行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

法国贸易账 (季调后) (10月)

法国贸易账 (季调后) (10月)公:--

预: --

欧元区就业人数年率 (季调后) (第三季度)

欧元区就业人数年率 (季调后) (第三季度)公:--

预: --

加拿大兼职就业人数 (季调后) (11月)

加拿大兼职就业人数 (季调后) (11月)公:--

预: --

前: --

加拿大失业率 (季调后) (11月)

加拿大失业率 (季调后) (11月)公:--

预: --

前: --

加拿大全职就业人数 (季调后) (11月)

加拿大全职就业人数 (季调后) (11月)公:--

预: --

前: --

加拿大就业参与率 (季调后) (11月)

加拿大就业参与率 (季调后) (11月)公:--

预: --

前: --

加拿大就业人数 (季调后) (11月)

加拿大就业人数 (季调后) (11月)公:--

预: --

前: --

美国PCE物价指数月率 (9月)

美国PCE物价指数月率 (9月)公:--

预: --

前: --

美国个人收入月率 (9月)

美国个人收入月率 (9月)公:--

预: --

前: --

美国核心PCE物价指数月率 (9月)

美国核心PCE物价指数月率 (9月)公:--

预: --

前: --

美国PCE物价指数年率 (季调后) (9月)

美国PCE物价指数年率 (季调后) (9月)公:--

预: --

前: --

美国核心PCE物价指数年率 (9月)

美国核心PCE物价指数年率 (9月)公:--

预: --

前: --

美国个人支出月率 (季调后) (9月)

美国个人支出月率 (季调后) (9月)公:--

预: --

美国五至十年期通胀率预期 (12月)

美国五至十年期通胀率预期 (12月)公:--

预: --

前: --

美国实际个人消费支出月率 (9月)

美国实际个人消费支出月率 (9月)公:--

预: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

美国消费信贷 (季调后) (10月)

美国消费信贷 (季调后) (10月)公:--

预: --

中国大陆外汇储备 (11月)

中国大陆外汇储备 (11月)公:--

预: --

前: --

日本贸易账 (10月)

日本贸易账 (10月)公:--

预: --

前: --

日本名义GDP季率修正值 (第三季度)

日本名义GDP季率修正值 (第三季度)公:--

预: --

前: --

中国大陆进口额年率 (人民币) (11月)

中国大陆进口额年率 (人民币) (11月)公:--

预: --

前: --

中国大陆出口额 (11月)

中国大陆出口额 (11月)公:--

预: --

前: --

中国大陆进口额 (人民币) (11月)

中国大陆进口额 (人民币) (11月)公:--

预: --

前: --

中国大陆贸易账 (人民币) (11月)

中国大陆贸易账 (人民币) (11月)公:--

预: --

前: --

中国大陆出口额年率 (美元) (11月)

中国大陆出口额年率 (美元) (11月)公:--

预: --

前: --

中国大陆进口额年率 (美元) (11月)

中国大陆进口额年率 (美元) (11月)公:--

预: --

前: --

德国工业产出月率 (季调后) (10月)

德国工业产出月率 (季调后) (10月)公:--

预: --

欧元区Sentix投资者信心指数 (12月)

欧元区Sentix投资者信心指数 (12月)公:--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数公:--

预: --

前: --

英国BRC同店零售销售年率 (11月)

英国BRC同店零售销售年率 (11月)--

预: --

前: --

英国BRC总体零售销售年率 (11月)

英国BRC总体零售销售年率 (11月)--

预: --

前: --

澳大利亚隔夜拆借利率

澳大利亚隔夜拆借利率--

预: --

前: --

澳联储利率决议

澳联储利率决议 澳联储主席布洛克召开货币政策新闻发布会

澳联储主席布洛克召开货币政策新闻发布会 德国出口月率 (季调后) (10月)

德国出口月率 (季调后) (10月)--

预: --

前: --

美国NFIB小型企业信心指数 (季调后) (11月)

美国NFIB小型企业信心指数 (季调后) (11月)--

预: --

前: --

墨西哥12个月通胀年率 (CPI) (11月)

墨西哥12个月通胀年率 (CPI) (11月)--

预: --

前: --

墨西哥核心CPI年率 (11月)

