行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

法国贸易账 (季调后) (10月)

法国贸易账 (季调后) (10月)公:--

预: --

欧元区就业人数年率 (季调后) (第三季度)

欧元区就业人数年率 (季调后) (第三季度)公:--

预: --

加拿大兼职就业人数 (季调后) (11月)

加拿大兼职就业人数 (季调后) (11月)公:--

预: --

前: --

加拿大失业率 (季调后) (11月)

加拿大失业率 (季调后) (11月)公:--

预: --

前: --

加拿大全职就业人数 (季调后) (11月)

加拿大全职就业人数 (季调后) (11月)公:--

预: --

前: --

加拿大就业参与率 (季调后) (11月)

加拿大就业参与率 (季调后) (11月)公:--

预: --

前: --

加拿大就业人数 (季调后) (11月)

加拿大就业人数 (季调后) (11月)公:--

预: --

前: --

美国PCE物价指数月率 (9月)

美国PCE物价指数月率 (9月)公:--

预: --

前: --

美国个人收入月率 (9月)

美国个人收入月率 (9月)公:--

预: --

前: --

美国核心PCE物价指数月率 (9月)

美国核心PCE物价指数月率 (9月)公:--

预: --

前: --

美国PCE物价指数年率 (季调后) (9月)

美国PCE物价指数年率 (季调后) (9月)公:--

预: --

前: --

美国核心PCE物价指数年率 (9月)

美国核心PCE物价指数年率 (9月)公:--

预: --

前: --

美国个人支出月率 (季调后) (9月)

美国个人支出月率 (季调后) (9月)公:--

预: --

美国五至十年期通胀率预期 (12月)

美国五至十年期通胀率预期 (12月)公:--

预: --

前: --

美国实际个人消费支出月率 (9月)

美国实际个人消费支出月率 (9月)公:--

预: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

美国消费信贷 (季调后) (10月)

美国消费信贷 (季调后) (10月)公:--

预: --

中国大陆外汇储备 (11月)

中国大陆外汇储备 (11月)公:--

预: --

前: --

日本贸易账 (10月)

日本贸易账 (10月)公:--

预: --

前: --

日本名义GDP季率修正值 (第三季度)

日本名义GDP季率修正值 (第三季度)公:--

预: --

前: --

中国大陆进口额年率 (人民币) (11月)

中国大陆进口额年率 (人民币) (11月)公:--

预: --

前: --

中国大陆出口额 (11月)

中国大陆出口额 (11月)公:--

预: --

前: --

中国大陆进口额 (人民币) (11月)

中国大陆进口额 (人民币) (11月)公:--

预: --

前: --

中国大陆贸易账 (人民币) (11月)

中国大陆贸易账 (人民币) (11月)公:--

预: --

前: --

中国大陆出口额年率 (美元) (11月)

中国大陆出口额年率 (美元) (11月)公:--

预: --

前: --

中国大陆进口额年率 (美元) (11月)

中国大陆进口额年率 (美元) (11月)公:--

预: --

前: --

德国工业产出月率 (季调后) (10月)

德国工业产出月率 (季调后) (10月)公:--

预: --

欧元区Sentix投资者信心指数 (12月)

欧元区Sentix投资者信心指数 (12月)公:--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数公:--

预: --

前: --

英国BRC同店零售销售年率 (11月)

英国BRC同店零售销售年率 (11月)--

预: --

前: --

英国BRC总体零售销售年率 (11月)

英国BRC总体零售销售年率 (11月)--

预: --

前: --

澳大利亚隔夜拆借利率

澳大利亚隔夜拆借利率--

预: --

前: --

澳联储利率决议

澳联储利率决议 澳联储主席布洛克召开货币政策新闻发布会

澳联储主席布洛克召开货币政策新闻发布会 德国出口月率 (季调后) (10月)

德国出口月率 (季调后) (10月)--

预: --

前: --

美国NFIB小型企业信心指数 (季调后) (11月)

美国NFIB小型企业信心指数 (季调后) (11月)--

预: --

前: --

墨西哥12个月通胀年率 (CPI) (11月)

墨西哥12个月通胀年率 (CPI) (11月)--

预: --

前: --

墨西哥核心CPI年率 (11月)

墨西哥核心CPI年率 (11月)--

预: --

前: --

墨西哥PPI年率 (11月)

