行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国对非欧盟贸易账 (季调后) (10月)

英国对非欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

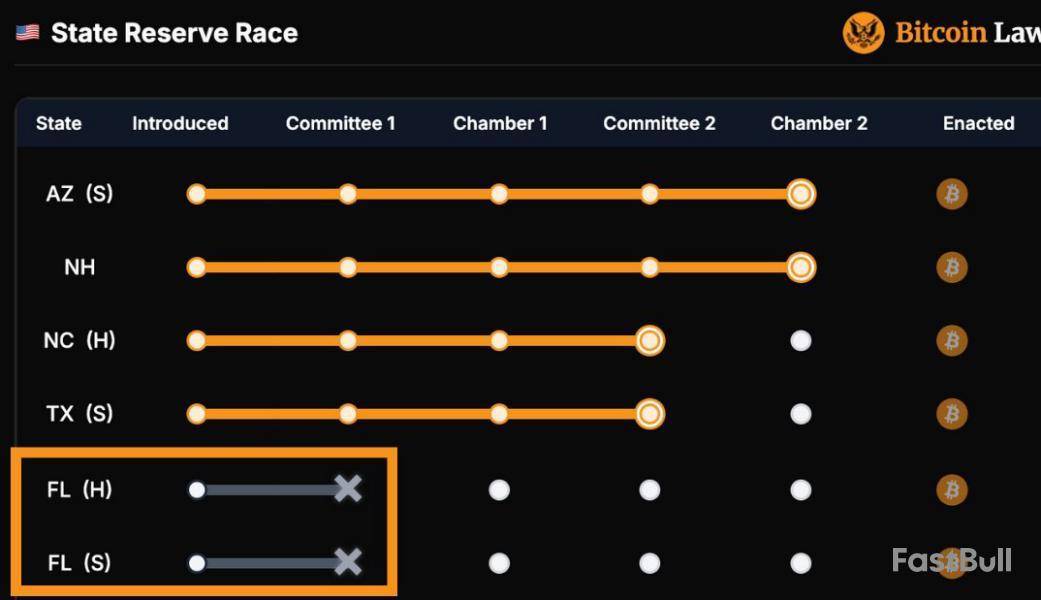

Two Florida crypto bills have been removed from the legislative process in the latest blow to American state-level strategic Bitcoin reserve ambitions.

Florida’s House Bill 487 and Senate Bill 550 have been “indefinitely postponed and withdrawn from consideration” on May 3, according to the Florida Senate.

Florida’s legislative session adjourned on May 2 without the passage of these two bills, which would have advanced legislation to establish a crypto reserve for the state. The Senate and House agreed to extend the session until June 6 to address budget plans.

Lawmakers passed about 230 bills during the session, dealing with things like prohibiting putting fluoride in the water, protecting state parks, and a school smartphone ban, but diversifying state treasury portfolios was not among them.

HB 487, which was introduced in February, would have allowed Florida’s chief financial officer and the State Board of Administration to invest up to 10% of certain state funds into Bitcoin .

SB 550 was also filed in February to enable investments of public funds in Bitcoin.

Florida has now dropped out of the race to pass state-level crypto investment legislation, along with Wyoming, South Dakota, North Dakota, Pennsylvania, Montana and Oklahoma, which have all seen Bitcoin bills fail to pass House or Senate votes, according to Bitcoin Laws.

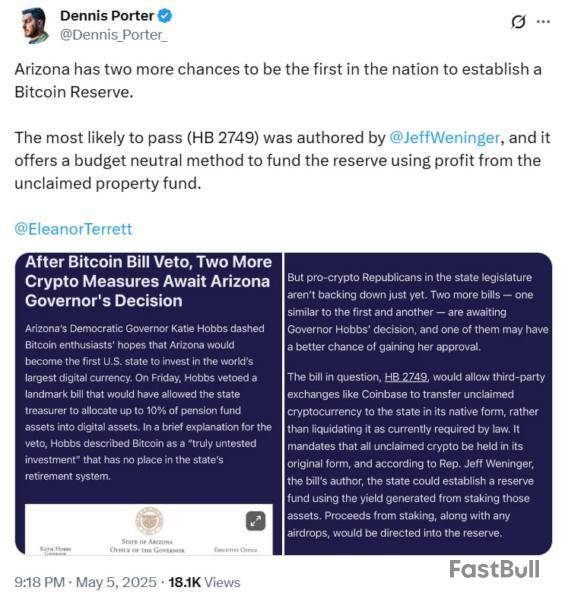

Arizona has two more chances

It came just days after Arizona advanced its strategic Bitcoin reserve legislation further than any other state, until House Bill 1025 was vetoed by Governor Katie Hobbs, who labelled digital assets “untested investments” on May 3.

