行情

新聞

分析

使用者

快訊

財經日曆

學習

數據

- 名稱

- 最新值

- 前值

VIP跟單

所有跟單

所有比賽

日本短觀小型製造業前景指數 (第四季度)

日本短觀小型製造業前景指數 (第四季度)公:--

預: --

前: --

日本短觀大型非製造業前景指數 (第四季度)

日本短觀大型非製造業前景指數 (第四季度)公:--

預: --

前: --

日本短觀大型製造業前景指數 (第四季度)

日本短觀大型製造業前景指數 (第四季度)公:--

預: --

前: --

日本短觀小型製造業景氣判斷指數 (第四季度)

日本短觀小型製造業景氣判斷指數 (第四季度)公:--

預: --

前: --

日本短觀大型製造業景氣判斷指數 (第四季度)

日本短觀大型製造業景氣判斷指數 (第四季度)公:--

預: --

前: --

日本短觀大型企業資本支出年增率 (第四季度)

日本短觀大型企業資本支出年增率 (第四季度)公:--

預: --

前: --

英國Rightmove住宅銷售價格指數年增率 (12月)

英國Rightmove住宅銷售價格指數年增率 (12月)公:--

預: --

前: --

中國大陸工業產出年增率 (年初至今) (11月)

中國大陸工業產出年增率 (年初至今) (11月)公:--

預: --

前: --

中國大陸城鎮失業率 (11月)

中國大陸城鎮失業率 (11月)公:--

預: --

前: --

沙地阿拉伯CPI年增率 (11月)

沙地阿拉伯CPI年增率 (11月)公:--

預: --

前: --

歐元區工業產出年增率 (10月)

歐元區工業產出年增率 (10月)公:--

預: --

前: --

歐元區工業產出月增率 (10月)

歐元區工業產出月增率 (10月)公:--

預: --

前: --

加拿大成屋銷售月增率 (11月)

加拿大成屋銷售月增率 (11月)公:--

預: --

前: --

加拿大全國經濟信心指數

加拿大全國經濟信心指數公:--

預: --

前: --

加拿大新屋開工率 (11月)

加拿大新屋開工率 (11月)公:--

預: --

美國紐約聯邦儲備銀行製造業就業指數 (12月)

美國紐約聯邦儲備銀行製造業就業指數 (12月)公:--

預: --

前: --

美國紐約聯邦儲備銀行製造業指數 (12月)

美國紐約聯邦儲備銀行製造業指數 (12月)公:--

預: --

前: --

加拿大核心消費者物價指數 (CPI) 年增率 (11月)

加拿大核心消費者物價指數 (CPI) 年增率 (11月)公:--

預: --

前: --

加拿大製造業未完成訂單月增率 (10月)

加拿大製造業未完成訂單月增率 (10月)公:--

預: --

前: --

美國紐約聯邦儲備銀行製造業物價獲得指數 (12月)

美國紐約聯邦儲備銀行製造業物價獲得指數 (12月)公:--

預: --

前: --

美國紐約聯邦儲備銀行製造業新訂單指數 (12月)

美國紐約聯邦儲備銀行製造業新訂單指數 (12月)公:--

預: --

前: --

加拿大製造業新訂單月增率 (10月)

加拿大製造業新訂單月增率 (10月)公:--

預: --

前: --

加拿大核心消費者物價指數 (CPI) 月增率 (11月)

加拿大核心消費者物價指數 (CPI) 月增率 (11月)公:--

預: --

前: --

加拿大截尾均值CPI年增率 (季調後) (11月)

加拿大截尾均值CPI年增率 (季調後) (11月)公:--

預: --

前: --

加拿大製造業庫存月增率 (10月)

加拿大製造業庫存月增率 (10月)公:--

預: --

前: --

加拿大CPI年增率 (11月)

加拿大CPI年增率 (11月)公:--

預: --

前: --

加拿大CPI月增率 (11月)

加拿大CPI月增率 (11月)公:--

預: --

前: --

加拿大CPI年增率 (季調後) (11月)

加拿大CPI年增率 (季調後) (11月)公:--

預: --

前: --

加拿大核心消費者物價指數 (CPI) 月增率 (季調後) (11月)

