行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国对非欧盟贸易账 (季调后) (10月)

英国对非欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

By George Glover

Crypto stocks were set to pare back some of their recent losses on Monday, after President Donald Trump struck a more conciliatory tone when discussing potential U.S. tariffs on China.

Shares in the digital-asset exchange Coinbase Global rose 2.8% ahead of the open, while Bitcoin treasurer Strategy, formerly known as MicroStrategy, added 1.9% and online trading platform Robinhood Markets rose 4%. Futures tracking the S&P 500 were 1.4% higher.

The moves came after Trump on Sunday softened his tone on China tariffs, which appeared to bolster investors' appetite for risk assets following Friday's broad and brutal selloff.

Crypto prices were rising as part of Monday's broader rebound, and that tends to boost stocks like Coinbase, Strategy, and Robinhood. The trading platforms' transaction fee revenue rises when cryptos are trading in the green, while the value of Strategy's Bitcoin pile is linked to the price of the world's largest token.

Investors will be closely watching Strategy's latest Bitcoin purchase update, which it typically files on Mondays, to see how much of the cryptocurrency it bought ahead of Friday's slump.

Write to George Glover at george.glover@dowjones.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

Key takeaways:

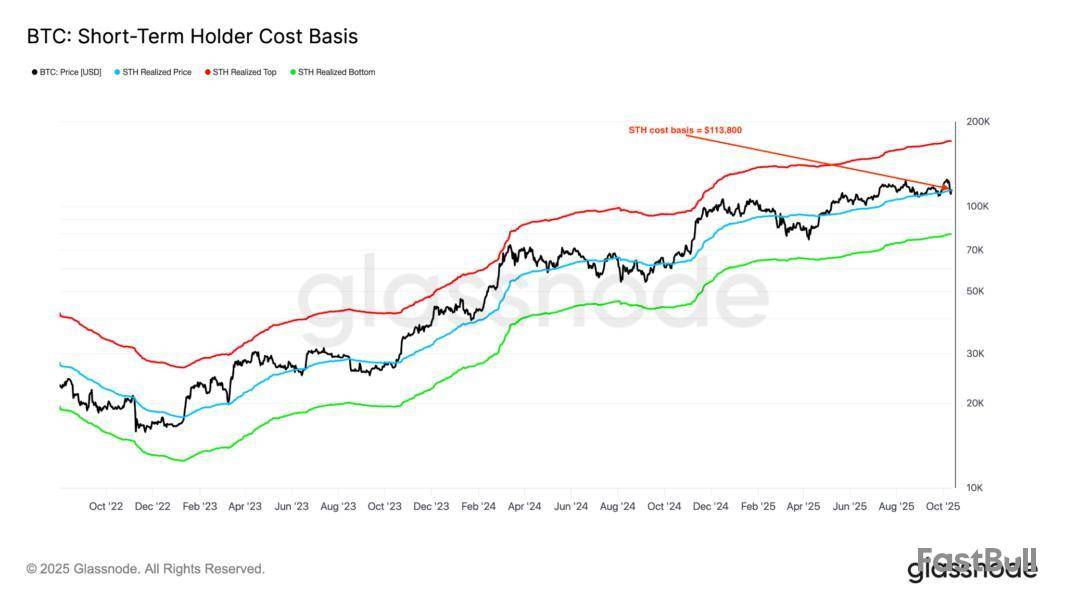

Bitcoin traded above short-term holder cost basis at $114,000, signaling recovering demand and potential for further gains.

Analysts believe Bitcoin could continue its uptrend, with targets between above $150,000.

Bitcoin price reclaimed the $115,000 level on Monday, recouping some of the losses from Friday’s historic sell-off, which resulted in over $20 billion in centralized exchange liquidations.

The 10%-15% price drop left a mark on BTC’s technicals, but traders say that Bitcoin’s macro outlook remains bullish with $150,000 still in the cards.

Bitcoin recovers above key trendline

The pair is trading 8% above the $107,500 low reached on Friday, according to Cointelegraph Markets Pro and TradingView.

