行情

新聞

分析

使用者

快訊

財經日曆

學習

數據

- 名稱

- 最新值

- 前值

VIP跟單

所有跟單

所有比賽

法國貿易帳 (季調後) (10月)

法國貿易帳 (季調後) (10月)公:--

預: --

歐元區就業人數年增率 (季調後) (第三季度)

歐元區就業人數年增率 (季調後) (第三季度)公:--

預: --

加拿大兼職就業人數 (季調後) (11月)

加拿大兼職就業人數 (季調後) (11月)公:--

預: --

前: --

加拿大失業率 (季調後) (11月)

加拿大失業率 (季調後) (11月)公:--

預: --

前: --

加拿大全職就業人數 (季調後) (11月)

加拿大全職就業人數 (季調後) (11月)公:--

預: --

前: --

加拿大就業參與率 (季調後) (11月)

加拿大就業參與率 (季調後) (11月)公:--

預: --

前: --

加拿大就業人數 (季調後) (11月)

加拿大就業人數 (季調後) (11月)公:--

預: --

前: --

美國PCE物價指數月增率 (9月)

美國PCE物價指數月增率 (9月)公:--

預: --

前: --

美國個人收入月增率 (9月)

美國個人收入月增率 (9月)公:--

預: --

前: --

美國核心PCE物價指數月增率 (9月)

美國核心PCE物價指數月增率 (9月)公:--

預: --

前: --

美國PCE物價指數年增率 (季調後) (9月)

美國PCE物價指數年增率 (季調後) (9月)公:--

預: --

前: --

美國核心PCE物價指數年增率 (9月)

美國核心PCE物價指數年增率 (9月)公:--

預: --

前: --

美國個人支出月增率 (季調後) (9月)

美國個人支出月增率 (季調後) (9月)公:--

預: --

美國五至十年期通膨率預期 (12月)

美國五至十年期通膨率預期 (12月)公:--

預: --

前: --

美國實際個人消費支出月增率 (9月)

美國實際個人消費支出月增率 (9月)公:--

預: --

美國當週鑽井總數

美國當週鑽井總數公:--

預: --

前: --

美國當周石油鑽井總數

美國當周石油鑽井總數公:--

預: --

前: --

美國消費信貸 (季調後) (10月)

美國消費信貸 (季調後) (10月)公:--

預: --

中國大陸外匯存底 (11月)

中國大陸外匯存底 (11月)公:--

預: --

前: --

日本貿易帳 (10月)

日本貿易帳 (10月)公:--

預: --

前: --

日本名義GDP季增率修正值 (第三季度)

日本名義GDP季增率修正值 (第三季度)公:--

預: --

前: --

中國大陸進口額年增率 (人民幣) (11月)

中國大陸進口額年增率 (人民幣) (11月)公:--

預: --

前: --

中國大陸出口額 (11月)

中國大陸出口額 (11月)公:--

預: --

前: --

中國大陸進口額 (人民幣) (11月)

中國大陸進口額 (人民幣) (11月)公:--

預: --

前: --

中國大陸貿易帳 (人民幣) (11月)

中國大陸貿易帳 (人民幣) (11月)公:--

預: --

前: --

中國大陸出口額年增率 (美元) (11月)

中國大陸出口額年增率 (美元) (11月)公:--

預: --

前: --

中國大陸進口額年增率 (美元) (11月)

中國大陸進口額年增率 (美元) (11月)公:--

預: --

前: --

德國工業產出月增率 (季調後) (10月)

德國工業產出月增率 (季調後) (10月)公:--

預: --

歐元區Sentix投資者信心指數 (12月)

歐元區Sentix投資者信心指數 (12月)公:--

預: --

前: --

加拿大全國經濟信心指數

加拿大全國經濟信心指數公:--

預: --

前: --

英國BRC同店零售銷售年增率 (11月)

英國BRC同店零售銷售年增率 (11月)--

預: --

前: --

英國BRC總體零售銷售年增率 (11月)

英國BRC總體零售銷售年增率 (11月)--

預: --

前: --

澳洲隔夜拆借利率

澳洲隔夜拆借利率--

預: --

前: --

澳洲央行利率決議

澳洲央行利率決議 澳洲聯儲主席布洛克召開貨幣政策記者會

澳洲聯儲主席布洛克召開貨幣政策記者會 德國出口月率 (季調後) (10月)

