行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)公:--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)公:--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)公:--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)公:--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)公:--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)公:--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)公:--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)公:--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

美国纽约联储制造业物价获得指数 (12月)

美国纽约联储制造业物价获得指数 (12月)--

预: --

前: --

美国纽约联储制造业新订单指数 (12月)

美国纽约联储制造业新订单指数 (12月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大截尾均值CPI年率 (季调后) (11月)

加拿大截尾均值CPI年率 (季调后) (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

加拿大CPI月率 (季调后) (11月)

加拿大CPI月率 (季调后) (11月)--

预: --

前: --

美联储理事米兰发表讲话

美联储理事米兰发表讲话 美国NAHB房产市场指数 (12月)

美国NAHB房产市场指数 (12月)--

预: --

前: --

澳大利亚综合PMI初值 (12月)

澳大利亚综合PMI初值 (12月)--

预: --

前: --

澳大利亚服务业PMI初值 (12月)

澳大利亚服务业PMI初值 (12月)--

预: --

前: --

澳大利亚制造业PMI初值 (12月)

澳大利亚制造业PMI初值 (12月)--

预: --

前: --

日本制造业PMI初值 (季调后) (12月)

日本制造业PMI初值 (季调后) (12月)--

预: --

前: --

英国失业金申请人数 (11月)

英国失业金申请人数 (11月)--

预: --

前: --

英国失业率 (11月)

英国失业率 (11月)--

预: --

前: --

英国三个月ILO失业率 (10月)

英国三个月ILO失业率 (10月)--

预: --

前: --

无匹配数据

Key Takeaways:

Solana's 15% surge and potential close above the 50-week EMA signal strong bullish momentum, which previously led to a 515% rally in 2024.

The $120 million in liquidity bridged to Solana reflects growing network confidence.

Solana (SOL) price gained 18% this week, signaling rising bullish momentum. The altcoin is approaching a pivotal point, with a potential close above the 50-week exponential moving average (EMA), a level that has historically catalyzed significant rallies.

In March, SOL dipped below the 50-week EMA and briefly dropped under $100 on April 7. Since then, Solana has staged a strong recovery, reclaiming key EMA levels (100W and 200W), with the 50-week EMA (blue line) now in focus.

Historical patterns reinforce a bullish outlook. In October 2023, SOL breached the 50- and 100-week EMAs, consolidating above these levels before rallying 515% by March 2024.

Notably, the relative strength index (RSI) was below 50 during both periods, mirroring the current setup, with the indicator rebounding above 50 after the 50-week EMA flipped to support. If the 50-week moving average holds, the price targets for SOL could be between $250 and $350 by September 2025.

The daily chart bolsters this narrative. Solana recently closed above the 200-day EMA, with immediate resistance at $180. A break above this level in the coming weeks and turning the range into a support level could potentially ignite a parabolic rally by Q3 2025.