墨西哥核心CPI年率 (11月)--

预: --

前: --

墨西哥PPI年率 (11月)

墨西哥PPI年率 (11月)--

预: --

前: --

美国当周红皮书商业零售销售年率

美国当周红皮书商业零售销售年率--

预: --

前: --

美国JOLTS职位空缺 (季调后) (10月)

美国JOLTS职位空缺 (季调后) (10月)--

预: --

前: --

中国大陆M1货币供应量年率 (11月)

中国大陆M1货币供应量年率 (11月)--

预: --

前: --

中国大陆M0货币供应量年率 (11月)

中国大陆M0货币供应量年率 (11月)--

预: --

前: --

中国大陆M2货币供应量年率 (11月)

中国大陆M2货币供应量年率 (11月)--

预: --

前: --

美国EIA当年短期前景原油产量预期 (12月)

美国EIA当年短期前景原油产量预期 (12月)--

预: --

前: --

美国EIA次年天然气产量预期 (12月)

美国EIA次年天然气产量预期 (12月)--

预: --

前: --

美国EIA次年短期原油产量预期 (12月)

美国EIA次年短期原油产量预期 (12月)--

预: --

前: --

EIA月度短期能源展望报告

EIA月度短期能源展望报告 美国当周API汽油库存

美国当周API汽油库存--

预: --

前: --

美国当周API库欣原油库存

美国当周API库欣原油库存--

预: --

前: --

美国当周API原油库存

美国当周API原油库存--

预: --

前: --

美国当周API精炼油库存

美国当周API精炼油库存--

预: --

前: --

韩国失业率 (季调后) (11月)

韩国失业率 (季调后) (11月)--

预: --

前: --

日本路透短观非制造业景气判断指数 (12月)

日本路透短观非制造业景气判断指数 (12月)--

预: --

前: --

日本路透短观制造业景气判断指数 (12月)

日本路透短观制造业景气判断指数 (12月)--

预: --

前: --

日本国内企业商品价格指数月率 (11月)

日本国内企业商品价格指数月率 (11月)--

预: --

前: --

日本国内企业商品价格指数年率 (11月)

日本国内企业商品价格指数年率 (11月)--

预: --

前: --

中国大陆PPI年率 (11月)

中国大陆PPI年率 (11月)--

预: --

前: --

中国大陆CPI月率 (11月)

中国大陆CPI月率 (11月)--

预: --

前: --

意大利工业产出年率 (季调后) (10月)

意大利工业产出年率 (季调后) (10月)--

预: --

前: --

无匹配数据

Understanding liquidity crises

A liquidity crisis occurs when an organization lacks sufficient liquid assets, such as cash or assets readily convertible to cash, to meet its short-term financial obligations.

