ตลาด

ข่าวสาร

การวิเคราะห์

ผู้ใช้

24x7

ปฏิทินเศรษฐกิจ

แหล่งเรียนรู้

ข้อมูล

- ชื่อ

- ค่าล่าสุด

- ครั้งก่อน

สัญญาณ VIP

ทั้งหมด

ทั้งหมด

ฝรั่งเศส การผลิตภาคอุตสาหกรรม MoM(SA) (ต.ค.)

ฝรั่งเศส การผลิตภาคอุตสาหกรรม MoM(SA) (ต.ค.)ค:--

ค: --

ฝรั่งเศส ดุลการค้า (SA) (ต.ค.)

ฝรั่งเศส ดุลการค้า (SA) (ต.ค.)ค:--

ค: --

ยูโรโซน การจ้างงาน YoY (SA) (ไตรมาส 3)

ยูโรโซน การจ้างงาน YoY (SA) (ไตรมาส 3)ค:--

ค: --

แคนาดา การจ้างงานนอกเวลา (SA) (พ.ย.)

แคนาดา การจ้างงานนอกเวลา (SA) (พ.ย.)ค:--

ค: --

ค: --

แคนาดา อัตราการว่างงาน (SA) (พ.ย.)

แคนาดา อัตราการว่างงาน (SA) (พ.ย.)ค:--

ค: --

ค: --

แคนาดา การจ้างงานเต็มเวลา (SA) (พ.ย.)

แคนาดา การจ้างงานเต็มเวลา (SA) (พ.ย.)ค:--

ค: --

ค: --

แคนาดา อัตราการมีส่วนร่วมในการจ้างงาน (SA) (พ.ย.)

แคนาดา อัตราการมีส่วนร่วมในการจ้างงาน (SA) (พ.ย.)ค:--

ค: --

ค: --

แคนาดา การจ้างงาน (SA) (พ.ย.)

แคนาดา การจ้างงาน (SA) (พ.ย.)ค:--

ค: --

ค: --

สหรัฐอเมริกา ดัชนีราคา PCE MoM (ก.ย.)

สหรัฐอเมริกา ดัชนีราคา PCE MoM (ก.ย.)ค:--

ค: --

ค: --

สหรัฐอเมริกา รายได้ส่วนบุคคล MoM (ก.ย.)

สหรัฐอเมริกา รายได้ส่วนบุคคล MoM (ก.ย.)ค:--

ค: --

ค: --

สหรัฐอเมริกา ดัชนีราคาPCEหลักMoM (ก.ย.)

สหรัฐอเมริกา ดัชนีราคาPCEหลักMoM (ก.ย.)ค:--

ค: --

ค: --

สหรัฐอเมริกา ดัชนีราคา PCE YoY (SA) (ก.ย.)

สหรัฐอเมริกา ดัชนีราคา PCE YoY (SA) (ก.ย.)ค:--

ค: --

ค: --

สหรัฐอเมริกา ดัชนีราคาPCEหลักYoY (ก.ย.)

สหรัฐอเมริกา ดัชนีราคาPCEหลักYoY (ก.ย.)ค:--

ค: --

ค: --

สหรัฐอเมริกา รายจ่ายส่วนบุคคล MoM(SA) (ก.ย.)

สหรัฐอเมริกา รายจ่ายส่วนบุคคล MoM(SA) (ก.ย.)ค:--

ค: --

สหรัฐอเมริกา การคาดการณ์เงินเฟ้อ 5-10 ปี (ธ.ค.)

สหรัฐอเมริกา การคาดการณ์เงินเฟ้อ 5-10 ปี (ธ.ค.)ค:--

ค: --

ค: --

สหรัฐอเมริกา ค่าใช้จ่ายการบริโภคส่วนบุคคลที่จริง MoM (ก.ย.)

สหรัฐอเมริกา ค่าใช้จ่ายการบริโภคส่วนบุคคลที่จริง MoM (ก.ย.)ค:--

ค: --

สหรัฐอเมริกา ปริมาณเครื่องเจาะทั้งหมดรายสัปดาห์

สหรัฐอเมริกา ปริมาณเครื่องเจาะทั้งหมดรายสัปดาห์ค:--

ค: --

ค: --

สหรัฐอเมริกา ปริมาณเครื่องเจาะน้ำมันทั้งหมดรายสัปดาห์

สหรัฐอเมริกา ปริมาณเครื่องเจาะน้ำมันทั้งหมดรายสัปดาห์ค:--

ค: --

ค: --

สหรัฐอเมริกา สินเชื่ออุปโภคบริโภค (SA) (ต.ค.)

สหรัฐอเมริกา สินเชื่ออุปโภคบริโภค (SA) (ต.ค.)ค:--

ค: --

จีนแผ่นดินใหญ่ เงินตราที่ใช้เป็นทุนสำรอง (พ.ย.)

จีนแผ่นดินใหญ่ เงินตราที่ใช้เป็นทุนสำรอง (พ.ย.)ค:--

ค: --

ค: --

ญี่ปุ่น ดุลการค้า (ต.ค.)

ญี่ปุ่น ดุลการค้า (ต.ค.)ค:--

ค: --

ค: --

ญี่ปุ่น GDP Nominal แก้ไขQoQ (ไตรมาส 3)

ญี่ปุ่น GDP Nominal แก้ไขQoQ (ไตรมาส 3)ค:--

ค: --

ค: --

จีนแผ่นดินใหญ่ การนำเข้า YoY (USD) (พ.ย.)

จีนแผ่นดินใหญ่ การนำเข้า YoY (USD) (พ.ย.)ค:--

ค: --

ค: --

จีนแผ่นดินใหญ่ การส่งออก (พ.ย.)

