行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

英国零售销售月率 (季调后) (12月)

英国零售销售月率 (季调后) (12月)公:--

预: --

前: --

法国制造业PMI初值 (1月)

法国制造业PMI初值 (1月)公:--

预: --

前: --

法国服务业PMI初值 (1月)

法国服务业PMI初值 (1月)公:--

预: --

前: --

法国综合PMI初值 (季调后) (1月)

法国综合PMI初值 (季调后) (1月)公:--

预: --

前: --

德国制造业PMI初值 (季调后) (1月)

德国制造业PMI初值 (季调后) (1月)公:--

预: --

前: --

德国服务业PMI初值 (季调后) (1月)

德国服务业PMI初值 (季调后) (1月)公:--

预: --

前: --

德国综合PMI初值 (季调后) (1月)

德国综合PMI初值 (季调后) (1月)公:--

预: --

前: --

欧元区综合PMI初值 (季调后) (1月)

欧元区综合PMI初值 (季调后) (1月)公:--

预: --

前: --

欧元区制造业PMI初值 (季调后) (1月)

欧元区制造业PMI初值 (季调后) (1月)公:--

预: --

前: --

欧元区服务业PMI初值 (季调后) (1月)

欧元区服务业PMI初值 (季调后) (1月)公:--

预: --

前: --

英国综合PMI初值 (1月)

英国综合PMI初值 (1月)公:--

预: --

前: --

英国制造业PMI初值 (1月)

英国制造业PMI初值 (1月)公:--

预: --

前: --

英国服务业PMI初值 (1月)

英国服务业PMI初值 (1月)公:--

预: --

前: --

墨西哥经济活动指数年率 (11月)

墨西哥经济活动指数年率 (11月)公:--

预: --

前: --

俄罗斯贸易账 (11月)

俄罗斯贸易账 (11月)公:--

预: --

前: --

加拿大核心零售销售月率 (季调后) (11月)

加拿大核心零售销售月率 (季调后) (11月)公:--

预: --

前: --

加拿大零售销售月率 (季调后) (11月)

加拿大零售销售月率 (季调后) (11月)公:--

预: --

美国IHS Markit 制造业PMI初值 (季调后) (1月)

美国IHS Markit 制造业PMI初值 (季调后) (1月)公:--

预: --

前: --

美国IHS Markit 服务业PMI初值 (季调后) (1月)

美国IHS Markit 服务业PMI初值 (季调后) (1月)公:--

预: --

前: --

美国IHS Markit 综合PMI初值 (季调后) (1月)

美国IHS Markit 综合PMI初值 (季调后) (1月)公:--

预: --

前: --

美国密歇根大学消费者信心指数终值 (1月)

美国密歇根大学消费者信心指数终值 (1月)公:--

预: --

前: --

美国密歇根大学现况指数终值 (1月)

美国密歇根大学现况指数终值 (1月)公:--

预: --

前: --

美国密歇根大学消费者预期指数终值 (1月)

美国密歇根大学消费者预期指数终值 (1月)公:--

预: --

前: --

美国谘商会领先指标月率 (11月)

美国谘商会领先指标月率 (11月)公:--

预: --

前: --

美国谘商会同步指标月率 (11月)

美国谘商会同步指标月率 (11月)公:--

预: --

前: --

美国谘商会滞后指标月率 (11月)

美国谘商会滞后指标月率 (11月)公:--

预: --

前: --

美国密歇根大学一年期通胀率预期终值 (1月)

美国密歇根大学一年期通胀率预期终值 (1月)公:--

预: --

前: --

美国谘商会领先指标 (11月)

美国谘商会领先指标 (11月)公:--

预: --

前: --

美国当周钻井总数

美国当周钻井总数公:--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数公:--

预: --

前: --

德国IFO商业预期指数 (季调后) (1月)

德国IFO商业预期指数 (季调后) (1月)--

预: --

前: --

德国IFO商业景气指数 (季调后) (1月)

