行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国对非欧盟贸易账 (季调后) (10月)

英国对非欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

BlackRock, the world’s largest asset manager, is preparing to launch a Bitcoin exchange-traded product (ETP) in Europe, according to a Feb. 5 report by Bloomberg.

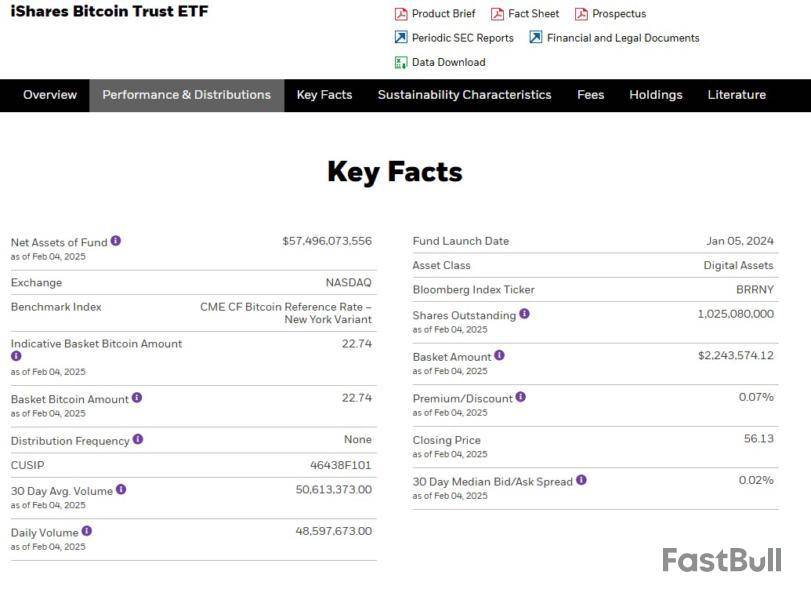

The move comes after BlackRock’s US spot Bitcoin exchange-traded fund (ETF), iShares Bitcoin Trust (IBIT), drew upward of $57 billion in net assets after launching in January 2024. BlackRock’s IBIT fund is America’s most popular spot Bitcoin ETF.

BlackRock’s European Bitcoin ETP will reportedly be domiciled in Switzerland. The asset manager plans to start marketing the fund as soon as this month, Bloomberg said, citing people familiar with the matter.

BlackRock is a top ETF issuer, with $4.4 trillion in assets under management (AUM) across its suite of ETPs. This would be BlackRock’s first Bitcoin ETP outside of North America, Bloomberg said.

Expanding crypto product suite

BlackRock has been doubling down on IBIT’s success with international expansions. In January, BlackRock launched a new Bitcoin ETF on the Cboe Canada. The ETF allowed Canadian investors to access BlackRock’s flagship US spot Bitcoin fund.

Overall, US Bitcoin ETFs saw more than $35 billion in aggregate net inflows in 2024, or roughly $144 million in net inflows each trading day, according to data from Farside Investors.

In November, US BTC ETFs broke $100 billion in net assets for the first time, according to data from Bloomberg Intelligence. Crypto analysts at Steno Research expect Bitcoin ETFs to attract another roughly $48 billion worth of net inflows in 2025.

Bitcoin has “become [a] more important component […] of investors’ portfolios structurally” as they increasingly seek to hedge against geopolitical risk and inflation, investment bank JPMorgan said in a December report, citing the “record capital inflow into crypto markets.”

Surging institutional inflows could cause positive demand shocks for Bitcoin, potentially sending BTC’s price soaring in 2025, asset manager Sygnum Bank said in December.

By Janet H. Cho

Cryptocurrency enthusiasts will be eyeing MicroStrategy's fourth-quarter earnings results after the markets close on Wednesday.

The world's largest corporate Bitcoin holder is expected to report adjusted earnings of 5 cents a share on sales of $122.4 million for the quarter, according to FactSet. That's down from adjusted earnings of 56 cents a share on sales of $124.5 million in the fourth quarter of 2023.

MicroStrategy on Monday disclosed in a regulatory filing that it had gone a week without purchasing any Bitcoin for the first time since early November. Its latest purchase — at the end of January — was for around 10,107 digital tokens, bringing its total holdings to around 471,107 Bitcoins.

Bitcoin was trading at around $97,000 early Wednesday, down from above $100,000 last week, according to CoinDesk.

MicroStrategy holds about $50 billion of Bitcoin, but it has no recurring earnings, based on generally accepted accounting principles. Its software business, with about $500 million in revenue, isn't profitable on a GAAP basis.

