Vantage Markets Faces Complaint Over Profit Deduction, Client Claims Over £10,000 Lost in Four Months

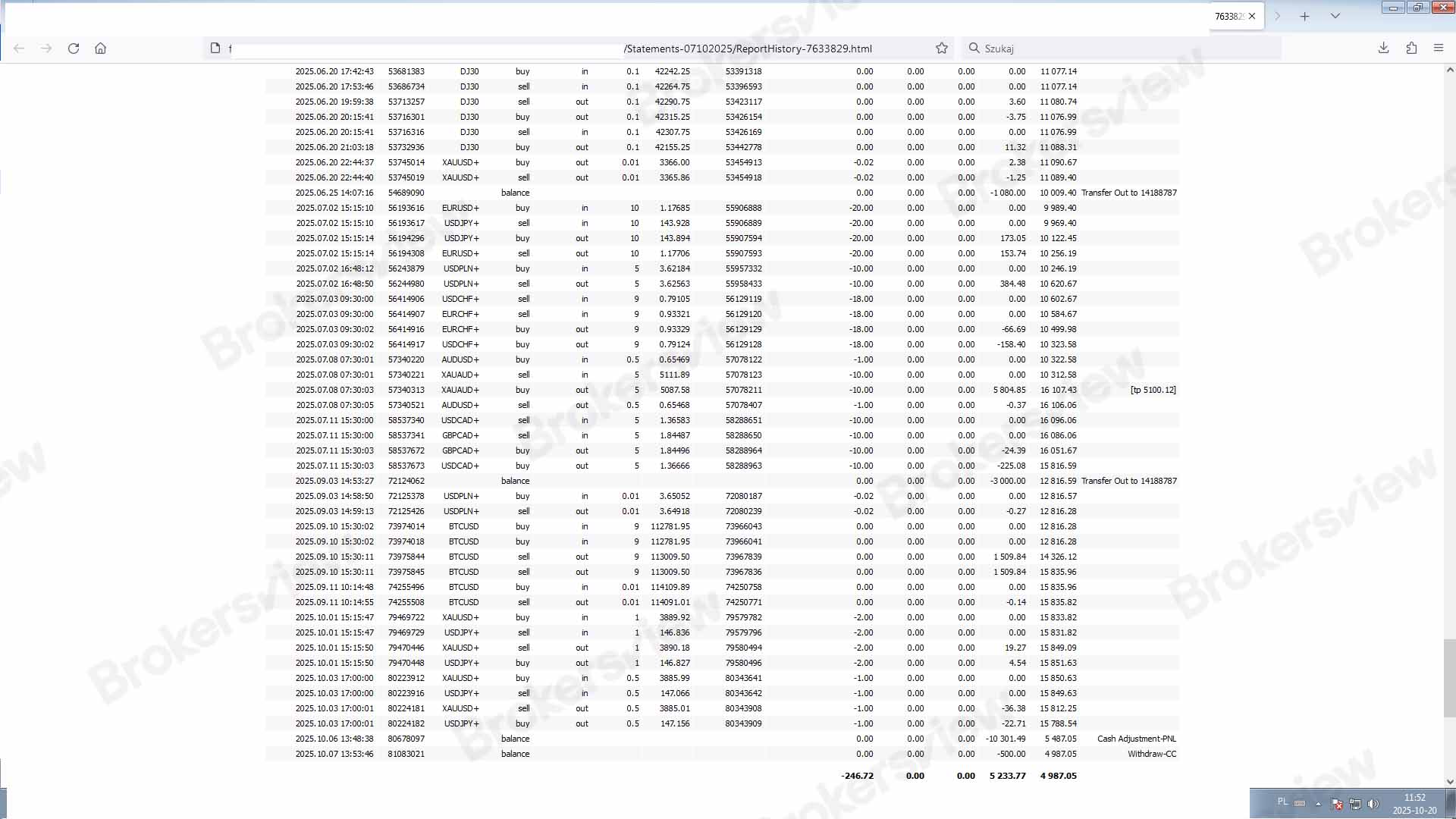

BrokersView recently noted a trader's complaint alleging that during roughly four months of trading with Vantage Markets, he executed nearly 20 trades and accumulated a total profit of about £10,301. Without any prior warning or notification, the trader's account was then subject to an adjustment labeled "Cash Adjustment–PNL –10,301.49 GBP." According to the trader, all trades were directional (non-arbitrage, non-hedging), and no system alerts or account warnings were issued during execution.

The trader stated that the platform cited the "Suspicious Trading Activity" clause in its client agreement as the basis for revoking profits, yet did not specify which trades were deemed in violation or provide detailed explanations or supporting data. The complaint also included screenshots below showing the executed adjustment in the account history.

