行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国贸易账 (10月)

英国贸易账 (10月)公:--

预: --

前: --

英国服务业指数月率

英国服务业指数月率公:--

预: --

前: --

英国建筑业产出月率 (季调后) (10月)

英国建筑业产出月率 (季调后) (10月)公:--

预: --

前: --

英国工业产出年率 (10月)

英国工业产出年率 (10月)公:--

预: --

前: --

英国贸易账 (季调后) (10月)

英国贸易账 (季调后) (10月)公:--

预: --

前: --

英国对欧盟贸易账 (季调后) (10月)

英国对欧盟贸易账 (季调后) (10月)公:--

预: --

前: --

英国制造业产出年率 (10月)

英国制造业产出年率 (10月)公:--

预: --

前: --

英国GDP月率 (10月)

英国GDP月率 (10月)公:--

预: --

前: --

英国GDP年率 (季调后) (10月)

英国GDP年率 (季调后) (10月)公:--

预: --

前: --

英国工业产出月率 (10月)

英国工业产出月率 (10月)公:--

预: --

前: --

英国建筑业产出年率 (10月)

英国建筑业产出年率 (10月)公:--

预: --

前: --

法国HICP月率终值 (11月)

法国HICP月率终值 (11月)公:--

预: --

前: --

中国大陆未偿还贷款增长年率 (11月)

中国大陆未偿还贷款增长年率 (11月)公:--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)公:--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)公:--

预: --

前: --

印度CPI年率 (11月)

印度CPI年率 (11月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

巴西服务业增长年率 (10月)

巴西服务业增长年率 (10月)公:--

预: --

前: --

墨西哥工业产值年率 (10月)

墨西哥工业产值年率 (10月)公:--

预: --

前: --

俄罗斯贸易账 (10月)

俄罗斯贸易账 (10月)公:--

预: --

前: --

费城联储主席保尔森发表讲话

费城联储主席保尔森发表讲话 加拿大营建许可月率 (季调后) (10月)

加拿大营建许可月率 (季调后) (10月)公:--

预: --

前: --

加拿大批发销售年率 (10月)

加拿大批发销售年率 (10月)公:--

预: --

前: --

加拿大批发库存月率 (10月)

加拿大批发库存月率 (10月)公:--

预: --

前: --

加拿大批发库存年率 (10月)

加拿大批发库存年率 (10月)公:--

预: --

前: --

加拿大批发销售月率 (季调后) (10月)

加拿大批发销售月率 (季调后) (10月)公:--

预: --

前: --

德国经常账 (未季调) (10月)

德国经常账 (未季调) (10月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

日本短观大型非制造业景气判断指数 (第四季度)

日本短观大型非制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)--

预: --

前: --

欧元区储备资产总额 (11月)

欧元区储备资产总额 (11月)--

预: --

前: --

英国通胀预期

英国通胀预期--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)--

预: --

前: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)--

预: --

前: --

加拿大CPI月率 (季调后) (11月)

加拿大CPI月率 (季调后) (11月)--

预: --

前: --

无匹配数据

Berachain will release 63.75 million tokens on 6th February 2026. Token unlocks can impact prices as they affect supply. A large number of new tokens entering the market might dilute the value, causing prices to drop. However, if the market has anticipated this release and it is priced in, the impact might be minimal. Investors should watch trading volumes and market sentiment closely when this unlock occurs. Such events can offer both risk and opportunity, depending on market conditions at that time. For more details, visit the source here.

Delaware's official registration portal shows that "Canary Sui ETF" was registered on March 6. Such registration typically signals that a fund manager is preparing to file an S-1 registration with the U.S. Securities and Exchange Commission.

The registration comes after Canary filed an S-1 registration with the SEC on Wednesday for an AXL ETF. Canary also seeks to launch ETFs that track Hedera, Litecoin, XRP and Solana.

The Block has reached out to Canary Capital for confirmation on the Sui ETF registration, as there have been instances of bogus filings in the past. For example, in November 2023, someone registered an entity named "iShares XRP Trust" and put the name of Blackrock asset management firm, which was later proved to be a fake filing.

