行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)公:--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)公:--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)公:--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)公:--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)公:--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)公:--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)公:--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)公:--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)公:--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)公:--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数公:--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)公:--

预: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)公:--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)公:--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)公:--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)公:--

预: --

前: --

美国纽约联储制造业物价获得指数 (12月)

美国纽约联储制造业物价获得指数 (12月)公:--

预: --

前: --

美国纽约联储制造业新订单指数 (12月)

美国纽约联储制造业新订单指数 (12月)公:--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)公:--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)公:--

预: --

前: --

加拿大截尾均值CPI年率 (季调后) (11月)

加拿大截尾均值CPI年率 (季调后) (11月)公:--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)公:--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)公:--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)公:--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)公:--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)公:--

预: --

前: --

加拿大CPI月率 (季调后) (11月)

加拿大CPI月率 (季调后) (11月)公:--

预: --

前: --

美联储理事米兰发表讲话

美联储理事米兰发表讲话 美国NAHB房产市场指数 (12月)

美国NAHB房产市场指数 (12月)--

预: --

前: --

澳大利亚综合PMI初值 (12月)

澳大利亚综合PMI初值 (12月)--

预: --

前: --

澳大利亚服务业PMI初值 (12月)

澳大利亚服务业PMI初值 (12月)--

预: --

前: --

澳大利亚制造业PMI初值 (12月)

澳大利亚制造业PMI初值 (12月)--

预: --

前: --

日本制造业PMI初值 (季调后) (12月)

日本制造业PMI初值 (季调后) (12月)--

预: --

前: --

英国三个月ILO就业人数变动 (10月)

英国三个月ILO就业人数变动 (10月)--

预: --

前: --

英国失业金申请人数 (11月)

英国失业金申请人数 (11月)--

预: --

前: --

英国失业率 (11月)

英国失业率 (11月)--

预: --

前: --

英国三个月ILO失业率 (10月)

英国三个月ILO失业率 (10月)--

预: --

前: --

英国三个月含红利的平均每周工资年率 (10月)

英国三个月含红利的平均每周工资年率 (10月)--

预: --

前: --

英国三个月剔除红利的平均每周工资年率 (10月)

英国三个月剔除红利的平均每周工资年率 (10月)--

预: --

前: --

法国服务业PMI初值 (12月)

法国服务业PMI初值 (12月)--

预: --

前: --

法国综合PMI初值 (季调后) (12月)

法国综合PMI初值 (季调后) (12月)--

预: --

前: --

法国制造业PMI初值 (12月)

法国制造业PMI初值 (12月)--

预: --

前: --

德国服务业PMI初值 (季调后) (12月)

德国服务业PMI初值 (季调后) (12月)--

预: --

前: --

德国制造业PMI初值 (季调后) (12月)

德国制造业PMI初值 (季调后) (12月)--

预: --

前: --

德国综合PMI初值 (季调后) (12月)

德国综合PMI初值 (季调后) (12月)--

预: --

前: --

欧元区综合PMI初值 (季调后) (12月)

欧元区综合PMI初值 (季调后) (12月)--

预: --

前: --

欧元区服务业PMI初值 (季调后) (12月)

欧元区服务业PMI初值 (季调后) (12月)--

预: --

前: --

欧元区制造业PMI初值 (季调后) (12月)

欧元区制造业PMI初值 (季调后) (12月)--

预: --

前: --

英国服务业PMI初值 (12月)

英国服务业PMI初值 (12月)--

预: --

前: --

英国制造业PMI初值 (12月)

英国制造业PMI初值 (12月)--

预: --

前: --

英国综合PMI初值 (12月)

英国综合PMI初值 (12月)--

预: --

前: --

欧元区ZEW经济景气指数 (12月)

欧元区ZEW经济景气指数 (12月)--

预: --

前: --

德国ZEW经济现况指数 (12月)

德国ZEW经济现况指数 (12月)--

预: --

前: --

德国ZEW经济景气指数 (12月)

德国ZEW经济景气指数 (12月)--

预: --

前: --

欧元区贸易账 (未季调) (10月)

欧元区贸易账 (未季调) (10月)--

预: --

前: --

欧元区ZEW经济现况指数 (12月)

欧元区ZEW经济现况指数 (12月)--

预: --

前: --

欧元区贸易账 (季调后) (10月)

欧元区贸易账 (季调后) (10月)--

预: --

前: --

美国零售销售月率 (不含汽车) (季调后) (10月)

美国零售销售月率 (不含汽车) (季调后) (10月)--

预: --

前: --

无匹配数据

XPIN Network will be listed on KuCoin, giving new buyers easy access to $XPIN trading. KuCoin is a well-known exchange, so listings there often push prices up, at least for a short time. Many traders like to buy on the first day for quick gains. However, sometimes prices drop soon after listing, as early buyers sell their coins for profit. XPIN’s focus on AI and decentralized networks may bring in extra attention, but long-term price movement depends on adoption and use of its technology after the hype fades. source

KuCoin@kucoincomAug 21, 2025World Premiere Listing: @XPINNetwork $XPIN is coming soon to #KuCoin!

