SEBI Issues Order Against Investment Adviser Over Compliance Breaches

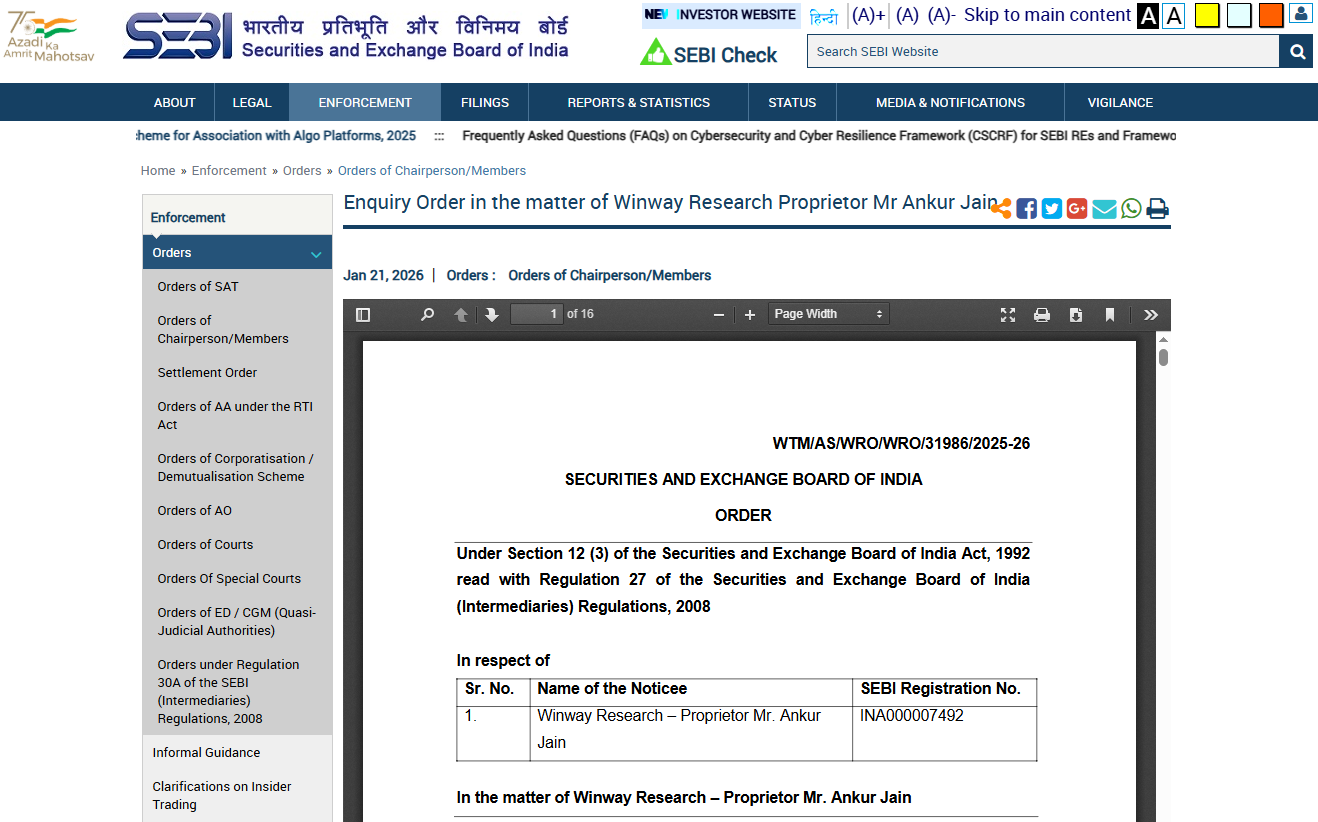

The Securities and Exchange Board of India (SEBI) has issued a 16‑page order reprimanding Winway Research proprietor Ankur Jain for multiple violations of Investment Advisers regulations. SEBI directed Jain to exercise greater diligence and care in his advisory practice following its investigation.

SEBI’s examination uncovered several serious compliance failures:

- Client funds routed through an employee’s personal bank account

- Fees charged for the same product during overlapping periods

- Failure to maintain and submit call records to SEBI

- Unresolved investor complaints on the SCORES portal

Background

The enforcement action followed complaints filed on SEBI’s SCORES portal, its official platform to handle investor complaints. SEBI launched a detailed probe after receiving an enquiry report on November 18, 2024, focusing on whether Jain had complied with regulatory requirements.

Jain contested the allegations, arguing that:

- His firm prohibits accepting client fees in third‑party bank accounts, and any violations were due to unauthorised actions by former employees allegedly misusing company credentials.

- Overlapping fee charges stemmed from misunderstandings of the pre‑2020 invoicing system, where combined bills covered multiple services.

- Call record issues were caused by technical failures beyond his control, despite efforts to maintain compliance.

SEBI rejected all of Jain’s defences, holding him accountable for the violations and proceeding with the disciplinary action. The regulator emphasised that principals must remain responsible for their firms’ operations and reinforced its strict stance on compliance in the investment advisory sector.

The action follows SEBI’s broader pattern of enforcement, including last December’s cancellation of research analyst Purooskhan’s registration for failing to safeguard regulatory credentials misused by an unregistered advisory firm.