墨西哥PPI年率 (11月)--

预: --

前: --

美国当周红皮书商业零售销售年率

美国当周红皮书商业零售销售年率--

预: --

前: --

美国JOLTS职位空缺 (季调后) (10月)

美国JOLTS职位空缺 (季调后) (10月)--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)--

预: --

前: --

美国EIA当年短期前景原油产量预期 (12月)

美国EIA当年短期前景原油产量预期 (12月)--

预: --

前: --

美国EIA次年天然气产量预期 (12月)

美国EIA次年天然气产量预期 (12月)--

预: --

前: --

美国EIA次年短期原油产量预期 (12月)

美国EIA次年短期原油产量预期 (12月)--

预: --

前: --

EIA月度短期能源展望报告

EIA月度短期能源展望报告 美国当周API汽油库存

美国当周API汽油库存--

预: --

前: --

美国当周API库欣原油库存

美国当周API库欣原油库存--

预: --

前: --

美国当周API原油库存

美国当周API原油库存--

预: --

前: --

美国当周API精炼油库存

美国当周API精炼油库存--

预: --

前: --

韩国失业率 (季调后) (11月)

韩国失业率 (季调后) (11月)--

预: --

前: --

日本路透短观非制造业景气判断指数 (12月)

日本路透短观非制造业景气判断指数 (12月)--

预: --

前: --

日本路透短观制造业景气判断指数 (12月)

日本路透短观制造业景气判断指数 (12月)--

预: --

前: --

日本国内企业商品价格指数月率 (11月)

日本国内企业商品价格指数月率 (11月)--

预: --

前: --

日本国内企业商品价格指数年率 (11月)

日本国内企业商品价格指数年率 (11月)--

预: --

前: --

中国大陆PPI年率 (11月)

中国大陆PPI年率 (11月)--

预: --

前: --

中国大陆CPI月率 (11月)

中国大陆CPI月率 (11月)--

预: --

前: --

无匹配数据

Weiss Crypto, a branch of financial rating agency Weiss Crypto, has poured cold water on the surrounding the Ripple-affiliated XRP cryptocurrency.

According to the agency, "a favorable regulatory shift" does not suddenly create a strong use case for the token.

As reported by U.Today, the U.S. Securities and Exchange Commission has now acknowledged multiple XRP exchange-traded fund (ETF) proposals. This could potentially be a watershed moment for the token, which might enjoy broader institutional acceptance in the near future. The odds of an XRP ETF being greenlit in 2025 have now surged to nearly 80%.

However, Weiss Crypto has noted that the "limited utility" of the XRP token has been a "fundamental issue" for the token since its inception.

Earlier this Friday, Messari founder Ryan Selkis opined that Ripple might struggle to pull off a comeback since stablecoins have already won."

"Stablecoins won. The legislation will soon codify that victory in the U.S. XRP is drawing dead, as stablecoins grew two orders of magnitude during the SEC battles.

Separating winners from noise

Meanwhile, Galaxy CEO Mike Novogratz argues that narrative is precisely what "separates winners from noise" as the supply of cryptocurrency tokens keeps increasing at a dramatic pace.

That said, he has stressed that utility is "the next frontier."

"Every lasting ecosystem has a story people believe in. But belief alone won’t cut it forever—utility is the next frontier," the crypto mogul noted.

The National Bank of Canada has ventured boldly into the realm of cryptocurrencies. The bank has made $2 million investments in Bitcoin exchange-traded funds (ETFs), changing the way conventional finance views digital assets. This choice emphasizes the evolving scene of controlled crypto investments and the increasing institutional curiosity in Bitcoin.

A Calculated Risk On Bitcoin ETFs

The National Bank of Canada decided on ETFs instead of directly purchasing Bitcoin, following a pattern among financial institutions looking for controlled access to the digital asset.

By means of Bitcoin ETFs, one can invest in Bitcoin free from the complications of direct ownership, including security of private keys or navigating cryptocurrency exchanges. This investment also coincides with a period of erratic BTC prices, which have lately ranged between $95,000-$97k.

Blockchain North@BlockchaiNorthFeb 13, 2025National Bank of Canada Invests $2M in Bitcoin ETFs

Canada’s sixth-largest commercial bank ($462B in assets) just made a bold move into Bitcoin, purchasing $2M worth of Bitcoin ETFs.