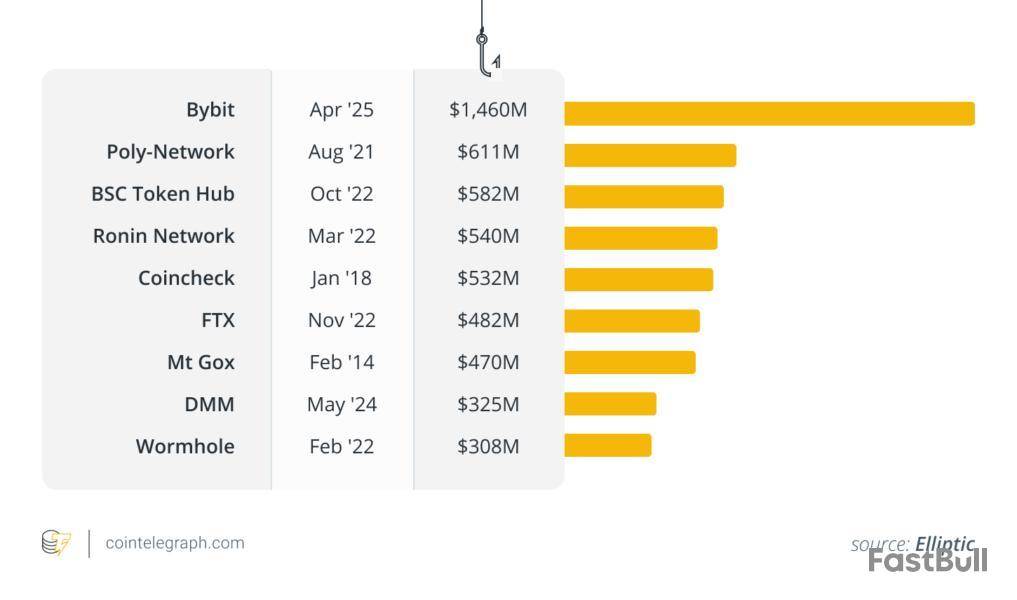

Major hacks in the cryptocurrency exchange sector can trigger liquidity crises in several ways. The immediate depletion of assets, especially from compromised hot wallets, can severely impact an exchange’s ability to process withdrawals and maintain normal operations.

Beyond the direct financial loss, panic-driven user withdrawals can escalate a crisis. Once news of a hack spreads, customers may rush to withdraw their assets, fearing further losses. This sudden spike in withdrawal requests puts immense pressure on an exchange’s remaining liquid reserves, making it even harder to maintain solvency.

Additionally, the broader market confidence in the exchange can deteriorate, leading to a decline in trading activity, reduced investor interest and further capital flight.

Without quick and strategic intervention, such liquidity shocks can spiral into insolvency, forcing the exchange to suspend operations or seek external financial assistance.

Immediate response actions to protect user funds after a hack

When a hack is detected, exchanges must act swiftly to contain the damage and protect user funds. The first steps include:

Did you know? The first 24 hours after discovering a cyberattack are often called the “golden hours.” Actions taken during this critical period can significantly impact the extent of damage and the success of recovery.

Containment and damage assessment after a crypto hack

Once the immediate threat is neutralized, exchanges focus on identifying the breach and securing assets. This phase involves determining exactly what happened, how the attack was executed and the extent of the financial loss.

Identifying the cause

A forensic investigation is launched to uncover the technical root of the hack. The 2016 Bitfinex breach was traced to a multisignature wallet vulnerability, while Bybit’s 2025 cold wallet exploit revealed new attack vectors in multisig security. Exchanges analyze logs and system activity to pinpoint weaknesses, whether from leaked private keys, software bugs or exploited smart contracts.

Quantifying financial impact

Exchanges must quickly calculate how much was stolen and which assets were affected. Blockchain analytics firms assist in tracking stolen funds, as seen in KuCoin’s 2020 hack when investigators identified hacker wallets within hours and disclosed them publicly. Knowing the exact financial damage helps exchanges determine their next steps in liquidity management and user compensation.

Securing remaining funds

To prevent further losses, exchanges transfer unaffected assets into new wallets, often switching hot wallets and reinforcing cold storage security. When KuCoin suffered a breach, it abandoned compromised wallets and moved all funds to new secure wallets, ensuring ongoing security. Some exchanges may also halt trading temporarily to prevent market manipulation.

Full damage assessment

With the breach contained, exchanges audit affected user accounts, currencies and potential personal data leaks. Many bring in external cybersecurity firms for deeper forensic analysis. This investigation, typically completed within one to two days, sets the foundation for the exchange’s recovery and compensation plan.

Did you know? Bybit’s February 2025 hack was the largest crypto heist in history, with hackers stealing about $1.5 billion worth of Ethereum during a routine transfer from an offline “cold” wallet to a “warm” wallet.

Liquidity management and fund recovery strategies after exchange hacks

As briefly explored earlier, hacks often lead to an immediate liquidity crisis for an exchange. Customers who hear about a breach may rush to withdraw funds when the exchange has a sudden hole in its balance sheet. Managing solvency and liquidity is a critical step.

Insurance and emergency reserves

Well-prepared exchanges tap into insurance funds or emergency reserves set aside for such events.

Binance provides a textbook example: After $40 million in Bitcoin was stolen in its 2019 hack, Binance announced it would use its reserves to cover the incident in full, assuring that “no user funds will be affected.”

Binance’s Secure Asset Fund for Users (SAFU) — an insurance pool funded by trading fees — absorbed the loss and users were fully reimbursed. This proactive planning kept Binance solvent and preserved user confidence.

