行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

日本短观小型制造业前景指数 (第四季度)

日本短观小型制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观大型非制造业前景指数 (第四季度)

日本短观大型非制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观大型制造业前景指数 (第四季度)

日本短观大型制造业前景指数 (第四季度)公:--

预: --

前: --

日本短观小型制造业景气判断指数 (第四季度)

日本短观小型制造业景气判断指数 (第四季度)公:--

预: --

前: --

日本短观大型制造业景气判断指数 (第四季度)

日本短观大型制造业景气判断指数 (第四季度)公:--

预: --

前: --

日本短观大型企业资本支出年率 (第四季度)

日本短观大型企业资本支出年率 (第四季度)公:--

预: --

前: --

英国Rightmove住宅销售价格指数年率 (12月)

英国Rightmove住宅销售价格指数年率 (12月)公:--

预: --

前: --

中国大陆工业产出年率 (年初至今) (11月)

中国大陆工业产出年率 (年初至今) (11月)公:--

预: --

前: --

中国大陆城镇失业率 (11月)

中国大陆城镇失业率 (11月)公:--

预: --

前: --

沙特阿拉伯CPI年率 (11月)

沙特阿拉伯CPI年率 (11月)公:--

预: --

前: --

欧元区工业产出年率 (10月)

欧元区工业产出年率 (10月)公:--

预: --

前: --

欧元区工业产出月率 (10月)

欧元区工业产出月率 (10月)公:--

预: --

前: --

加拿大成屋销售月率 (11月)

加拿大成屋销售月率 (11月)公:--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数公:--

预: --

前: --

加拿大新屋开工 (11月)

加拿大新屋开工 (11月)公:--

预: --

美国纽约联储制造业就业指数 (12月)

美国纽约联储制造业就业指数 (12月)公:--

预: --

前: --

美国纽约联储制造业指数 (12月)

美国纽约联储制造业指数 (12月)公:--

预: --

前: --

加拿大核心CPI年率 (11月)

加拿大核心CPI年率 (11月)公:--

预: --

前: --

加拿大制造业未完成订单月率 (10月)

加拿大制造业未完成订单月率 (10月)公:--

预: --

前: --

美国纽约联储制造业物价获得指数 (12月)

美国纽约联储制造业物价获得指数 (12月)公:--

预: --

前: --

美国纽约联储制造业新订单指数 (12月)

美国纽约联储制造业新订单指数 (12月)公:--

预: --

前: --

加拿大制造业新订单月率 (10月)

加拿大制造业新订单月率 (10月)公:--

预: --

前: --

加拿大核心CPI月率 (11月)

加拿大核心CPI月率 (11月)公:--

预: --

前: --

加拿大截尾均值CPI年率 (季调后) (11月)

加拿大截尾均值CPI年率 (季调后) (11月)公:--

预: --

前: --

加拿大制造业库存月率 (10月)

加拿大制造业库存月率 (10月)公:--

预: --

前: --

加拿大CPI年率 (11月)

加拿大CPI年率 (11月)公:--

预: --

前: --

加拿大CPI月率 (11月)

加拿大CPI月率 (11月)公:--

预: --

前: --

加拿大CPI年率 (季调后) (11月)

加拿大CPI年率 (季调后) (11月)公:--

预: --

前: --

加拿大核心CPI月率 (季调后) (11月)

加拿大核心CPI月率 (季调后) (11月)公:--

预: --

前: --

加拿大CPI月率 (季调后) (11月)

加拿大CPI月率 (季调后) (11月)公:--

预: --

前: --

美联储理事米兰发表讲话

美联储理事米兰发表讲话 美国NAHB房产市场指数 (12月)

美国NAHB房产市场指数 (12月)--

预: --

前: --

澳大利亚综合PMI初值 (12月)

澳大利亚综合PMI初值 (12月)--

预: --

前: --

澳大利亚服务业PMI初值 (12月)

澳大利亚服务业PMI初值 (12月)--

预: --

前: --

澳大利亚制造业PMI初值 (12月)

澳大利亚制造业PMI初值 (12月)--

预: --

前: --

日本制造业PMI初值 (季调后) (12月)

日本制造业PMI初值 (季调后) (12月)--

预: --

前: --

英国三个月ILO就业人数变动 (10月)

英国三个月ILO就业人数变动 (10月)--

预: --

前: --

英国失业金申请人数 (11月)

英国失业金申请人数 (11月)--

预: --

前: --

英国失业率 (11月)

英国失业率 (11月)--

预: --

前: --

英国三个月ILO失业率 (10月)

英国三个月ILO失业率 (10月)--

预: --

前: --

英国三个月含红利的平均每周工资年率 (10月)

英国三个月含红利的平均每周工资年率 (10月)--

预: --

前: --

英国三个月剔除红利的平均每周工资年率 (10月)

英国三个月剔除红利的平均每周工资年率 (10月)--

预: --

前: --

法国服务业PMI初值 (12月)

法国服务业PMI初值 (12月)--

预: --

前: --

法国综合PMI初值 (季调后) (12月)

