Cotizaciones

Noticias

Análisis

Usuario

24/7

Calendario económico

Educación

Datos

- Nombres

- Último

- Anterior

Cuentas de Señal para Miembros

Todas las Cuentas de Señal

Todos los Concursos

Reino Unido Balanza Comercial fuera de la Unión Europea (SA) (Octubre)

Reino Unido Balanza Comercial fuera de la Unión Europea (SA) (Octubre)A:--

P: --

A: --

Reino Unido Balanza comercial (Octubre)

Reino Unido Balanza comercial (Octubre)A:--

P: --

A: --

Reino Unido Índice del sector servicios Intermensual

Reino Unido Índice del sector servicios IntermensualA:--

P: --

A: --

Reino Unido Producción de la construcción intermensual (SA) (Octubre)

Reino Unido Producción de la construcción intermensual (SA) (Octubre)A:--

P: --

A: --

Reino Unido Producción industrial Interanual (Octubre)

Reino Unido Producción industrial Interanual (Octubre)A:--

P: --

A: --

Reino Unido Balanza Comercial (SA) (Octubre)

Reino Unido Balanza Comercial (SA) (Octubre)A:--

P: --

A: --

Reino Unido Balanza comercial de la UE (SA) (Octubre)

Reino Unido Balanza comercial de la UE (SA) (Octubre)A:--

P: --

A: --

Reino Unido Producción manufacturera interanual (Octubre)

Reino Unido Producción manufacturera interanual (Octubre)A:--

P: --

A: --

Reino Unido PIB Intermensual (Octubre)

Reino Unido PIB Intermensual (Octubre)A:--

P: --

A: --

Reino Unido PIB Interanual (SA) (Octubre)

Reino Unido PIB Interanual (SA) (Octubre)A:--

P: --

A: --

Reino Unido Producción industrial intermensual (Octubre)

Reino Unido Producción industrial intermensual (Octubre)A:--

P: --

A: --

Reino Unido Producción de la construcción interanual (Octubre)

Reino Unido Producción de la construcción interanual (Octubre)A:--

P: --

A: --

Francia IPCA Final Intermensual (Noviembre)

Francia IPCA Final Intermensual (Noviembre)A:--

P: --

A: --

China continental Incremento anual de préstamos pendientes (Noviembre)

China continental Incremento anual de préstamos pendientes (Noviembre)A:--

P: --

A: --

China continental M2 Oferta monetaria interanual (Noviembre)

China continental M2 Oferta monetaria interanual (Noviembre)A:--

P: --

A: --

China continental M0 oferta monetaria Interanual (Noviembre)

China continental M0 oferta monetaria Interanual (Noviembre)A:--

P: --

A: --

China continental M1 Oferta monetaria Interanual (Noviembre)

China continental M1 Oferta monetaria Interanual (Noviembre)A:--

P: --

A: --

India IPC Interanual (Noviembre)

India IPC Interanual (Noviembre)A:--

P: --

A: --

India Crecimiento de los depósitos Interanual

India Crecimiento de los depósitos InteranualA:--

P: --

A: --

Brasil Crecimiento del sector servicios Interanual (Octubre)

Brasil Crecimiento del sector servicios Interanual (Octubre)A:--

P: --

A: --

México Producción industrial interanual (Octubre)

México Producción industrial interanual (Octubre)A:--

P: --

A: --

Rusia Balanza comercial (Octubre)

Rusia Balanza comercial (Octubre)A:--

P: --

A: --

El presidente de la Reserva Federal de Filadelfia, Henry Paulson, pronuncia un discurso

El presidente de la Reserva Federal de Filadelfia, Henry Paulson, pronuncia un discurso Canada Permisos de construcción intermensuales (SA) (Octubre)

Canada Permisos de construcción intermensuales (SA) (Octubre)A:--

P: --

A: --

Canada Ventas al por mayor interanuales (Octubre)

Canada Ventas al por mayor interanuales (Octubre)A:--

P: --

A: --

Canada Inventario mayorista intermensual (Octubre)

Canada Inventario mayorista intermensual (Octubre)A:--

P: --

A: --

Canada Inventario mayorista interanual (Octubre)

Canada Inventario mayorista interanual (Octubre)A:--

P: --

A: --

Canada Ventas al por mayor intermensuales (SA) (Octubre)

Canada Ventas al por mayor intermensuales (SA) (Octubre)A:--

P: --

A: --

Alemania Cuenta corriente (no SA) (Octubre)

