行情

新聞

分析

使用者

快訊

財經日曆

學習

數據

- 名稱

- 最新值

- 前值

VIP跟單

所有跟單

所有比賽

日本短觀小型製造業前景指數 (第四季度)

日本短觀小型製造業前景指數 (第四季度)公:--

預: --

前: --

日本短觀大型非製造業前景指數 (第四季度)

日本短觀大型非製造業前景指數 (第四季度)公:--

預: --

前: --

日本短觀大型製造業前景指數 (第四季度)

日本短觀大型製造業前景指數 (第四季度)公:--

預: --

前: --

日本短觀小型製造業景氣判斷指數 (第四季度)

日本短觀小型製造業景氣判斷指數 (第四季度)公:--

預: --

前: --

日本短觀大型製造業景氣判斷指數 (第四季度)

日本短觀大型製造業景氣判斷指數 (第四季度)公:--

預: --

前: --

日本短觀大型企業資本支出年增率 (第四季度)

日本短觀大型企業資本支出年增率 (第四季度)公:--

預: --

前: --

英國Rightmove住宅銷售價格指數年增率 (12月)

英國Rightmove住宅銷售價格指數年增率 (12月)公:--

預: --

前: --

中國大陸工業產出年增率 (年初至今) (11月)

中國大陸工業產出年增率 (年初至今) (11月)公:--

預: --

前: --

中國大陸城鎮失業率 (11月)

中國大陸城鎮失業率 (11月)公:--

預: --

前: --

沙地阿拉伯CPI年增率 (11月)

沙地阿拉伯CPI年增率 (11月)公:--

預: --

前: --

歐元區工業產出年增率 (10月)

歐元區工業產出年增率 (10月)公:--

預: --

前: --

歐元區工業產出月增率 (10月)

歐元區工業產出月增率 (10月)公:--

預: --

前: --

加拿大成屋銷售月增率 (11月)

加拿大成屋銷售月增率 (11月)公:--

預: --

前: --

加拿大全國經濟信心指數

加拿大全國經濟信心指數公:--

預: --

前: --

加拿大新屋開工率 (11月)

加拿大新屋開工率 (11月)公:--

預: --

美國紐約聯邦儲備銀行製造業就業指數 (12月)

美國紐約聯邦儲備銀行製造業就業指數 (12月)公:--

預: --

前: --

美國紐約聯邦儲備銀行製造業指數 (12月)

美國紐約聯邦儲備銀行製造業指數 (12月)公:--

預: --

前: --

加拿大核心消費者物價指數 (CPI) 年增率 (11月)

加拿大核心消費者物價指數 (CPI) 年增率 (11月)公:--

預: --

前: --

加拿大製造業未完成訂單月增率 (10月)

加拿大製造業未完成訂單月增率 (10月)公:--

預: --

前: --

美國紐約聯邦儲備銀行製造業物價獲得指數 (12月)

美國紐約聯邦儲備銀行製造業物價獲得指數 (12月)公:--

預: --

前: --

美國紐約聯邦儲備銀行製造業新訂單指數 (12月)

美國紐約聯邦儲備銀行製造業新訂單指數 (12月)公:--

預: --

前: --

加拿大製造業新訂單月增率 (10月)

加拿大製造業新訂單月增率 (10月)公:--

預: --

前: --

加拿大核心消費者物價指數 (CPI) 月增率 (11月)

加拿大核心消費者物價指數 (CPI) 月增率 (11月)公:--

預: --

前: --

加拿大截尾均值CPI年增率 (季調後) (11月)

加拿大截尾均值CPI年增率 (季調後) (11月)公:--

預: --

前: --

加拿大製造業庫存月增率 (10月)

加拿大製造業庫存月增率 (10月)公:--

預: --

前: --

加拿大CPI年增率 (11月)

加拿大CPI年增率 (11月)公:--

預: --

前: --

加拿大CPI月增率 (11月)

加拿大CPI月增率 (11月)公:--

預: --

前: --

加拿大CPI年增率 (季調後) (11月)

加拿大CPI年增率 (季調後) (11月)公:--

預: --

前: --

加拿大核心消費者物價指數 (CPI) 月增率 (季調後) (11月)

加拿大核心消費者物價指數 (CPI) 月增率 (季調後) (11月)公:--

預: --

前: --

加拿大CPI月增率 (季調後) (11月)

加拿大CPI月增率 (季調後) (11月)公:--

預: --

前: --

聯準會理事米蘭發表演說

聯準會理事米蘭發表演說 美國NAHB房產市場指數 (12月)

