Bizarre Price Spike Wipes Out 310,000 Dollars as LMAX Faces Targeted Liquidation Accusations

In the world of leveraged trading, a difference of just a few dollars is often the gap between financial freedom and total ruin. Recently, BrokersView received a complaint against the long-established broker LMAX: a dispute over a "ghost quote" that caused a trader's principal of nearly $310,000 to evaporate instantly.

The Missing $3 Gap and the Sudden Liquidation

According to the detailed complaint submitted to BrokersView, the incident occurred on January 15 between 7:00 AM and 7:03 AM. At that time, the investor held a large number of short positions on London Silver, with an average entry price of approximately $91.5 per unit. However, within those three minutes, his account was forcibly liquidated at a staggering price of $96.4 per unit.

This left him in disbelief. According to his verification, the highest quote for London Silver on the LMAX platform and all other mainstream precious metal trading platforms at that time did not exceed $93.6 per unit. This means his liquidation price was nearly $3 higher than the market's acknowledged peak. Once this price was triggered, the funds in his account—totaling approximately 2.17 million RMB—instantly dropped to zero.

Adding to his frustration was the subsequent market trend. By the time he wrote the complaint (11:30 AM the same day), the price of London Silver had retreated to $87. Had it not been for that suspected "non-market" candlestick triggering the liquidation, his original 14-lot short position would not only have been safe but would have yielded a massive profit of nearly $300,000 based on real-time prices. In his description, this was a classic "targeted hit," where the platform used a non-existent error price to precisely wipe out his position.

Promises and Silence from the "Head of Asia-Pacific"

The story began more than two months earlier. In November 2025, the complainant contacted "Mark (Xiong Xiang)," the "Head of Asia-Pacific," through the LMAX official website. To verify the platform's reliability, the two met in person in Shenzhen.

Mark claimed to have been with LMAX for over a decade as a core executive and repeatedly emphasized that LMAX holds a legitimate UK FCA license and is a globally renowned compliant platform. Based on this trust, the complainant began trading gold and silver, and for the first two months, both trading and withdrawals were normal.

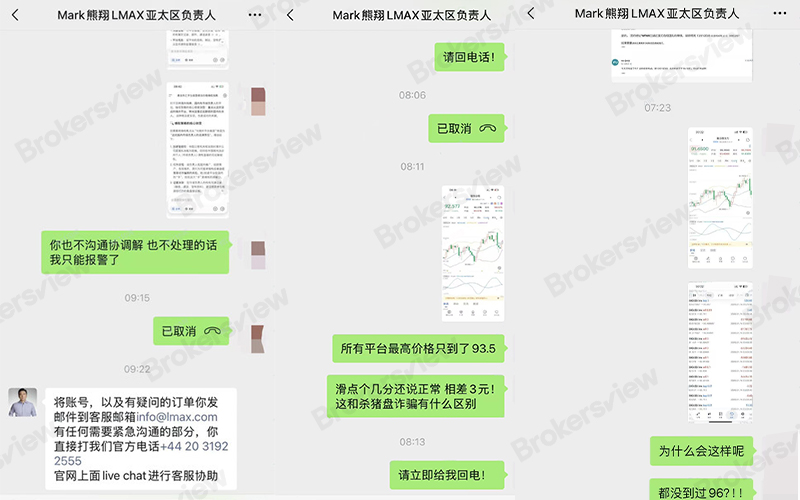

However, when the "bizarre liquidation" occurred, this personal connection failed to provide the expected support. Facing the complainant's questioning, Mark's attitude appeared quite formulaic—only replying that the user should send the account number and disputed orders to the official customer service email or communicate via the website's Live Chat and phone. According to the screenshots provided by the complainant, Mark did not seem to respond further to the accusations.