จีนแผ่นดินใหญ่ การส่งออก (พ.ย.)ค:--

ค: --

ค: --

จีนแผ่นดินใหญ่ การนำเข้า (CNH) (พ.ย.)

จีนแผ่นดินใหญ่ การนำเข้า (CNH) (พ.ย.)ค:--

ค: --

ค: --

จีนแผ่นดินใหญ่ ดุลการค้า (CNH) (พ.ย.)

จีนแผ่นดินใหญ่ ดุลการค้า (CNH) (พ.ย.)ค:--

ค: --

ค: --

จีนแผ่นดินใหญ่ ปริมาณการส่งออก YoY (USD) (พ.ย.)

จีนแผ่นดินใหญ่ ปริมาณการส่งออก YoY (USD) (พ.ย.)ค:--

ค: --

ค: --

จีนแผ่นดินใหญ่ การนำเข้าYoY (USD) (พ.ย.)

จีนแผ่นดินใหญ่ การนำเข้าYoY (USD) (พ.ย.)ค:--

ค: --

ค: --

เยอรมนี การผลิตภาคอุตสาหกรรม MoM(SA) (ต.ค.)

เยอรมนี การผลิตภาคอุตสาหกรรม MoM(SA) (ต.ค.)ค:--

ค: --

ยูโรโซน ดัชนีความเชื่อมั่นนักลงทุน Sentix (ธ.ค.)

ยูโรโซน ดัชนีความเชื่อมั่นนักลงทุน Sentix (ธ.ค.)ค:--

ค: --

ค: --

แคนาดา ดัชนีความเชื่อมั่นเศรษฐกิจแห่งชาติ

แคนาดา ดัชนีความเชื่อมั่นเศรษฐกิจแห่งชาติ--

ค: --

ค: --

สหราชอาณาจักร ดัชนียอดค้าปลีก Like-For-Like BRC YoY (พ.ย.)

สหราชอาณาจักร ดัชนียอดค้าปลีก Like-For-Like BRC YoY (พ.ย.)--

ค: --

ค: --

สหราชอาณาจักร ดัชนียอดค้าปลีกรวม BRC YoY (พ.ย.)

สหราชอาณาจักร ดัชนียอดค้าปลีกรวม BRC YoY (พ.ย.)--

ค: --

ค: --

ออสเตรเลีย อัตราหลัก(ดอกเบี้ยเงินกู้)O/N

ออสเตรเลีย อัตราหลัก(ดอกเบี้ยเงินกู้)O/N--

ค: --

ค: --

คำแถลงอัตราของธนาคารกลางออสเตรเลีย

คำแถลงอัตราของธนาคารกลางออสเตรเลีย ประธานธนาคารกลางออสเตรเลีย Bullock จัดงานแถลงข่าวนโยบายการเงิน

ประธานธนาคารกลางออสเตรเลีย Bullock จัดงานแถลงข่าวนโยบายการเงิน เยอรมนี อัตราการส่งออก MoM (SA) (ต.ค.)

เยอรมนี อัตราการส่งออก MoM (SA) (ต.ค.)--

ค: --

ค: --

สหรัฐอเมริกา ดัชนีความเชื่อมั่นของธุรกิจขนาดเล็ก NFIB (SA) (พ.ย.)

สหรัฐอเมริกา ดัชนีความเชื่อมั่นของธุรกิจขนาดเล็ก NFIB (SA) (พ.ย.)--

ค: --

ค: --

เม็กซิโก อัตราเงินเฟ้อ 12-เดือน (CPI) (พ.ย.)

เม็กซิโก อัตราเงินเฟ้อ 12-เดือน (CPI) (พ.ย.)--

ค: --

ค: --

เม็กซิโก CPI หลัก YoY (พ.ย.)

เม็กซิโก CPI หลัก YoY (พ.ย.)--

ค: --

ค: --

เม็กซิโก PPI YoY (พ.ย.)

เม็กซิโก PPI YoY (พ.ย.)--

ค: --

ค: --

สหรัฐอเมริกา Redbook ประจำปีการขายปลีกเชิงพาณิชย์รายสัปดาห์

สหรัฐอเมริกา Redbook ประจำปีการขายปลีกเชิงพาณิชย์รายสัปดาห์--

ค: --

ค: --

สหรัฐอเมริกา ตำแหน่งงานว่างJOLTS (SA) (ต.ค.)

สหรัฐอเมริกา ตำแหน่งงานว่างJOLTS (SA) (ต.ค.)--

ค: --

ค: --

จีนแผ่นดินใหญ่ Money Supply ปริมาณเงิน M1 YoY (พ.ย.)

จีนแผ่นดินใหญ่ Money Supply ปริมาณเงิน M1 YoY (พ.ย.)--

ค: --

ค: --

จีนแผ่นดินใหญ่ Money Supply ปริมาณเงิน M0 YoY (พ.ย.)

จีนแผ่นดินใหญ่ Money Supply ปริมาณเงิน M0 YoY (พ.ย.)--

ค: --

ค: --

จีนแผ่นดินใหญ่ Money Supply ปริมาณเงิน M2 YoY (พ.ย.)

จีนแผ่นดินใหญ่ Money Supply ปริมาณเงิน M2 YoY (พ.ย.)--

ค: --

ค: --

สหรัฐอเมริกา การพยากรณ์การผลิตระยะสั้นประจำปีน้ำมัน EIA (ธ.ค.)

สหรัฐอเมริกา การพยากรณ์การผลิตระยะสั้นประจำปีน้ำมัน EIA (ธ.ค.)--

ค: --

ค: --

สหรัฐอเมริกา การพยากรณ์การผลิตในปีหน้าก๊าซธรรมชาติ EIA (ธ.ค.)

