Seven-Week Withdrawal Deadlock: Client Demands Accountability from Trade Nation Over Missing Funds

Following a prior report in which an investor’s confirmed withdrawal failed to arrive within the promised five-day timeframe and was delayed for half a month, Trade Nation is now facing another complaint. The latest case also mirrors the unresolved withdrawal issue, outlined below in further detail.

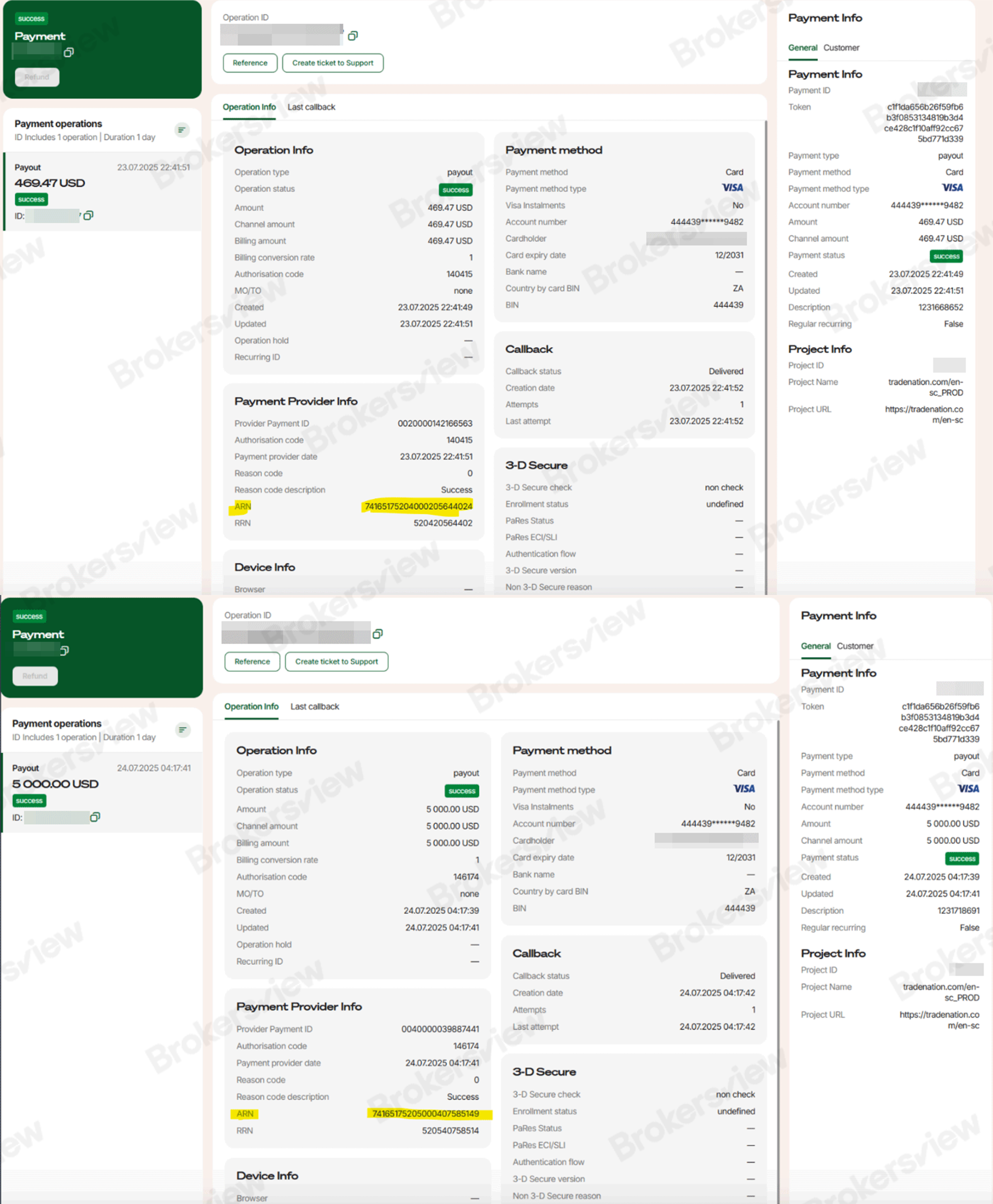

The client, Daniel, from South Africa, reported a prolonged and unresolved withdrawal issue with Trade Nation involving two transactions—$469.47 and $5,000—submitted on July 23 and 24, 2025. Over seven weeks later, the client claims the funds have still not arrived.

Email records show Trade Nation initially processed the withdrawal via Skrill, a method Daniel did not want to use. The broker later stated the Skrill payment was canceled and the funds reprocessed to the card linked to his Apple Pay deposit. They provided ARN (Acquirer Reference Number) codes as proof of successful transfers.

