行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

加拿大CPI月率 (季调后) (11月)

加拿大CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

The Ethereum network’s capacity to handle more transactions increased further late Monday as validators agreed on a gas limit increase for the first time since late 2021, also the first time in the network’s Merge era.

The gas limit on Ethereum reached nearly 32 million gas units as of Tuesday morning with a maximum expected capacity of 36 million units. The last significant increase was in 2021, when the limit jumped from 15 million to 30 million gas units.

This change was implemented after more than half of the validators supported the adjustment, which was enacted automatically without the need for a hard fork (or a split in the network).

On Ethereum, gas is a unit that measures the computational work required to execute operations like transactions or smart contract functions. Each operation has a gas cost associated with it, ensuring that users pay for the exact amount of computational effort their actions require.

The gas limit is the total amount of gas that can be used in a block. If transactions in a block exceed this limit, they are either delayed to the next block or must compete for inclusion based on the gas price offered.

Raising the gas limit allows Ethereum to process more transactions or more complex operations within each block, thus improving network throughput and allowing the creation of sophisticated decentralized financial (DeFi) applications with minimal downtime.

Higher gas limits also mean less congestion during peak times, which can make the network costly to use and turn users away to cheaper networks such as Solana.More network utility can add to investor demand for ETH, helping buoy the world’s second-largest token that has fallen out of investor favor in the past year.

Ether slumped Sunday to its lowest level against bitcoin since March 2021 as the world’s second-largest token extended losses against its larger rival.

One ether dropped to 0.03 BTC in January, as CoinDesk reported, almost 50% lower than a year ago, as bitcoin soared in the run-up to U.S. President-elect Donald Trump's inauguration.

The exchange rate for the two tokens, conventionally called the ETH/BTC ratio, peaked above 0.08 in 2022 and ETH's value proposition has been on the decline ever since.

https://x.com/VitalikButerin/status/1886580315965009964

In addition, the upcoming Pectra upgrade is expected to double the capacity of layer-2 networks — or blockchains that operate atop Ethereum — by increasing the blob target from 3 to 6."Blobs" are large data packets used by layer-2 networks to store data for a certain time period, with 3 blobs included in each Ethereum block as of Tuesday.

According to the data provided by the public blockchain data tracker Shibburn, which monitors SHIB burn transfers on the Ethereum chain and shares the details on its website and X account, over the past day, burn efforts have been quite successful, pushing millions of meme coins out of circulation.

Meanwhile, the SHIB price did not mirror the big burn rate increase and faced a sudden plunge after a more than 31% increase.

SHIB burns spike 567%

A recent tweet issued by the abovementioned data source shows that over the past 24 hours, the SHIB community has made significant progress in diminishing the circulating meme coin supply. They shoveled a total of 4,618,788 SHIB into unspendable blockchain wallets, raising the burn rate by 567.83%.

The two biggest burn transfers here carried lumps of 1,913,509 and 1,425,595 SHIB to dead-end wallets.

Shibburn@shibburnFeb 04, 2025HOURLY SHIB UPDATE$SHIB Price: $0.00001619 (1hr -0.15% ▼ | 24hr 23.62% ▲ )

Market Cap: $9,538,053,730 (23.60% ▲)

Total Supply: 589,255,663,205,393

TOKENS BURNT

Past 24Hrs: 4,618,788 (567.83% ▲)

Past 7 Days: 1,163,645,543 (3829.29% ▲)

As for the weekly burn rate, things are a lot better here, with the weekly rise of 3,829.29% and 1,163,645,543 SHIB meme coins burned overall.

Currently, the circulating supply of the second-biggest meme cryptocurrency, Shiba Inu, comprises 584,276,060,739,814 coins. Of these, 410,744,336,857,535 have been burned, mostly in May 2021 by Ethereum leader Vitalik Buterin, who received half of the quadrillion SHIB supply as a gift from mysterious SHIB creator Ryoshi. A total of 4,979,602,402,649 SHIB have been staked in various DeFi projects.