The Digital Assets Strategic Reserve bill would have permitted Arizona to invest seized funds into Bitcoin and create a reserve managed by state officials.

The move drew the ire of crypto advocates and Bitcoiners, including entrepreneur Anthony Pompliano, who said: “Imagine the ignorance of a politician to believe they can make investment decisions.”

“Arizona has two more chances to be the first in the nation to establish a Bitcoin reserve,” said Satoshi Action Fund founder Dennis Porter on May 5, citing an article from Fox’s Eleanor Terrett.

He added that the most likely to pass is HB 2749, which offers a budget-neutral method to fund the reserve using profit from the unclaimed property fund.

There is also a related bill, SB 1373, which would authorize the state treasurer to allocate up to 10% of Arizona state funds into digital assets. It has yet to reach a final vote.

XRP price started a downside correction below the $2.20 zone. The price is now declining and might extend losses toward the $2.020 level.

XRP Price Dips Further

XRP price failed to continue higher above $2.25 and started a downside correction, like Bitcoin and Ethereum. The price declined below the $2.20 and $2.180 support levels.

The bears even pushed the price below the $2.120 support zone. A low was formed at $2.095 and the price is now consolidating losses. It is trading below the 23.6% Fib retracement level of the downward move from the $2.2579 swing high to the $2.095 low.

The price is now trading below $2.180 and the 100-hourly Simple Moving Average. Besides, there is a key bearish trend line forming with resistance near $2.1750 on the hourly chart of the XRP/USD pair.

On the upside, the price might face resistance near the $2.1320 level. The first major resistance is near the $2.1750 level and the 50% Fib retracement level of the downward move from the $2.2579 swing high to the $2.095 low.

The next resistance is $2.1950. A clear move above the $2.1950 resistance might send the price toward the $2.220 resistance. Any more gains might send the price toward the $2.250 resistance or even $2.30 in the near term. The next major hurdle for the bulls might be $2.320.

More Losses?

If XRP fails to clear the $2.1750 resistance zone, it could start another decline. Initial support on the downside is near the $2.10 level. The next major support is near the $2.080 level.

If there is a downside break and a close below the $2.080 level, the price might continue to decline toward the $2.050 support. The next major support sits near the $2.020 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $2.10 and $2.080.

Major Resistance Levels – $2.1320 and $2.1950.

Bitcoin (BTC) may be facing short-term volatility, but fresh on-chain data from Glassnode suggests a resilient foundation beneath the market’s surface.

Despite a recent pullback from its all-time high (ATH) of over $109,000, BTC has rebounded from its April lows near $75,000 to consolidate above $94,000, putting 88% of its circulating supply in profit.Market Reset with Strong Fundamentals

Glassnode reported that Bitcoin’s Market Value to Realized Value (MVRV) ratio has cooled off to its long-term mean of 1.74. According to the analytics firm, historically, such a reset level often corresponds with phases of market consolidation, with the latest seen in an August 2022 drawdown where unrealized gains were similarly trimmed before another leg upward.

Meanwhile, the Realized Profit/Loss Ratio has gone above 1.0 again, pointing to a change in sentiment as traders move from underwater positions to take modest profits. Per Glassnode’s analysis, the development indicates that the market has enough liquidity and confidence to absorb the realized gains, which is an important sign of strength.

Macro indicators seem to agree, with analyst Axel Adler Jr indicating that the 30-day change in Bitcoin’s Composite Volatility Index remains at -3.5%, suggesting that the market is still in an accumulation phase. According to Adler, panic-selling phases usually emerge when the index climbs above 15%, further strengthening the notion that the majority of market participants are quietly positioning for a bigger price boost.Consolidation Before the Next Move?

However, BTC’s current market movement paints a more tempered short-term picture. At the time of writing, the world’s largest cryptocurrency by market cap was down a slight 1.3% in the last 24 hours and was trading at $94,306 after oscillating between intraday opposites of $93,806 and $95,741.

It had also slipped 0.9% over the past week, but still remained up 8.5% across two weeks. Additionally, the asset has gained 13% in the last 30 days, and is also just 13% away from its ATH.