美國NAHB房產市場指數 (12月)--

預: --

前: --

澳洲綜合PMI初值 (12月)

澳洲綜合PMI初值 (12月)--

預: --

前: --

澳洲服務業PMI初值 (12月)

澳洲服務業PMI初值 (12月)--

預: --

前: --

澳洲製造業PMI初值 (12月)

澳洲製造業PMI初值 (12月)--

預: --

前: --

日本製造業PMI初值 (季調後) (12月)

日本製造業PMI初值 (季調後) (12月)--

預: --

前: --

英國三個月ILO就業人數變動 (10月)

英國三個月ILO就業人數變動 (10月)--

預: --

前: --

英國失業金申請人數 (11月)

英國失業金申請人數 (11月)--

預: --

前: --

英國失業率 (11月)

英國失業率 (11月)--

預: --

前: --

英國三個月ILO失業率 (10月)

英國三個月ILO失業率 (10月)--

預: --

前: --

英國三個月含紅利的平均每週工資年增率 (10月)

英國三個月含紅利的平均每週工資年增率 (10月)--

預: --

前: --

英國三個月剔除紅利的平均每週工資年增率 (10月)

英國三個月剔除紅利的平均每週工資年增率 (10月)--

預: --

前: --

法國服務業PMI初值 (12月)

法國服務業PMI初值 (12月)--

預: --

前: --

法國綜合PMI初值 (季調後) (12月)

法國綜合PMI初值 (季調後) (12月)--

預: --

前: --

法國製造業PMI初值 (12月)

法國製造業PMI初值 (12月)--

預: --

前: --

德國服務業PMI初值 (季調後) (12月)

德國服務業PMI初值 (季調後) (12月)--

預: --

前: --

德國製造業PMI初值 (季調後) (12月)

德國製造業PMI初值 (季調後) (12月)--

預: --

前: --

德國綜合PMI初值 (季調後) (12月)

德國綜合PMI初值 (季調後) (12月)--

預: --

前: --

歐元區綜合PMI初值 (季調後) (12月)

歐元區綜合PMI初值 (季調後) (12月)--

預: --

前: --

歐元區服務業PMI初值 (季調後) (12月)

歐元區服務業PMI初值 (季調後) (12月)--

預: --

前: --

歐元區製造業PMI初值 (季調後) (12月)

歐元區製造業PMI初值 (季調後) (12月)--

預: --

前: --

英國服務業PMI初值 (12月)

英國服務業PMI初值 (12月)--

預: --

前: --

英國製造業PMI初值 (12月)

英國製造業PMI初值 (12月)--

預: --

前: --

英國綜合PMI初值 (12月)

英國綜合PMI初值 (12月)--

預: --

前: --

歐元區ZEW經濟景氣指數 (12月)

歐元區ZEW經濟景氣指數 (12月)--

預: --

前: --

德國ZEW經濟現況指數 (12月)

德國ZEW經濟現況指數 (12月)--

預: --

前: --

德國ZEW經濟景氣指數 (12月)

德國ZEW經濟景氣指數 (12月)--

預: --

前: --

歐元區貿易帳 (未季調) (10月)

歐元區貿易帳 (未季調) (10月)--

預: --

前: --

歐元區ZEW經濟現況指數 (12月)

歐元區ZEW經濟現況指數 (12月)--

預: --

前: --

歐元區貿易帳 (季調後) (10月)

歐元區貿易帳 (季調後) (10月)--

預: --

前: --

美國零售銷售月增率 (不含汽車 ) (季調後) (10月)

美國零售銷售月增率 (不含汽車 ) (季調後) (10月)--

預: --

前: --

無匹配數據

LayerZero’s proposal to acquire Stargate (STG) is now open for voting on the Stargate DAO Snapshot page. This event can be important for STG’s price. If the proposal passes, there could be strong interest from new users or investors, leading to higher demand and possible price increase. Acquisitions also sometimes bring new features or stronger partnerships. However, if the community does not like the proposal, the price could fall. The impact depends on how people feel about this news. You can read the official statement here: source.

Stargate@StargateFinanceAug 16, 2025LayerZero's proposal to acquire Stargate (STG) is now live on the Stargate DAO Snapshot page.