德國出口月率 (季調後) (10月)--

預: --

前: --

美國NFIB小型企業信心指數 (季調後) (11月)

美國NFIB小型企業信心指數 (季調後) (11月)--

預: --

前: --

墨西哥12個月通膨年增率 (CPI) (11月)

墨西哥12個月通膨年增率 (CPI) (11月)--

預: --

前: --

墨西哥核心消費者物價指數 (CPI) 年增率 (11月)

墨西哥核心消費者物價指數 (CPI) 年增率 (11月)--

預: --

前: --

墨西哥PPI年增率 (11月)

墨西哥PPI年增率 (11月)--

預: --

前: --

美國當周紅皮書同店零售銷售指數年增率

美國當周紅皮書同店零售銷售指數年增率--

預: --

前: --

美國JOLTS職位空缺 (季調後) (10月)

美國JOLTS職位空缺 (季調後) (10月)--

預: --

前: --

中國大陸M1貨幣供應量年增率 (11月)

中國大陸M1貨幣供應量年增率 (11月)--

預: --

前: --

中國大陸M0貨幣供應量年增率 (11月)

中國大陸M0貨幣供應量年增率 (11月)--

預: --

前: --

中國大陸M2貨幣供應量年增率 (11月)

中國大陸M2貨幣供應量年增率 (11月)--

預: --

前: --

美國EIA當年短期前景原油產量預期 (12月)

美國EIA當年短期前景原油產量預期 (12月)--

預: --

前: --

美國EIA次年天然氣產量預期 (12月)

美國EIA次年天然氣產量預期 (12月)--

預: --

前: --

美國EIA次年短期原油產量預期 (12月)

美國EIA次年短期原油產量預期 (12月)--

預: --

前: --

EIA月度短期能源展望報告

EIA月度短期能源展望報告 美國當週API汽油庫存

美國當週API汽油庫存--

預: --

前: --

美國當週API庫欣原油庫存

美國當週API庫欣原油庫存--

預: --

前: --

美國當週API原油庫存

美國當週API原油庫存--

預: --

前: --

美國當週API精煉油庫存

美國當週API精煉油庫存--

預: --

前: --

韓國失業率 (季調後) (11月)

韓國失業率 (季調後) (11月)--

預: --

前: --

日本路透短觀非製造業景氣判斷指數 (12月)

日本路透短觀非製造業景氣判斷指數 (12月)--

預: --

前: --

日本路透短觀製造業景氣判斷指數 (12月)

日本路透短觀製造業景氣判斷指數 (12月)--

預: --

前: --

日本國內企業商品價格指數月增率 (11月)

日本國內企業商品價格指數月增率 (11月)--

預: --

前: --

日本國內企業商品價格指數年增率 (11月)

日本國內企業商品價格指數年增率 (11月)--

預: --

前: --

中國大陸PPI年增率 (11月)

中國大陸PPI年增率 (11月)--

預: --

前: --

中國大陸CPI月增率 (11月)

中國大陸CPI月增率 (11月)--

預: --

前: --

意大利工業產出年增率 (季調後) (10月)

意大利工業產出年增率 (季調後) (10月)--

預: --

前: --

無匹配數據

TL;DR

Time for a New Surge?

The second-largest meme coin witnessed a solid price increase towards the end of April, when the entire cryptocurrency market recorded a substantial revival. However, in the past week, Shiba Inu (SHIB) has slipped by almost 10%, currently trading at approximately $0.0000127 (per CoinGecko’s data).

Certain factors, though, suggest that a new pump might soon replace the downtrend. The burn rate, for instance, has soared by over 300% in the past week, resulting in more than 300 million tokens sent to a null address.

While the USD equivalent of the destroyed stash remains insignificant, continuous efforts in that field will make SHIB more scarce and possibly more valuable. It is important to note that this scenario will require demand to head north or at least remain at current levels.

Shiba Inu introduced the burning mechanism in 2022. Since then, the team and community have scorched over 410 trillion tokens, leaving around 584.4 trillion in circulation.

