Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Maersk CEO: We Have Seen A Type Of Normalisation Of Tariff Policies, Consumers Have Been Less Impacted By Trade Wars Than Initially Expected

Maersk CEO: We Don't Know If We'll See A Full Return To Red Sea In 2026, Our Guidance Includes A Gradual Reopening Of The Route In 2026

[Announcement: U.S. Initial Jobless Claims Data For Last Week To Be Released Tonight, Expected At 212K] February 5Th, The US Initial Jobless Claims For The Week Ending January 31St Will Be Announced Tonight At 21:30, With The Previous Value At 209K And An Expected Value Of 212K

India Foreign Ministry: Open To Exploring Commercial Merits Of Any Crude Supply, Including From Venezuela

India Foreign Ministry: Diversifying Energy Sourcing In Keeping With Objective Market Conditions, International Dynamics At Core Of Our Strategy

[The Washington Post Announces One-Third Job Cuts] According To Foreign Media Reports, The Washington Post, Owned By Amazon Founder Jeff Bezos, Announced On The 4th That It Will Lay Off One-third Of Its Employees, Stating That The Historic Newspaper Needs A "painful" Restructuring. The Layoffs Will Affect Journalists Across Almost All Reporting Lines, Including Sports, International, Technology, And Breaking News Teams, As Well As Employees In Business And Technology Departments

Danske Bank CEO: We Are Going Into One Of The Larger Investment Cycles Of Our Time, Driven By Energy Transition, Defence, And Changes In Technology

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)A:--

F: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)A:--

F: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction YieldA:--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP GrowthA:--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)A:--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)A:--

F: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)A:--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest Rate--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Reserve Bank of Australia Governor Bullock testified before Parliament.

Reserve Bank of Australia Governor Bullock testified before Parliament. India Benchmark Interest Rate

India Benchmark Interest Rate--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve Ratio--

F: --

P: --

India Repo Rate

India Repo Rate--

F: --

P: --

No matching data

View All

No data

The Euro edged higher against the U.S. Dollar on Friday, supported by a cooling in geopolitical fears and softer U.S. economic data.

1.15251

Entry Price

1.16867

TP

1.14200

SL

74.6

Pips

Profit

1.14200

SL

1.15997

Exit Price

1.15251

Entry Price

1.16867

TP

Despite a dramatic UK retail sales miss, the Euro failed to sustain gains against the Pound as the BoE’s hawkish pause provided Sterling with support.

0.85300

Entry Price

0.84000

TP

0.85700

SL

40.0

Pips

Loss

0.84000

TP

0.85701

Exit Price

0.85300

Entry Price

0.85700

SL

Recently, the Federal Reserve maintained interest rates but delivered hawkish signals. Simultaneously, the fade of safe-haven sentiment triggered a pullback in gold prices. However, geopolitical risks have not entirely dissipated; if conflicts escalate, gold prices are likely to rebound.

3358.97

Entry Price

3295.00

TP

3390.00

SL

310.3

Pips

Loss

3295.00

TP

3390.00

Exit Price

3358.97

Entry Price

3390.00

SL

Crude prices climbed on Thursday as the Iran-Israel conflict escalated, raising fears of a wider regional war and potential supply disruptions.

75.000

Entry Price

80.000

TP

70.000

SL

500.0

Pips

Loss

70.000

SL

69.994

Exit Price

75.000

Entry Price

80.000

TP

The Pound Sterling struggled on Thursday as the Bank of England held interest rates steady at 4.25%, splitting the Monetary Policy Committee on the decision.

1.34300

Entry Price

1.31000

TP

1.36000

SL

170.0

Pips

Loss

1.31000

TP

1.36000

Exit Price

1.34300

Entry Price

1.36000

SL

The Australian Dollar fell sharply on Thursday, undermined by escalating Middle East tensions, soft domestic labor data, and a hawkish message from the Federal Reserve.