Not all exchanges have large insurance funds, so other liquidity strategies come into play.

Corporate capital, loans and investors

One approach is to use corporate capital or seek emergency financing. For instance, in response to the Bybit hack, the exchange demonstrated a commitment to transparency and customer protection. It initiated efforts to trace the stolen funds, with reports indicating that 77% of the stolen assets remain traceable on the blockchain.

Bybit's approach to managing the aftermath of the hack mirrors strategies employed by other exchanges facing security challenges. For example, after a $530 million hack in 2018, Japan’s Coincheck famously used its own capital to reimburse customers to the tune of 46.3 billion yen (about $422 million). This was a massive outlay, but it prevented a loss of customer funds and helped Coincheck avoid bankruptcy.

In South Korea, Bithumb’s $30 million hack in 2018 was similarly met with a promise to “pay back victims using its own reserves,” which experts praised as the right move.

In cases where internal funds aren’t enough, exchanges have turned to external loans or investors to shore up liquidity. A notable case was Liquid Global’s hack in 2021. The Japanese exchange lost around $90 million, raising fears of insolvency. To respond, Liquid secured a $120 million loan from FTX a week later.

This emergency credit provided the liquidity to cover user withdrawals and stabilize operations (FTX went on to acquire Liquid later). Such industry partnerships can act as a backstop in crises, with a bigger exchange or investor acting as a lender of last resort to prevent a domino effect in the market.

Suspension of activity

Exchanges may also temporarily suspend certain services to manage liquidity. It’s common to keep trading open (to avoid wider market panic) but pause withdrawals until a recovery plan is set. This was seen in the Binance case, where trading continued during the week withdrawals were frozen.

Bybit’s 2025 hack response was unusual in that it kept withdrawals and services running uninterrupted, which was possible only because Bybit could immediately guarantee 1:1 reserves for all customers. In most scenarios, some freeze is necessary to prevent a “run on the bank” scenario while the exchange evaluates its financial standing.

Assurances

Finally, communication plays a big role in liquidity management. Exchange executives must convince users and stakeholders that the platform remains solvent. This often involves publishing proof of reserves or making public statements of assurance. Bybit’s leadership, for instance, emphasized that “all client assets are backed one-to-one” despite the $1.5 billion theft, effectively saying they could absorb the hit.

Similarly, Bitfinex in 2016 chose to “generalize” losses across users, implementing a 36% haircut on all accounts but crucially accompanying that with BFX tokens as IOUs to compensate users over time.

That difficult decision kept Bitfinex afloat when a total immediate payout was impossible. Within eight months, Bitfinex had redeemed all the tokens at full value, demonstrating a full recovery and restoration of liquidity.

Fund recovery and user compensation post-exchange hacks

After stabilizing operations and finances, attention turns to recovering the stolen assets and compensating affected users.

Technically, cryptocurrency theft doesn’t always mean the funds are gone forever. The open ledger of blockchain can help track and sometimes reclaim assets. Exchanges often collaborate with blockchain analytics firms and law enforcement to trace stolen funds.

In many instances, the hacker’s addresses are flagged within hours. For example, within 18 minutes of Bybit confirming its hack, investigators had identified the hacker’s wallet and were tracking movements. Similarly, KuCoin quickly published the wallet addresses the thief used, enabling a global effort to monitor and freeze the funds.

Cooperation with other industry players is vital in fund recovery. Because hackers typically try to launder funds through other exchanges or swap services, exchanges worldwide form a defensive alliance. As mentioned, major platforms may blacklist addresses linked to hacks, effectively freezing the stolen assets in place if the hacker attempts to cash out on a compliant exchange.

In the KuCoin 2020 hack (~$285 million stolen), this collaboration paid off: Tether blacklisted about $22 million USDT belonging to the hacker, and numerous crypto projects like Ocean Protocol, Aave and others either disabled or upgraded their contracts to render the thief’s tokens unusable.

Through these collective actions, an estimated 84% of KuCoin’s stolen funds were eventually recovered. KuCoin’s insurance fund covered the remaining gap, so users were fully compensated.

