行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国对非欧盟贸易账 (季调后) (10月)

英国对非欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

Binance co-founder Changpeng “CZ” Zhao has proposed Bitcoin and BNB as the first digital assets to form Kyrgyzstan’s national crypto reserves.

On May 5, Zhao shared on X that he advised Kyrgyzstan to start with Bitcoin and BNB when building its national crypto reserve. In 2024, Forbes claimed that Zhao holds about 94 million BNB tokens, about 64% of BNB’s circulating supply. At the time of writing, these tokens are worth about $55 billion.

The proposal follows Zhao’s earlier announcement that he had begun advising Kyrgyzstan’s National Investment Agency (NIA) on blockchain and crypto-related matters.

On April 3, Zhao confirmed he’s been officially and unofficially advising governments on crypto frameworks and blockchain solutions. The former Binance CEO said that he finds the work extremely meaningful.

Binance to launch crypto payments in Kyrgyzstan

A month after CZ announced his role in advising Kyrgyzstan, Binance announced a partnership with the country to launch a crypto payments service.

On May 4, Binance signed a memorandum of understanding (MOU) with the NIA to introduce Binance Pay to the country, enabling crypto transactions. The partnership also aims to boost crypto education in the country, with Binance Academy set to work with government agencies to develop blockchain-focused educational programs.

Binance also said that the exchange had been advising multiple governments and jurisdictions on crypto-related policy. On April 17, Binance CEO Richard Teng said in a Financial Times interview that the exchange had been advising countries on crypto reserves.

Kyrgyzstan has been making moves to become a digital asset-friendly jurisdiction. On April 17, Kyrgyzstan President Sadyr Zhaparov signed a law authorizing a central bank digital currency pilot project while giving the national currency's digital form a legal tender status.

Kyrgyzstan reportedly plans a gold-backed stablecoin

The country also reportedly plans to launch a gold-backed stablecoin. The gold-backed stablecoin will be pegged to the United States dollar and called the Gold Dollar (USDKG). This will be backed by $500 million in gold provided by the country's Ministry of Finance.

Cointelegraph reached out to the country’s Ministry of Finance to confirm the reports but did not get a response before publication.

Although the XRP price is hovering above $2, a crypto analyst contends that this level is still low. Comparing XRP’s current price action to its explosive rally in 2017, the analyst argues that the market has not recognized the full scope of the cryptocurrency’s evolving fundamentals.

XRP Price At $2.2 Is Still Undervalued

Pumpius, a crypto analyst on X (formerly Twitter), firmly believes that the XRP price is poised for a stronger rally, arguing that a $2.21 target remains significantly undervalued. The market expert’s analysis starkly compares the current market positioning with its historic rally in 2017.

Back in 2017, the altcoin skyrocketed from a low price of $0.005 to a staggering all-time high of $3.84, marking its most historic price rally. At its peak, XRP briefly overtook Ethereum’s market cap, securing the position of the second-largest cryptocurrency in the world, just behind Bitcoin.

During this historic rally, the XRP price soared by an astonishing 64,000%, reflecting a monumental gain despite lacking real-world use cases, institutional backing, or regulatory clarity. According to Pumpius, this surge was purely driven by retail Fear Of Missing Out (FOMO), with no stablecoins, IPOs, or financial infrastructure supporting the cryptocurrency’s rapid ascent.

Fast-forward to today, and the landscape surrounding XRP has evolved significantly. Ripple Labs, an enterprise blockchain company and the largest holder of XRP, has launched its stablecoin, RLUSD, which indirectly strengthens XRP’s position in the digital currency space. The company has also secured prime brokerages and regulatory clarity from the US, expanding Ripple’s market reach and creating a stable environment for XRP’s growth.

With an IPO allegedly in the pipeline, the infrastructure supporting XRP is more robust than ever, far exceeding the conditions seen in 2017. However, despite these developments and milestones, the altcoin’s price has yet to revisit its former all-time high and continues to trade above $2. As a result, Pumpius claims that the cryptocurrency has still not been “activated,” suggesting that it has not fully realized its potential or experienced the level of growth expected of it.

Why This Time Could Be Different

Unlike in 2017, the potential for XRP is no longer based on hype alone. Pumpius’s analysis estimates that if XRP were to repeat its historical 64,000% rally, starting from $2.21, its price could reach $1,414.40.

While this target is purely speculative, the number underscores the massive upside that could follow if institutional capital and real-world adoption combine with retail momentum. Pumpius’s commentary also includes a conspiracy narrative, alleging that powerful, unknown entities have worked behind the scenes to suppress XRP’s rise.