SHIB price 11% down

In an unexpected turn of events, the prominent meme-inspired cryptocurrency, SHIB, plunged more than 11% over the past 24 hours. After a marginal rebound, it is now changing hands at $0.00001522 after losing the $0.00001690 price level.

Notably, this price decline came after a mind-blowing price surge when SHIB soared by almost 31% on Monday, following the Bitcoin price trajectory.

The world’s primary cryptocurrency, Bitcoin, spiked by 10% on Monday, recovering from the 12% collapse it faced between Friday and Monday as the U.S. government unleashed trade war on Canada, Mexico and China. However, following the negotiations, Trump paused the 25% tariffs on Mexican imports and came to an agreement with Canada. Bitcoin responded immediately by going up. On Monday, it managed to regain the $102,000 level, but by now it has dropped 3.8% and is changing hands at $98,255, losing $100,000 again.

After a vicious crash, XRP recently saw one of the most dramatic price swings in its history, recovering 42%. The chart's enormous knife caused the asset to fall below important support levels before rapidly rising again. This move offered a nearly 50% profit in a very short period of time for traders who were able to catch the bottom.

But such high volatility raises questions about XRP's long-term stability, so it is not always a good thing. The precipitous decline led to panic-selling, which caused XRP to fall below two important support levels that had previously held firm: $2.62 and $2.16. The market became uncertain as a result of the quick breach of these levels, and even with the quick recovery, XRP is currently in a precarious position. Chart by TradingView">

Technically speaking, it appears that buyers may not be as strong as they were during earlier uptrends given how quickly XRP lost those supports. The 200 EMA offers an additional layer of possible support at the $1.60 level, which XRP may revisit if momentum wanes. The 42% bounce raises questions about future stability even though it indicates demand at lower prices.

The market may quickly lose faith in XRP if it is unable to sustain its current levels above $2.00. The level of $2.16 becomes the next crucial area to keep an eye on if XRP is unable to maintain this level. On the positive side, a return above $3.00 would indicate that buyers are returning to the market and that the recovery is genuine.

Until that time, XRP is still in a shaky position, and the price could drop again with a fresh round of selling. For now, XRP's historic recovery serves as a warning of impending trouble as well as a testament to its tenacity. Traders should keep a close eye out for confirmation of either another decline or a sustained recovery.

Ethereum reached the consensus needed to increase the network's gas limit, with 50% of the validators signaling for this change to help improve the network's scalability.

The gas limit is a critical parameter that dictates the network’s transaction capacity. Previously capped at 30 million, the gas limit has increased above the 31 million mark.

More than half of the validators’ approval was needed for the gas limit adjustment to take effect, which occurred yesterday. Once more than 50% of validators signaled support, the block gas limit automatically adjusted without requiring a hard fork.

This is the first time such a change has been implemented under Ethereum’s proof-of-stake consensus mechanism. The last adjustment took place in 2021 when the gas limit doubled from 15 million to 30 million gas units.

On Ethereum, gas is the fundamental unit to measure the computational effort needed to execute transactions or smart contracts. The gas limit is the maximum amount of gas all transactions can consume within a single block.

According to data from gas limit.pics, the average gas limit over the last 24 hours was 31.5 million gas units, and it's expected to adjust to a max capacity of 36 million gas units.

Despite recent scalability improvements from the Dencun upgrade and proto-dank sharding, increasing the gas limit was necessary as demand and complexity for Ethereum’s decentralized applications grew.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Bitcoin returned below $100,000 on Feb. 4 as fresh trade war fears punctured a snap rebound.

BTC price comeback sours on fresh tariff woes

Data from Cointelegraph Markets Pro and TradingView showed reversing around 3% after the daily open.

Markets had surged on news that US tariffs on Mexico and Canada would be delayed by a month, along with President Donald Trump signing an executive order to create a first-of-its-kind sovereign wealth fund.

White House cryptocurrency director David Sacks will hold a press conference at 2.30 pm Eastern Time to reveal details of the US digital asset policy.