Shibarium may also contribute to a potential price expansion for the self-proclaimed Dogecoin killer. The layer-2 scaling solution is specifically designed to advance the Shiba Inu ecosystem, and since its launch, it has reached multiple milestones. Most recently, the total number of addresses that have interacted with the protocolsurgedpast 200 million.

Daily transactions on the network have been in the millions in the past several weeks, signaling strong user engagement. Among the industry participants who believe the further development of Shibarium could positively impact the price of SHIB is the popular Bitcoin advocateJeremie Davinci.Exchange Outflows

Last but not least, we will examine Shiba Inu’s exchange netflow. Data from CryptoQuant shows that in the last three days, outflows have surpassed inflows, indicating that investors may be moving their holdings off centralized platforms and into self-custody solutions. This, in turn, reduces the immediate selling pressure.

The trend contrasts with what was observed at the end of last month, when inflows dominated from April 22 to April 29. This is usually considered a bearish factor since it increases selling pressure. Interestingly, it was during this particular period that SHIB reached its local peak before heading south after April 26.

As a bonus, we would like to refer you to a previous article, which showed that the AI-powered chatbot ChatGPT is also bullish on the asset, estimating that it “is positioned to ride the next wave.”

Mentions of the word "cryptocurrency" in SEC filings hit an all-time high of 786 in April, a 38% jump from 569 in March and an 8% increase year over year from 727 in April 2024. Between January 2024 and March 2025, the monthly average was 457.

The spike suggests that federal agencies are dedicating more attention and resources to digital assets, likely in anticipation of new frameworks or forthcoming guidance from the U.S. Securities and Exchange Commission. The hope is that increased regulatory engagement will lead to clearer, more consistent rules that support long-term industry growth and boost institutional confidence.

Mentions of "stablecoins" also surged in recent months. Between January 2024 and January 2025, SEC filings referenced the term an average of 48 times per month. But from February to April 2025, that figure more than doubled to an average of 103 monthly mentions, with 81 in February, 124 in March, and 104 in April.

The rise in stablecoin mentions reflects heightened regulatory interest in reserve standards and consumer protections. If formalized, these measures could help increase trust and expand both enterprise and retail adoption.

Altogether, crypto is evolving from a niche asset into a key component of corporate risk management and investor relations, reinforcing its growing legitimacy across institutional and regulatory sectors.

This is an excerpt from The Block's Data & Insights newsletter. Dig into the numbers making up the industry's most thought-provoking trends.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Ripple is pledging $25 million in RLUSD to support teachers in the US. The firm partnered with DonorsChoose and Teach for America, two major nonprofits in the education sector.

Technically, the donation does not entirely consist of Ripple’s stablecoin, but the exact split is uncertain. A post from DonorsChoose suggests that $10 million may be in fiat.

Ripple Spends RLUSD on Education

Teacher Appreciation Week is kicking off in the US, and the threat of cuts to education funding is growing. In this environment, Ripple identified a chance to make a meaningful contribution with RLUSD, its new stablecoin.

According to a press release from the firm, its $25 million in funding will help teachers in a few key ways.

“Proud to support US teachers and classrooms through Ripple’s $25 million commitment to DonorsChoose and Teach For America. Delivered primarily through RLUSD, it’s a meaningful example of how stablecoins can drive real-world impact—starting in the classroom,” claimed Eric van Miltenburg, Ripple’s SVP of Strategic Initiatives.

To be clear, this donation doesn’t seem to go to any sort of blockchain-specific education. In the short term, Ripple’s press release claims that the RLUSD will support all-purpose education resources across public schools.

Later, the partners will also “support new initiatives focused on financial literacy,” but this seems like a more long-term goal.

DonorsChoose’s announcement prominently credited Ripple’s RLUSD contribution but also mentioned Good Morning America, a television program, and Eli Manning, a famous football player.

In other words, it might not be easy to prioritize financial literacy and other economics-centric education if other major donors aren’t as interested.

DonorsChoose also mentions $10 million in funding, not $25 million. Ripple’s press release states that most of the grant will be delivered in RLUSD, but it doesn’t go into specifics. The nonprofit might be indicating that $10 million was the proportion donated in fiat.