This recovery has seen BTC rise back above its short-term (STH) cost basis, suggesting possible higher gains.

STH cost basis, or realized price, represents the average acquisition price of BTC for investors who have held Bitcoin for less than 155 days.

“BTC back above the STH cost basis of $114K,” said Frank Fetter, a quant analyst at investment firm Vibes Capital Management, adding:

The STH cost basis trendline acts as support during Bitcoin bull market corrections, and reclaiming it boosts investor confidence that the pair could see further gains.

Additional data from Glassnode also highlights that the cost basis of the 1w-1m holders has crossed back above the 1m–3m cost basis, signaling a rising momentum in demand and net capital inflows, as traders bought the dip.

Bitcoin’s uptrend remains intact

Bitcoin’s latest flash crash below $110,000 was short-lived as traders affirmed that the upside is not over for BTC.

“The crucial factor is that Bitcoin holds the support above the 20-Week MA” currently at $113,300, said MN Capital founder Michael van de Poppe in an X post on Sunday.

Van de Poppe added that Friday’s drop below this level “provided a massive opportunity” for buyers and reclaiming it indicates “we are continuing the uptrend.”

Echoing these sentiments, fellow Mickybull crypto said that Bitcoin “is still in bullish territory from a price action structural perspective,” adding:

Daan Crypto Trades said that his “base case for this cycle has always been $120K-$150K.”

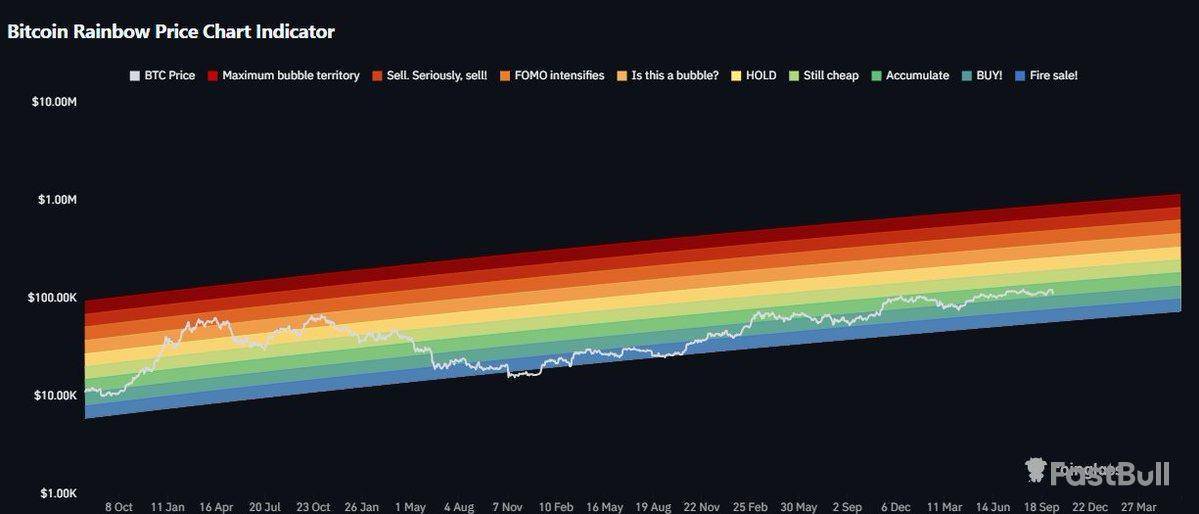

Looking at Bitcoin’s rainbow price chart indicator, the analyst said that the “light green/yellowish region ($140K-$200K)” would probably be a good point to start scaling out more heavily once the price reaches these levels.

Crypto analyst Jelle said Bitcoin has experienced a “2017-style washout” but still holds key levels, adding:

As Cointelegraph reported, Bitcoin is retesting the “golden cross,” a bullish technical pattern that has historically preceded rallies of 2,200% in 2017 and 1,190% in 2020. A confirmed breakout could see Bitcoin’s price go parabolic in the coming weeks.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

The crypto market enters a packed week as Ethereum prepares for network upgrades, token events draw attention, and global economic developments continue to impact digital assets. Bitcoin currently trades around $115,261, while Ethereum holds near $4,173, showing some recovery after recent market volatility.

