行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

美国个人收入月率 (9月)

美国个人收入月率 (9月)公:--

预: --

前: --

美国PCE物价指数年率 (季调后) (9月)

美国PCE物价指数年率 (季调后) (9月)公:--

预: --

前: --

美国PCE物价指数月率 (9月)

美国PCE物价指数月率 (9月)公:--

预: --

前: --

美国个人支出月率 (季调后) (9月)

美国个人支出月率 (季调后) (9月)公:--

预: --

前: --

美国核心PCE物价指数月率 (9月)

美国核心PCE物价指数月率 (9月)公:--

预: --

前: --

美国核心PCE物价指数年率 (9月)

美国核心PCE物价指数年率 (9月)公:--

预: --

前: --

美国密歇根大学五年通胀年率初值 (12月)

美国密歇根大学五年通胀年率初值 (12月)公:--

预: --

前: --

美国实际个人消费支出月率 (9月)

美国实际个人消费支出月率 (9月)公:--

预: --

前: --

美国密歇根大学现况指数初值 (12月)

美国密歇根大学现况指数初值 (12月)公:--

预: --

前: --

美国密歇根大学消费者信心指数初值 (12月)

美国密歇根大学消费者信心指数初值 (12月)公:--

预: --

前: --

美国密歇根大学一年期通胀率预期初值 (12月)

美国密歇根大学一年期通胀率预期初值 (12月)公:--

预: --

前: --

美国密歇根大学消费者预期指数初值 (12月)

美国密歇根大学消费者预期指数初值 (12月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

美国单位劳动力成本初值 (季调后) (第三季度)

美国单位劳动力成本初值 (季调后) (第三季度)--

预: --

前: --

美国消费信贷 (季调后) (10月)

美国消费信贷 (季调后) (10月)公:--

预: --

前: --

中国大陆外汇储备 (11月)

中国大陆外汇储备 (11月)公:--

预: --

前: --

日本工资月率 (10月)

日本工资月率 (10月)公:--

预: --

前: --

日本贸易账 (10月)

日本贸易账 (10月)公:--

预: --

前: --

日本名义GDP季率修正值 (第三季度)

日本名义GDP季率修正值 (第三季度)公:--

预: --

前: --

日本贸易帐 (季调后) (海关数据) (10月)

日本贸易帐 (季调后) (海关数据) (10月)公:--

预: --

前: --

日本年度GDP季率修正值 (第三季度)

日本年度GDP季率修正值 (第三季度)公:--

预: --

中国大陆出口额年率 (人民币) (11月)

中国大陆出口额年率 (人民币) (11月)公:--

预: --

前: --

中国大陆贸易账 (美元) (11月)

中国大陆贸易账 (美元) (11月)公:--

预: --

前: --

中国大陆进口额年率 (人民币) (11月)

中国大陆进口额年率 (人民币) (11月)公:--

预: --

前: --

中国大陆出口额 (11月)

中国大陆出口额 (11月)公:--

预: --

前: --

中国大陆进口额 (人民币) (11月)

中国大陆进口额 (人民币) (11月)公:--

预: --

前: --

中国大陆贸易账 (人民币) (11月)

中国大陆贸易账 (人民币) (11月)公:--

预: --

前: --

中国大陆进口额年率 (美元) (11月)

中国大陆进口额年率 (美元) (11月)公:--

预: --

前: --

中国大陆出口额年率 (美元) (11月)

中国大陆出口额年率 (美元) (11月)公:--

预: --

前: --

德国工业产出月率 (季调后) (10月)

德国工业产出月率 (季调后) (10月)--

预: --

前: --

欧元区Sentix投资者信心指数 (12月)

欧元区Sentix投资者信心指数 (12月)--

预: --

前: --

加拿大先行指标月率 (11月)

加拿大先行指标月率 (11月)--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

美国达拉斯联储PCE物价指数年率 (9月)

美国达拉斯联储PCE物价指数年率 (9月)--

预: --

前: --

中国大陆贸易账 (美元) (11月)

中国大陆贸易账 (美元) (11月)--

预: --

前: --

美国3年期国债拍卖收益率

美国3年期国债拍卖收益率--

预: --

前: --

英国BRC总体零售销售年率 (11月)

英国BRC总体零售销售年率 (11月)--

预: --

前: --

英国BRC同店零售销售年率 (11月)

英国BRC同店零售销售年率 (11月)--

预: --

前: --

澳大利亚隔夜拆借利率

澳大利亚隔夜拆借利率--

预: --

前: --

澳联储利率决议

澳联储利率决议 澳联储主席布洛克召开货币政策新闻发布会

澳联储主席布洛克召开货币政策新闻发布会 德国出口月率 (季调后) (10月)

