行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

加拿大CPI月率 (季调后) (11月)

加拿大CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

Strategy founder Michael Saylor says Bitcoin hasn’t reached $150,000 yet because holders without a long-term outlook have been selling off while a new cohort of investors are beginning to enter the market.

“I think we’re going through a rotation right now,” Saylor said on the Coin Stories podcast with Natalie Brunell on May 9.

The lack of “10-year investor mindset” led to Bitcoin sell-off

Saylor said “lots of non-economically interested parties are rotating out of the asset.” However, at the same time, “a new cohort of investors are entering.”

“A lot of Bitcoin, for whatever reason, was left in the hands of the governments and the hands of lawyers, and in the hands of bankruptcy trustees,” he added.

Saylor said that many of these trustees do not have a “10-year investors mindset,” and as Bitcoin’s price began to rally, they took advantage and “thought this is a good exit point to get liquidity.”

After Bitcoin reached its all-time high of $109,000 on Jan. 20 just hours before US President Donald Trump’s presidential inauguration, it experienced a downtrend, falling as low as $76,273 on April 9, before starting to show signs of recovery.

On May 8, Bitcoin reclaimed $100,000 for the first time since Feb. 1 after US President Donald Trump proposed tariffs. The recent price surge has pushed Strategy’s Bitcoin holdings to 50.27% above their average Bitcoin purchase price of $68,569. At the time of publication, the firm holds 555,450 Bitcoin, valued at approximately $57.23 billion, according to Saylor Tracker data.

Saylor is surprised at US government sentiment shift

Spot Bitcoin ETFs posted $564.7 in inflows over the past five trading days, according to Farside data.

Meanwhile, Saylor said he’s not surprised the US government hasn’t yet bought Bitcoin for its Strategic Bitcoin Reserve which Trump signed an executive order for on March 7. The reserve is holding Bitcoin that was forfeited as part of criminal or civil asset forfeiture proceedings.

However, Saylor didn’t anticipate their stance to change so quickly following Trump’s inauguration.

“I was surprised that the US embraced Bitcoin as radically as it has over the last six months, I think I didn’t expect all the Cabinet members to be so enthusiastic,” he said.

Bitcoin was back in the news this week after surging past $104,000 before retracting a bit. The rally, which started around May 7, propelled the world’s largest cryptocurrency from $93,000 to as much as $104,000 by May 9.

After retreating 4% in the following 24 hours, Bitcoin still maintained a weekly gain of around 6%. That short-term action is now driving larger predictions, including one that forecasts Bitcoin will increase another 10 times in value.

Another 10x Jump ‘Inevitable,’ Expert Says

Muneeb Ali, the brains behind the Bitcoin Layer 2 solution Starks, thinks the next giant leap is imminent. In his opinion, Bitcoin has already taken three distinct steps in its price trajectory: from $100 to $1,000, then to $10,000, and then to over $100,000.

muneeb.btc@muneebMay 08, 2025i’ve seen bitcoin go:

– from $100 to $1,000. – from $1,000 to $10,000. – from $10,000 to $100,000.

one more 10x to $1,000,000 is inevitable.

Ali pointed out how each move took more time but followed a familiar pattern. In 2013, Bitcoin climbed from $100 to $1,000 in four months. Four years later, in 2017, it reached $10,000. By December 2024, it had crossed the $100,000 mark. Based on that path, Ali said another 10x jump to $1 million isn’t just likely — it’s “inevitable”. However, he didn’t explain what would actually drive that kind of rise.

New Projection Sees $116K Next Month

The latest Bitcoin price forecast by CoinCodex has the price increasing by 13% and hitting $116,600 on June 8, 2025. Technical analysis indicates a positive trend, with 20 of the past 30 days (67%) closing in the positive. During the same timeframe, Bitcoin recorded 6.50% price volatility.

The Fear & Greed Index is currently at 73, which is Greed. Though this prediction is not quite hinting at reaching $1 million yet, it validates the notion that there is still space for Bitcoin to rise in the near future.A US Government Buy-In Could Speed Things Up

Zack Shapiro, a Bitcoin Policy Institute lawyer, also thinks that Bitcoin has a lot of potential — and quick. He studied a bill called the Bitcoin Act, which was reintroduced last March. The bill proposes the US government to purchase 1 million BTC within five years. That represents 5% of the total supply.

If passed, the bill would fund the acquisition using profits from gold revaluation. Shapiro indicated that a plan like that would fuel demand so high it drives Bitcoin to $1 million earlier than anticipated. That’s provided that the bill gains momentum and secures the financing it requires.