德国IFO商业景气指数 (季调后) (1月)--

预: --

前: --

德国IFO商业现况指数 (季调后) (1月)

德国IFO商业现况指数 (季调后) (1月)--

预: --

前: --

墨西哥失业率 (未季调) (12月)

墨西哥失业率 (未季调) (12月)--

预: --

前: --

加拿大全国经济信心指数

加拿大全国经济信心指数--

预: --

前: --

美国非国防资本耐用品订单月率 (不含飞机) (11月)

美国非国防资本耐用品订单月率 (不含飞机) (11月)--

预: --

前: --

美国耐用品订单月率 (不含国防) (季调后) (11月)

美国耐用品订单月率 (不含国防) (季调后) (11月)--

预: --

前: --

美国耐用品订单月率 (不含运输) (11月)

美国耐用品订单月率 (不含运输) (11月)--

预: --

前: --

美国耐用品订单月率 (11月)

美国耐用品订单月率 (11月)--

预: --

前: --

美国达拉斯联储商业活动指数 (1月)

美国达拉斯联储商业活动指数 (1月)--

预: --

前: --

英国BRC商店物价指数年率 (1月)

英国BRC商店物价指数年率 (1月)--

预: --

前: --

中国大陆工业利润年率 (年初至今) (12月)

中国大陆工业利润年率 (年初至今) (12月)--

预: --

前: --

墨西哥贸易账 (12月)

墨西哥贸易账 (12月)--

预: --

前: --

美国S&P/CS20座大城市房价指数年率 (未季调) (11月)

美国S&P/CS20座大城市房价指数年率 (未季调) (11月)--

预: --

前: --

美国S&P/CS20座大城市房价指数月率 (季调后) (11月)

美国S&P/CS20座大城市房价指数月率 (季调后) (11月)--

预: --

前: --

美国FHFA房价指数月率 (11月)

美国FHFA房价指数月率 (11月)--

预: --

前: --

美国联邦住房金融局 (FHFA) 房价指数 (11月)

美国联邦住房金融局 (FHFA) 房价指数 (11月)--

预: --

前: --

美国里奇蒙德联储制造业综合指数 (1月)

美国里奇蒙德联储制造业综合指数 (1月)--

预: --

前: --

美国谘商会消费者现况指数 (1月)

美国谘商会消费者现况指数 (1月)--

预: --

前: --

美国谘商会消费者预期指数 (1月)

美国谘商会消费者预期指数 (1月)--

预: --

前: --

美国里奇蒙德联储制造业装船指数 (1月)

美国里奇蒙德联储制造业装船指数 (1月)--

预: --

前: --

美国里奇蒙德联储服务业收入指数 (1月)

美国里奇蒙德联储服务业收入指数 (1月)--

预: --

前: --

美国谘商会消费者信心指数 (1月)

美国谘商会消费者信心指数 (1月)--

预: --

前: --

澳大利亚澳联储截尾均值CPI年率 (第四季度)

澳大利亚澳联储截尾均值CPI年率 (第四季度)--

预: --

前: --

澳大利亚CPI年率 (第四季度)

澳大利亚CPI年率 (第四季度)--

预: --

前: --

澳大利亚CPI季率 (第四季度)

澳大利亚CPI季率 (第四季度)--

预: --

前: --

德国GFK消费者信心指数 (季调后) (2月)

德国GFK消费者信心指数 (季调后) (2月)--

预: --

前: --

印度工业生产指数年率 (12月)

印度工业生产指数年率 (12月)--

预: --

前: --

印度制造业产出月率 (12月)

印度制造业产出月率 (12月)--

预: --

前: --

加拿大隔夜目标利率

加拿大隔夜目标利率--

预: --

前: --

加拿大央行利率决议

加拿大央行利率决议

无匹配数据

WazirX hack fallout: User challenges $9,400 XRP account freeze

The case began when Rhutikumari, an XRP (XRP) holder, filed a petition against WazirX after the exchange froze her account containing 3,532.30 XRP worth approximately $9,400. The dispute stemmed from WazirX’s response to a July 2024 hack that led to the theft of about $235 million in assets.