Trade Nation also shared confirmation from its payment provider that the payouts were completed. However, the funds never appeared in Daniel’s bank account. Despite repeated follow-ups, Trade Nation maintained that the issue lies with the receiving bank ABSA, and cited a lack of response from the bank to the payment provider’s inquiries.

Between mid-August and early September, communication stalled in a circular argument: Daniel requested reprocessing via PayPal or EFT, while Trade Nation insisted on a formal bank confirmation letter. Daniel condemned the ongoing dispute for weeks with Trade Nation without resolution.

Daniel eventually submitted a full set of supporting documents—including ABSA emails, stamped bank statements, and a formal response from ABSA Card Product Control referencing Apple Pay’s refund policy. Trade Nation, however, seemed to reject the evidence as insufficient.

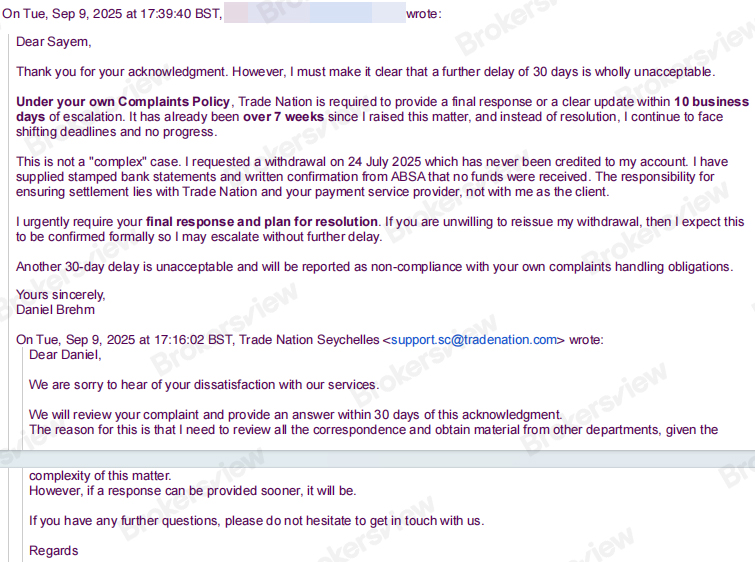

The case reached a deadlock. Daniel filed a formal complaint, but Trade Nation stated it requires an additional 30 days to respond—an unacceptable delay for Daniel.

Daniel maintains that Trade Nation has refused to reissue the payments despite multiple requests and clear proof of non-receipt. He emphasizes that once non-receipt is verified, the broker is fully responsible for resolving the issue with its payment provider, rather than deflecting blame or prolonging the process.