Featured image from Gemini Imagen, chart from TradingView

Bitcoin has surged to $104,300, confirming the uptrend and reinforcing the bullish outlook that many analysts projected for 2025. This move places BTC deep into range-highs territory, with the next major challenge now clearly in sight: the all-time high at $109,000. The market’s strength comes on the back of strong technical performance and increasingly optimistic sentiment, as BTC continues to lead the crypto rally and altcoins follow suit.

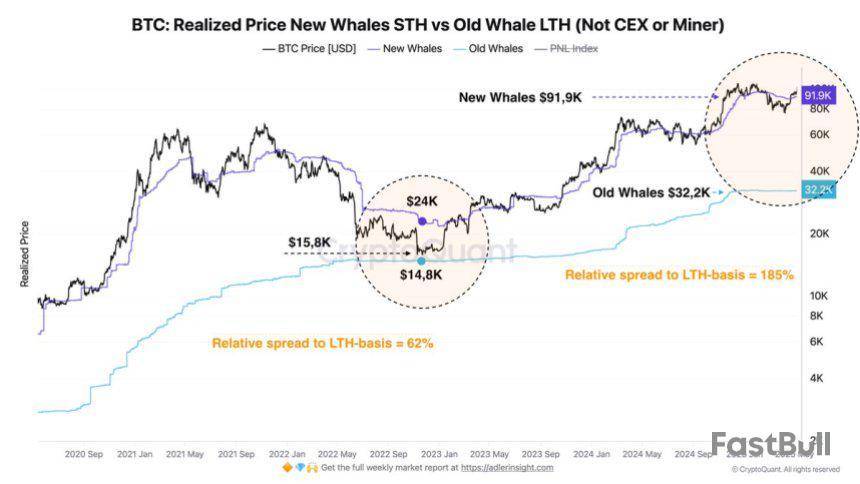

On-chain data from CryptoQuant adds further weight to the bullish narrative. One standout metric highlights the growing confidence among large holders: the absolute difference between the Realized Price of new whales and old whales now stands at $59.7K. Specifically, new whales have entered the market at an average price of $91.9K, while old whales’ basis remains at $32.2K. This translates to a 185% relative spread to the long-term holder (LTH) basis—a massive divergence.

This wide gap signals that a new wave of high-conviction buyers is entering the market at significantly elevated prices. Unlike the cautious whale accumulation during previous cycle lows, this phase reflects strong belief in continued upside, even at premium levels. It’s a clear sign that institutional FOMO may be kicking in.

Bitcoin Faces Resistance At $104K As Whale Activity Signals Growing FOMO

Bitcoin is currently encountering resistance around the $104,000 mark—a level that may take time to break as it represents a critical barrier before entering price discovery above the all-time high near $109,000. The recent rally has shown remarkable strength, but as BTC consolidates just below its ATH, some selling pressure is expected. A successful breakout could lead to a swift surge beyond $109K; however, failure to do so may result in short-term consolidation or retracement.

Top analyst Axel Adler shared key on-chain insights on X that highlight the evolving psychology of Bitcoin’s largest holders. According to Adler, the absolute difference between the Realized Price of new whales ($91.9K) and old whales ($32.2K) is $59.7K, representing a 185% relative spread to the long-term holder (LTH) basis. This sharp divergence reveals that new “whales” are entering the market at nearly three times the price of early entrants.

In comparison, the same spread in November 2022 was only 62%, indicating more cautious accumulation near the market bottom. The current surge to 185% reflects rising confidence and FOMO, with large buyers willing to accumulate even at elevated prices. For context, during the 2021 cycle peak at $63K, the spread widened to 437%.

This trend suggests that the market is entering a more aggressive accumulation phase, where belief in higher prices is driving demand despite the premium. If bulls manage to absorb the resistance around $104K, it could mark the start of a parabolic move—fueled not just by momentum, but by conviction from both retail and institutional players betting on a new Bitcoin all-time high.

BTC Price Analysis: Key Levels To Watch

Bitcoin is trading around $103,000 after reaching a high of $104,300 earlier today. The 4-hour chart shows BTC facing resistance at the $103,600 level, which aligns with a key supply zone from late December 2024 and early January 2025. This area acted as a previous rejection point during the last major rally and is now being tested again as potential resistance.

BTC’s recent surge from the $87K–$90K consolidation zone has been aggressive, breaking above both the 200 EMA and 200 SMA (currently at $91,806 and $89,400, respectively) with strong volume. This confirms bullish strength and trend continuation, suggesting that buyers are still in control. However, the current range between $103K and $104K is historically significant, and bulls may need to absorb selling pressure before attempting a move toward the all-time high near $109K.