Still, risks remain. As BTC approaches the psychological $100,000 mark, a level linked with aggressive distribution by long-term holders in past cycles, observers are wary of a potential influx of supply. Glassnode warns that sustaining upward momentum from here will require equally strong demand to absorb any profit-taking.

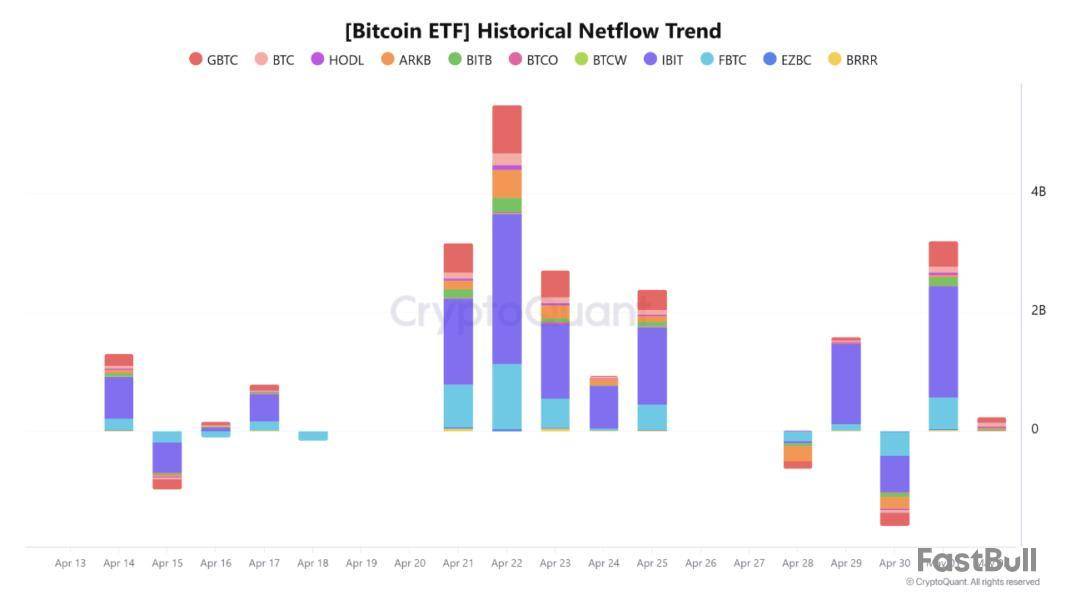

Whether this comes from continued ETFinflows, corporate treasurybuys, or retail interest remains the key question as May rolls along.

Bitcoin’s recent recovery has encountered resistance as the asset remains range-bound between $93,000 and $97,000. After briefly climbing late last month, Bitcoin has struggled to maintain upward momentum since then.

At the time of writing, BTC is trading at approximately $94,305, reflecting a modest 1.3% decline over the past day. While price action has slowed, activity on the backend of the market suggests underlying shifts in investor behavior.