สหรัฐอเมริกา การพยากรณ์การผลิตในปีหน้าก๊าซธรรมชาติ EIA (ธ.ค.)--

ค: --

ค: --

สหรัฐอเมริกา การพยากรณ์การผลิตระยะสั้นในปีหน้าน้ำมัน EIA (ธ.ค.)

สหรัฐอเมริกา การพยากรณ์การผลิตระยะสั้นในปีหน้าน้ำมัน EIA (ธ.ค.)--

ค: --

ค: --

แนวโน้มพลังงานระยะสั้นรายเดือน EIA

แนวโน้มพลังงานระยะสั้นรายเดือน EIA สหรัฐอเมริกา สต็อกน้ำมันเบนซินรายสัปดาห์ API

สหรัฐอเมริกา สต็อกน้ำมันเบนซินรายสัปดาห์ API--

ค: --

ค: --

สหรัฐอเมริกา สต็อกน้ำมันดิบที่เมืองคุชชิ่งรายสัปดาห์ API

สหรัฐอเมริกา สต็อกน้ำมันดิบที่เมืองคุชชิ่งรายสัปดาห์ API--

ค: --

ค: --

สหรัฐอเมริกา สต็อกน้ำมันดิบรายสัปดาห์ API

สหรัฐอเมริกา สต็อกน้ำมันดิบรายสัปดาห์ API--

ค: --

ค: --

สหรัฐอเมริกา สต็อกน้ำมันสำเร็จรูปรายสัปดาห์ API

สหรัฐอเมริกา สต็อกน้ำมันสำเร็จรูปรายสัปดาห์ API--

ค: --

ค: --

เกาหลีใต้ อัตราการว่างงาน (SA) (พ.ย.)

เกาหลีใต้ อัตราการว่างงาน (SA) (พ.ย.)--

ค: --

ค: --

ญี่ปุ่น ดัชนีนอกภาคการผลิต Reuters Tankan (ธ.ค.)

ญี่ปุ่น ดัชนีนอกภาคการผลิต Reuters Tankan (ธ.ค.)--

ค: --

ค: --

ญี่ปุ่น ดัชนีภาคการผลิต Reuters Tankan (ธ.ค.)

ญี่ปุ่น ดัชนีภาคการผลิต Reuters Tankan (ธ.ค.)--

ค: --

ค: --

ญี่ปุ่น ดัชนีราคาสินค้าของวิสาหกิจในประเทศ MoM (พ.ย.)

ญี่ปุ่น ดัชนีราคาสินค้าของวิสาหกิจในประเทศ MoM (พ.ย.)--

ค: --

ค: --

ญี่ปุ่น ดัชนีราคาสินค้าของวิสาหกิจในประเทศ YoY (พ.ย.)

ญี่ปุ่น ดัชนีราคาสินค้าของวิสาหกิจในประเทศ YoY (พ.ย.)--

ค: --

ค: --

จีนแผ่นดินใหญ่ PPI YoY (พ.ย.)

จีนแผ่นดินใหญ่ PPI YoY (พ.ย.)--

ค: --

ค: --

จีนแผ่นดินใหญ่ CPI MoM (พ.ย.)

จีนแผ่นดินใหญ่ CPI MoM (พ.ย.)--

ค: --

ค: --

ไม่มีข้อมูลที่ตรงกัน

ทัศนคติล่าสุด

ทัศนคติล่าสุด

หัวข้อยอดนิยม

คอลัมนิสต์ยอดนิยม

อัปเดตล่าสุด

ไวท์เลเบล

Data API

ปลั๊กอินเว็บไซต์

โครงการพันธมิตร

ดูผลการค้นหาทั้งหมด

ไม่มีข้อมูล

Sharps Technology is a medical device company, has surprised the market with its plan to build the world’s largest Solana treasury worth $400 million. The decision has raised an important question in the crypto community: why Solana and not Bitcoin, Ethereum, or Binance Coin?

This comes right after the company completed a private placement offering, marking a big step toward its entry into blockchain finance.

Sharps Technology Announces $400M SOL Treasury

In a recent announcement, Sharps Technology has secured $400 million to build the world’s largest Solana treasury. This move shows Solana’s rising strength compared to big names like Bitcoin, Ethereum, and BNB.

Backed by investors such as ParaFi, Pantera, and Monarq, Sharps will purchase most of the SOL directly from the open market. In addition, it has signed a deal with the Solana Foundation to buy $50 million worth of SOL at a 15% discount.

The financing was done through a PIPE deal, where each unit included common stock and stapled warrants priced at $6.50. The warrants, valid for three years, come with an exercise price of $9.75.

The transaction is expected to close by August 28, 2025, subject to standard conditions.

Why Solana, Not Bitcoin, Ethereum, or BNB?

Bitcoin may be the king of crypto, and Ethereum may have the biggest developer base, but when it comes to speed and scalability, neither can match Solana.

Solana handles more activity than all other blockchains combined, showing why Sharps sees it as the future.

On top of it, Solana also offers one of the most attractive staking yields among top blockchains, currently around 7%. Add to that its $1.3 billion in app revenue this year alone, and it’s clear why this chain is attracting institutional players.

Sharps Technology Leadership and Strategy

Executive Chairman Paul K. Danner summed up the company’s bold vision: “With the right team, strategy, and partners, we believe Sharps Technology is positioned to build the world’s largest and most impactful SOL treasury

To drive this plan, Sharps has built a team with strong ties to the Solana ecosystem. James Zhang, a well-known Solana community leader, has joined as a strategic advisor.

