行情

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

【数字货币市场周日冲高回落】目前,Marketvectortm数字资产100小盘指数涨3.35%,暂报2678.70点,北京时间10:07曾达到2799.63点,随后逐步回吐涨幅。Marketvectortm数字资产100中盘指数涨2.00%,报2717.02点,曾在10:07达到2830.33点。Marketvector数字资产100指数涨2.67%,报13431.13点,10:46曾涨至13784.24点。目前,Solana涨0.38%,狗狗币跌1.11%,Xrp跌0.39%。比特币跌0.68%,暂报66395美元;以太坊涨1.06%,暂报1982美元。

法国PPI月率 (1月)

法国PPI月率 (1月)公:--

预: --

德国失业率 (季调后) (2月)

德国失业率 (季调后) (2月)公:--

预: --

前: --

印度GDP年率

印度GDP年率公:--

预: --

前: --

印度季度GDP年率 (第三季度)

印度季度GDP年率 (第三季度)公:--

预: --

前: --

法国失业人数 (Class A) (1月)

法国失业人数 (Class A) (1月)公:--

预: --

前: --

印度存款增长年率

印度存款增长年率公:--

预: --

前: --

墨西哥贸易账 (1月)

墨西哥贸易账 (1月)公:--

预: --

前: --

南非贸易账 (1月)

南非贸易账 (1月)公:--

预: --

前: --

德国CPI月率初值 (2月)

德国CPI月率初值 (2月)公:--

预: --

前: --

德国HICP月率初值 (2月)

德国HICP月率初值 (2月)公:--

预: --

前: --

德国CPI年率初值 (2月)

德国CPI年率初值 (2月)公:--

预: --

前: --

德国HICP年率初值 (2月)

德国HICP年率初值 (2月)公:--

预: --

前: --

美国PPI月率终值 (不含食品、能源和贸易) (季调后) (1月)

美国PPI月率终值 (不含食品、能源和贸易) (季调后) (1月)公:--

预: --

美国PPI年率 (不含食品、能源和贸易) (1月)

美国PPI年率 (不含食品、能源和贸易) (1月)公:--

预: --

前: --

加拿大GDP季率 (季调后) (第四季度)

加拿大GDP季率 (季调后) (第四季度)公:--

预: --

前: --

加拿大年度GDP季率 (季调后) (第四季度)

加拿大年度GDP季率 (季调后) (第四季度)公:--

预: --

前: --

加拿大GDP年率 (季调后) (第四季度)

加拿大GDP年率 (季调后) (第四季度)公:--

预: --

前: --

美国核心PPI月率 (季调后) (1月)

美国核心PPI月率 (季调后) (1月)公:--

预: --

加拿大GDP月率 (季调后) (12月)

加拿大GDP月率 (季调后) (12月)公:--

预: --

前: --

美国PPI月率 (季调后) (1月)

美国PPI月率 (季调后) (1月)公:--

预: --

美国核心PPI年率 (1月)

美国核心PPI年率 (1月)公:--

预: --

前: --

加拿大GDP年率 (12月)

加拿大GDP年率 (12月)公:--

预: --

前: --

美国PPI年率 (1月)

美国PPI年率 (1月)公:--

预: --

前: --

加拿大GDP平减指数季率 (第四季度)

加拿大GDP平减指数季率 (第四季度)公:--

预: --

前: --

美国芝加哥PMI (2月)

美国芝加哥PMI (2月)公:--

预: --

前: --

美国建筑支出月率 (12月)

美国建筑支出月率 (12月)公:--

预: --

加拿大联邦政府预算余额 (12月)

加拿大联邦政府预算余额 (12月)公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

韩国贸易账初值 (2月)

韩国贸易账初值 (2月)公:--

预: --

日本制造业PMI终值 (2月)

日本制造业PMI终值 (2月)--

预: --

前: --

印度尼西亚IHS Markit 制造业PMI (2月)

印度尼西亚IHS Markit 制造业PMI (2月)--

预: --

前: --

印度尼西亚贸易账 (1月)

印度尼西亚贸易账 (1月)--

预: --

前: --

印度尼西亚核心通胀年率 (2月)

印度尼西亚核心通胀年率 (2月)--

预: --

前: --

印度尼西亚通胀年率 (2月)