XPIN Network is the leading DePIN project on BNB Chain, building a decentralized, AI-powered communication infrastructure for secure, efficient, and borderless connectivity.

Trading starts: August 22,… pic.twitter.com/1F9OSgUl4J

ONFA will launch its new coin, OFC, with a sale through a launchpad. Usually, launchpad sales create a strong first price move since only a small number of coins will be sold at the start. When a project’s main coin becomes available, speculators and long-term investors may rush in, pushing prices up. OFC claims fast technology and a limited supply, which can help the price rise. Still, prices may fall after the launch if there is too much excitement and buyers sell for quick profit. Regular updates about real-world use will be important. source

ONFA@onfaofficialAug 21, 2025ONFA OFFICIALLY LAUNCHES OFC – THE CORE COIN OF ONFA CHAIN. DON’T MISS OUT!

Launchpad Sale: September 1, 2025 (California Time)

ONFA proudly announces the birth of OFC (ONFA Coin) – the core and only coin on ONFA Chain – a symbol of technological freedom and financial… pic.twitter.com/LwXoyV8dsc

Sonic’s first governance vote is about bringing $S into the U.S. market and connecting it with big finance, including a plan to put $S on NASDAQ and use trusted U.S. custodians. If this proposal passes, the project may get more attention from banks and investment firms. This could mean more money flowing into $S, which often raises the price. However, the vote is just the first step so the impact will depend on how quickly the team can make these plans happen. Watch for news after the vote to see real changes. source

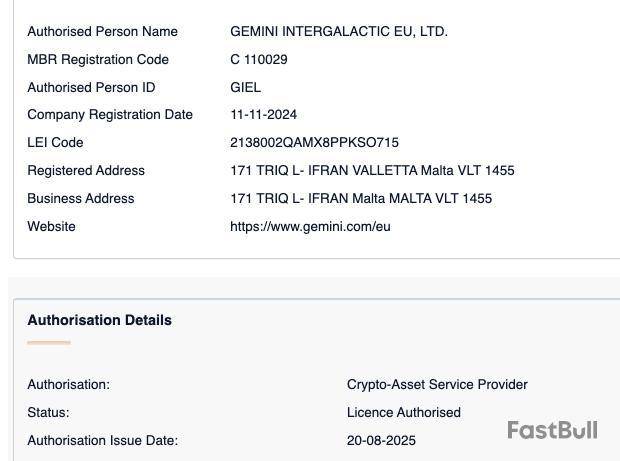

Cryptocurrency exchange Gemini has received a Markets in Crypto-Assets Regulation (MiCA) license in Malta, supporting the company’s ongoing expansion in Europe.

The Cameron and Tyler Winklevoss-owned exchange secured a MiCA license from the Malta Financial Services Authority on Wednesday, according to official MFSA records.

“Receiving this approval marks a critical milestone in our regulated European expansion, as it will allow us to expand our secure and reliable crypto products for customers in over 30 European countries and jurisdictions,” Gemini said in a statement shared with Cointelegraph.

The regulatory milestone came shortly after Gemini filed to list its Class A common stock on the Nasdaq Global Select Market under the ticker GEMI last Friday.

Gemini welcomes “clear regulation”

“Today’s announcement cements Gemini’s long-standing dedication to upholding the highest standards of regulatory compliance as we scale in the region,” Gemini said, highlighting the importance of MiCA for crypto adoption.

“We believe that clear regulation of the industry is the foundation of global crypto adoption, and MiCA’s implementation has proven that Europe is one of the most innovative and forward-thinking regions regarding this,” Gemini’s statement added.

Gemini also holds a Markets in Financial Instruments Directive (MiFID II) license, received in May, allowing the exchange to offer derivatives in the European market.

This is a developing story, and further information will be added as it becomes available.