According to this theory, the analyst claims that the US SEC’s lawsuit against Ripple wasn’t just about compliance but a calculated move to delay adoption and shake out retail momentum. The underlying message is that XRP’s disruptive potential posed an early threat, allegedly leading to attempts to delay its growth and prevent widespread accumulation before institutions were ready to enter the market.

Co-founder and former CEO, Michael Saylor, announced the latest bitcoin acquisition made by the corporate giant, Strategy (formerly MicroStrategy).

The company has spent over $180 million to purchase 1,895 BTC, bringing its total to well over 555,000 BTC.

$MSTR has acquired 1,895 BTC for ~$180.3 million at ~$95,167 per bitcoin and has achieved BTC Yield of 14.0% YTD 2025. As of 5/4/2025, we hodl 555,450 $BTC acquired for ~$38.08 billion at ~$68,550 per bitcoin. $STRK $STRF https://t.co/rusgfuyCTG

— Michael Saylor (@saylor) May 5, 2025

Saylor hinted at the acquisition on Sunday, posting a chart from the saylortracker website, in which he wrote that there are not enough orange dots (used to showcase the company’s BTC purchases).

The latest buy comes at a more modest $180.3 million, which is a lot less than the previous ones, including last week’sannouncementfor $1.4 billion.

Nevertheless, Strategy continues with its years-long strategy (no pun intended) to acquire BTC on a frequent basis. It has really ramped up its efforts after the US elections.

Its total stash has surged to 555,450 BTC, bought at an average price of $68,550 per bitcoin. This means that the firm has spent $38.08 billion to acquire it, and its unrealized profit is currently north of $14 billion as BTC stands above $94,000.

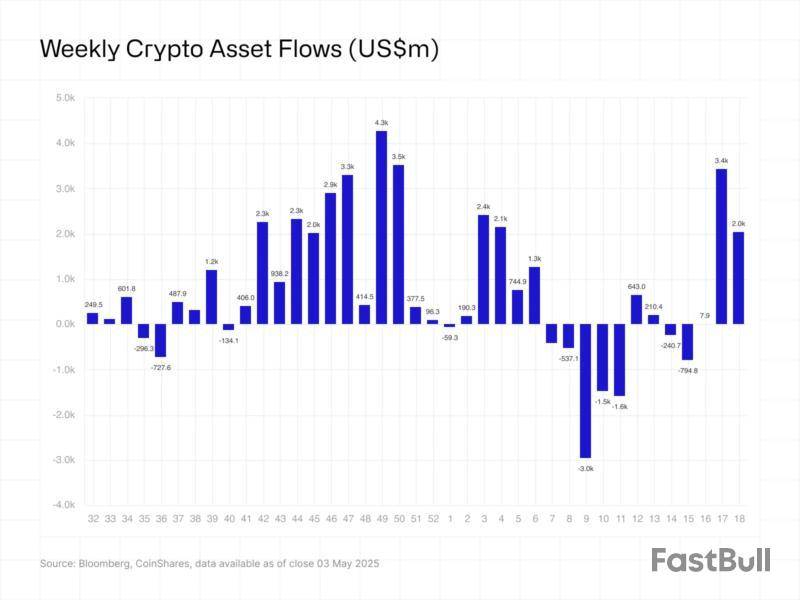

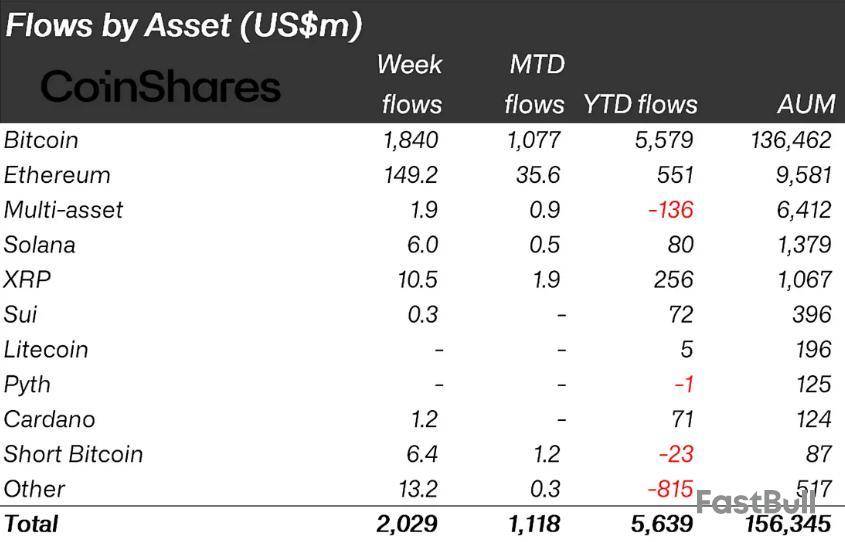

Digital asset products attracted $2 billion in inflows last week, which increased three-week inflows to $5.5 billion and lifted year-to-date inflows to $5.6 billion. Total assets under management climbed to a 10-week high of $156 billion, according to a CoinShares report on Monday.