“The Trump administration plans to reposition America as the leader in digital assets,” popular trader Jelle responded in part of an X post on the topic, preparing for a “big day.”

After bouncing near $91,500, gained over $10,000 in a single daily candle.

Progress was halted, however, when it emerged that China was retaliating against US tariffs with its own measures targeting oil, coal and more.

“Going to be a volatile day again,” Jelle added.

Crypto trader, analyst and entrepreneur Michaël van de Poppe agreed that volatility would likely continue.

“Bitcoin bounced back swiftly and is currently acting within the range,” he summarized alongside the daily chart.

Others, such as popular trader Phoenix, suggested that would investigate a new short-term range as a result of the volatility.

“After such an event, it feels logical for me to expect some sort of a new range to form,” he argued on the day.

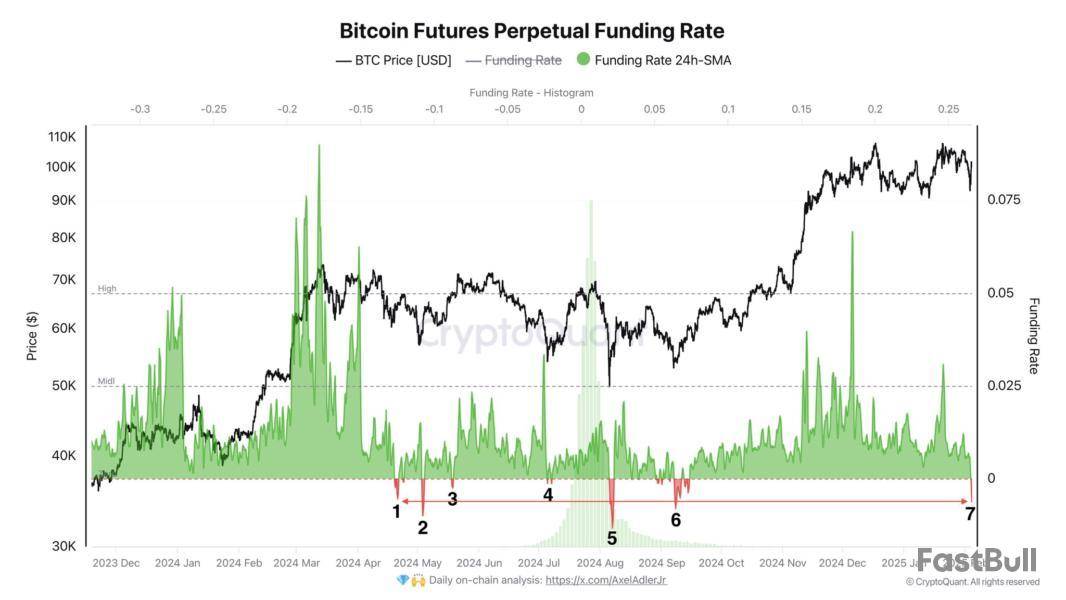

Funding rates add to rare Bitcoin bull cues

Meanwhile, funding rates across derivatives markets gave Axel Adler Jr., a contributor to onchain analytics platform CryptoQuant, cause for celebration.

Funding rates, Adler noted, had printed a key bull signal during Bitcoin’s trip toward $90,000.

“For the seventh time this year, the Bitcoin Funding Rate has turned negative,” he revealed, with the first such instance coming in April 2024.

The day prior, Cointelegraph reported on Bitcoin’s Relative Strength Index (RSI) flashing a similarly rare upside signal on 4-hour timeframes.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

As most of the crypto market remains in red, Solana (SOL) has started to recover from the market’s sharp correction. The cryptocurrency’s price has surged 7.5% in the last 24 hours, recovering from its three-week low and leading some analysts to suggest the bleeding might be over.Solana Falls To Three-Week Low

Over the weekend, Solana recorded a 27% price plunge from Friday’s highs to a three-week low of $175. This performance followed the overall market crash, fueled by the US president’s recently announced tariff on the country’s three biggest trading partners.