Also on Thursday, Sui Foundation said it plans to collaborate with the World Liberty Financial crypto project, backed by U.S. President Donald Trump, although it's not immediately clear how the two will cooperate.

Developed by Mysten Labs, Sui leads in one-year price performance among L1 tokens. As of March 5, Sui recorded a one-year gain of 79%, followed by BNB's 39.7%, according to The Block's data dashboard. The price of Sui climbed 5.4% over the past 24 hours to change hands at $2.83.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Layer-1 (L1) coin SUI has defied the broader market downturn, surging 4% in the past 24 hours to become the top-performing cryptocurrency.

The price surge follows news that World Liberty Financial (WLFI), a decentralized finance (DeFi) protocol affiliated with US President Donald Trump, has entered a “strategic reserve deal” with the blockchain network.

SUI’s Uptrend Gains Momentum

According to a March 6 blog post by the Sui Foundation, the developer team behind Layer-1 blockchain Sui has entered into a partnership with WLFI. The collaboration explores product development opportunities by leveraging Sui’s technology and includes integrating Sui-based assets into WLFI’s “Macro Strategy” reserve.

Following the news, SUI’s price jumped by double digits and reached a high of $3.11 on Thursday. This price hike was also fueled by news that Canary Capital filed to establish a trust entity in Delaware for its proposed Canary SUI ETF.

While it has since experienced a slight correction, Sui has continued to experience steady demand over the past 24 hours, increasing the likelihood of a sustained rally in the short term.

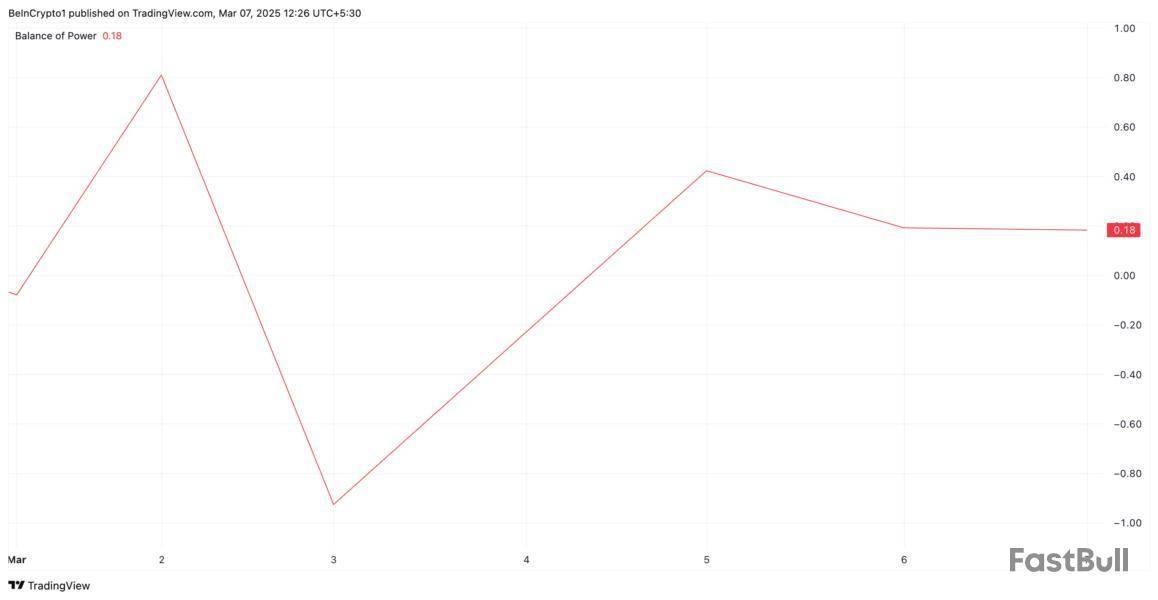

SUI’s Balance of Power (BoP) on the daily chart confirms this buying pressure. At press time, this indicator, which compares the strength of the bulls against the bears, is above zero at 0.18.

When an asset’s BoP climbs during a price rally, buying pressure strengthens, with bulls exerting significant control over price action. This suggests that SUI’s current uptrend has strong momentum and could potentially continue if demand remains high.