U.S.-based funds accounted for most of the patronage, some $1.9 billion. Germany, Switzerland, and Canada also contributed modest flows in a signal of “broad supportive sentiment” for cryptocurrencies, Butterfill wrote.

Ethereum-based investment products recorded positive flows for the second week in a row and brought in $149 million between April 27 and May 2. Funds underpinned by ether now boast $336 million in inflows since late last month. XRP and tezos notched the most notable influx after ETH, with $10.5 million and $8.2 million each, while Solana products shed $6 million. Elsewhere, blockchain equities saw $15.9 million in net inflows from investors.

Same old, same old for bitcoin

Meanwhile, bitcoin continued its spot crypto product dominance from last week. “As usual, Bitcoin was the prime beneficiary, seeing $1.84 billion inflows,” per CoinShares’ Head of Research.

Once again, funds located within the U.S. led the pack last week and noted $1.8 billion in net inflows. This extended bullish flows into spot BTC ETFs issued by the likes of BlackRock and Fidelity to a third consecutive week. Bitcoin traded down 1.5% before the U.S. market opened, changing hands around $94,051 according to The Block’s price page.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Crypto inflows extended their streak of positive flows last week, with total inflows over the past three weeks reaching $5.5 billion.

It comes amid growing optimism in the market, with macroeconomic data adding to the list of tailwinds for the pioneer crypto.

Crypto Inflows Reached $2 Billion Last Week

The latest CoinShares report indicates that crypto inflows reached $2 billion last week, marking the third consecutive stream of positive flows.

The week prior, crypto inflows reached $3.4 billion as investors turned to digital assets for their haven status. Before that, inflows into digital asset investment products were $146 million, where XRP bucked the trend.

Last week, however, Bitcoin was the prime beneficiary, recording up to $1.8 billion in inflows. Similarly, Ethereum saw the second week of solid inflows reaching $149 million. Meanwhile, peers such as Solana saw minor inflows of $6 million.

CoinShares cites optimism in the market despite Trump’s tariffs, ascribing the bullish sentiment to positive US economic indicators last week.

Specifically, markets closed the week optimistically, driven by strong employment data despite earlier weak GDP figures. Headline GDP fell 0.3%, impacted by export declines due to US tariffs. However, core GDP, reflecting private sector strength, rose 3.0%.

In part, CoinShares’ researcher James Butterfill ascribes this to businesses preempting tariffs. Futures markets now expect 86 basis points (bps) of rate cuts in 2025, though strong payrolls (177k vs. 135k expected) and elevated core PCE inflation reduce the likelihood of an FOMC rate cut on Wednesday.

“We believe the current data is likely insufficient to prompt the Federal Open Market Committee (FOMC) to cut rates at next Wednesday’s meeting,” wrote Butterfill.

Services inflation shows weakness, suggesting cautious consumer behavior. Equities and Bitcoin remain sensitive to tariff developments, with employers delaying job cuts.

Against these backdrops, digital asset investment products continue to register positive sentiment, with Bitcoin’s momentum looking positive, particularly in the US.

“Our latest Digital Asset Manager Fund Survey reflects this evolving sentiment: investor preference for Bitcoin has strengthened post-U.S. election, with 63% of respondents now holding it—a 15 percentage point increase since January. Digital asset weightings have risen to 1.8%, the highest level in a year, driven by both price appreciation and improving sentiment. Institutional allocations have climbed to an average of 2.5%,” Butterfill explained.

Yet, despite Bitcoin’s improving sentiment, CoinShares highlights that both new and seasoned investors continue to cite volatility as their top concern.

According to Butterfill, this highlights a persistent disconnect between perceived risk and actual market behavior.

BeInCrypto data shows BTC was trading for $93,997 as of this writing. It was down by almost 2% in the last 24 hours, having slipped below the $94,000 range on Monday.

Dubai, UAE – May 2025 — TheBlock, the International Chamber of Virtual Assets, has announced a strategic partnership with Cointelegraph, the world’s leading Web3 media platform. The collaboration brings together two major players in the blockchain and virtual asset space, with the shared goal of amplifying the global adoption of tokenisation, advancing regulatory dialogue, and supporting builders entering the MENA region.

The agreement, signed during Token2049 Dubai, highlights Cointelegraph’s growing collaboration with key players in the UAE. This new partnership will foster deeper collaboration and mutual support across TheBlock’s ecosystem.

