Security Lapse? Axi Client Alleges Unauthorized Withdrawal and Denial of Responsibility

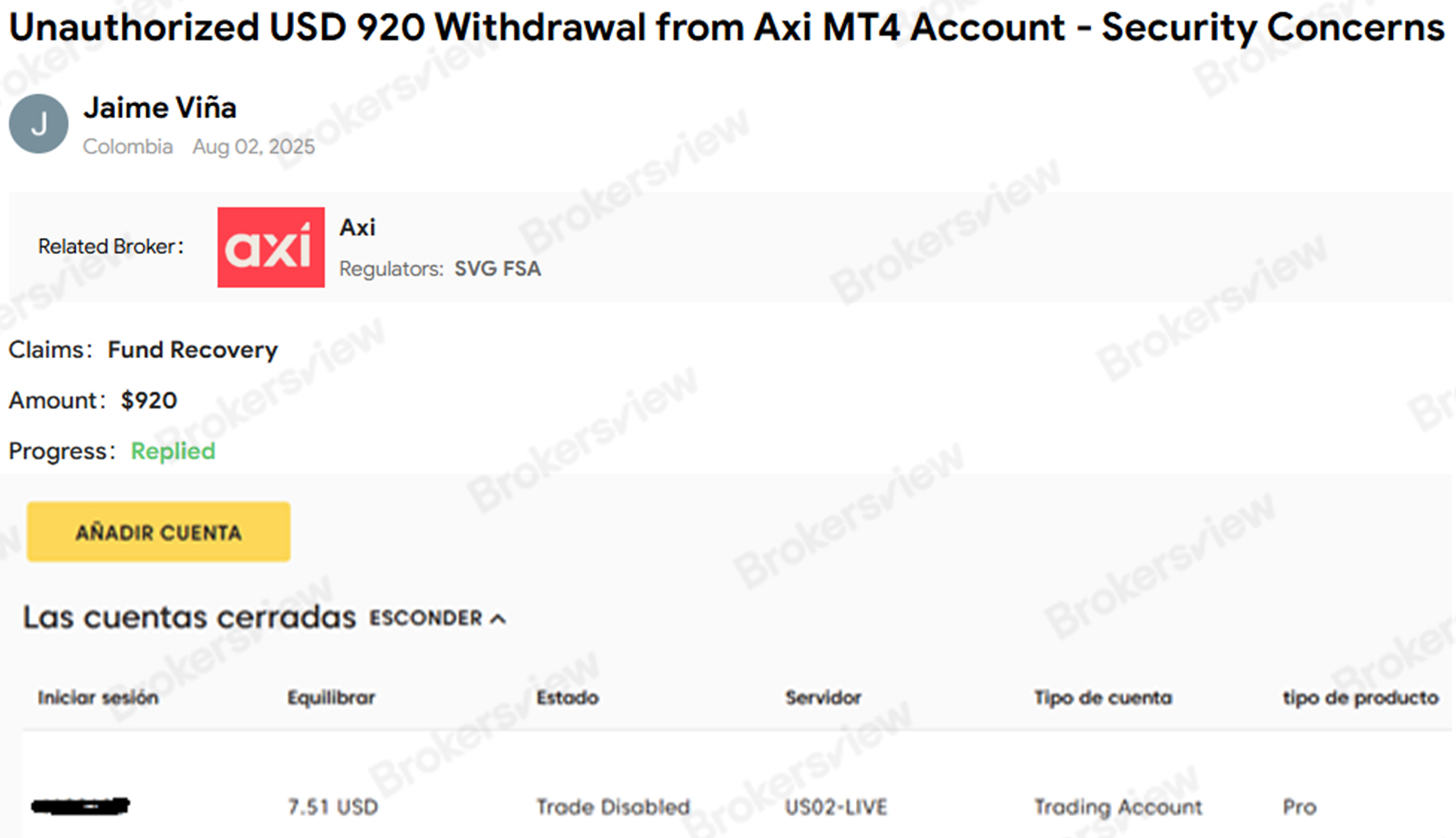

The multi-regulated online trading broker Axi is facing a client complaint over fund security after an unauthorized $920 withdrawal was allegedly made from the client’s MT4 account.