In some extraordinary cases, negotiation with the attackers can lead to fund returns. Crypto history has seen “white hat” hackers who return money for a bounty or even outright negotiations where a portion is returned to avoid prosecution. The Poly Network hack of 2021 is a striking example (though it was a DeFi platform, not a centralized exchange): A hacker exploited $610 million due to a code flaw, then communicated with Poly Network and returned nearly all funds after being offered a reward and a security adviser position.

While exchanges typically involve law enforcement rather than pay ransoms, they have also offered bug bounties for information leading to recovery. For instance, Bitfinex offered rewards to hackers or informants after its 2016 hack. Years later, the US DOJ seized a significant portion (94,000 BTC) of the Bitfinex stolen funds in 2022, which are now pending return through legal processes.

User compensation is the flip side of fund recovery. If users lose assets, how and when will they be made whole? The ideal scenario is immediate full reimbursement, as done by Binance, Coincheck, Upbit, Bithumb, KuCoin and others discussed earlier.

In cases where not all funds can be recovered or instantly repaid, exchanges have innovated, like when Bitfinex issued BFX tokens (essentially debt tokens) to customers equal to their loss, which were tradable and later redeemable.

Did you know? Mt. Gox, unfortunately, exemplified the worst case: it went into bankruptcy, and users have waited years for partial refunds through legal bankruptcy proceedings. (Mt. Gox’s trustee is still distributing the recovered coins as of Feb.2025, illustrating the slow path of legal compensation.)

Regulatory and compliance actions following a major exchange hack

Major hacks invariably draw the attention of regulators and law enforcement, adding another dimension to crisis response.

Exchanges must navigate legal obligations to report hacks and often solicit help from authorities to investigate. In many jurisdictions, a hack triggers an automatic review by financial regulators. For example, following the $530 million Coincheck hack in Japan, the Financial Services Agency (FSA) immediately issued an administrative order requiring Coincheck to improve operations and protect clients.

The FSA even raided Coincheck’s offices a week later to ensure evidence was preserved and that the exchange was taking proper steps. This level of direct regulatory action underscores how serious such incidents are viewed in regulated markets.

Working with regulators can also help an exchange in crisis. Officials may allow an exchange to continue operating under supervision if they believe the team is acting in good faith to resolve the issue (Coincheck was allowed to keep running while it formulated a compensation plan under FSA oversight).

However, if negligence is suspected, regulators can suspend licenses or even force operations to halt to protect consumers. In South Korea, after incidents like the Bithumb hack, government agencies like KISA (Korea Internet and Security Agency) got involved to investigate security lapses. Exchanges are generally expected to report breaches promptly under cybersecurity and financial regulations, and failure to do so can result in penalties.

Law enforcement plays an important role, especially for international hacks. Exchanges often coordinate with police, cybercrime units, and agencies like the FBI or Interpol.

Bybit’s 2025 hack, for example, saw the exchange collaborating with regulators and law enforcement to address the hack, setting an example of public-private partnership in cyber investigations. Such cooperation can facilitate freezing assets across borders and increase the chances of catching the perpetrators. It also helps exchanges demonstrate compliance and due diligence, which may be critical for maintaining their operating licenses.

High-profile hacks often become catalysts for regulatory change. After the Mt. Gox collapse in 2014, Japan was among the first countries to introduce a licensing regime for crypto exchanges. By 2017, exchanges in Japan had to register with the FSA and meet minimum standards for security, asset segregation and audits. The Coincheck hack then prompted the FSA to tighten those rules further (and led to the formation of a self-regulatory body to oversee exchanges).

Regulators in other countries also pay attention: A massive hack might lead to new guidance on how much of an exchange’s funds must be kept in cold storage, requirements for proof-of-reserves or mandatory insurance coverage.

In the US, while there isn’t a federal exchange license yet, a hack affecting US customers could invite SEC or CFTC scrutiny, and certainly, state regulators would ask questions if the exchange was under their jurisdiction.

How crypto exchanges strengthen security after hacks

Surviving a hack forces exchanges to overhaul security, improve risk management and adopt best practices to prevent future breaches.

Key improvements include:

While hacks remain a threat, past incidents have driven major improvements in crisis management and user protection, strengthening trust in the crypto ecosystem.