加拿大核心消費者物價指數 (CPI) 月增率 (季調後) (11月)公:--

預: --

前: --

加拿大CPI月增率 (季調後) (11月)

加拿大CPI月增率 (季調後) (11月)公:--

預: --

前: --

聯準會理事米蘭發表演說

聯準會理事米蘭發表演說 美國NAHB房產市場指數 (12月)

美國NAHB房產市場指數 (12月)--

預: --

前: --

澳洲綜合PMI初值 (12月)

澳洲綜合PMI初值 (12月)--

預: --

前: --

澳洲服務業PMI初值 (12月)

澳洲服務業PMI初值 (12月)--

預: --

前: --

澳洲製造業PMI初值 (12月)

澳洲製造業PMI初值 (12月)--

預: --

前: --

日本製造業PMI初值 (季調後) (12月)

日本製造業PMI初值 (季調後) (12月)--

預: --

前: --

英國三個月ILO就業人數變動 (10月)

英國三個月ILO就業人數變動 (10月)--

預: --

前: --

英國失業金申請人數 (11月)

英國失業金申請人數 (11月)--

預: --

前: --

英國失業率 (11月)

英國失業率 (11月)--

預: --

前: --

英國三個月ILO失業率 (10月)

英國三個月ILO失業率 (10月)--

預: --

前: --

英國三個月含紅利的平均每週工資年增率 (10月)

英國三個月含紅利的平均每週工資年增率 (10月)--

預: --

前: --

英國三個月剔除紅利的平均每週工資年增率 (10月)

英國三個月剔除紅利的平均每週工資年增率 (10月)--

預: --

前: --

法國服務業PMI初值 (12月)

法國服務業PMI初值 (12月)--

預: --

前: --

法國綜合PMI初值 (季調後) (12月)

法國綜合PMI初值 (季調後) (12月)--

預: --

前: --

法國製造業PMI初值 (12月)

法國製造業PMI初值 (12月)--

預: --

前: --

德國服務業PMI初值 (季調後) (12月)

德國服務業PMI初值 (季調後) (12月)--

預: --

前: --

德國製造業PMI初值 (季調後) (12月)

德國製造業PMI初值 (季調後) (12月)--

預: --

前: --

德國綜合PMI初值 (季調後) (12月)

德國綜合PMI初值 (季調後) (12月)--

預: --

前: --

歐元區綜合PMI初值 (季調後) (12月)

歐元區綜合PMI初值 (季調後) (12月)--

預: --

前: --

歐元區服務業PMI初值 (季調後) (12月)

歐元區服務業PMI初值 (季調後) (12月)--

預: --

前: --

歐元區製造業PMI初值 (季調後) (12月)

歐元區製造業PMI初值 (季調後) (12月)--

預: --

前: --

英國服務業PMI初值 (12月)

英國服務業PMI初值 (12月)--

預: --

前: --

英國製造業PMI初值 (12月)

英國製造業PMI初值 (12月)--

預: --

前: --

英國綜合PMI初值 (12月)

英國綜合PMI初值 (12月)--

預: --

前: --

歐元區ZEW經濟景氣指數 (12月)

歐元區ZEW經濟景氣指數 (12月)--

預: --

前: --

德國ZEW經濟現況指數 (12月)

德國ZEW經濟現況指數 (12月)--

預: --

前: --

德國ZEW經濟景氣指數 (12月)

德國ZEW經濟景氣指數 (12月)--

預: --

前: --

歐元區貿易帳 (未季調) (10月)

歐元區貿易帳 (未季調) (10月)--

預: --

前: --

歐元區ZEW經濟現況指數 (12月)

歐元區ZEW經濟現況指數 (12月)--

預: --

前: --

歐元區貿易帳 (季調後) (10月)

歐元區貿易帳 (季調後) (10月)--

預: --

前: --

美國零售銷售月增率 (不含汽車 ) (季調後) (10月)

美國零售銷售月增率 (不含汽車 ) (季調後) (10月)--

預: --

前: --

無匹配數據

Reserve Rights Token will host a full-day program during the Ethereum Community Conference in Cannes, on July 2nd. The schedule runs from 07:00 to 19:00 UTC and features coworking sessions, DTF workshops and DeFi panels with speakers such as Ryne Saxe, Martin de Rijke and Matthew Fisher.

