行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

加拿大CPI月率 (季调后) (11月)

加拿大CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

Ethena (ENA) will unlock about 40.63 million tokens, which is about 0.62% of its supply. When projects unlock many tokens, there is a risk of price going down if holders decide to sell. But, because this amount is less than 1% of the supply, the effect might be small if the market expects it and is ready. Watch to see if big investors move tokens after this unlock. If most tokens stay untraded, the price might not move much. source

Chad's Lounge Live will talk about a new NFT collection on Rujira Network, which uses $RUNE and gives holders 0% trading fees. This event might push $RUNE up because it brings attention to its use in NFTs and trading with no fees, a big interest for users. More use cases can make people buy more $RUNE. But, if interest in the NFT project is low or not many people join, the price may not change much. Watch for news after the event for hints of higher demand. source

THORChain@THORChainSep 12, 2025Weekly Chad's Lounge Live Sep 13th 3 PM UTC

w/ @KentonC137 @patriotsounds @ctbutt114 diving into the NFT collection coming to @RujiraNetwork backed by $RUNE and offers holders 0% trading fees.

Join in to learn all about it.https://t.co/361awEb3wF

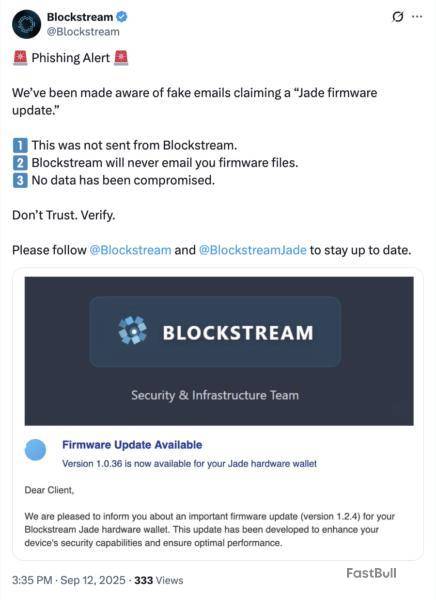

Blockstream, an infrastructure and hardware wallet provider, issued a warning about a new email phishing campaign attempting to target Blockstream Jade hardware wallet users.

The company confirmed on Friday that it never sends firmware files through email and said that no data has been compromised in the attack.

Phishing attacks are designed to steal crypto and sensitive user information through seemingly legitimate communication. According to Blockstream, the email featured a simple message directing users to download the latest version of Blockstream Jade wallet firmware by clicking on a link, which was malicious.

Phishing scams cost crypto users over $12 million in August and affected over 15,000 victims — a 67% increase from July, according to anti-scam service Scam Sniffer.

As phishing campaigns and other crypto scams increase in complexity and diversity, crypto users must exercise a heightened sense of awareness and take online safety measures to protect their funds and sensitive information from theft.

Staying safe amid a rising threat landscape

Crypto users lost over $3.1 billion due to scams and hacks in the first half of 2025, a sharp rise from 2024, according to a report from blockchain security firm Hacken.

Phishing scams are designed to catch users off guard by cloaking malicious links designed to steal data in messages disguised to look like they are from reputable crypto companies.

Typically, this involves a customer service email sent to the target warning of an imminent account closure, theft, cybersecurity breach or some other issue, and demanding a user’s private keys or passwords to fix the problem.

Users can avoid phishing scams by double-checking URL addresses to ensure that websites are legitimate.

Scammers will often create URLs that are nearly identical to legitimate crypto websites, with one or two small errors, such as including or excluding periods or substituting the letter “o” with the number zero and vice versa.

Users should also bookmark trusted pages instead of typing in the URL into the search bar manually or relying on search engines. Even paid advertisements thrust to the top of popular search engine sites like Google can be scams.

Other good practices include avoiding clicking links from unknown senders altogether, using a virtual private network (VPN) to mask IP addresses and locations, and checking emails and websites for spelling or grammatical mistakes.

