Three Domains, One Content? Trader Accuses NCE of Malicious Slippage and Account Manipulation

BrokersView has recently noted accusations from a trader alleging that the brokerage firm NCE (XNCE) engages in severe malicious slippage and inexplicable account anomalies. Our investigation has uncovered an even more unusual phenomenon: the broker appears to operate at least three domains, all displaying identical web content. What is the true foundation of credibility for this broker, which attempts to present itself with multiple faces?

Three Domains, Who is the Real Entity?

NCE operates at least three primary domains simultaneously:

ncetrader.com

xnce.com

ncemarkets.com

When we visit these three URLs, the page design, promotional copy, contact information, and even the regulatory claims seen are completely identical copies. However, these websites are not set up with standard redirects (where visiting A automatically redirects to the main site B).

For legitimate financial service platforms, companies typically lock down one primary domain and redirect others to the main site for brand consistency and Search Engine Optimization (SEO). NCE's operating model of "multi-domain mirroring" (where multiple domains point to the same server content without redirecting) is typically found among unregulated offshore platforms. The purposes often include:

Evading Network Blocks: When one domain is blocked by a firewall in a certain jurisdiction, a backup domain can be swiftly activated.

Avoiding Regulatory Crackdown: Making it harder for regulators to blacklist the entity. This deliberate creation of "network clones" is itself a major red flag for a lack of compliance and transparency.

