行情

新闻

分析

用户

快讯

财经日历

学习

数据

- 名称

- 最新值

- 前值

VIP跟单

所有跟单

所有比赛

法国10年期OA国债拍卖平均收益率

法国10年期OA国债拍卖平均收益率公:--

预: --

前: --

欧元区零售销售月率 (10月)

欧元区零售销售月率 (10月)公:--

预: --

前: --

欧元区零售销售年率 (10月)

欧元区零售销售年率 (10月)公:--

预: --

前: --

巴西GDP年率 (第三季度)

巴西GDP年率 (第三季度)公:--

预: --

前: --

美国挑战者企业裁员人数 (11月)

美国挑战者企业裁员人数 (11月)公:--

预: --

前: --

美国挑战者企业裁员月率 (11月)

美国挑战者企业裁员月率 (11月)公:--

预: --

前: --

美国挑战者企业裁员年率 (11月)

美国挑战者企业裁员年率 (11月)公:--

预: --

前: --

美国当周初请失业金人数四周均值 (季调后)

美国当周初请失业金人数四周均值 (季调后)公:--

预: --

前: --

美国当周初请失业金人数 (季调后)

美国当周初请失业金人数 (季调后)公:--

预: --

前: --

美国当周续请失业金人数 (季调后)

美国当周续请失业金人数 (季调后)公:--

预: --

前: --

加拿大Ivey PMI (季调后) (11月)

加拿大Ivey PMI (季调后) (11月)公:--

预: --

前: --

加拿大Ivey PMI (未季调) (11月)

加拿大Ivey PMI (未季调) (11月)公:--

预: --

前: --

美国非国防资本耐用品订单月率修正值 (不含飞机) (季调后) (9月)

美国非国防资本耐用品订单月率修正值 (不含飞机) (季调后) (9月)公:--

预: --

美国工厂订单月率 (不含运输) (9月)

美国工厂订单月率 (不含运输) (9月)公:--

预: --

前: --

美国工厂订单月率 (9月)

美国工厂订单月率 (9月)公:--

预: --

前: --

美国工厂订单月率 (不含国防) (9月)

美国工厂订单月率 (不含国防) (9月)公:--

预: --

前: --

美国当周EIA天然气库存变动

美国当周EIA天然气库存变动公:--

预: --

前: --

沙特阿拉伯原油产量

沙特阿拉伯原油产量公:--

预: --

前: --

美国当周外国央行持有美国国债

美国当周外国央行持有美国国债公:--

预: --

前: --

日本外汇储备 (11月)

日本外汇储备 (11月)公:--

预: --

前: --

印度回购利率

印度回购利率公:--

预: --

前: --

印度基准利率

印度基准利率公:--

预: --

前: --

印度逆回购利率

印度逆回购利率公:--

预: --

前: --

印度央行存款准备金率

印度央行存款准备金率公:--

预: --

前: --

日本领先指标初值 (10月)

日本领先指标初值 (10月)公:--

预: --

前: --

英国Halifax房价指数年率 (季调后) (11月)

英国Halifax房价指数年率 (季调后) (11月)公:--

预: --

前: --

英国Halifax房价指数月率 (季调后) (11月)

英国Halifax房价指数月率 (季调后) (11月)公:--

预: --

前: --

法国经常账 (未季调) (10月)

法国经常账 (未季调) (10月)公:--

预: --

前: --

法国贸易账 (季调后) (10月)

法国贸易账 (季调后) (10月)公:--

预: --

前: --

法国工业产出月率 (季调后) (10月)

法国工业产出月率 (季调后) (10月)公:--

预: --

前: --

意大利零售销售月率 (季调后) (10月)

意大利零售销售月率 (季调后) (10月)--

预: --

前: --

欧元区就业人数年率 (季调后) (第三季度)

欧元区就业人数年率 (季调后) (第三季度)--

预: --

前: --

欧元区GDP年率终值 (第三季度)