Refer to the official tweet by RSR:

Reserve 🌐@reserveprotocolJun 12, 2025DTFs go to @EthCC 🇫🇷 Join Reserve for a full day of coworking, DTF workshops & DeFi panels w/@rynesaxe, @MartindRijke, @mfisher10x, @RegenRene & more

🗓ï¸ Wednesday, July 2

⌚ 9am – 9pm

📍 Espace Croisette

Come diversify & chill on the Croisette 😎 pic.twitter.com/OrQtmNeFJs

RSR Info

Reserve Rights is a stablecoin platform consisting of two tokens, including the Reserve Stablecoin (RSV), which is a value-backed coin, and the Reserve Rights Token (RSR).

The Reserve Rights Token (RSR) is used to maintain the stability of the RSV token. When the price of RSV deviates from the $1 peg, the protocol’s algorithms automatically utilize RSR to buy or sell RSV on the open market until its price is restored to the $1 level.

Therefore, the RSR token plays a crucial role in maintaining the stability of RSV and ensuring its liquidity. RSR holders can also participate in protocol governance and vote on matters related to its development and improvement.

Kadena will participate in Istanbul Blockchain Week in Istanbul, on June 26–27. The program includes an address by CEO and co-founder Stuart Popejoy.

Refer to the official tweet by KDA:

Kadena@kadena_ioJun 12, 2025🗓 ISTANBUL BLOCKCHAIN WEEK 🗓@SirLensALot, CEO & Co-Founder of $KDA, will be speaking at @IstanbulBlockWk later this month.

Come say hello at our booth on June 26 & 27 - we'd love to meet you!

KDA Info

Kadena is a public blockchain platform that provides a secure, scalable, and user-friendly environment for developing and launching distributed applications (dApps).

One of the unique features of Kadena is its utilization of a new form of Proof-of-Work (PoW) in its consensus protocol. This protocol, called "Chainweb," is designed to achieve high throughput and scalability while maintaining security and decentralization.

The Kadena token (KDA) is a digital currency that is used to pay for computation on the Kadena public chain. Similar to ETH on Ethereum, KDA on Kadena is the token in which miners are compensated for mining blocks on the network and is the transaction fee that users pay in order to have their transactions included in a block.

Even though some coins are in the green zone today, the prices of most cryptocurrencies are falling, according to CoinMarketCap.CoinMarketCap">

The rate of Cardano has dropped by 1.10% since yesterday. Over the last week, the price has fallen by 5.46%.TradingView">

On the hourly chart, the price of ADA is rising after a false breakout of the local support of $0.6211.

If the growth continues to the resistance, one can expect a test of the $0.64 area next week.TradingView">

On the bigger time frame, the picture remains bearish as the rate is near the support level. If a breakout of $0.6104 happens, the accumulated energy might be enough for a move to the $0.58-$0.60 range.TradingView">

From the midterm point of view, there are no reversal signals yet. If a breakout of the interim level of $0.60 happens, traders may witness an ongoing decline to the $0.55 area.

ADA is trading at $0.6295 at press time.

Bulls are back in the game in the second half of the day, according to CoinStats.CoinStats">

The rate of Bitcoin has increased by 0.55% over the last 24 hours.TradingView">

On the hourly chart, the price of BTC is in the middle of the local channel, between the support of $104,923 and the resistance of $106,130.

As the rate is far from the key levels, any sharp moves are unlikely to happen by tomorrow.TradingView">

On the bigger time frame, the situation is similar. The rate of the main crypto is within yesterday's candle, which means ongoing sideways trading remains the more likely scenario within the next few days.TradingView">

On the weekly chart, traders are also unlikely to witness increased volatility shortly. Such a statement is also confirmed by the falling volume. All in all, one can expect consolidation in the range of $103,000-$110,000 until the end of the month.

Bitcoin is trading at $105,462 at press time.