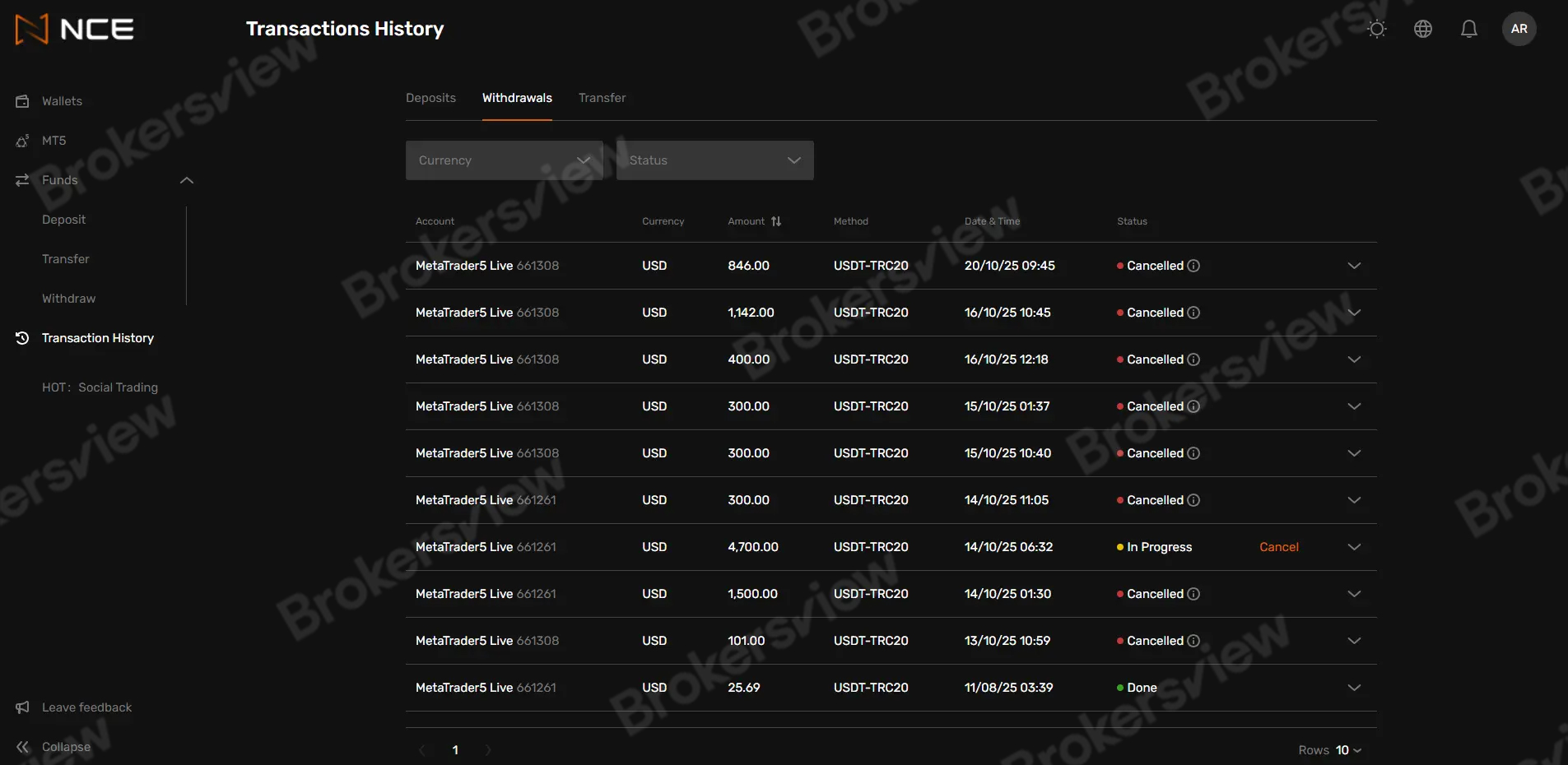

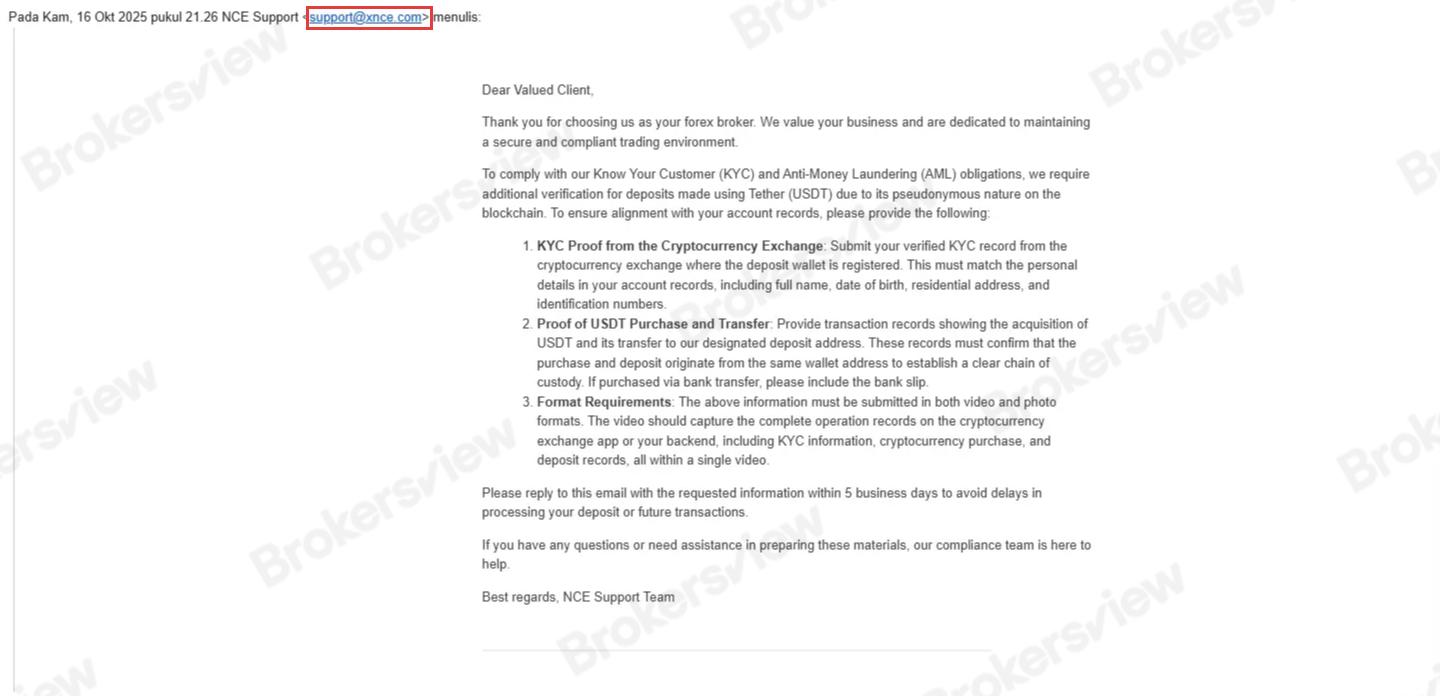

Malicious Slippage and Account Manipulation

Beyond the perplexing multiple domains, a trader has also reported suffering losses at the hands of this broker. According to the trader, the NCE platform exhibits severe suspicion of manual manipulation in trade execution.

A professional conducted a trace analysis of the user's cryptocurrency (USDT) deposit. Although the amount involved in this case was less than $200, the path of the funds is highly representative:

The user's deposit was sent to the wallet address provided by NCE (ending in ...kbCdXKrZ), but the funds did not remain there. They were swiftly consolidated and emptied into a secondary wallet (ending in ...JNfAAHyG).

Analysis of this secondary target wallet via TokenView led the professional to point out that this is by no means a simple cold storage address. The address handles a massive volume of hundreds of millions of USDT and exhibits features of continuous, high-frequency fund inflows and outflows.

He further pointed out that this pattern is not standard corporate financial operation but bears the characteristics of a typical "laundering hub" or "mixer." This mechanism is commonly used to obfuscate the trail of victim funds before they are sent to exchanges for cashing out. This suggests the platform harbors suspicion of operating an organized fraud network, where transactions of any size are within its scope of "harvesting."

BrokersView Reminds You

NCE's current operational status—domain confusion and abnormal on-chain fund flows—presents typical characteristics of extremely high risk. Therefore, exercise caution when opening an account with NCE until its brand architecture and regulatory status are thoroughly clarified.

If you have already suffered losses, please retain all transaction Hashes and communication records, and attempt to initiate a crypto forensic investigation or submit an asset freeze request to the compliance departments of relevant exchanges. Simultaneously, BrokersView welcomes traders with similar experiences to submit their complaints on our website.