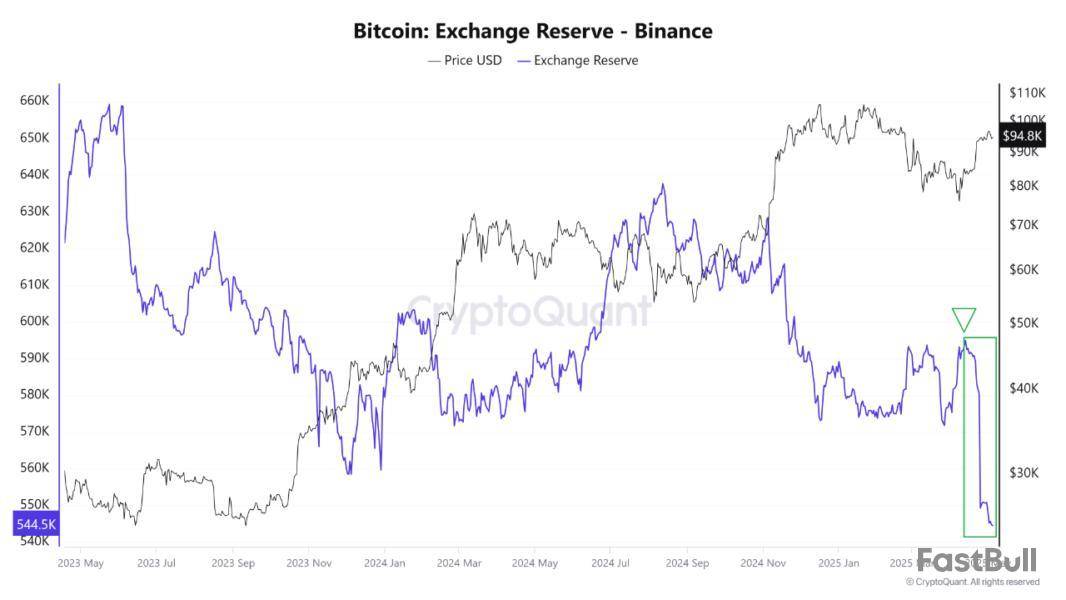

New on-chain data points to a significant decrease in Bitcoin reserves held on Binance, the world’s largest cryptocurrency exchange by trading volume.

One of CryptoQuant’s contributors, Amr Taha, highlighted the development in a recent QuickTake post, signaling that over 51,000 BTC have been withdrawn from Binance wallets since mid-April.

This drop from roughly 595,000 BTC to around 544,500 BTC could indicate a recalibration in investor strategy, with growing interest in long-term holding or redeployment of assets outside centralized platforms.

What’s Driving the Bitcoin Outflows from Binance?

According to Taha, multiple factors may be contributing to this steep decline in exchange-held reserves. One explanation involves institutional investors and long-term holders moving their Bitcoin into cold storage.

This off-exchange behavior is typically interpreted as a signal of longer-term conviction, as these participants seek to secure assets while reducing the likelihood of short-term selling. Given the rise of custodial solutions and more institutional-grade wallets, this trend may reflect maturing market behavior.

Another key factor could be the increasing use of Bitcoin within decentralized finance (DeFi) and cross-platform arbitrage strategies. Taha noted that entities may be withdrawing BTC to access yield opportunities or deploy capital in other blockchain ecosystems.

Additionally, the recent positive flows into Bitcoin spot exchange-traded funds (ETFs), especially between April 21 and May 1, where daily net inflows crossed the $2 billion mark on several occasions, may have encouraged larger players to accumulate and withdraw Bitcoin in anticipation of further price appreciation.

Exchange Reserve Trends Offer Signals Amid Price Consolidation

Though Bitcoin’s price has remained largely stagnant over the past week, the shift in exchange reserve data could carry significant implications for future price action.

Historically, a decrease in exchange reserves, particularly from major venues like Binance, has been associated with supply tightening. As fewer coins are readily available for sale, reduced liquidity can amplify the impact of incoming demand, especially in bullish phases.

Taha emphasized that while short-term market performance may appear indecisive, tracking reserve metrics offers important clues about underlying sentiment.

A consistent drawdown of BTC from exchange platforms often sets the stage for renewed price movement, especially when accompanied by institutional accumulation and long-term holding behavior.

If these patterns persist, they may contribute to reduced sell-side pressure, enabling Bitcoin to challenge its next resistance zones, including the psychological $100,000 level.

Featured image created with DALL-E, Chart from TradingView

Ethereum price started a downside correction below the $1,850 zone. ETH is now consolidating and might drop further below the $1,785 support zone.

Ethereum Price Struggles To Clear Resistance

Ethereum price failed to clear the $1,880 resistance and started a downside correction, like Bitcoin. ETH declined below the $1,850 and $1,820 support levels.

There was a move below the 50% Fib retracement level of the upward move from the $1,734 swing low to the $1,872 high. The bears even pushed the price below the $1,800 level, but the price found support near the $1,785 support level.

Ethereum price is now trading below $1,800 and the 100-hourly Simple Moving Average. There is also a key bearish trend line forming with resistance at $1,830 on the hourly chart of ETH/USD.

On the upside, the price seems to be facing hurdles near the $1,820 level. The next key resistance is near the $1,830 level and the trend line. The first major resistance is near the $1,880 level.

A clear move above the $1,880 resistance might send the price toward the $1,920 resistance. An upside break above the $1,920 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,000 resistance zone or even $2,050 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,830 resistance, it could start a fresh decline. Initial support on the downside is near the $1,785 level and the 61.8% Fib retracement level of the upward move from the $1,734 swing low to the $1,872 high. The first major support sits near the $1,750 zone.

