行情

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

【报道:美国监管机构计划放宽针对华尔街银行的部分资本要求提案】美国监管机构拟提出一揽子新的资本要求,旨在鼓励部分华尔街银行及其中型竞争对手扩大信贷投放。知情人士称,美联储、联邦存款保险公司(Fdic)和货币监理署(Occ)官员最快将于下周公布相关提案。该方案将包括三项与资本相关的关键措施,其中一项计划是美国银行资本重大提案“巴塞尔协议Iii”(Basel Iii)的修订版,美联储还准备调整对美国全球系统重要性银行(G-Sib)的附加资本要求,使其与名义国内生产总值(Gdp)的变化挂钩。

【Circle、Binance加入万事达卡加密货币合作伙伴计划】3月11日,万事达卡公司(Mastercard Inc.)正在招募超过85家数字资产公司、支付提供商和金融机构加入一个新的全球合作伙伴计划,其中包括Circle、Binance以及Gemini。该计划目标保持加密支付与万事达卡网络的连接,同时将稳定币定位为传统支付轨道的替代方案。

欧洲央行行长拉加德发表讲话

欧洲央行行长拉加德发表讲话 美国当周API库欣原油库存

美国当周API库欣原油库存公:--

预: --

前: --

美国当周API原油库存

美国当周API原油库存公:--

预: --

前: --

美国当周API精炼油库存

美国当周API精炼油库存公:--

预: --

前: --

美国当周API汽油库存

美国当周API汽油库存公:--

预: --

前: --

日本国内企业商品价格指数年率 (2月)

日本国内企业商品价格指数年率 (2月)公:--

预: --

前: --

日本国内企业商品价格指数月率 (2月)

日本国内企业商品价格指数月率 (2月)公:--

预: --

前: --

日本PPI月率 (2月)

日本PPI月率 (2月)公:--

预: --

前: --

德国CPI年率终值 (2月)

德国CPI年率终值 (2月)公:--

预: --

前: --

德国CPI月率终值 (2月)

德国CPI月率终值 (2月)公:--

预: --

前: --

德国HICP年率终值 (2月)

德国HICP年率终值 (2月)公:--

预: --

前: --

德国HICP月率终值 (2月)

德国HICP月率终值 (2月)公:--

预: --

前: --

土耳其零售销售年率 (1月)

土耳其零售销售年率 (1月)公:--

预: --

前: --

意大利12个月期BOT国债拍卖平均收益率

意大利12个月期BOT国债拍卖平均收益率公:--

预: --

前: --

德国10年期Bund国债拍卖平均收益率

德国10年期Bund国债拍卖平均收益率公:--

预: --

前: --

美国MBA抵押贷款申请活动指数周环比

美国MBA抵押贷款申请活动指数周环比公:--

预: --

前: --

巴西零售销售月率 (1月)

巴西零售销售月率 (1月)公:--

预: --

前: --

美国核心CPI年率 (未季调) (2月)

美国核心CPI年率 (未季调) (2月)公:--

预: --

前: --

美国CPI月率 (未季调) (2月)

美国CPI月率 (未季调) (2月)公:--

预: --

前: --

美国核心CPI月率 (季调后) (2月)

美国核心CPI月率 (季调后) (2月)公:--

预: --

前: --

美国CPI年率 (未季调) (2月)

美国CPI年率 (未季调) (2月)公:--

预: --

前: --

美国CPI月率 (季调后) (2月)

美国CPI月率 (季调后) (2月)公:--

预: --

前: --

美国核心CPI (季调后) (2月)

美国核心CPI (季调后) (2月)公:--

预: --

前: --

美国实际收入月率 (季调后) (2月)