If successful, this initiative won’t just be a milestone for Sharps Technology but could also strengthen Solana’s place as the backbone of a new era in global markets.

FAQs

Why is Sharps Technology building a Solana treasury?Sharps chose Solana for its superior speed, scalability, and high staking yield, viewing it as a more future-proof blockchain investment than Bitcoin or Ethereum.

How large is Sharps Technology’s Solana treasury?The medical device company is building a $400 million SOL treasury, which will be the world’s largest corporate holding of Solana.

What makes Solana attractive for corporate treasuries?Solana offers high speed, 7% staking yield, and processes 9B quarterly transactions, making it attractive for its scalability and revenue potential.

Key takeaways

ChatGPT helps simplify complex crypto projects by summarizing white papers, explaining use cases and breaking down tokenomics.

Researching the team, partnerships and security risks is crucial before investing in any crypto token.

Comparing projects with competitors highlights strengths and weaknesses for better decision-making.

ChatGPT can suggest relevant research questions, acting as a guide for beginners and experienced investors alike.

Investing in cryptocurrency can be exciting and overwhelming, especially with the thousands of coins and tokens available today. From Bitcoin and Ether to lesser-known altcoins and memecoins, the market is flooded with opportunities and risks. Before investing your money, proper research is essential.

That’s where ChatGPT can help.

This article walks you through how to use ChatGPT to research cryptocurrency projects (using different projects as examples), assess their credibility, and make smarter, data-informed investment decisions. Whether you’re a beginner or a seasoned trader looking to streamline your workflow, ChatGPT can be a powerful research assistant.

Why research matters in crypto investing

Unlike traditional stocks backed by earnings reports and regulatory filings, crypto assets often lack standardized financial data. Instead, you must sift through white papers, GitHub repositories, community sentiment and more. Failing to do proper research can lead to investing in overhyped or even fraudulent projects.

Crypto scams can take many forms, but here are a few common examples to illustrate why research is crucial:

Rug pulls: These occur when developers create a new token, promote it heavily to attract investors, then suddenly withdraw all funds, leaving investors with worthless tokens. A notorious case was the “Squid Game” token in 2021, which surged in price before the creators vanished with millions.

Pump-and-dump schemes: Groups artificially inflate a coin’s price by spreading false hype, only to sell off their holdings at a profit, crashing the price and leaving others with losses.

Fake projects or plagiarized white papers: Some tokens have white papers copied from legitimate projects or contain vague, technical jargon that obscures a lack of a real product or team.

Pig butchering: Scammers build long-term relationships to gain trust, then convince victims to invest heavily in fake crypto projects, eventually stealing their funds.

Deepfake scams: Sophisticated AI-generated videos or audio impersonate influencers or company executives to trick people into sending crypto or revealing private keys.

Cybersquatting: Fraudsters register domain names similar to legitimate crypto projects or exchanges to mislead users and steal credentials or funds.

Phishing and fake websites: Scammers create websites that mimic popular tokens or exchanges to steal private keys and funds.

Thus, before investing in any coin, it’s critical to verify these fundamental points:

What the project does

Who’s behind it

What problem it solves

Whether it has a working product

How it’s different from competitors

ChatGPT can help you answer all of these questions, faster and more clearly.

Did you know? Scammers have impersonated Coinbase in phishing attacks by sending fake emails or text messages that look like official Coinbase alerts. These messages often ask users to click on malicious links to “verify” their account or “resolve security issues,” tricking them into revealing login credentials or transferring crypto funds. Always double-check the sender’s email address and access Coinbase through their official website or app to avoid falling victim to these scams.

Step-by-step: Using ChatGPT to research crypto projects

Here’s how to use ChatGPT effectively when researching coins before investing:

1. Start with a project summary

Use ChatGPT to generate a high-level overview of any coin. This helps you quickly understand the project’s purpose and goals.

Example prompt:

“Explain what Bitcoin Hyper (HYPER) does in simple terms.”

As observed, ChatGPT can break down complex technical language and help you grasp the core idea, even if you’re not a blockchain developer.

2. Get a breakdown of the white paper

White papers are foundational documents that outline a crypto project’s technology and roadmap. They can be technical and dense.

ChatGPT can scan or summarize white papers (if you paste them in) and give you a readable version of what matters most, saving you time while retaining clarity.

Example prompt:

“Summarize the main points of the Stellar white paper.”

3. Check the use case and market fit

Many coins promise innovation, but do they solve a real-world problem? To find out, you may ask ChatGPT to help you assess the utility of a coin.

Example prompt:

“What problem does Chainlink solve, and who uses it?”

This gives you context around how the project fits into the broader ecosystem.

4. Evaluate the team and partners

A credible founding team and strong partnerships often signal legitimacy and execution potential.

Example prompt:

“Who founded the Avalanche blockchain and what’s their background?”