印度尼西亚通胀年率 (2月)--

预: --

前: --

印度HSBC 制造业PMI终值 (2月)

印度HSBC 制造业PMI终值 (2月)--

预: --

前: --

澳大利亚商品价格年率 (2月)

澳大利亚商品价格年率 (2月)--

预: --

前: --

俄罗斯IHS Markit 制造业PMI (2月)

俄罗斯IHS Markit 制造业PMI (2月)--

预: --

前: --

英国Nationwide住宅销售价格指数月率 (2月)

英国Nationwide住宅销售价格指数月率 (2月)--

预: --

前: --

英国Nationwide住宅销售价格指数年率 (2月)

英国Nationwide住宅销售价格指数年率 (2月)--

预: --

前: --

土耳其GDP年率 (第四季度)

土耳其GDP年率 (第四季度)--

预: --

前: --

德国实际零售销售月率 (1月)

德国实际零售销售月率 (1月)--

预: --

前: --

土耳其制造业PMI (2月)

土耳其制造业PMI (2月)--

预: --

前: --

意大利制造业PMI (季调后) (2月)

意大利制造业PMI (季调后) (2月)--

预: --

前: --

南非制造业PMI (2月)

南非制造业PMI (2月)--

预: --

前: --

欧元区制造业PMI终值 (2月)

欧元区制造业PMI终值 (2月)--

预: --

前: --

英国M4货币供应量月率 (1月)

英国M4货币供应量月率 (1月)--

预: --

前: --

英国M4货币供应量年率 (1月)

英国M4货币供应量年率 (1月)--

预: --

前: --

英国央行抵押贷款发放额 (1月)

英国央行抵押贷款发放额 (1月)--

预: --

前: --

英国央行抵押贷款许可 (1月)

英国央行抵押贷款许可 (1月)--

预: --

前: --

英国M4货币供应量 (季调后) (1月)

英国M4货币供应量 (季调后) (1月)--

预: --

前: --

英国制造业PMI终值 (2月)

英国制造业PMI终值 (2月)--

预: --

前: --

印度制造业产出月率 (1月)

印度制造业产出月率 (1月)--

预: --

前: --

印度工业生产指数年率 (1月)

印度工业生产指数年率 (1月)--

预: --

前: --

巴西IHS Markit 制造业PMI (2月)

巴西IHS Markit 制造业PMI (2月)--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

欧洲央行行长拉加德发表讲话

欧洲央行行长拉加德发表讲话 加拿大制造业PMI (季调后) (2月)

加拿大制造业PMI (季调后) (2月)--

预: --

前: --

美国IHS Markit 制造业PMI终值 (2月)

美国IHS Markit 制造业PMI终值 (2月)--

预: --

前: --

美国纽约联储主席威廉姆斯发表讲话

美国纽约联储主席威廉姆斯发表讲话 美国ISM库存指数 (2月)

