行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国对非欧盟贸易账 (季调后) (10月)

英国对非欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

NEW YORK, NY / ACCESS Newswire / April 17, 2025 / Fast Finance Pay Corp. (OTC PINK:FFPP) announced today the appointment of Wolf & Company, P.C. as the Company's independent registered public accounting firm effective immediately.

Wolf & Company, P.C. provides external audit and assurance services that provide businesses with the confidence to achieve their financial and reporting goals. Their team of experienced auditors are registered with the Public Company Accounting Oversight Board (PCAOB).

Ole Jensen, CEO, President and Chairman of Fast Finance Pay Corp. stated, "We are pleased to engage Wolf & Company as our new independent auditor. The firm has deep experience in the financial services sector, specifically crypto and digital payments, working with many of our peers across the industry. Their leading expertise and fresh perspective will be valuable assets as we continue executing our growth strategy and striving for excellence in financial reporting and corporate governance."

About Fast Finance Pay Corp.

Fast Finance Pay Corp is a global provider of innovative communication and digital payment solutions. The company offers a messenger platform with app and web applications that enable seamless communication while integrating a crypto wallet, debit card services and B2B merchant tools. Fast Finance Pay Corp stands out by combining messaging, payment solutions, and crypto exchange services, facilitating smooth interactions between Fiat and Cryptocurrencies. Through its brands - OK.de, OK.secure, OK.merchants, OK.pay, and DigiClerk - the company delivers scalable B2C and B2B solutions for payment processing. Its offerings include both noncustodial and custodial crypto wallets, empowering users to trade cryptocurrencies and participate in Decentralized Finance (DeFi). Customer acquisition is driven by a strong partner network, social media presence, and effective referral programs. Revenue is generated through advertising, commissions on Fiat and crypto transactions, and fees for credit card payments. Fast Finance Pay Corp is redefining communication and digital payments by making them more secure, seamless, and globally connected.

For additional information, visit www.ff24pay-corp.com.

Forward-looking statements

This news release may contain forward-looking statements within the meaning of Section 27a of the Securities Act of 1933 (as amended) and section 21e of the Securities and Exchange Act of 1934 (as amended). Those statements include the intent, belief or current expectations of the Company and its management team. Forward-looking statements are projections of events, revenues, income, future economics, research, development, reformulation, product performance or management's plans and objectives for future operations. Some or all the events or results anticipated by these forward-looking statements may not occur. Prospective investors are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially from those projected in the forward-looking statements because of various factors. Accomplishing the strategy described herein is significantly dependent upon numerous factors, many that are not in management's control.

CONTACT:

Investor Relations

Andrew Barwicki

516-662-9461

andrew@barwicki.com

SOURCE: Fast Finance Pay Corp.

View the original press release on ACCESS Newswire

XRP price fluctuations in the last 24 hours saw the coin flashing mixed signals to investors in the ecosystem. Although XRP attempted a bullish breakout as it looked to reclaim higher levels, market volatility prevailed, leading to mild liquidations.

XRP maintains resilience despite mixed liquidation trends

However, the price movement only recorded a temporary dip to $2.05 in a crucial support level retest. As of press time, XRP's price changed hands at $2.09, a 0.84% increase in the last 24 hours.

This might account for the near-even liquidation seen on XRP, which registered a total liquidation of $4.75 million.

According to CoinGlass data, the difference in liquidation between long and short position traders reached just $20,000 in the last 24 hours.

Notably, traders betting long on XRP to hit higher levels lost $2.39 million as the price dropped. XRP hit $2.12 as it teased breaching the $2.20 level before witnessing a correction. Meanwhile, short position traders saw $2.37 million of investment wiped out within the same time frame.

Considering the cumulative figure, the resulting liquidations between long and short position traders are mild. This could be attributed to XRP's resilience in the broader crypto market space so far this year.