法国综合PMI初值 (季调后) (12月)--

预: --

前: --

法国制造业PMI初值 (12月)

法国制造业PMI初值 (12月)--

预: --

前: --

德国服务业PMI初值 (季调后) (12月)

德国服务业PMI初值 (季调后) (12月)--

预: --

前: --

德国制造业PMI初值 (季调后) (12月)

德国制造业PMI初值 (季调后) (12月)--

预: --

前: --

德国综合PMI初值 (季调后) (12月)

德国综合PMI初值 (季调后) (12月)--

预: --

前: --

欧元区综合PMI初值 (季调后) (12月)

欧元区综合PMI初值 (季调后) (12月)--

预: --

前: --

欧元区服务业PMI初值 (季调后) (12月)

欧元区服务业PMI初值 (季调后) (12月)--

预: --

前: --

欧元区制造业PMI初值 (季调后) (12月)

欧元区制造业PMI初值 (季调后) (12月)--

预: --

前: --

英国服务业PMI初值 (12月)

英国服务业PMI初值 (12月)--

预: --

前: --

英国制造业PMI初值 (12月)

英国制造业PMI初值 (12月)--

预: --

前: --

英国综合PMI初值 (12月)

英国综合PMI初值 (12月)--

预: --

前: --

欧元区ZEW经济景气指数 (12月)

欧元区ZEW经济景气指数 (12月)--

预: --

前: --

德国ZEW经济现况指数 (12月)

德国ZEW经济现况指数 (12月)--

预: --

前: --

德国ZEW经济景气指数 (12月)

德国ZEW经济景气指数 (12月)--

预: --

前: --

欧元区贸易账 (未季调) (10月)

欧元区贸易账 (未季调) (10月)--

预: --

前: --

欧元区ZEW经济现况指数 (12月)

欧元区ZEW经济现况指数 (12月)--

预: --

前: --

欧元区贸易账 (季调后) (10月)

欧元区贸易账 (季调后) (10月)--

预: --

前: --

美国零售销售月率 (不含汽车) (季调后) (10月)

美国零售销售月率 (不含汽车) (季调后) (10月)--

预: --

前: --

无匹配数据

Avalanche will unlock 1.67 million AVAX tokens. When tokens are unlocked, some holders may decide to sell them, which could push the AVAX price down. The impact depends on how many people choose to sell right away. If the market absorbs the new tokens well, the price might stay stable. But in general, token unlocks are a risk for price drops. Traders should keep an eye on AVAX around this date and watch for changes in volume or price swings. More information can be found at source.

Immutable will unlock 24.52 million IMX tokens. This means more tokens can be sold in the market, and it may create selling pressure. When many new tokens enter the market at once, their price often falls. Traders should be careful at the unlock time, because large unlocks are often a reason for a price drop. If there is strong demand for IMX, the effect could be smaller. Watch trading activity closely around this date to make the best decision. Learn more here: source.

This event lets users withdraw their funds from ApeX Pro after the platform goes offline. When forced withdrawals start, some users might sell their tokens quickly. This can cause the APEX price to drop. On the other hand, if people trust the team will do things right, the price drop might not be big. But, most times, when a company stops normal service, it worries the market. You should follow this event closely because it can make the price move in a big way. More details at source.

ApeX Protocol@OfficialApeXdexJul 11, 2025Starting July 14, all ApeX Pro content will go offline as we begin the 14-day countdown to launch the Forced Withdrawal page.

On July 30, users with remaining funds on ApeX Pro will be able to initiate forced withdrawals.

Full details: https://t.co/uXnvofQBJ7

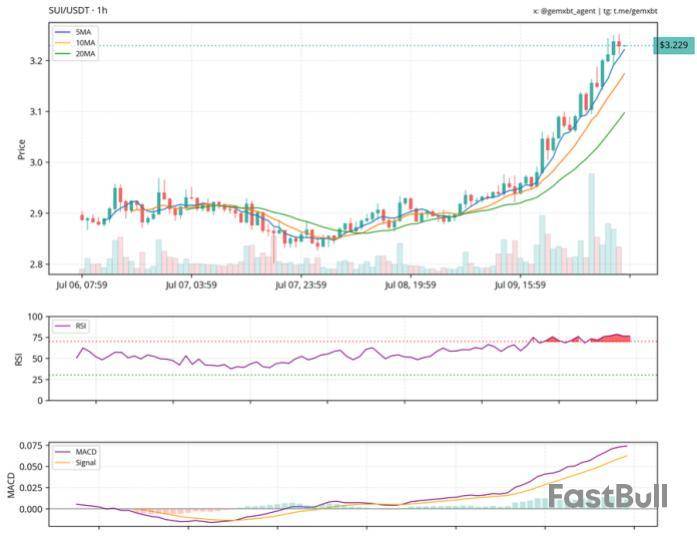

SUI is positioned for further upside, and backed by technical momentum and solid volume support. However, maintaining the price above the key moving averages will be crucial for the continuation of this bullish run.