Ethereum is up $256.20 today or 5.80% to $4674.99

Note: The Ethereum price is a 5 p.m. ET snapshot from Kraken

Data compiled by Dow Jones Market Data

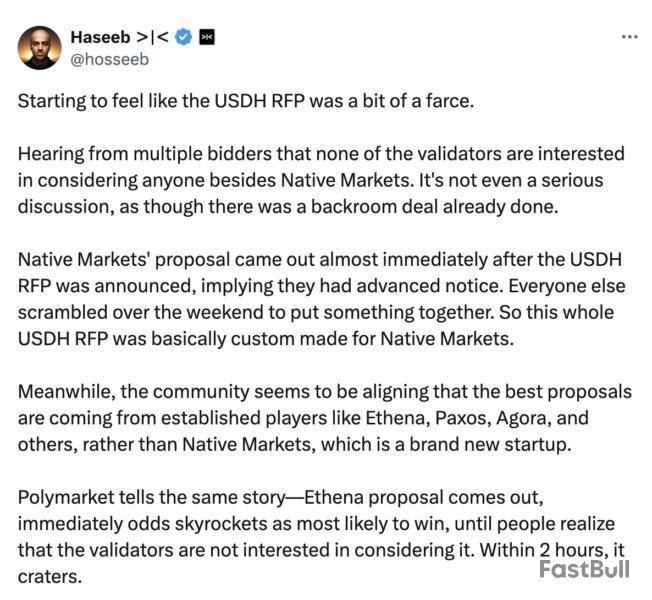

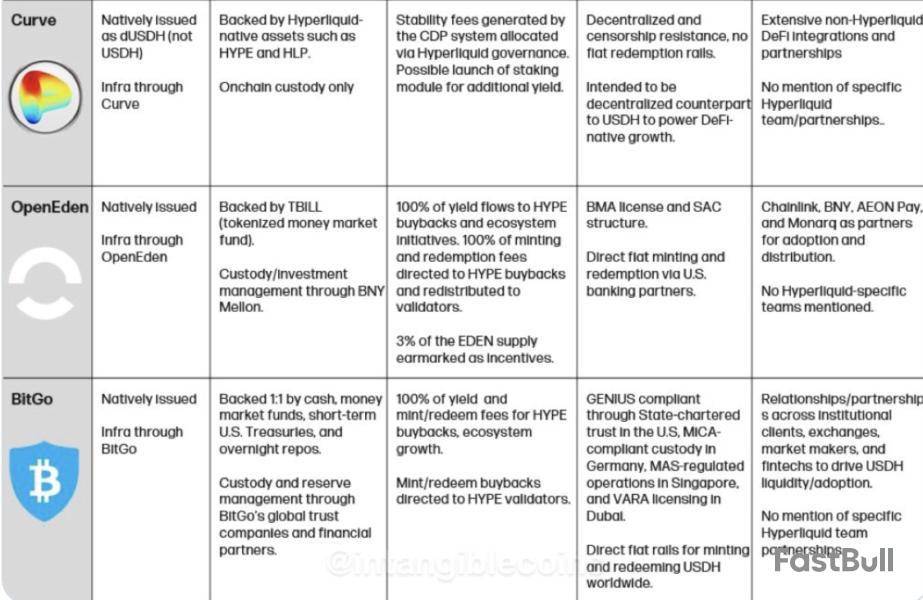

One week after opening a contest to decide the issuer of its first native stablecoin, USDH, Hyperliquid is preparing for a validator vote on Sunday to select the winner in what has quickly become one of the industry’s most closely watched community decisions.

Hyperliquid, a decentralized exchange for perpetual futures that launched its own layer-1 in November 2024, handled $330 billion in trading volume in July with a team of 11 people. USDH will serve as the platform’s first dollar-pegged asset, providing traders with a stable unit of account and collateral option within the Hyperliquid ecosystem.

The vote will decide which company controls the exchange’s canonical stablecoin and gains access to billions in stablecoin flows.

The race has already seen twists. On Thursday, Ethena withdrew its bid and endorsed newcomer Native Markets. That leaves Paxos, Frax, Sky, Agora, Curve, OpenEden and Bitgo still in contention.

Native Markets

Native Markets was first team to file a proposal for USDH, which it did on Sept. 5.

Explicitly formed to launch a Hyperliquid-native stablecoin, the group pledged to mint USDH directly on HyperEVM and split reserve yield evenly between HYPE buybacks and ecosystem growth.