Institutional adoption is accelerating, with traditional financial giants deepening… pic.twitter.com/aLuBGjUbed

Following The Footsteps Of Global Institutions

Regarding the reception of Bitcoin ETF, Canada is setting the benchmark. The action of the National Bank of Canada is in line with those of other big multinational companies like as BlackRock, which lately started the iShares BTC Trust in the US. The growing participation of conventional banks and asset managers suggests that Bitcoin is starting to acquire popularity as a choice of investment.Weighing Opportunity And Risk

Despite the surrounding buzz, detractors of ETFs contend they do not provide the advantages of direct Bitcoin ownership. Although ETFs depend on outside custodians, direct ownership of the cryptocurrencies gives investors total control over their money. ETF investments often come with management fees that could cut possible returns.

Still, the National Bank of Canada seems to consider ETFs as a safer, more readily available way to expose to Bitcoin free from direct ownership and related legal concerns.What This Means For Bitcoin’s Future

Bitcoin’s increasing engagement with the financial sector suggests that digital assets are gradually becoming a part of traditional finance. If additional businesses follow suit, crypto acceptance might increase even more, which would improve its price and market dynamics.

The National Bank of Canada’s $2 million investment, albeit tiny at the moment, reflects a broader trend of mainstream financial actors adopting Bitcoin as a long-term asset.

As interest in Bitcoin ETFs grows, it is uncertain whether other banks will follow suit, potentially bridging the gap between traditional banking and the cryptocurrency market.

Featured image from Gemini Imagen, chart from TradingView

Bitcoin has seen net outflows of $651 million from US spot exchange-traded funds (ETFs) since Feb. 10, raising concerns among traders about a potential drop below the $95,000 support level from the past 30 days. If this trend continues for another week, the spot Bitcoin ETF market could shrink by approximately $1.65 billion.

Despite these outflows, Bitcoin managed to push above $98,000 on Feb. 14, suggesting that bullish momentum is not entirely reliant on institutional investors. However, it remains unclear whether these movements were hedged, meaning that some entities may have simultaneously bought Bitcoin futures to offset the market impact of ETF sales.

To counterbalance ETF outflows, several companies, including Strategy (formerly MicroStrategy), Metaplanet, and KULR Technology, have increased their Bitcoin reserves. Even traditional financial institutions, such as Italy’s Intesa Sanpaolo, have recently added Bitcoin to their holdings. Additionally, the supply held by addresses with less than 1 BTC has been steadily increasing.

Wallets typically associated with retail investors—holding between 0.1 and 1 BTC—added over $80 million worth of Bitcoin between Feb. 3 and Feb. 13, reversing a two-week downtrend. This data further supports the notion that buying pressure is not coming exclusively from institutional investors.