欧元区GDP年率终值 (第三季度)--

预: --

前: --

欧元区GDP季率终值 (第三季度)

欧元区GDP季率终值 (第三季度)--

预: --

前: --

欧元区就业人数季率终值 (季调后) (第三季度)

欧元区就业人数季率终值 (季调后) (第三季度)--

预: --

前: --

欧元区就业人数终值 (季调后) (第三季度)

欧元区就业人数终值 (季调后) (第三季度)--

预: --

巴西PPI月率 (10月)

巴西PPI月率 (10月)--

预: --

前: --

墨西哥消费者信心指数 (11月)

墨西哥消费者信心指数 (11月)--

预: --

前: --

加拿大失业率 (季调后) (11月)

加拿大失业率 (季调后) (11月)--

预: --

前: --

加拿大就业参与率 (季调后) (11月)

加拿大就业参与率 (季调后) (11月)--

预: --

前: --

加拿大就业人数 (季调后) (11月)

加拿大就业人数 (季调后) (11月)--

预: --

前: --

加拿大兼职就业人数 (季调后) (11月)

加拿大兼职就业人数 (季调后) (11月)--

预: --

前: --

加拿大全职就业人数 (季调后) (11月)

加拿大全职就业人数 (季调后) (11月)--

预: --

前: --

美国个人收入月率 (9月)

美国个人收入月率 (9月)--

预: --

前: --

美国达拉斯联储PCE物价指数年率 (9月)

美国达拉斯联储PCE物价指数年率 (9月)--

预: --

前: --

美国PCE物价指数年率 (季调后) (9月)

美国PCE物价指数年率 (季调后) (9月)--

预: --

前: --

美国PCE物价指数月率 (9月)

美国PCE物价指数月率 (9月)--

预: --

前: --

美国个人支出月率 (季调后) (9月)

美国个人支出月率 (季调后) (9月)--

预: --

前: --

美国核心PCE物价指数月率 (9月)

美国核心PCE物价指数月率 (9月)--

预: --

前: --

美国密歇根大学五年通胀年率初值 (12月)

美国密歇根大学五年通胀年率初值 (12月)--

预: --

前: --

美国核心PCE物价指数年率 (9月)

美国核心PCE物价指数年率 (9月)--

预: --

前: --

美国实际个人消费支出月率 (9月)

美国实际个人消费支出月率 (9月)--

预: --

前: --

美国五至十年期通胀率预期 (12月)

美国五至十年期通胀率预期 (12月)--

预: --

前: --

美国密歇根大学现况指数初值 (12月)

美国密歇根大学现况指数初值 (12月)--

预: --

前: --

美国密歇根大学消费者信心指数初值 (12月)

美国密歇根大学消费者信心指数初值 (12月)--

预: --

前: --

美国密歇根大学一年期通胀率预期初值 (12月)

美国密歇根大学一年期通胀率预期初值 (12月)--

预: --

前: --

美国密歇根大学消费者预期指数初值 (12月)

美国密歇根大学消费者预期指数初值 (12月)--

预: --

前: --

美国当周钻井总数

美国当周钻井总数--

预: --

前: --

美国当周石油钻井总数

美国当周石油钻井总数--

预: --

前: --

美国消费信贷 (季调后) (10月)

美国消费信贷 (季调后) (10月)--

预: --

前: --

无匹配数据

In a recent social media post, Coinbase CEO Brian Armstrong has stated that crypto helps to inject economic freedom and capitalism into every country in the world.

"If we want greater prosperity, especially for the poorest people in society, we need more capitalism, and less socialism," the Coinbase head said.

Is it that simple?

Armstrong has quoted popular economics blogger Noah Smith, who has compared the development of Venezuela and Poland.

Venezuela implemented policies of nationalization and state control under Hugo Chávez, which stifled its oil industry and other vital sectors of the economy. As a result, the country has faced hyperinflation, mass emigration, shortages, and so on.

