行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国对非欧盟贸易账 (季调后) (10月)

英国对非欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

Strategy co-founder and executive chairman Michael Saylor has ignited attention in the crypto community with a bold warning for those still undecided about Bitcoin. In a striking tweet, Saylor wrote: "Own Bitcoin or serve the Silicon Overlord."

Michael Saylor@saylorJul 06, 2025Own Bitcoin or serve the Silicon Overlord. pic.twitter.com/sVmF1hGbvX

Without Bitcoin, Saylor contends, individuals may become subjects in a digital system from which they cannot escape or influence. This viewpoint is consistent with Saylor's Bitcoin outlook, referring to the cryptocurrency as "money" and "freedom."

Over the last five years, Saylor has become a Wall Street and crypto industry phenomenon, transforming his business intelligence software company into the world's first and most leveraged Bitcoin proxy.

As of June 29, Strategy held 597,325 BTC, acquired for around $42.40 billion at nearly $70,982 per Bitcoin, following a purchase of 4,980 BTC, or $531.9 million, announced at the end of June.

According to a recent Bloomberg report, Strategy recorded an unrealized gain of over $14 billion in the second quarter, putting the once-struggling business software developer turned leveraged Bitcoin proxy among the elite ranks of corporate heavyweights such as Amazon and JPMorgan Chase.

Bitcoin and Strategy shares up

Strategy's stock has risen by more than 3,300% since Saylor began purchasing Bitcoin in mid-2020 as an inflation hedge. Bitcoin has climbed by around 1,000% during the same period, whereas the S&P 500 has increased by approximately 115%.

Bitcoin was trading at $108,025 at the time of writing, down 0.07% in the prior 24 hours after recovering to $110,000 in the previous week. The largest crypto traded at its strongest price since June 9, reaching a high of $110,590 on July 3.

July is shaping up to be a potentially volatile month for Bitcoin, with key events to look out for. July 22 marks the final deadline for action on the long-awaited crypto executive order, as well as prospective updates on the U.S. Strategic Bitcoin Reserve.

More than $8 billion worth of Bitcoin mined during the cryptocurrency's earliest days, known as the "Satoshi era," was transferred on Friday in the largest such transfer ever recorded.

Eight wallets that had been dormant since 2011 moved 10,000 BTC to new SegWit addresses on Friday, more than 14 years after receiving the BTC. The identity of the wallets is unknown, including their ownership.

The incident has caused speculation and curiosity in the crypto community. Coinbase director Conor Grogan, who goes by "Connor" on X, has recently reacted to a rumor surrounding one of the mysterious addresses that had shifted 10,000 Bitcoin.

An X user claimed that one of the wallets that moved 10,000 BTC (worth over $1 billion) was mentioned on a forum in 2013. The user even posted a screenshot of the old forum post, alleging that someone had once sent 1.5 BTC to a friend using the same wallet address.

Grogan, however, was quick to respond, calling the claim fake. "Guy made it up," Grogan posted on X. "There was never a 1.5 BTC transaction to or from the address."

Conor@jconorgroganJul 05, 2025Guy made it up, there was never a 1.5 btc transaction to or from the address pic.twitter.com/kOMYF7kzqs

The Coinbase director shared a screenshot of blockchain data that supports this assertion, indicating that no such transaction ever occurred with the address.

New update emerges

On Friday, eight Bitcoin wallets shifted 10,000 BTC each, for a total of 80,000 BTC, or $8.6 billion, drawing attention from the crypto community. The moved coins belong to the rarest class of BTC: mined or transacted during the "Satoshi era," which lasted from the launch of Bitcoin in 2009 to 2011, when its pseudonymous founder was still active online.

On-chain intelligence platform, Arkham, speculated that all the wallets appear to be owned by the same entity. However, no individual or company has publicly claimed possession of the wallets.

Arkham recently tweeted an update on the situation, putting to rest speculation that a Bitcoin OG whale was selling; "$8 billion transfers were possibly related to address upgrades, moving from 1- addresses to bc1q-addresses. There are no indications that this whale is selling Bitcoin," Arkham stated.

Bitcoin (BTC) prices showed a sideways movement in the past day producing no significant changes. Following the recent rejection at the $110,000 price range, the maiden cryptocurrency failed to break out of a descending consolidatory channel; therefore, fears on the current status of the bull market remain intact.

Amidst the current mood of uncertainty, prominent market analyst Ali Martinez has identified two important support levels in the advent of a price downturn.