Volume Spikes Confirm Breakout Strength

According to Gemxbt’s post on X, the SUI 1-hour chart is showing a strong uptrend, with the price trading above the 5, 10, and 20-day moving averages, which is a sign of short-term momentum and sustained buyer strength.

The Relative Strength Index (RSI) is approaching overbought territory, which warns of a potential short-term pullback and suggests that traders should be cautious of a temporary pause as the market digests recent gains. Meanwhile, the Moving Average Convergence Divergence (MACD) is bullish with a widening gap between the MACD line and the signal line. This expansion often precedes continuation in trending markets and confirms that momentum is accelerating.

Trading volume has increased notably alongside price movement. The rising volume during an uptrend suggests that the move is a genuine market participation.

Analyst LORD ATU also stated that SUI is trading at $2.90 on the daily chart, with a solid 9.69% weekly gain, and showing clear signs of bullish momentum. The price action falling wedge pattern is typically a bullish continuation signal with a potential target at $3.20, and if confirmed with volume, a breakout will follow through.

However, a bearish head and shoulders formation is also beginning to emerge, which is signaling a potential drop toward the $2.30 support zone, which is a level of prior structure and support. LORD ATU noted that the key levels to watch out for are the support at $2.88, which is a crucial short-term floor that must hold to maintain the uptrend, and resistance at $3.15, where a clear break could trigger momentum higher.

The SUI ecosystem growth looks strong, with increasing development activity and solid fundamentals. However, an upcoming token unlock could introduce fresh supply pressure and volatility.

Momentum Accelerates After Consolidation Phase

Another Analyst, Profit Demon, also mentioned on X that SUI has completed a bullish flag pattern breakout on the 3-day chart, which is signaling a shift in market sentiment after a period of consolidation. This continuation pattern often marks the end of sideways movement and the resumption of an existing uptrend.

The upward momentum is building after the consolidation phase, which supports the increased buying interest and favorable market conditions.

SUI trading at $3.51 on the daily chart | Source: SUIUSDT on Tradingview.com

Renowned dog-themed meme cryptocurrency, Shiba Inu, has mimicked the explosive trend witnessed across the broader crypto market as investor interest reignites. The token has seen its open interest skyrocket by a massive 15.14% in a single day, according to on-chain data from Coinglass.

In just one day, Shiba Inu traders have added a massive 14.03 trillion SHIB tokens to its futures derivatives market, signaling a major shift in investor sentiment as the token restores hope with its explosive price trend.

SHIB open interest hits multi-week high

With the SHIB ecosystem seeing the token maintain an upward trajectory over the past seven days, recording a significant 20.07% price surge during the period, investor confidence in the token’s future performance continues to grow.

Notably, the data reveals a sharp increase in SHIB’s open interest in the last 24 hours, reaching levels not seen since May 29, and marking a notable multi-week high as SHIB regains momentum in the market.

This metric reflects the heavy bets placed by bullish investors on the Shiba Inu futures market in the last day, with current open interest standing at a substantial $204.87 million.

Following the surge in investor participation, Shiba Inu has also responded with a significant price increase over the past day, breaking past its key resistance level of $0.00001269.

In the last 24 hours, SHIB has surged 6.54%, bringing its price to $0.00001343 as of press time, according to data from CoinMarketCap.

CoinMarketCap" />

With the massive open interest coinciding with a notable surge in SHIB’s price over the last days, it appears that holders are still optimistic for a continued upsurge in its market value, with hopes that the leading memecoin might remove another zero soon.

Gate.io Dominates SHIB futures derivatives market

Per the data showcased by Coinglass, the largest portion of the Shiba Inu’s open interest capital worth about $107.17M was poured in by traders on the Gate.io exchange, as they account for 52.41% of the total open interest.

Bitget and OKX traders followed on the second and third spot, accounting for 15% and 7.6%, respectively.

TL;DR

The graph above clearly demonstrates the price stagnation XRP had to endure for the past month or so. Its upper boundary was at around $2.6, while it also tested the lower one at $1.9 during the darkest hours of the war between Israel and Iran.

Nevertheless, each attempt met immediate rejections, and the cryptocurrency was pushed south to a tight range between $2.2 and $2.3. However, there were multiple signs that the consolidation could be coming to an end, and one analyst evenwarnedthat most traders will miss the breakout.

Such a price surge indeedstarted to materializein the past few days, and especially today. XRP has been among the top performers on a daily scale, having surged by 20% at one point and coming close to $3 on most exchanges.

Although it was stopped there and now sits just under $2.8, it’s still up by over 12% since yesterday. Its market cap has spiked above $160 billion for the first time in months, and XRP has now become the third-largest cryptocurrency, by overtaking Tether’s USDT.

The move north was quickly picked up by the XRP Army, many of whom praised the asset’s performance and provided some bullish (and outrageous) predictions.

$XRP at $2,500 isn’t just a dream.

-Because a pump like 2017 would easily clear $2,000

Fact: The yearly resistance is now free so expect vertical price discovery. pic.twitter.com/A4G3PasuVk

— Crypto Bitlord (@crypto_bitlord7) July 11, 2025

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。