In the meantime, Poland implemented a set of privatization and liberalization reforms following the fall of the Soviet Union, experiencing steady economic growth.

However, some naysayers argue that Poland's example is actually misleading, given that the country has secured billions of euros worth of subsidies from Germany and other EU members on an annual basis.

Moreover, the Central European country still has a lot of socialist policies, such as free education, free healthcare, and various other social protections.

Socialism in New York

The debate comes after extreme socialist Zohran Mamdani was elected as the new mayor of New York. Roughly 9% of the entire city stated that they would leave the financial capital of the world if Mamdani were to spearhead it.

There are persistent concerns about the tax base eroding due to high-net-worth individuals leaving the city.

As reported by U.Today, Robert Kiyosaki, the author of "Rich Dad Poor Dad," previously urged investors to protect themselves with Bitcoin and Ethereum following Mamdani's victory.

Long-term Bitcoin holders could be selling their holdings to shift into exchange-traded funds (ETFs) and to diversify their crypto portfolios, says Dr. Martin Hiesboeck, the head of research at cloud-based financial service platform Uphold.

“There are several reasons why OG crypto holders are selling,” Hiesboeck said on Sunday. “Number one is to buy them back in the form of ETFs, which offer incredible tax advantages with current rules, especially in the US.”

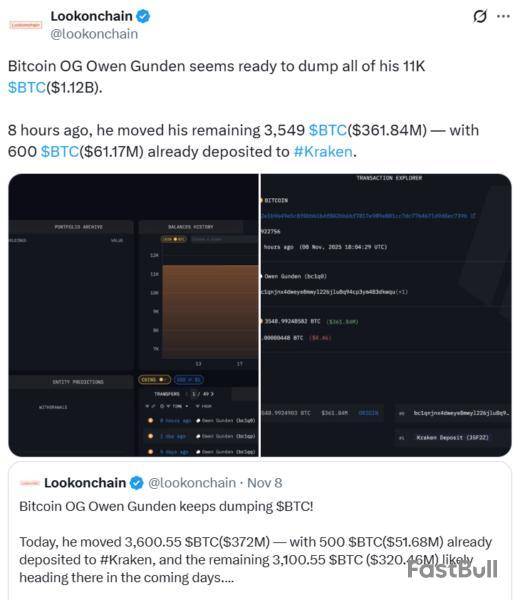

Early Bitcoin (BTC) arbitrage trader Owen Gunden was among the latest to shift his 11,000 Bitcoin holdings to an exchange, with a final transfer of 3,549 coins on Sunday, according to Lookonchain.

Several long-term Bitcoin whales have also woken up after years of dormancy this year and sold off their holdings, including a Satoshi-era Bitcoin whale with 80,000 Bitcoin, which had been inactive for 14 years before it started moving around its massive stash in July.

Bitcoin a more mature asset now

Hiesboeck said Bitcoin’s compound annual growth rate (CAGR) has been diminishing, suggesting it’s moving away from being a high-growth asset to use “as a hedge against traditional financial systems failures and fiat.”

Bitcoin's four-year CAGR has been steadily declining this year and dropped into single digits for the first time in April. As of Nov. 10, it’s around 13%, according to Bitbo.

“This maturity is accelerated by events like the launch of spot Bitcoin exchange-traded funds, which bring in large, institutional capital that is generally less volatile than retail-driven speculative flows, thus dampening extreme price swings and contributing to a lower, steadier growth rate,” Hiesboeck said.

Macro analyst Jordi Visser suggested earlier this month that Bitcoin is in an initial product offering phase, with original holders rotating out and new traders scooping up the tokens, thereby widening distribution.

Next phase isn’t about Bitcoin versus altcoins

Hiesboeck also argues the distinction between Bitcoin and altcoins is no longer relevant, as the space is ever-evolving, and it would be better to let go of old rivalries and focus on projects “that will change the world and avoid those that will likely fail.”