Its plan relies on Stripe’s tokenization platform, Bridge, to manage reserves. This choice won early validator backing but also sparked pushback from competitors warning of potential conflicts with Stripe’s blockchain ambitions.

Hyperliquid investor Max Fiege, former Uniswap Labs resident MC Lader and blockchain researcher Anish Agnihotri lead the venture.

Native Markets’ current odds on Polymarket: 96%.

Paxos

Also on Sept. 5, stablecoin infrastructure company Paxos submitted a proposal to launch USDH, a Hyperliquid-first stablecoin designed to comply with both the US Stablecoins Act (GENIUS Act) and the European Union’s Markets in Crypto-Assets (MiCA) framework.

The filing stated that 95% of the interest generated from USDH reserves would be directed toward buying back Hyperliquid’s native token HYPE and redistributing it to validators, users and partner protocols.

“We are the only firm that has launched and scaled multiple regulated stablecoins, including Binance USD to $25B+ and PayPal USD to $1B+,” Paxos said in its announcement.

Paxos also pledged to integrate USDH into its brokerage platform, already used by PayPal and Venmo.

Paxos’ current odds on Polymarket: 4%.

Sky

On Sept. 8, Ethereum decentralized finance (DeFi) pioneer Sky, the issuer of the decentralized stablecoin USDS (formerly DAI), submitted its proposal. Sky’s pitch stands out for pledging to make USDH natively multichain via LayerZero, allowing the token to circulate across networks from day one.

The team also committed to deploying part of its balance sheet into Hyperliquid, offering the community a 4.85% return on USDH, and direct profits toward HYPE buybacks and the Assistance Fund.

Sky’s current odds on Polymarket: less than 1%.

Frax Finance

Decentralized finance protocol Frax Finance, issuer of the frxUSD stablecoin, outlined its proposal to issue USDH through a partnership with a federally regulated US bank, though the bank was not named.

The plan would back USDH one-for-one with tokenized US Treasurys, ensure full GENIUS Act compliance, and recycle the entire treasury yield into Hyperliquid’s ecosystem.

Frax described its approach as “something no one else will match: give everything back to the community.”

Frax Finance’s current odds on Polymarket: less than 1%.

Agora

Also on Sept. 8, Agora, the issuer of the AUSD stablecoin, put forward a proposal to launch USDH with VanEck as asset manager. The bid proposal features a commitment to direct 100% of net revenue from reserves into HYPE buybacks or the Assistance Fund.

Agora also sharply criticized Native Markets’ reliance on Stripe’s Bridge, warning that Stripe’s plans for its own Tempo blockchain could create conflicts of interest for Hyperliquid.

“If Hyperliquid relinquishes its canonical stablecoin to Stripe, a vertically integrated issuer with clear conflicts, what are we all even doing? We strongly urge caution against using Stripe (Bridge) as an issuer,” Nick VanEck, co-founder of Agora, said on X.

Agora’s current odds on Polymarket: less than 1%.

The remaining competitors

Three last-minute bids were submitted on Sept. 10, the final day of the proposal window, and have not yet appeared on Polymarket’s prediction markets.

They came from Curve, the Ethereum-based decentralized exchange known for its stablecoin pools; OpenEden, a real-world asset tokenization platform; and BitGo, a US crypto custodian and trust company.

How the USDH vote will work

The USDH vote marks Hyperliquid’s first major governance decision beyond routine asset delistings. Voting will occur entirely onchain between 10:00 and 11:00 UTC on Sunday, with validator power determined by the amount of HYPE tokens staked and delegators free to shift their support.

A proposal must win two-thirds of the total stake to pass, though the Hyperliquid Foundation and staking provider Kinetiq — which control about 63% of tokens — have pledged to abstain.

The buildup to the vote has coincided with a rally in HYPE, which hit a new all-time high of $57.30 on Friday, according to data from CoinGecko.