Barron's noted in December that the gap between MicroStrategy's market value and the value of its Bitcoin holdings is at the heart of the debate about the company. Chairman and controlling shareholder Michael Saylor calls MicroStrategy a "Bitcoin treasury company," and has helped the company gain a huge retail following.

MicroStrategy last week priced about 7.3 million shares of 8% convertible preferred stock offering at $584 million, with a 10% dividend yield.

MicroStrategy's stock has risen 16% year to date and 563% over the past 12 months. Barron's has said the premium looks too high, and the stock is vulnerable to a pullback, especially if Bitcoin's postelection surge begins to reverse.

Julian Klymochko, CEO of Canadian investment firm Accelerate, thinks analysts and investors are going to extremes to justify the MicroStrategy valuation, calling it "mental jujitsu to justify buying the shares at such an inflated price and in such a convoluted way through a holding company that is basically a closed-end fund." Closed-end funds raise money by issuing shares and using the proceeds to buy financial assets, and usually trade at a discount to their net asset value, not a premium.

On Dec. 13, MicroStrategy, along with Palantir Technologies and Axon Enterprises, was added to the Nasdaq 100 index of the 100 largest nonfinancial companies in the Nasdaq Composite index. MicroStrategy's inclusion was because of a quirk classifying it as a software company because that was its main business before it became the largest corporate holder of Bitcoin, even though software now accounts for less than 5% of its current value.

Write to Janet H. Cho at janet.cho@dowjones.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

Caroline Pham, acting chair of the US Commodity Futures Trading Commission (CFTC), announced that the agency would be winding down its practice of regulation by enforcement, likely impacting its approach to crypto firms during the Trump administration.

In a Feb. 4 notice, Pham said the CFTC was restructuring the priorities for its Division of Enforcement to focus on fraud, suggesting that the move “will stop regulation by enforcement” against “good citizens.” The commission will divide its responsibilities into two task forces focused mainly on retail fraud and violations of the Commodity Exchange Act and “complex fraud and manipulation.”

“This taskforce realignment will enhance our vigorous and energetic enforcement program by empowering our talented staff to focus their expertise on matters that secure justice for victims and uphold public confidence in the integrity of our markets,” said acting enforcement director Brian Young.

The shift in the commission’s approach to enforcement was one of Pham’s first actions since becoming the CFTC acting chair on Jan. 20 following former chair Rostin Behnam’s stepping down. At the time of publication, it was unclear whom US President Donald Trump intended to nominate to fill Behnam’s seat at the CFTC once he leaves on Feb. 7.

In December, the CFTC reported more than $17 billion in monetary relief for fiscal year 2024, mainly from the regulator’s actions against defunct crypto exchange FTX. The commission has also filed enforcement actions against Binance and its CEO, Changpeng Zhao, former Voyager CEO Stephen Ehrlich, and former Celsius CEO Alex Mashinsky.

Changes across US regulators under Trump

Another major US financial regulator, the Securities and Exchange Commission, announced on Jan. 21 that it would form a crypto task force to develop a framework for digital assets. SEC Commissioner Mark Uyeda has been leading the agency as acting chair until the US Senate decides whether to confirm Paul Atkins, Trump’s pick to replace former Chair Gary Gensler.

On Jan. 27, Pham announced that the commission would hold public roundtable discussions on market issues, engaging with industry leaders to potentially include digital assets. Reports also suggested the CFTC was investigating Super Bowl bets — the championship game is scheduled for Feb. 9 — offered by Crypto.com and betting platform Kalshi.

By Tomi Kilgore

The company announced in its last earnings report a plan to raise $42 billion to buy bitcoin in three years. It's already spent nearly half of that.

MicroStrategy Inc. is scheduled to release results about its software business after Wednesday's close, but it's unlikely that many on Wall Street will care. Because for most investors, the stock is really just a bitcoin play.

In its last earnings report, MicroStrategy (MSTR) stunned investors by announcing a plan to raise $42 billion over the next three years, through the sale of common stock and debt, so that it could buy bitcoin (BTCUSD).

Investors may be hoping for another announcement, albeit not of the same magnitude. Because in just three months, the company has already completed nearly half of its three-year plan, as it spent $20.5 billion to buy 218,887 bitcoins from Oct. 31 through Jan. 26.

Read: MicroStrategy is still loading up on bitcoin, but the pace of buying is slowing.

Basically, investors want to hear that the company will keep up its pace of bitcoin purchases, because that's what the stock's fate is tied to.