To manage the losses, WazirX proposed a controversial “socialization of losses” plan, which would distribute the financial impact proportionally across all user accounts. Rhutikumari challenged the plan, arguing that it infringed on her ownership rights.

In its defense, WazirX argued that the dispute was governed by a Singapore High Court-approved restructuring plan, which outlined a three-step process for pro rata compensation to all users. The exchange argued that it does not directly own user wallets and claimed the Madras High Court lacked jurisdiction because arbitration was based in Singapore. It also added that trading and withdrawals had been temporarily paused for all users during the restructuring process.

This situation prompted the Madras High Court to rule not only on Rhutikumari’s account but also on whether cryptocurrencies like XRP qualify as personal property under Indian law.

Did you know? XRP can settle cross-border transactions in just three to five seconds, making it one of the fastest digital assets for payments.

Court sets legal precedent in India

In a significant interim ruling, the Madras High Court declared that cryptocurrencies are “property capable of being possessed and held in trust,” formally recognizing them under Indian law.

Justice N. Anand Venkatesh held that digital assets such as XRP constitute a form of property — intangible yet capable of being possessed, enjoyed and held in trust — rather than mere speculative instruments. In reaching this conclusion, he referred to Section 2(47A) of the Income Tax Act and drew from both Indian jurisprudence and international precedents, including the New Zealand case Ruscoe v. Cryptopia Ltd.

Although WazirX argued that a Singapore court-approved restructuring scheme governed the dispute, the Madras High Court disagreed. The court held that it retained jurisdiction since the petitioner, Rhutikumari, had transferred funds from an Indian bank account. It also noted that she accessed the WazirX platform from within India, creating a domestic cause of action.

As interim relief, the court prohibited Zanmai Labs, the Indian company operating WazirX, from reallocating Rhutikumari’s 3,532.30 XRP and ordered the exchange to provide a bank guarantee of approximately $11,500 until the matter is resolved. The ruling established cryptocurrency ownership as a legally protected property right in India.

Did you know? Many people confuse Ripple and XRP, but they’re not the same. Ripple is the company building blockchain-based payment solutions, while XRP is the decentralized digital asset that powers those transactions on the XRP Ledger, the blockchain network.

Why this ruling matters for crypto holders in India

The Madras High Court’s ruling marks a turning point for India’s crypto market, providing much-needed legal clarity. For the first time, a high court has formally recognized a digital asset like XRP as “property” under Indian law, granting investors clear ownership rights.

The Madras High Court’s interim order protects holders by restraining Zanmai Labs from reallocating or liquidating an investor’s XRP to offset losses from a hack or restructuring. It sets a precedent in which courts may treat crypto holdings as customer-owned property instead of unsecured claims on an exchange.

The ruling is widely expected to strengthen investor confidence in XRP in India, given the new legal clarity it provides.

The judgment may prompt lawmakers to introduce clearer and stronger rules on the ownership and rights of virtual digital asset holders. While this may take time, the ruling could serve as an important first step.

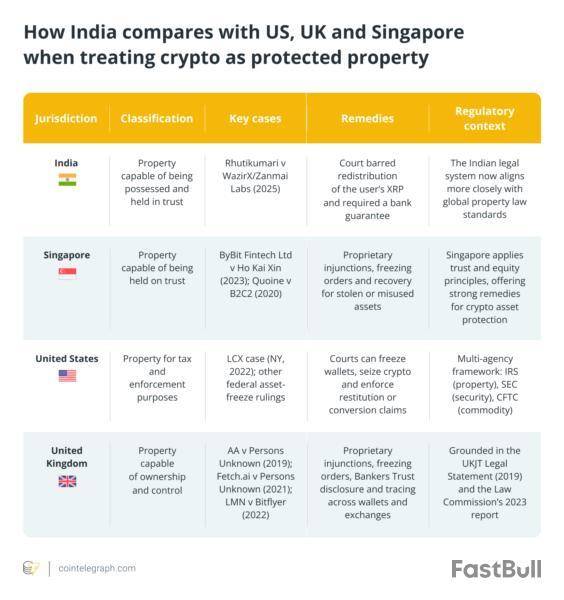

India joins the US, UK and Singapore in treating crypto as protected property

The Madras High Court’s ruling recognizes that cryptocurrencies constitute property under Indian law, offering legal protection to holders in India. With this decision, India aligns with other jurisdictions — including Singapore and the United States — that have also treated crypto assets as property in certain legal contexts.