A clear move below the $1,750 support might push the price toward the $1,720 support. Any more losses might send the price toward the $1,685 support level in the near term. The next key support sits at $1,640.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,765

Major Resistance Level – $1,830

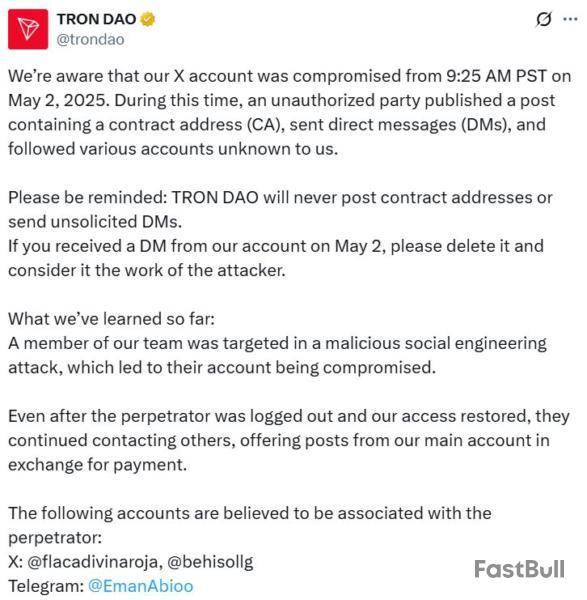

A hacker who took over the Tron DAO X account is estimated to have made around $45,000 in improperly solicited funds, according to a spokesperson from Tron.

Speaking to Cointelegraph, the Tron public relations team confirmed that on May 2, the Tron DAO account posted a contract address and sent direct messages to solicit payments in exchange for promotional advertising on the Tron account.

“Our security team quickly identified the intrusion and cut off access to the hacker, but we ask the community to continue to be vigilant. We will never ask anyone for payments like this via DM or otherwise,” they said.

The team said that based on the illicit contract address the hacker posted, the amount improperly solicited appeared to be around $45,000.

Asked whether the same hacker could be responsible for the supposed New York Post’s X account hack on May 3, the Tron team told Cointelegraph that there “appear to be some similarities” between the two security incidents; however, they also cautioned that the investigation is ongoing and “any definitive connection would be premature.”

After regaining access, Tron DAO said in a May 2 X update that they suspect the hack resulted from a team member being “targeted in a malicious social engineering attack, which led to their account being compromised.”

“Even after the perpetrator was logged out and our access restored, they continued contacting others, offering posts from our main account in exchange for payment,” Tron DAO said.

The Tron team is still investigating and says they are in contact with law enforcement. Tron founder Justin Sun also accused crypto exchange OKX of failing to act on a law enforcement request to freeze stolen funds connected to the attack.

OKX founder and CEO Star Xu has publicly denied the allegation, and Sun has removed the original post with the accusation.

Curve Finance joins list of X account hacks

Decentralized lending protocol Curve Finance also recently suffered an X account takeover by a bad actor, adding to the growing list of high-profile firms and individuals “silently” accessed by social media hackers.

In a now-deleted May 5 X post, a scammer posing as Curve Finance shared a link to a CRV airdrop with a weeklong registration period, which some eagle-eyed X users quickly suspected could be fraudulent.

Curve Finance founder Michael Egorov confirmed in a reply to analyst CrediBULL Crypto that it was a bad actor posting sham links so far, “No other account appears to be hacked — the control over X account was just silently taken by someone.”

The Curve Finance team has since regained access with the help of a team that included the cybersecurity group SEAL, and found that aside from posting scam links, the hacker also blocked some users who flagged the account takeover, including CrediBULL Crypto.

The cause of the hack has yet to be shared publicly, but in response to a user’s query, the Curve finance team said it’s still “unclear how account” access was taken, and there was “No sign of any client-side compromise.”

Other high-profile X account hacks

A slew of other high-profile X accounts have also been taken over by bad actors this year. On April 15, a member of the UK’s Parliament, Lucy Powell, had her account taken over to promote a scam crypto token called the House of Commons Coin (HOC).

Crypto data aggregator Kaito AI and its founder, Yu Hu, were the victims of an X social media hack on March 15, when scammers posted that the Kaito wallets were compromised and users' funds were at risk.

Meanwhile, Pump.fun’s X account was also hacked on Feb. 26 and promoted several fake tokens, including a fraudulent governance token for the platform called Pump.