0.64590

Entry Price

0.63800

TP

0.65500

SL

79.0

Pips

Profit

0.63800

TP

0.63799

Exit Price

0.64590

Entry Price

0.65500

SL

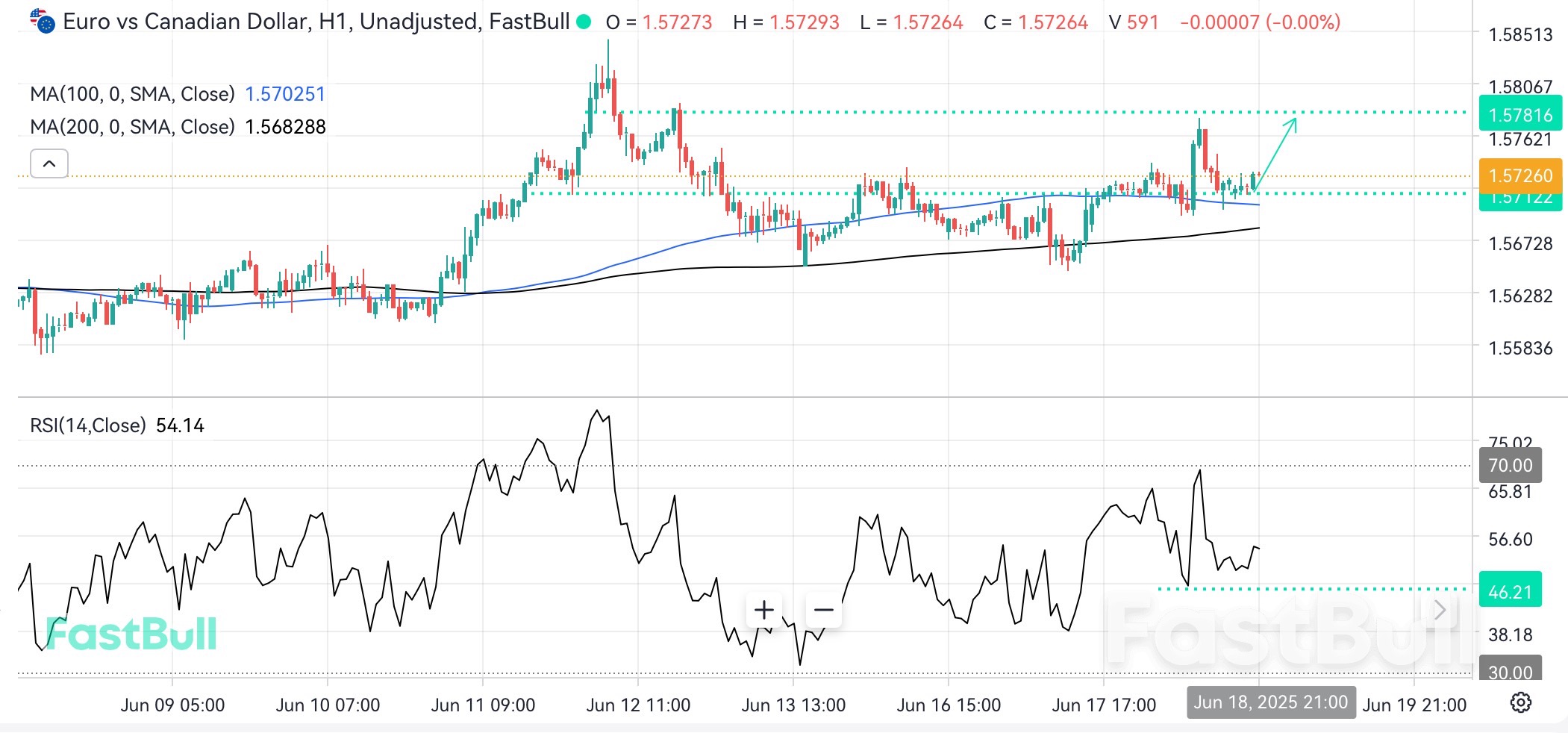

Despite the recent consolidation, the inability of the RSI to break lower suggests a lack of strong bearish momentum.

1.57093

Entry Price

1.57800

TP

1.56700

SL

16.9

Pips

Profit

1.56700

SL

1.57262

Exit Price

1.57093

Entry Price

1.57800

TP

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up