In any event, this is not Ripple’s first major charitable donation using RLUSD. In January, the firm pledged $50,000 to fight wildfires in California, but $25 million is a much larger contribution.

The massive increase in scale may reflect an increased focus on PR; for example, the firm has outwardly portrayed RLUSD as compliant with impending stablecoin regulations.

Between the SEC lawsuit getting dropped and XRP ETF optimism, Ripple is on a roll right now. This RLUSD donation has received wide praise from the crypto community, and may boost Ripple’s notoriety in the future.

As seen on the official social media post from DonorsChoose, several community members, even outside of the crypto industry, are praising Ripple for their philanthropic efforts.

Key Takeaways:

88% of Bitcoin’s supply is in profit below $95,000, indicating a reset in investor expectations.

The current price range of $75,000–$95,000 may represent a structural bottom, aligning with market conditions from Q3 2024.

The Market Value to Realized Value (MVRV) Ratio at 1.74 acts as a historical support zone, signaling cooling unrealized gains and potential for future growth.

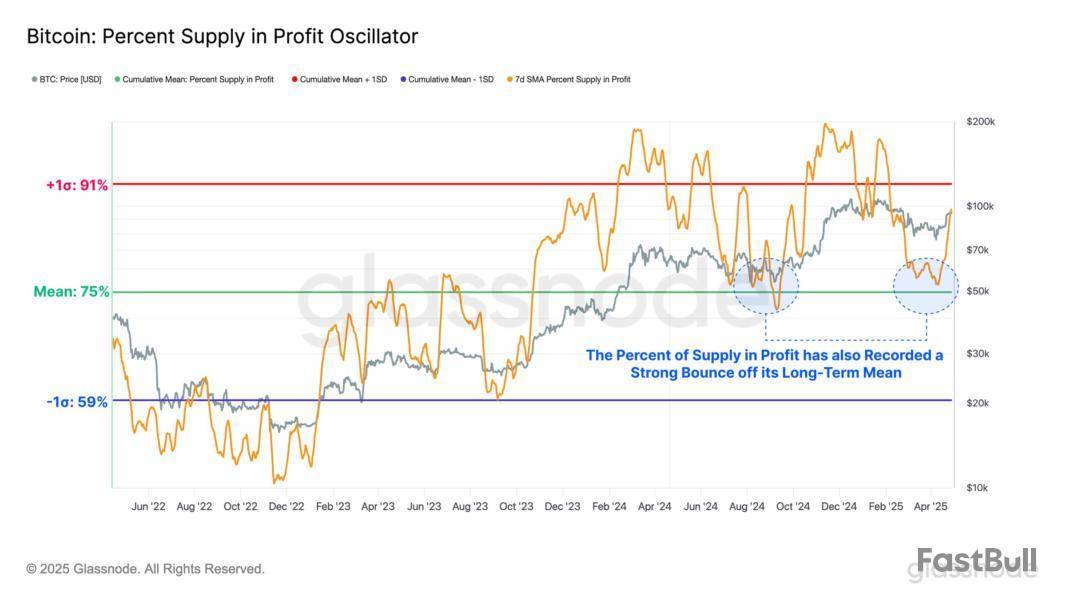

Bitcoin’s (BTC) market dynamics are shifting, as Glassnode data reveals that 88% of the supply is currently in profit, with losses concentrated among buyers in the $95,000-$100,000 range. This high profitability, rebounding from a long-term mean of 75%, indicates a reset in investor expectations.

Bitcoin's price staged a recovery from its long-term cumulative mean percentage in profit, marking a notable shift. Previously, in August 2024, Bitcoin retested the 75% mean at around $60,000. This suggests that the price range of $75,000–$95,000 may represent the bottom, aligning with the structural market conditions observed in Q3 2024.