美国实际收入月率 (季调后) (2月)公:--

预: --

前: --

美国当周EIA原油进口变动

美国当周EIA原油进口变动公:--

预: --

前: --

美国当周EIA取暖油库存变动

美国当周EIA取暖油库存变动公:--

预: --

前: --

美国EIA原油产量预测当周需求数据

美国EIA原油产量预测当周需求数据公:--

预: --

前: --

美国当周EIA汽油库存变动

美国当周EIA汽油库存变动公:--

预: --

前: --

美国当周EIA原油库存变动

美国当周EIA原油库存变动公:--

预: --

前: --

美国当周EIA俄克拉荷马州库欣原油库存变动

美国当周EIA俄克拉荷马州库欣原油库存变动公:--

预: --

前: --

美国主要消费者信心指数 (PCSI) (3月)

美国主要消费者信心指数 (PCSI) (3月)--

预: --

前: --

美国克利夫兰联储CPI月率 (2月)

美国克利夫兰联储CPI月率 (2月)--

预: --

前: --

美国克里夫兰联储CPI月率 (季调后) (2月)

美国克里夫兰联储CPI月率 (季调后) (2月)--

预: --

前: --

美国10年期国债拍卖平均收益率

美国10年期国债拍卖平均收益率--

预: --

前: --

美国预算余额 (2月)

美国预算余额 (2月)--

预: --

前: --

澳大利亚消费者通胀预期 (3月)

澳大利亚消费者通胀预期 (3月)--

预: --

前: --

英国三个月RICS房价指数 (2月)

英国三个月RICS房价指数 (2月)--

预: --

前: --

IEA月度原油市场报告

IEA月度原油市场报告 南非黄金产量年率 (1月)

南非黄金产量年率 (1月)--

预: --

前: --

南非矿业产出年率 (1月)

南非矿业产出年率 (1月)--

预: --

前: --

英国央行行长贝利发表讲话

英国央行行长贝利发表讲话 印度CPI年率 (2月)

印度CPI年率 (2月)--

预: --

前: --

英国主要消费者信心指数 (PCSI) (3月)

英国主要消费者信心指数 (PCSI) (3月)--

预: --

前: --

土耳其延迟流动性窗口操作利率 (3月)

土耳其延迟流动性窗口操作利率 (3月)--

预: --

前: --

南非主要消费者信心指数 (PCSI) (3月)

南非主要消费者信心指数 (PCSI) (3月)--

预: --

前: --

土耳其一周回购利率

土耳其一周回购利率--

预: --

前: --

土耳其隔夜借贷利率 (3月)

土耳其隔夜借贷利率 (3月)--

预: --

前: --

巴西IPCA通胀指数年率 (2月)

巴西IPCA通胀指数年率 (2月)--

预: --

前: --

巴西CPI年率 (2月)

巴西CPI年率 (2月)--

预: --

前: --

美国年度新屋开工数量 (季调后) (1月)

美国年度新屋开工数量 (季调后) (1月)--

预: --

前: --

美国营建许可总数 (季调后) (1月)

美国营建许可总数 (季调后) (1月)--

预: --

前: --

美国贸易账 (1月)

美国贸易账 (1月)--

预: --

前: --

加拿大批发库存年率 (1月)

加拿大批发库存年率 (1月)--

预: --

前: --

加拿大批发库存月率 (1月)

加拿大批发库存月率 (1月)--

预: --

前: --

加拿大批发销售年率 (1月)

加拿大批发销售年率 (1月)--

预: --

前: --

加拿大进口额 (季调后) (1月)

加拿大进口额 (季调后) (1月)--

预: --

前: --

加拿大出口额 (季调后) (1月)

加拿大出口额 (季调后) (1月)--

预: --

前: --

加拿大营建许可月率 (季调后) (1月)

加拿大营建许可月率 (季调后) (1月)--

预: --

前: --

美国出口额 (1月)

美国出口额 (1月)--

预: --

前: --

美国新屋开工年化月率 (季调后) (1月)

美国新屋开工年化月率 (季调后) (1月)--

预: --

前: --

加拿大批发销售月率 (季调后) (1月)

加拿大批发销售月率 (季调后) (1月)--

预: --

前: --

无匹配数据

WazirX hack fallout: User challenges $9,400 XRP account freeze

The case began when Rhutikumari, an XRP (XRP) holder, filed a petition against WazirX after the exchange froze her account containing 3,532.30 XRP worth approximately $9,400. The dispute stemmed from WazirX’s response to a July 2024 hack that led to the theft of about $235 million in assets.