“We are in an exciting tech space with room for many projects, it’s not a question which football team you support,” he said.

Following last week’s sharp decline, the cryptocurrency market has rebounded with strong momentum. In just 24 hours, global crypto valuation jumped nearly 5%, reaching $3.58 trillion. Bitcoin climbed past $107,000, while Ethereum, Solana, and XRP saw double-digit gains. But what’s causing this sudden market comeback? Here are five key reasons driving the rally.

Trump’s $400 Billion Tariff Dividend

The biggest jump came from Donald Trump’s announcement of a massive “tariff dividend,” a $2,000 payment for Americans funded by U.S. tariff revenues. This move, expected to inject over $400 billion into the economy, immediately lifted market sentiment.

Traders believe a portion of this money could flow into risk assets, such as Bitcoin and altcoins, just as previous stimulus checks fueled rallies in 2021.

Government Shutdown Nearing Its End

Adding to the positive tone, Washington finally appears close to ending its prolonged government shutdown. A bipartisan deal reached over the weekend promises stability, avoiding layoffs and restoring key government functions.

This move removes a major risk factor and brings back the release of vital economic data on jobs and inflation, both key for market stability.

SOFR Rate Declines to Multi-Year Low

Another key reason behind this rally is the steady decline in the Secured Overnight Financing Rate (SOFR), now sitting at its lowest level in years. This rate reflects the cost of short-term borrowing among major banks.

When SOFR drops, it typically encourages investors to take on more risk, a key reason why both stocks and crypto are seeing inflows again.

Massive Short Liquidations

Bitcoin’s jump above $106K triggered massive short liquidations, forcing traders to close bearish positions and fueling a rapid market rebound. In just 24 hours, over 118,000 traders were liquidated, totaling $342 million, with the largest single order worth nearly $19 million on Hyperliquid.

Surge in Trading Volume and Open Interest

Crypto trading activity has picked up again, signaling growing investor participation. Open interest in crypto futures rose 5% in 24 hours to $148 billion, showing traders are regaining trust and re-entering the market with leverage.

FAQs

Why is the crypto market surging today?The market is rising due to Trump’s tariff dividend plan, easing shutdown risks, lower SOFR rates, short liquidations, and higher trading activity.

How does Trump’s $2,000 tariff dividend affect crypto prices?A large cash injection boosts investor confidence and may push some Americans to buy crypto, lifting prices across major coins.

Is the end of the U.S. government shutdown helping the crypto market?Yes. A likely end to the shutdown restores stability and key economic data, improving risk sentiment and supporting crypto gains.

Why are trading volumes and open interest rising?More traders are returning to the market with leverage as confidence improves, pushing up trading volumes and open interest.

Multiple US economic events are on the calendar this week, and could either hinder the Bitcoin price’s path to $110,000 or be the tailwinds that drive it further north.

The influence of US economic signals on Bitcoin and crypto remains significant in 2025, with associated sentiment becoming a critical factor in short-term price action.

US Economic Signals to Watch This Week

With increasing optimism about a deal to end the longstanding US government shutdown, the Bitcoin price is already showing strength and has climbed above the $105,000 threshold. However, whether it extends further north or retracts may hinge on the following headlines this week.