Ripple’s price is experiencing a recovery following its deep correction over the past month. However, key obstacles still remain in front of the price for creating a new higher high.

By Edris Derakhshi (TradingRage)The USDT Paired Chart

On the USDT pair’s daily timeframe, XRP has lost around a third of its value since failing to stay above the $3 level.

Yet, the $2 support zone has held the market, and the price is now rebounding and moving toward the $3 level once more. If the asset breaks above this area, a rally toward the $3.5 mark would be highly probable in the coming weeks.

Looking at the XRP/BTC pair, things are looking quite similar, as Ripple’s token is recovering and rising toward the 3400 SAT resistance level. With the 2800 SAT area now acting as a support level, it is highly probable for the market to reach and even break through the 3400 SAT level.

The RSI is also indicating that the momentum is bullish, further adding to the probability of such a bullish scenario.

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 2966.55, up 1.0% (+29.05) since 4 p.m. ET on Wednesday.

Ten of 20 assets are trading higher.

Leaders: NEAR (+4.4%) and XRP (+4.0%).

Laggards: ADA (-5.6%) and APT (-5.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.

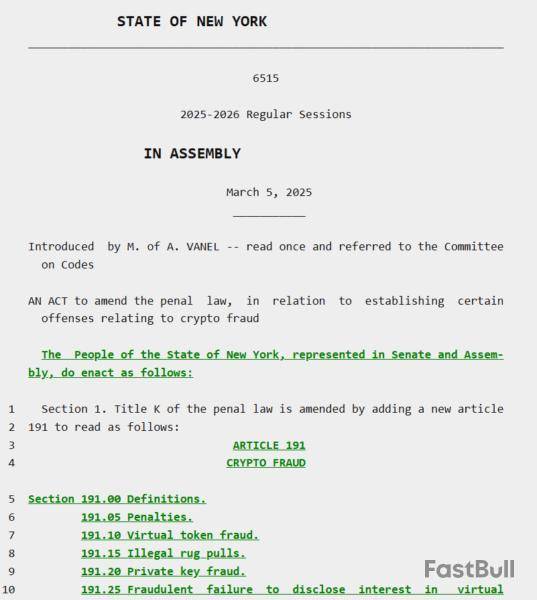

New York lawmakers have introduced legislation aimed at protecting cryptocurrency investors by targeting scams known as rug pulls, where project insiders abruptly abandon a project and drain investor funds.

Assemblyman Clyde Vanel, chair of the New York Assembly’s Banks Committee, introduced Bill A06515 on Wednesday, March 5. The bill would establish criminal penalties specifically aimed at preventing cryptocurrency fraud and protecting investors from what the industry calls “rug pulls” — schemes where project insiders abruptly withdraw investors’ funds and abandon the project.

Under the proposal, new criminal charges would be created for offenses involving “virtual token fraud,” explicitly targeting deceptive practices associated with cryptocurrencies.

“Virtual tokens” refer to security tokens and stablecoins, while “security tokens” include “any form of fungible and non-fungible computer code by which all such forms of ownership of said computer code is determined through verification of transactions or any derivative method, and that is stored on a peer-to-peer computer network.”

The bill comes shortly after widespread investor disappointment in memecoins, particularly after the launch of the Libra token, which was endorsed by Argentine President Javier Milei.

The project’s insiders allegedly siphoned over $107 million worth of liquidity in a rug pull, triggering a 94% price collapse within hours and wiping out $4 billion in investor capital.

The growing wave of Solana-based memecoin scams led to a crypto capital flight to “safety” which resulted in over $485 million in outflows for Solana during February.

Rug pulls “should fall firmly within the jurisdiction of law enforcement”

The rise of memecoin-related scams presents significant regulatory challenges, according to Anastasija Plotnikova, co-founder and CEO of blockchain regulatory firm Fideum.

Insider scams and “outright fraudulent activities” like rug pulls, which are “not only unethical but also clearly illegal, with case law to support enforcement,” should see more thorough regulatory attention, Plotnikova told Cointelegraph, adding:

More troubling revelations have emerged since the meltdown of the Milei-endorsed Libra token, notably that Libra was an “open secret” in memecoin insider circles and that some members of the Jupiter decentralized exchange knew about the token launch two weeks in advance.

