How OctaFX India Reflects the Growing Cat-and-Mouse Game of Indian Forex Regulation

In recent years, India's Forex trading market has experienced rapid growth, attracting numerous brokers and local investors. However, this expansion has been accompanied by heightened regulatory risks.

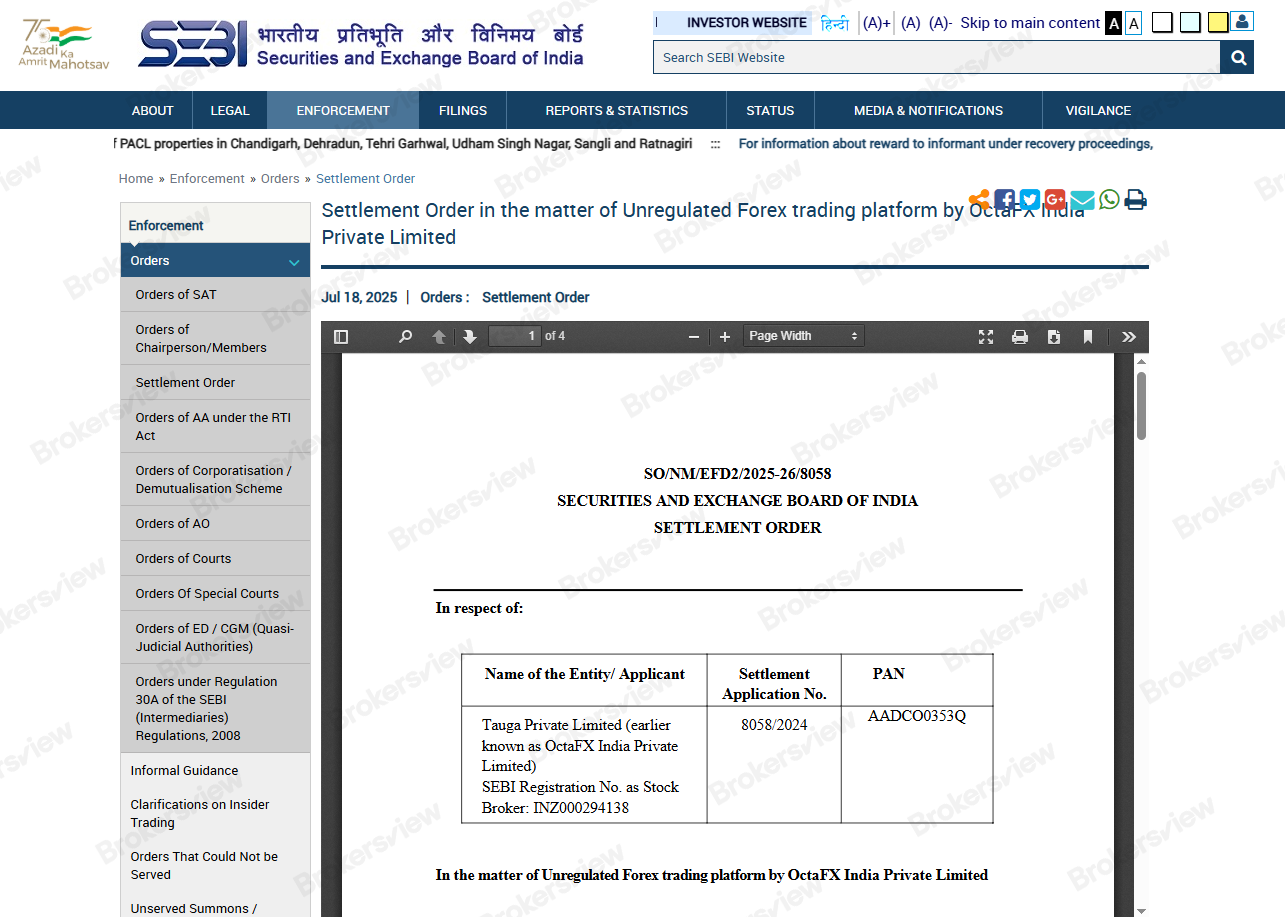

Recently, the Securities and Exchange Board of India (SEBI) reached a settlement with Tauga Private Limited (formerly known as OctaFX India), under which the company agreed to pay ₹3.2 million to resolve charges related to its alleged involvement with the unauthorized forex trading platform OctaFX.