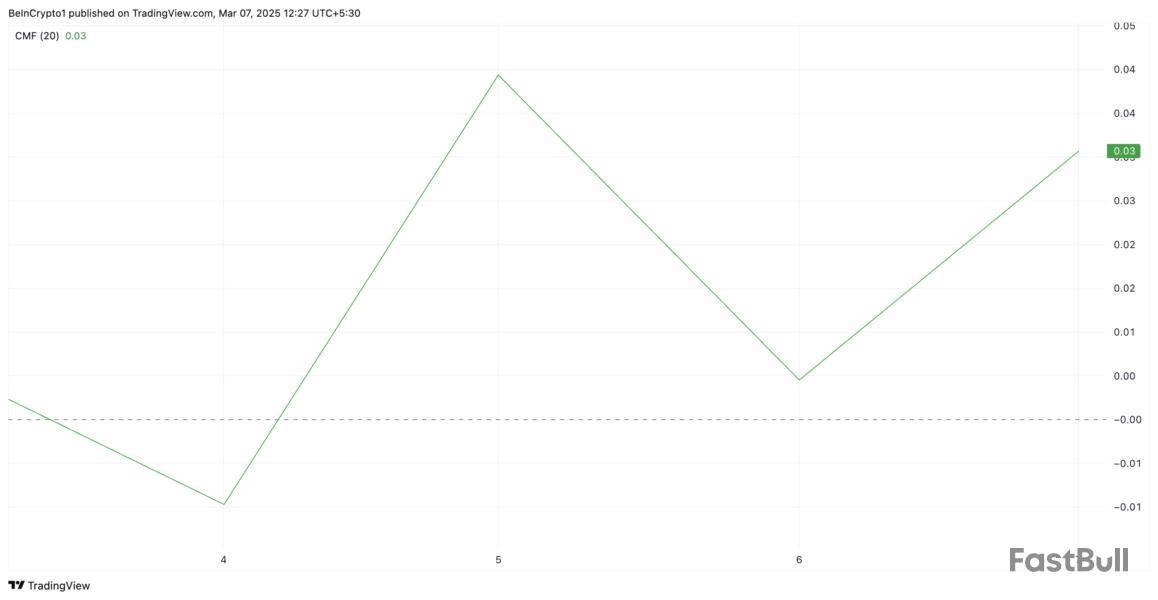

Furthermore, its rising Chaikin Money Flow (CMF) supports this bullish outlook. At press time, this indicator, which tracks how money flows into and out of an asset, posts a positive value of 0.02.

SUI’s CMF setup indicates more capital flows into its spot markets than out. This suggests strong accumulation and is a bullish signal, reinforcing the likelihood of continued price appreciation.

SUI Faces Key Decision Point

SUI trades at $2.79 at press time, exchanging hands slightly below the resistance formed at $3. If demand strengthens, SUI could break above this resistance and flip it into a support floor.

A successful breach of this level could propel the coin’s price to revisit its all-time high of $5.35, last reached on January 6.

However, if this fails, it will trigger a downturn, which could cause SUI to shed its recent gains and drop to $2.10.

With the documents for the U.S. Strategic Bitcoin Reserve signed, the price of the major cryptocurrency experienced a big sell-off, momentarily losing 4.9% within just an hour. Not quite the reaction the crypto community would expect, but it seems the old market rule to "buy the rumor, sell the news" is still alive in 2025.

Markets do not forget their own habits. Psychology runs deep, patterns repeat. Some traders saw an opportunity, took profits and left the crowd wondering what’s next.

What to expect next is the question making crypto market participants scratch their heads intensely, such as in the first crypto roundtable at the White House today. It could be a space for potential manipulation and high-stakes positioning.

Anything could happen; sentiment could swing fast. Some will speculate, others will hedge. But one thing seems certain: no matter in which direction exactly, volatility will come.

For Max Keiser, though, there is no hesitation. The direction is obvious. Thus, one of the most vocal early Bitcoin evangelists, in a recent post, made his expectations clear, proclaiming that Bitcoin will reach $100,000 in the next few hours. That is pretty ambitious, considering that the price of BTC right now is quoted 13.37% below the coveted six-figure mark.