德国出口月率 (季调后) (10月)--

预: --

前: --

美国NFIB小型企业信心指数 (季调后) (11月)

美国NFIB小型企业信心指数 (季调后) (11月)--

预: --

前: --

墨西哥核心CPI年率 (11月)

墨西哥核心CPI年率 (11月)--

预: --

前: --

墨西哥12个月通胀年率 (CPI) (11月)

墨西哥12个月通胀年率 (CPI) (11月)--

预: --

前: --

墨西哥PPI年率 (11月)

墨西哥PPI年率 (11月)--

预: --

前: --

墨西哥CPI年率 (11月)

墨西哥CPI年率 (11月)--

预: --

前: --

美国当周红皮书商业零售销售年率

美国当周红皮书商业零售销售年率--

预: --

前: --

美国JOLTS职位空缺 (季调后) (10月)

美国JOLTS职位空缺 (季调后) (10月)--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)--

预: --

前: --

美国EIA次年短期原油产量预期 (12月)

美国EIA次年短期原油产量预期 (12月)--

预: --

前: --

美国EIA当年短期前景原油产量预期 (12月)

美国EIA当年短期前景原油产量预期 (12月)--

预: --

前: --

美国EIA次年天然气产量预期 (12月)

美国EIA次年天然气产量预期 (12月)--

预: --

前: --

EIA月度短期能源展望报告

EIA月度短期能源展望报告 美国10年期国债拍卖平均收益率

美国10年期国债拍卖平均收益率--

预: --

前: --

美国当周API库欣原油库存

美国当周API库欣原油库存--

预: --

前: --

美国当周API原油库存

美国当周API原油库存--

预: --

前: --

美国当周API精炼油库存

美国当周API精炼油库存--

预: --

前: --

无匹配数据

Orca is launching Dynamic Tick Arrays, making it much cheaper and easier to create liquidity pools on Solana. This upgrade makes Orca more attractive for developers and traders because it lowers costs and makes integration simple. If more people build on Orca, trading volume and user numbers could rise, which may help push ORCA’s price higher. However, if the feature does not attract many users, the effect on price might be small. Still, this upgrade aims to strengthen Orca’s place in the Solana ecosystem. Read more from the official announcement here.

Orca ️@orca_soJul 05, 2025Orca is pushing DeFi efficiency forward again!

We're excited to announce Dynamic Tick Arrays, a major upgrade that makes creating liquidity pools on @Solana dramatically cheaper!

Let’s dive into how we’re tackling onchain costs. pic.twitter.com/S99KfFuVxs

ONFA is launching NFT Infinity Thanksgiving, which promises a stable, long-term income stream for holders. The NFT can be seen as a tool for financial planning or passive income, which could attract more long-term investors. The mining duration of 11 years adds to the appeal for those seeking steady returns. If the launch gets strong demand, price for OFT and related NFTs could go up. However, if few people find the concept useful or if rewards are not reliable, the impact could be limited. Learn more about the launch here.

ONFA@onfaofficialJul 04, 2025HOT NEWS | LAUNCHING MASTERPIECE: NFT INFINITY THANKSGIVING – An Endless Gratitude for a Journey of Reborn. GET YOURS NOW!

Launch Date: From July 5th, 2025 (California Time)

With a vision to offer a long-term financial solution and symbolize our unwavering commitment… pic.twitter.com/FC5RjLmSb7

CROSS will be listed on Bitget Onchain. Being added to a large exchange like Bitget can bring higher trading volume and more attention from investors. New listings often lead to price jumps because more people can easily buy and sell the token. Since Bitget is popular and supports on-chain trading, CROSS may get a strong boost in activity. However, if the overall market is weak or interest is low, the impact could be smaller. Watch for trading volume and price changes as the listing happens. See the official announcement here.

