Japanese Investor Defrauded by Sanon Capital, Giving JPY 2.4 Million to 'Withdraw Profits'

In October, a Japanese investor fell victim to an investment scam on the fraudulent platform Sanon Capital, losing $15,000.

According to the victim, he was lured into investing $250 and agreed to use "LIFETIME 07050" as a secret code for communication. A few days later, a company claiming to be "Sanon Capital" informed him that his account had generated $60,000 in profits.

The scammers stated the profits would be transferred in cryptocurrency, but imposed a condition: a "processing fee" must be paid first to receive the funds.

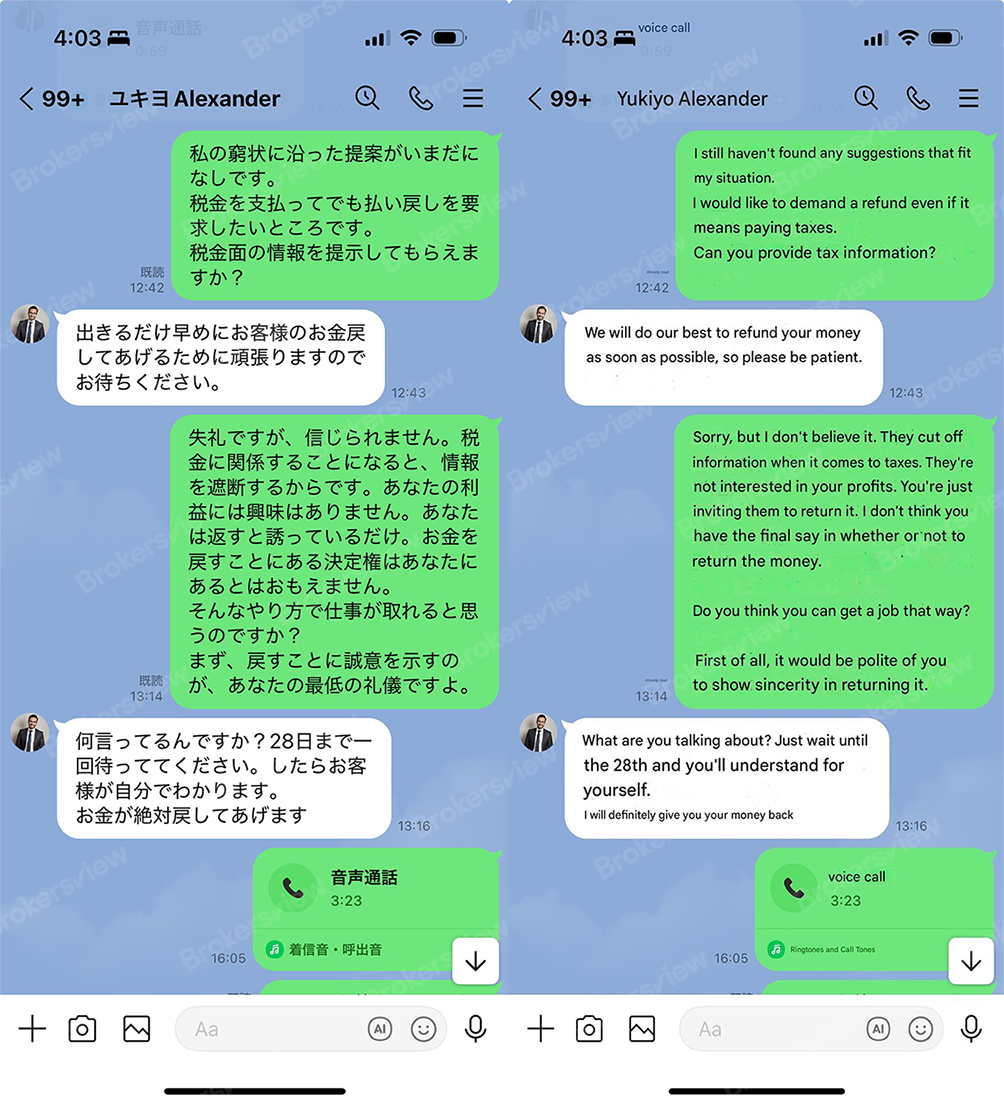

The investor complied, transferring a total of 2.4 million yen (approximately $15,000 USD) through the cryptocurrency exchange Coincheck. To reassure him, the scammers displayed a fabricated screenshot of the account balance on Sanon Trade.

Sanon Capital had promised to return the principal along with the $60,000 profit within 30 minutes, but ultimately disappeared. The victim lost the principal, the promised profits, and all associated fees to the fraudsters.

In June, New Zealand's Financial Markets Authority (FMA) issued a warning about Sanon Capital. The regulator received public reports and identified Sanon Capital as a fraudulent online trading platform involved in investment scams and fund recovery schemes.

The platform impersonated the UK Financial Conduct Authority (FCA), falsely informing victims that their lost funds had been recovered in cryptocurrency and demanding fees to release them. According to the Japanese victim, the scammers also falsely claimed to be FCA officers.

In this kind of recovery scam, even if victims pay the demanded fees, the scammers never return the funds.

Meanwhile, the FMA has presented websites associated with Sanon Capital (Sanoncapital.pro; Sanoncapital.trade) and email (support@sanoncapital.pro; karolina.harper@sanoncapital.pro), urging investors to exercise caution.

BrokersView reminds you

The unregulated broker Sanon Capital has been warned by the regulator for fraudulent activities. Investors should exercise extreme caution with such unlicensed trading platforms to avoid falling victim to scams.

Additionally, investors should remain vigilant against investment schemes that promise "small deposits, huge profits." Any opportunity that sounds too good to be true is almost certainly a scam.

To verify the regulatory status of a forex broker, investors can search the broker's name on BrokersView or ask a Question.