美国ISM库存指数 (2月)--

预: --

前: --

是的,兄弟,找些简单的语言就行了。

是的,兄弟,找些简单的语言就行了。

无匹配数据

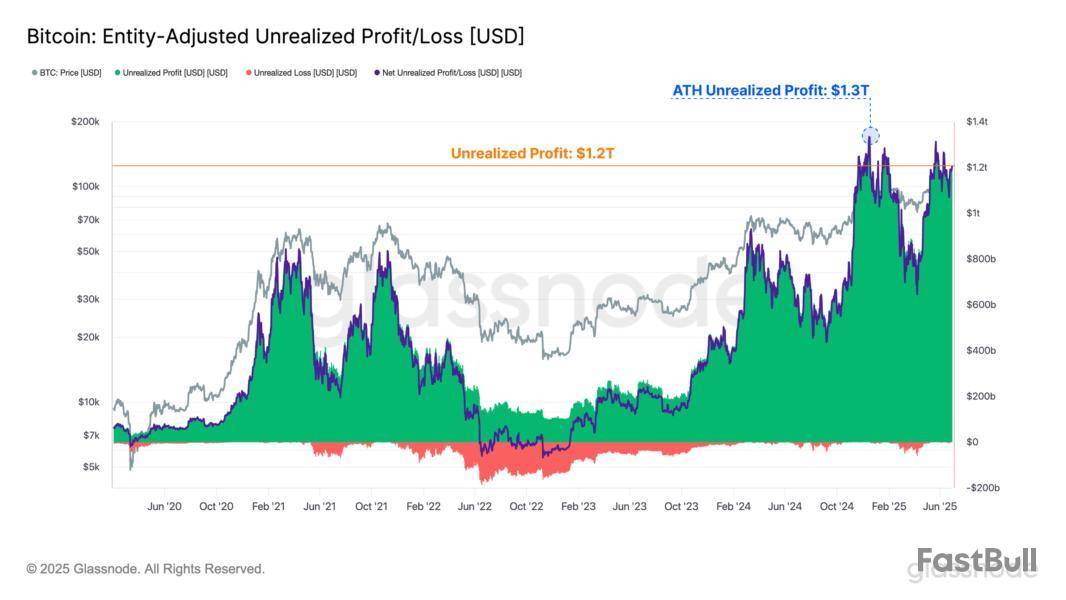

Bitcoin investors are currently holding an estimated $1.2 trillion in unrealized profits, according to on-chain analytics platform Glassnode.

This significant figure highlights the paper gains accumulated by long-term holders as Bitcoin continues to trade close to its record highs.

Bitcoin Investor Base Shifts From Traders to Long-Term Institutional Allocators

Glassnode data reveals that the average unrealized profit per investor stands at around 125%, which is lower than the 180% seen in March 2024, when the BTC price reached a peak of $73,000.

However, despite these massive unrealized gains, investor behavior suggests no major rush to sell the top crypto. BeInCrypto previously reported that daily realized profits have remained relatively subdued, averaging just $872 million.

This starkly contrasts previous price surges, when realized gains surged to between $2.8 billion and $3.2 billion at BTC price points of $73,000 and $107,000, respectively.

Moreover, current market sentiment suggests that investors are waiting for a more decisive price movement before adjusting their upward or downward positions. The trend points to firm conviction among long-term holders, with accumulation continuing to outweigh selling pressure.

“This underscores that HODLing remains the dominant market behavior amongst investors, with accumulation and maturation flows significantly outweighing distribution pressures,” Glassnode stated.

Meanwhile, Bitcoin analyst Rezo noted that the current trend reflects a fundamental shift in the significantly evolved profile of Bitcoin holders. According to him, the typical BTC holder has shifted from short-term speculative traders to long-term institutional investors and allocators.

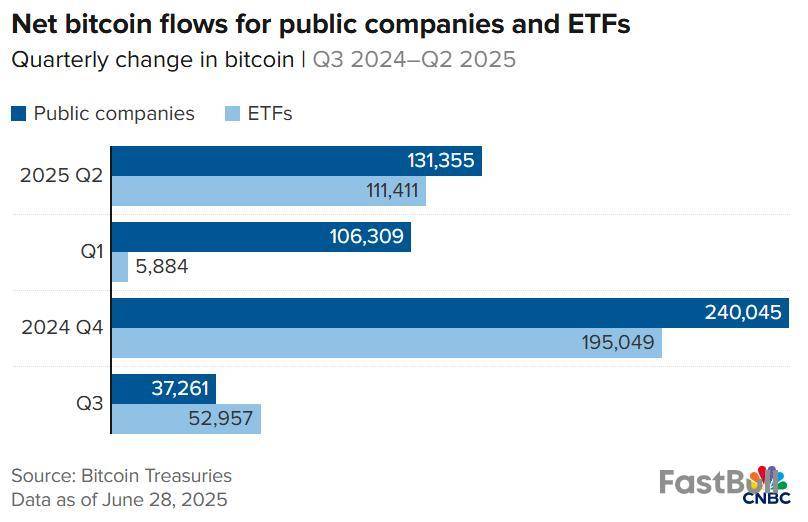

Rezo pointed to the increasing influence of institutional players such as ETFs and public companies like Strategy (formerly MicroStrategy).

“The holder base has changed – from traders seeking exit to allocators seeking exposure. MicroStrategy, sitting on tens of billions in unrealized gains, keeps adding. ETFs = constant bid, not swing traders,” he said.

Notably, public companies like Strategy increased their Bitcoin holdings by 18% in Q2, while ETF exposure to Bitcoin climbed by 8% in the same period.

Considering this, Rezo concluded that most short-term sellers likely exited between $70,000 and $100,000. He added that what remains are investors who treat Bitcoin less as a speculative trade and more as a strategic long-term allocation.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。