According to the complaint, on May 7, 2025, the client Jaime Viña discovered that $920 had been withdrawn from his Axi MT4 account on April 24 without his permission. The funds were transferred to a bank in the UAE, leaving only $7.51 in his account.

Axi confirmed the transaction was fraudulent and traced it to an IP address in Bosnia-Herzegovina. However, the client stated he resides in Colombia and has never been to that region. Jaime Viña reported that Axi blamed him for the breach, citing possible VPN use or shared login credentials, and refused to take responsibility. Additionally, his KYC documents were removed from Axi’s portal, and no record of the fraudulent receiving account was retained. After 16 days, Axi allegedly referenced its terms and conditions and closed the case. Jaime Viña said that the only “temporary” solution Axi offered was a bank reference number.

Jaime Viña has since reported the incident to ASIC, FCA, and The Financial Commission, citing security lapses and poor response from AXI, which resulted in substantial financial loss.

BrokersView has conveyed Jaime Viña’s complaint to Axi, waiting for a response.

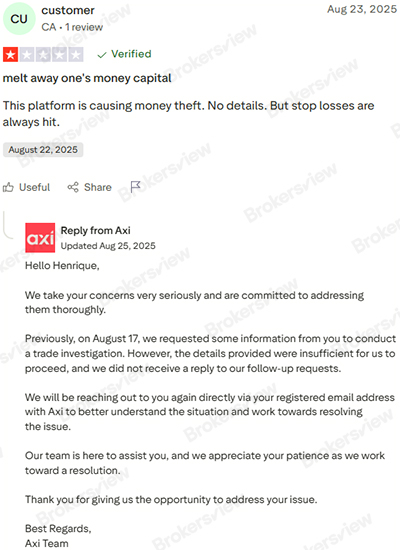

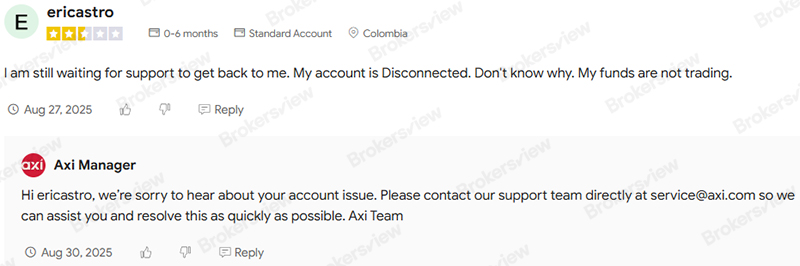

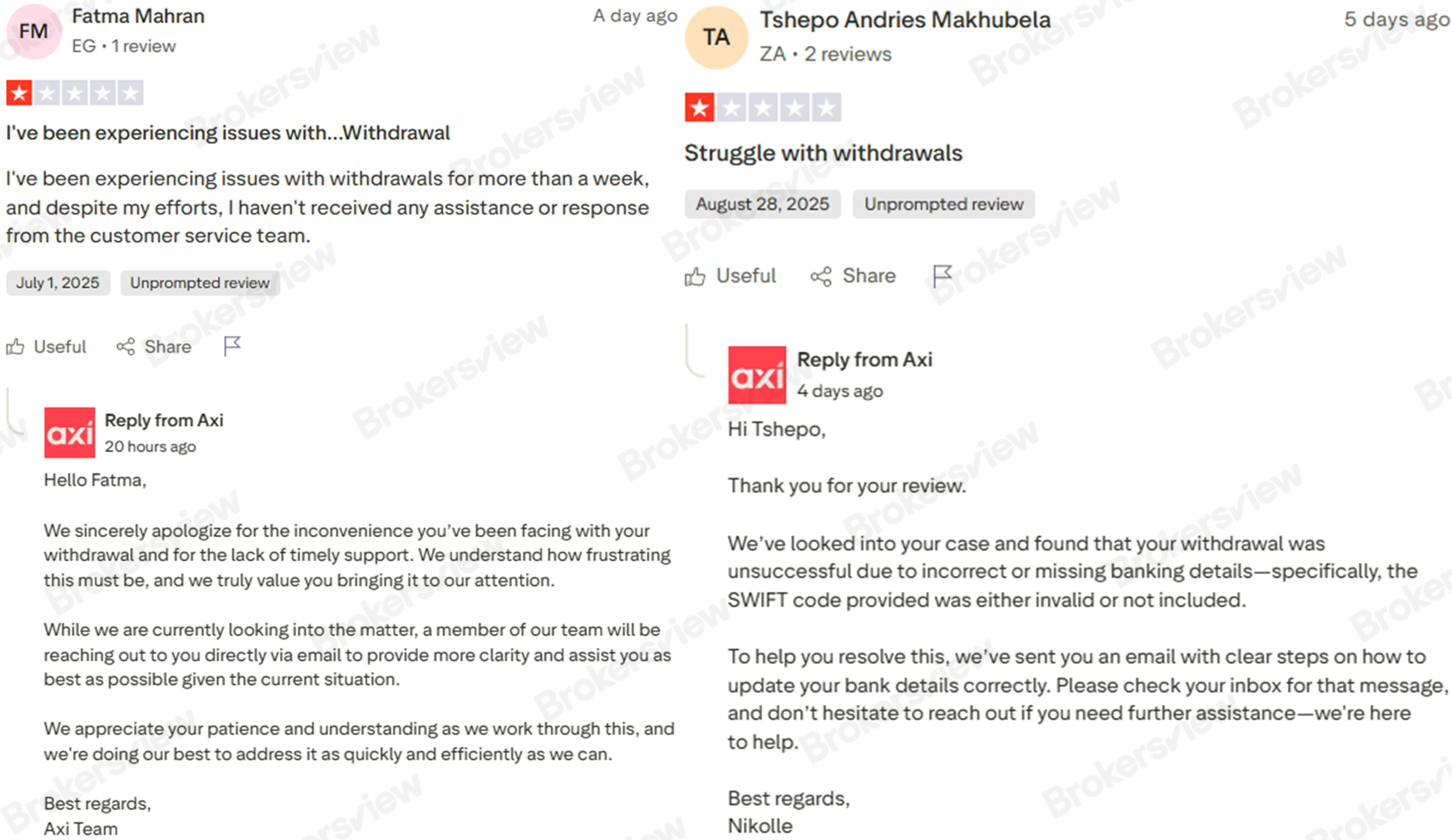

Meanwhile, several Axi clients have also reported suspicious “money theft”, account disconnection, and withdrawal issues.

An unnamed client alleged that the Axi platform was causing “money theft,” claiming stop-loss orders were consistently triggered. No further details were provided as Axi’s initial trade investigation failed to proceed.

“ericastro” remains awaiting support from customer service after his account was allegedly disconnected for unknown reasons. As a result, his funds are not being traded.

“Fatma Mahran” faced withdrawal delays exceeding one week, with no support received from the Axi customer service team, while “Tshepo Andries Makhubela” similarly reported struggles with withdrawing funds.