Magazine: TradFi is building Ethereum L2s to tokenize trillions in RWAs — Inside story

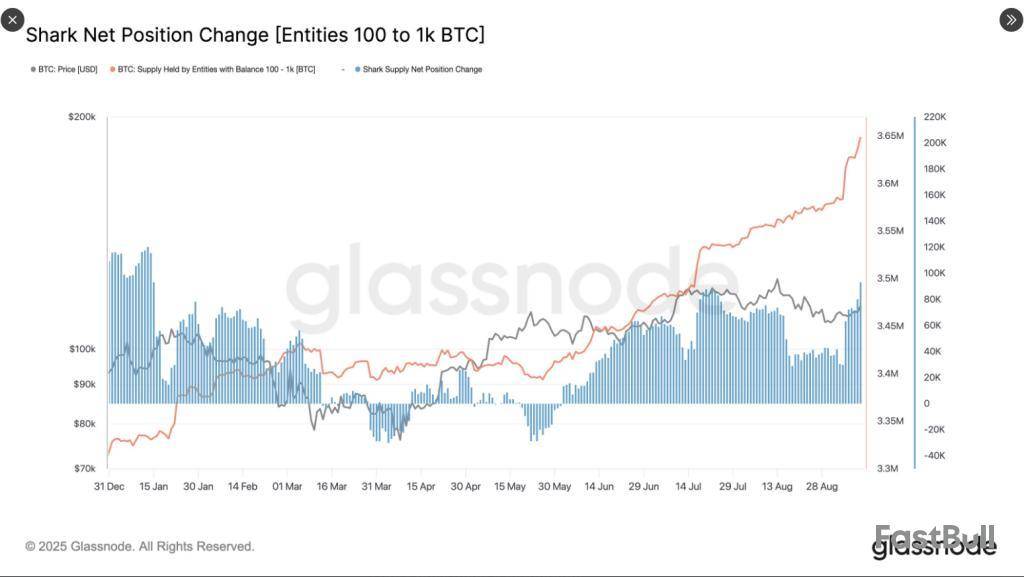

According to data from blockchain analytics firm Glassnode, a group of mid-sized Bitcoin holders has stepped up buying this week, taking in roughly 65,000 BTC over the past seven days.

At a spot price of $113,595, that haul equals about $7.35 billion. Reports have disclosed that these investors — wallets holding between 100 and 1,000 BTC — have pushed their monthly net accumulation to 93,000 BTC.

Sharks Expand Their Holdings

Those mid-sized holders a.k.a. “sharks” now control about 3.65 million BTC. That is roughly 18% of Bitcoin’s circulating supply, which is about 19.91 million coins.

The shift is striking because it removes a meaningful chunk of coins from the pool of easily traded supply. Less available BTC can change how quickly prices move when demand rises.

glassnode@glassnodeSep 11, 2025#Bitcoin entities holding 100–1k #BTC (“sharks”) have sharply ramped up accumulation. Over the past 7 days, their holdings grew by ~65k $BTC. The pace of accumulation has grown as well, with a 30D net increase of 93k $BTC. This group now holds a record 3.65M $BTC. pic.twitter.com/MRcIPcTB1T

What This Means For Supply And Demand

While these sharks are not the same as the very large institutional whales, their moves still affect market balance. Buying at this scale reduces liquid supply and can push prices up if fresh buying keeps coming.

Some market participants see the pattern as a sign of growing confidence among this class of investors. At the same time, it can raise short-term volatility: when a concentrated group holds more coins, their future decisions to sell or hold will matter. Market Moves And Recent Price Action

Bitcoin’s run this year has been strong. Based on market tracker numbers, BTC has climbed about 100% over the past year, is up 23% year-to-date, and has gained over 40% over the past six months.

Price action has not been smooth, though. The market fell to about $107,000 on September first, then recovered to a little over $116,000 earlier today. At the time of writing, BTC was inching near $114,000. Forecasts And Investor Expectations

Public forecasts have been bold. Strategy executive chairman Michael Saylor has suggested Bitcoin could top $150,000 by Christmas. Tom Lee of Fundstrat has forecast $200,000 by the same date.Risks And What To Watch For

This aggressive accumulation comes with caveats. Markets can reverse quickly. Large inflows into or out of ETFs, miner sell pressure, or a shift in macro conditions could halt the rally.

Also, heavy concentration in certain wallet groups can amplify moves if those groups change course. Investors should watch wallet flows, trading volumes, and major announcements that might tilt sentiment.

In short, the recent buying by mid-sized holders is a clear, measurable trend. It tightens the pool of coins available to trade and has coincided with strong price gains this year.

Featured image from Meta, chart from TradingView

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。