If BTC consolidates above $100K and holds this level as new support, it would strengthen the case for continued upside. On the flip side, failure to break above $103,600 cleanly could lead to a short-term pullback. Market structure remains bullish overall, but this resistance zone will be critical in determining whether Bitcoin enters price discovery or pauses for accumulation.

Featured image from Dall-E, chart from TradingView

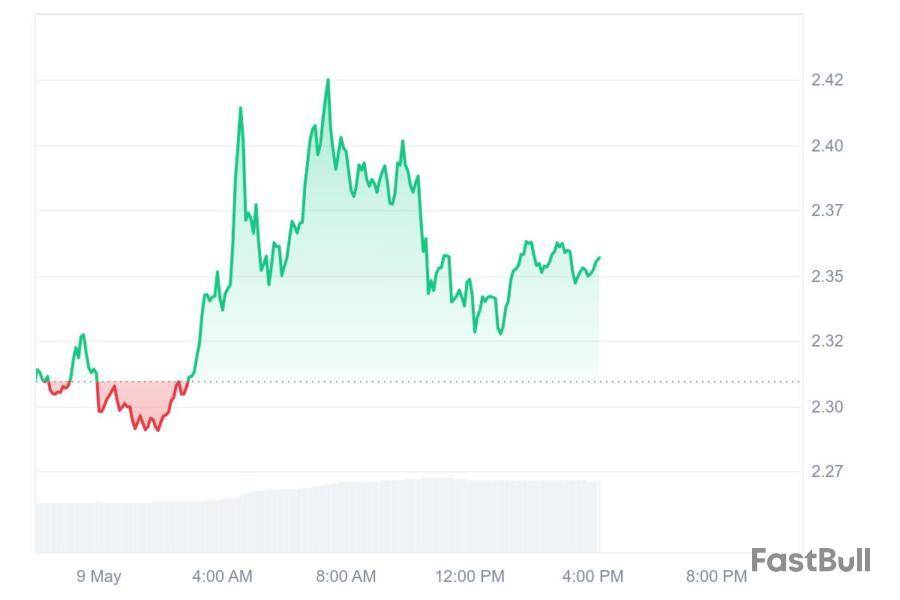

Ethereum just blew through several resistance levels in a matter of hours, igniting the cryptocurrency market with a stunning 31% surge. The 200-day moving average, which frequently distinguishes between bullish momentum and bearish continuation, is just below the $2,300 mark, which the rally has propelled ETH above.

According to the price action, as of right now, this may be the start of a significant structural reversal rather than merely a random spike. With robust volume supporting the move, Ethereum has technically broken through the 50 EMA, 100 EMA and even 150 EMA in a single sweep. Although RSI is currently just above 81, which would typically indicate caution as it is entering overbought territory. However, explosive moves such as these RSI extremes can last longer than usual. Chart by TradingView">

The enormous candle not only breaks the previous downward trend but also makes way for a move toward $2,600 and higher, with the psychological $3,000 zone as the potential next macro resistance level. When Ethereum showed this kind of rally behavior previously, it resulted in months of steady upward movement.

In general, investor sentiment toward Ethereum is rapidly improving, particularly as institutional interest in the post-ETF narratives grows and ETH/BTC parity is given renewed attention. Ethereum is probably going to follow Bitcoin's lead as it gets closer to $100,000, taking advantage of positive market sentiment.

In the short term, it would not be shocking to see a slight decline or consolidation around $2,300 to $2,400. Nonetheless, Ethereum would validate the breakout and change the overall trend to a bullish one if it closed several daily candles above the 200 EMA. For traders hoping to ride this wave, cautious accumulation and scaling into strength may be the best course of action.

Shiba Inu revitalized

Based on its most recent price action, Shiba Inu is displaying renewed strength on the charts with a potential breakout toward the $0.00002 level. The asset has effectively surpassed significant resistance levels, breaching the $0.000014 zone and advancing toward the 200-day exponential moving average (EMA), which is presently hovering around $0.000016.

Throughout its downward trajectory, this long-term EMA has served as a resolute ceiling for SHIB, and it will be difficult to break through. The recent increase in purchasing volume, however, suggests that the meme coin is gaining traction and interest. This most recent price move is consistent with increases in on-chain and market volume, suggesting that it is backed by market activity and not just a speculative bounce.

The move to $0.00002 is much more likely if SHIB can close a daily candle above the 200 EMA with sustained volume support. Given the historical price congestion and relative thinness in the $0.000016-$0.00002 zone, SHIB may move swiftly closer to its target if the 200 EMA breaks.