On February 1, the white house revealed that Donald Trump was implementing new tariffs on imported goods from Canada, Mexico, and China. This measure was met with similar responses from the two neighboring countries, which announced they would implement tariffs on US imports.

The fear of a global tariff war sparked a massive sell-off that saw Bitcoin’s price plummet to $91,200 and Ethereum’s price drop to $2,100. Additionally, the market registered at least $2.3 billion in liquidation, although Bybit’s CEO suggested the figure could be up to $10 billion.

Solana lost the key $200 support zone and fell below $180 on Sunday night. As the market struggled, some analysts suggested that SOL’s price risked a deeper fall. Analyst Ali Martinez noted that SOL could retrace to $138 if it lost the $191 support from its multi-month ascending channel.

Crypto trader Bluntz considers that losing the $220 support was “really bad” for the altcoin, as it resembled 2021’s bearish divergence sign. Additionally, it invalidated the “ABC from the highs” and made it look “more impulsive,” which would require a “miracle” to overcome it.

SOL Must Hold These Levels

Despite falling below the crucial levels, the cryptocurrency retested the $170-180 support zone and bounced from the $175 mark, attempting to break the $200 resistance in the following hours.

Crypto analyst Jelle noted that Solana “retraced the TRUMP memecoin pump,” which saw SOL reclaim the $220 resistance and jump to its latest all-time high (ATH) of $295.

However, Jelle considered that SOL’s structure “remained sound” during the drop and that its chart looked “very solid” as the cryptocurrency recovered on Monday morning.

It’s worth noting that amid the market bleeding, Solana was among the cryptocurrencies that showed strength. SOL, like BTC, held its key horizontal levels, remaining within its post-US elections price range.

Martinez pointed out that “In the middle of this madness, the TD Sequential indicator presents a buy signal on the Solana daily chart.” Meanwhile, Miles Deutscher highlighted that BTC and SOL’s prices were “now higher than yesterday’s pre-liquidations,” noting the high volatility affecting the market.

Moreover, Solana, alongside BTC and XRP, is among the only top 10 cryptocurrencies recording green numbers. Jelle considers that if SOL closes above the monthly and weekly supports between $200 and $210, it will continue its solid performance to retest the $240 resistance and see “another push for $300.”

As of this writing, Solana is trading at $211, a 7.5% increase in the daily timeframe.

What is Stellar?

Stellar is a decentralized payments network designed to offer fast, secure and cost-effective cross-border transactions. Established in 2014, Stellar facilitates near-instant global payments and currency exchanges.

The platform connects individuals, banks and payment systems to transfer currencies reliably and almost instantaneously at a fraction of traditional costs. It has positioned itself as a robust cross-border remittance tool, enabling the transfer of all forms of money and value, whether a fiat currency like the US dollar or euro or a cryptocurrency such as Bitcoin .

Stellar is a decentralized, open-source blockchain run by independent validators. The Stellar Development Foundation (SDF) is a nonprofit, non-stock organization founded by Jed McCaleb. It maintains the Stellar protocol’s codebase, supports technical and business communities within the ecosystem, and engages with regulators and institutions on policy matters.

The SDF’s operations are funded by a reserve of digital assets, known as lumens , which were allocated at the protocol’s inception. The use of these holdings is governed by specific mandates.

On Oct. 15, 2020, the SDF announced that Stellar will be an official USD Coin blockchain. USDC is a stablecoin issued by Circle.

This led to the October 2021 collaboration between the SDF and MoneyGram, a global financial technology company, transforming settlement flows by facilitating near-instant settlement in USDC. This partnership allowed users of digital wallets connected to the Stellar network to access MoneyGram’s global retail platform, creating a bridge between digital assets and local currencies.

In September 2023, EURC, Circle’s euro-backed digital currency, became available on the Stellar Network, enabling real-time, global payments.

The network enabled full-featured smart contracts in 2024. It aims to transform international payments and remittances, making them safer, faster and more affordable, as well as to connect real-world assets to decentralized finance to support products offering the full range of everyday financial services.

