison sentence.”

Mashinsky pleaded guilty to two out of seven charges

As part of a plea agreement, Mashinsky pleaded guilty in December 2024 to commodities fraud and manipulating the price of CEL, earning $48 million by selling his holdings before Celsius collapsed in June 2022. Prosecutors initially filed seven charges in July 2023.

Lawyers acting for Mashinsky allege the DOJ’s push for a 20-year sentence is because their client is unwilling to “capitulate to the government’s exaggerated characterizations of his actions,” specifically that he was a “fraud from the get-go.”

“Alex is inserted as the scapegoat for every corporate action, every group decision, every unanimous vote, every market fluctuation, and every employee's watercooler speculation,” they said.

As part of its April 28 sentencing request, the DOJ said Mashinsky’s guilty plea showed that his crimes were deliberate, calculated decisions to lie, deceive and steal.

Days earlier on April 23, US federal prosecutors also filed statements from hundreds of victims who lost money due to the Celsius collapse. They detailed how some had entrusted their life savings to the protocol, believing Mashinsky’s assurances that it was safe.

Celsius filed for Chapter 11 bankruptcy on July 13, 2022, owing $4.7 billion to creditors after halting withdrawals in June, citing volatile market conditions.

In November 2023, a US bankruptcy court approved Celsius' restructuring plan to repay customers, and in August 2024, $2.53 billion was paid to 251,000 creditors.

Former Celsius chief revenue officer Roni Cohen-Pavon also pleaded guilty in September 2023 to similar charges, but his Dec. 11 sentencing has been delayed until after Mashinsky is sentenced.

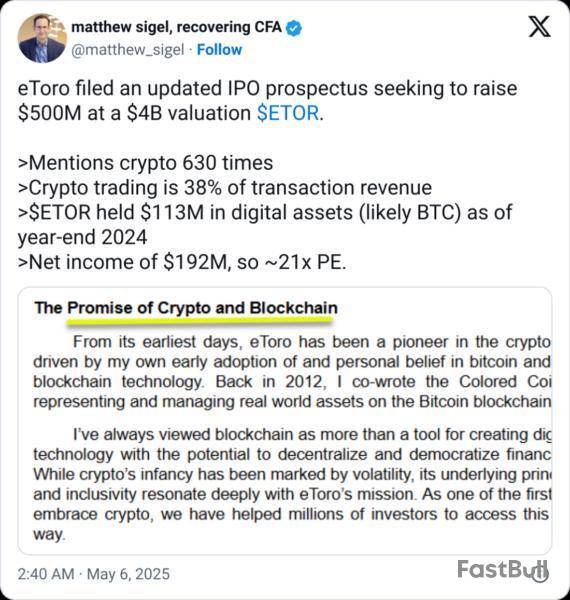

The Israel-based eToro Group says it’s looking for a valuation of up to $4 billion with its initial public offering in the US, as the stock and crypto trading platform forges ahead with listing on the Nasdaq.

The company and existing stockholders are aiming to raise $500 million through offering a total of 10 million shares priced between $46 to $50 apiece, eToro said on May 5.

A filing with the US Securities and Exchange Commission shows eToro is offering 5 million shares, with a further 5 million being put up by the likes of the company’s co-founder and CEO, Yoni Assia; his brother and executive director, Ronen Assia; along with venture firms Spark Capital, BRM Group and Andalusian Private Capital, among others.

The company offers stock and crypto trading targeting retail and plans to list on the tech-heavy Nasdaq Global Select Market under the ticker “ETOR.”

It's slated to compete with Robinhood Markets Inc. (HOOD), which saw crypto trading dip in the first quarter but whose shares have climbed by nearly 30% so far this year, according to Google Finance.

In the filing, eToro said some BlackRock funds and accounts indicated interest in buying up to $100 million worth of shares at IPO. eToro has also put aside 500,000 shares to sell through a directed share program, typically targeted at employees.

The company reported that its revenue from crypto in 2024 was $12.1 billion, up from $3.4 billion in 2023. It expected crypto to account for 37% of its commission from trading activity in the first quarter of 2025, down from 43% in the year-ago quarter.

In a section of its filing listing possible risks to the business, eToro warned its users could leave, or it could struggle to get more users, due to negative perceptions of the cryptocurrencies it lists, “either as a result of media coverage or by experiencing significant losses.”

Other crypto-related risks the eToro flagged included US state-level crypto regulation, which it said “may place strain on our resources and make it difficult to operate in certain jurisdictions, if at all.”

It also said it expects “to continue to incur significant costs” due to the European Union’s Markets in Crypto-Assets (MiCA) laws “on an ongoing basis.”

IPOs ready to push after Trump tariff jolt

EToro initially made confidential filings with the SEC in January for a public offering, before publicly announcing the plans on March 24.