Since momentum indicators like the RSI are still rising and have not yet entered extremely overbought territory, there is still opportunity for additional growth before a significant decline is anticipated. Although the psychological $0.000018 level has served as both support and resistance in the past, traders should continue to monitor possible resistance there.

In other words, Shiba Inu is preparing for a significant run, but it is facing one of its most difficult technical obstacles. The price of $0.00002 is not only feasible but may arrive quickly if bulls can maintain pressure and break the 200 EMA. If this breakout is confirmed or another rejection is indicated, the next few trading sessions will be critical.

Bitcoin recovers

Unquestionably, bulls enjoyed a significant psychological victory, with Bitcoin's recent breakout above $100,000, but do not celebrate just yet — this move could be a temporary overextension rather than the start of an unstoppable rally. On the price chart, Bitcoin taps out close to $104,000 after cleanly breaking through the $98,000 resistance.

For Bitcoin, this pattern is not uncommon and frequently comes before consolidation or significant declines. This is a warning sign for volume. The volume should be increasing rather than decreasing for a move of this magnitude. The Relative Strength Index (RSI), which typically identifies local peaks at 75, is likewise well into overbought territory.

Furthermore, the current range of important support zones is $98,000 to $95,000. A swift decline back to the $92,000 or even $90,000 region might occur if Bitcoin is unable to maintain above this range. Bulls must defend the 50 EMA, which is approximately $93,000. Long term, the route to $100,000+ is still open, but maintaining a strong rally will probably require more time consolidation and volume.

The Dogecoin price appears to be on a continued rebound, with bulls regaining some control over the market after weeks of sideways trading and downward pressure. However, the momentum is being tested as strong resistance builds around the $0.205 level. A recent analysis highlights this crucial zone and outlines the roadmap for Dogecoin’s next move.

Dogecoin Price Recovery Faces Critical Resistance

TradingView crypto analyst Lingrid recently shared a technical analysis featuring a classic continuation pattern unfolding for Dogecoin. The analyst revealed that the Dogecoin price is attempting a recovery after rebounding from a key ascending trendline and breaking out of a Falling Wedge pattern.

Following this, Dogecoin is now retesting the breakout level around $0.175, where both the wedge resistance and ascending trendline converge. The cryptocurrency has also formed a higher low structure on its price chart. Notably, this breakout zone is critical, as holding above it would confirm the breakout and set the stage for potential gains.

Lingrid has revealed that traders are currently watching closely for continuation toward the next resistance area. The $0.19 level has been set as the next immediate breakout target, aligning with the top of the previous range and the midpoint of the broader resistance area.

A push beyond $0.19 would open the door for a run toward the range between $0.2 – $0.21, a key resistance area where selling pressures could intensify. While Dogecoin’s structure remains relatively bullish with higher lows forming, Lingrid has also cautioned that overhead resistance near $0.19 and $0.2 could slow down the momentum.

Notably, Dogecoin’s trading volume will also play a key role in its price action and future moves. As the price approaches the wedge apex, fluctuations in volume could either sustain the strength of the rally or weaken it.

DOGE To Decline Further If Support Fails

Since the beginning of this year, the Dogecoin price has recorded its fair share of unexpected price declines and volatility. While Lingrid’s analysis shares encouraging signs of a potential price recovery and bull rally, Dogecoin’s breakout remains at risk.

If its price fails to hold the critical support zone at $0.175, especially with a strong candle close below this level, the projected breakout could be invalidated. This would, in turn, potentially lead to a steeper price breakdown toward $0.15, representing a 25% decrease from its current market value of $0.2.

Lingrid also mentions that a failure to maintain buyer interest near the wedge apex and weakening volume could also contribute to market indecision, making a swift recovery less likely. As a result, traders are advised to watch the $0.175 zone closely as a key breakout point that will determine whether Dogecoin resumes its climb or faces renewed downward pressure.

On May 9, blockchain monitoring firm Whale Alert identified a massive transfer of 29,532,534 XRP, worth $69,536,183, to leading U.S.-based crypto exchange Coinbase.

This large transaction has raised eyebrows as it coincides with the ongoing bull market run, prompting investors to closely monitor on-chain activities.

Whales already dumping?

According to the data, the massive transfer was executed by an unknown wallet address in a single transaction, suggesting a possible sell-off attempt.

Although the exact motive behind the transaction remains unclear, it has sparked concern within the XRP community, especially as it aligns with a period of bullish momentum for the token.

Despite the transfer, XRP continues to exhibit strong bullish indicators. Over the past 24 hours, CoinMarketCap data shows that XRP has experienced a 3% daily surge, following an 8% gain the day prior. As of press time, XRP is trading at $2.35.