Related: Solana lacks ‘convincing signs’ of besting Ethereum: Sygnum

Users bridge $165 million to Solana

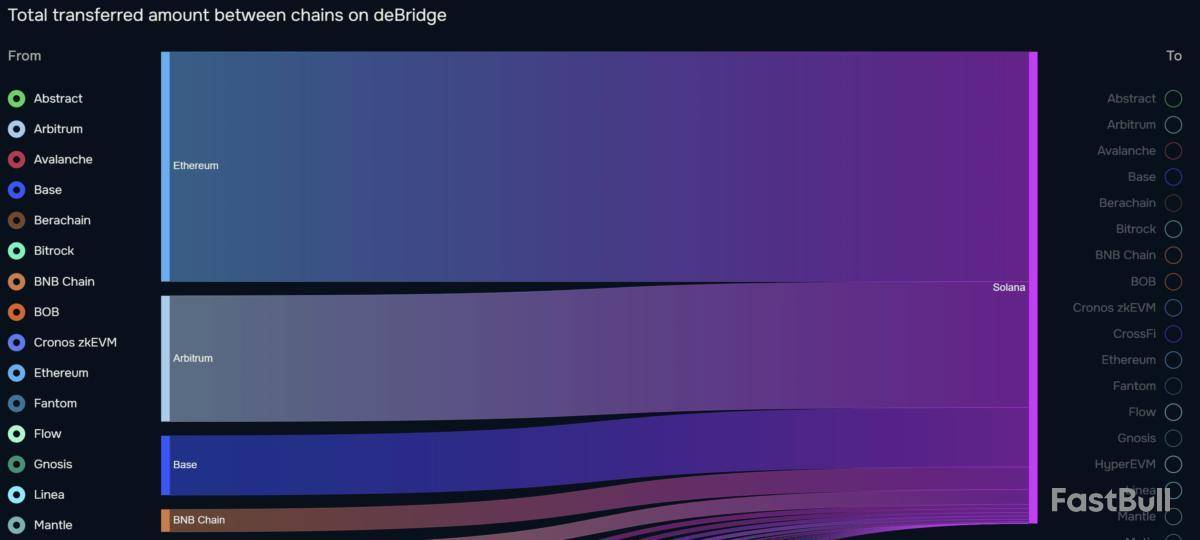

In the last 30 days, over $165 million in liquidity has been bridged to Solana from other blockchains, reflecting growing confidence in the network. Ethereum led with $80.4 million in transfers, followed by Arbitrum with $44 million, per Debridge data. Base, BNB Chain, and Sonic contributed $20 million, $8 million, and $6 million, respectively.

Similarly, data from DefiLlama indicates that Solana posted the highest decentralized exchange (DEX) volumes, 3.32 billion, over the past 24 hours. The network currently holds 28.99% of the market share among other chains.

With a 28.99% market share among competing chains, Solana’s dominance in DeFi activity highlights its scalability and user adoption.

Currently, substantial liquidity inflows and strong DEX volumes position Solana for a sustained price breakout.

Related: Chance of Bitcoin price highs above $110K in May increasing — Here’s why

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Wall Street giant BlackRock met with the Securities and Exchange Commission (SEC) Crypto Task Force to discuss staking within crypto exchange-traded products (ETPs) and tokenization of securities. The discussion could advance institutional interest in the crypto industry.

According to a May 9 memo published by the task force, BlackRock sought to “[d]iscuss perspectives on treatment of staking, including considerations for facilitating ETPs with staking capabilities.” The company has previously said that Ether (ETH) exchange-traded funds, while successful, are less perfect without staking.

Other crypto ETF issuers share that view. On Feb. 15, the New York Stock Exchange proposed a rule change to introduce staking services for Grayscale’s spot Ether ETFs. In April, the SEC delayed a decision on whether to approve or disapprove the rule change. BlackRock and Grayscale are behind the largest Ether ETFs by market capitalization, according to Sosovalue.

Many blockchains rely on proof-of-stake consensus mechanisms that allow users to lock their native coins for yield. A potential SEC approval of staking for Ether ETFs could lead to future requests among altcoins, including Solana (SOL) ETFs.

Tokenization on the agenda

BlackRock also discussed “tokenization of securities under federal securities regulatory framework.” Securities are traditional financial instruments where the investor expects monetary gain, such as bonds and stocks. Tokenizing securities has many benefits, including faster settlement times, lower costs than with traditional finance infrastructure, and 24-hour markets.

BlackRock already offers a US federal debt tokenized fund called BUIDL, the largest fund with a $2.9 billion market cap. Competing products include Franklin Templeton's BENJI fund.

Brokerage firm Robinhood is also exploring securities tokenization. The company is reportedly working on a blockchain that would allow retail investors in Europe to trade US securities like stocks.

Magazine: Ethereum is destroying the competition in the $16.1T TradFi tokenization race

Bitcoin blasted back through the psychologically charged $100,000 threshold for only the second time in its 16-year history, reclaiming a level last seen in February. As the world’s first stateless money ticked higher, SkyBridge Capital founder Anthony Scaramucci told podcast host Anthony “Pomp” Pompliano that sovereign wealth funds are already accumulating the asset and are poised to scale those purchases dramatically once Washington finishes writing the rules of the road.

Sovereigns Are Pouring Billions into Bitcoin

Scaramucci, whose new Little Book of Bitcoin chronicles his own conversion from skeptic to evangelist, said overseas officials are quietly adding the digital asset even before the United States clarifies stablecoin legislation, bank-custody guidance and broader tokenization rules.