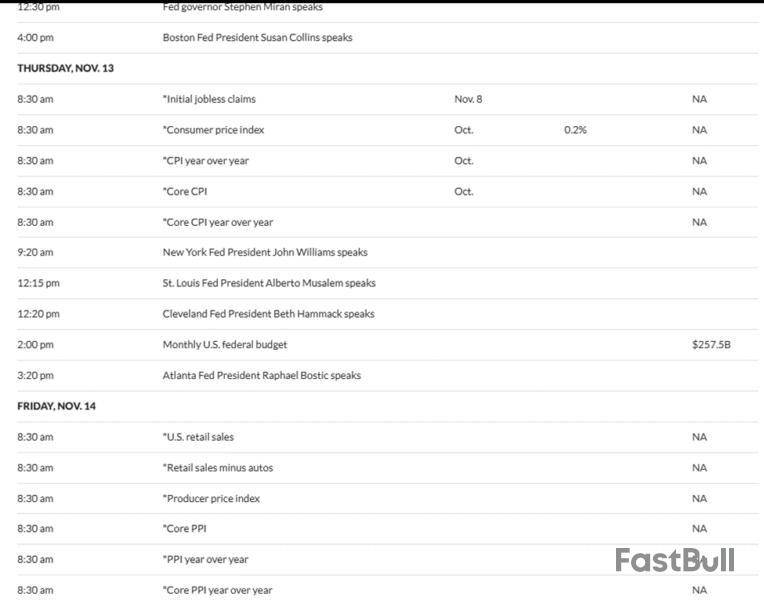

Fed Speeches

A long list of Federal Reserve (Fed) officials is expected to speak this week. Fed governor Michael Barr speaks on Tuesday, while New York Fed President John Williams, Philadelphia Fed President Anna Paulson, Fed governor Chris Waller, Atlanta Fed President Raphael Bostic, Fed governor Stephen Miran, and Boston Fed President Susan Collins speak on Wednesday.

Sentiments from these Fed officials, among others, in the week could influence investor sentiment, influencing the Bitcoin price’s directional bias.

US Federal Reserve Chairman Jerome Powell recently stated that the Fed will soon expand its balance sheet again. This signaled preparation for a new phase of quantitative easing (QE).

“Our long-stated plan has been to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions,” Fed Chair Jerome Powell said at a recent press conference. “Signs have clearly emerged that we have reached that standard in money markets,” he added.

The news sent crypto investors into a frenzy in anticipation of a surge in fresh liquidity. At the same time, skeptics warned that it could inflate a dangerous bubble.

Against this backdrop, further indications or statements regarding QE down the road could further influence sentiment.

Initial Jobless Claims

Another key US economic event to watch this week is the Initial Jobless Claims, which reports the number of US Citizens who filed for unemployment insurance the previous week.

This metric serves as a leading indicator of labor market health. As such, lower-than-expected claims signal economic strength and stability, while higher-than-expected claims indicate weakness, potential layoffs, and increased recession risks.

Higher-than-expected jobless claims are Bullish for Bitcoin, as they signal potential Fed rate cuts. Conversely, lower-than-expected claims are bearish, often signaling delays or cuts.

Notably, however, the release of this data point, or its absence, depends on whether the US government shutdown will have ended by Thursday.

“After 40 days, the Senate unlocked a path to reopen the government. Final vote: 60-40. I voted for the 15th time to end the Schumer Shutdown… I’m frustrated that Oklahomans have faced almost six weeks of unnecessary hardship, travel delays, and missed paychecks. Still, after this important vote, I’m optimistic the Schumer Shutdown will soon come to an end,” said Oklahoma Senator Markwayne Mullin.

Reportedly, eight Democrats voted with Republicans to reach the necessary 60-vote threshold to end the filibuster. This vote has failed 14 times in the past 40 days.

CPI

The October CPI (Consumer Price Index) data may also be released this week, on Thursday, to show how prices rose in October. Like the initial jobless claims, however, this schedule is contingent on the government shutdown ending.

It follows the September CPI, which came in below expectations, showing inflation rose at an annual rate of 3% year-over-year in October.

“We’ve got 4 days until CPI. The narrative leading into it will shape what comes next, another local top or a local bottom,” crypto analyst Killa stated.

As long as inflation remains above the Fed’s 2% target, it keeps monetary policy restrictive, delaying aggressive rate cuts. This is mildly bearish for Bitcoin, which thrives on liquidity.