XRP has edged out Dogecoin in this liquidation trend outlook. Within the same time frame, Dogecoin, the leading meme coin, recorded a cumulative liquidation of $3.73 million.

Unlike XRP, long position traders lost fewer funds than short traders. The liquidation of long position traders was $100,000 less than that of short position traders, which came in at $1.82 million. Short position traders saw $1.92 million wiped out.

Eyes on XRP ETF momentum

Despite these liquidations, XRP’s resilience has helped it stay ahead of Ethereum, the leading altcoin. XRP remains on track to hit six months of outperforming Ethereum in the crypto market.

Market participants bet that XRP will register more growth when the U.S. Securities and Exchange Commission (SEC) approves the spot XRP ETF for trading. Some asset managers have submitted applications for the product to the regulatory body.

Meanwhile, as per a U.Today report, notable stakeholders in the crypto space, including Nate Geraci, believe there is no reason for the SEC to deny approving the spot XRP ETF.

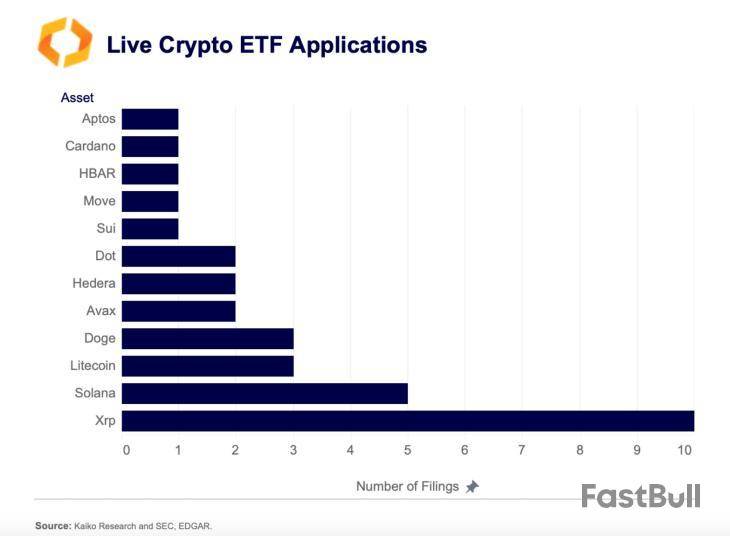

XRP remains one of the most popular coins in the market, with a cult-like community that has supported it for years. With the bullish sentiment surrounding it, the altcoin has performed quite well and continues to inspire support. The most recent developments for XRP have been the ETF filings that suggest it might be the next altcoin to get an SEC nod after Ethereum. The number of filings also puts it well ahead of investor favorites such as Solana and Dogecoin in the running for the next ETF approval.

XRP ETF Filings Climb To 10

XRP ETF filings have been coming out of the market over the past year, especially with the approvals of Ethereum Spot ETFs. These ETFs are expected to give institutional investors an official vehicle to get proper exposure to the market. As Bitcoin and Ethereum ETFs have been done and dusted, issuers have looked to other large cap altcoins to bring into the market.

The next favorites on the list have been XRP, in addition to heavy hitters such as Solana, Dogecoin, and Litecoin. However, in the race, XRP has clearly differentiated itself in terms of interest, boasting twice as many filings as any other altcoin.

According to data from Kaito Research, there are currently 10 XRP ETF filings pending approval or rejection from the SEC. In contrast, there are five Solana ETF filings, 3 Litecoin filing, and 3 Dogecoin filings. This shows clearly that interest in XRP as the next altcoin to gain ETF approval is the highest.

Additionally, the SEC has acknowledged the XRP ETF filings from industry leaders such as Grayscale. There are also filings from ProShares, Franklin Templeton, Bitwise, 21Shares, among others. However, BlackRock has not made a move to file for an XRP ETF despite leading the Bitcoin and Ethereum ETF campaigns.

Nevertheless, the filings for XRP ETFs remain a big deal for the altcoinm and their approval could trigger another wave of price hikes.