WeChat screenshots provided by the trader

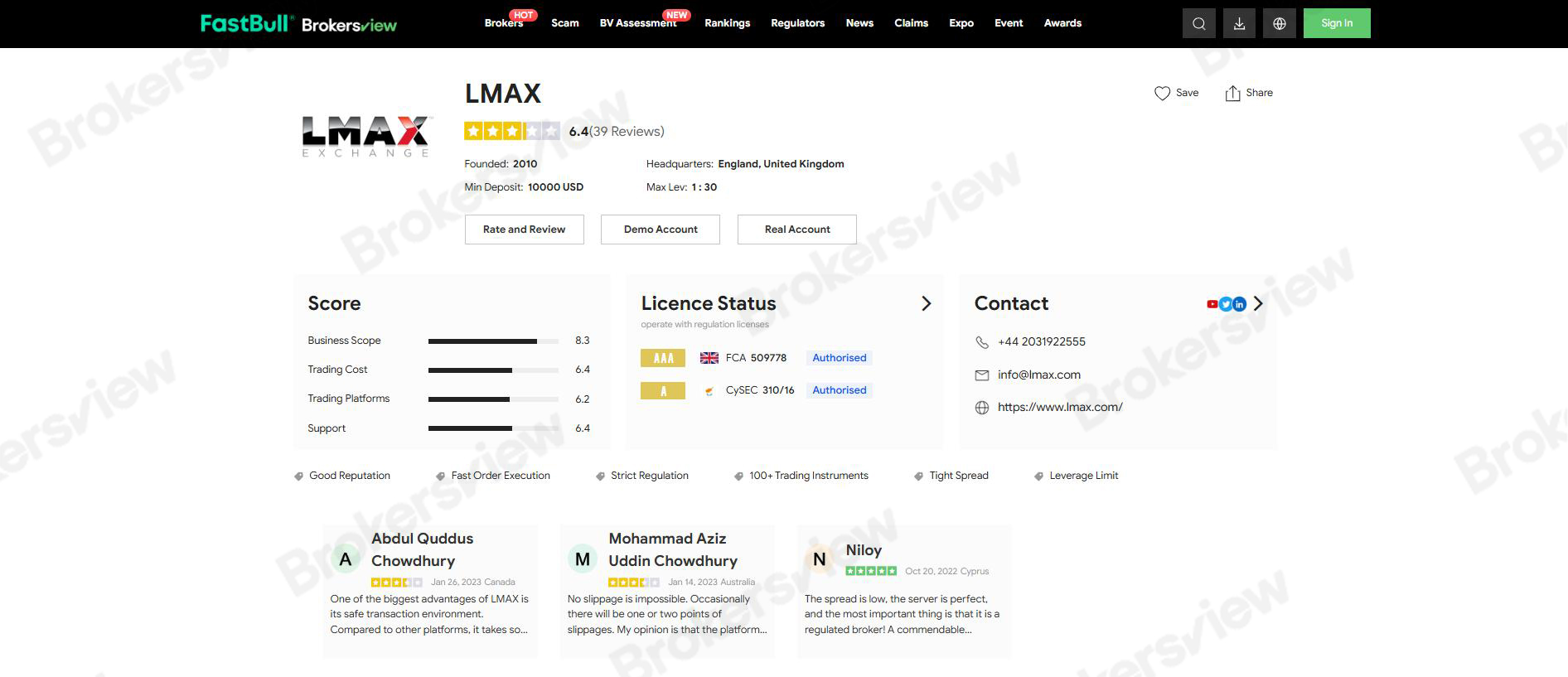

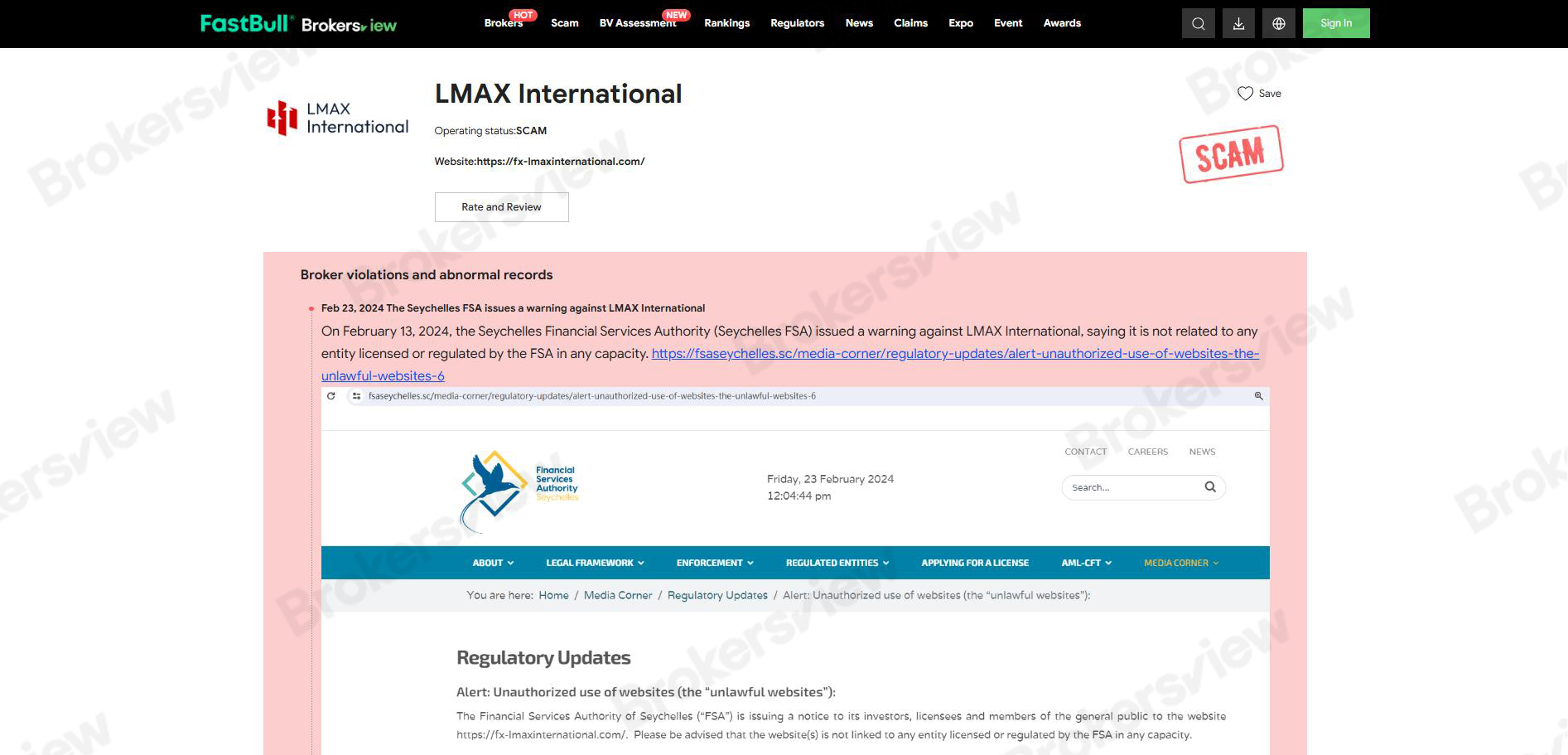

The complexity of this complaint lies in the information asymmetry, making it difficult to determine whether this was a technical glitch or a deeper trap. BrokersView's review page confirms that LMAX is indeed regulated by the UK FCA and the Cyprus CySEC. However, historical records show that a fake clone broker named "LMAX International" previously existed (though its website is now unavailable).

Did the complainant encounter extreme slippage caused by a liquidity drain on the legitimate platform, or did he fall into the hands of a "pig butchering" agent posing as the real firm from the very beginning? There is currently no official investigation conclusion from the platform.

BrokersView Reminds You

Financial derivative trading carries immense market risk, and even regulated platforms may experience price discrepancies during extreme market conditions. If you have a dispute with a broker, you can file a complaint with BrokersView, and we will assist you in following up on the matter.