The company reportedly delayed its IPO after President Donald Trump’s April 2 “Liberation Day” tariff announcements tanked global markets and stopped many in-the-works public offerings.

Crypto companies are also lining up to go public, with stablecoin issuer Circle filing on April 1 but then pausing its plans amid the uncertainty.

Crypto exchange Kraken is also reportedly considering a public offering for early next year, which has accelerated its plan with Trump’s election.

EToro’s public offering is led by Goldman Sachs, Jefferies, UBS Investment Bank and Citigroup.

Legal Panel: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

Bitcoin and crypto markets could face headwinds preventing new peaks if certain scenarios play out, wrote Bitcoin researcher and author Timothy Peterson.

The economist provided the analysis to counter hisbullish predictionthat BTC could reach $135,000 in the next three months or so. Continued poor or declining sentiment could impact crypto markets should things not improve soon.

The UMich consumer sentiment survey is bad, trending worse, while the AAII investor sentiment is 20% bullish, 60% bearish, “a huge gap and also trending worse,” he observed.

Meanwhile, the NAAIM Equity Exposure index is a respectable 60% allocation to equity, “but still well below the 80% associated with bull markets,” he said.

Three things that could prevent a new Bitcoin ATH.

Thing 1: Continued poor or declining sentiment. UMich consumer sentiment survey is bad trending worse; AAII investor sentiment is 20% bullish, 60% bearish, a huge gap, and also trending worse. NAAIM Equity Exposure index is a… https://t.co/T3jdA3khyn pic.twitter.com/AOVOra1jBb

— Timothy Peterson (@nsquaredvalue) May 3, 2025

The Fed and Event Risk

The Federal Reserve could also impact Bitcoin prices since markets have already priced in approximately three rate cuts for the remainder of 2025.

“Risk assets have rallied on the expectation that looser monetary policy will return, boosting liquidity and supporting higher multiples,” he said before adding Bitcoin’s recent strength reflects this forward-looking optimism.

However, if the Fed fails to deliver these cuts, the market narrative will shift, choking these speculative flows.

“For Bitcoin, which thrives on liquidity and risk appetite, the absence of rate cuts could stall momentum or even trigger a drawdown.”

The Fed is expected to keep rates unchanged at itsmeetingon Wednesday, May 7.

Finally, event risk, or unforeseen macro-level shocks that cannot be predicted in timing or magnitude, can cause severe disruption to financial markets.

“For Bitcoin, these risks bypass conventional forecasting tools and risk models, creating sharp breaks from trend behavior.”

Peterson cited examples that included nuclear accidents, large-scale terrorist attacks on critical infrastructure, cyberattacks on financial systems, another pandemic, or massive natural disasters.

Bitcoin behaves like a “high-beta asset” under these conditions, “subject to indiscriminate selling, access limitations, and temporary narrative collapse,” he said, concluding the analysis on May 5.BTC Price Outlook

Doom and gloom aside, Bitcoin was still trading within its rangebound channel, where it has been for the past fortnight.

The asset has swung frombelow $93,750in late trading on Monday to retap $95,000 during Tuesday morning trading in Asia.

BTC had retreated slightly at the time of writing when it was changing hands for $94,380, according to CoinGecko.

Kenya's High Court has ordered the World Foundation, formerly known as Worldcoin and co-founded by OpenAI CEO Sam Altman, to delete the biometric data of local users, ruling that its collection violated the right to privacy.

Justice Aburili Roselyne ruled on Monday that the project must permanently delete users' biometric data, including facial images and iris scans, within seven days under the supervision of the data protection officer, according to Katiba Institute, which, together with ICJ Kenya, brought the case against World.

The judge also issued an order prohibiting World from collecting or processing any further biometric data in Kenya. Additionally, the court issued an order of Certiorari nullifying the decision by World and its agents to collect or process biometric data without conducting an adequate data protection impact assessment.

"The judgment rightly underscores that even in the digital age, constitutional rights especially the right to privacy under Article 31 of the Constitution must be upheld," said ICJ Kenya.

Kenya was once one of the largest markets for sign-ups to World, with hundreds of thousands of users registering before the project was suspended by local authorities in August 2023. However, in June 2024, the project announced plans to resume operations after local police dropped their investigation.

World did not immediately respond to The Block's request for comment.

World’s launches in other countries have frequently sparked concerns over data privacy and protection. On Sunday, Indonesia's digital ministry suspended the operating permit of World for alleged violations of electronic system operation regulations.

However, the project announced last week that it is expanding in the U.S., initially launching in six cities — Atlanta, Austin, Los Angeles, Miami, Nashville and San Francisco.

The price of WLD fell 6.99% in the past 24 hours to trade at $0.89 at press time, according to The Block's price page. It has a market capitalization of $1.2 billion.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。