Further details about this proposal below: https://t.co/AAofvVnJiI

On August 31, the TGE (token generation event) unlock claim window for Redacted (RDAC) will close. When claim periods end, some holders may sell unlocked tokens, which can cause higher selling pressure and price drops. However, after the window closes, fewer unlocked tokens will be released, which can reduce selling pressure and help the price stabilize or rise. It is useful for traders to follow this event, because demand and supply can shift quickly before and after the deadline. More details are available at the official announcement: source.

Jirasan@JirasanOfficialAug 14, 2025REMINDER: Claim Your $RDAC TGE Unlock

The clock is ticking ️

Your TGE unlock claim window closes August 31, 2025 (11:59 PM UTC)

If you haven’t claimed yet, now is the time!

Head to the claim site via the link in bio on @redactedcoin to claim.

Need a refresher on what… pic.twitter.com/CIJtfajZbI

The SupraLiquid sale on August 20 is different from usual token sales. The $SUPRA tokens raised will not be sold on the market, but will instead go back to the community and for incentives over time. This is positive, as there will not be large selling pressure after the sale, which often causes price drops. It may even help the market price if people expect fewer new tokens actively sold. Still, changes depend on how the community reacts. For full information about the sale and community plans, read the official post: source.

Supra@SUPRA_LabsAug 16, 2025The $SUPRA raised in the SupraLiquid sale will in fact NOT be sold.

It'll just go back to the community and incentives over time.

Stay ready chat, it starts on August 20 from 8AM EST.

Set email alerts: https://t.co/bdLunu8FVP

Get all the sale details in the AMA below https://t.co/CQmPk6kHOv pic.twitter.com/jzb2yBsQDk

TL;DR

$2.81 is the key support for $XRP, where 1.70 million tokens were accumulated. pic.twitter.com/oYYMcEHeFP

— Ali (@ali_charts) August 16, 2025

The support line in question is located around $2.81. Martinez said 1.70 million tokens were purchased at these levels, which are valued at well over $5 billion at today’s prices.

Such sizable accumulation zones typically serve as significant support or resistance lines, as investors tend to panic if their positions change from being in the water to an unrealized loss after a long time and vice versa.

XRP tested that support at the beginning of the month. At the time, the entire cryptocurrency market was in a free-fall state due to Donald Trump’s latest actions on the trade war front, as well as the movement of a couple of US nuclear submarines.

However, the bulls managed to defend it, and Ripple’s native token bounced confidently above it and hasn’t looked back since. Just the opposite, it challenged the $3.30 resistance, which, for now, has been too strong to breach.

Nevertheless, whales seem bullish on XRP’s future price movements as they keep accumulating the token. After last week’s $1 billion worth of XRPpurchase, they bought another 120 million coins just a few days later.

Meanwhile, Martinezoutlined$3.26 as a key resistance level for the asset’s future trajectory. If broken, it could jump to a new all-time high of $3.90, he added.

Galaxy Digital CEO Mike Novogratz says a million-dollar Bitcoin next year wouldn’t be a victory but rather a sign that the US economy is in serious trouble.

“People who cheer for the million-dollar Bitcoin price next year, I was like, Guys, it only gets there if we’re in such a shitty place domestically,” Novogratz told Natalie Brunell on the Coin Stories podcast on Wednesday.

Novogratz prefers stability over soaring BTC prices

“I’d rather have a lower Bitcoin price in a more stable United States than the opposite,” Novogratz said, explaining that severe currency devaluations often come at the expense of civil society.

When a national currency falls, investors often seek alternative safe havens to protect their wealth, and Bitcoin (BTC) is frequently referred to as digital gold.

Crypto analyst Wolf Of All Streets echoed a similar sentiment in an interview with Cointelegraph Magazine in July 2023: “The faster it happens, the worse the world is.”

However, several Bitcoiners have been speculating on the possibility of a million-dollar Bitcoin by 2026. One of them is BitMEX founder Arthur Hayes, who said in October 2023 that he expects Bitcoin to be $750,000 to $1 million by then. He has recently been more vocal about his prediction of Bitcoin reaching $250,000 by the end of this year.

More recently, Jan3 founder Samson Mow told Cointelegraph Magazine in June that Bitcoin could reach $1 million “maybe this year, maybe next year.”

Novogratz says Scott Bessent “is failing”

Novogratz also voiced concerns over the US’ ongoing debt issues. He suggested that US President Donald Trump’s decision to bring on Treasury Secretary Scott Bessent has not had the anticipated outcome.

“As much as I like Scott Bessent and I think he meant everything he said, he’s failing at bending debt to GDP,” Novogratz said.

“The deficit is going to be higher, not lower,” he added.