Alemania Cuenta corriente (no SA) (Octubre)A:--

P: --

A: --

Estados Unidos Perforación total Semanal

Estados Unidos Perforación total SemanalA:--

P: --

A: --

Estados Unidos Total semanal de perforaciones petrolíferas

Estados Unidos Total semanal de perforaciones petrolíferasA:--

P: --

A: --

Japón Índice Tankan de difusión de las grandes empresas no manufactureras (Cuarto trimestre)

Japón Índice Tankan de difusión de las grandes empresas no manufactureras (Cuarto trimestre)--

P: --

A: --

Japón Índice Tankan de difusión de la pequeña industria manufacturera (Cuarto trimestre)

Japón Índice Tankan de difusión de la pequeña industria manufacturera (Cuarto trimestre)--

P: --

A: --

Japón Índice Tankan de perspectivas de la gran industria no manufacturera (Cuarto trimestre)

Japón Índice Tankan de perspectivas de la gran industria no manufacturera (Cuarto trimestre)--

P: --

A: --

Japón Índice Tankan de perspectivas de la gran industria manufacturera (Cuarto trimestre)

Japón Índice Tankan de perspectivas de la gran industria manufacturera (Cuarto trimestre)--

P: --

A: --

Japón Índice Tankan de la pequeña industria manufacturera (Cuarto trimestre)

Japón Índice Tankan de la pequeña industria manufacturera (Cuarto trimestre)--

P: --

A: --

Japón Índice Tankan de difusión de las grandes manufacturas (Cuarto trimestre)

Japón Índice Tankan de difusión de las grandes manufacturas (Cuarto trimestre)--

P: --

A: --

Japón Gasto de capital de las grandes empresas Tankan Interanual (Cuarto trimestre)

Japón Gasto de capital de las grandes empresas Tankan Interanual (Cuarto trimestre)--

P: --

A: --

Reino Unido Índice Rightmove de precios de la vivienda interanual (Diciembre)

Reino Unido Índice Rightmove de precios de la vivienda interanual (Diciembre)--

P: --

A: --

China continental Producción industrial interanual (Noviembre)

China continental Producción industrial interanual (Noviembre)--

P: --

A: --

China continental Zona urbana Tasa de desempleo (Noviembre)

China continental Zona urbana Tasa de desempleo (Noviembre)--

P: --

A: --

Arabia Saudita IPC Interanual (Noviembre)

Arabia Saudita IPC Interanual (Noviembre)--

P: --

A: --

Zona Euro Producción industrial Interanual (Octubre)

Zona Euro Producción industrial Interanual (Octubre)--

P: --

A: --

Zona Euro Producción industrial intermensual (Octubre)

Zona Euro Producción industrial intermensual (Octubre)--

P: --

A: --

Canada Ventas de viviendas existentes Intermensual (Noviembre)

Canada Ventas de viviendas existentes Intermensual (Noviembre)--

P: --

A: --

Zona Euro Total de activos de reserva (Noviembre)

Zona Euro Total de activos de reserva (Noviembre)--

P: --

A: --

Reino Unido Expectativas de tasa de inflación

Reino Unido Expectativas de tasa de inflación--

P: --

A: --

Canada Índice Nacional de Confianza Económica

Canada Índice Nacional de Confianza Económica--

P: --

A: --

Canada Nuevas viviendas iniciadas (Noviembre)

Canada Nuevas viviendas iniciadas (Noviembre)--

P: --

A: --

Estados Unidos Índice de empleo manufacturero de la Fed de Nueva York (Diciembre)

Estados Unidos Índice de empleo manufacturero de la Fed de Nueva York (Diciembre)--

P: --

A: --

Estados Unidos Índice manufacturero de la Fed de Nueva York (Diciembre)

Estados Unidos Índice manufacturero de la Fed de Nueva York (Diciembre)--

P: --

A: --

Canada IPC subyacente Interanual (Noviembre)

Canada IPC subyacente Interanual (Noviembre)--

P: --

A: --

Canada Pedidos pendientes de fabricación intermensual (Octubre)

Canada Pedidos pendientes de fabricación intermensual (Octubre)--

P: --

A: --

Canada Nuevos pedidos manufactureros intermensuales (Octubre)

Canada Nuevos pedidos manufactureros intermensuales (Octubre)--

P: --

A: --

Canada IPC subyacente intermensual (Noviembre)

Canada IPC subyacente intermensual (Noviembre)--

P: --

A: --

Canada Inventario manufacturero intermensual (Octubre)