Broker Responses and Regulatory Information

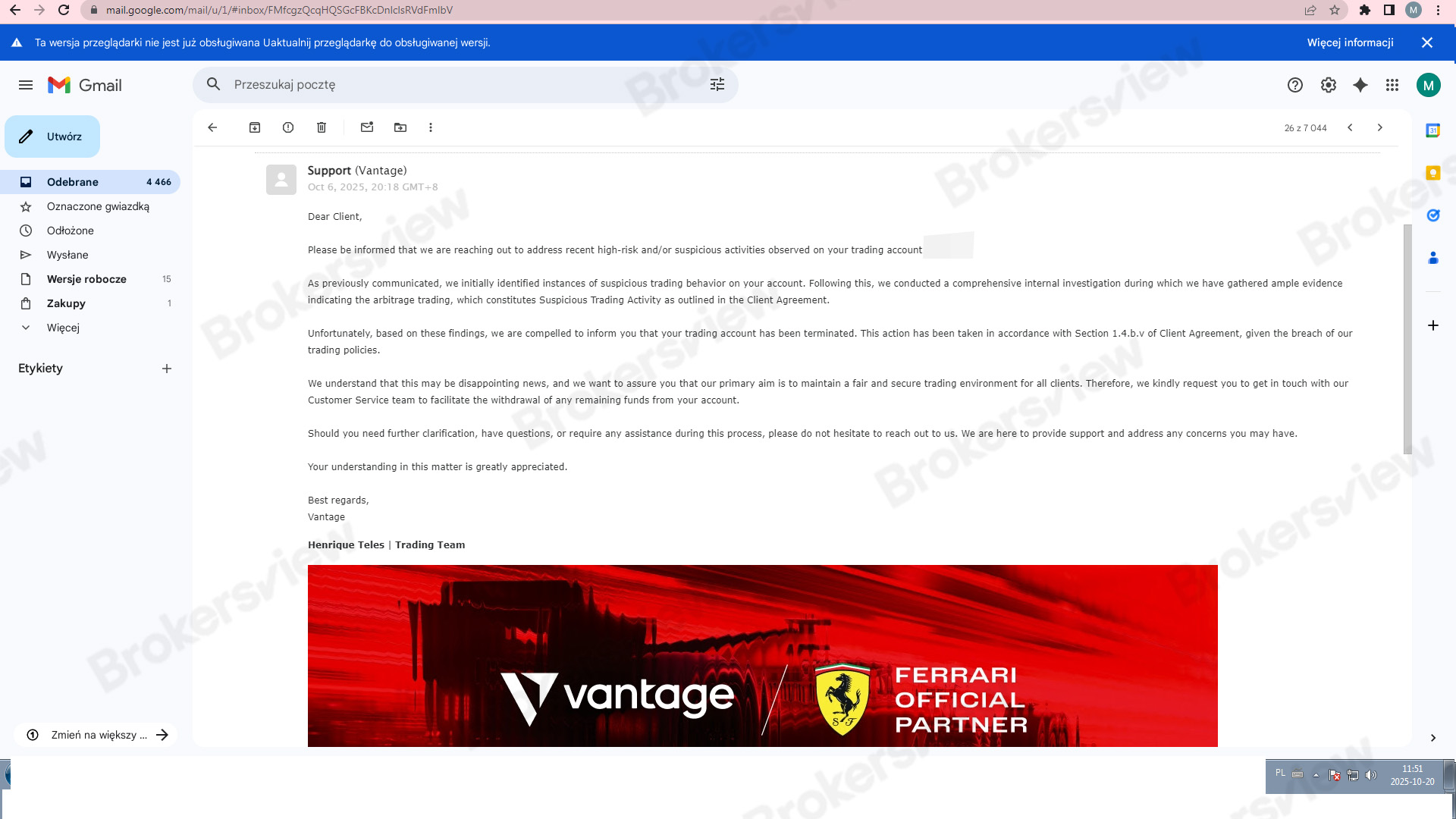

Vantage Markets made three replies as response:

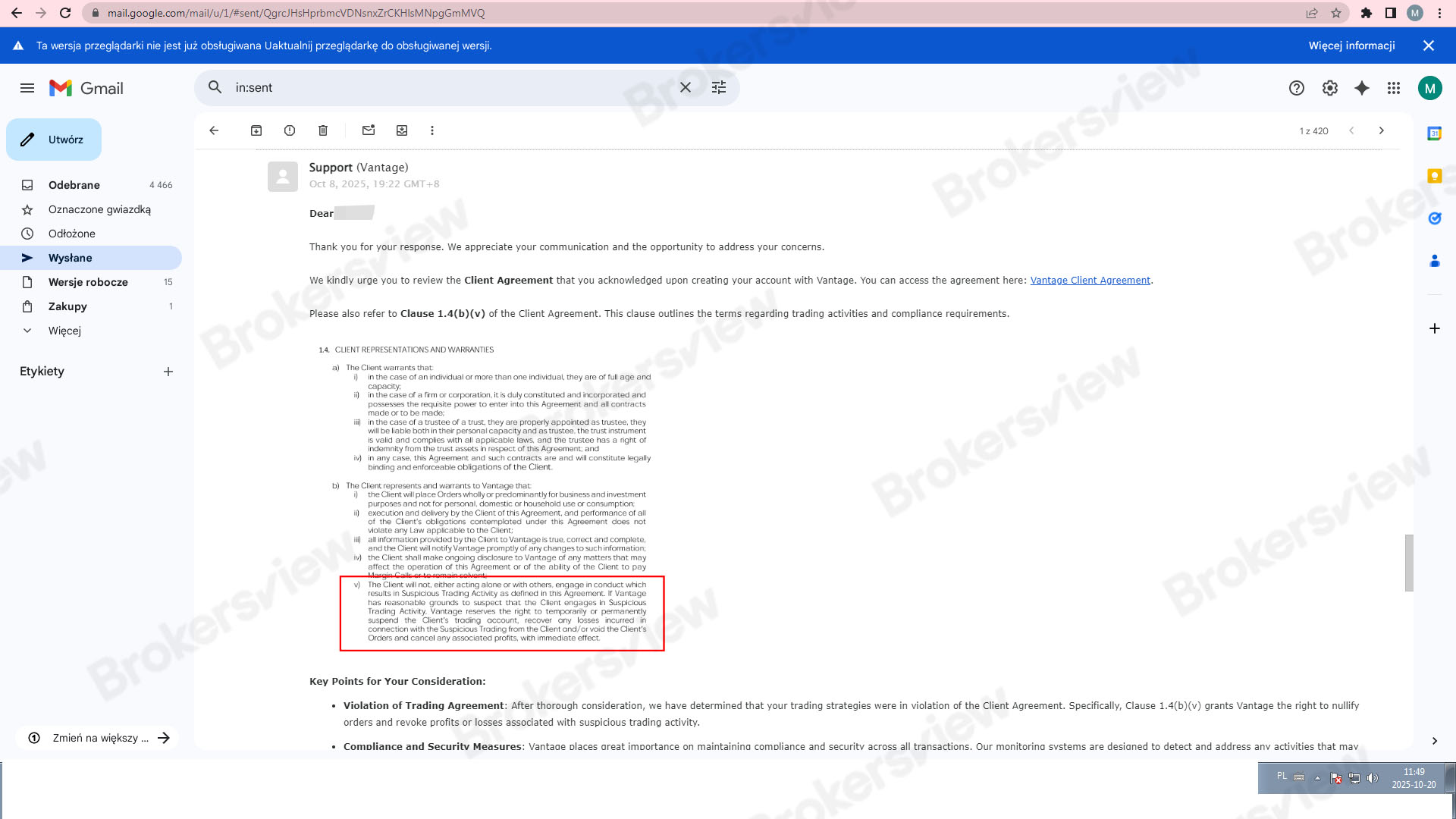

- First, the broker said it had identified "high-risk and/or suspicious behaviour" and terminated the account in accordance with its client agreement, specifically citing Clause 1.4(b)(v).

- Second, Vantage requested the client's cooperation in withdrawing remaining funds but maintained that its actions fully complied with the agreement.

- Third, the broker did not disclose any calculation details behind the profit revocation or provide a transaction audit report in public communications.

Additionally, the trader revealed that the account was registered under Vantage Global Limited, incorporated in Vanuatu and said to be regulated by the Vanuatu Financial Services Commission (VFSC). It is not a secret that investor protection under the VFSC framework is comparatively limited when measured against those of major financial regulators.

Key Takeaways

This incident highlights several important risks:

- A broker may revoke trading profits post-execution, citing "suspicious activity," without providing clients with clear rule violations or identifiable trade evidence.

- Traders should pay close attention to which legal entity their account is opened under and which regulator oversees it, as investor protection levels vary significantly.

- Even when a broker claims to hold "global regulation," if the actual trading entity operates under weaker jurisdictions, clients may face much higher costs and difficulty in pursuing recourse.

If you encounter similar account adjustments or profit revocations, it is advisable to collect transaction records, adjustment screenshots, email correspondence, or chat logs with customer support. You may also file a complaint through the relevant regulatory authority or compliance channels of the operating entity. Alternatively, you can submit a case via the BrokersView complaint center for further assistance.