Ethereum Fusaka Upgrade on Testnet

Ethereum developers are rolling out the Fusaka hard fork on the Sepolia testnet on October 14. This upgrade aims to enhance network efficiency and transaction speed, laying the groundwork for future mainnet improvements. Traders and developers are closely monitoring the test results, as a successful rollout could strengthen confidence in Ethereum’s long-term roadmap.

U.S. Government Shutdown Weighs on Market

Investor caution remains high as the U.S. government shutdown delays crucial economic data, including inflation and producer price index (PPI) reports. Pending crypto ETF approvals are also on hold, adding uncertainty for short-term price movements. This backdrop makes it a critical week for assessing market direction.

Governance Votes and Token Unlocks

Several DAOs are conducting key governance votes. Superfluid DAO and ENS DAO are deciding on upgrades to improve usability and yield. Sandbox DAO and GnosisDAO focus on operational improvements, while Arbitrum DAO addresses quorum rules. Token unlocks are also scheduled: STRK, SEI, ARB, and FTN release significant portions of their circulating supply between October 15-18, potentially affecting prices in the short term.

New Projects Launching

New initiatives are coming online this week. SANDchain, a zk-powered Ethereum layer-2, launches on October 14, while ZBCN will be listed on Kraken on October 15. The Aster airdrop claiming period ends on October 17, attracting attention from traders and community members.

Major Events Across the Globe

The crypto calendar is packed with conferences and summits. The Digital Asset Summit in London starts on October 13, followed by DC Fintech Week and the Future of Finance Tokenisation Event. Other notable events include the European Blockchain Convention in Barcelona, the Bitcoin 2140 Forum in Dubai, and ETHShanghai in China from October 18-22.

Key Event Highlights:

This week promises a blend of technological upgrades, governance decisions, token events, and global economic influences, making it a critical period for crypto investors and traders.

Crypto exchange WazirX has finally secured approval from the Singapore High Court for its restructuring plan, paving the way for user repayments following the $234 million hacking incident last year.

The court’s decision comes weeks after creditors backed a revised proposal. The approval allows WazirX to start the next phase of its recovery process, including token-based fund distributions and reviving the exchange’s operations.

“Thank you to everyone who supported this difficult phase of WazirX. The Singapore High Court has approved the scheme,” WazirX founder Nischal Shetty said in a post on X. “It’s your support and love that has made this possible.”

The court’s approval marks a major milestone for the India-based exchange, which already spent over a year navigating the legal hurdles required to return funds to over 150,000 affected users.

WazirX users inch closer to fund recovery after $234 million hack

WazirX lost about $234 million in crypto assets from a Safe Multisig wallet breach in July 2024, which forced the exchange to pause withdrawals on the platform.

The attack has since been linked to North Korean hackers, as analysts observed similar techniques often used by the Lazarus hacking group.

In April, WazirX creditors approved a similar scheme months after the exchange told users that non-approval could delay repayments until 2030.

However, the Singapore High Court did not approve the proposal, citing concerns over how the recovery tokens, which will be used to compensate users, would be affected by a proposed regulatory framework for digital token service providers.

WazirX eyes swift restart, but repayment timelines vary

With the latest development, users are inching closer to seeing their funds back after over a year of waiting.

On Aug. 20, Shetty said that after the court’s approval, the exchange would be revived, and users could get their funds within ten days of the scheme taking effect.

While Shetty seemed optimistic about a quick turnaround, George Gwee, a director at restructuring firm Kroll that is working with WazirX, said users may need to wait two to three months after the approval before they can finally receive funds.

At the time of writing, WazirX has not published any definite estimates of when the repayments will officially begin.

Cointelegraph reached out to WazirX for clarification, but did not get a response by publication.

Bitcoin has come a long way from being dismissed as a tool for money launderers and thieves. Even Larry Fink, CEO of BlackRock, the world’s largest asset manager with $12 trillion under management, has changed his view.