Bitget@bitgetglobalJul 05, 2025New Launch Alert at #BitgetOnchain

Find the next 100x gem:

Bitget App → Markets → Onchain pic.twitter.com/u4hzU1Rctm

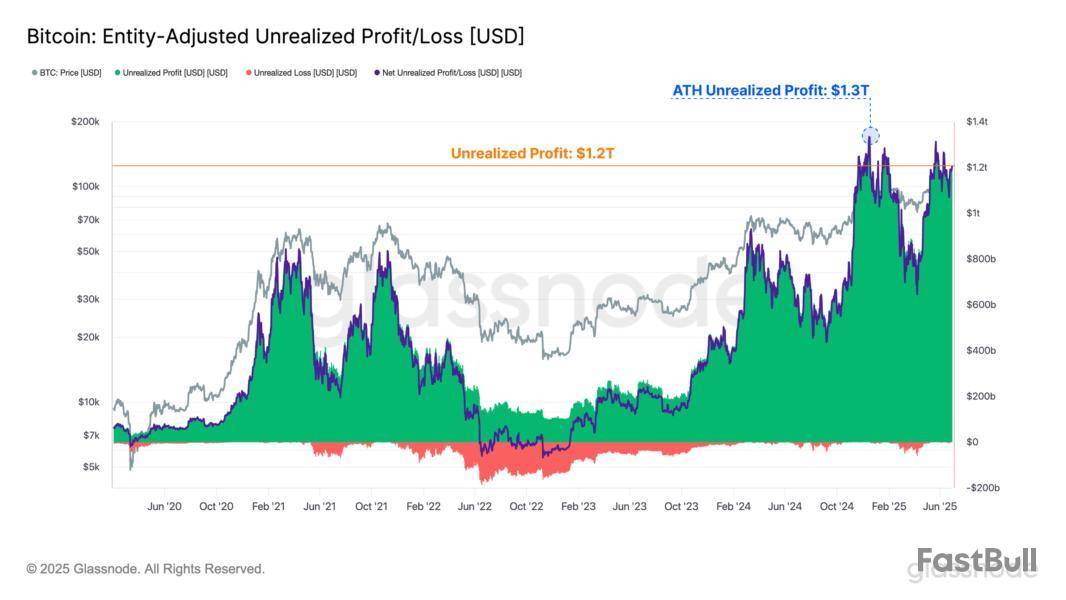

Bitcoin investors are currently holding an estimated $1.2 trillion in unrealized profits, according to on-chain analytics platform Glassnode.

This significant figure highlights the paper gains accumulated by long-term holders as Bitcoin continues to trade close to its record highs.

Bitcoin Investor Base Shifts From Traders to Long-Term Institutional Allocators

Glassnode data reveals that the average unrealized profit per investor stands at around 125%, which is lower than the 180% seen in March 2024, when the BTC price reached a peak of $73,000.

However, despite these massive unrealized gains, investor behavior suggests no major rush to sell the top crypto. BeInCrypto previously reported that daily realized profits have remained relatively subdued, averaging just $872 million.

This starkly contrasts previous price surges, when realized gains surged to between $2.8 billion and $3.2 billion at BTC price points of $73,000 and $107,000, respectively.

Moreover, current market sentiment suggests that investors are waiting for a more decisive price movement before adjusting their upward or downward positions. The trend points to firm conviction among long-term holders, with accumulation continuing to outweigh selling pressure.

“This underscores that HODLing remains the dominant market behavior amongst investors, with accumulation and maturation flows significantly outweighing distribution pressures,” Glassnode stated.

Meanwhile, Bitcoin analyst Rezo noted that the current trend reflects a fundamental shift in the significantly evolved profile of Bitcoin holders. According to him, the typical BTC holder has shifted from short-term speculative traders to long-term institutional investors and allocators.

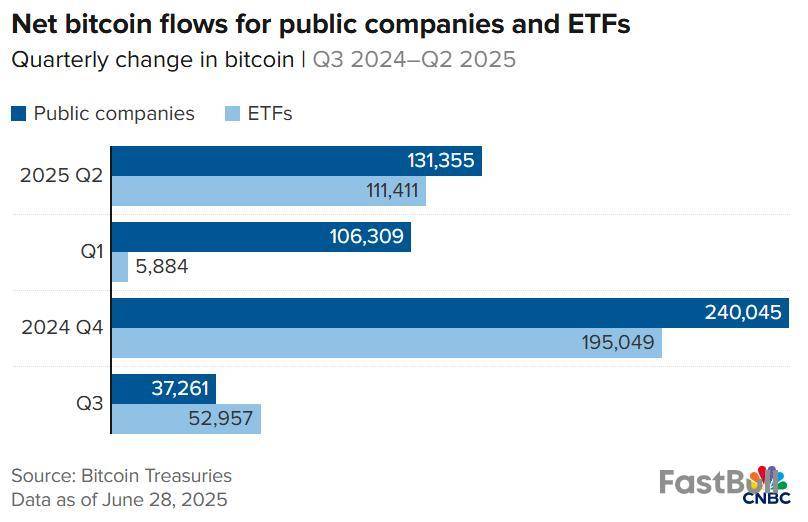

Rezo pointed to the increasing influence of institutional players such as ETFs and public companies like Strategy (formerly MicroStrategy).