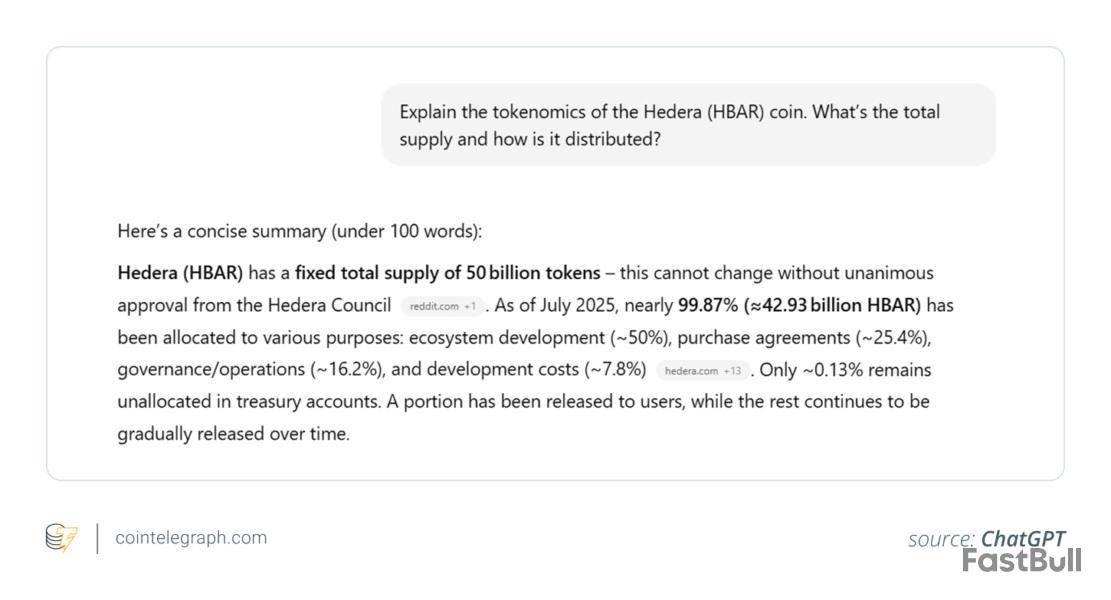

5. Assess tokenomics

Tokenomics refers to how a coin’s supply, incentives and distribution are structured. Poor tokenomics often lead to inflation, rug pulls or price crashes.

Example prompt:

“Explain the tokenomics of the Hedera (HBAR) coin. What’s the total supply and how is it distributed?”

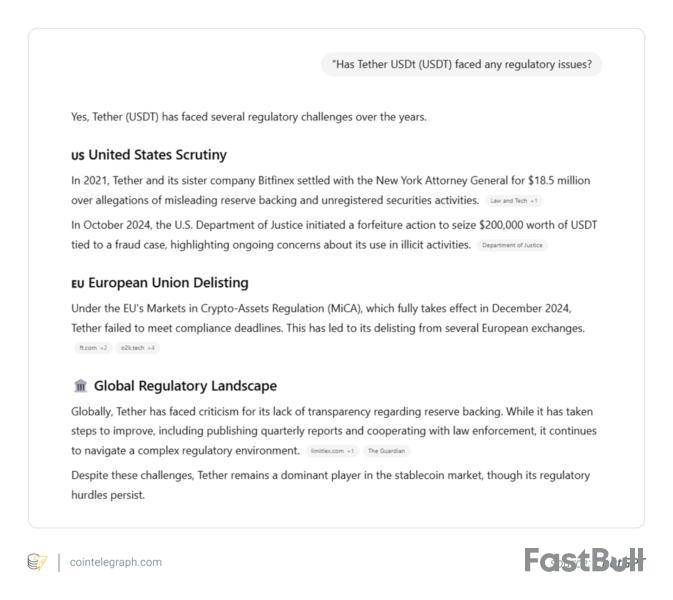

6. Check for compliance and security concerns

Security and regulatory issues can derail even the most promising crypto projects. You could ask ChatGPT for risk factors.

Example prompt:

“Has Tether USDt (USDT) faced any regulatory issues?”

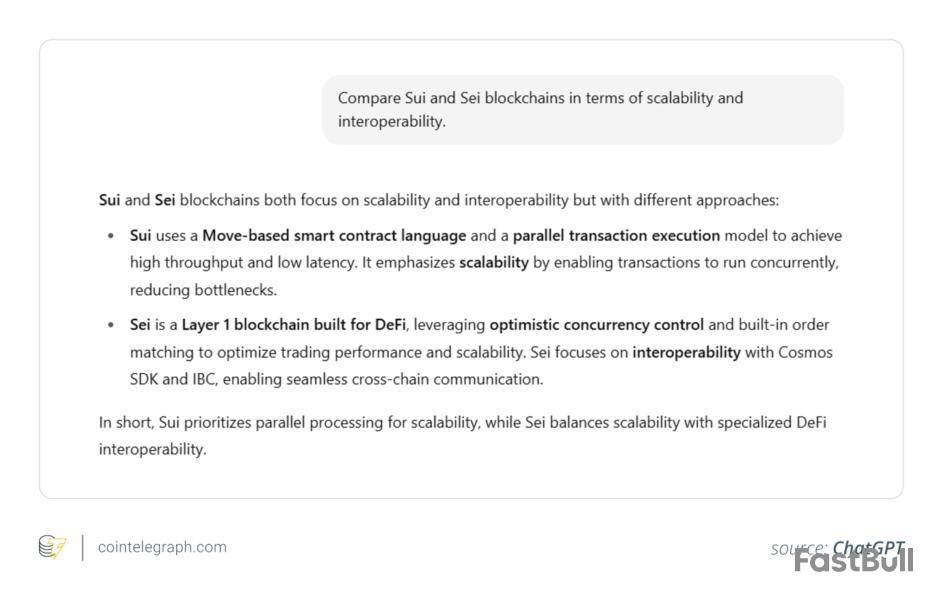

7. Compare with competitors

Understanding how a coin compares to others in its category (DeFi, layer 1, NFTs, oracles, etc.) helps you identify strengths or weaknesses.

Example prompt:

“Compare Sui and Sei blockchains in terms of scalability and interoperability.”

You can even ask for pros and cons in table format to make analysis easier..

Did you know?ChatGPT was trained on a massive data set of diverse text from books, websites and articles, enabling it to generate informed answers across many subjects.