The majority of the coins have returned to the red zone on the last day of the week, according to CoinStats.CoinStats">

The price of DOGE has declined by 1.63% over the last day.TradingView">

On the hourly chart, the rate of DOGE is rising after a bounce back from the local support level. If buyers can hold the gained initiative, one can expect a test of the upper level by tomorrow.TradingView">

On the bigger time frame, the price of the meme coin is far from the key levels. The volume remains low, which means neither buyers nor sellers are powerful enough to seize the initiative.

In this case, sideways trading in the area of $0.1750-$0.18 is the more likely scenario.TradingView">

From the midterm point of view, the situation remains bearish. If a breakout of the support level happens, there is a chance to witness a test of the $0.16 mark soon.

DOGE is trading at $0.1760 at press time.

Bitcoin is still trying to regain short-term bullish momentum, as shown by its price action in the past 24 hours. After briefly slipping below $104,500, the cryptocurrency bounced back to trade above $106,000, and technical analysis now shows a technical formation that could cause the start of a more extended rally.

Interestingly, as seen in the daily Ichimoku chart shared by analyst Titan of Crypto, Bitcoin is currently on the verge of confirming a golden cross, which is a bullish signal, within the coming days.

Ichimoku Cloud Builds Case For Bullish Breakout

Taking to the social media platform X, crypto analyst Titan of Crypto highlighted the recent daily price close above the Tenkan line as a strong technical signal for Bitcoin. The Tenkan, also known as the conversion line, is an intriguing indicator for short-term trend strength in Ichimoku analysis. According to the analyst, the current setup on Bitcoin’s daily chart shows the conditions aligning for a golden cross where the shorter-term average overtakes the longer-term one, which is a potential long-term bullish shift. This crossover, if confirmed, would be one of the most reliable trend-reversal patterns in technical trading.

Right now, Bitcoin’s price action is consolidating around $105,000. However, if this golden cross does play out well, Bitcoin could attempt another run toward the key resistance level around $111,600. However, current geopolitical instability, especially the rising tensions in the Middle East, could disrupt this technical picture at any moment and cause a reassessment of the bullish outlook.

Image From X: Titan of Crypto

Support And Whale Activity Clash With Bullish Setup

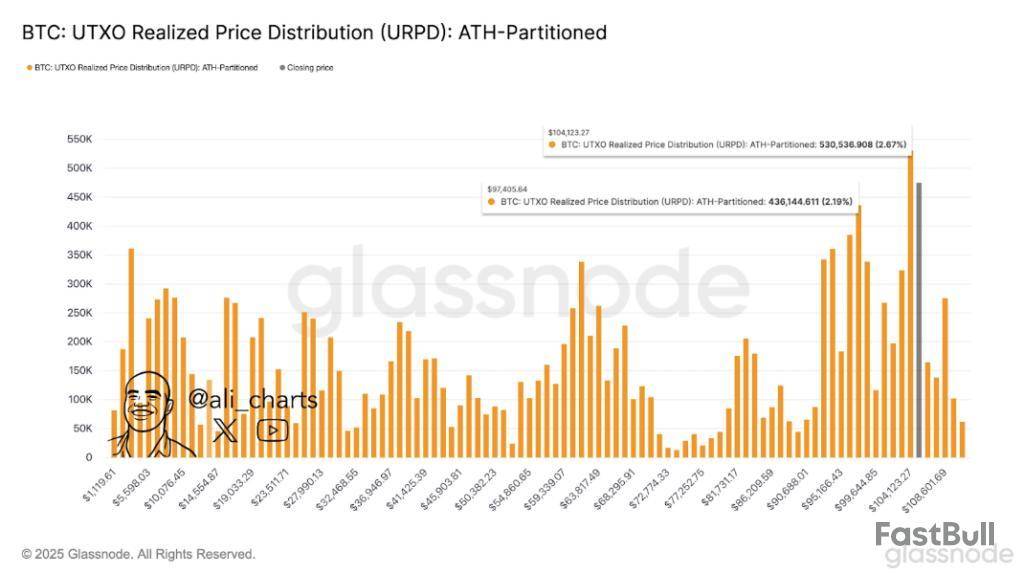

Despite the bullish technical backdrop, other market signals are flashing warnings for Bitcoin. Notably, analyst Ali Martinez identified $104,124 as an important support level for Bitcoin. This price point is not just arbitrary, as it represents a heavy concentration of UTXO realized prices.