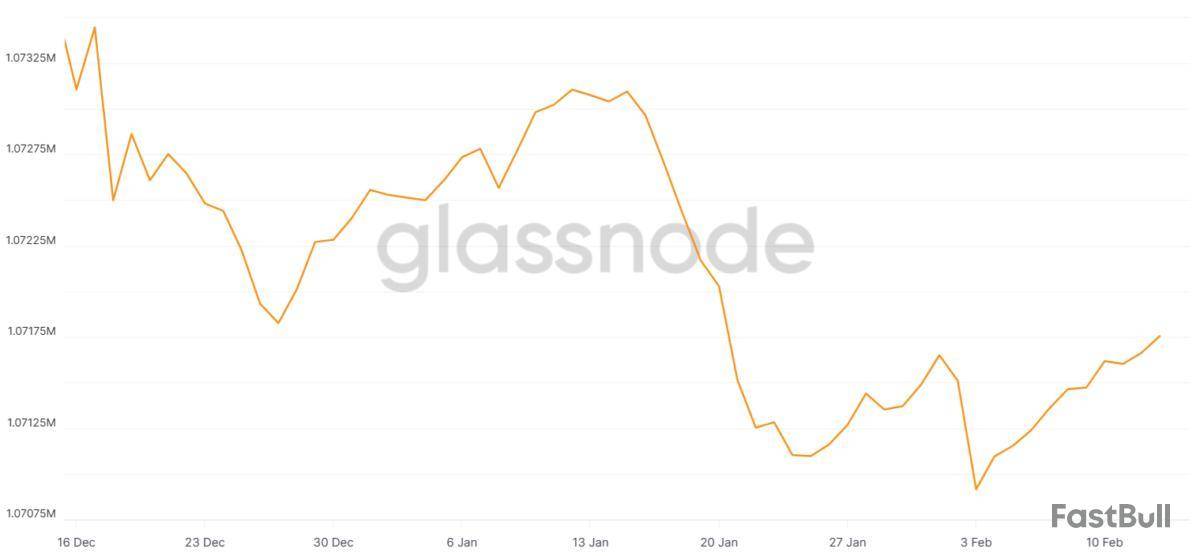

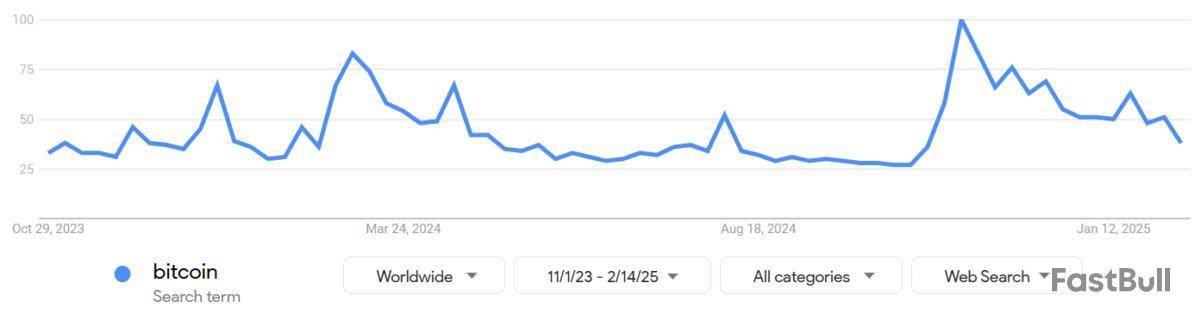

A potential breakout above $105,000 could be driven by small retail traders, who, contrary to expectations, have yet to show significant optimism. Addresses holding less than 0.1 BTC have been net sellers since Jan. 31, according to Glassnode data, while Google searches for “Bitcoin” term have declined significantly over the past three months.

Bitcoin search trends on Google peaked in mid-November 2024, coinciding with a 38% price surge in less than ten days. However, Bitcoin continued to rise by another $16,000 after that period, reaching an all-time high of $109,340 on Jan. 20, yet retail interest did not increase according to this metric.

Weak US economic growth could drive capital toward Bitcoin

Investor sentiment has been bolstered by strong corporate earnings, with the S&P 500 index trading within 0.5% of its all-time high. Notable examples include Exxon’s 10% year-over-year quarterly earnings growth, JPMorgan’s 12% increase in profits, and UnitedHealth’s 15% rise in quarterly earnings.

It is important to note that even a modest 2% gain in the S&P 500 translates into a $1 trillion increase in market capitalization. As a result, a small reallocation of capital from equities to Bitcoin could propel the cryptocurrency’s price above $105,000. Furthermore, concerns over corporate profitability are rising due to the ongoing global tariff war, increasing the appeal of uncorrelated assets like Bitcoin.

US retail sales fell 0.9% in January from the previous month, marking the sharpest decline in over a year, according to data released on Feb. 14. Jefferies US economist Thomas Simons reportedly told clients that, if similar data persists, first-quarter US GDP could turn negative, according to Yahoo Finance.

Bitcoin’s upside has also been constrained by investor disappointment with the proposed US strategic Bitcoin reserves, initially backed by President Donald Trump, but still unrealized. Similarly, several state-level legislative proposals have focused on digital asset regulation rather than directly advancing Bitcoin reserves, creating uncertainty about government-led adoption.

Ultimately, the continued ETF outflows should be viewed as a bullish sign, considering Bitcoin has remained above $95,000 despite selling pressure. Additionally, deteriorating macroeconomic conditions and rising uncertainty in traditional markets could push investors to seek alternative assets, including Bitcoin.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.