In the US, the Internal Revenue Service (IRS) classifies virtual currency as property for federal tax purposes. Courts can freeze wallets, issue injunctions and seize crypto under property law and civil forfeiture rules. This property classification may help victims of hacks or fraud by providing a legal basis for recovery strategies, although actual recovery depends on traceability, jurisdiction and exchange cooperation.

English courts recognize crypto assets as property, enabling injunctive relief, tracing and disclosure orders. A landmark decision was AA v. Persons Unknown [2019] EWHC 3556 (Comm), where the court held that crypto assets such as Bitcoin (BTC) can be treated as property because they are definable, identifiable, transferable and satisfy the criteria for property rights.

Although English law traditionally divides property into “things in possession” and “things in action,” the court accepted that novel assets such as crypto assets may fall into a third category of personal property.

In Singapore, the High Court in ByBit Fintech Ltd v Ho Kai Xin & Ors [2023] SGHC 199 held that crypto assets are “property capable of being held on trust” and accordingly declared a constructive trust over misappropriated digital assets. The court’s decision enabled proprietary rights and equitable remedies (such as freezing orders and tracing) in respect of those assets, reinforcing that ownership of crypto can attract protection equivalent to traditional property.

How property status for crypto could impact XRP in India

The Madras High Court’s recognition of XRP as property could significantly impact India’s crypto market and boost investor confidence.

For XRP, stronger legal protections may increase local demand in India and strengthen investor confidence. As of Nov. 3, 2025, XRP was trading at approximately $2.3, with technical resistance around $2.80. If the ruling boosts demand in India, XRP could break above that resistance level.

For exchanges, the ruling may require a reorganization of their terms of service. They may need to revisit custody arrangements and restructuring plans, as the law now treats users’ tokens as protected property rather than shared assets.

For investors, understanding their legal rights is crucial. They now have stronger ownership recognition over the crypto assets they keep with exchanges. India now stands closer to jurisdictions such as the US, UK and Singapore. This alignment could accelerate India’s regulatory progress, fostering greater transparency, accountability and trust in the digital asset ecosystem.

Did you know? Unlike Bitcoin, XRP uses a consensus protocol that consumes very little energy. Some estimates put it at around 0.0079 kilowatt-hours (kWh) per transaction, compared to estimates of hundreds of kWh for Bitcoin.

Limitations of India’s landmark crypto property ruling

The Madras High Court’s ruling is a significant step forward, but it comes with certain limitations. As a crypto trader, it’s important to understand these constraints clearly.

Sphere: The Madras High Court’s decision is an interim order specific to one holder’s 3,532 XRP, so it may not automatically apply to all wallets, tokens or exchanges.

Token type: The court clarified that XRP and similar assets are not “currency” but intangible property, leaving uncertainty over how other types of virtual digital assets might be classified.

Enforcement and recovery: While property status offers potential protection, actual enforcement and recovery will depend on each exchange’s custody practices and transparency.

Regulatory evolution: India still lacks a comprehensive regulatory framework. This ruling is judicial, not legislative, and future legislation could override the court’s decision.

Inter-jurisdictional issues: Cross-border crypto transactions may introduce additional complexity, as protections granted in one jurisdiction may not extend to another.

Ripple's $1B share buyback sees low participation despite $40B valuation

Ripple's buyback has seen low participation, according to a recent report by The Information.