As Mizuho analyst Dan Dolev wrote in a recent note to clients, while bitcoin itself has no intrinsic value, increasing global adoption of the digital currency, a slow rate of bitcoin supply growth and a favorable political environment suggest bitcoin prices will continue to rise.

Also read: Trump vows to build U.S. bitcoin reserve. Crypto community is cheering.

And MicroStrategy's stock needs a boost. While the stock was trading about 38% higher since the company's last earnings report, it has stalled in the last couple months and is trading about 28% below its postearnings, postelection record close of $473.83 on Nov. 20.

Meanwhile, bitcoin didn't peak until Dec. 17, when it hit an all-time intraday high of $109,224, and was recently trading just a little over 11% below that peak.

In the company's last disclosure, it said it had spent a total of about $30.4 billion to buy 471,107 bitcoins, at an average price of $64,511 per bitcoin. At current prices, that holding would be worth roughly $45.6 billion.

As for MicroStrategy's software business - which Mizuho's Dolev said was a nearly "inconsequential portion" of its valuation - analysts surveyed by FactSet expect, on average, the company to swing to an operating loss per share of 9 cents, from a profit of 50 cents a share in the same period a year ago.

Revenue is expected to slip to $122.4 million from $124.5 million. Revenue for its largest product-support business is expected to slip to $61.8 million from $65.5 million, product-licenses revenue is seen falling to $12.4 million from $18.4 million, and subscription-services revenue is forecast to rise to $30.6 million from $21.5 million.

-Tomi Kilgore

This content was created by MarketWatch, which is operated by Dow Jones & Co. MarketWatch is published independently from Dow Jones Newswires and The Wall Street Journal.

Decentralized crypto trading engine Raydium is making a bid for Solana's multibillion dollar perpetuals market – and gaining traction fast.

Raydium's weeks-old foray into offering these hyper-popular derivatives contracts – they allow crypto traders to speculate on price swings without holding the actual token – is already racking up $100 million in daily trading volume.

It's now Solana's third most popular venue for trading perps, behind Jupiter and Drift, this ecosystem's trading heavyweights. The growth comes despite Raydium perps' nascency; its builders haven't poured marketing capital on promoting a trading tool that's yet to officially launch.

"Raydium brand still packs a punch," said InfraRAY, a core contributor to the project.

The push caps Raydium's ascendence to the top of Solana's decentralized crypto trading landscape. Its automated market maker (AMM) setup, which enables anyone to spin up a trading pool of any asset, has been a difference-maker in Solana's memecoin era.

And yet, most traders who use Raydium's swap rails never visit its website. Instead, they access its services through trading aggregators that split orders across multiple venues. This means potentially less activity for Raydium and, crucially, a weaker relationship with direct users, the traders.

In industry parlance, these traders are the "takers," the ones who execute a trade. Makers, meanwhile, are the ones providing liquidity, perhaps by funneling assets into Raydium's AMM.

"Raydium has done well on the maker-side," said InfraRAY, "But greater network effects exist when you own the relationship with the taker."

Behind the scenes, Raydium's perps trading is being supported by Orderly Network, a trading project with roots outside the Solana ecosystem. Orderly allows perps traders working from multiple blockchains to trade assets on a unified order book. This provides smoother sailing for all orders.

Orderly's month-old Raydium rollout is proving to be a major boon. Perps traders on Solana are now driving 25 percent of Orderly's total volume.

"We're trading anywhere from $200 to $400 million a day in volumes" across the couple dozen projects that offer Orderly-supported perps trading, said CEO Ran Yi.

Facilitating trades via Orderly – in lieu of executing perps transactions on-chain, as many of Raydium's more entrenched competitors do – can save the protocol money and better ensure transactions process correctly, InfraRAY said. But it also comes with its own cross-chain complexities that he said are still being worked through.

Next stop: full launch. In a few weeks Raydium's perps service will be ready for a proper debut and shake off the "public beta" training wheels. Once it does, the teams behind it plan to push harder on marketing and outreach.

Even at $100 million in daily volumes, Raydium's perps service is far from displacing the Solana DeFi ecosystem's top on-chain perps service, Jupiter. The best-known swaps aggregator's derivatives exchange sees nearly $2 billion in daily volume; the runner-up, Drift, sees double the volume of Raydium.

But InfraRAY is confident Raydium can chip away at the bigger protocols' respective leads. For one, its perps service offers trading in vastly more assets than either competitor. Orderly allows for speedy listings of new contracts, meaning Raydium can move fast to capture, and potentially corner, new markets.

He thinks the total addressable market for Solana-based perps is only set to grow.

"I expect there to be more competition and innovation. But currently Raydium has a seat at the table."

