Australian Securities and Investments Commission Calls on Companies to Take Measures to Protect Whistleblowers

On December 4, the Australian Securities and Investments Commission (ASIC) urged companies to establish more robust whistleblower mechanisms and protect whistleblowers.

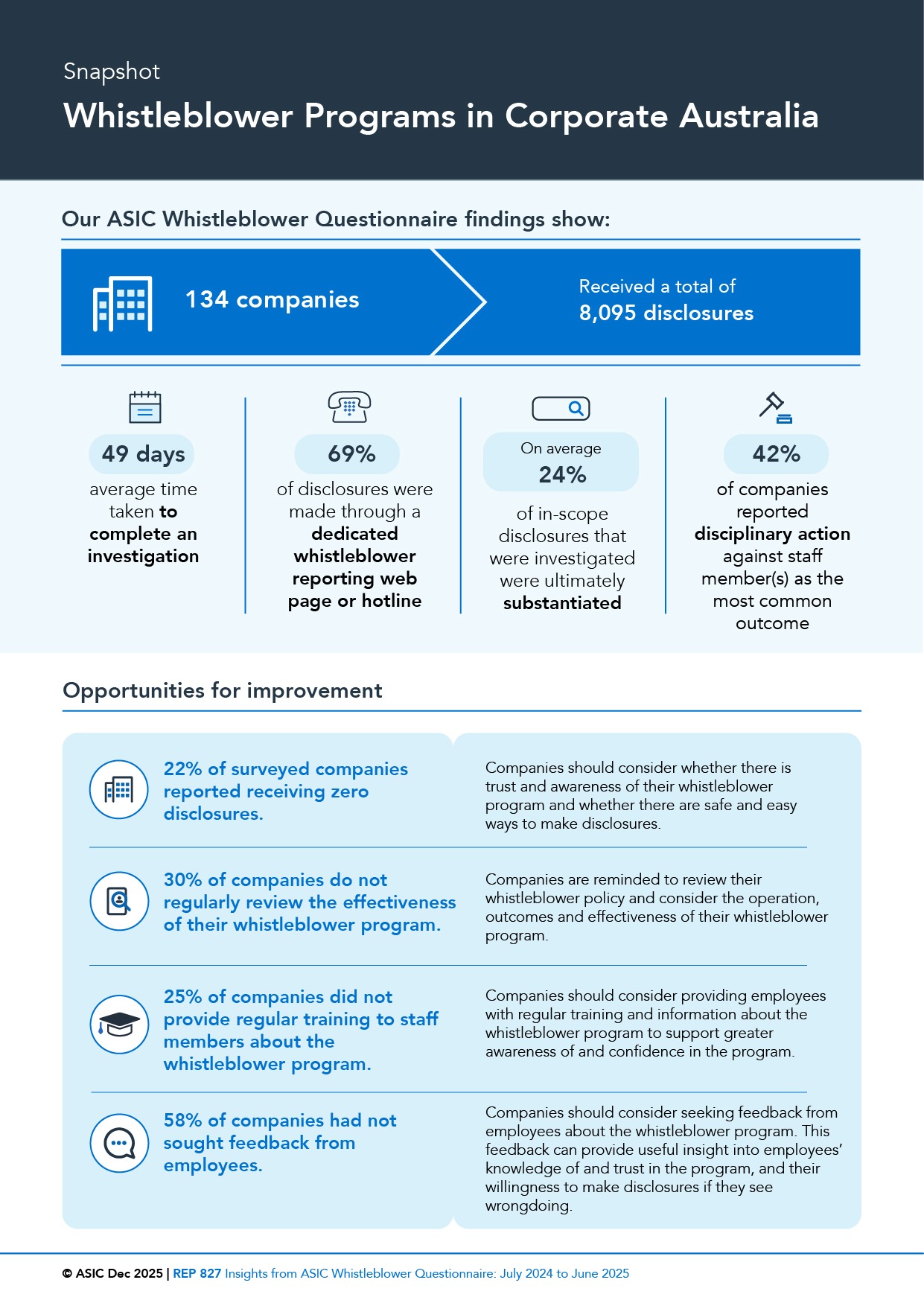

Through its Insights from the ASIC Whistleblower Questionnaire: July 2024 to June 2025, ASIC examined whistleblower policies and practices across 134 entities in 18 industries. The survey revealed significant variation in the maturity of whistleblower practices among different companies.

Key findings include:

- 22% of surveyed entities received no whistleblower disclosures;

- 30% did not regularly review the effectiveness of their whistleblower programs;

- 25% failed to provide regular training on whistleblower programs to employees;

- 58% did not seek employee feedback.

The Australian regulator concluded that local companies have space for improvement in whistleblower disclosure and offered suggestions.

ASIC Commissioner Alan Kirkland emphasized that whistleblowers play a vital role in identifying and exposing misconduct. Without effective policies and programs to encourage reporting, corporate wrongdoing may go unreported or undetected.

While whistleblower processes vary by firms, Kirkland highlighted the necessity of dedicated reporting web pages. He noted this approach facilitates contact with anonymous disclosers, fosters a culture of speaking up, and represents a viable measure for companies to support whistleblowers and encourage disclosure.

The regulator found that while larger enterprises often exhibit more mature whistleblower practices and higher disclosure rates, some smaller businesses also demonstrate sound practices. This indicates that corporate size does not correlate strongly with the effectiveness of whistleblower programs.

ASIC reminds companies that they must provide specific protections for whistleblowers as required, ensuring the confidentiality of their information. A proper whistleblower policy should reflect these protections and outline how the company will support and safeguard whistleblowers, tailored to its specific circumstances and characteristics.

BrokersView reminds you

The Australian Securities and Investments Commission (ASIC) is the national regulatory body overseeing local companies, markets, and financial services. Brokers operating in the country or providing financial services must hold an Australian Financial Services (AFS) license issued by ASIC.