Max Keiser@maxkeiserMar 07, 2025I predict we cross $100,000 in the next few hours and cross $120,000 this month.

Yet confidence like Keiser’s is not unusual in crypto - some see it as overoptimism, others as conviction. And what’s more stunning in Keiser’s prediction is his call for BTC to hit $120,000 this March. That would mean a new all-time high, something the market has not seen since January.

It is worth mentioning is that Keiser’s long-term Bitcoin vision is $220,000. So, his recent price prediction may not be the final stop at all. Some believe it, some dismiss it. But the market? The market will decide.

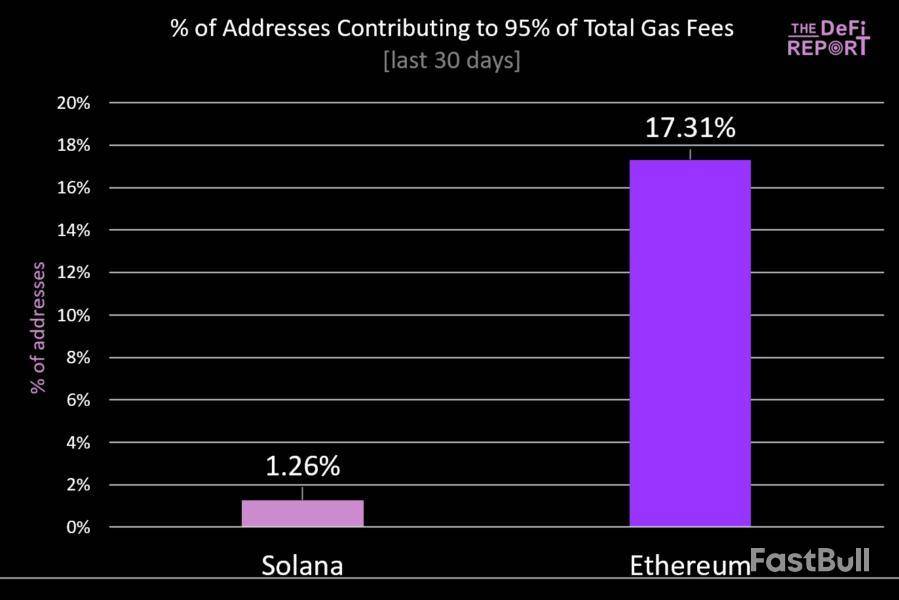

According to The DeFi Report, over the past month, only 1.26% of Solana’s wallet addresses have generated 95% of its total fees.

This concentration has raised significant concerns about the blockchain’s fee model and its implications for decentralization.

Solana’s Fee Structure Faces Criticism

Data from DefiLlama, shows that Solana generated 89.73 million in fees in February. As of March 7, it had generated 8.21 million.

In comparison, Ethereum generated 46.28 million in fees in February, with 7.49 million as of March 7. While these numbers suggest Solana is ahead, Michael Nadeau, the founder of The DeFi Report, claims this comparison may be misleading.

Although Nadeau acknowledges Solana’s impressive growth, he cautions that it might be less organic than it seems.

“But if you look under the hood, it looks like a house of cards,” he wrote.

According to Nadeau, over the past 30 days, 17.31% of addresses have contributed to 95% of the total fees generated on Ethereum. For Solana, the figure is strikingly small, only 1.26%.

Nadeau added that Wintermute, a prominent market-making firm, is the primary driver behind this fee generation. The rest of the fee is attributed to bots.

He claimed that these wallets drive the network’s activity through practices such as sandwich attacks and pumping meme coins. This often comes at the expense of retail investors.

For context, a sandwich attack is a front-running strategy in which an attacker exploits large trades. The attacker buys the asset before the large trade, anticipating a price increase, and sells afterward, profiting from the price movement while negatively impacting the original trader.

Nadeau cautioned that the reliance on a small subset of users for fee generation creates vulnerabilities. If retail traders become aware of the extent of bot-driven manipulation, they may withdraw from the ecosystem. This, in turn, could significantly impact Solana’s revenue projections.