According to a recent report by The Information, Ripple Labs offered to repurchase $1 billion worth of shares at a $40 billion valuation last month. However, the company reportedly saw the lowest participation rate yet in this tender offer, with many private shareholders choosing not to sell their stakes.

This shows that investors are confident in Ripple's long-term potential following the company's victory over the SEC and massive acquisition spree.

In January 2024, Ripple announced a buyback of US$285 million of its shares from early investors/employees that valued the company at about $11.3 billion. However, as reported by U.Today, CEO Brad Garlinghouse then stated that the valuation was too low, citing the company's vast XRP holdings that surpassed a whopping $100 billion last year.

In June, the San Francisco-headquartered company initiated a significantly larger tender offer of $700 million at $175 per share.

Dogecoin faces bearish setup as analysts warn of potential drop below $0.10

DOGE has formed its weakest setups in months after losing key support, setting the stage for a brutal 40% correction.

According to the latest price projections, Dogecoin’s price setup looks like a time bomb with a slow fuse. It turns out the break under $0.18 was not manipulation or an accidental slip but the final line keeping DOGE from reopening the path back toward $0.12. What's even worse, it may be below $0.10 by the end of 2025.

Thus, prominent analyst Ali Martinez revealed how the DOGE chart now sits inside a prolonged channel, where every rebound runs into the same wall of trapped sell supply, and nothing about the current conjecture suggests the market wants to defend this zone anymore from Dogecoin.

If the projection plays out as it usually does, the next 12 months for Dogecoin will be more painful. A dip to $0.16 looks almost guaranteed this quarter, followed by a slow crawl into $0.14-$0.12 territory through the end of the year.

Bitcoin nears key breakdown zone as liquidation pressure mounts

Bitcoin is close to losing a fundamental level that investors fought for throughout 2025.

As the price of Bitcoin hovers around $104,000, close to breaking through a crucial psychological threshold, its steep decline continues. With little structural support left below, concentrated liquidation clusters are visible just below the current price on the most recent CoinGlass liquidation heatmap.

A dense liquidity pocket that is presently being tested is shown on the heatmap between $103,000 and $104,000. The next significant liquidation bands, which are probably stacked with more stop-loss orders and leveraged positions, will emerge between $101,500 and $100,000 if this zone gives way. Given the increasing downside pressure indicated by both technical and on-chain data, these levels might only offer short-term stabilization.

MultiversX has outlined a three-phase roadmap titled “From Consensus to a New Era”, detailing its upcoming governance process and technical upgrades.

–– Phase 1 (Governance): Proposal presentation, forum sessions, and a governance vote are complete.

–– Phase 2 (Technical Development & Rollout): Includes publication of the economics paper for Staking v5 and the Accelerator, Battle of Nodes: A New Dawn event on November 4, and updates to the staking and emissions model on November 15. Additional economic model and governance updates are expected in December.

–– Phase 3 (Core Protocol Upgrades): Launch of New Genesis: Supernova following the completion of Battle of Nodes, along with a new fee model, KPI dashboard, and roadmap planned for mid-January 2026.

EGLD Info

MultiversX (formerly Elrond) is a technology ecosystem for the new internet. Its smart contracts execution platform is capable of 15,000 TPS, 5s latency and $0.001 tx cost, focused on fintech, DeFi and IoT.

MultiversX money & DeFi app Maiar offers an intuitive first-time experience with blockchain, offering progressive security and a gamified approach to unlocking more useful features.

The MultiversX Proof of Stake economic model has a limited supply; its token is named eGold to convey the notion of digital store of value to the next billion users.

Ripple has officially indicated the start of Swell, its most important event of the year, which convenes leaders in crypto, payments, banking and policy to discuss what's ahead for the future of finance.

The Swell event now being held in New York City will run from Nov. 4 to 5, with high expectations already spanning the crypto community.

According to a recent tweet by Ripple, Swell 2025 kicks off with opening remarks by Ripple President Monica Long and a Fireside chat with Nasdaq chair and CEO Adena Friedman.

