行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

加拿大CPI月率 (季调后) (11月)

加拿大CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

By Elsa Ohlen

Bitcoin and other cryptocurrencies edged down Wednesday, again mirroring global markets.

Bitcoin is down 2.7% to $83,441 over the last 24 hours, according to CoinDesk data. It rose Tuesday so profit-taking could be contributing to Wednesday's drop.

Ether, the world's second largest crypto, is down 4.7% to $1,568 while XRP, the coin used to facilitate payments on Ripple's platform, dropped 4.5% to $2.06.

The Hang Seng Index is down 1.5% while Japan's Nikkei 225 fell 1%. Europe's benchmark index Stoxx 600 was down 0.9%.

Futures tracking the S&P 500 were down 1.3%.

Global markets, and Japan currency in particular, may be contributing to the decline of digital assets Wednesday.

"The yen has strengthened against other currencies because of rising Japanese bond yields... this could discourage the so-called 'yen carry trade,'--a strategy where investors borrow yen at a lower interest rate to invest in high-yield international assets, Arthur Azizov at B2 Ventures, a financial firm, said. "As a result, it may lead to a reduction in global liquidity and affect the crypto market."

Bitcoin tends to benefit from a surplus of liquidity and low interest rates as, typically, investors then turn to riskier assets. "A higher yield offered by traditional assets such as bonds could pose a threat to Bitcoin," Azizov adds.

Write to Elsa Ohlen at elsa.ohlen@barrons.com

This content was created by Barron's, which is operated by Dow Jones & Co. Barron's is published independently from Dow Jones Newswires and The Wall Street Journal.

On the higher time frame, Bitcoin appears to still be in a bearish market with the asset recording a 21.7% decrease away from its all-time high (ATH) above $109,000 recorded in January.

However, when slightly zoomed in, it is seen that the asset is seeing a gradual and steady rebound surging 6.8% in the past week to bring its asset closer to the psychological $90,000 mark with a current trading price hovering above $85,000.

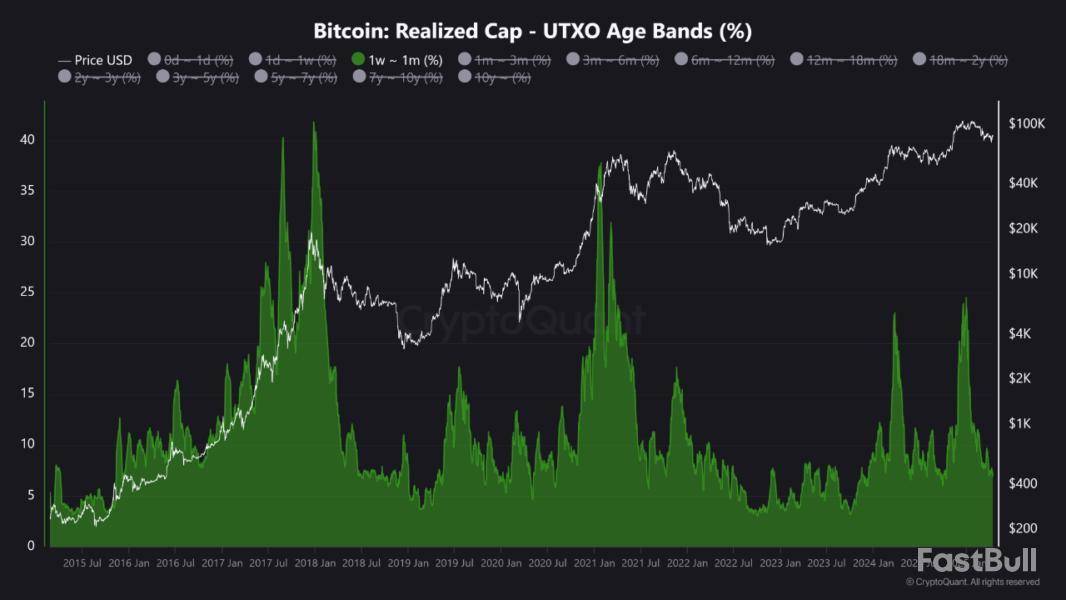

The latest analysis from CryptoQuant analyst Crypto Dan offers context for this cautious optimism. In a post titled “Why does this cycle feel so boring?”, Dan explained that, unlike previous bull cycles that featured fast-paced rallies and surging interest from short-term participants, the current cycle appears subdued.