Novogratz is nervous about the Bitcoin treasury play

Novogratz warned that the growing adoption by Bitcoin treasury companies could be turning into a bubble.

“I’m a little nervous in general that there is what feels like a frenzy,” he said, revealing that Galaxy Digital receives approximately five calls weekly from new companies adopting the asset on the balance sheet.

“At one point, that’s what bubbles feel like, when the cab driver asks you about the balance sheet company,” he said.

It came only a couple of months after the venture capital (VC) firm Breed shared similar concerns.

Breed argued a few Bitcoin treasury companies will stand the test of time and avoid the vicious “death spiral” that will impact BTC holding companies that trade close to net asset value (NAV).

Top Stories of The Week

SharpLink shares drop 12% on Q2 crypto impairment loss

SharpLink Gaming, an online gaming company with the second-largest corporate Ether treasury, announced a net loss of $103 million for the second quarter of 2025, driven by a paper loss from accounting for liquid staked Ether (LsETH). The loss marks a steep drop from a $500,000 loss in the same period of 2024 a year-over-year change of -25,980%.

According to a Friday announcement, SharpLink now holds 728,804 Ether worth approximately $3.5 billion at this writing. The only publicly traded company with more ETH is BitMine Immersion Technologies, which holds a little more than 1.15 million ETH worth approximately $5.1 billion.

Of SharpLinks Q2 loss, $87.8 million or 85% is related to the companys LsETH. A SharpLink representative told Cointelegraph that the company still has all its LsETH and that the impairment reflects accounting rules, not a sale or loss of ETH.

Under US GAAP, LsETH is currently treated as a digital intangible asset, which is recorded at cost and subject to impairment, a SharpLink spokesperson said. In Q2, the lowest market price of LsETH was $2300, triggering the $87.8M non-cash impairment.

US Fed to end oversight program for banks crypto activities

The Federal Reserve Board said that it would end a novel activities supervision program set up in 2023 to supervise certain activities related to crypto assets and distributed ledger technology.

In a Friday notice, the Fed said it will sunset the program created in August 2023 and return to monitoring banks novel activities through the normal supervisory process. The 2023 program said it would be risk-focused and include supervision of banks providing deposits, payments, and lending to crypto-asset-related entities and fintechs.

Since the Board started its program to supervise certain crypto and fintech activities in banks, the Board has strengthened its understanding of those activities, related risks, and bank risk management practices, said the Fed. As a result, the Board is integrating that knowledge and the supervision of those activities back into the standard supervisory process and is rescinding its 2023 supervisory letter creating the program.

Coinbase says a full-scale altcoin season may be just ahead

Altcoins have seen significant recent growth, while crypto market conditions suggest there could soon be a shift toward cryptocurrencies outside of Bitcoin, according to Coinbase.

We think current market conditions now suggest a potential shift towards a full-scale altcoin season as we approach September, Coinbases global head of research, David Duong, wrote in a monthly outlook report on Thursday.

The Coinbase analyst joined a growing chorus of traders and market observers tipping for an imminent altcoin season.

The firm defines altcoin season as when at least 75% of the top 50 altcoins by market capitalization outperform Bitcoin over the preceding 90 days.

Duong added that there was significant retail capital sitting on the sidelines in money market funds, and Federal Reserve easing could unlock greater retail participation in the medium term.

FBI warns of fictitious law firms targeting crypto scam victims

The US Federal Bureau of Investigation (FBI) has issued a public service announcement for victims of crypto scams looking for legal advice to recover their funds.

In a Wednesday notice, the FBI said that fictitious law firms were targeting individuals who had previously been scammed out of some or all of their crypto holdings, putting them at additional risk. According to the bureau, the scammers actions left victims at risk of compromising their personal data and other funds.

The announcement, based on an update for similar warnings from the FBI in August 2023 and June 2024, cautioned people against accepting assistance from anyone recommending a crypto recovery law firm or any law firm requesting payment in cryptocurrency or prepaid gift cards.

Be cautious of law firms contacting you unexpectedly, especially if you have not reported the crime to any law enforcement or civil protection agencies, the notice reads.

Justin Sun, Bloomberg in legal dispute over billionaires index

Justin Sun, founder of the Tron blockchain, has sued Bloomberg and sought a temporary restraining order, alleging it published false and private financial information in its billionaires list.

Suns representatives said on Tuesday in a blog post by Tron that his profile on the Bloomberg Billionaires Index released on Monday had published inaccurate data that dramatically and dangerously misrepresents Mr. Suns assets.