Ripple@RippleNov 04, 2025Good morning, NYC! 🗽

Swell 2025 kicks off with opening remarks from @MonicaLongSF and a fireside chat with @adenatfriedman.

Tune in live right here on X at 9:30 am ET. ⬇️ pic.twitter.com/ztU5d5PxGZ

The Ripple Swell event's roll call of speakers includes prominent industry leaders from Ripple, BlackRock, Nasdaq, Mastercard, BNY Mellon, Fidelity and Franklin Templeton, among others.

What to expect?

Besides Nasdaq CEO Adena Friedman, who will participate in the first fireside chat at the event, other speakers include Maxwell Stein, Director of Digital Assets at Blackrock; Cynthia Lo Bessette, Head of Fidelity Digital Asset Management; Hunter Horsley, Bitwise CEO; Scott Lucas, Head of Markets and Digital Assets at J.P. Morgan; and Christian Rau, Senior Vice President of Blockchain Digital Assets and Fintech Enablement at Mastercard, among others.

At the event, insights beneficial for the digital asset space and the financial markets are expected, with the crypto community tuning in.

Carlos Domingo, Securitize CEO, will also participate in a panel discussion at the Ripple Swell event, on the theme "Driving Global Growth and Trust with RLUSD."

Hours from the start of the event, Ripple announced the acquisition of digital asset wallet and custody company Palisade, expected to significantly expand Ripple's custody capabilities to directly serve the core needs of fintechs, crypto-native firms and corporations.

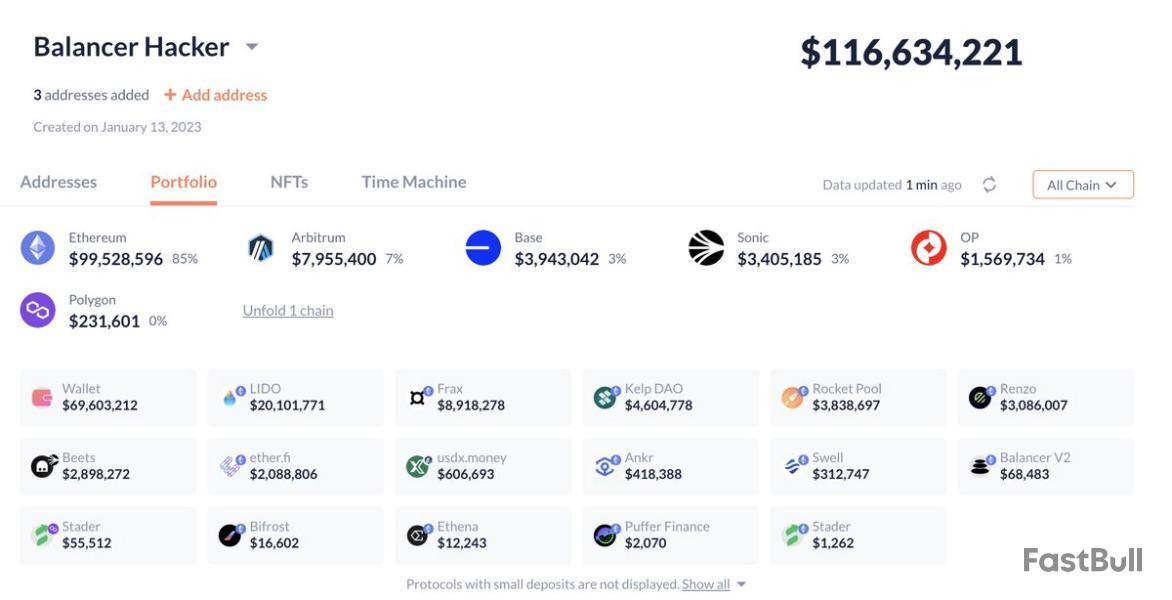

Balancer, a major DeFi protocol, has suffered a significant exploit, with approximately $116 million drained from protocol vaults. On-chain data shows large, unusual outflows from Balancer’s “0xBA1…BF2C8” address to an external wallet, including 6,587 WETH (~$24.5M), 6,851 osETH (~$26.9M), and 4,260 wstETH (~$19.3M). The scale and nature of the transfers point to a coordinated attack involving high-value assets across multiple vaults.

