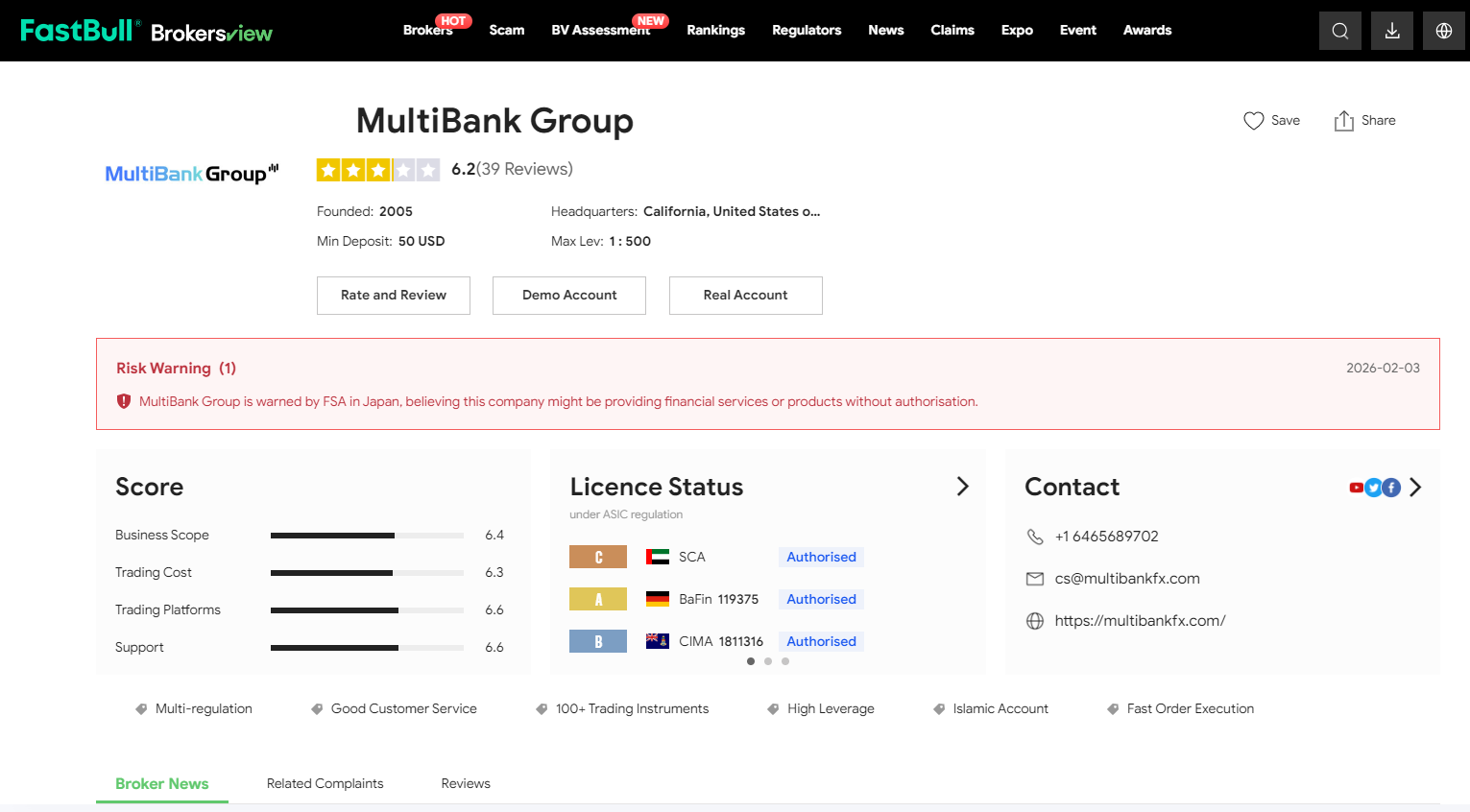

MEX Exchange Appoints Edgewater Veteran Brian Andreyko as Chief Product Officer

MEX Exchange, the institutional arm of MultiBank Group, has appointed Brian Andreyko, CFA, as its new Chief Product Officer, strengthening its senior leadership as it expands its institutional trading offering.

Based in New York, Andreyko will be responsible for shaping the product strategy across MEX Exchange’s ECN, execution, and technical services businesses. His remit spans institutional FX, precious metals, emerging markets, and prime services, with a focus on scalability, performance, and execution quality.

Andreyko joins MEX Exchange after nearly six years as Chief Product Officer at Edgewater Markets, a specialist in FX execution and liquidity aggregation. During his tenure, he worked on building and refining institutional-grade trading infrastructure, with a strong emphasis on market structure, liquidity management, and electronic execution workflows.

Earlier in his career, Andreyko held senior roles across several major electronic trading and market infrastructure firms. These include leadership positions at TradAir, where he served as Chief Business Officer, as well as executive roles at Currenex, ICAP, and Mako FX. His background covers ECNs, interdealer platforms, and buy-side connectivity, giving him broad exposure to both sell-side and institutional trading environments.

In his new role, Andreyko will oversee the full product lifecycle at MEX Exchange. This includes enhancing the depth and resilience of the MEX ECN, expanding connectivity and technical services for clients, and developing liquidity and direct market access solutions tailored to institutional participants. He will also focus on strengthening the firm’s technology stack to support growing client demand and evolving execution requirements.

David Ogg, Chief Executive Officer of MEX Exchange, said Andreyko’s experience across FX, metals, and emerging markets would be central to advancing the firm’s global product capabilities and supporting institutional clients.

MEX Exchange provides electronic trading, liquidity, smart order routing, and credit intermediation services to banks, brokers, hedge funds, and professional trading firms. As part of MultiBank Group, it operates with a focus on technology-driven execution, transparency, and regulatory strength across global markets.