ETFs And The SEC Battle Conclusion

For many, the major hindrance to an SEC approval of an XRP ETF was the ongoing battle between the crypto firm and the regulator, which began in 2020. However, in March 2025, Ripple CEO Brad Garlinghouse announced that the case was officially over.

With this development, expectations that the regulator will look favorably upon an XRP ETF are high. If the ETFs are approved, even with a fraction of the Bitcoin ETF volumes, the XRP price is expected to explode in response, with some analysts predicting that the altcoin’s price could rise to the double-digits.

Mantra’s recent token collapse highlights deeper-rooted issues within the crypto industry around fluctuating liquidity levels, creating additional downside volatility over the weekend, which may have exacerbated the token’s crash.

The Mantra (OM) token’s price collapsed by over 90% on April 13, from roughly $6.30 to below $0.50, triggering market manipulation allegations among disillusioned investors, Cointelegraph reported.

While blockchain analysts are still piecing together the reasons behind the OM collapse, the event highlights critical issues for the crypto industry, according to Gracy Chen, the CEO of cryptocurrency exchange Bitget.

“The Om token crash exposed several critical issues that we are seeing not just in OM, but also as an industry,” Chen said during Cointelegraph’s Chainreaction daily X show, adding:

Cointelegraph@CointelegraphApr 15, 2025🎙️ CEXs hit with outages as AWS runs into trouble. The question is, do we need more decentralization?

Today, @RKBaggs and @ZVardai are joined by @GracyBitget, CEO of @Bitgetglobal on #CHAINREACTION to unpack the problem!https://t.co/OPoyu1IORC

At least two wallets linked to Laser Digital were among 17 wallets that moved a combined 43.6 million OM tokens — worth about $227 million at the time — to exchanges before the crash, the blockchain analytics platform Lookonchain reported on April 13, citing Arkham Intelligence data.

However, Mantra CEO John Mullin denied the allegations related to large-scale token transfers from Mantra investors, Cointelegraph reported on April 14.

Mantra released a post-crash statement on April 16, reiterating that the OM crash didn’t involve token sales by the project itself and that the Mantra team continues investigating the incident. The report did not explain the rapid movement of OM tokens to exchanges and subsequent liquidations.

Exchange movements point to strong “insider dumping” signal

While the exact reason behind the collapse remains unclear, Mullin attributed the crash to “massive forced liquidations” on centralized exchanges during low-liquidity hours on Sunday.

Mullin told an X user that the Mantra team believes one exchange “in particular” is to blame, but said the team was still “figuring out the details,” specifying that the exchange in question is not Binance.

“I think OKX was the main exchange being accused of so-called liquidations,” said Chen, adding that the large transfers to multiple exchanges raised significant red flags. She added:

Weekend liquidity issues have impacted even major cryptocurrencies like Bitcoin (BTC).

The lack of weekend trading volume, combined with Bitcoin’s 24/7 liquidity, resulted in Bitcoin’s correction below $75,000 on Sunday, April 6, Cointelegraph reported.

The April 6 correction may have occurred due to Bitcoin being the only large tradable asset over the weekend available for de-risking amid global trade war concerns, Lucas Outumuro, head of research at crypto intelligence platform IntoTheBlock, told Cointelegraph.

The macroeconomic environment remains uncertain as global trade relations realign, reported onchain analytics firm Glassnode on April 16.

However, it added that “the performance of hard assets remains remarkable,” citing gold’s all-time high and Bitcoin holding above $80,000 despite theheadwinds.

“One could consider this a fascinating signal as the foundations of the financial system enter a period of transition and change,” the analysts noted.