Did you know? The Stellar Ambassador Program supports builders and educators passionate about the Stellar network. This includes facilitating the establishment of regional chapters, organizing local events, and leading educational initiatives.How Stellar works

The Stellar network is an open-source, public blockchain that facilitates seamless and cost-effective interoperability between global financial systems and currencies.

Stellar’s unique proof-of-agreement (PoA) consensus mechanism is called the Stellar Consensus Protocol (SCP). This algorithm makes Stellar a better option for representing real-world value by securing the network through reputation rather than through computing resources or staked crypto tokens. It is also more energy-efficient and cost-effective than most blockchains.

The Stellar network comprises computers, called validators or validator nodes, that agree on the transactions to be added to the blockchain. The SCP is the rule those validators follow to keep a common ledger and validate and finalize transactions to update their state.

This is how blocks are added to the Stellar blockchain:

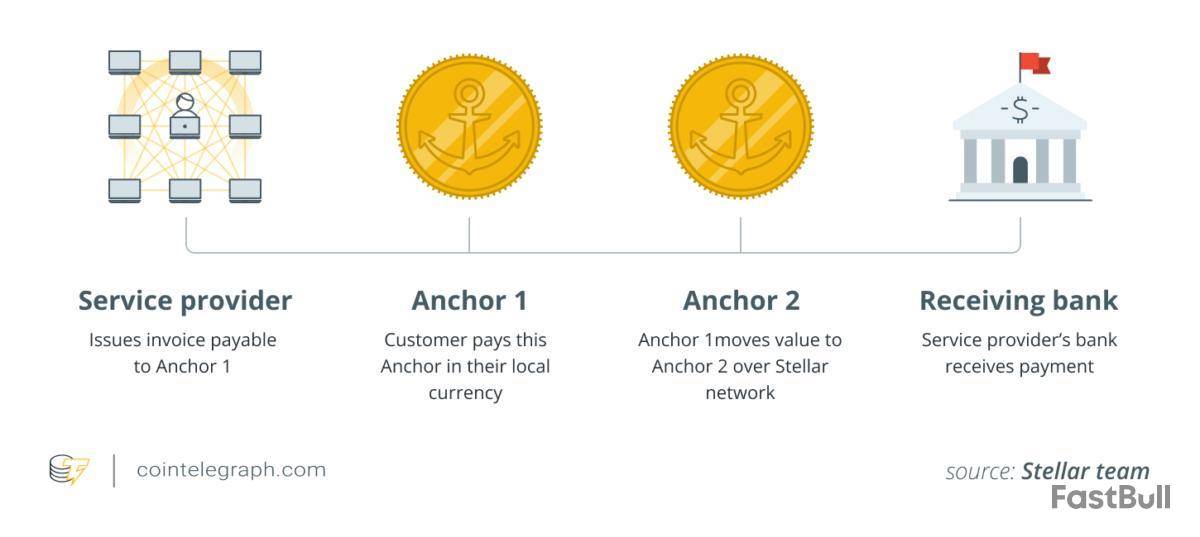

The Anchor platform, an open-source set of tools built on Stellar, makes it straightforward for existing banking systems to connect to the Stellar network, allowing for smooth cross-border transactions.

Anchors serve as trusted entities, depositing fiat currency and issuing digital tokens of equivalent value on the network, providing seamless interoperability between fiat and tokenized assets. Anchors also play a key role in enabling quick, low-cost payments and remittances worldwide by combining financial institutions with the Stellar blockchain.

Role of Lumen in Stellar

The Stellar network uses its native token, Lumen (XLM), to maintain efficiency. Without a nominal fee, the ledger could become overloaded with spam or misused, affecting its performance as a fast and reliable payment system.

XLM is used to denominate network costs, helping prevent any bias toward specific fiat currencies and maintaining independence from economic or political factors. It allows users to access various Stellar features, such as payments, asset tokenization and the development of decentralized finance (DeFi) applications.

Unlike many other cryptocurrencies, XLM is not mined or distributed as rewards. When Stellar launched, 100 billion XLM was created, with an initial annual inflation of 1%.

