JustMarkets Trust Crisis: Users Report Successful Withdrawal Status with No Funds Received

Even a long-established broker like JustMarkets, backed by multiple regulatory licenses, has recently been unable to escape scrutiny regarding fund security and technical stability.

According to a recent complaint from a trader, he initiated a withdrawal request for 48 Tether (USDT) via his MT5 Standard account on the morning of January 15, 2026. JustMarkets' back-office system showed the transaction was processed in just three minutes. The internal status bar indicated that the funds were successfully deducted and labeled as "Completed." However, in reality, the user's receiving wallet remained empty.

What troubled the user most was the absence of key evidence. A defining feature of blockchain transfers is traceability, with the Transaction Hash (TXID) serving as the sole proof that funds have been moved on-chain. Although the back-office generated an internal Transaction ID (7692505) and a record that appeared to be a serial number, the user pointed out that the platform failed to provide a valid TXID searchable on a blockchain explorer. This left him unable to track the destination of the funds, as if the entire transfer had vanished into a digital black hole.

In response to the user's urgent inquiries, the JustMarkets support team replied via email stating that the case (Case ID: CAS-5359657-G9L6M7) required more time to find an optimal solution and apologized for the delay. However, this "form letter" email, lacking substantive proof of transfer, failed to alleviate the user's concerns.

The Fatal "Network Glitch"

Just a week after the aforementioned withdrawal incident, another dispute regarding technical stability surfaced on January 22. A user posted a plea for help in a community, claiming he encountered a severe network failure at 11:00 PM (GMT+8) that night.

According to the user, his positions were originally in a profitable state, but due to a sudden network lag, he was unable to execute any closing orders during a critical hour. He watched helplessly as the market reversed, eventually leading to a Margin Call on his account. The user emphasized that after verification, this was not a global market outage but a localized network issue specific to JustMarkets. Although he retained relevant screenshots and trading logs to submit to the platform, he remains anxious about whether he will receive compensation.

A Trust Crisis for a Regulated Broker

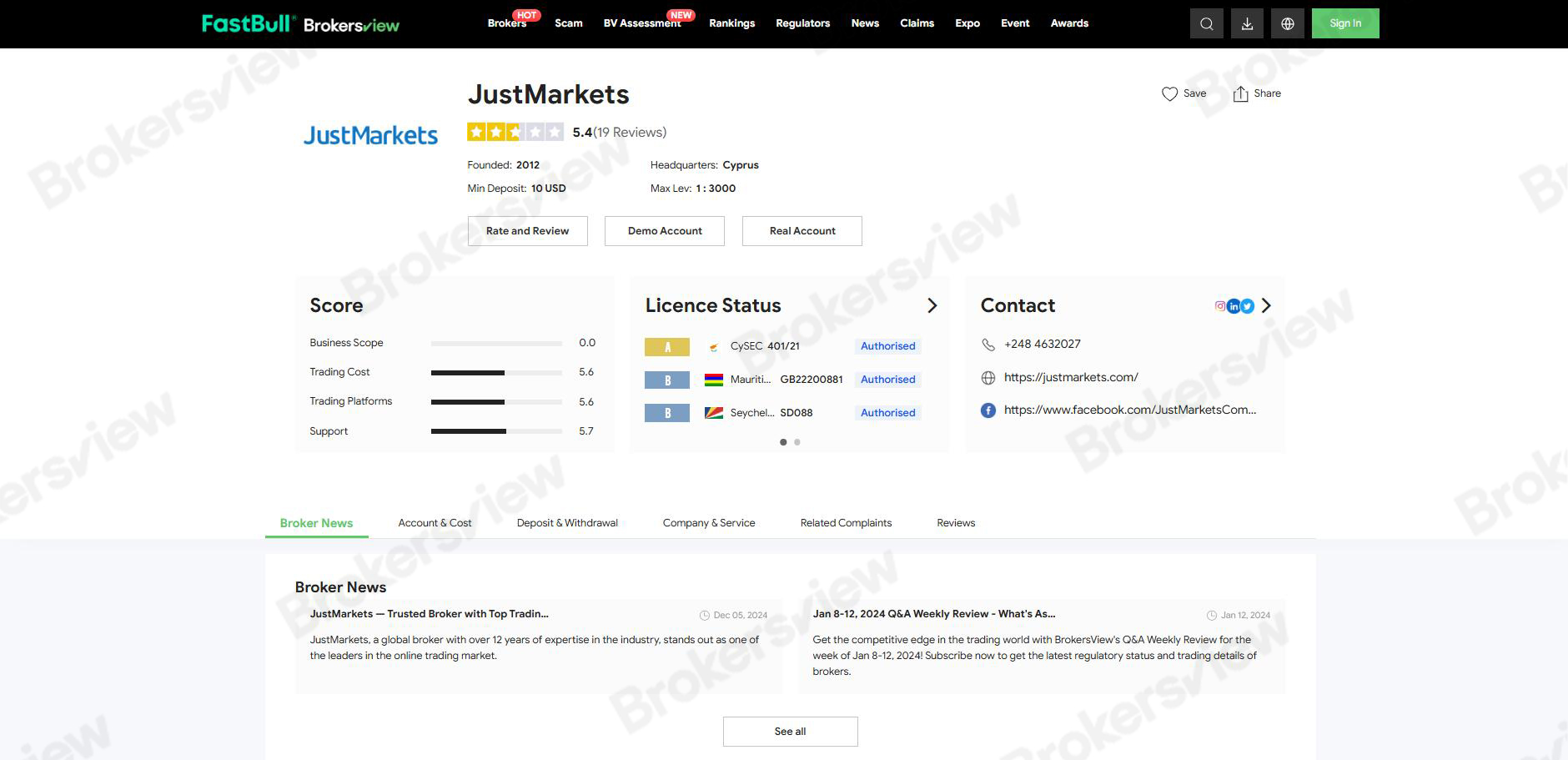

From a regulatory standpoint, BrokersView's review page shows that JustMarkets holds multiple licenses from authorities including the Cyprus Securities and Exchange Commission (CySEC), the Mauritius Financial Services Commission (FSC), the Seychelles Financial Services Authority (FSA), and the South African Financial Sector Conduct Authority (FSCA), placing it within the ranks of compliant brokers.

