Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

OPEC Expects Strong Air Travel Demand And Healthy Road Mobility To Support Oil Demand, Says Drop In USA Dollar Has Provided More Demand Support

OPEC Forecasts World Demand For OPEC+ Crude Will Average 42.6 Million Barrels/Day In Q1 2026 And 42.2 Mbpd In Q2 (Both Unch From Previous Forecast)

Brazil's Central Bank Monetary Policy Director Galipolo: It Would Not Be Beneficial To Our Mandate For The Central Bank To Change Its Reaction Function Based On Election Polls

Brazil's Central Bank Monetary Policy Director Galipolo: Key Point In Elections Is How To Separate Noise From Signal And Have The Serenity To Process Data Without Altering Our Reaction Function

EU Commission Chief Von Der Leyen: She Will Discuss The Revenue From The Carbon Emissions Trading System With EU Leaders On Thursday

EU Commission Chief Von Der Leyen: Industry Taxes On Electricity Are 15 Times Higher Than On Gas, This Is Wrong And Needs To Change

Ukrainian President Zelensky: It Is Unclear Whether Russia Has Agreed To Meet In The United States

Ukrainian President Zelensky: Ukraine Is Ready To Meet In The United States On February 17 Or 18

Ukrainian President Zelensky: Territorial Issues Will Be The Focus Of The Next Round Of Negotiations With The United States

Bulgarian President Names Senior Central Banker As Caretaker Prime Minister To Prepare Way For Election

Ukraine President Zelenskiy: USA Should Realise As Long As Russia Continues To Kill , There Will No Sufficient Trust In Diplomacy

Brazil's Central Bank Monetary Policy Director Galipolo: We Continue To See Wage Adjustments That Exceed Inflation And Productivity Gains

Brazil's Central Bank Monetary Policy Director Galipolo: Brazil's Labor Market Remains Very Tight

Ukraine President Zelenskiy: Security Issues Are Key Priority, Everything Else Must Be Addressed In Conjunction With Them

[Israeli Military Says It Is Expanding Standing Forces To Enhance Overall Combat Readiness] On The 11th Local Time, The Inauguration Ceremony Of The Israel Defense Forces' 38th Division Was Held At An IDF Base. IDF Chief Of Staff Zamir Stated At The Ceremony That The Multi-theater Conflicts Of The Past Two Years Have Demonstrated The "irreplaceable" Role Of Mobile Combat Divisions Penetrating Deep Into Enemy Territory In Modern Warfare. Zamir Stated That The Reconstruction Of The 38th Division Is Not Merely An Organizational Adjustment, But Also Part Of The IDF's Deep Reforms Following The Events Of October 7, 2023. Zamir Stated That The Newly Formed 38th Division Will Undertake Both Training And Combat Missions, Becoming An Important Component Of The IDF's Ground Force System. Zamir Also Stated That The IDF Is Expanding Its Standing Forces To Alleviate Pressure On Reserve Forces And Enhance Overall Combat Readiness

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Commercial Inventory MoM (Nov)

U.S. Commercial Inventory MoM (Nov)A:--

F: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Year (Feb)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Feb)A:--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)

U.S. EIA Natural Gas Production Forecast For The Next Year (Feb)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook FOMC Member Hammack Speaks

FOMC Member Hammack Speaks U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction YieldA:--

F: --

P: --

Argentina 12-Month CPI (Jan)

Argentina 12-Month CPI (Jan)A:--

F: --

P: --

Argentina CPI MoM (Jan)

Argentina CPI MoM (Jan)A:--

F: --

P: --

Argentina National CPI YoY (Jan)

Argentina National CPI YoY (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Jan)

South Korea Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Australia House Loan Permits MoM (SA) (Q4)

Australia House Loan Permits MoM (SA) (Q4)A:--

F: --

P: --

China, Mainland PPI YoY (Jan)

China, Mainland PPI YoY (Jan)A:--

F: --

P: --

China, Mainland CPI MoM (Jan)

China, Mainland CPI MoM (Jan)A:--

F: --

P: --

China, Mainland CPI YoY (Jan)

China, Mainland CPI YoY (Jan)A:--

F: --

P: --

Turkey Retail Sales YoY (Dec)

Turkey Retail Sales YoY (Dec)A:--

F: --

P: --

Italy Industrial Output YoY (SA) (Dec)

Italy Industrial Output YoY (SA) (Dec)A:--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. YieldA:--

F: --

P: --

Mexico Industrial Output YoY (Dec)

Mexico Industrial Output YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Dec)

Brazil PPI MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Russia Trade Balance (Dec)

Russia Trade Balance (Dec)--

F: --

P: --

U.S. Average Weekly Working Hours (SA) (Jan)

U.S. Average Weekly Working Hours (SA) (Jan)--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Jan)

U.S. Private Nonfarm Payrolls (SA) (Jan)--

F: --

P: --

U.S. Manufacturing Employment (SA) (Jan)

U.S. Manufacturing Employment (SA) (Jan)--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Jan)