The macroeconomic environment remains uncertain as global trade relations realign. Still, the performance of hard assets remains remarkable, with gold surging to new ATH of $3300 and #Bitcoin holding above $80k. Discover more in the latest Week On-Chain:https://t.co/FWiMuimRUk pic.twitter.com/W4136o3dgx

— glassnode (@glassnode) April 16, 2025

Gold at ATH

Volatile US Treasury yields swinging from 3.7% to 4.5% have created major turbulence in financial markets, affecting both bonds and equities. The MOVE and VIX indexes reflect this high volatility.

The former measures expected volatility in the US bond market, while the latter measures expected volatility in the US stock market. Both reflect market stress; when they spike, investors are nervous.

Bitcoin has seen its largest drawdown of this cycle at around 32%, but this remains milder than in past cycles, indicating strongerinvestor confidenceand demand resilience, it noted.

Glassnode reported that the median drawdown for the current cycle is “considerably shallower” than all previous cases. Additionally, corrections since 2023 have been shallower and more controlled in nature, “suggesting a more resilient demand profile, and that many Bitcoin investors are more willing to hodl through market turmoil.”

It noted that currently, profit and loss-taking activities are “relatively balanced,” which results in a relatively neutral rate of capital inflow, which could lead to extended consolidation.

Meanwhile, gold prices hit an all-time high of $3,354 per ounce on April 16, having gained a whopping 26% since the beginning of this year as investors flee to safe-haven assets.

“As the world adjusts to changing trade relationships, Gold and Bitcoin are increasingly entering the centre stage as global neutral reserve assets.”Bitcoin Price Outlook

Bitcoinhit an intraday high of $85,300 on Wednesday but has fallen back since to trade at around $84,340 during the Thursday morning Asian session.

The asset has been very tightly range-bound at this price level for the past five days and trading within a wider channel since the beginning of March.

The three-month downtrend is still intact, but it is shallowing out, which could lead to a longer period of consolidation before any breakout.

$BTC

Holding up better than stocks, for now.

If equities keep nuking I expect BTC to do what it does best which is catch up and then overperform to the downside. pic.twitter.com/x9EYsKUAoV

— Mayne (@Tradermayne) April 16, 2025

The enigmatic Shiba Inu lead known to the community under the pseudonym Shytoshi Kusama has returned after yet another long, almost three-week absence.

The pseudonymous SHIB marketing expert Lucie shared a screenshot of Kusama’s Telegram post addressed to the SHIB team and the community.

"Let's go back to it," Shytoshi says

Lucie took to social media to share with the SHIB community a fresh message published by Shytoshi Kusama on his Telegram channel. Kusama published a call to action: “Next week let’s go back to it can we?”

𝐋𝐔𝐂𝐈𝐄@LucieSHIBApr 17, 2025Look @ShytoshiKusama in Shy telegram ☺️ Cooking? pic.twitter.com/CZ1thnPggv

It sounds as if the SHIB leader has been away or on holiday, and now he is eager to get back to hard work and continue to expand the Shiba Inu ecosystem.

Kusama also published a post on his X account, sharing a link to a podcast he hosted. In that episode of “Shy Speaks SHIB,” Kusama and his guest discussed the Karma reputation system integrated into the testnet Puppynet at the start of April.

Karma is a mechanism that was created for tracking and then rewarding user engagement within the SHIB ecosystem, and particularly on layer-2 solution Shibarium itself. Karma gives each SHIB user a “reputation score” based on their activities on Shibarium. Various activities include SHIB coin burns, purchasing virtual land in the SHIB metaverse using SHIB tokens adding liquidity to the network.

This week, the top developer of the SHIB ecosystem and Shytoshi’s right hand, Kaal Dhairya, likened Karma to an “XP system” in games, where players earn points of experience for completing certain actions: “Karma works like an XP system—just like in gaming.”

Kaal@kaaldhairyaApr 14, 2025Karma works like an XP system—just like in gaming. As mentioned in the podcast, it’ll be used across our ecosystem and, combined with Reputation and Aura, will help foster trust. Keep in mind, though, that Karma scores and levels are in BETA and may still change. https://t.co/CQXBXVVIRP

He once again reminded the SHIB community that the Karma system is still running only on the testnet, therefore, it may be adjusted or see major changes added to it: “Karma scores and levels are in BETA and may still change.”