Balancer has since confirmed the breach, stating that “around 7:48 AM UTC, an exploit affected Balancer V2 Composable Stable Pools.” According to the team, these pools have been live for several years, and some were outside the pause window, leaving them vulnerable. Pools that could be paused have been halted and are now in recovery mode, with the exploit confirmed to be isolated to V2 Composable Stable Pools. Balancer V3 and all other pools remain unaffected.

The protocol says it is working with leading security researchers and legal teams to investigate and will release a full post-mortem. Balancer also warned users about fraudulent communications circulating in the aftermath, emphasizing that official updates will only come through its verified X account and official Discord.

This incident marks one of the largest DeFi exploits of the year and has heightened security concerns across the sector.

Hacker Offloads Stolen Tokens Into ETH as Crypto Markets Face Broad Selloff

According to Lookonchain, the Balancer exploiter has begun swapping the stolen assets for ETH, accelerating concerns that the attacker intends to consolidate and move value quickly before defenses or recovery mechanisms can engage. Converting large amounts of liquid-staking tokens and wrapped assets into ETH not only solidifies the hacker’s control over the stolen funds but also signals an intent to exit positions entirely rather than negotiate or return funds — a troubling sign for victims and the protocol.

This development is unfolding during one of the sharpest pullbacks the market has seen in recent months. Ethereum has fallen below $3,500, a key psychological and technical level, while Bitcoin has broken under the $105,000 support, intensifying fears of deeper downside as liquidity thins and sentiment deteriorates. Altcoins, already under pressure from macro-driven derisking, are bleeding heavily, with capital rotation stalling and speculative flows evaporating.

For Balancer, the timing compounds the severity of the crisis. A major security breach during a fragile market period magnifies losses, erodes confidence, and increases the risk of liquidity dislocations. The DeFi ecosystem is now closely watching both the hacker’s next moves and Balancer’s recovery plan as the sector navigates heightened stress on both technical and sentiment fronts.

BAL Breaks Down Further As Market Selloff Drives Heavy Pressure

BAL has entered another phase of sustained weakness, with the weekly chart showing a clear downtrend that has now intensified following the confirmed exploit. After trading near the $1 region for months, the token has broken lower, currently hovering around $0.80 and showing a sharp weekly decline. The chart reflects heavy selling volume, suggesting that the security breach accelerated an already fragile market structure.

Technically, BAL remains below the 50-week and 200-week moving averages, reinforcing a long-term bearish trend with no immediate signs of reversal. Each attempt to establish support has been met with lower highs and breakdowns, indicating persistent distribution and a lack of sustained buyer interest. The recent spike in volume during the selloff confirms capitulation behavior rather than accumulation, as fear spreads across the DeFi sector.

Market sentiment around BAL has deteriorated further given the exploit’s timing. With Ethereum trading below $3,500, Bitcoin losing key support near $105,000, and altcoins bleeding across the board, risk appetite is at a low point. For BAL to show recovery signals, it would need to reclaim psychological support near $1 and stabilize volume flows. Until then, price action remains vulnerable, and further downside cannot be ruled out as confidence rebuilds slowly.

Featured image from ChatGPT, chart from TradingView.com

With 19 years remaining for Sam “SBF” Bankman-Fried in prison, the former FTX CEO’s legal team will present arguments in the appellate court as to why a panel of judges should consider overturning his conviction or sentence.

On Tuesday, the US Court of Appeals for the Second Circuit will hear oral arguments from SBF’s lawyers. Though the details of the appeal were unclear at the time of publication, the former FTX CEO’s legal team said in its initial appeals filing from September 2024 that it intended to argue SBF was “never presumed innocent,” claiming that it was not allowed to present information to the court regarding the crypto exchange’s solvency.