Canada Inventario manufacturero intermensual (Octubre)--

P: --

A: --

Canada IPC Interanual (Noviembre)

Canada IPC Interanual (Noviembre)--

P: --

A: --

Canada IPC Intermensual (Noviembre)

Canada IPC Intermensual (Noviembre)--

P: --

A: --

Canada IPC Interanual (SA) (Noviembre)

Canada IPC Interanual (SA) (Noviembre)--

P: --

A: --

Canada IPC subyacente intermensual (SA) (Noviembre)

Canada IPC subyacente intermensual (SA) (Noviembre)--

P: --

A: --

Sin datos que coincidan

Gráficos Gratis para siempre

Charlar P&R con expertos Filtros Calendario económico Datos HerramientaMembresía CaracterísticasTendencias del mercado

Indicadores populares

Últimas perspecivas

Últimas perspecivas

Temas en Tendencia

Columnistas Principales

Última actualización

Etiqueta blanca

API de datos

Complementos web

Programa de afiliados

Ver todo

Sin datos

The US dollar rose against its major trading partners early Thursday, except for a decline versus the pound, after the Federal Open Market Committee maintained the target range for its federal funds rate at 4.25% to 4.50%, but said there is heightened risk of higher inflation and rising unemployment.

Thursday's schedule starts with weekly initial jobless claims and the first look at Q1 productivity, both at 8:30 am ET.

Wholesale inventories data for March are due to be released at 10:00 am ET, followed by natural gas stocks inventory data at 10:30 am ET and an update to the Atlanta Federal Reserve's gross domestic product Nowcast estimate for Q2 around midday. The New York Federal Reserve's inflation outlook survey for April will be released at 11:00 am ET.

A quick summary of foreign exchange activity heading into Thursday:

fell to 1.1293 from 1.1306 at the Wednesday US close and 1.1366 at the same time Wednesday morning. There are no Eurozone data on Thursday's schedule. The next European Central Bank meeting is scheduled for June 4-5.

rose to 1.3322 from 1.3296 at the Wednesday US close but was below a level of 1.3355 at the same time Wednesday morning. The Bank of England lowered its target rate by 25 basis points at its meeting Thursday by a vote of five-to-four, with two voters preferring a larger 50 basis point cut and two wanting no reduction at all. Bank of England Governor Andrew Bailey is due to speak at 9:15 am ET. The decision comes ahead of an expected trade pact announcement with the US later in the day. The next Bank of England meeting is scheduled for June 19. Prior to the rate announcement, data showed that UK home prices rebounded in April from a March decline.

rose to 144.6947 from 143.8144 at the Wednesday US close and 143.2742 at the same time Wednesday morning. There were no Japanese data released overnight. The next Bank of Japan meeting is scheduled for June 16-17.

rose to 1.3883 from 1.3830 at the Wednesday US close and 1.3790 at the same time Wednesday morning. There are no Canadian data on Thursday's schedule. The next Bank of Canada meeting is scheduled for June 4.

The euro pared earlier losses to stabilize around $1.13 as markets digested a series of monetary policy decisions and awaited key developments in global trade.

The U.S. Federal Reserve held interest rates steady, as expected, but cautioned that President Donald Trump’s tariffs could drive up prices, slow economic growth, and increase unemployment if sustained.

Meanwhile, the Bank of England cut its base rate by 25 basis points to 4.25%—a two-year low—following a narrowly split vote, as policymakers responded to persistent domestic weakness and mounting global trade tensions.

Elsewhere in Europe, central banks in Sweden and Norway left rates unchanged, despite growing concerns over the economic outlook amid escalating trade uncertainty.

In related news, Trump announced that a major trade agreement between the U.S. and the UK would be revealed today, while high-level U.S.-China negotiations are set to resume this weekend.

Soaring demand for cleaner marine fuel in Europe, driven by shipping companies like Maersk, has led to a complete acquisition of all four April cargoes of Chadian Doba crude by Dutch and German oil refineries, according to a Reuters report.

This surge in demand is directly linked to the shipping industry’s efforts to adopt fuels with lower emissions.

The strategic importance of Chadian Doba crude lies in its suitability for producing the cleaner marine fuels that are currently highly sought after in the European market.

The complete uptake of available cargoes underscores the intensity of this rising demand and the potential for further shifts in crude oil trade flows based on evolving fuel preferences within the maritime industry.

Prior to April 2025, Asia served as the primary recipient of Doba cargoes, with China and Malaysia specifically accounting for multiple shipments, data from Kpler indicated.