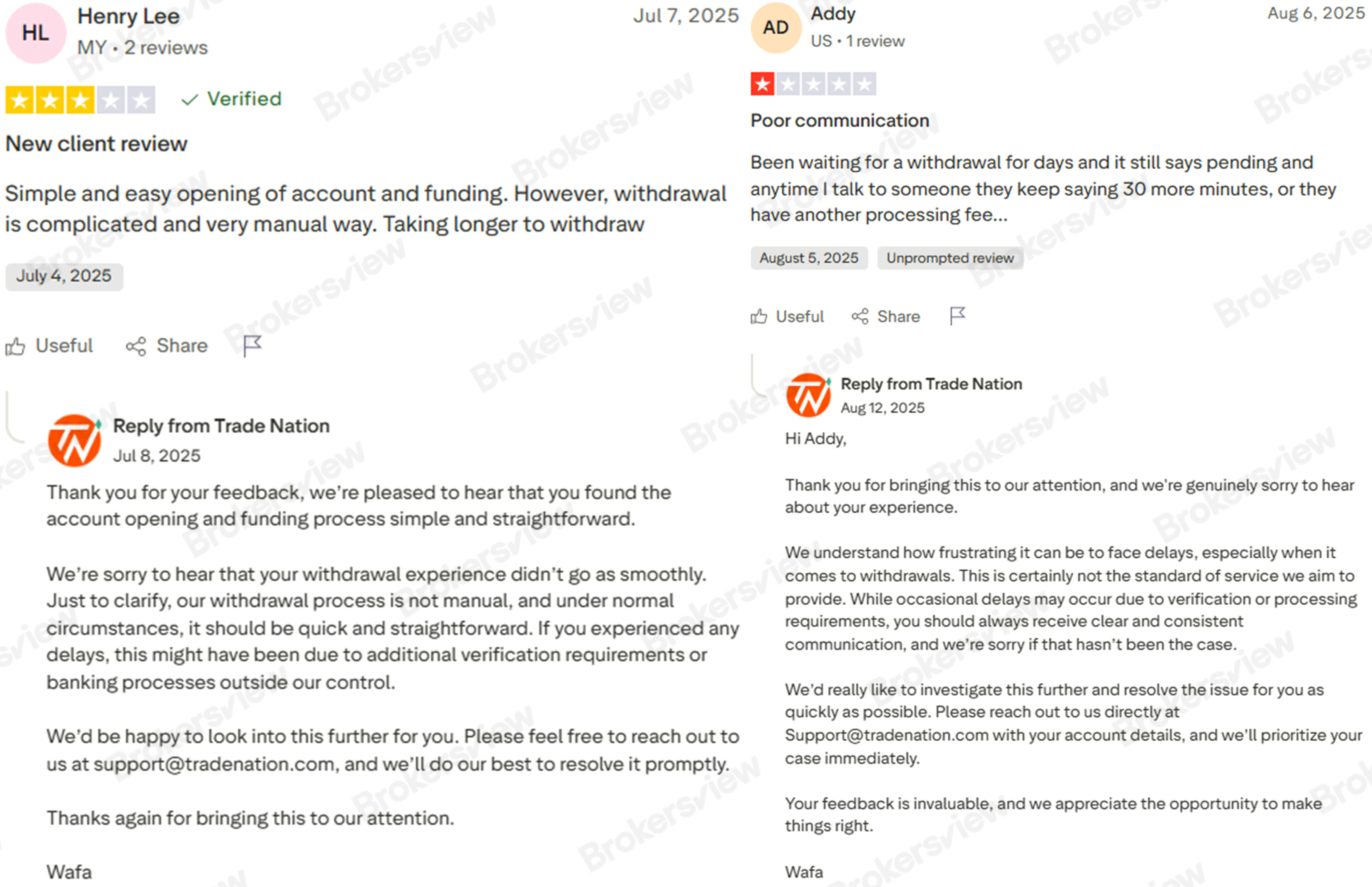

Other Trade Nation clients have similarly reported prolonged processing of withdrawals and ineffective communication. In contrast, account opening and deposit procedures are allegedly swift.

BrokersView reminds you

The Forex and CFD broker Trade Nation is regulated by several financial authorities, including the UK FCA, the Australian ASIC, the South African FSCA, the Seychelles FSA, and the Bahamas Securities Commission. You can review verified regulatory details here.

If you encounter broker misconduct, report it directly to the relevant authority in the jurisdiction where Trade Nation holds authorization.

For withdrawal delays or unresolved issues with your broker, you may also Submit a Complaint via BrokersView.

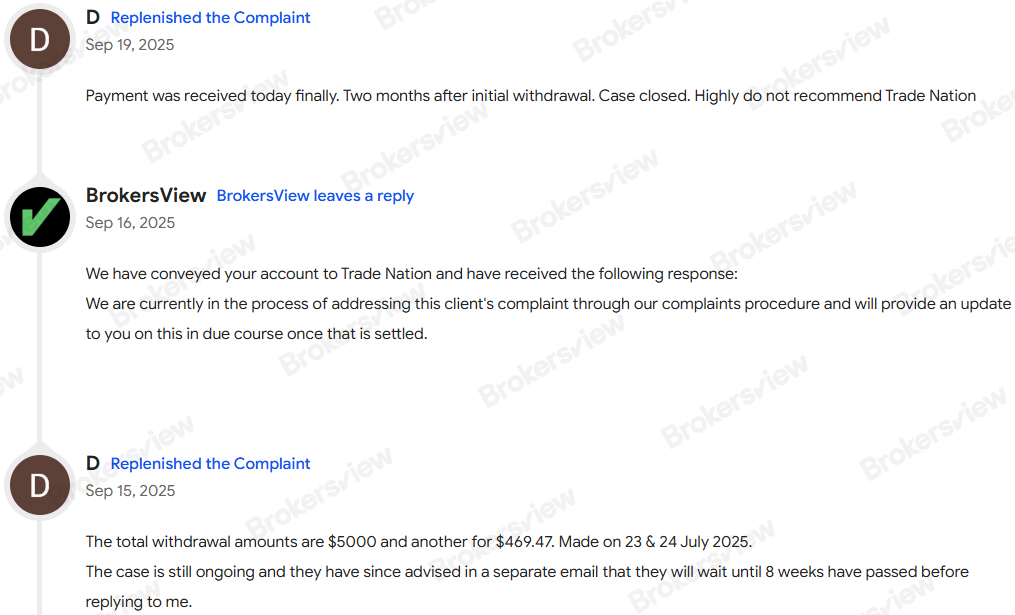

Update

As of 19 September 2025, the client confirmed receipt of the withdrawn funds, nearly two months after the initial request. Although the case is now closed, the client maintains a negative stance toward Trade Nation due to the prolonged delay and does not recommend the broker.