Bitwise, the cryptocurrency index fund manager, has made its first DeFi allocation via Maple Finance, the onchain credit platform. According to an announcement on Thursday, the partnership will provide Bitwise’s institutional clients access to compliant, onchain investment opportunities.

The partnership highlights a growing trend of institutional capital moving beyond traditional fixed-income products into onchain credit opportunities tailored to their risk profiles. "This marks a pivotal step as institutional capital increasingly seeks structured, transparent and yield-generating opportunities within the digital asset space," Bitwise wrote in a statement.

Crypto lending is a complicated industry that has seen a number of bankruptcies, including by centralized credit firms like BlockFi and Celsius. In theory, bringing the activity onchain increases transparency and decreases the risks of human bias during defaults.

"In 2022, I would say overall leverage was much higher in the market than where it sits today," Maple founder Sid Powell told The Block. "The problem with that was it exacerbated contagion because you would have people borrowing from each other and then lending to third parties, causing too much interconnectivity between different lending partners."

Maple issues over- and under-collateralized loans backed by digital assets and has delivered fairly consistent, risk-adjusted yields since launching in 2021. The protocol launched its SYRUP token in 2024, offering a way for holders to participate in governance as well as stake the asset to secure the protocol while earning rewards.

Powell noted that "at this point" the protocol mostly manages over-collateralized loans in a departure from its original focus on under-collateralized lending. "When we entered the market back in 2021, over-collateralized was already very saturated," he said. The protocol has about $620 million in total value locked.

"What we do a bit differently, though, from others is that we segregate the pools," Powell said. "So if you're risk-averse, you can have a strategy where you're only putting your dollars into Bitcoin and ETH-backed loans. If you're willing to get paid a little bit more to take a little bit more risk, you can put it into a pool that will do loans against Solana or XRP."

In January, Maple launched a "Lend + Long" structured yield product that buys bitcoin call options using revenue from its high-yield lending pool. The product was marketed towards institutional investors, corporate treasuries and yield funds. In 2023, it launched a direct lending arm called Maple Direct.

Launched in 2017, Bitwise manages a suite of index funds and actively managed investment products including ETFs, separately managed accounts, private funds and staking products. It counts "thousands" of financial advisors, family offices and institutional investors as clients. The company, which claims to manage $12 billion in client assets, has been particularly active in filing alternative crypto ETFs in recent months, including products that would give investors exposure to APT and XRP tokens.

Last month, Bitwise raised $70 million from a host of investors including Electric Capital, MassMutual and Haun Ventures, according to a social media post.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

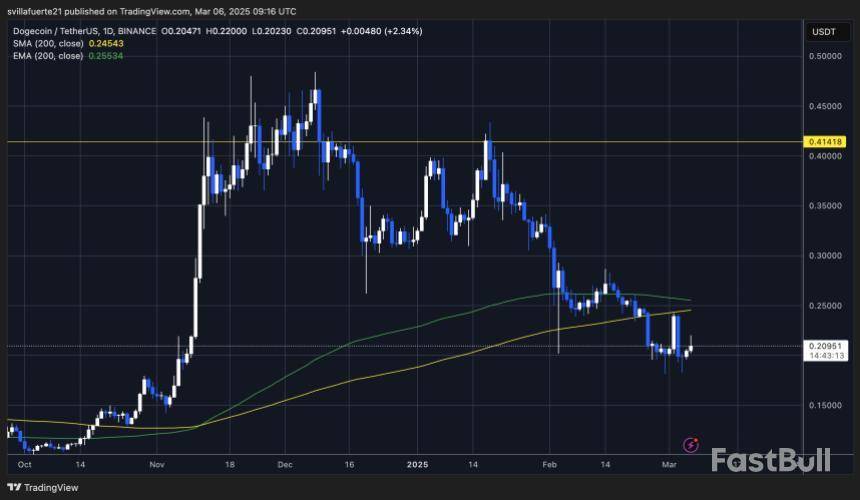

Dogecoin (DOGE) is currently trading below the $0.25 level after experiencing massive volatility and price swings in recent days. As the crypto market faces a broad correction, meme coins, including DOGE, have been some of the most affected assets, with bulls struggling to regain momentum.