This suggests a significant trade flow of Doba to these key Asian markets during that period.

The concentration of shipments in China and Malaysia highlights their importance as consumers or processors of this particular commodity.

IMO regulations

The International Maritime Organization (IMO) designated the Mediterranean Sea as an Emission Control Area (ECA) in May.

This new regulation mandates that ships operating in this region must use fuels with a sulphur content of no more than 0.1%, a decrease from the previous limit of 0.5%.

The rise in demand for ultra-low sulfur fuel oil (ULSFO) in Europe, driven by stricter environmental regulations aimed at reducing sulfur emissions from maritime transport, led to a substantial increase in exports of Doba crude.

This heavy, sweet crude oil, characterised by its low sulfur content and density, possesses qualities that make it exceptionally well-suited for the refining process required to produce ULSFO, which has a maximum sulfur content specification of just 0.1%.

Advantage of Doba crude

European refiners found Doba crude to be an advantageous feedstock, offering a higher yield of compliant ULSFO compared to many other crude oil grades.

This optimized their production processes and met the evolving regulatory landscape.

This confluence of environmental policy and the specific characteristics of Doba crude resulted in a notable surge in its export volumes to European markets.

According to Rystad Energy analyst Valerie Panopio, Doba is well-suited for blending ultra-ULSFO. The increase in exports to Germany and the Netherlands observed in April may be an effort to capitalise on the expected increase in demand for ULSFO.

Panopio was quoted in the report:

There aren’t very many grades with the same properties as Doba Blend, even harder to find is one with ample and steady supply.

Chad exports

Chad’s oil exports, approximately 130,000 barrels daily, are regularly shipped to Asia, Europe, and the Middle East, according to Kpler shipping data.

Additionally, Kpler reports that April saw the highest volume of Doba crude oil in a year, approximately 127,000 barrels per day, being transported to Europe via four Suezmax vessel fixtures.

Since January, two European oil refineries have received Doba crude: Dutch storage firm Chane’s Rotterdam plant and HES International’s Wilhelmshaven unit in Germany, according to Kpler data.

To meet new regulations in the Mediterranean, Maersk’s bunker buyer, Maersk Energy Markets, has secured a deal to purchase ULSFO from Chane’s Rotterdam facility for its fleet, according to Maersk.

has drifted lower and is testing support at 1.1300 on Thursday, said ING.

The bank has been saying that the US dollar bounce has been lackluster, but positioning probably means that a move under 1.1250/1260 Thursday could do some damage.

Thursday's Bank of England policy meeting should be a market mover, stated ING. With a 25bps rate cut to 4.25% widely expected, probably the most important development Thursday will be what the BoE does with this sentence: "Based on the Committee's evolving view of the medium-term outlook for inflation, a gradual and careful approach to the further withdrawal of monetary policy restraint is appropriate." Those more dovish in the market are looking for "gradual and careful" to be dropped/amended to signal a sharper set of BoE rate cuts. ING isn't so sure the BoE is ready to drop that phrase just yet.

Given that the market is now pricing four 25bps rate cuts this year and ING expects three — in May, August and November — if BoE easing remains "gradual and careful," sterling could rally, wrote the bank in a note. For reference, the foreign exchange options market prices an 80 USD pip break-even range for over the next day.

For , that break-even is 39 GBP pips. could get distorted by global risk sentiment on Thursday, but the bank would say a less dovish than expected BoE Thursday could drive to the 0.8435/40 area.

The Czech market is closed Thursday for a public holiday. However, looks fair to ING at current levels slightly below 24.900. The bank retains a slightly bullish view on the koruna (CZK) in the medium-term, given the outlook for inflation on still dovish market pricing.

However, after Wednesday's policy meeting at the Czech central bank (CNB) in which it cut rates by 25bps, it is clear that the downside for is less than ING expected.

, on the other hand, may receive some downside support if Thursday's press conference confirms a smaller cutting cycle than market pricing suggests, but conviction is low here given the Polish central bank's (NBP) unclear communication. For ING, is likely to find a bottom for now and remain stuck in the 5.800-850 range.

broke 5.100 on Wednesday and it seems this line in the sand didn't last long, said ING. One-month forward implied yield reached 10% and the ROMGB sell-off continues, especially in front-end following implied yields, suggesting continued pressure on the Romanian currency (RON), leaving upside open for now.

The euro dipped slightly below $1.13 as investors remained on the sidelines following a wave of monetary policy decisions and ahead of key developments in global trade policy.