The OctaFX case: Cross-border games under regulatory scrutiny

Although a settlement has been reached, many questions remain unanswered. The SEBI continues to investigate OctaFX for suspected violations of anti-money laundering laws. Meanwhile, the Enforcement Directorate (ED) has frozen assets valued at ₹2.96 billion and launched an investigation into Pavel Prozorov, the individual believed to be behind the OctaFX brand.

OctaFX denied any affiliation with the Indian firm Tauga Private Limited. However, investigations revealed that OctaFX had been conducting forex trading through unregulated channels, evading regulatory oversight via a local representative network. By utilizing offshore servers and cryptocurrency payment, the platform obscured the flow of funds, engaging in 'regulatory arbitrage.' Within just nine months, OctaFX allegedly amassed over ₹8 billion from the Indian market through illicit means. These activities have since become a primary focus of enforcement actions by both the SEBI and the ED.

Besides, the SEBI has collaborated with the Bombay Stock Exchange (BSE) to further intensify regulations of cross-border forex brokers. Meanwhile, SEBI found that OctaFX India concealed its affiliation with an unregistered platform and participated in its promotion.

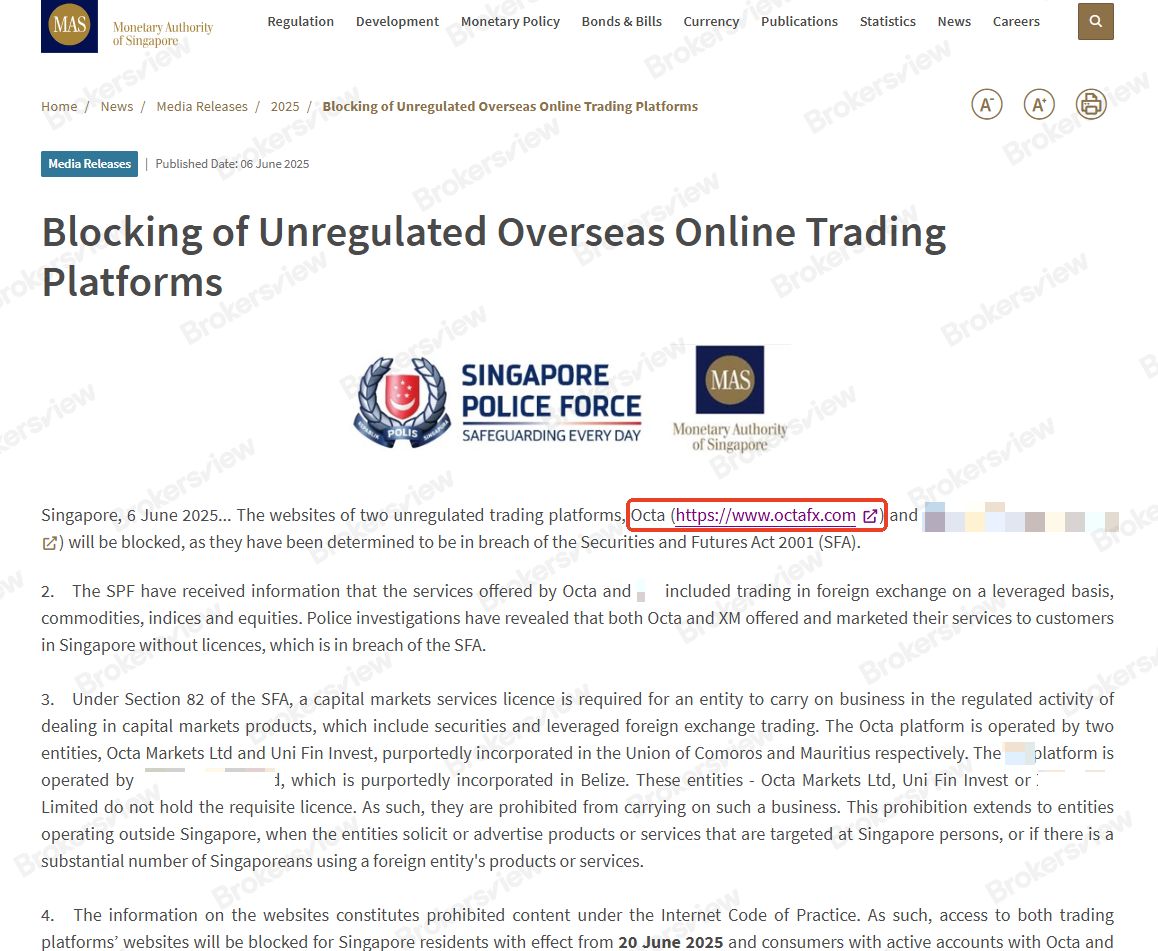

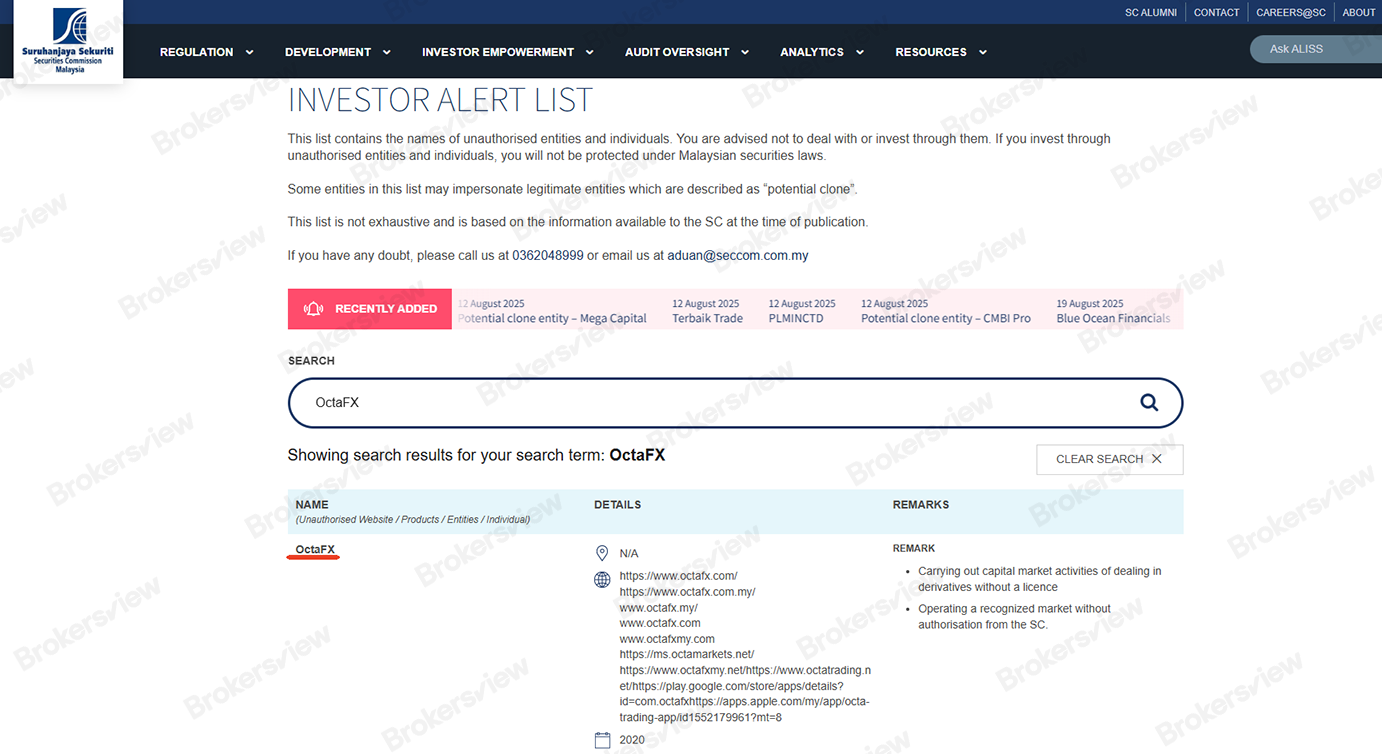

The Securities Commission of Malaysia (SC) and the Monetary Authority of Singapore (MAS) have placed OctaFX on their warning lists.

It is worth noting that despite increasingly strict regulations on forex platforms, challenges persist in the legal grey areas of the Indian market and the operations of cross-border brokers.

Three grey areas in the Indian market

License

Under the Foreign Exchange Management Act (FEMA), forex brokers are required to obtain authorization from either the SEBI or the Reserve Bank of India (RBI). However, many international platforms bypass these regulations by operating through offshore entities with local agents.

Challenges in tracing payment methods

Some platforms use cryptocurrencies or third-party payment gateways to process funds, making it more difficult to trace the funds.

Rebrand strategy

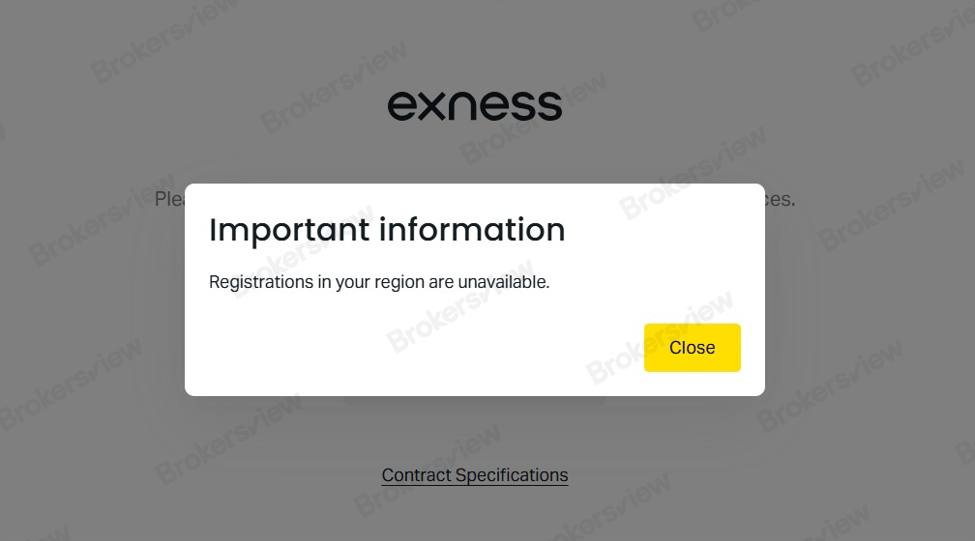

Exness has recently suspended the onboarding of new clients in India. And payment-related issues appeared in the platform, particularly with deposits and withdrawals. Although the platform has not disclosed the reasons for the suspension or indicated whether it plans to re-enter the Indian market, industry insiders speculate that this move may be related to India's ban on CFD trading and associated regulatory risks. Some believe that OctaFX may follow the example of Exness by re-entering the Indian market through rebranding.

Exness continues to serve Indian clients who have already opened accounts. However, these clients' accounts have been transferred from the Seychelles entity to the Vanuatu entity. In the Indian market, Exness primarily relies on affiliate and introducing brokers to conduct its business.

BrokersView reminds you

The OctaFX case marks a shift in Indian financial regulation - from a passive stance to a more proactive approach. Yet, as global finance and technology continue to evolve rapidly, the games between regulators and violators will persist well into the future.

Investors should be clearly informed that verifying the details of a trading platform is essential, especially when engaging in forex or digital currency investments. If you have any doubts about a platform, feel free to reach out to BrokersView. Our team offers free verification support.