Despite the recent crypto market crash, Larry Fink called cryptocurrency (Bitcoin) a legitimate alternative asset, similar to gold, useful for diversifying investment portfolios.

Fink Admits Past Mistakes

In a recent CBS 60 Minutes interview, Fink said that Bitcoin and other cryptocurrencies have grown and are now seen as real alternative investments.

He admitted, “I did say Bitcoin was for money launderers and thieves. But the market teaches you to always rethink your assumptions.”

This shows a big change in his view, moving from doubt to cautious acceptance, as crypto becomes more important in global finance.

Crypto Rover@rovercrcOct 13, 2025💥BREAKING:

BLACKROCK CEO LARRY FINK JUST TOLD 60 MINUTES THAT #BITCOIN IS THE SAME AS GOLD! pic.twitter.com/H4GKIZVr5h

Bitcoin as an Alternative Asset Similar To Gold

Today, Larry Fink sees Bitcoin as an alternative investment similar to Gold, suggesting that crypto could serve as a portfolio diversification tool and an inflation hedge.

While gold has a $15 trillion market, Bitcoin is emerging as a smaller but complementary asset. Meanwhile, for those looking to diversify, this is not a bad asset.

However, Fink warned not to put too much into crypto. He advised keeping it as a small part of any investment portfolio.

Institutional Adoption Accelerates Bitcoin Growth

This change in stance comes as BlackRock successfully launched its Bitcoin ETF, signaling strong institutional interest. BlackRock’s IBIT ETF is now ranked in the top 20 for U.S. ETF assets under management, breaking the $90 billion mark.

Other major financial institutions, including JPMorgan and Goldman Sachs, have also entered the crypto space, offering services to clients seeking digital asset exposure.

Following Fink’s interview, Bitcoin’s price has already jumped roughly 4%, reaching $115,300, recovering strongly from the recent market crash.

The crypto market is up today following the weekend’s correction, with the cryptocurrency market capitalization rising by 4.4%, going back to $4 trillion. 97 of the top 100 coins have appreciated over the past 24 hours. At the same time, the total crypto trading volume is at $270 billion. TLDR:

At the time of writing, all top 10 coins per market capitalization have seen their prices increase over the past 24 hours.

Bitcoin (BTC) appreciated 2.9%, currently trading at $115,097. It’s the second-lowest rise of the category.Bitcoin (BTC)24h7d30d1yAll time

Ethereum (ETH) is up by 8.7%, now changing hands at $4,152. This is the third-highest increase in the category.

The highest one is Binance Coin (BNB)’s 14.9% to $1,318. It’s followed by 10% by Dogecoin (DOGE), now trading at $0.2087.

The lowest increase is Tron (TRX)’s 2.2% to $0.3227.

When it comes to the top 100 coins, 97 have seen an increase, the highest of which is 51.1% by , followed by Bittensor (TAO)’s 32.1% to $402. A dozen more coins have recorded price increases.

On the other hand, MemeCore (M) fell the most: 7.7% to $2.05.‘Now That the Dust Has Settled, Many Blue-Chip Tokens Have Seen a Strong Rebound’

Nick Forster, Founder at onchain options platform Derive.xyz, commented that we saw “an unprecedented market meltdown” on Friday, as well as $19 billion in liquidations across the industry.

“The crash was triggered by renewed fears of a U.S.-China trade war, after Donald Trump threatened an additional 100% tariff on Chinese imports,” Forster says. “This came on the heels of China announcing new restrictions on rare earth element exports, escalating tensions between the two economies.”

Moreover, “with order books thinned out, forced liquidations and panic selling had an outsized impact on price, fueling a self-reinforcing cascade of liquidations and accelerating the flash crash.”

Nic Puckrin, crypto analyst and co-founder of The Coin Bureau, said that “the bloodbath we saw in markets over the weekend is a brutal reminder that, as the crypto market grows and matures, the risks are amplified.”

