Vantage Accused of Freezing Profitable Accounts Under “Compliance Review” as Withdrawal Dispute Emerges

A retail trader has raised concerns over alleged withdrawal obstruction by broker Vantage, claiming that the firm froze his account shortly after it became profitable. The trader questioned whether KYC and AML procedures were being selectively enforced, drawing attention within the trading community.

According to the trader, he had maintained an active trading account with Vantage for several months, trading commodities and indices such as gold, Bitcoin, and the Dow Jones. Individual trade sizes ranged from approximately HKD 1,000 to HKD 15,000. During this period, the account remained overall unprofitable, and deposits, trading activity, and occasional withdrawals proceeded without issue.

The trader stated that full account verification had been completed prior to trading, including submission of a Hong Kong ID card and proof of address. All transactions were conducted using a personal debit card held in his own name.

Withdrawal Request Triggers Account Review

The dispute arose on January 2, 2026, when the trader made several small deposits totaling HKD 4,500, consistent with his previous trading behavior. After executing a successful trade, his account balance increased to HKD 23,630.82, which became available for withdrawal.

However, upon submitting a withdrawal request, Vantage initiated an “account review” and froze the funds, halting the withdrawal process.

Escalating Verification Demands Raise Concerns

The trader reported that Vantage subsequently imposed a series of additional verification requirements. These included re-verifying identity through selfies holding his HKID card, followed by a request for bank statements explaining the source of the HKD 4,500 deposits.

He questioned the necessity of this request, citing the modest amount involved and the fact that similar scrutiny had never been applied to prior deposits. Despite submitting bank statements and explaining that the funds originated from personal savings, the broker allegedly deemed the information insufficient.

According to the trader, Vantage then requested that he record a personal video explaining the source of funds, a demand he described as intrusive and lacking a clear compliance basis. He also raised concerns regarding data privacy and the handling of biometric information.

Selective Enforcement of Compliance Questioned

The trader emphasized that his identity had already been fully verified through official documents and contact verification, and that all deposits and withdrawals were conducted through a single bank account under his own name. Under these circumstances, he argued that repeated identity and source-of-funds reviews lacked reasonable justification.

From an AML perspective, the trader noted that a HKD 4,500 transaction circulating within the regulated Hong Kong banking system would generally not be classified as high risk. His trading activity was also limited to global commodities and indices, rather than individual equities or high-risk instruments.

According to the complaint, compliance checks were only triggered once the account became profitable and a withdrawal was requested. As of publication, the trader reports that his HKD 23,630.82 balance remains frozen.

BrokersView reminds investors

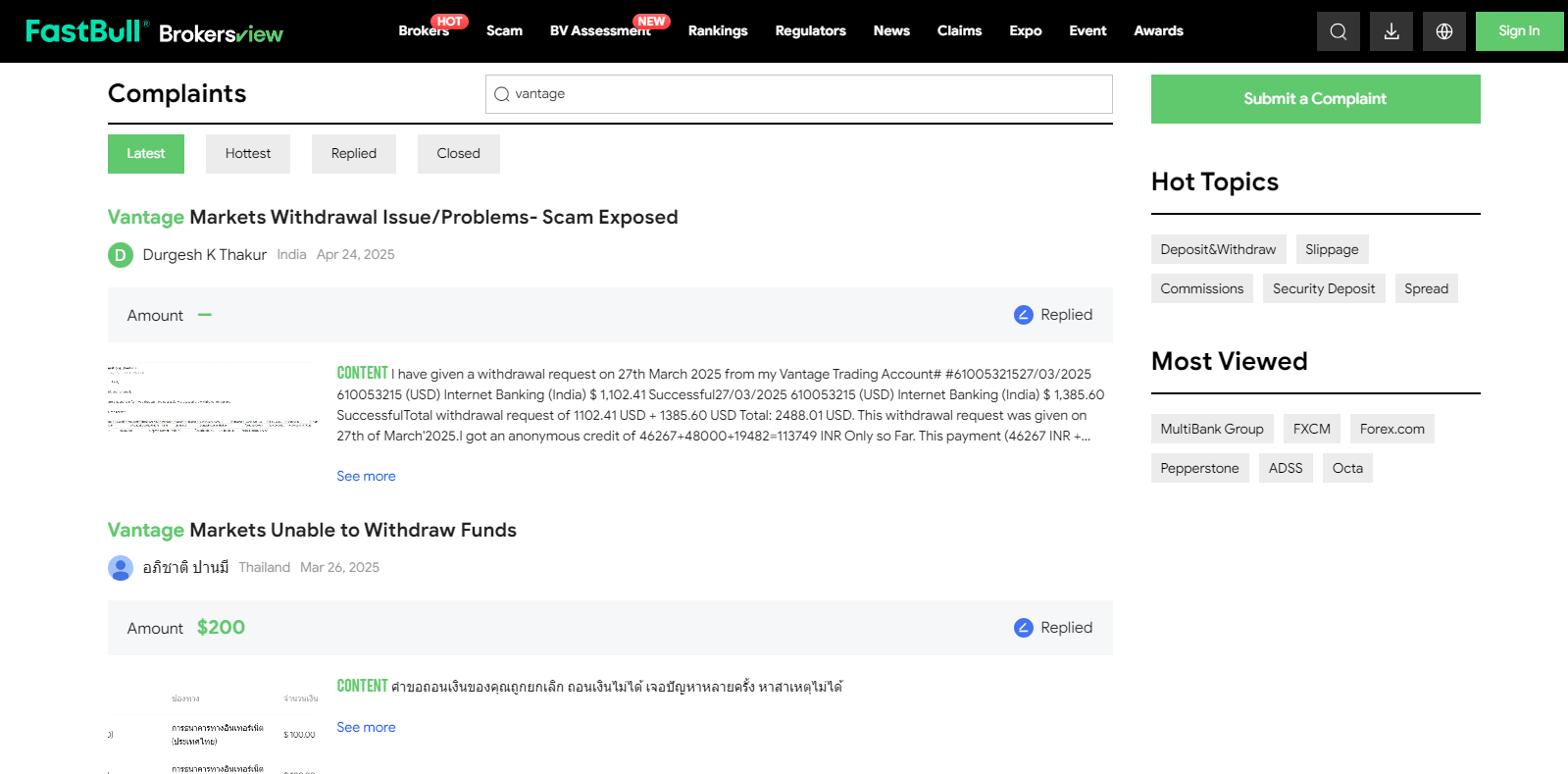

Vantage (also known as Vantage Markets) is a brokerage firm offering leveraged trading services such as forex and contracts for difference (CFDs). The broker claims to hold regulatory licenses in multiple jurisdictions and provides trading services to retail clients globally. However, publicly available information indicates that in recent years, the platform has been repeatedly cited by traders and, in some cases, by regulators over withdrawal-related disputes and issues concerning regulatory cooperation.

In recent years, disputes surrounding trading accounts, withdrawal procedures, and so-called “compliance reviews” have become increasingly complex. In the financial markets, any situation where funds are frozen for extended periods under explanations such as “account unlocking” or “final verification,” without clear standards or defined timelines, warrants heightened caution from investors.

If you encounter similar withdrawal obstacles or abnormal verification demands during your trading activities, it is advisable to promptly retain all relevant records and communications, and to exposure or complaint through credible channels.