Despite multiple attempts to push higher, DOGE has remained under pressure, failing to reclaim key resistance levels. Investors are closely watching whether bulls can regain control or if further downside is ahead. The uncertainty has left traders cautious, with many waiting for a strong signal of recovery before re-entering the market.

Crypto analyst, Ali Martinez, shared insights on X, revealing that Dogecoin may be gearing up for a rebound. According to his analysis, the TD Sequential indicator has flashed a buy signal on a high time frame, suggesting that DOGE could be nearing a potential reversal. If bulls step in at current levels and capitalize on this setup, DOGE could see a strong recovery in the coming days.

Is Dogecoin Preparing For A Recovery Rally?

Dogecoin has been at its lowest since late 2024 as bullish sentiment fades, following a 60% decline from its multi-year high of $0.48. The correction has been brutal, with meme coins bleeding the most amid broader market weakness. DOGE now struggles to reclaim crucial liquidity levels, making it difficult to start a recovery rally.

Market participants are closely watching for a decisive move, as analysts and investors remain on the sidelines, waiting for confirmation of either a break above crucial supply or a breakdown below current demand levels. Until a clear trend is established, uncertainty dominates DOGE’s price action.

Despite the bearish outlook, Martinez’s insights suggest Dogecoin may be gearing up for a rebound. According to his analysis, the TD Sequential indicator has flashed a buy signal on the 4-day chart, which could indicate that selling exhaustion is near.

The TD Sequential is a well-regarded technical analysis tool that helps traders identify trend exhaustion and potential price reversals. On higher time frames, this indicator has historically been very effective, meaning this could present a major buying opportunity if DOGE follows its typical pattern.

As market sentiment remains mixed, traders are keeping a close eye on DOGE’s next major move. If buyers step in and confirm the TD Sequential’s buy signal, Dogecoin could see a strong recovery in the coming days. However, failure to reclaim key levels may lead to further downside pressure, delaying any meaningful rebound.

DOGE Holding Crucial Demand

Dogecoin is currently trading at $0.209 after a period of volatile price swings, briefly dipping below $0.20 before recovering above $0.22. The market remains uncertain, with bulls attempting to regain control after weeks of selling pressure.

For DOGE to confirm a strong recovery, bulls must reclaim the $0.25 level and establish it as a solid support zone. This would open the door for a push above the 200-day Moving Average (MA) and Exponential Moving Average (EMA), key resistance levels that could trigger a breakout to higher price targets. If DOGE successfully clears these technical barriers, momentum could shift in favor of buyers, leading to a more sustained uptrend.

However, losing the $0.20 level again would be a bearish signal as it would indicate a lack of strong demand at current prices. If this scenario plays out, DOGE could drop further into lower demand levels around $0.14, a price zone that previously acted as a major accumulation area.

Featured image from Dall-E, chart from TradingView

A senior Russian official has stated that sanctions will not fully prevent Russians from accessing the cryptocurrency market or using it to bypass sanctions.

Deputy Head of the State Duma Committee on Information Policy Anton Gorelkin stated that it is impossible to completely block the cryptocurrency market for Russians. He also noted that cryptocurrencies will continue to be one of the most effective tools for circumventing sanctions.

According to TASS, Gorelkin wrote on his Telegram channel, "It should be acknowledged that it is impossible to fully block the cryptocurrency market for Russia, and cryptocurrencies will remain one of the most effective tools for bypassing sanctions, although USDT can be safely crossed off this list."

Sanctions imposed on Russian crypto exchange Garantex

Gorelkin’s comments came amid EU sanctions targeting the Garantex cryptocurrency exchange. He expressed his belief that the recent sanctions will not be the last instance of Western countries applying pressure on various aspects of cryptocurrency infrastructure for political purposes.

In February, the European Union imposed sanctions on the Russia-based Garantex exchange, which has been under U.S. sanctions since April 2022. The EU's sanctions package targeted Garantex for its "close association with EU-sanctioned Russian banks."

“This package continues targeting actors responsible for circumventing EU sanctions, including through third countries,” the EU announcement read. “The European Union remains ready to step up pressure on Russia.”

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。