However, this inflation mechanism was eliminated by a community vote in 2019, and the total XLM supply was subsequently reduced to approximately 50 billion. Of these, 28.9 billion are in circulation, while the SDF holds the remainder for network development and promotion as detailed in the public SDF mandate.

Stellar requires each account to hold a minimum balance of one XLM and requires transaction fees, at the network minimum of 0.00001 XLM per operation, and increase dynamically based on network demand and smart-contract resource consumption. This ensures the network remains accessible and affordable.

To buy XLM:

How to set up a Stellar validator

Stellar is an open-participation network, meaning anyone can install Stellar Core on a server and connect it to the network to validate transactions and participate in network governance.

Here are the steps to set up a Stellar validator:

Step 1: Choose your node type — Stellar Core has the following kinds of validators:

Step 2: Meet computing requirements — Stellar Core doesn’t require specialized hardware and can be run on many consumer machines, including Raspberry Pi. The specs suggested in the Stellar docs are 8x Intel Xeon vCPUs at 3.4 GHz, 16 GB RAM and 100 GB NVMe SSD (10,000 iops).

Step 3: Network access — Stellar Core relies on a peer-to-peer (P2P) network to maintain a synchronized ledger. This necessitates that a validator has specific TCP ports open for incoming and outgoing connections.

Step 3: Install Stellar Core — Download and install the Stellar Core software package for your operating system.

Step 4: Configuration

Use cases of Stellar

Stellar offers many features, such as cross-border transactions, asset issuance and more, making it suitable for various applications.

Let’s explore Stellar’s key use cases, from global remittances to decentralized finance (DeFi) and beyond, in a bit more detail.

Payments

Stellar supports cross-border financial applications, including remittances, peer-to-peer (P2P) payments, payroll, supplier invoices, government transactions and e-commerce payments.

Depending on the costs involved, payment service providers set their own fee structures, with some charging for transactions or forex. Stellar’s transaction fees are exceptionally low and cost a fraction of a cent on average.

Fees are dynamic, meaning they start at the network minimum and switch to an auction-based system when network usage is high and block space is under contention. In addition, smart contract transactions use a fine-grained fee structure that calculates fees based on resource consumption for read, write, compute and storage designed to keep pricing fair and optimize block efficiency.

As for compliance requirements in payments, businesses using Stellar must address their obligations based on their services and operating regions. Financial institutions offering on-/off-ramps ensure compliance with Know Your Customer (KYC), Anti-Money Laundering (AML), Combating the Financing of Terrorism (CFT) and sanctions regulations, helping maintain secure and legal operations across the network.

Asset tokenization

Stellar has built-in features that allow issuers to tokenize real-world assets efficiently and cost-effectively. The platform facilitates tokenization without a role for smart contracts, thus simplifying tokenization and reducing development time, counterparty risk and errors. Moreover, users get controls for approving, revoking and freezing assets, which ensures accurate distribution.

You can tokenize fiat currencies as stablecoins pegged to their value. Assets like money market funds, private bonds, stocks, commodities and others are convertible into tokens reflecting the value of the original asset. The Stellar Asset Sandbox enables issuers to explore the tokenization process on the Stellar testnet without coding.

Here is the asset tokenization process on Stellar:

Decentralized finance (DeFi)

Develop DeFi applications on the Stellar network, leveraging its infrastructure and access to a global ecosystem of on-/off-ramps, stablecoins and assets.

You can use Soroban, a Rust-based smart contracts platform designed for scalability to build applications. Soroban forces developers to use only a narrow subset of the Rust language and specialized libraries for most tasks.

You can also invoke a Soroban contract by submitting a transaction containing the new operation:

You can build various DeFi applications, including borrowing, lending and staking protocols. To enhance the functionality of your smart contract, you may integrate it with wallets, bridges and oracles.

Notably, projects looking to build on top of Stellar can launch with the Stellar Community Fund (SCF), an open-application awards program for supporting developers building on the Stellar network.