U.S. Labor Force Participation Rate (SA) (Jan)--

F: --

P: --

U.S. Average Hourly Wage MoM (SA) (Jan)

U.S. Average Hourly Wage MoM (SA) (Jan)--

F: --

P: --

U.S. U6 Unemployment Rate (SA) (Jan)

U.S. U6 Unemployment Rate (SA) (Jan)--

F: --

P: --

U.S. Average Hourly Wage YoY (Jan)

U.S. Average Hourly Wage YoY (Jan)--

F: --

P: --

U.S. Unemployment Rate (SA) (Jan)

U.S. Unemployment Rate (SA) (Jan)--

F: --

P: --

U.S. Nonfarm Payrolls (SA) (Jan)

U.S. Nonfarm Payrolls (SA) (Jan)--

F: --

P: --

Canada Building Permits MoM (SA) (Dec)

Canada Building Permits MoM (SA) (Dec)--

F: --

P: --

U.S. Employment Benchmark (Not SA)

U.S. Employment Benchmark (Not SA)--

F: --

P: --

U.S. Employment Benchmark (SA)

U.S. Employment Benchmark (SA)--

F: --

P: --

U.S. Government Employment (Jan)

U.S. Government Employment (Jan)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Feb)--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. Budget Balance (Jan)

U.S. Budget Balance (Jan)--

F: --

P: --

FOMC Member Hammack Speaks

FOMC Member Hammack Speaks Japan Domestic Enterprise Commodity Price Index MoM (Jan)

Japan Domestic Enterprise Commodity Price Index MoM (Jan)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Jan)

Japan Domestic Enterprise Commodity Price Index YoY (Jan)--

F: --

P: --

Japan PPI MoM (Jan)

Japan PPI MoM (Jan)--

F: --

P: --

Australia Consumer Inflation Expectations (Feb)

Australia Consumer Inflation Expectations (Feb)--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Jan)

U.K. 3-Month RICS House Price Balance (Jan)--

F: --

P: --

U.K. Manufacturing Output MoM (Dec)

U.K. Manufacturing Output MoM (Dec)--

F: --

P: --

U.K. GDP MoM (Dec)

U.K. GDP MoM (Dec)--

F: --

P: --

No matching data

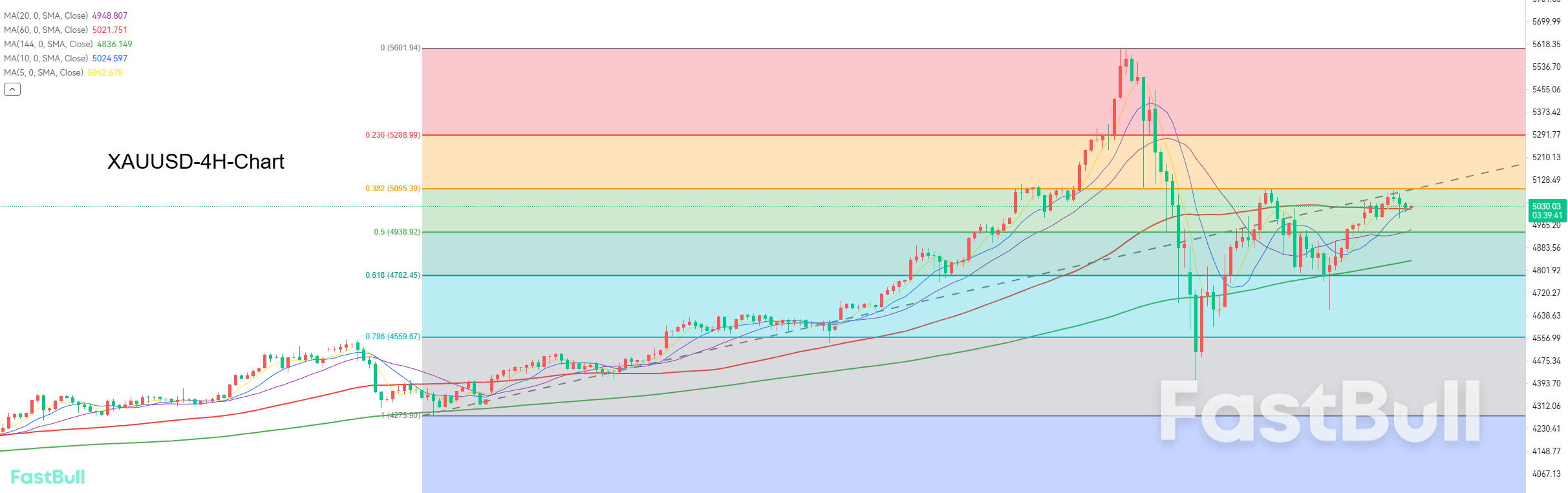

Gold is likely to maintain a range-bound trading pattern between 5100 and 4780 in the short term, with the main strategy being to buy low and sell high.

5035.41

Entry Price

4605.00

TP

5115.00

SL

795.9

Pips

Loss

4605.00

TP

5115.00

Exit Price

5035.41

Entry Price

5115.00

SL

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up