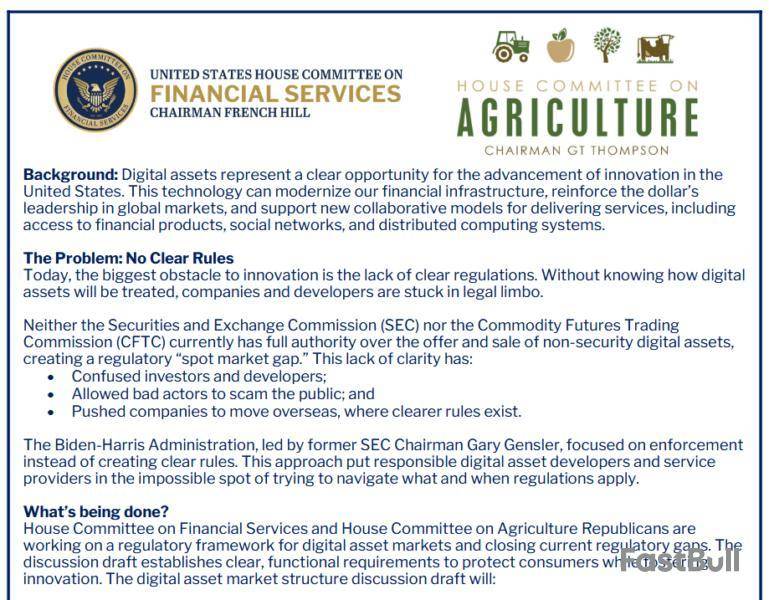

The new “Digital Asset Market Structure Discussion Draft” introduced by House Republicans on May 5 could work to reduce the dominance of large crypto firms and promote more participation in the broader market, according to an executive from Paradigm.

The discussion draft, led by the House agricultural and financial services committee chairs Glenn Thompson and French Hill, is an “incremental, albeit meaningful, rewrite” of the Financial Innovation and Technology for the 21st Century Act (FIT21), Paradigm’s vice president of regulatory affairs Justin Slaughter said in a May 5 X post.

One of the major changes from FIT21 is that the draft defines an affiliated person as anyone who owns more than 1% of a digital commodity issued by the project — down from 5% in the FIT21 bill — a move Slaughter said may curb the influence of big crypto firms and lead to more participation in the crypto market.

The draft also defines a “mature blockchain system” as one that, together with its related digital commodity, is not under the “common control” of any person or group.

The Securities and Exchange Commission would be the main authority regulating activity on crypto networks until they become sufficiently decentralized, Slaughter noted.

The draft also clarified that decentralized finance trading protocols are those that enable users to engage in a financial transaction in a “self-directed manner.” Protocols that meet this criterion are exempt from registering as digital commodity brokers or dealers.

The draft also referred to digital commodities as “investment contract assets” to distinguish their treatment from stocks and other traditional assets under the Howey test.

According to Slaughter’s analysis, securities laws won’t be triggered unless the secondary sale of tokens also transfers ownership or profit in the underlying business.

Crypto firms would also have a path to raise funds under the SEC’s oversight while also having a “clear process” to register their digital commodities with the Commodity Futures Trading Commission, the committee members said in a separate May 5 statement.

Joint rulemaking, procedures, or guidelines related to crypto asset delisting must be established by the CFTC and SEC should a registered asset no longer comply with rules laid out by the regulators.

A ‘clear opportunity’ to advance crypto innovation, rules once and for all

Speaking about the need for a comprehensive crypto regulatory framework, the House committee members said crypto is a “clear opportunity” to advance innovation in the US — most notably through modernizing America’s financial infrastructure and reinforcing US dollar dominance.

The Republicans criticized the previous Biden administration and the Gary Gensler-led SEC for adopting a regulation-by-enforcement strategy rather than creating clear rules for market participants.

Many crypto firms were stuck in “legal limbo” as a result of the unclear rules, which pushed some industry players overseas, where clearer rules exist, the House committee members said.

“America needs to be the powerhouse for digital asset investment and innovation. For that to happen, we need a commonsense regulatory regime,” said Dusty Johnson, chairman of the subcommittee on commodity markets, digital assets and rural development.

Slaughter added: “This is the bill that will, finally, provide a clear regulatory regime on crypto that many have been calling for.”

Republicans already facing roadblocks over discussion draft

House Financial Services Committee Ranking Member Maxine Waters plans to block a Republican-led event discussing digital assets on May 6, a Democratic staffer told Cointelegraph.

The hearing, “American Innovation and the Future of Digital Assets,” is expected to discuss the new crypto markets draft discussion paper pitched by Thompson, Hill, and other committee members.

However, according to the unnamed Democratic staffer, the current rules require all members of the House Financial Services Committee to agree on such hearings.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。