TL;DR

Increasing the Exposure

Ethereum’s (ETH) price was booming earlier this month, reaching a local peak of almost $4,800 on August 14. Since then, though, it headed south and currently trades at around $4,250 (per CoinGecko’s data).

Instead of panicking, however, large investors (known as whales) saw the correction as an opportunity to fill their bags at cheaper prices.

X user Ali Martinez revealed that market participants holding between 10,000 and 100,000 coins purchased 400,000 ETH during the latest dip. The USD equivalent of the stash is north of $1.7 billion, while this cohort of investors now controls almost 30 billion tokens, or roughly 25% of the asset’s circulating supply.

The significant accumulation during the pullback indicates firm conviction among whales and can be interpreted as a positive sign. After all, purchases of that type reduce the amount of ETH tokens available on the open market, which, combined with steady or increased demand, should push the price up. The whales’ actions may also encourage other market participants to follow suit.

Another factor suggesting that a resurgence might soon replace ETH’s plunge is the asset’s exchange netflow, which recentlytumbledto a nine-year low. This means that investors have moved their holdings from centralized platforms toward self-custody methods, which reduces the immediate selling pressure.ATH Still on the Agenda?

Many experts and analysts on X believe the second-largest cryptocurrency remains poised to reach a new historical peak in the short term. X user CryptoGoos argued that the “supertrend (is) holding steady,” predicting that the price might rally above $6,000 in the following weeks.

Lucky told their 2.2 million followers on the social media platform that institutional adoption of ETH “is on a serious run,” reminding that some renowned companies have recently stacked a substantial amount of the asset.

Tom Lee – Chairman of Bitmine Immersion Technologies, which holds billions of dollars worth of ether –calledthe recent price retreat “a minor correction.” He expects the valuation to dip under $4,100 this week but remains bullish on the long term. Less than a month ago, he forecasted that ETH could skyrocket to the ridiculous (at least as of now) $60,000 per coin.

Bitcoin’s two biggest trading volume spikes of 2025 have turned out to be near-perfect signals for traders, according to fresh data from behavioral analytics platform Santiment.

The firm shared on X that the cryptocurrency’s heaviest weekly volume clusters over the past six months lined up with a market bottom and a new all-time high, suggesting that watching volume extremes has once again been a profitable contrarian strategy.Trading Volumes Flagged the Bottom and the Top

Santiment’s chart highlighted two defining moments. One was an $84.08 billion trading volume burst during the tariff-driven dip in April that marked the “bottom signal,” with the second being a much larger $90.90 billion spike in recent weeks that coincided with Bitcoin hitting a new all-time high above $124,000.

According to the analytics firm, the first flagged a sharp selloff that provided bargain entry points for investors, while the second was a top signal, coming in sync with intense profit-taking as BTC set its record high.

“The two largest volume spikes from Bitcoin signaled the optimal time to buy (as prices were falling) and sell (as prices peaked to a new ATH),” noted Santiment.

Its assessment comes a couple of days after Glassnode shared an update showing that “First Buyers” hadadded50,000 BTC to their holdings in five days, while so-called “Conviction Buyers” also accumulated, albeit more cautiously.

Meanwhile, “Loss Sellers” had increased by nearly 38%, reflecting capitulation from weaker hands, with profit-takers expanding their take to the highest level seen this year. Indeed, on August 20, the platform reported that long-term holders hadbooked$2.8 billion in profits across Bitcoin, Ethereum (ETH), XRP, and Solana (SOL) as the market cooled.

BTC led the rush, realizing its largest profit-taking event since December 2024, when investors pocketed $1.5 billion on July 18. That wave of exits helped push the OG crypto under $113,000 earlier this week, dragging other majors lower and erasing more than $70 billion in total market value overnight.

Adding to the bearish mood, Santiment’s metrics also showed that crowd sentiment on social platforms had swung negative,registeringthe most pessimism since June.Price Action

Meanwhile, at the market, Bitcoin was trading at $113,705 at the time of this writing. The price reflects an almost 7% dip over the past week, a relatively poor performance compared to the broader crypto market, which shed 3.5% in the same period.

Furthermore, the asset slipped 3.1% in the last 30 days, although it remains up nearly 91% year-over-year.

Crypto has struggled with one major problem for years. People own digital assets but can’t spend them anywhere useful. SpacePay tackles this issue head-on by enabling merchants to accept crypto payments through their existing card machines.

The London-based fintech startup converts crypto to cash instantly, works with over 325 different wallets, and charges just 0.5% in fees. Their approach removes the complexity that has kept businesses away from digital currencies for so long.