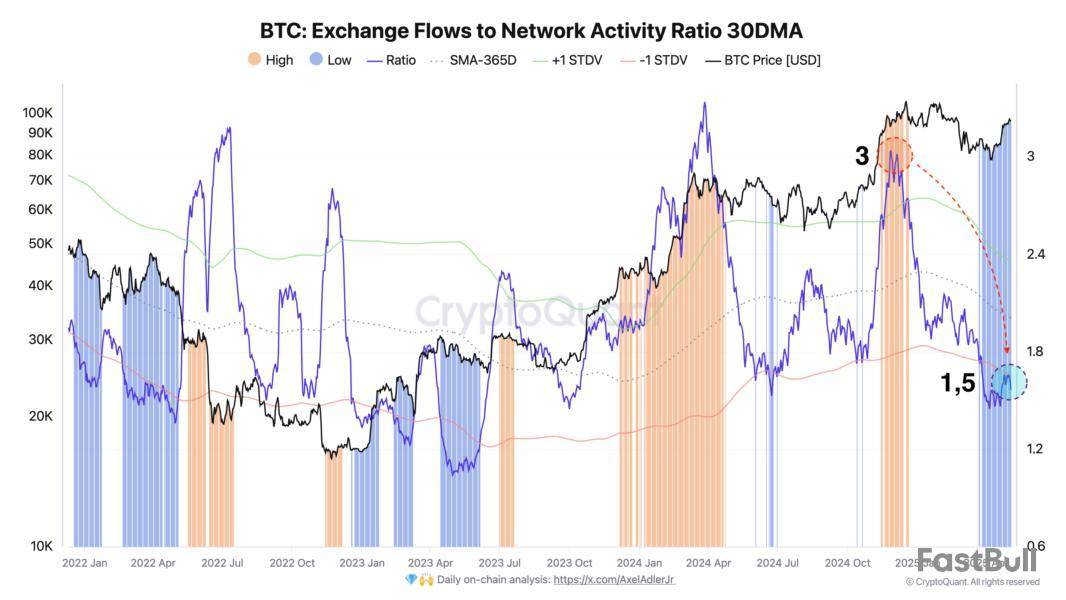

Confirming the decrease in holder sales through exchanges, the total exchange flow (inflow + outflow) to network activity ratio provides further insight. Bitcoin researcher Axel Adler Jr. explained that the chart shows a 1.5x decrease in ratio following Bitcoin’s all-time high, directly confirming that the current growth is more organic.

The analyst explained that, unlike previous price peaks, where a high ratio (marked by orange bars) signaled heavy selling, current levels show no such urgency, reinforcing a more stable market environment.

High profitability and reduced exchange inflows indicate diminished selling pressure from holders, enabling an improved holder’s mindset between $75,000 and $95,000. This suggests that investors viewed BTC as undervalued and not as an exit opportunity, which aligned with the broader bullish sentiment.

Related: Watch these Bitcoin price levels as BTC meets ‘decision point’

BTC data hint at cooling unrealized gains under $95K

Glassnode noted that the Market Value to Realized Value (MVRV) Ratio, a key market sentiment indicator, has returned to its long-term mean of 1.74. Historically, this level has been a support zone (since January 2024) during consolidation phases, signaling a cooling of unrealized gains and a potential base for future growth.