SHIB burns crash despite market recovery

Meanwhile, an important metric of the Shiba Inu ecosystem, the SHIB burn rate, is in free fall deep in the red zone. As of press time, it shows minus 97.95%, with 1,705,330 SHIB meme coins burned, i.e., transferred out of the circulating supply and locked in unspendable wallets.

This is totally opposite to Wednesday, when 60,456,635 SHIB were burned in a single transfer.

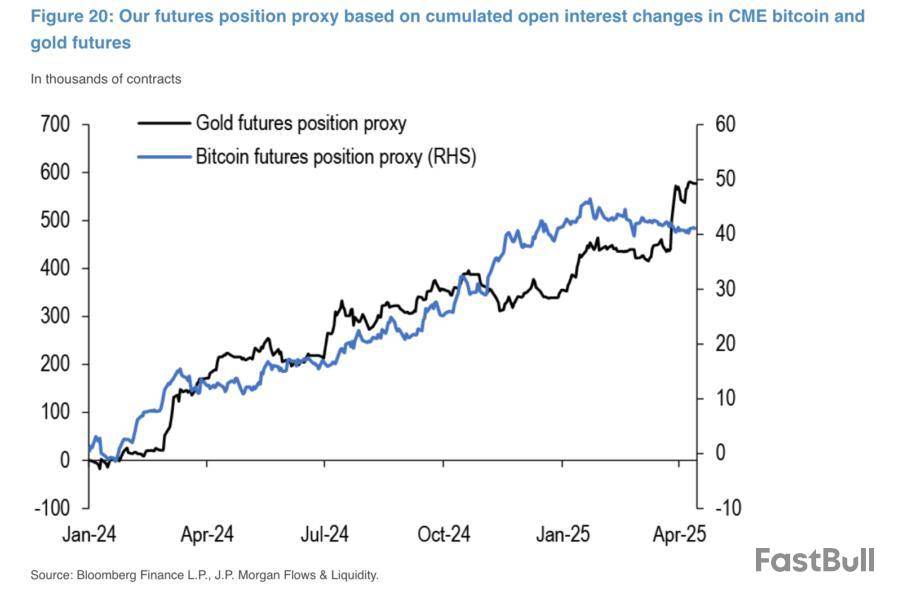

Safe haven demand is lifting gold, but bitcoin is missing out, according to JPMorgan analysts.

Gold is attracting inflows in both the exchange-traded fund (ETF) and futures markets, driven by investors seeking safety amid macro uncertainty, JPMorgan analysts led by managing director Nikolaos Panigirtzoglou wrote in a Wednesday report shared with The Block.

Bitcoin, on the other hand, is being left behind, with declining speculative interest in futures and three straight months of ETF outflows, the analysts noted.

"Despite a decline in market breadth and liquidity, gold continues to benefit from safe haven flows in a similar fashion to currencies like the Swiss franc and the yen," the analysts wrote. "These safe haven flows are seen in both the ETF and futures spaces."

Global gold ETFs saw $21.1 billion in net inflows in the first quarter of 2025, with $2.3 billion coming from China and Hong Kong ETFs alone, according to World Gold Council data cited in the report. These inflows represented around 6% of total assets under management (AUM) for gold ETFs globally, compared to 16% for China/HK gold ETFs — underscoring a faster-growing impulse in the region, the analysts noted.

Gold futures have also seen increased buying from speculative investors since February, the analysts said.

In contrast, bitcoin has not shared in the same flows. "Therefore, bitcoin has failed to benefit from the safe haven flows that have been supporting gold," the analysts concluded.

Bitcoin is currently trading at around $84,300, up 0.5% over the past 24 hours, according to The Block's bitcoin price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。