“From day one, the prevailing narrative—initially spun by the lawyers who took over FTX, quickly adopted by their contacts at the US Attorney’s Office— was that Bankman-Fried had stolen billions of dollars of customer funds, driven FTX to insolvency, and caused billions in losses,” said the September 2024 appeal. “Now, nearly two years later, a very different picture is emerging—one confirming FTX was never insolvent, and in fact had assets worth billions to repay its customers. But the jury at Bankman-Fried’s trial never got to see that picture.”

Following the collapse of FTX in November 2022, US authorities extradited SBF from the Bahamas to face charges, including money laundering and fraud. A jury convicted the former CEO on seven felony counts in November 2023, and a judge sentenced him to 25 years in prison in March 2024.

The case involving the high-profile cryptocurrency executive drew attention from many in the industry, as well as lawmakers, since SBF had contributed millions of dollars to politicians through his companies. The appeals court will decide whether to grant Bankman-Fried a new trial or affirm his conviction in New York.

Also angling for a presidential pardon?

Following his conviction and sentencing hearing, SBF appeared to campaign to more align himself with Republicans and right-leaning politicians, in an attempt to draw positive attention from US President Donald Trump.

Trump has signaled a willingness to pardon or commute the sentences of cryptocurrency figures who support him or who have business relationships with members of his family.

In January, he pardoned Silk Road founder Ross Ulbricht, who had been sentenced to life in prison, reportedly as part of an appeal to libertarian voters in the 2024 election.

Most recently, the president pardoned former Binance CEO Changpeng “CZ” Zhao, who served four months in prison in 2024 after pleading guilty to violating the US Bank Secrecy Act. The act increased speculation among many crypto users that SBF could be next, but as of Tuesday, the White House had not announced any pardon.

Solana is among the top cryptocurrencies hit by the ongoing market liquidations. The Solana crypto has plunged more than 8.7% over the past 24 hours and over 20% in the past week.

Solana founder shifts attention from price

Amid the ongoing price drawdown, Solana Founder Anatoly Yakovenko has named the most important focus for the blockchain.

Yakovenko urged developers to stop staring at the red candles and build stuff people actually use. To the Solana founder, price is a lagging indicator, while code is the leading one.

"The number one thing to focus on right now is shipping great products," Yakovenko wrote in an X post.

His comment is in response to a post from Raydium, a leading decentralized exchange (DEX) and automated market maker (AMM) built on Solana.

In its post, Radium shared a quick morale booster with the Solana enthusiasts who are still holding their bags despite the recent price crash.

"Shoutout to all of the Solana bulls," the Radium team wrote.

While Radium is sending love to Solana bulls, Yakovenko is encouraging the launch of products that make the bear market irrelevant.

toly 🇺🇸@aeyakovenkoNov 04, 2025The number one thing to focus on right now is shipping great products. https://t.co/oyLNmKEuC5

Intriguingly, his comments come shortly after Western Union revealed plans to introduce a Solana-based stablecoin. The new product, dubbed the “U.S. Dollar Payment Token” (USDPT), is set to launch next year.

Solana ETFs see robust inflows

Additionally, the SOL price drop is happening right after the first U.S. spot Solana ETFs launched in the U.S.

According to Farside Investors' data, Solana spot exchange-traded funds (ETFs) actually pulled in $70 million of inflows on November 3, 2025.

The Bitwise Solana ETF (BSOL) saw the highest inflows of $65.2 million, while Grayscale’s Solana ETF (GSOL) followed with $4.9 million.

This marks a record-breaking daily high, signaling strong investor demand for Solana-based investment products.

Thus, the SOL price decline reflects broader market jitters, possibly influenced by macroeconomic factors, including interest rates.

Notably, the SOL ETFs began trading on October 28, after the U.S. Securities and Exchange Commission (SEC) gave the go-ahead.

In their first week of trading, the ETFs attracted nearly $200 million in inflows, according to a U.Today report. If this momentum continues this week, the SOL price could recover from its lows and climb to new highs.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。