Stellar’s role in CBDCs and tokenized assets

Stellar’s efficient, low-cost and scalable blockchain architecture makes it a viable option for issuing central bank digital currencies (CBDCs). These same qualities have attracted financial firms like Franklin Templeton and WisdomTree, which have used Stellar to launch tokenized assets.

The network’s compliance-friendly design, asset control features and fast settlement times align with regulatory requirements, making it an option for institutions seeking approval from the US Securities and Exchange Commission. Its ability to support regulated financial instruments positions Stellar as a platform of interest for financial firms and regulators.

Franklin Templeton established a tokenized money market fund on Stellar, leveraging its transparency and programmability, while WisdomTree explored blockchain-based financial products using its interoperability and compliance framework.

As the industry debates tokenized assets and the adoption of blockchain in institutional finance, Stellar’s experience with regulated financial instruments remains highly relevant.

Did you know? CBDCs are programmable. Organizations can issue CBDCs to their employees for specific purposes and locations. As digital assets, CBDCs are also vulnerable to unauthorized access and cyberattacks.

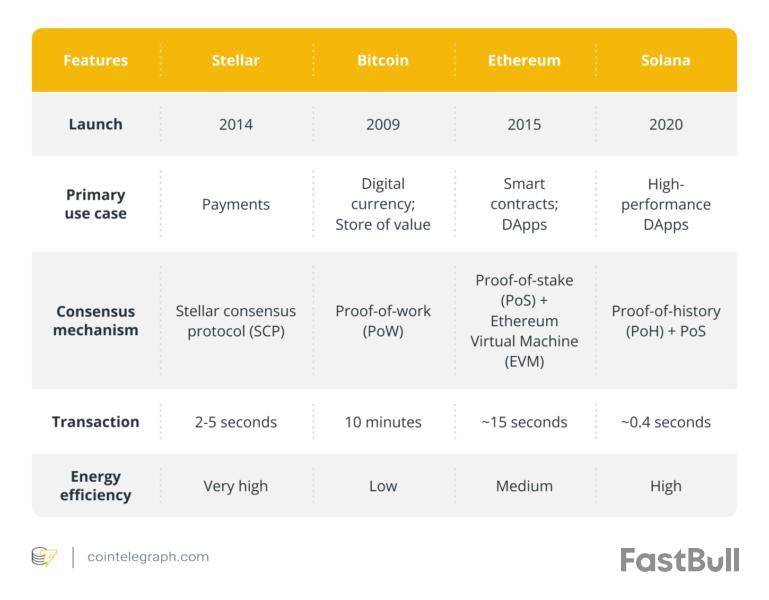

How does Stellar compare with other blockchain networks?

What sets Stellar apart from other blockchain networks is Stellar’s emphasis on the financial inclusivity of individuals.

While blockchain projects usually focus on corporate and business solutions, Stellar aims to build a global digital economy that benefits individuals, especially in underserved regions. It achieves this with a fully interoperable financial ecosystem, offering developers various application programming interfaces (APIs) and software development kits (SDKs) to integrate seamlessly.

Stellar is an efficient solution for global fund transfers. Transactions are processed quickly, within two to five seconds, and fees are very low. On Stellar, the minimum balance for users is 1 XLM, and the minimum per-transaction fee is 0.00001 XLM. This makes it much more affordable compared to international wire transfers, which can cost as much as $75, depending on the bank and transfer amount.

Stellar combines affordability, speed and inclusivity to emerge as a transformative force in international finance. The following table illustrates how Stellar compares with major blockchain platforms:

Did you know? The United Nations utilizes the Stellar network to disburse humanitarian aid to Ukrainians.