The U.S. Federal Reserve held interest rates steady, as expected, while cautioning that President Donald Trump’s tariffs could drive up prices, dampen economic growth, and increase unemployment if sustained.

Similarly, central banks in Sweden and Norway opted to keep borrowing costs unchanged, despite mounting concerns over the economic outlook amid escalating trade tensions.

Meanwhile, the Bank of England is expected to cut its base rate by 25 basis points—its fourth consecutive reduction—in response to both the global trade war and persistent domestic economic weakness.

In related news, Trump claimed a major trade agreement would be announced today, while high-level U.S.-China trade talks are set to resume this weekend.

Indian rupee open 20 paise up on May 8at 84.6387 against the US dollar as there was no major news from border even though tensions continue to build, currency experts said.

The local currency opened at 84.6387 against the US, as compared to 84.5912 against the greenback at previous close.

On May 7, Indian rupee depreciated around 20 paise driven by sharp rise in geopolitical tensions.

In response to the Pahalgam terror attack, Indian forces executed 24 precision strikes across terror sites in Pakistan and PoK under Operation Sindoor.

Further, currency experts said the trades will also take cues after the US Federal Reserve kept rates unchanged.

The Federal Reserve held interest rates steady at 4.25 percent to 4.5 percent. The central bank also sounded concerns over economic uncertainties.

"The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated," said the Federal Reserve, in a statement.

"The Committee is attentive to the risks to both sides of its dual mandate and judges that the risks of higher unemployment and higher inflation have risen," the statement further added.In a press conference following the decision, the Fed Chair said, "The risk of higher inflation and higher inflation have risen."

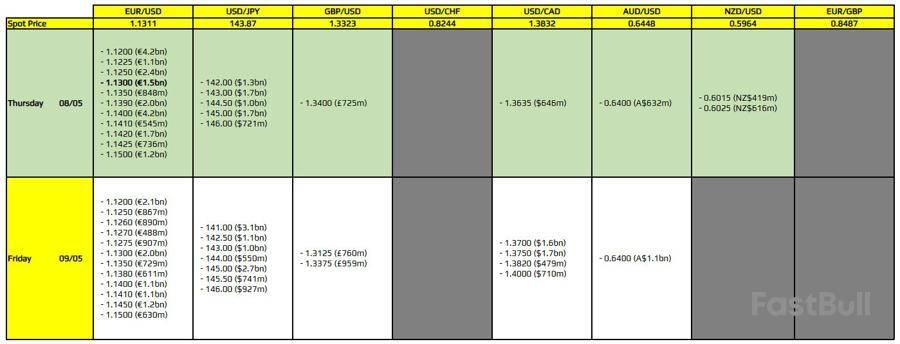

There is just one to take note of on the day, as highlighted in bold.

That being for EUR/USD at the 1.1300 level. It isn't one that ties to any technical significance though, so the impact might not be too striking. But amid a bit of a wait until we get to Trump's trade deal announcement, the expiries could help to provide a bit of a magnet for price action in the session ahead.

But as has been the case in the past two to three weeks, it's all about trade headlines and the risk mood. So, those will remain as the key drivers of trading sentiment as we look to the day ahead.

For more information on how to use this data, you may refer to this post here.

Etiqueta blanca

API de datos

Complementos web

Creador de carteles

Programa de afiliados

El riesgo de pérdida en el comercio de activos financieros como acciones, divisas, materias primas, futuros, bonos, ETF o criptomonedas puede ser considerable. Puede sufrir una pérdida total de los fondos que deposita con su corredor. Por lo tanto, debe considerar cuidadosamente si dicha negociación es adecuada para usted tomando en cuenta sus circunstancias y recursos financieros.

No se debe considerar invertir sin llevar a cabo, su propia diligencia de manera minuciosa o consultar con sus asesores financieros. Nuestro contenido web puede no ser adecuado para usted, ya que no conocemos su situación financiera ni sus necesidades de inversión. Es posible que nuestra información financiera tenga latencia o contenga inexactitudes, por lo que usted debe ser completamente responsable de cualquiera de sus transacciones y decisiones de inversión. La empresa no se hará responsable de su capital perdido.

Sin obtener el permiso del sitio web, no se le permite copiar los gráficos, textos o marcas comerciales del sitio web. Los derechos de propiedad intelectual sobre los contenidos o datos incorporados a este sitio web pertenecen a sus proveedores y comerciantes de intercambio.

No conectado

Inicia sesión para acceder a más funciones

Membresía FastBull

Todavia no

Comprar

Iniciar sesión

Registrarse