When asked if sovereigns are buying Bitcoin secretly, Scaramucci answered: “I think they are buying it, I think they’re buying it on the margin,” he said, adding that regulatory green lights will unleash a massive wave of capital inflow. “I don’t think it’s going to be a gigantic ground swell of buying until we green light legislation in the United States,” he stated. This, in Scaramucci’s view, will make “people worth 10, 20, 30 trillion dollars buying a half-a-billion dollars of Bitcoin, buying a billion dollars of Bitcoin.”

Vivek⚡️@Vivek4real_May 08, 2025🇺🇸 ANTHONY SCARAMUCCI JUST CONFIRMED THAT ALL SOVEREIGNS ARE BUYING BILLIONS OF #BITCOIN

THIS IS WILD!!! 🚀 pic.twitter.com/AInDVGR6Jh

The former White House communications director framed today’s discreet allocations as a rational response to an increasingly erratic policy environment. With tariffs ricocheting through global supply chains and the dollar’s primacy “controlling the global economy,” he argued, officials outside the United States are searching for insurance against what he called “executive-policy behavior.” “We may need to be decoupled from one sovereign currency,” Scaramucci said, predicting that gold’s record highs and Bitcoin’s resilience during this year’s stock-market slump stem from the same instinct for self-protection.

He stopped short of predicting that Bitcoin will replace the dollar, but he insisted that sovereign accumulation is the precondition for an eventual seven-figure price tag. “If you want to see a million-dollar Bitcoin, that’s when somebody at a sovereign says, ‘Okay, this is part of the infrastructure of the world’s financial-services architecture.’” In that scenario, he expects official portfolios to target 1%-3% allocations—enough, in his view, to lift Bitcoin’s market capitalization toward gold’s $20-30 trillion domain.

Digital Gold Will Win

For now, the “digital gold” thesis appears to be holding. While global equity indices have fallen 5%-8% since the latest tariff salvos, Scaramucci noted, Bitcoin is “roughly where it was at the beginning of the year.” Thursday’s breakout above $100,000 underscores that relative strength.

SkyBridge itself has ridden that wave. Scaramucci reminded listeners that he began buying Bitcoin for his flagship fund around $20,000, calling the position “quite beneficial to our performance.” Independent fund-database figures show the $1.7 billion vehicle returned 43% in 2024, outpacing its hedge-fund benchmark by more than four-to-one—results Scaramucci attributes chiefly to the Bitcoin stake. “This is the best idea I have seen in my career,” he said. “I knew the risks of not jumping in were far greater than playing it safe.”

Generational dynamics are reinforcing those flows. While older asset-managers still lean toward bullion, Scaramucci said, younger allocators already treat Bitcoin as an heirloom asset. “My grandchildren will end up having Bitcoin as a store of value,” he predicted.

Still, he cautioned that widespread institutional adoption will not occur until the United States clarifies its regulatory stance. “If we green-light legislation before the end of the congressional term … then I will tell you that there’ll be large blocks of buying,” he said. Absent that clarity, purchases will remain incremental—yet even incremental flows from trillion-dollar institutions can tally in the billions.

At press time, BTC traded at $103,077.

Ethereum is up $154.75 today or 7.08% to $2339.29

Note: The Ethereum price is a 5 p.m. ET snapshot from Kraken

Data compiled by Dow Jones Market Data

One of the most popular meme cryptocurrencies, Shiba Inu , is back in the spotlight after a significant rise in derivatives activity.

The latest data from Coinglass shows that SHIB's futures open interest has increased to $220 million, its highest level in the last 30 days.

Source: Coinglass">

Open interest is the total value of all open futures contracts on an asset. Typically, a rise in open interest signals increased investor confidence in the asset’s short-term price direction.

Coinglass shows a gradual increase in SHIB open interest since late April and into May, including a significant breakout in the last 48 hours. This increase coincides with a modest rally in SHIB’s price, indicating renewed optimism among traders.

The sharp rise in futures activity suggests that investors are positioning themselves to benefit from SHIB’s next price move, with many expecting a breakout and the start of a rally.

Starting from April 9, 2025, open interest in SHIB grew from $93 million to over $200 million, before surpassing $220 million on May 9. This increase represents more than double the value from just a month earlier.

SHIB traders brace for volatility

Even though SHIB’s price remained relatively stable during this period, the spike in open interest shows that more capital is flowing into the market. Typically, traders interpret this trend as a sign of upcoming volatility or rising confidence in the coin.