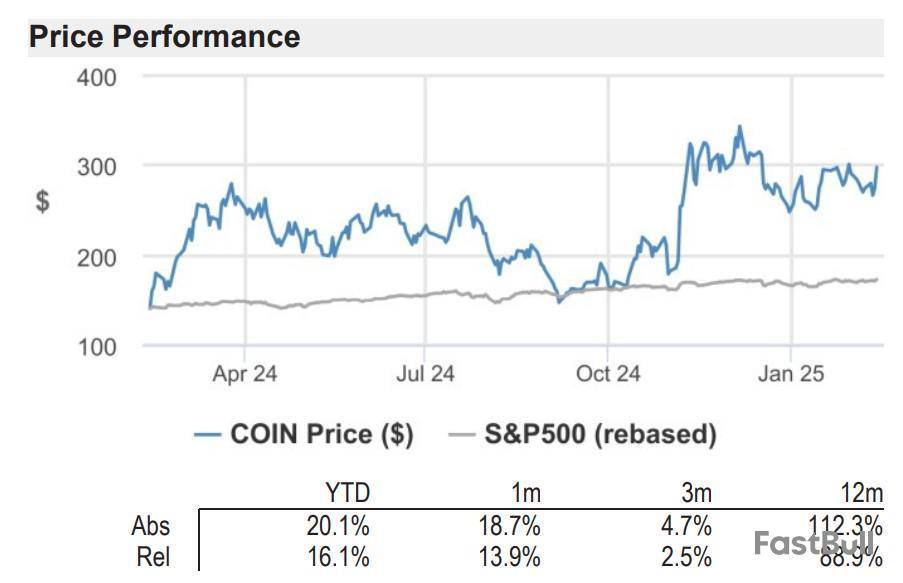

Stock analysts raised price targets on Coinbase and Robinhood after the exchanges crushed expectations during fourth-quarter earnings calls, according to equity research notes shared with Cointelegraph.

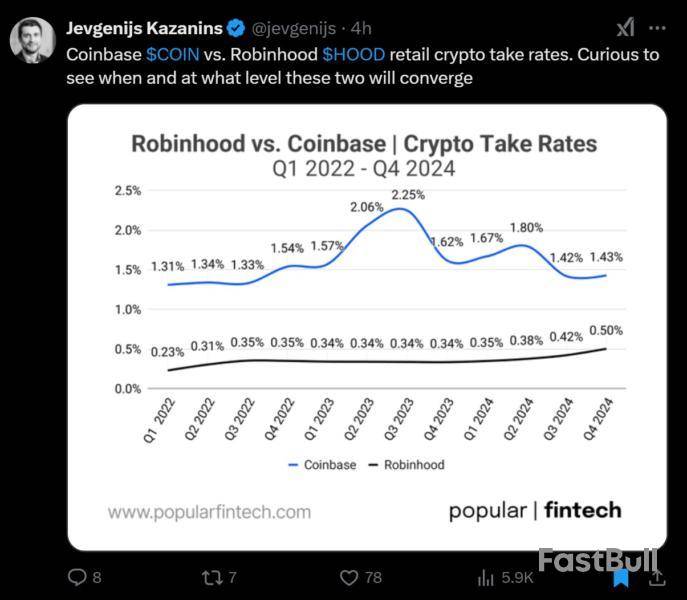

Soaring crypto trading volumes in the last three months of 2024 drove higher-than-expected revenues and profits for Coinbase and Robinhood — which is best known as a stock trading platform but is investing heavily in crypto.

In Q4, Coinbase posted its strongest quarter of earnings in over a year as crypto prices and trading surged after the election of US President Donald Trump. Robinhood’s Q4 profits beat consensus estimates, with crypto revenue jumping 700% year-on-year.

“The fourth quarter, and we would argue 2024 overall, was a pivotal and consequential period for the crypto ecosystem — market caps exploded, volumes jumped, new participants entered the market, and regulatory confidence completely flipped,” analysts for JPMorgan wrote in a Feb. 14 research note shared with Cointelegraph.

The surge in crypto trading was “fueled by renewed market optimism post-U.S. election,” crypto researcher Coin Metrics said on Feb. 11. Trump has promised to make America “the world’s crypto capital” and has nominated pro-industry leaders to head key agencies.

In the past 12 months, shares of Coinbase and Robinhood have risen by approximately 112% and 365%, respectively, according to JPMorgan.