“The arrival of spot crypto ETFs and institutional interest has lulled investors into a false sense of security, but it remains the only market that trades after hours. In this environment, thin liquidity, overleverage, and the involvement of big players make for a toxic cocktail.”

Ironically, Puckrin says, “now that the dust has settled, many blue-chip tokens have seen a strong rebound – including Ethereum, which is looking particularly strong back above $4,000. As such, many spot investors find themselves in a similar position to where they were before the flash crash. This is certainly an argument against excessive leverage in a market with fluctuating liquidity in such an uncertain geopolitical climate.”

“The good news is that this has cleaned out the excessive leverage and reset the risk in the market, for now. However, Bitcoin now faces another uphill battle to break past key resistance levels that will allow it to reach a meaningful new all-time high this year,” he concluded.Levels & Events to Watch Next

At the time of writing on Monday morning, BTC trades at $115,097. On 10 October, the coin dropped from $121,561 to $109,883 on 12 October. Since then, it has recovered to the current price.

Over the past 24 hours, the coin moved between the low of $111,247 and the high of $115,792. Over the past week, its intraday low was $109,883, and the intraday high was $126,080.

If BTC moves above $117,000, a short-term rally toward $124,000 could follow, and then toward $126,000 to retest previous highs. However, a drop below $108,000 may lead to $103,000 and below $100,000 towards $98,200.Bitcoin Price Chart. Source: TradingView

Ethereum is currently trading at $4,152. The price fell from $4,350 on Friday to $3,683 the following day.

In the past day, ETH moved between $3,802 and $4,196, as well as between $3,686 and $4,747 in a week.

A breakout above $4,055 could open doors for a move toward $4,200 and $4,330. However, a drop below $3,720 may lead to the $3,512 zone.Ethereum (ETH)24h7d30d1yAll time

Meanwhile, the crypto market sentiment had dropped over the weekend before rising slightly today. The crypto fear and greed index fell into the fear zone over the weekend, hitting 31, before rising to , on the verge of the neutral zone.

Investors are growing increasingly cautious, waiting to see where the market will go next.Source: CoinMarketCapETFs Turn Red

The US BTC spot exchange-traded funds (ETFs) saw in outflows on Friday, following significant inflows and breaking the green streak.

Of the 12 ETFs, one saw inflows, and five saw outflows. BlackRock took in $74.21 million, while Bitwise let go of $37.45 million.Source: SoSoValue

Moreover, the US ETH ETFs recorded in outflows on 10 October.

Five of the nine finds saw negative flows, and none saw positive flows. BlackRock let go of the highest amount: $80.19 million. It’s followed by Grayscale’s $30.57 million.Source: SoSoValue

Meanwhile, major Bitcoin mining company MARA Holdings has purchased an additional 400 BTC on Monday, worth $46.31 million. The company holds a total of 53,250 BTC, worth $6.12 billion.

MARA Holdings, which holds 52,850 ($6.12B), bought another 400 ($46.31M) through 2 hours ago. — Lookonchain (@lookonchain) Quick FAQ

The crypto market has increased over the past day, and the stock market pulled further back on Friday after the latest all-time highs. By the closing time on 10 October, the S&P 500 was down by 2.71%, the Nasdaq-100 decreased by 3.49%, and the Dow Jones Industrial Average fell by 1.9%. The markets fell on Friday as the US-China trade tensions resumed.

The market has been recovering following the plunge it had seen on Friday. Investors are likely to await further economic and geopolitical signals that could point the direction the market will take short term.You may also like:(LIVE) Crypto News Today: Latest Updates for October 13, 2025Crypto markets staged a sharp rebound after easing U.S.-China tensions and renewed investor optimism. Major sectors posted 24-hour gains between 6% and 20%, led by Layer2 tokens up 19.4%. Mantle (MNT) jumped 38%, while Celestia (TIA) and Zora (ZORA) rose over 15% and 25%, respectively. Bitcoin climbed 4.85% to surpass $115,000, and Ethereum rallied 11.6% above $4,100. AI, CeFi, and DeFi sectors also saw double-digit gains. The rebound follows what analysts called a “historic crash” triggered...