BrokersView Reminds You

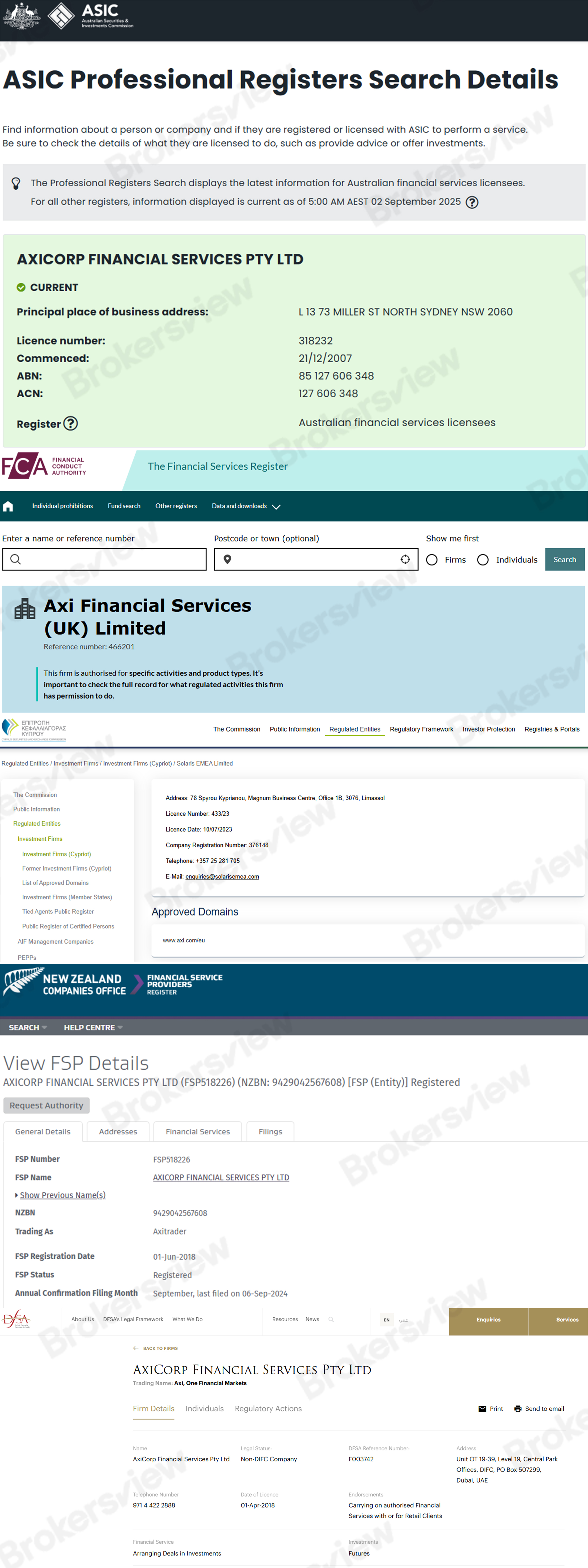

Axi (formerly AxiTrader) holds licenses from multiple regulators, including the Australian Securities and Investments Commission (ASIC), the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the New Zealand Financial Markets Authority (FMA), and the Dubai Financial Services Authority (DFSA). When experiencing broker misconduct, you can report it directly to the relevant authority in the jurisdiction where Axi is authorized.

If you’re facing unresolved withdrawal issues or suspect broker misconduct, you can also submit a complaint through BrokersView’s Submit a Complaint for further assistance.

Update

BrokersView has received Axi’s response to the incident. Axi stated it promptly initiated a recall request upon receiving the client’s complaint, but he recall attempt was unsuccessful. The broker confirmed no system breach occurred.

The following is Axi’s response:

Following an internal investigation, we confirm that:

- The withdrawal in question was made through Axi’s secure Client Portal using valid credentials (account number and password).

- The funds were transferred to a bank account in the client’s name, and the client’s profile had been fully KYC verified since March 2020.

- Upon receiving the complaint on 6 May 2025, Axi immediately initiated a transfer recall request and maintained ongoing communication with the client.

- Our intermediary bank attempted the recall but was unsuccessful, after which the client was advised to contact the beneficiary bank directly, consistent with standard industry practice.

- There is no evidence of any system breach on Axi’s part. The issue arose from compromised credentials, though the method of compromise (e.g., phishing or malware) could not be established.

- Axi’s actions were fully compliant with our Client Agreement and all applicable regulatory obligations.