Raising price targets

Analysts at JPMorgan and US Tiger Securities, a stock research firm, raised price targets for Coinbase’s stock, COIN, to $344 and $300 per share, respectively, up from $264 and $265.

Coinbase’s Feb. 13 financial results show the firm hit a total revenue of $2.3 billion, up 88% quarter-on-quarter, while net income was $1.3 billion, both far exceeding analyst expectations.

In Q4, retail trading volumes on Coinbase surged to $94 billion, and institutional volumes hit $345 billion — a three-year high — “on the back of rapidly appreciating crypto market that inspired traders to reengage,” the analysts said.

Beyond trading, Coinbase earns revenues from services including digital asset custody, on-ramping stablecoins and facilitating crypto staking.

Waning regulatory barriers will increase Coinbase’s competition, but the exchange “is welcoming it as COIN sees greater participation across crypto peers and potentially TradFi players as a net positive for the overall ecosystem,” JPMorgan said.

Meanwhile, JPMorgan raised targets for Robinhood shares, HOOD, to $45 from $39. It noted that crypto trading revenues are becoming an increasingly important part of Robinhood’s business.

Robinhood “reported $358mn in crypto transaction revenue, representing ~35% of total revenue, which is its highest contribution ever,” the JPMorgan analysts said in a Feb. 12 note shared with Cointelegraph.

“Typically, we see crypto revenue contribute 10-20% of revenue any given quarter,” they said.

Robinhood’s crypto revenues are poised for further growth as the brokerage prepares to add more token types and finalize its acquisition of crypto exchange Bitstamp, which Robinhood agreed to buy in June 2024.

Another top US exchange, CME Group, reported record cryptocurrency trading volumes during the fourth quarter of 2024. It also plans to add more crypto products in 2025.

The following article is adapted from The Block’s newsletter, The Daily, which comes out on weekday afternoons.

It's Friday! No Valentine's Day plans? No worries, we've got a crypto update you'll absolutely love.

In today's newsletter, an Abu Dhabi sovereign wealth fund discloses $437 million in Bitcoin ETF holdings, President Trump's memecoin surges 50%, the SEC acknowledges proposals for Grayscale's XRP and Dogecoin ETFs and more.

Let's get started.

Abu Dhabi sovereign wealth fund declares $437 million BlackRock Bitcoin ETF investment

Abu Dhabi bought $436.9 million worth of BlackRock's spot Bitcoin ETF IBIT in Q4, according to a 13F filing with the Securities and Exchange Commission on Friday.

Official Trump memecoin surges 50%

President Trump's official memecoin surged nearly 50% over the last 24 hours to $23.93 — its highest level in two weeks — generating $3.4 billion in trading volume.

SEC weighs proposals for Grayscale's XRP and Dogecoin ETFs

The SEC acknowledged NYSE Arca's 19b-4 filings for Grayscale's proposed conversion of its XRP and Dogecoin Trusts into spot ETFs late Thursday.

Crypto Task Force meets with Jito and Multicoin to discuss ETF staking

The SEC's Crypto Task Force met with Solana infrastructure company Jito Labs and VC firm Multicoin Capital to discuss integrating staking into ETFs, according to meeting notes from the regulator published Friday.

'Make Juventus Great Again'

The investment arm of USDT stablecoin issuer Tether has acquired a minority stake in Italian football (soccer) giant Juventus, aligning with its goal of bringing digital assets mainstream.

Looking ahead to next week

Never miss a beat with The Block's daily digest of the most influential events happening across the digital asset ecosystem.

Disclaimer: This article was produced with the assistance of OpenAI’s ChatGPT 3.5/4 and reviewed and edited by our editorial team.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2024 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