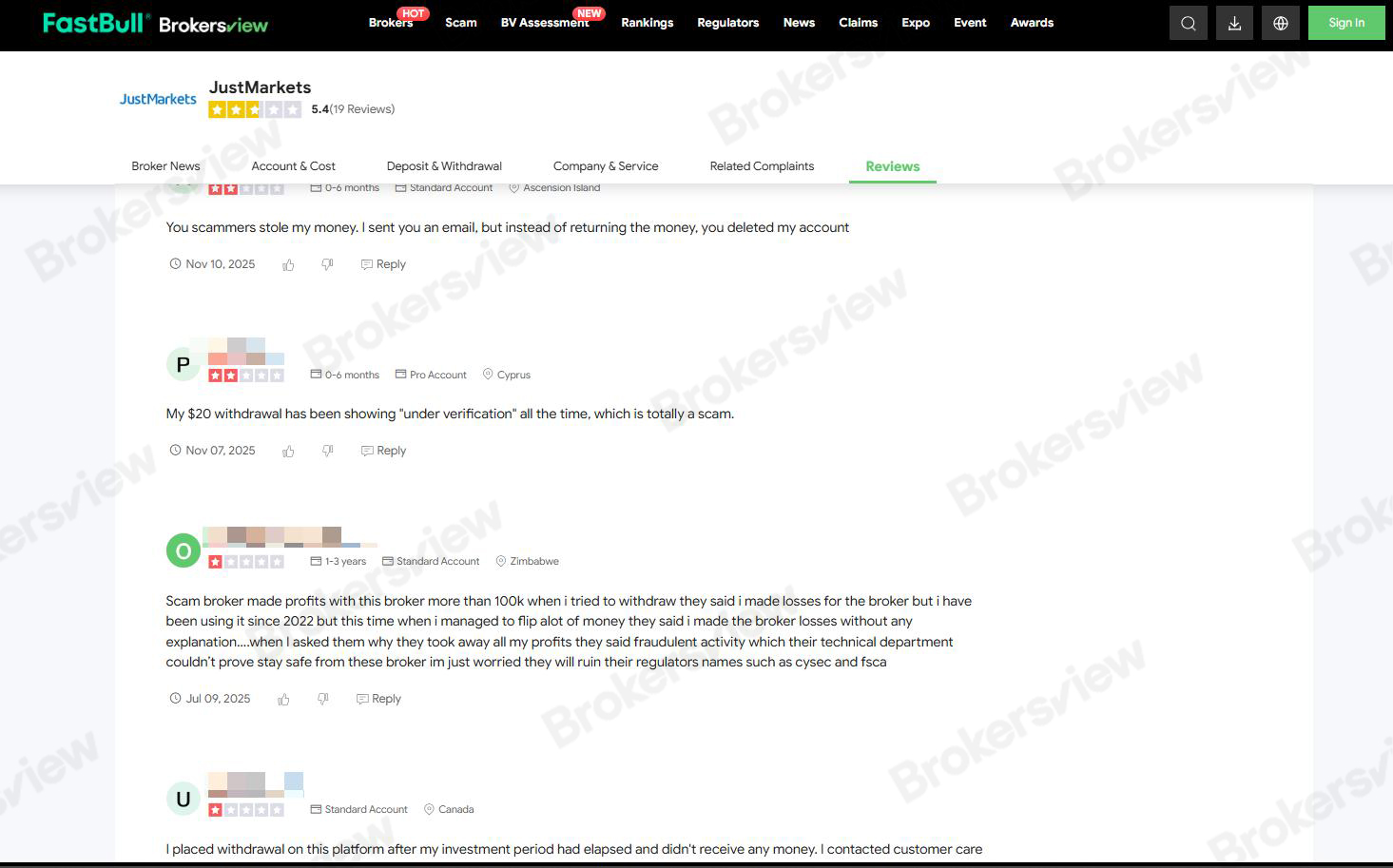

However, there is a noticeable discrepancy between these regulatory credentials and the actual experiences of some clients. On the BrokersView user review section, the proportion of negative comments is significant. Whether it is the lack of a TXID for crypto withdrawals or system lag at critical moments, these issues point toward potential shortcomings in the platform's operational details.

As of now, JustMarkets has not publicly released a final investigation conclusion or compensation plan for these two latest complaints.

BrokersView Reminds You

Due to the irreversible nature of cryptocurrency withdrawals, the integrity of transaction credentials is vital.

- Request a TXID: When withdrawing cryptocurrency from any platform, ensure you request the on-chain Transaction Hash (TXID) immediately after funds are deducted. Without this credential, the funds may not have been truly sent.

- Retain Evidence of Technical Failures: If you incur losses due to system lag, please record your screen or take screenshots of logs (Journal/Log) with timestamps. This is critical evidence for future rights protection.

If you have a dispute with a broker, you can file a complaint with BrokersView, and we will assist you in monitoring the progress of the situation.