To manage the losses, WazirX proposed a controversial “socialization of losses” plan, which would distribute the financial impact proportionally across all user accounts. Rhutikumari challenged the plan, arguing that it infringed on her ownership rights.

In its defense, WazirX argued that the dispute was governed by a Singapore High Court-approved restructuring plan, which outlined a three-step process for pro rata compensation to all users. The exchange argued that it does not directly own user wallets and claimed the Madras High Court lacked jurisdiction because arbitration was based in Singapore. It also added that trading and withdrawals had been temporarily paused for all users during the restructuring process.

This situation prompted the Madras High Court to rule not only on Rhutikumari’s account but also on whether cryptocurrencies like XRP qualify as personal property under Indian law.

Did you know? XRP can settle cross-border transactions in just three to five seconds, making it one of the fastest digital assets for payments.

Court sets legal precedent in India

In a significant interim ruling, the Madras High Court declared that cryptocurrencies are “property capable of being possessed and held in trust,” formally recognizing them under Indian law.

Justice N. Anand Venkatesh held that digital assets such as XRP constitute a form of property — intangible yet capable of being possessed, enjoyed and held in trust — rather than mere speculative instruments. In reaching this conclusion, he referred to Section 2(47A) of the Income Tax Act and drew from both Indian jurisprudence and international precedents, including the New Zealand case Ruscoe v. Cryptopia Ltd.

Although WazirX argued that a Singapore court-approved restructuring scheme governed the dispute, the Madras High Court disagreed. The court held that it retained jurisdiction since the petitioner, Rhutikumari, had transferred funds from an Indian bank account. It also noted that she accessed the WazirX platform from within India, creating a domestic cause of action.

As interim relief, the court prohibited Zanmai Labs, the Indian company operating WazirX, from reallocating Rhutikumari’s 3,532.30 XRP and ordered the exchange to provide a bank guarantee of approximately $11,500 until the matter is resolved. The ruling established cryptocurrency ownership as a legally protected property right in India.

Did you know? Many people confuse Ripple and XRP, but they’re not the same. Ripple is the company building blockchain-based payment solutions, while XRP is the decentralized digital asset that powers those transactions on the XRP Ledger, the blockchain network.

Why this ruling matters for crypto holders in India

The Madras High Court’s ruling marks a turning point for India’s crypto market, providing much-needed legal clarity. For the first time, a high court has formally recognized a digital asset like XRP as “property” under Indian law, granting investors clear ownership rights.

The Madras High Court’s interim order protects holders by restraining Zanmai Labs from reallocating or liquidating an investor’s XRP to offset losses from a hack or restructuring. It sets a precedent in which courts may treat crypto holdings as customer-owned property instead of unsecured claims on an exchange.

The ruling is widely expected to strengthen investor confidence in XRP in India, given the new legal clarity it provides.

The judgment may prompt lawmakers to introduce clearer and stronger rules on the ownership and rights of virtual digital asset holders. While this may take time, the ruling could serve as an important first step.