Why The Current Cycle Is Different

One major indicator supporting Dan’s observation is the notably lower percentage of Bitcoin held for short durations (1 week to 1 month), reflecting minimal engagement from newer market entrants. Dan attributes this behavioral shift to two primary structural changes. First is the macroeconomic environment.

In contrast to the aggressive liquidity injections and near-zero interest rates of the 2020–2021 period, the current market faces tight liquidity and high interest rates, reducing the pace and scale of capital inflows. Second is the transition in market leadership from retail traders to institutional investors.

The approval and growing adoption of Bitcoin exchange-traded funds (ETFs) have transformed the nature of capital movement into the space, making price movements more measured and incremental.

As a result, the market’s development is more cautious, lacking the euphoria typically seen in previous cycles. Dan emphasized that while some on-chain metrics may suggest a cycle top, the current structure could instead be pointing to a more extended and gradual market evolution.

He suggested that long-term patience, rather than short-term speculation, may yield better outcomes under these conditions, noting:

Bitcoin On-Chain Metrics Signal Strength Despite Unusual Cycle

Supporting this longer-term perspective, another CryptoQuant analyst elcryptotavo noted that a key on-chain metric remains strong. According to his analysis, over 70% of the Bitcoin supply remains in profit—a level historically associated with price stability.

This metric tracks the percentage of circulating BTC with a cost basis below the current market price. A supply-in-profit ratio that remains elevated, particularly above the 70% mark, has often served as a foundation for further upward momentum.

Elcryptotavo added that the next target is to push this metric back toward the 80% level, which would reinforce bullish momentum and possibly sustain the current upward trend.

If this threshold is achieved alongside improving macro conditions and continued ETF inflows, Bitcoin could see renewed strength even in the absence of speculative enthusiasm.Featured image created with DALL-E, Chart from TradingView