The following article is adapted from The Block’s newsletter, The Daily, which comes out on weekday afternoons.

Happy Wednesday! The crypto market wasn't impressed by Trump's new crypto czar's first press conference on Tuesday, and we'll have to wait 170 days for a concrete plan from David Sacks. However, a sovereign wealth fund proposal from Scott Bessent and Howard Lutnick could be coming within the next 90 days.

In today's newsletter, Standard Chartered expects bitcoin to reach $500,000 by 2028, while CoinShares says Trump's recent tariff orders could boost bitcoin and accelerate global de-dollarization. Plus, XRP Ledger experiences an hour-long halt and more.

Meanwhile, the supply of ether reaches levels not seen since before The Merge, BlackRock reportedly plans to launch a Bitcoin ETP in Europe and MicroStrategy rebrands to simply "Strategy."

Let's get started.

Bitcoin to reach $500,000 before Trump leaves office?

Standard Chartered Head of Digital Assets Research Geoffrey Kendrick predicts bitcoin will reach $500,000 before President Trump leaves office, driven by improved investor access and a decline in volatility.

Trump's tariffs could boost bitcoin, analysts say

President Trump's use of the International Emergency Economic Powers Act (IEEPA) to impose universal tariffs on Mexico, Canada and China raises concerns over U.S. dollar dominance, according to CoinShares Head of Research James Butterfill.

XRP Ledger witnesses hour-long halt

XRP Ledger experienced a 64-minute halt late Tuesday, sparking debate between its critics and proponents over consensus tradeoffs.

SEC scales down crypto enforcement unit

The Securities and Exchange Commission is taking steps to downsize its crypto enforcement unit, The New York Times reported, citing five sources familiar with the matter.

Crypto Czar David Sacks praises bitcoin as an 'excellent store of value'

President Trump's Crypto Czar David Sacks said bitcoin is an "excellent store of value," during an interview with CNBC on Tuesday, as speculation mounts regarding the prospect of a strategic national reserve.

In the next 24 hours

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Crypto donations exceeded $1 billion in 2024 alone, spurred by the boom in the digital asset market and increased regulatory clarity around the world, according to data compiled by The Giving Block, a platform that helps nonprofits raise money from crypto enthusiasts.

“More regulatory clarity means more institutional investment and stronger crypto platforms that are built to last,” the platform told Cointelegraph. “All of this lends itself to growing the crypto sector, which is the tailwind that drives all crypto philanthropy.”

The Giving Block noted a number of growing trends in crypto philanthropy, including the increased number of nonprofits accepting crypto as donations (more than 70% of the top US-based charities) and the geographical diversity of crypto giving in the US.

In the United States, four states and the District of Columbia accounted for around 69% of total donation volume: New York (22%), Florida (15%), California (13%), Pennsylvania (11%) and the District of Columbia (10%). The states with the most crypto-giving volume have been changing over the past few years, indicating increased geographical diversity.

There was significant diversity in the types of causes donated to as well. Just two causes individually accounted for more than 10% of crypto donations: education (16%) and health/medicine (14%). Six more categories accounted for 5%–10% of donations, while seven categories accounted for between 1% and 5%.

Another emerging trend is the intersection between artificial intelligence and crypto philanthropy, with the new technology facilitating and, eventually, autonomously managing philanthropic activities. This intersection could increase the possibilities of impact-driven blockchain applications.

While stablecoins accounted for 44% of crypto giving in 2023, the past year saw a rise in crypto giving with appreciating assets, most notably Bitcoin (BTC), Ether (ETH), XRP (XRP) and Solana (SOL). Together, those four cryptocurrencies accounted for 90% of all crypto donated in 2024. The report notes that donors often give stablecoins during market downturns due to those cryptocurrencies’ price stability.

According to The Giving Block’s report, the average crypto donor is often in their 20s and 30s and is frequently wealthier and more philanthropic than the average donor. They tend to be either “crypto evangelists” who donate to “pay it forward” or “optimistic investors” who are primarily interested in the financial advantages of donating crypto while supporting causes they care about.

The Giving Block told Cointelegraph that donating crypto is “far more tax efficient than giving cash while being easier to give than stocks.” Donors “can maximize their impact by leveraging tax advantages, selecting the right assets to donate, and timing their contributions.”

The Giving Block expects to see $2.5 billion donated in crypto during 2025 due to increased crypto wealth generation from a favorable political landscape and more adoption of crypto assets. In addition to the tokens already mentioned, memecoins may play a larger role in crypto giving in 2025. By 2035, the amount of crypto giving could reach a projected $89 billion.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。