If CPI rises from the 3.0% seen in September, the persistent inflation could force the Fed to pause or hike, draining risk appetite. Conversely, a drop below the 3.0% would confirm disinflation, boosting rate-cut expectations.

PPI

The PPI is also contingent on the end of the US government shutdown, as it measures wholesale inflation or the cost that producers pay for goods before they reach consumers.

“This week is all about inflation + politics. Markets are bracing for a double-header: CPI on Thursday and PPI + Retail Sales on Friday, a full read on inflation and consumer strength. These prints will set the tone for risk assets into year-end,” analyst Mark Cullen stated.

Based on these tentative US economic events, the US government shutdown drama remains a crucial factor in the Bitcoin price’s directional bias this week.

As of this writing, BTC was trading for $106,195, up by over 4% in the last 24 hours.

November 10, 2025 06:15:25 UTC

Ripple Trust Bank Set to Gain Edge in Basel III Era

With Basel III Endgame taking effect on January 1, 2026, global banks will face tougher capital rules, but Ripple Trust Bank stands out. Operating under a U.S. Trust Bank charter, it avoids lending risks and focuses on digital asset custody and settlement. Integrated with the Federal Reserve’s RTGS system and XRP Ledger, its RLUSD stablecoin, backed by U.S. Treasuries, meets Basel III liquidity standards, positioning Ripple Trust Bank as a low-risk bridge between traditional finance and blockchain.

November 10, 2025 06:14:01 UTC

Stablecoin Supply Slips After Months of Growth — Is Market Liquidity Cooling?

The stablecoin market cap is starting to decline after months of steady growth, signaling a potential cooling in crypto liquidity. Analysts often view stablecoin trends as a leading indicator of capital inflows and outflows across digital assets. The recent drop suggests that fresh money entering the market may be slowing, a development traders are watching closely as it could hint at reduced buying power and a short-term pullback in risk assets like Bitcoin and Ethereum.

November 10, 2025 05:23:34 UTC

U.S. Set to Inject $500 Billion — Crypto Market Goes Parabolic

The U.S. government is reportedly preparing a massive $500 billion market injection, marking the first major liquidity boost since 2021. Back then, a similar move triggered an explosive 10,000% crypto rally in just weeks. Traders are calling it “Giga Bullish” as Bitcoin surges parabolic in early reaction. With fresh liquidity on the horizon, market sentiment is shifting sharply bullish — and investors are bracing for another historic crypto breakout.

November 10, 2025 05:23:34 UTC

Bitcoin Clings to $100K Support as Traders Brace for CPI Data

Bitcoin is testing a historic support level near $99,200, dubbed the “Golden Line” — a price zone it hasn’t lost since the 2023 bull market began. Analyst DrProfit warns that closing below this level could mark a major shift from bull to bear territory. Despite a brief bounce, he expects Bitcoin to break lower amid rising leverage and market manipulation. His strategy remains fully in USDT, holding shorts from $119K with plans to add more near $117K, ahead of key CPI and PPI data this week.

November 10, 2025 05:23:34 UTC

Key Events to Watch: $2,000 Dividend, Fed Talks, and OPEC Report Signal Volatility Ahead

Markets brace for another volatile week as major macro events unfold. On Monday, traders will react to Trump’s proposed $2,000 “tariff dividend” and the U.S. government shutdown, now in its 41st day. Tuesday brings the NFIB Small Business Index, followed by OPEC’s Monthly Report on Wednesday. Thursday features the Federal Budget Balance, while nine Fed officials are set to speak throughout the week — potentially shaping market sentiment and fueling swings across stocks, bonds, and crypto.

November 10, 2025 05:23:34 UTC

Robert Kiyosaki Predicts Gold at $27K, Bitcoin at $250K — Says “Crash Will Make Me Rich”

Rich Dad Poor Dad author Robert Kiyosaki says he’s buying, not selling ahead of what he calls an inevitable market crash. Kiyosaki revealed bold targets: Gold at $27,000, Bitcoin at $250,000, Silver at $100, and Ethereum at $60,000 by 2026. Citing lessons from Gresham’s and Metcalfe’s laws, he blames the U.S. Treasury and Fed for “printing fake money,” making savers “the biggest losers.” Despite warning of a looming crash, Kiyosaki remains confident: “Massive riches ahead.”