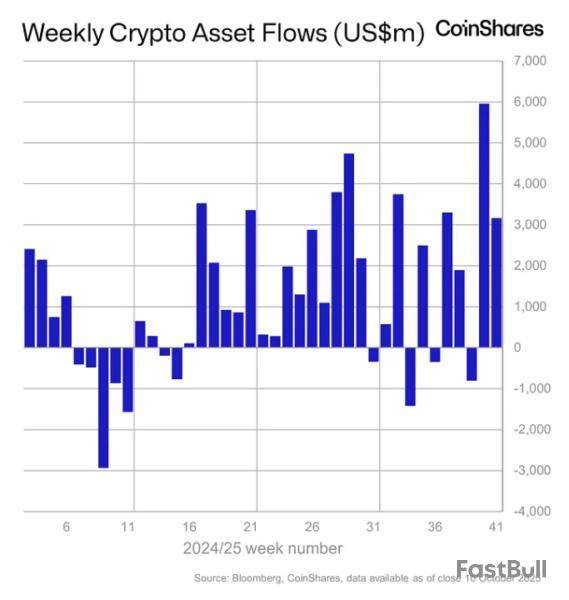

Global crypto investment products managed by asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares generated net inflows of $3.17 billion last week, according to CoinShares' data.

As a result, year-to-date inflows have now surpassed last year's record tally, totaling $48.7 billion so far in 2025 — notwithstanding the chaotic end to last week, when cascading liquidations wiped billions of dollars in value from the crypto sector.

"Despite the significant price correction caused by the China tariff threats by the U.S., Friday saw little reaction with a paltry $159 million outflows," CoinShares Head of Research James Butterfill wrote in a Monday report.

Weekly crypto asset flows. Images: CoinShares.

Weekly trading volumes in digital asset exchange-traded products also surged to a record $53 billion — more than double the 2025 weekly average — while Friday alone saw an all-time-high $15.3 billion in daily turnover, Butterfill noted. However, following President Trump's tariff announcement, total assets under management slipped 7% from last week's peak to $242 billion, though his comments were later walked back to some extent.

At least $20 billion of positions were wiped out on Friday as some cryptocurrencies briefly fell literally to zero — the largest crypto liquidation event in history in U.S. dollar terms. However, as liquidation data is imperfect — with Bybit publishing in full, but Binance and OKX still underreporting in incomplete bursts, for example — the true figure is likely far higher.

Nevertheless, major cryptocurrencies were more resilient, with BTC and ETH falling 6.8% and 8.3%, respectively, over the past week, according to The Block's price page.

Bitcoin and US lead the flows

U.S.-based digital asset investment products continued their dominance, accounting for $3.01 billion of net inflows alone. Crypto funds in Switzerland and Germany also continued to fare well, adding another $132 million and $53.5 million last week. However, products in Sweden, Brazil, and Hong Kong all witnessed outflows.

Bitcoin-based funds again led the weekly inflows by asset, adding $2.67 billion and bringing year-to-date inflows to a record $30.2 billion. "Volumes on Friday's price correction were the highest on record at $10.4 billion for the day, while flows on Friday were only $0.39 million," Butterfill noted.

The U.S. spot Bitcoin exchange-traded funds saw $2.71 billion in net inflows alone, according to data compiled by The Block, offset by outflows from other regions. They witnessed just $4.5 million in net outflows on Friday, potentially benefitting from the tradfi market close, though it remains to be seen if outflows will escalate following the weekend.

Ethereum products also added $338.3 million last week, pushing year-to-date inflows to a record of nearly $14 billion. However, they witnessed outflows of $172 million on Friday — the largest of any digital asset — suggesting investors saw it as being the most vulnerable in this correction, Butterfill said.

The U.S. spot Ethereum ETFs brought in $488.2 million overall last week, but lost $174.9 million on Friday.

Meanwhile, despite growing hype around the upcoming U.S. SOL and XRP ETF launches, inflows for existing ETPs linked to those assets cooled to $93.3 million and $61.6 million, respectively.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。