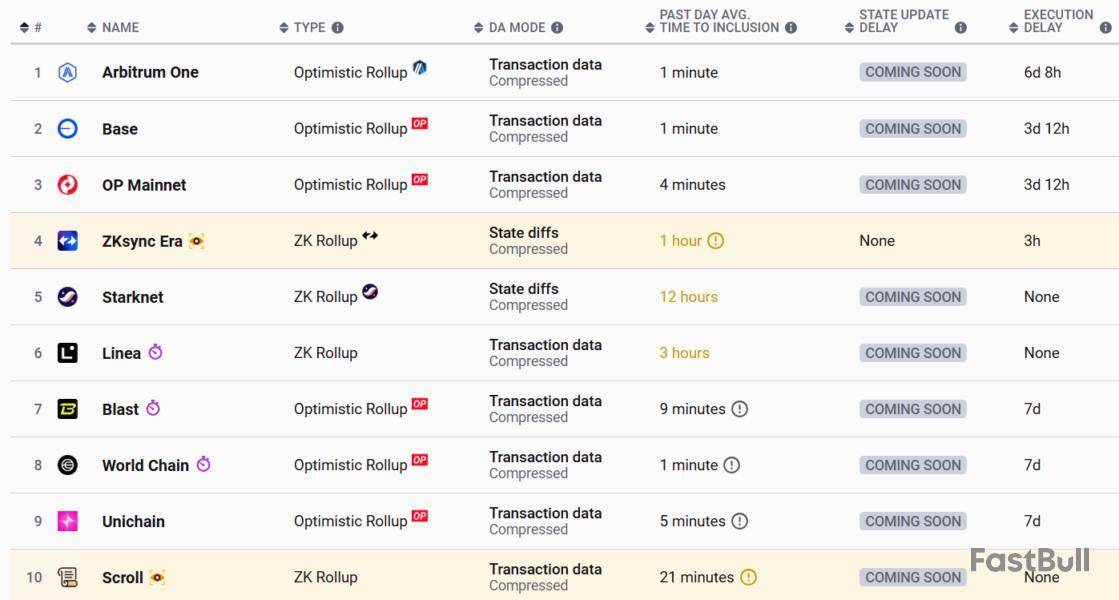

Soneium, a layer-2 (L2) blockchain network developed by Sony Block Solutions Labs, said it has slashed its blockchain finality time by over 98%, as it aims to solve one of the biggest challenges in blockchain scalability.

Astar, a Japanese Web3 adoption collective bridging Astar Network and Soneium, announced a strategic partnership with AltLayer and EigenLayer to launch a “Fast Finality Layer” for Sony’s L2 blockchain.

In blockchain settlement, finality is the assurance that a transaction is irreversible, which happens after it is added to a block on the blockchain ledger.

The new finality layer provides a crypto-economic security guarantee through a decentralized network of validators to reduce the reliance on centralized sequencers and enable more secure crosschain interactions.

This could result in a sub-10-second transaction finality for Soneium, a 98% reduction from its initial 15-minute finality, which was achieved through Optimism’s OP Stack, according to an announcement shared with Cointelegraph.

The new validator network will be secured by both restaked Ether and Astar (ASTR) tokens.

Reducing blockchain finality is key for enabling more advanced decentralized finance (DeFi) use cases and improving developer and user experience, since most solutions experience finality delays from 15 minutes to several days, according to Maarten Henskens, head of Astar Foundation.

The new partnership is a “crucial step toward secure, high-speed, crosschain interoperability,” he told Cointelegraph, adding:

“This milestone is just the beginning — and there’s a much larger story unfolding around how fast finality will reshape developer UX, DeFi, and crosschain experiences,” he added.

Arbitrum One is currently the fastest blockchain, with an average finality time of one minute, the same as Coinbase’s Base L2 network, both relying on optimistic rollups, L2beat data shows.

Blockchain L2 finality a key bottleneck for adoption

Solving blockchain finality remains the biggest barrier to mainstream Web3 adoption, according to YQ Jia, CEO of AltLayer.

“By combining EigenLayer’s restaking with MACH validation and support from Astar Network, we’re creating an infrastructure that offers the best of both worlds — Ethereum’s security guarantees with near-instant finality,” Jia said. “This is exactly the kind of solution needed to bring blockchain technology to mainstream adoption.”

EigenLayer has sought to advance mainstream blockchain adoption since it launched.

In February 2025, EigenLayer and blockchain protocol Cartesi launched a new initiative to find the next key prototype consumer application with new use cases that may bolster mainstream crypto adoption.

Chinese local governments have been selling seized cryptocurrencies via private companies despite an ongoing crypto trading ban in mainland China, according to Reuters.

Amid a slowing economy, local governments have been selling crypto assets confiscated from illicit activities for cash to replenish public coffers — a practice that legal experts say could lead to opaque processes and foster corruption — Reuters reported on Wednesday, citing transaction and court documents.

China continues to ban cryptocurrency trading and mining activities on the mainland, while Hong Kong has repeatedly expressed its ambition to become a crypto hub with a trading licensing regime. The Chinese authorities, however, have enlisted local companies to help dispose of seized crypto assets. While it is illegal for individuals to trade crypto, operating a business that assists the government in selling crypto remains legitimate — which has attracted a growing number of participants — the report said.

For example, Shenzhen-based tech firm Jiafenxiang has facilitated the sale of over 3 billion yuan ($408 million) worth of cryptocurrencies in offshore markets since 2018, acting on behalf of several local governments in Jiangsu province, including the cities of Xuzhou, Hua'an, and Taizhou, according to the report.

Transaction records cited by Reuters show that U.S. dollar proceeds were first converted into yuan through local banks and then transferred to regional finance bureau accounts.