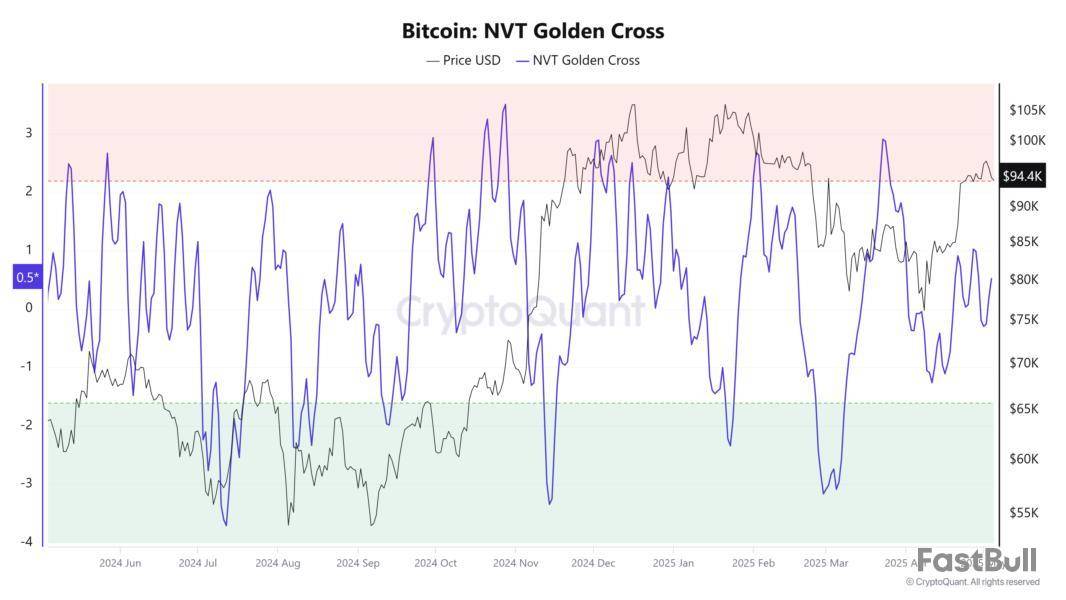

Similarly, the Network Value to Transactions (NVT) ratio is neutral at 0.5 with Bitcoin priced at $94,400, in contrast to its overbought signal when BTC was previously at this level in February 2025.

This shift in market dynamics and evolving holder behavior indicates that the current cohort of profitable investors may be less inclined to sell at these levels. This could further strengthen the bullish case of the present market structure.

Related: BTC dominance due ‘collapse’ at 71%: 5 things to know in Bitcoin this week

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Goldfinch and Fidu are set to announce their biggest partner integration yet, making investors excited about the potential impact on price. Partnerships usually bring new resources, increased adoption, and added credibility. These can lead to higher demand and price increases. However, the true impact depends on the partner’s identity and the specifics of the collaboration. If the partner is a major player, this could be a big boost for both FIDU and GFI. Keep an eye on the announcement for more details. source

Space and Time (SXT) will be listed on Binance Alpha, a major step for any cryptocurrency because Binance is one of the largest exchanges. This listing can significantly boost SXT’s visibility and liquidity, potentially driving its price higher. Early access and promotions linked to Binance Alpha Points could further enhance demand. However, price impact will also depend on wider market conditions and early investor reactions. A listing often brings an initial price spike, so keeping watch on trading patterns could be important for traders. source

Binance@binanceMay 05, 2025Get ready! Binance Alpha will be the first platform to feature Space and Time (SXT)! Trading will open on May 8th, with the exact time to be announced.

Users who meet the Alpha Points threshold will receive their airdrop within 10 minutes after trading starts. The threshold… pic.twitter.com/x0KfLPq029

CopXToken (COPX) is getting listed on CoinUp.io, bringing it to a broader audience. Listings can drive new interest and purchases of the token due to increased accessibility and trading ease. CoinUp.io might not be as large as Binance, but it still can attract traders seeking new opportunities. If the token catches traders' interest, its price might rise. However, if demand doesn’t pick up or is overwhelmed by sellers taking profits, any price increase could be short-lived. Traders should monitor trading volumes and market sentiment post-listing. source

COPX.AI@Copx_AIMay 03, 2025https://t.co/XcKbik3XhQ (CopXToKen)

Global Debut is Here

Official Launch on May 15, 2025

Simultaneously listed on https://t.co/ku0HZNGwqk @CoinUpOfficials and https://t.co/nHUqHQ6AD2 @XTexchange — two major exchanges!

Empowered by AI. Shaping the future, winning the now!… pic.twitter.com/juzX75rYJU

交易股票、貨幣、商品、期貨、債券、基金等金融工具或加密貨幣屬高風險行為,這些風險包括損失您的部分或全部投資金額,所以交易並非適合所有投資者。

做出任何財務決定時,應該進行自己的盡職調查,運用自己的判斷力,並諮詢合格的顧問。本網站的內容並非直接針對您,我們也未考慮您的財務狀況或需求。本網站所含資訊不一定是即時提供的,也不一定是準確的。本站提供的價格可能由造市商而非交易所提供。您做出的任何交易或其他財務決定均應完全由您負責,並且您不得依賴通過網站提供的任何資訊。我們不對網站中的任何資訊提供任何保證,並且對因使用網站中的任何資訊而可能造成的任何交易損失不承擔任何責任。

未經本站書面許可,禁止使用、儲存、複製、展現、修改、傳播或分發本網站所含數據。提供本網站所含數據的供應商及交易所保留其所有知識產權。