“Nothing against Solana. Massive comeback story. But my sense tells me another period of “chewing glass” is yet to come,” he concluded.

Solana’s speed and cost efficiency have made it a favorite among developers and traders. However, this concentration of fees has raised concerns among market analysts.

“When 95% of fees come from 1.26% of users, it’s less “decentralized finance” and more “exclusive finance,” Superchargd co-founder wrote on X.

Another user also warned that Solana may not thrive well as the industry matures and free market forces fully take effect.

“Solana doesn’t have a future; it’s a Ponzi scheme designed for grifting,” he said.

Meanwhile, some questioned SOL’s inclusion in President Trump’s US crypto strategic reserve.

“Solana is a complete house of cards built on wash trading bots and centralized control,” a user remarked.

He also emphasized that validators profiting from failed transactions and the rise of Solana meme coins have harmed the space.

The criticism comes just after financial giant Franklin Templeton predicted in a report that Solana’s DeFi ecosystem could rival—and even surpass—Ethereum’s market valuation. The firm highlighted Solana’s scalability, low fees, and surging user activity as key factors driving its potential.

Amid the mounting criticism, Solana faces a pivotal moment. While its technological advancements and cost-efficiency have earned it a loyal following, its centralized fee-generation model and reliance on market manipulation tactics could pose significant risks to its future. How Solana adapts to these concerns will determine whether it can sustain its growth or struggle to maintain relevance.

By Adam Whittaker

U.S. stock futures nudged up after the Trump administration's seesawing trade policy hit stocks on Wall Street Thursday, with strong after-hours earnings from Broadcom a potential bright spot as investors increasingly fret about growth.

On Friday, stock markets in Asia and Europe fell, the dollar continued to ease, and bonds steadied following a week of soaring yields.

U.S. nonfarm payrolls will be a major focus later Friday.

-Bitcoin fell 1.4% to $88,188, according to LSEG. "Cryptocurrencies are lower amid news that a strategic bitcoin reserve and a stockpile of other digital assets established by President Trump's executive order yesterday evening will be capitalized by forfeited assets already owned by the federal government rather than any new government funding," Deutsche Bank analysts said in a note.

Write to Adam Whittaker at adam.whittaker@wsj.com

Dow Jones Newswires staff contributed to this article.

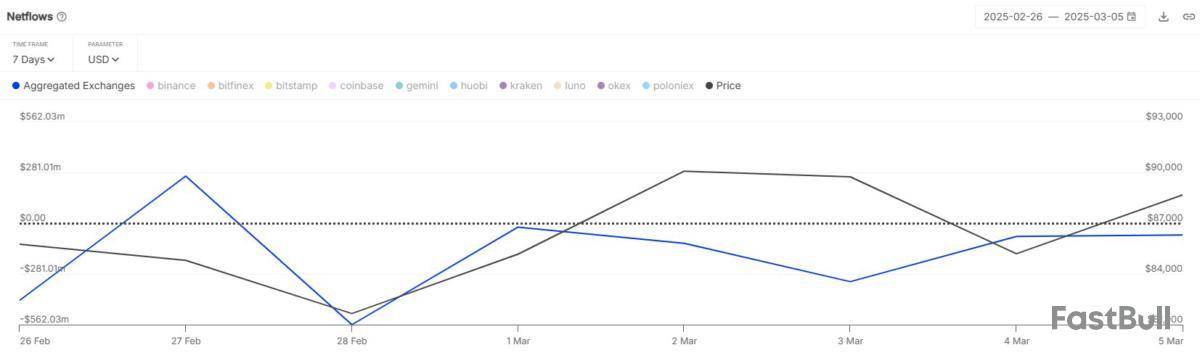

On-chain data shows the exchanges have witnessed net Bitcoin outflows through the latest volatility, a sign that could be positive for BTC’s price.

Bitcoin Exchange Netflow Has Been Negative Recently

According to data from the market intelligence platform IntoTheBlock, Bitcoin has been leaving exchanges recently. The on-chain metric of relevance here is the “Exchange Netflow,” which measures the net amount of BTC entering into or exiting out of the wallets associated with all centralized exchanges.