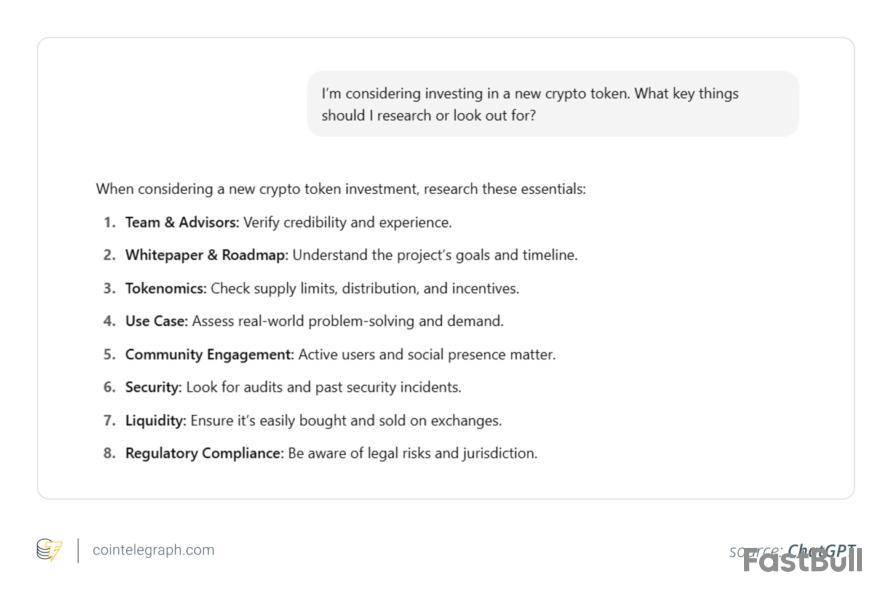

Bonus tip: Ask ChatGPT what you should be asking

If you’re new to crypto, you might not know which questions to ask. Try this:

Example prompt:

“I’m considering investing in a new crypto token. What key things should I research or look out for?”

ChatGPT can give you a checklist covering fundamentals, technicals, sentiment and security, perfect for building your own research framework.

Did you know? ChatGPT’s architecture is based on the transformer model, which uses self-attention mechanisms to understand context in text, enabling it to generate coherent and context-aware responses.

What ChatGPT can’t do (yet)

While ChatGPT is a powerful research assistant, it’s important to know its limitations:

No real-time data unless integrated with tools like web browsing or APIs.

No investment advice or guaranteed predictions.

May generate outdated or incorrect info (always verify facts).

Whether you’re investing a small amount like $10 or a significant sum such as $10,000, doing thorough and careful research remains your best defense against risks. Fortunately, AI tools like ChatGPT now make it easier than ever to gather insights, organize information and ask the right questions.

It’s vital to use ChatGPT to supplement your research process, not as a replacement for your critical thinking and due diligence.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Jeremie Davinci, an early Bitcoin adopter, crypto millionaire and YouTuber, has triggered a heated discussion among his followers on the social media giant X with a simple BTC tweet.

This X message comes after the world’s largest cryptocurrency has tumbled by 3.04% over the past day and is currently trading below the $111,500 level.

Davinci's major Bitcoin message

Jeremie Davinci addressed the community on Crypto Twitter with a message that reveals a very simple but winning Bitcoin strategy that anyone — even the most inexperienced crypto enthusiast — can use.

His scheme was built out of “pointing blackhand index” emojis. A large amount of them form a large square, where a Bitcoin sign sits at the very middle, and a whole bunch of “index finger” emojis are pointing at it.

Davinci Jeremie@Davincij15Aug 25, 2025👉🏿👇🏾👇🏾👇🏾👇🏾👇🏾👇🏾👇🏾👇🏾👇🏾👈🏿

👉🏿👉🏾👇🏽👇🏽👇🏽👇🏽👇🏽👇🏽👇🏽👈🏾👈🏿

👉🏿👉🏾👉🏽👇🏼👇🏼👇🏼👇🏼👇🏼👈🏽👈🏾👈🏿

👉🏿👉🏾👉🏽👉🏼👇🏻👇🏻👇🏻👈🏼👈🏽👈🏾👈🏿

👉🏿👉🏾👉🏽👉🏼👉🏻₿👈🏻👈🏼👈🏽👈🏾👈🏿

👉🏿👉🏾👉🏽👉🏼👆🏻👆🏻👆🏻👈🏼👈🏽👈🏾👈🏿

👉🏿👉🏾👉🏽👆🏼👆🏼👆🏼👆🏼👆🏼👈🏽👈🏾👈🏿

👉🏿👉🏾👆🏽👆🏽👆🏽👆🏽👆🏽👆🏽👆🏽👈🏾👈🏿

👉🏿👆🏾👆🏾👆🏾👆🏾👆🏾👆🏾👆🏾👆🏾👆🏾👈🏿

👉🏿👆🏿👆🏿👆🏿👆🏿👆🏿👆🏿👆🏿👆🏿👆🏿👈🏿

This ignited an agitated discussion among Davinci’s followers. While many interpreted this scheme as “a Bitcoin dip” or “Bitcoin to the moon,” some also suggested that it could simply mean that one should just hold BTC no matter what and keep increasing one’s stash by adding more Satoshis to it.

This aligns with what other influencers often recommend on Crypto Twitter, and it is called “stacking Sats” with the idea that this may lead to ownership of a single Bitcoin. Davinci himself did not respond to any of those comments.

Why is Bitcoin rising so slowly? Willy Woo opines

Over the past day, the flagship cryptocurrency has lost slightly more than 3%, falling from $114,590 to the $111,106 level, where it is changing hands as of press time. Since Friday, the decline has constituted 5.42%; back on that day, Bitcoin traded above $117,000.