According to data from BitcoinTreasuries.net, China holds about 190,000 BTC, making it the world’s second-largest national holder of bitcoin, behind the U.S., which holds 198,012 BTC.

Handling crypto in legal cases has become a key topic in the country’s judicial system, with authorities holding multiple seminars on the issue. For example, in February, representatives from the Supreme People's Court and several other top judiciary authorities and universities gathered in Beijing for a seminar to discuss research studies and the legal treatment of cryptocurrency.

In December, the PBOC, the central bank, highlighted crypto regulation in its latest annual financial stability report, noting that it is working to improve an international regulatory framework for crypto assets.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

The crypto community is abuzz as the prominent blockchain tracker Whale Alert shared the details of a transaction that moved a whopping 131,000,000 XRP anonymously. Still, additional on-chain data helped to shed light on the identity of the recipient.

Whale Alert is widely known in the crypto space for monitoring large cryptocurrency transactions and sharing the details on its X account and website.

This transaction coincided with a decline of 5.37% experienced by XRP over the past day.

131,000,000 XRP on move, recipient unveiled

The aforementioned data source reported that two unknown wallets had exchanged a massive amount of crypto – 131,000,000 XRP. At the time of the transfer, this XRP chunk was valued at $273,945,648.

The XRP community became intrigued by this massive transaction between anonymous wallets and began to guess as to the likely purpose of this transfer. Many assumed it was a large over-the-counter sell. One X user, however, stated that this was allegedly a transaction made between wallets affiliated with the Binance crypto exchange.

Whale Alert@whale_alertApr 15, 2025🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 🚨 131,000,000 #XRP (273,945,648 USD) transferred from unknown wallet to unknown wallethttps://t.co/CnMiTrxABL

Still, the details of the transaction provided by XRP-focused data platform Bithomp show that the receiving wallet indeed is linked to Binance, while the owner of the sending wallet was not identified.

Earlier this week, Whale Alert spotted two other large XRP transfers. On April 14, an anonymous wallet exchanged 70,000,000 XRP worth $150,361,090. The community believes it was an internal Ripple transfer linked to its Ripple Payments system.

On the following day, an unknown whale shoveled 29,532,534 XRP to the largest cryptocurrency in the U.S. – Coinbase. However, according to Bithomp, it was an internal Coinbase transaction.

Ripple integrates RLUSD into Ripple Payments

Earlier this week, Ripple cryptocurrency giant reported that its most recent product, dollar-pegged stablecoin RLUSD, has been fully integrated into the Ripple Payments network. The stablecoin was issued after the company secured the necessary licenses and regulatory permissions. It is 100% backed by deposits in U.S. dollars, government bonds or other cash equivalents. The leading independent accounting and consulting company BPM conducts RLUSD audits on a monthly basis.

As Ripple said in a blog post, Ripple Payments has already processed a transaction volume of more than $70 billion across more than 90 payout markets. RLUSD is becoming popular because it is focused on compliance, transparency and security.

Bitcoin edges lower after Nvidia said it faces a $5.5 billion hit from tighter U.S. rules on shipments of its new artificial intelligence chip to China. The microchip maker will require licences to export its chip to China as the U.S.-China trade war escalates. "Trump also launched a probe into whether critical minerals should face tariffs, so that added to fears that further tariffs were on the horizon," Deutsche Bank analysts say in a note. That raises fears that the trade war could still get worse from here, they say. Bitcoin falls 0.9% to $83,215, according to LSEG. (renae.dyer@wsj.com)

By Dow Jones Newswires Staff

Global markets traded lower with U.S. futures set to fall as investor confidence sours on signs of escalating trade tensions between the U.S and China.

U.S. President Trump has imposed restrictions on chip maker Nvidia's exports to China and his administration is set to examine whether critical minerals should face tariffs. The company said Tuesday that it expects to book an up to $5.5 billion charge due in its fiscal first quarter due to the restrictions, causing its shares to fall.

Write to Barcelona Editors at barcelonaeditors@dowjones.com

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。