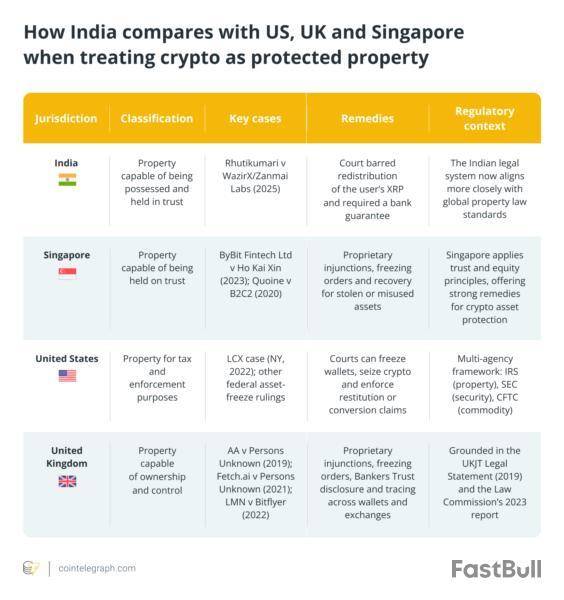

India joins the US, UK and Singapore in treating crypto as protected property

The Madras High Court’s ruling recognizes that cryptocurrencies constitute property under Indian law, offering legal protection to holders in India. With this decision, India aligns with other jurisdictions — including Singapore and the United States — that have also treated crypto assets as property in certain legal contexts.

In the US, the Internal Revenue Service (IRS) classifies virtual currency as property for federal tax purposes. Courts can freeze wallets, issue injunctions and seize crypto under property law and civil forfeiture rules. This property classification may help victims of hacks or fraud by providing a legal basis for recovery strategies, although actual recovery depends on traceability, jurisdiction and exchange cooperation.

English courts recognize crypto assets as property, enabling injunctive relief, tracing and disclosure orders. A landmark decision was AA v. Persons Unknown [2019] EWHC 3556 (Comm), where the court held that crypto assets such as Bitcoin (BTC) can be treated as property because they are definable, identifiable, transferable and satisfy the criteria for property rights.

Although English law traditionally divides property into “things in possession” and “things in action,” the court accepted that novel assets such as crypto assets may fall into a third category of personal property.

In Singapore, the High Court in ByBit Fintech Ltd v Ho Kai Xin & Ors [2023] SGHC 199 held that crypto assets are “property capable of being held on trust” and accordingly declared a constructive trust over misappropriated digital assets. The court’s decision enabled proprietary rights and equitable remedies (such as freezing orders and tracing) in respect of those assets, reinforcing that ownership of crypto can attract protection equivalent to traditional property.

How property status for crypto could impact XRP in India

The Madras High Court’s recognition of XRP as property could significantly impact India’s crypto market and boost investor confidence.

For XRP, stronger legal protections may increase local demand in India and strengthen investor confidence. As of Nov. 3, 2025, XRP was trading at approximately $2.3, with technical resistance around $2.80. If the ruling boosts demand in India, XRP could break above that resistance level.

For exchanges, the ruling may require a reorganization of their terms of service. They may need to revisit custody arrangements and restructuring plans, as the law now treats users’ tokens as protected property rather than shared assets.

For investors, understanding their legal rights is crucial. They now have stronger ownership recognition over the crypto assets they keep with exchanges. India now stands closer to jurisdictions such as the US, UK and Singapore. This alignment could accelerate India’s regulatory progress, fostering greater transparency, accountability and trust in the digital asset ecosystem.

Did you know? Unlike Bitcoin, XRP uses a consensus protocol that consumes very little energy. Some estimates put it at around 0.0079 kilowatt-hours (kWh) per transaction, compared to estimates of hundreds of kWh for Bitcoin.

Limitations of India’s landmark crypto property ruling

The Madras High Court’s ruling is a significant step forward, but it comes with certain limitations. As a crypto trader, it’s important to understand these constraints clearly.

Sphere: The Madras High Court’s decision is an interim order specific to one holder’s 3,532 XRP, so it may not automatically apply to all wallets, tokens or exchanges.

Token type: The court clarified that XRP and similar assets are not “currency” but intangible property, leaving uncertainty over how other types of virtual digital assets might be classified.

Enforcement and recovery: While property status offers potential protection, actual enforcement and recovery will depend on each exchange’s custody practices and transparency.

Regulatory evolution: India still lacks a comprehensive regulatory framework. This ruling is judicial, not legislative, and future legislation could override the court’s decision.

Inter-jurisdictional issues: Cross-border crypto transactions may introduce additional complexity, as protections granted in one jurisdiction may not extend to another.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。