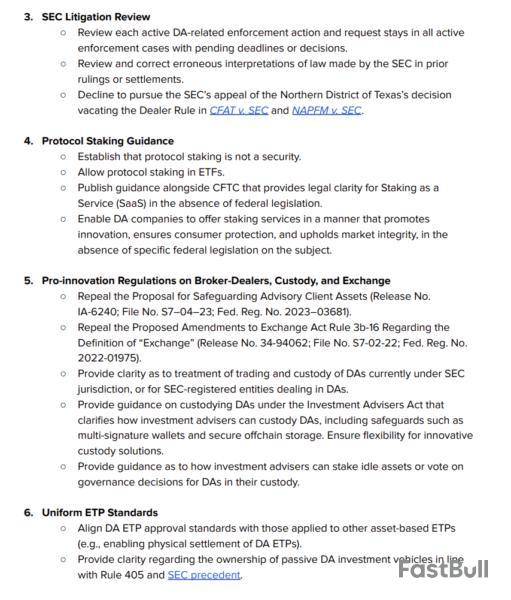

The US Securities and Exchange Commission’s Crypto Task Force met with several representatives from the cryptocurrency and traditional finance sectors to discuss regulatory issues impacting digital assets in early February. Key themes included staking, clear guidelines for exchange-traded products (ETPs) and a new framework for policing the emerging asset class.

According to memoranda available on the SEC’s website, the Crypto Task Force met with the Blockchain Association, an industry lobby group, on Feb. 4.

The lobby group suggested six priority areas the task force should focus on to “tackle issues that impact the digital asset industry.”

In addition to establishing regulatory principles and clearer guidelines, the SEC was requested to adopt a pro-innovation approach to broker-dealers, custodians and exchanges, establish uniform ETP standards, and ensure protocol staking is not classified as a security.

The Blockchain Association also called on the SEC to “review and correct erroneous interpretations of law” made by the previous administration. This “retroactive” review process was outlined by SEC Commissioner Hester Peirce earlier this month.

On Feb. 5, representatives from Jito Labs and Multicoin Capital met with the Crypto Task Force to discuss the possibility of adding staking to ETPs. According to the SEC document, the representatives described staking as the “true nature” of proof-of-stake tokens.

When the SEC approved spot Ether (ETH) exchange-traded funds last year, it asked issuers to remove the ability for funds to earn staking rewards. According to Jito and Multicoin Capital, “We understand the [SEC] Staff may now be amenable to revisiting staking in ETH and other crypto asset ETPs, including in connection with new applications filed for a SOL ETP.”

Also on Feb. 5, the task force met with Andreessen Horowitz’s capital management group, AH Capital Management. The discussion centered around token classification and issuance and market intermediaries.

A separate SEC document showed that the Crypto Task Force met with representatives from Nasdaq on Feb. 6. In addition to bringing regulatory clarity to digital assets, the SEC’s Task Force was requested to clarify the “venues” that are permitted to trade cryptocurrencies.

“It is appropriate to allow non-securities digital assets to be traded alongside securities in the same venues to allow for consistent rule sets,” the Nasdaq representatives said.

Finally, bankruptcy law firm and former FTX counsel Sullivan & Cromwell sent Colin D. Lloyd to meet with the task force on Feb. 7 to discuss blockchain technology and topics related to securities law.

A new dawn for crypto regulation

The election of Donald Trump has raised expectations of a major policy shift for the US digital asset sector. The SEC’s Task Force, which is being led by the SEC’s pro-crypto Peirce, was established on President Trump’s second day in office.

Peirce has vowed to clean up the “mess” left behind by former SEC Chair Gary Gensler, who brought more than 125 enforcement actions against the industry during his tenure.

On Feb. 11, the US House Subcommittee on Digital Assets, Financial Technology and Artificial Intelligence heard from five witnesses on the future of crypto regulations in the country.

Kraken’s deputy general counsel, Jonathan Jachym, called for establishing “fundamental rules for centralized intermediaries,” while the Crypto Council for Innovation’s president, Ji Hun Kim, said policymakers must “unwind the significant damage and uncertainty caused by the regulation-by-enforcement approach by the prior administration.”

Meanwhile, former Commodity Futures Trading Commission Chair Timothy Massad called for major revisions to the STABLE Act, a draft bill that was recently put forward by Representatives French Hill and Bryan Steil.

A federal judge in Washington D.C. has granted a joint motion to put on hold the Securities and Exchange Commission's case against cryptocurrency exchange Binance for 60 days. The order came after the SEC made the request in a joint motion filed earlier this week with the crypto exchange. It proposed a 60-day stay while a new task force, set up by President Trump's acting SEC Chairman Mark Uyeda, works on a regulatory framework for cryptocurrencies. The judge ordered the two parties to file a status report by April 14. (mengqi.sun@wsj.com; @_MengqiSun)

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。