Sun sued Bloomberg in a Delaware federal court on Monday, asking a judge to stop it from publishing the information, claiming the action was to prevent the outlet from recklessly and improperly disclosing his highly confidential, sensitive, private, and proprietary financial information.

Lawyers for Bloomberg said in a letter to the court on Tuesday that the company will oppose Suns application for a restraining order and asserted the entire basis of the application was moot as the outlet had published the information before the application was filed.

Most Memorable Quotations

ETH is arguably the biggest macro trade for the next 10 to 15 years as AI creates a token economy on the blockchain and as Wall Street financializes on the blockchain.

Tom Lee, co-founder and head of research at Fundstrat Global Advisors

Has anyone else noticed that the topping price action in 2021 looks exactly the same as current price action?

Nebraskangooner, pseudonymous crypto trader

We think current market conditions now suggest a potential shift towards a full-scale altcoin season as we approach September.

David Duong, global head of research at Coinbase

No matter what, its impossible that Ethereum is worth 4,600,000 BTC.

Samson Mow, CEO of Jan3

With key stakeholders accumulating loose coins that small ETH traders are willing to part with right now, prices are showing very little sentiment resistance from breaking through and making history in the near future.

Santiment, sentiment platform

Its a Darwinian stage for Web3 gaming: tough for small players, but potentially healthy for long-term stability.

Sara Gherghelas, analyst at DappRadar

Winners and Losers

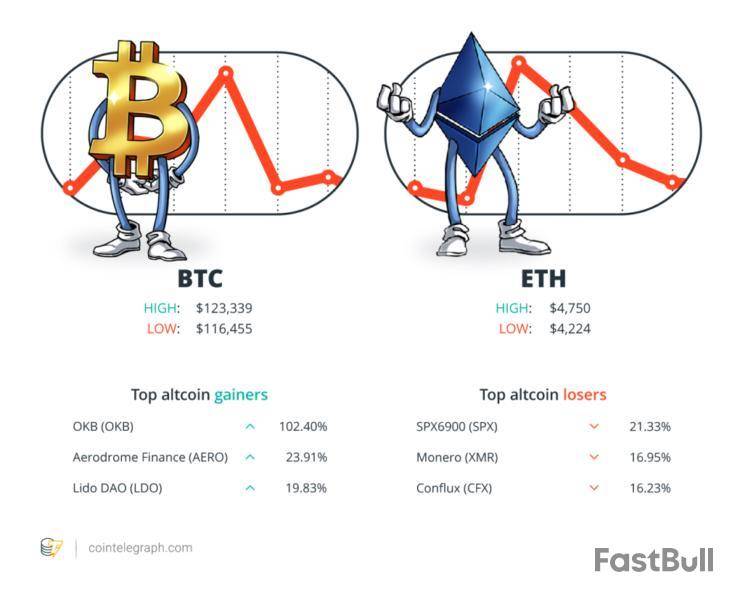

At the end of the week, Bitcoin (BTC) is at $117,594, Ether (ETH) at $4,445 and XRP at $3.11. The total market cap is at $3.97 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are OKB (OKB) at 102.40%, Aerodrome Finance (AERO) at 23.91% and Lido DAO (LDO) at 19.83%.

The top three altcoin losers of the week are SPX6900 (SPX) at 21.33%, Monero (XMR) at 16.95% and Conflux (CFX) at 16.23%. For more info on crypto prices, make sure to read Cointelegraphs market analysis.

Top Prediction of The Week

Ether bull flag targets $6K as ETH supply on exchanges falls to 12%

Ether price registered a multi-year high of $4,792 on Thursday after a 45% rise from its Aug. 3 low at $3,354. The price is now consolidating below its $4,867 all-time high after validating a classic bullish continuation pattern.

Can Ethers price rise 34% in the next few days?

Read also Features Financial nihilism in crypto is over Its time to dream big again Columns Socios boss goal? To knock crypto out of the parkETH rallied more than 126% between June 22 and Thursday to reach a multi-year high just below $4,800. The latest rally saw the price breach the resistance provided by the upper boundary of a bull flag at $3,770 on the daily chart, confirming a bullish breakout.

A bull flag is a continuation pattern that occurs after a significant rise, followed by a consolidation period at the higher price end of the range.

Ether has confirmed a textbook bull flag in the daily time frame, said trader Mister Crypto in an earlier analysis on X.

Top FUD of The Week

New BIS plan could make dirty crypto harder to cash out

The Bank for International Settlements (BIS) has proposed a provenance-based risk score system for crypto-to-fiat off-ramps.