Robert Kiyosaki@theRealKiyosakiNov 09, 2025CRASH COMING: Why I am buying not selling.

My target price for Gold is $27k. I got this price from friend Jim Rickards….and I own two goldmines.

I began buying gold in 1971….the year Nixon took gold from the US Dollar.

Nixon violated Greshams Law, which states “When fake…

Earlier this Monday, the price of Bitcoin, the leading cryptocurrency, surged above the $106,000 level.

The price uptick has coincided with the US Senate voting to advance a deal that would end the longest-ever government shutdown, which has been going on for a total of 40 days. The crucial bill has managed to advance by a vote of 60-40.

The US government initially entered a shutdown on Oct. 1 after Congress did not manage to pass the necessary appropriations to continue funding the government. The Democrats wanted to extend some healthcare subsidies, but the Republicans were opposed to this as well as some other funding issues.

During the initial days of the shutdown, the price of BTC rallied to an all-time high of $126,080. However, the cryptocurrency's bullish momentum then faltered as the shutdown continued to drag on.

ETF floodgates

According to Geraci, the end of the shutdown means that spot ETF floodgates are about to open.

The Securities and Exchange Commission is operating in a limited capacity during the ongoing shutdown, which is why it could not deal with a backlog of filings.

Some ETF filings did manage to get through with the help of "automatic effectiveness" provisions, but the floodgates are yet to truly open.

Solana started a recovery wave above the $162 pivot zone. SOL price is now consolidating and faces hurdles near the $172 zone.

Solana Price Starts Recovery

Solana price extended losses below $150 before the bulls appeared, like Bitcoin and Ethereum. SOL tested the $145 zone and recently started a recovery wave.

There was a move above the $155 and $162 resistance levels. Besides, there was a break above a contracting triangle with resistance at $162 on the hourly chart of the SOL/USD pair. The pair even spiked above the 50% Fib retracement level of the downward move from the $188 swing high to the $145 low.

Solana is now trading above $162 and the 100-hourly simple moving average. On the upside, immediate resistance is near the $168 level. The next major resistance is near the $172 level or the 61.8% Fib retracement level of the downward move from the $188 swing high to the $145 low.

The main resistance could be $178. A successful close above the $178 resistance zone could set the pace for another steady increase. The next key resistance is $185. Any more gains might send the price toward the $196 level.

Another Decline In SOL?

If SOL fails to rise above the $172 resistance, it could continue to move down. Initial support on the downside is near the $162 zone. The first major support is near the $160 level.

A break below the $160 level might send the price toward the $155 support zone. If there is a close below the $155 support, the price could decline toward the $150 zone in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $155 and $150.

Major Resistance Levels – $168 and $172.

交易股票、货币、商品、期货、债券、基金等金融工具或加密货币属高风险行为,这些风险包括损失您的部分或全部投资金额,所以交易并非适合所有投资者。

做出任何财务决定时,应该进行自己的尽职调查,运用自己的判断力,并咨询合格的顾问。本网站的内容并非直接针对您,我们也未考虑您的财务状况或需求。本网站所含信息不一定是实时提供的,也不一定是准确的。本站提供的价格可能由做市商而非交易所提供。您做出的任何交易或其他财务决定均应完全由您负责,并且您不得依赖通过网站提供的任何信息。我们不对网站中的任何信息提供任何保证,并且对因使用网站中的任何信息而可能造成的任何交易损失不承担任何责任。

未经本站书面许可,禁止使用、存储、复制、展现、修改、传播或分发本网站所含数据。提供本网站所含数据的供应商及交易所保留其所有知识产权。