“The holder base has changed – from traders seeking exit to allocators seeking exposure. MicroStrategy, sitting on tens of billions in unrealized gains, keeps adding. ETFs = constant bid, not swing traders,” he said.

Notably, public companies like Strategy increased their Bitcoin holdings by 18% in Q2, while ETF exposure to Bitcoin climbed by 8% in the same period.

Considering this, Rezo concluded that most short-term sellers likely exited between $70,000 and $100,000. He added that what remains are investors who treat Bitcoin less as a speculative trade and more as a strategic long-term allocation.

Bitcoin prices dipped by 0.93% in the last day after the premier cryptocurrency suffered another price rejection in the $110,000 range. This latest price pullback forces Bitcoin to maintain a consolidatory movement that has dominated the majority of last month drawing speculations about a potential market top. Interestingly, prominent market analyst Ted Pillows has weighed in on this discourse stating that historical data shows that Bitcoin is yet to achieve a peak price for the current market cycle.

Bitcoin’s Consolidation: A Preparation For Final Bull Leg

In an X post on July 4, Ted Pillows shares a bullish market insight following another Bitcoin price dip. Notably, the premier cryptocurrency seemed on course to resume its market uptrend after a significant price rebound from $99,000 in late June following weeks of downward consolidatory movement. However, another decisive rejection in the $110,000 indicates Bitcoin’s prices remain range-bound thereby worsening investors’ concern across the market. In interpreting this situation, Pillows has called for calm stating the recent price dip is merely a “leverage flush” that requires no panic. Using a visual study on the BTC weekly chart, the renowned analyst shows that the current and previous price pullbacks are part of a predictable pattern that has played out across previous Bitcoin cycles.

The chart shows that after each halving event, Bitcoin tends to peak approximately 18 months (518 days) later. With the most recent halving occurring in mid April 2024, the expected peak for this cycle would fall somewhere around Q4 2025, specifically on October 13, 2025, consistent with historical performance. Furthermore, a recurring 140-day rally window is also depicted in the chart, usually forming the final leg of the bull run. In each previous cycle, this 10-bar stretch delivered parabolic price movements. If history is rhyming once again, Bitcoin is now within range of initiating this 10-week bull run, suggesting the equivalent rally seen in previous could soon kick in.

How High Can Bitcoin Price Go?

Based on Pillows’ recent analysis, Bitcoin may be gathering momentum for its final rally of the present market cycle. The extent of this anticipated uptrend remains unknown; however, the presence of bullish factors most notably the high influx of institutional investment and the US pro-crypto policies supports a range of sky scraping targets. For example, Pillows has previously shared that the popular stock-to-flow model which uses Bitcoin’s scarcity to project long-term price trajectory has predicted a potential price target of $368,925 by 2025 end. If this prediction holds true, Bitcoin investors are eyeing an estimated 242% from current market prices. At press time, Bitcoin continues to trade at $108,299 reflecting a 0.83% gain in the past week.

As the second half of 2025 begins, Bitcoin is showing decreased volatility and logging fewer monthly transactions, as its U.S.-based spot ETFs near $50 billion in cumulative net inflows.

Bitcoin's "at-the-market" implied volatility, a measure of how volatile Bitcoin is expected to trade across timespans ranging from seven days to six months, has fallen in July to its lowest levels since October, 2023, when Bitcoin traded around a third of its current value, according to data from The Block.

Alongside the decrease in volatility, monthly transactions on the Bitcoin network fell by 15% in June compared to May, The Block's data shows, logging the fewest monthly transactions since October, 2023. Transaction activity has seen notable lows in recent weeks, with some abnormally low-fee transactions even being scooped up by miners looking deep in the mempool for transactions to add to blocks.

As transaction activity on the network falls, Wall Street's demand for BTC has only increased, with U.S. spot Bitcoin ETFs continually logging new cumulative inflow records. The funds logged over $1 billion in inflows over two days last week, bringing the cumulative total net inflow to just below $50 billion. The funds hold around $137.6 billion worth of BTC in total, a new all-time high, according to SoSoValue data.

Publicly-listed companies also bought BTC in June—around 65,000 BTC, worth about $7 billion at current prices, according to data from BitcoinTreasuries. A Glassnode analysis in June found that, though Bitcoin's onchain activity is a 'ghost town,' the increase in transactions from high net worth agents signals institutions and whales are becoming more dominant on the network.

A decrease in Bitcoin futures volume could also signal a summer slump for the world's largest cryptocurrency, The Block recently reported.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。