Most crypto payment solutions ask merchants to replace their entire system. SpacePay works differently by updating the software on Android terminals that millions of shops already use every day.

How This Altcoin Solves Real Crypto Problems

The $SPY token serves multiple purposes within SpacePay’s ecosystem. Token holders receive voting rights on platform decisions and monthly rewards for staying active in the community. They also get early access to new features before public release.

Revenue sharing creates a direct connection between platform success and token value. When more merchants process payments through SpacePay, holders earn a portion of those transaction fees. This ties the token’s utility to actual business performance rather than pure speculation.

Every three months, SpacePay jumps on video calls where anyone holding tokens can ask the team whatever’s on their mind. That’s refreshing when most crypto projects disappear after taking your money and only surface again if things go well.

You can pay with Bitcoin, Ethereum, Binance Coin, USDT, or whatever crypto you’ve got sitting in your wallet. No need to download yet another app or convert everything to some random coin you’ve never heard of.

Why Payments Could Explode in 2025

The stars seem to be aligning for crypto payments to finally take off in 2025. Instead of just saying “crypto bad,” governments are writing real rules that businesses can follow. When shop owners know they won’t get in trouble for accepting digital money, they’re way more likely to try it.

Traditional payment processors continue raising their fees while crypto solutions become more reliable. Small businesses especially feel the pinch when credit card companies take 3% or more from every sale. SpacePay’s 0.5% rate could save restaurants and retail stores thousands of dollars annually.

About 400 million people worldwide own cryptocurrency now, but most can’t spend it anywhere practical. This creates enormous pent-up demand for payment solutions that actually work in physical stores. SpacePay positions itself to capture this market by making crypto spending as simple as tapping a phone.

The tech side has gotten its act together too. Remember when Bitcoin transactions took forever and cost a fortune? Those days are mostly behind us now. Everything works faster and cheaper than it used to.

SpacePay’s Growing Presale Success

The $SPY token presale has attracted significant investment, with funding now approaching $1.3 million. This demonstrates genuine market interest in practical crypto payment solutions rather than speculative trading opportunities.

Token prices increase as each presale stage sells out, rewarding early participants with better rates. The dynamic pricing model creates some urgency while still allowing newcomers to join at reasonable entry points.

Here’s what’s smart about SpacePay – they actually built something that works before asking people for money. Most crypto teams do it backwards, raising millions with nothing but fancy presentations and big promises.

Instead of blowing cash on celebrity endorsements or Super Bowl ads, they’re putting money into boring stuff like compliance and business partnerships. It’s not exciting, but it’s exactly what you want to see from a company planning to stick around.

Visit SpacePay Presale

Real-World Integration That Works

Most businesses avoid crypto payments because of volatility concerns. Nobody wants to accept $100 in Bitcoin only to find it’s worth $85 an hour later. SpacePay eliminates this risk by converting payments to regular currency immediately.

Merchants receive their local currency within seconds of the transaction. They never actually hold cryptocurrency or need to monitor price charts. This removes the gambling aspect that scares shop owners away from digital payments.

The platform requires minimal technical knowledge from business owners. Staff members don’t need training on blockchain concepts or wallet management. Transactions look identical to regular card payments from their perspective.

Security features include encryption and real-time monitoring without making the system complicated for users. Everything happens automatically in the background, where regular people don’t have to think about it.

Looking Ahead at Market Opportunities

Traditional payment companies know crypto is coming, but they’re moving slowly to adapt. Most of their solutions are expensive and require significant operational changes. SpacePay’s simpler approach could capture substantial market share before larger competitors catch up.

Corporate adoption continues accelerating as major companies add Bitcoin to their balance sheets. This legitimizes cryptocurrency for smaller businesses that follow industry leaders.

The shift toward digital payments isn’t slowing down either. Cash usage drops every year while contactless payments become the norm. Crypto transactions represent a natural progression in this trend.

Anyone interested in the $SPY presale can visit SpacePay’s official website and connect their crypto wallet. The platform accepts ETH, BNB, MATIC, AVAX, USDT, USDC, and regular bank cards for those new to cryptocurrency.

With tokens currently priced at $0.003181 each, participants can select their desired amount and complete the purchase through straightforward on-screen instructions.

JOIN THE SPACEPAY ($SPY) PRESALE NOW

Website | (X) Twitter | Telegram

The post This Altcoin Bridging Crypto and Real-World Use Is Set to Explode in 2025, Presale Ongoing appeared first on 99Bitcoins.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。