On-Chain Data Reveals Strong Bitcoin Support At $106,500 And $98,500

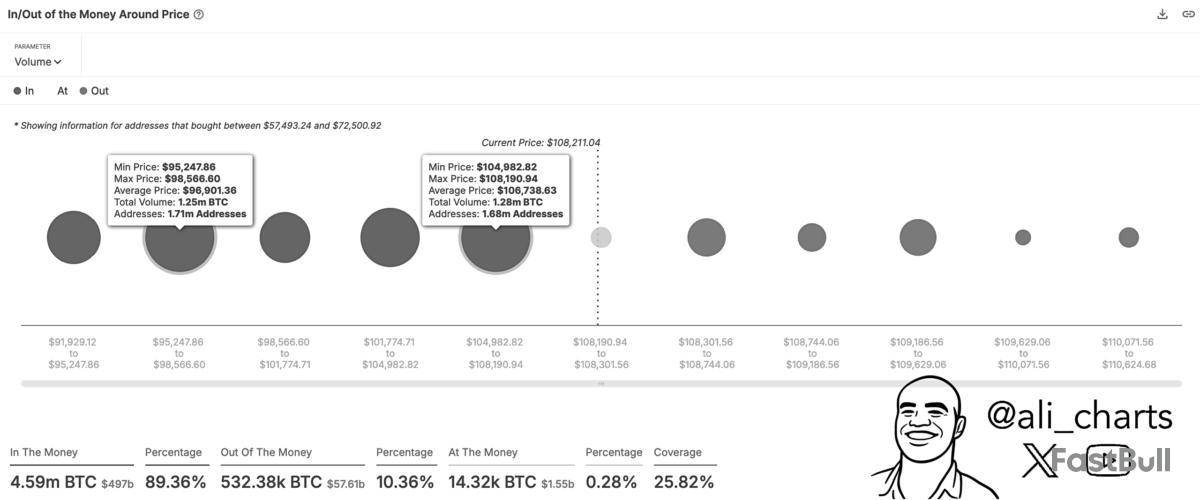

In an X post on July 5, Ali Martinez shares a potentially impactful on-chain insight on the Bitcoin market. Using data from the In/Out Money Around Price (IOMAP) Chart from Sentora, the analyst shares that major support zones have emerged that could play a crucial role in shaping the BTC’s short-term price direction.

The IOMAP chart analyzes Bitcoin wallet addresses and the average prices at which they acquired BTC, giving insights into potential zones of buying or selling pressure. Essentially, it shows where holders are currently in profit i.e. in the money” or at a loss i.e. out of the money.

From the chart, it is observed that 1.68 million addresses bought 1.28 million BTC between $104,982 and $108,190, with an average acquisition price of $106,738. Historically, such large concentrations of buying activity tend to form strong support zones, as holders may defend their positions from slipping into loss. Therefore, this development makes the $106,700 range a formidable near-term support level.

A second significant support level is identified in the $95,247 to $98,566 range, where 1.7 million addresses acquired 1.25 million BTC at an average price of $96,901. Should Bitcoin lose its footing above $106,000, this lower range would act as the next major cushion, potentially absorbing downward momentum. However, a decisive price close below $96,901 would confirm significant bearish intent by the Bitcoin market.

Bitcoin Market Overview

According to data from the IOMAP chart, around 89.36% of all BTC addresses are “in the money,” meaning their holdings were purchased at a lower price than the current market value. This is generally considered a bullish signal, suggesting the majority of market participants are in profit and thus less pressured to sell.

Meanwhile, only 10.36% of addresses are “out of the money,” highlighting the relatively low risk of widespread panic selling, unless Bitcoin were to break below these critical levels highlighted above. At press time, the premier cryptocurrency continues to trade at $108,154 reflecting a 0.24% gain in the past day. Meanwhile, it’s daily trading volume is down by 27.09% and valued at $31.04 billion.

Mike Novogratz has urged followers to buy Bitcoin amid increasing pressure that is being exerted on Jerome Powell.

Powell is facing hostile attacks due to his reluctance to cut interest rates, with some Republicans urging him to resign.

FHFA director Bill Pulte is now routinely targeting Powell in order to push for his termination. His most recent social media post is now accusing Powell of lying during his congressional testimony.

Novogratz believes that these are "Banana Republic moves," defending Powell.

Critics argue that cutting interest rates would help to boost the U.S. economy since Powell's current stance causes higher borrowing costs.

At the same time, Powell and the Fed are not willing to rush to cut interest rates since persistent inflation remains well above the central bank's long-touted 2% target. Premature rate cuts could potentially exacerbate the inflation problem.

Strong job numbers also give more credence to Powell's reluctance to reduce the benchmark interest rate.

Amid this growing pressure, there are some concerns that the independence of the Fed could end up being undermined, with markets previously rejecting the idea of firing Powell.

The central bank head has stressed that interest rate decisions have to be based on data instead of political biases.

Bitcoin proponents such as Novogratz believe that undermining the credibility of the most powerful central bank strengthens the case for the leading cryptocurrency.

Politicizing the Fed could lead to aggressive rate cuts, which will further weaken the dollar.

As reported by U.Today, Novogratz previously opined that the passage of the sweeping tax and spending bill was also bullish for Bitcoin, given that billions would be added to the U.S. deficit.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。