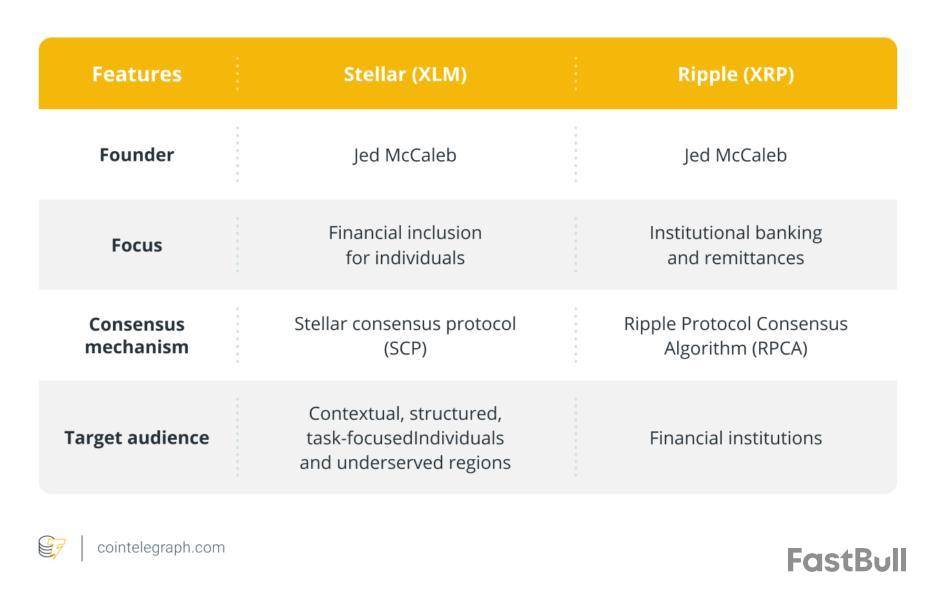

Stellar vs. Ripple — A comparison

Stellar and Ripple are often compared because of two common factors — focus on payment networks and ties to Jed McCaleb, the founder of both projects. While both projects have similarities, their goals, target markets and technologies differ greatly.

Ripple focuses on institutions looking to collaborate with global banks to transform remittance processes by replacing established networks such as SWIFT. On the other hand, Stellar aims to promote financial inclusion by focusing on individuals and encouraging global financial literacy.

Initially, the two projects had greater similarities in terms of functionality and codebase. However, Stellar has evolved to adopt the Stellar Consensus Protocol (SCP), which employs a Federated Byzantine Agreement model. Ripple, on the other hand, uses a Ripple Protocol Consensus Algorithm (RPCA) mechanism.

Furthermore, the token models of both projects also vary. Ripple’s XRP (XRP) has a fixed supply of 100 billion tokens and a deflationary mechanism driven by token burning. Stellar’s XLM started off with the same total supply, but the SDF burned 50 billion XLM in 2019, reducing XLM supply to just over 50 billion XLM.

Can Stellar achieve mass adoption?

Stellar has the potential to achieve mass adoption through its fast, low-cost cross-border payment solutions, strategic partnerships and focus on financial inclusion, but it must overcome competition, volatility and awareness challenges to succeed.

Stellar has long been hailed as a promising blockchain platform, focusing on fast, low-cost cross-border payments and financial inclusion. Yet despite its strengths, the question remains: Can Stellar truly achieve mass adoption, or will it remain a niche player in the crowded blockchain space?

One of Stellar’s most compelling features is its energy-efficient SCP, which allows for thousands of transactions per second at minimal costs. This scalability, combined with its focus on regulatory compliance, makes it an attractive option for institutions and individuals alike.

Moreover, its integration with stablecoins like USDC addresses the volatility of its native token, XLM, making it more practical for everyday use.

Stellar’s commitment to financial inclusion is also commendable, as it aims to empower the unbanked by providing affordable financial services — a mission that could drive adoption from the ground up.

However, Stellar is not without its challenges. For instance, Stellar faces competition from Ripple, which shares a similar use case but has a more established presence in the financial sector. In addition, while Stellar boasts impressive partnerships, mainstream financial institution adoption has been slower than some anticipated.

Furthermore, Stellar’s decentralized nature has been called into question due to the SDF controlling a significant portion of the XLM supply (over 40%), raising concerns about potential influence.

The blockchain space is evolving rapidly, and Stellar’s ability to adapt and innovate will determine whether it will become a global payment solution or remain a promising yet underutilized platform. The stakes are high, and the world is watching.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。