When the value of the indicator is positive, it means the investors are making net deposits of the cryptocurrency into these platforms. As one of the main reasons why holders transfer their tokens to exchanges is for selling-related purposes, this kind of trend can have a bearish impact on the BTC price.

On the other hand, the metric being under the zero mark suggests the outflows are overwhelming the inflows. Generally, investors take their coins off into self-custody when they plan to hold into the long term, so such a trend can prove to be bullish for the asset.

Now, here is a chart that shows the trend in the Bitcoin Exchange Netflow over the past week or so:

As is visible in the above graph, the Bitcoin Exchange Netflow saw a spike into the positive region on the 27th of last month, but the metric has since remained in the negative region.

This trend has maintained despite the fact that the asset has been observing volatility in both directions recently. Thus, it would appear that the investors are still bullish on the cryptocurrency.

“Despite the recent market fear, traders have shown conviction in BTC, withdrawing nearly $900 million worth of Bitcoin from exchanges in the past 7 days,” notes the analytics firm.

While exchange inflows can be bearish when it comes to volatile assets like BTC, the same doesn’t hold true in the case of stablecoins, digital assets that have their value tied to fiat.

Usually, investors who hold these coins eventually plan to invest into the volatile side of the market. Once they feel the time has come, they deposit into the exchanges to swap to the tokens of their choice, thus providing a buying pressure to their prices.

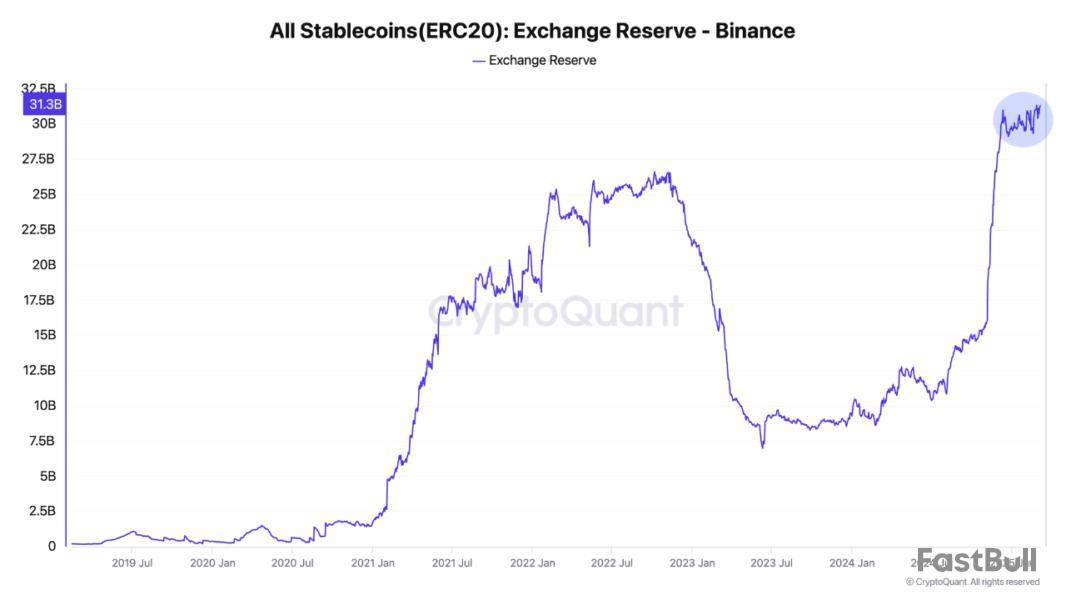

As such, an increase in stablecoin inflows can be a positive sign for Bitcoin and other cryptocurrencies. This trend has recently been developing in the sector, as an analyst has pointed out in a CryptoQuant Quicktake post.

As displayed in the above chart, the Binance Stablecoin Exchange Reserve, a metric that keeps track of the total amount of these fiat-tied tokens sitting in the wallets of the Binance platform, has jumped to a new all-time high (ATH) recently.

BTC Price

Bitcoin has been unable to sustain recovery as its price has once again dipped to $88,600.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。