A renowned trader and crypto entrepreneur, Willy Woo, shared his take on what is happening to BTC this cycle and why it is taking so long to rise, despite reaching several new all-time highs this year already. The most recent one was above $124,000.

Willy Woo@woonomicAug 24, 2025Why is BTC moving up so slowly this cycle?

BTC supply is concentrated around OG whales who peaked their holdings in 2011 (orange and dark orange).

They bought their BTC at $10 or lower. It takes $110k+ of new capital to absorb each BTC they sell. pic.twitter.com/7CbWXsvX2l

Woo believes that the noncirculating Bitcoin supply is mostly held by early buyers (OG), who bought their BTC at $10 or lower. And now, as many of those OGs are coming out of dormancy and selling their coins, “It takes $110k+ of new capital to absorb each BTC they sell,” Willy Woo tweeted. He believes this is the key reason why the Bitcoin price is rising slowly.

Recently, the cryptocurrency market has turned red once again today, as top assets like Bitcoin, Ethereum, and XRP have all faced steep declines. Particularly, Bitcoin led the drop with prices slipping under $112,000, while ETH/USD and XRP/USD followed suit with significant corrections of their own.

Therefore, with liquidations mounting and strong bearish sentiment spreading, today’s market highlights why caution remains critical.

Bitcoin Extends Decline Below $112K

The chart reveals that the Bitcoin price today fell by 2.13%, extending its streak of bearish candles as BTC/USD dropped to $111,111.

This has marked a decisive break below $112,000, driven by a recent wave of whale sell-offs. According to data, over 24,000 BTC, which are worth approximately $2.7 billion, were offloaded, and this sparked heavy liquidations across exchanges.

CoinGlass data revealed that $837.92 million in liquidations occurred in the past 24 hours alone, with $672.62 million in longs wiped out.

Whereas the data shows, the single largest liquidation happened on OKX’s BTC-USDT-SWAP pair, valued at $12.49 million.

This sudden selling pressure pushed Bitcoin price closer to its key May support level near $110,000, raising concerns of a possible slide toward $101,000 if that zone is breached.

On the BTC price chart, the asset recently broke down from an ascending wedge formation, further worsening investors’ and traders’ fears. Therefore, with the BTC price USD now 10.2% away from its all-time high of $124,533, market sentiment remains fragile.

ETH Price Today Slips From ATH Momentum

Coming to the second top crypto asset -Ethereum, it is also busy following Bitcoin’s footsteps today, losing 3.85% in the past 24 hours.

Currently, the ETH price today trades at $4,597, pulling back from its recent all-time high of $4,955. Despite outperforming Bitcoin in relative strength, ETH/USD could face further short-term weakness.

Technical indicators suggest Ethereum may revisit $4,151 before stabilizing. The rejection near $5,000 shows that Ethereum’s rally is heavily affected by today’s Bitcoin performance, and there’s no guarantee that it won’t be affected by BTC in the future.

Still, ETH has demonstrated resilience, and odds remain that it could lead the recovery once broader market conditions improve.

XRP Price Today Dips Below $3

Coming to the third most powerful crypto asset, XRP also mirrored the downturn, with the XRP price today down 2.55% at $2.9484.

The XRP/USD has been trending lower since mid-August, and Bitcoin’s correction only accelerated the decline. Traders are now eyeing August’s low of $2.74, with the possibility of a retest near $2.40 if selling pressure intensifies.

This move underlines how closely the altcoins remain tied to Bitcoin’s market swings, and today’s decline confirms those ties.

Despite earlier optimism around XRP’s trajectory, the recent wave of liquidations and risk-off sentiment has weakened its outlook in the near term.

As crypto captures more mainstream attention, investors are looking for ways to access U.S.-linked digital assets through simpler, regulated investment vehicles like ETFs.

Canary Capital Files for U.S.-Focused Crypto ETF

In a latest move, asset manager Canary Capital has filed for a new ETF, called the Canary American-Made Crypto ETF, which focuses exclusively on U.S.-linked cryptocurrencies.

Eric Balchunas@EricBalchunasAug 25, 2025New filing for Canary American-Made Crypto ETF, a spot product that will hold only coins invented in U.S., are majority mined in U.S. or have majority of operations in U.S. 🇺🇸 As we’ve predicted, thx to category’s success, get ready for ETFs to try every combo imaginable. pic.twitter.com/8KqovVtgeF

This ETF is designed to hold only cryptocurrencies with strong ties to the United States-

The fund will track the Made-in-America blockchain index and will also generate rewards from validating blockchain transactions. It joins a wave of products giving investors access to digital assets without the complexities and risks of holding crypto directly.

If approved, the ETF will list on the Cboe BZX Exchange under the ticker symbol MRCA. This comes as U.S.-focused investing gains momentum.

On February 21, 2025, the White House issued a memorandum establishing an “America First” investment strategy, linking economic security to national security. The policy aims to protect U.S. technology, infrastructure, and strategic industries.

Hard to Say Which Coins Will Qualify

Eric Balchunas, senior ETF analyst at Bloomberg, said it’s tough to know which coins would be included. “Maybe it’s easier to ask which ones wouldn’t,” he added.

He also sparked a debate about Bitcoin’s origin, asking, “Bitcoin was invented in America, right?” One user replied that there’s no evidence it was made in the U.S., noting that Satoshi used British English and was active during UK hours.

Altcoin ETFs Gain Momentum

Meanwhile, Altcoin ETFs are also picking up steam as investors seek exposure to assets other than BTC and ETH.

Investment firms are increasingly filing ETFs for altcoins like XRP, Dogecoin, and Sui. Several XRP ETF issuers, including Canary Capital, recently updated their applications following SEC feedback, and analysts such as Eric Balchunas anticipate a wave of approvals beginning in October.