Many investors bought in at that level, and if Bitcoin falls below it, the next likely destination could be $97,405. The URPD chart confirms that the safety net between $104,000 and $97,000 is somewhat thin. This means that once $104,000 is breached to the downside, a swift and steep correction could follow due to the lack of strong buying interest in that gap.

Image From X: Ali_charts

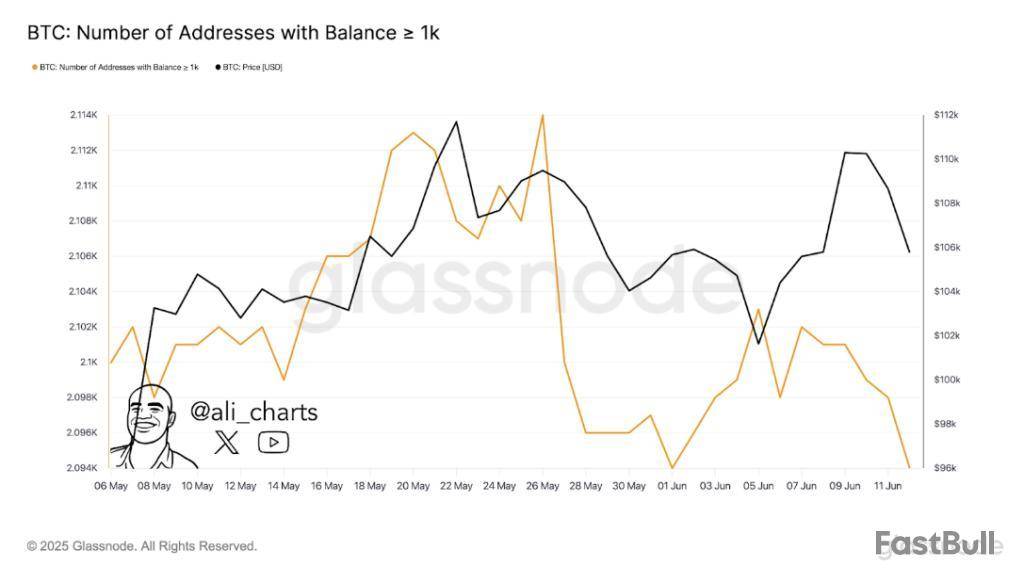

Further complicating the picture is the behavior of large Bitcoin holders. On-chain data shows that some of the biggest whales, addresses holding over 1,000 BTC, have started reducing their holdings in recent days. This decline in whale wallet count initially began shortly after Bitcoin reached its new all-time high of $111,800 on May 22. The reduction in whale count resumed again after Bitcoin was rejected at the $110,000 region early last week.

Image From X: Ali_charts

As such, whale addresses holding over 1,000 BTC have fallen from a recent peak of 2,114 to a recent reading of 2,094 addresses. At the time of writing, Bitcoin is trading at $105,505.

Featured image from Unsplash, chart from TradingView

交易股票、貨幣、商品、期貨、債券、基金等金融工具或加密貨幣屬高風險行為,這些風險包括損失您的部分或全部投資金額,所以交易並非適合所有投資者。

做出任何財務決定時,應該進行自己的盡職調查,運用自己的判斷力,並諮詢合格的顧問。本網站的內容並非直接針對您,我們也未考慮您的財務狀況或需求。本網站所含資訊不一定是即時提供的,也不一定是準確的。本站提供的價格可能由造市商而非交易所提供。您做出的任何交易或其他財務決定均應完全由您負責,並且您不得依賴通過網站提供的任何資訊。我們不對網站中的任何資訊提供任何保證,並且對因使用網站中的任何資訊而可能造成的任何交易損失不承擔任何責任。

未經本站書面許可,禁止使用、儲存、複製、展現、修改、傳播或分發本網站所含數據。提供本網站所含數據的供應商及交易所保留其所有知識產權。