In its Wednesday BIS Bulletin, the institution outlined an approach to anti-money laundering compliance for cryptoassets, recommending that a compliance score be assigned to crypto holdings before they are exchanged for fiat currency.

An AML compliance score based on the likelihood that a particular cryptoasset unit or balance is linked with illicit activity may be referenced at points of contact with the banking system, the document said. The score would then be used to prevent inflows of illicit funds and encourage a duty of care among crypto market participants.

The BIS said existing Anti-Money Laundering (AML) approaches relying on trusted intermediaries have limited effectiveness in the context of crypto. Public blockchain transaction histories could provide valuable tools for compliance monitoring, it said.

BtcTurk halts withdrawals amid suspected $48M crypto hack

Turkish cryptocurrency exchange BtcTurk has halted withdrawals amid reports suggesting that the platform has suffered a major loss of funds due to a hack.

Cybersecurity firm Cyvers took to X on Thursday to report that it had detected $48 million worth of digital assets, including Ether, involved in unusual activity.

Read also Features Crypto Indexers Scramble to Win Over Hesitant Investors Features I became an Ordinals RBF sniper to get rich but I lost most of my BitcoinOur system detected multiple alerts across ETH, AVAX, ARB, BASE, OP, MANTLE and MATIC networks, Cyvers reported, adding that the attacker had moved the assets to two addresses and begun swapping them.

BtcTurk subsequently halted deposits and withdrawals, citing a technical issue with hot wallets, reporting that trading and local currency withdrawals and deposits remained intact.

Ether rally turns Radiant Capital exploit into $103M windfall for hacker

The trove stolen from decentralized lender Radiant Capital in October 2024 has nearly doubled in value as Ether climbed, blockchain data shows.

Decentralized finance protocol Radiant Capital was hacked in mid-October 2024 when the crosschain lending protocol suffered a $58 million cybersecurity breach on BNB Chain and Arbitrum.

Radiant Capital lost about $58 million in the breach. The attacker later swapped proceeds into Ether and now holds 21,957 ETH worth about $103 million, according to Lookonchain, up from an estimated $58 million at the time of the exploit.

Ether closed Oct. 15, 2024, above $2,300, and was trading above $4,700 Thursday.

Top Magazine Stories of The Week

Everybody hates GPT-5, AI shows social media cant be fixed: AI Eye

OpenAIs GPT-5 has debuted to a wave of hatred, but heres what its critics get wrong. Plus, AI proves social media cant be fixed.

Altcoin season 2025 is almost here but the rules have changed

Ignore all previous calls, altcoin season is finally upon us. Maybe.

South Koreans dump Tesla for Ethereum treasury BitMine: Asia Express

South Koreas retail investors dump Tesla for Ethereum treasury companies. Thai crypto mule account crackdown.

Subscribe The most engaging reads in blockchain. Delivered once a week.Email address

SUBSCRIBE

There will be a Sui Ecosystem call with the founders of Cetus Protocol, Ika, and Nexa. In this event, they will talk about their products and answer questions from the public. If the teams make big announcements or share news of new features, many traders may become interested, and the price could rise. But if there is no new information or people are not excited, the price impact may be very small. Such calls often make prices move if there are surprises. source

cato batato@chowtatoAug 15, 2025Sui eco call coming at you next week on Tuesday Time to ask your burning questions on Ika and Nexa. What do you wanna ask them? Drop ur questions below. Plus @CetusProtocol will be the first project roasted. Will definitely be an interesting session https://t.co/QsXnOme8b8

交易股票、貨幣、商品、期貨、債券、基金等金融工具或加密貨幣屬高風險行為,這些風險包括損失您的部分或全部投資金額,所以交易並非適合所有投資者。

做出任何財務決定時,應該進行自己的盡職調查,運用自己的判斷力,並諮詢合格的顧問。本網站的內容並非直接針對您,我們也未考慮您的財務狀況或需求。本網站所含資訊不一定是即時提供的,也不一定是準確的。本站提供的價格可能由造市商而非交易所提供。您做出的任何交易或其他財務決定均應完全由您負責,並且您不得依賴通過網站提供的任何資訊。我們不對網站中的任何資訊提供任何保證,並且對因使用網站中的任何資訊而可能造成的任何交易損失不承擔任何責任。

未經本站書面許可,禁止使用、儲存、複製、展現、修改、傳播或分發本網站所含數據。提供本網站所含數據的供應商及交易所保留其所有知識產權。