Nate Geraci@NateGeraciAug 25, 2025Institutional barriers to investing in crypto are *quickly* crumbling…

Perhaps many institutions can only invest in DATs today, but mandates are *rapidly* shifting towards allowing direct (or at least ETF) access.

Seems obvious.

ETF expert Nate Geraci notes that the barriers preventing institutional investors from entering the crypto market are quickly disappearing. Rules are rapidly evolving, making it possible for these investors to gain direct access to crypto or invest via ETFs.

Strategy disclosed another bitcoin purchase on Monday, adding 3,081 BTC for $356.9 million at an average price of $$115,829 per coin. The haul lifts the company’s treasury to about 632,457 BTC, cementing its lead among public corporate holders.

The bitcoin treasury company now sits on about $70 billion worth of BTC at current prices, acquired at an average of $$73,527 per bitcoin for a total cost of roughly $46.50 billion, including fees. That implies about $23.5 billion in unrealized gains.

Funding and capital-markets playbook

Last week’s purchases were funded from the firm’s preferred-stock programs. Strategy has leaned on perpetual preferreds, convertibles, and at-the-market equity to finance BTC buys, a model Wall Street analysts say lets the company issue when its market value trades at a premium to the bitcoin per share implied by its balance sheet.

At a roughly $112 billion market capitalization against about $70 billion in bitcoin holdings, Strategy’s equity is trading near a 1.6x market-to-NAV multiple or about a 60% premium to the value of its BTC stash, based on The Block’s bitcoin treasury and company stock dashboards.

TD Cowen this month reiterated a $680 price target after Strategy bought another $51.4 million in bitcoin, citing the accretive nature of its issuance cadence and relatively modest debt profile.

Also, Strategy updated its MSTR Equity ATM Guidance, mapping issuance intensity to mNAV bands to give management more flexibility. In brief, the higher the mNAV multiple, the more actively Strategy expects to issue shares to acquire additional bitcoin. At lower mNAV levels, it prioritizes obligations and may consider repurchases.

The latest buy followed a weekend hint from Executive Chairman Michael Saylor, who posted “Bitcoin is on sale” alongside a SaylorTracker graphic of the firm’s holdings. A week earlier, he touted Strategy’s “Bitcoin Standard” scorecard, noting the stock’s annualized performance since adopting BTC has outpaced the “Magnificent 7” and major asset classes, according to the company’s tracker. According to The Block's price page, BTC traded 10% down from its all-time high as whales migrate to Ethereum.

Strategy's bitcoin acquisitions. Image: Strategy.

Still, MSTR fell to its lowest close since April last week before rebounding, as investors continued to debate the stock’s premium to its underlying bitcoin net asset value. Supporters argue the premium is a feature, not a bug, and provides lower-cost capital to acquire more BTC when mNAV is elevated.

Beyond Strategy, a growing roster of public companies has embraced bitcoin treasury strategies. The Block’s data dashboard shows miners MARA and Riot, financial firms like Galaxy Digital, and other firms, including Bitcoin Standard Treasury Company, Trump Media, and Metaplanet, among notable holders. Still, Strategy remains the pace-setter. After today’s disclosure, its stash is just under/around 3% of bitcoin’s 21 million-coin cap.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

ไวท์เลเบล

Data API

ปลั๊กอินเว็บไซต์

เครื่องมือออกแบบโปสเตอร์

โครงการพันธมิตร

ความเสี่ยงของการสูญเสียในการซื้อขายสินทรัพย์ทางการเงิน เช่น หุ้น FX สินค้าโภคภัณฑ์ ฟิวเจอร์ส พันธบัตร ETFs หรือเงินดิจิทัลอาจมีมาก คุณอาจสูญเสียเงินทุนทั้งหมดที่คุณฝากไว้กับโบรกเกอร์ของคุณ ดังนั้น คุณควรพิจารณาอย่างรอบคอบว่าการซื้อขายดังกล่าวเหมาะสมกับคุณหรือไม่ในสถานการณ์และทรัพยากรทางการเงินของคุณ

ไม่ควรตัดสินใจลงทุนโดยไม่ได้ดำเนินการตรวจสอบสถานะอย่างละเอียดถี่ถ้วนด้วยตัวเองหรือปรึกษากับที่ปรึกษาทางการเงินของคุณ เนื้อหาเว็บของเราอาจไม่เหมาะกับคุณเนื่องจากเราไม่ทราบเงื่อนไขทางการเงินและความต้องการในการลงทุนของคุณ ข้อมูลทางการเงินของเราอาจมีความล่าช้าหรือมีความไม่ถูกต้อง ดังนั้นคุณควรรับผิดชอบอย่างเต็มที่ต่อการตัดสินใจซื้อขายและการลงทุนของคุณ บริษัทจะไม่รับผิดชอบต่อการสูญเสียเงินทุนของคุณ

หากไม่ได้รับอนุญาตจากเว็บไซต์ คุณจะไม่สามารถคัดลอกกราฟิก ข้อความ หรือเครื่องหมายการค้าของเว็บไซต์ได้ สิทธิ์ในทรัพย์สินทางปัญญาในเนื้อหาหรือข้อมูลที่รวมอยู่ในเว็บไซต์นี้เป็นของผู้ให้บริการและผู้ค้าแลกเปลี่ยน

ไม่ได้ล็อกอิน

เข้าสู่ระบบเพื่อเข้าถึงฟังก์ชั่นเพิ่มเติม

สมาชิก FastBull

ยังไม่ได้เปิด

สมัคร

เข้าสู่ระบบ

ลงทะเบียน