CoinMarketCap">

In addition to the price uptick, XRP has also recorded a 60.35% surge in trading volume, reflecting heightened activity among both retail and institutional traders.

While large transfers to exchanges are often associated with intent to sell, this specific transfer has the XRP community questioning whether whales are starting to take profits after the recent bull run.

What next for XRP?

XRP’s current positive price trend has fueled investor optimism, with expectations that the token could reach the $3 mark soon. Longer-term, some believe XRP could hit a new all-time high (ATH) before the onset of the next bear cycle.

However, if large holders begin to sell off holdings, this could stall XRP’s bullish trajectory. Whale profit-taking can lead to a spike in supply, outpacing demand and potentially driving prices down.

Such actions might also trigger panic selling among smaller, less experienced investors, leading to further downward pressure on the token’s price.

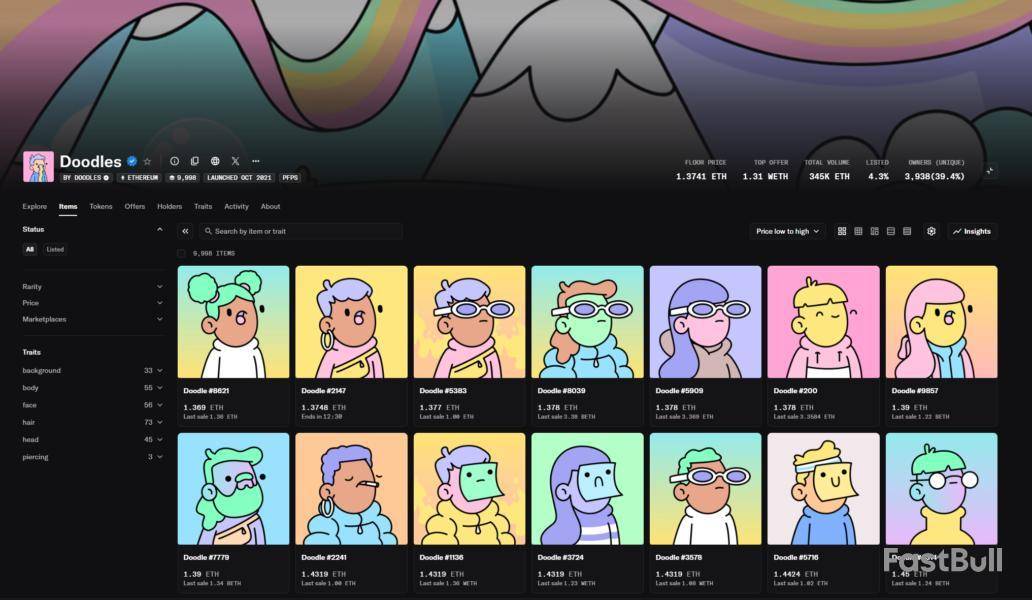

The newly launched DOOD token from Ethereum-based NFT project Doodles has seen a steep drop in market capitalization following its May 9 airdrop on the Solana network.

According to data from DEX Screener, DOOD’s market cap fell from over $100 million shortly after launch to around $60 million at the time of writing.

Overall, the much-anticipated airdrop was “[d]efinitely underwhelming,” a crypto commentator said in a May 9 X post.

Falling NFT values

Joining the trend, NFTs in Doodle’s flagship collection sharply dropped in value on May 9.

The collectibles are down roughly 60% to less than 1.5 Ether per NFT from about 3.5 ETH on May 8, according to OpenSea. As of May 9, the NFTs are collectively worth around $31 million, according to data from CoinGecko.

NFT prices often dip immediately after an airdrop, as holders look to capitalize on their allocations by selling into the market. For instance, sales of Doodles’ NFTs surged by some 97% on May 8 in anticipation of the airdrop.

Over the past week, Doodles clocked roughly $2.6 million in total sales volume, up more than 350% from the week prior, according to data from CryptoSlam.

Doodles announced its token launch in February, outlining plans to mint 10 billion DOOD tokens on Solana and to eventually bridge them to Base, an Ethereum layer-2.

Doodles is the latest Ethereum-native NFT brand to list a token on the Solana network. It follows Pudgy Penguins, an even larger NFT project that airdropped its PENGU token on Solana in December.

Similarly to Doodles, Pudgy Penguin’s token dropped by around 50% on the day of its airdrop.

The PENGU token’s market cap reached an all-time high of roughly $2.8 billion and has since traded down to roughly $900 million, according to CoinGecko.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。