It also suggests that speculators are anticipating a significant price move and are opening leveraged positions to capitalize on the potential swing.

With its meme-driven community and a history of sharp price changes, Shiba Inu has long been considered a high-risk, high-reward asset.

Majority of SHIB investors break even

Meanwhile, the latest on-chain data from IntoTheBlock shows that more than half of token holders are currently at breakeven. This data also offers insight into the overall profitability of SHIB holders.Source: IntoTheBlock">

According to the data, only 18.49% of SHIB addresses, holding 182.19 trillion SHIB, are currently “in the money” (or in profit), meaning the current price is higher than their average purchase price.

However, 27.93% of SHIB addresses, holding 275.19 trillion SHIB tokens, are at a loss, or “out of the money.”

US Vice President JD Vance will speak at the Bitcoin 2025 conference in Las Vegas, roughly a year after then-presidential candidate Donald Trump spoke at the same event.

According to a May 9 notice from the event’s organizers, Vance will address conference attendees in person on May 28, making him the first sitting US vice president to speak at a digital asset conference.

Trump provided a pre-recorded video of himself from the White House to the organizers of the Digital Asset Summit in March — his first appearance at a crypto event since taking office in January — and spoke in person at the Bitcoin 2024 conference in Nashville while campaigning.

Though Vance is a Bitcoin holder — he holds $250,000 to $500,001 worth of the cryptocurrency, according to a financial disclosure filed in August 2024 — it’s unclear whether the vice president intends to make a substantive policy statement at the event. Cointelegraph reached out to Vance’s office for comment but had not received a response at time of publication.

Since taking office alongside Trump in January, Vance has largely stayed out of the media spotlight in terms of crypto-related policy. The president has signed executive orders on establishing a crypto reserve and regulating stablecoins, while Vance’s involvement with overseeing the industry seemed to be limited to speaking on AI regulation.

Two of the president’s sons, Donald Trump Jr. and Eric Trump, who are tied to the crypto platform World Liberty Financial, were also scheduled to speak at the May event. Many lawmakers have expressed concerns that the platform, backed by the Trump family, is being used to personally enrich the president.

Trump’s ties to crypto holding up legislation?

The vice president’s appearance at the crypto conference was announced the same week Democratic lawmakers in the House of Representatives and the Senate strongly criticized Trump’s connections to the crypto industry.

In the House, Representative Maxine Waters halted a joint hearing discussing a crypto market structure bill and led a group of lawmakers to explore “Trump’s crypto corruption.” In the Senate, nine Democrats blocked a crucial vote on a stablecoin bill, saying the legislation lacked certain safeguards, hinting at the Trump family enriching itself through the USD1 stablecoin issued by World Liberty Financial.

According to analyst Charlie Morris, Bitcoin, the leading cryptocurrency, has reached a new record high relative to the tech-heavy Nasdaq index.

The ratio of Bitcoin to Nadsaq futures (the "BitDAQ ratio") is now at its new peak, surging above 5. Morris believes that the aforementioned threshold is psychologically significant.

This essentially means that one Bitcoin is worth five times the value of a single Nasdaq futures contract.

Bitcoin, which tends to be correlated with traditional tech, has significantly outperformed this sector by acting as a safe haven asset. This is despite the fact that the leading cryptocurrency historically has a rather high correlation with tech stocks.

As reported by U.Today, the cryptocurrency has reached $103,000, hitting its highest level in four months.

The Nasdaq-100 index is down 4.3% on a year-to-date basis, recovering from the tariff-induced crash that occurred in early April.

This week, major U.S. stock indices rallied due to renewed trade optimism stemming from rumors about potential negotiations between the U.S. and China. The US also announced its very first major deal with the UK, further boosting risk assets.

Bitcoin managed to return to six-digit territory earlier this week for the first time since February. The rally has coincided with the massive inflow streak logged by BlackRock's record-shattering Bitcoin ETF.

The cryptocurrency is now on the cusp of reaching a new record peak.

"If at any point in the last 15 years, you were debating whether to buy and hold Bitcoin or the Nasdaq, you would have been better off in Bitcoin," Matt Weller, global head of market research at StoneX, said on X.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。