Trader Exposes ACY Over Absurd Charges and 40000 Dollar Profit Confiscation

Recently, an experienced retail trader detailed his bizarre experience with ACY Securities. From being accused of single-handedly "manipulating the market" to having penalty amounts arbitrarily changed within a month, this profit dispute involving over $40,000 reveals the broker's disturbing compliance logic.

Retail Trader Allegedly Accused of "Market Manipulation" by Broker

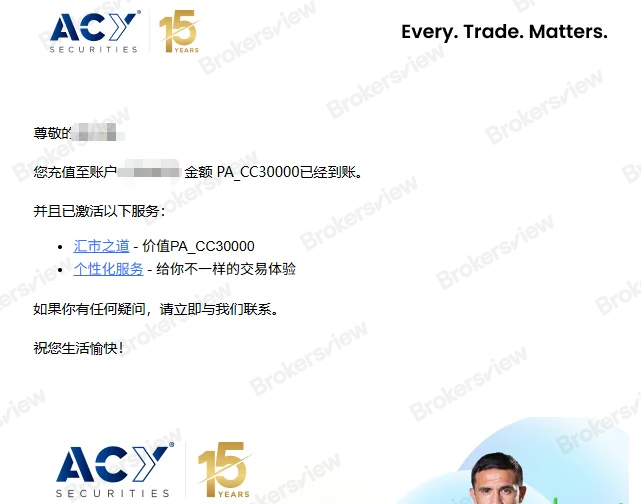

According to the trader's description, after depositing $30,000 in principal into his ACY account, he seized favorable market conditions through manual trading and accumulated a profit of $40,085.19. However, when he attempted to withdraw these legitimate earnings, the broker did not release the funds but instead sent a violation notice.

In the email sent by ACY to the client, the risk control department claimed that during Gold (XAUUSD) trades on February 1, the client utilized price differences between the underlying futures market and the CFD market to conduct "price manipulation arbitrage" and "price control operations" via "technical means."

The trader described this accusation as "unbelievable." As a retail trader with only $30,000 in capital, his trading volume is negligible in the highly liquid international gold market. Therefore, in his view, accusing a retail trader of influencing or even manipulating market prices or liquidity is logically untenable.

Even so, the platform did not provide any specific order flow data, complaint records from liquidity providers (LPs), or quantitative evidence of latency arbitrage. They merely cited vague clauses in the client agreement as grounds for confiscating the profits.

Penalty Decisions Changed Repeatedly

Screenshots of email correspondence provided by the trader show that ACY initially determined a violation had occurred and demanded a deduction of $32,879.19 from the profits, promising to refund the remaining funds. Out of concern for the safety of his principal, the trader stated that despite being under immense psychological pressure, he had no choice but to agree to this proposal, hoping only to retrieve the remaining balance as soon as possible.

However, after reaching the agreement, ACY did not release the funds as promised but delayed the review process for nearly a month. After a long wait, the trader received a second email. This notice, marked as a "correction," overturned the previous decision and declared that to avoid unnecessary disputes, they had decided to increase the deduction amount to $40,085.19—confiscating 100% of the profits.

The trader angrily denounced this behavior of "baselessly increasing the penalty severity after the client had already accepted the punishment" as "testing his bottom line." He stated that this practice not only violates the spirit of the contract but also casts doubt on the seriousness of their risk control compliance: How can a compliant broker arbitrarily change the penalty amount simply due to the passage of time without any new evidence?

Furthermore, the trader mentioned rumors regarding ACY's "Visitor Mode" (Please note: The authenticity of this rumor has not yet been verified by BrokersView). This mode allegedly automatically flags accounts with profits exceeding 20% as "abnormal" and freezes funds. Under this mechanism, losing clients face no obstacles, while profitable clients are labeled as "violators."

Although ACY executives have promoted a certain mode as an innovation, in the victim's view, this mechanism—which allows losses but forbids wins—is essentially a trap targeting profitable traders. Currently, the investor has refused to accept this outcome and has submitted all evidence to the Australian Securities and Investments Commission (ASIC).

BrokersView Reminds You

The deduction of profits by brokers on the grounds of "abnormal trading" is a common type of dispute within the industry. The final outcome of this event awaits further response from the broker and whether the trader can provide more evidence.

If you encounter withdrawal obstructions, please ensure you save all trading logs and email correspondence, and submit a complaint to regulatory bodies and BrokersView in a timely manner to protect your legal rights.