As part of the collaboration, Cointelegraph will set up a presence at TheBlock’s headquarters in Dubai World Trade Center, offering opportunities for engagement with founders, partners, and clients within the ecosystem. The partnership also includes joint participation in educational panels, roundtables, and summits focused on real-world assets (RWAs), compliance, and capital allocation.

“This partnership is not just about media,” said Farbod Sadeghian, Founder of TheBlock. “It is about building an access layer for the global virtual asset economy. By working with Cointelegraph, we are strengthening how the industry connects, informs, and grows — from regulatory frameworks to investment pipelines.”

Cointelegraph will engage with TheBlock’s ecosystem through media coverage, speaker participation, and collaborative events. The partnership reflects ongoing efforts to support the growth of Dubai’s virtual asset sector, where regulatory developments and real-world applications continue to evolve.

“The partnership reflects Cointelegraph’s ongoing efforts to broaden its network of like-minded collaborators, all working toward the shared goal of strengthening and advancing the ecosystem,” said Yana Prikhodchenko, CEO of Cointelegraph. “We aim to grow the community by leveraging this partnership while also expanding our regional presence in the UAE. This collaboration will help strengthen both efforts.”

With over 100 events planned annually, a growing portfolio of international members, and over $8 billion in projects deal flow, TheBlock continues to serve as a launchpad for startups, enterprises, and institutions looking to expand their presence in the region.

The partnership represents a new step in aligning media and access to foster trust, facilitate knowledge sharing, and support progress in the virtual asset space.

About TheBlock:

As an international chamber of virtual assets based in Dubai, TheBlock connects regulators, founders, investors, and institutions shaping the future of virtual assets. It provides a structured platform for dialogue, collaboration, and access across key pillars of the virtual asset economy. Through membership programs, strategic partnerships, and curated events, TheBlock offers its members direct engagement with the people and policies driving the industry forward. With a growing global network and strong regional footprint, it supports meaningful growth and influence in the virtual asset landscape.

Website | Twitter | Instagram | Linkedin

About Cointelegraph:

Founded in 2013, Cointelegraph is the leading independent publication covering blockchain, crypto and Web3 developments globally. With correspondents and bureaus across key regions — including North America, Europe, Asia, and the Middle East — Cointelegraph delivers trusted news, in-depth analysis, and expert commentary to millions of readers. Through its editorial, research, video, and events arms, Cointelegraph empowers decision-makers, innovators, and investors with timely insights into the evolving digital economy. The platform is committed to journalistic integrity and thought leadership at the forefront of the decentralized future.

Michael Saylor's Strategy (formerly MicroStrategy) purchased an additional 1,895 bitcoin for about $180 million between April 28 and May 4, according to a regulatory filing with the Securities and Exchange Commission on Monday. The company paid an average price of $95,167 per bitcoin.

The funds came from selling its own shares through ongoing stock sale programs. During the week, Strategy sold 353,825 million shares of its common stock (MSTR) and 575,392 shares of its preferred stock (STRK), raising a total of $180.3 million to finance the bitcoin purchase.

The MSTR and STRK stock sale programs — launched in October 2024 and March 2025, respectively — are part of Strategy's "21/21 Plan," which targeted $42 billion in capital for bitcoin acquisitions. As of May 4, the MSTR program is depleted and has been terminated, while $20.87 billion in STRK capacity remains available.

With the 21/21 Plan's MSTR capacity now deployed, Strategy recently introduced the "42/42 Plan," aiming to raise another $42 billion — split evenly between equity and debt — through 2027 to fund future bitcoin purchases. The company also issues STRK and STRF perpetual preferred stocks, which are separate from both capital plans and are also used to fund bitcoin purchases.

With the latest buy, Strategy now holds 555,450 bitcoin, acquired for a total of $38.08 billion and now worth roughly $52.2 billion at current prices. That's more than 2.6% of bitcoin's total supply and implies around $14.1 billion in paper gains.

The latest purchase comes shortly after Strategy reported first-quarter earnings last week, missing both revenue and profit estimates. The company posted a $4.2 billion net loss, driven largely by nearly $6 billion in unrealized losses on its bitcoin holdings under new fair value accounting rules. Despite its lower-than-estimated financial results, analysts remain bullish on Strategy due to its unmatched scale in bitcoin ownership, innovative capital-raising instruments, and institutional investor appeal.

Strategy remains the dominant corporate holder of bitcoin, though others are quickly joining in. Last month, Cantor Fitzgerald, SoftBank, Bitfinex and Tether announced plans to launch a $3.6 billion bitcoin venture called Twenty One Capital. Companies like Semler Scientific, KULR and Metaplanet have also adopted bitcoin as part of their treasury strategy.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。